Robotic Process Automation in Accounts Receivable: Build it or Buy it?

- 9 min read

This blog explores robotic process automation (RPA) in accounts receivable and whether it’s better for businesses to build bots or invest in existing solutions.

The merits of digital accounts receivable (AR) processes over manual or analog ones are no longer up for debate. Ever since the first finance teams started using robotic process automation (RPA) to automate workflows, more companies of all sizes have benefitted from faster payments, fewer disputes, and improved customer satisfaction.

Efficiency and accuracy are the main drivers of RPA adoption in accounts receivable. Digital assistants, or “bots,” work around the clock, swiftly completing the mundane and time-consuming tasks that typically keep AR staff away from more value-added activities, such as customer service and strategic planning.

Businesses that haven’t embraced AR automation are increasingly seeing it as an urgent need. According to Russell Lester, CFO at Versapay, the period of 'lazy capital' is over.

“Liquidity isn’t as free flowing as it was before, so companies can no longer afford the manual processes and labor-intensive workflows that slow down cash flow.”

So, what’s the best way to embrace robotic process automation in accounts receivable? The question for many companies is: build or buy? This blog explains why working with a trusted partner can help you automate much faster, while creating a solid foundation for the artificial intelligence (AI) advances that will continue to transform AR teams into strategic engines of growth.

Jump to a section of interest:

Robotic process automation can address the challenges of today—and tomorrow →

The downsides of do-it-yourself robotic process automation →

Get your accounts receivable automation up and running fast →

Accounts receivable automation and RPA defined

Accounts receivable automation enables machines to handle time-consuming tasks that your AR professionals would otherwise have to do manually. These include, but aren’t limited to:

Generating and distributing invoices

Processing and reconciling payments

Creating and sending payment reminders and collection notices

Most current AR automation is powered by robotic process automation. RPA uses low-code software to create bots, which are programmed to follow specific rules and conditions. While RPA is not as sophisticated as artificial intelligence, it’s necessary for facilitating the predictive AI tools that will further transform accounts receivable in the months and years ahead.

The urgent need for accounts receivable automation

Versapay asked 1,000 C-level executives what they thought of enterprise digitization, and a whopping 90% said that every department in an organization must digitize. While efforts have been made to digitize accounts receivable in recent years, 96% of respondents said there's still work to be done.

But why is AR automation so important?

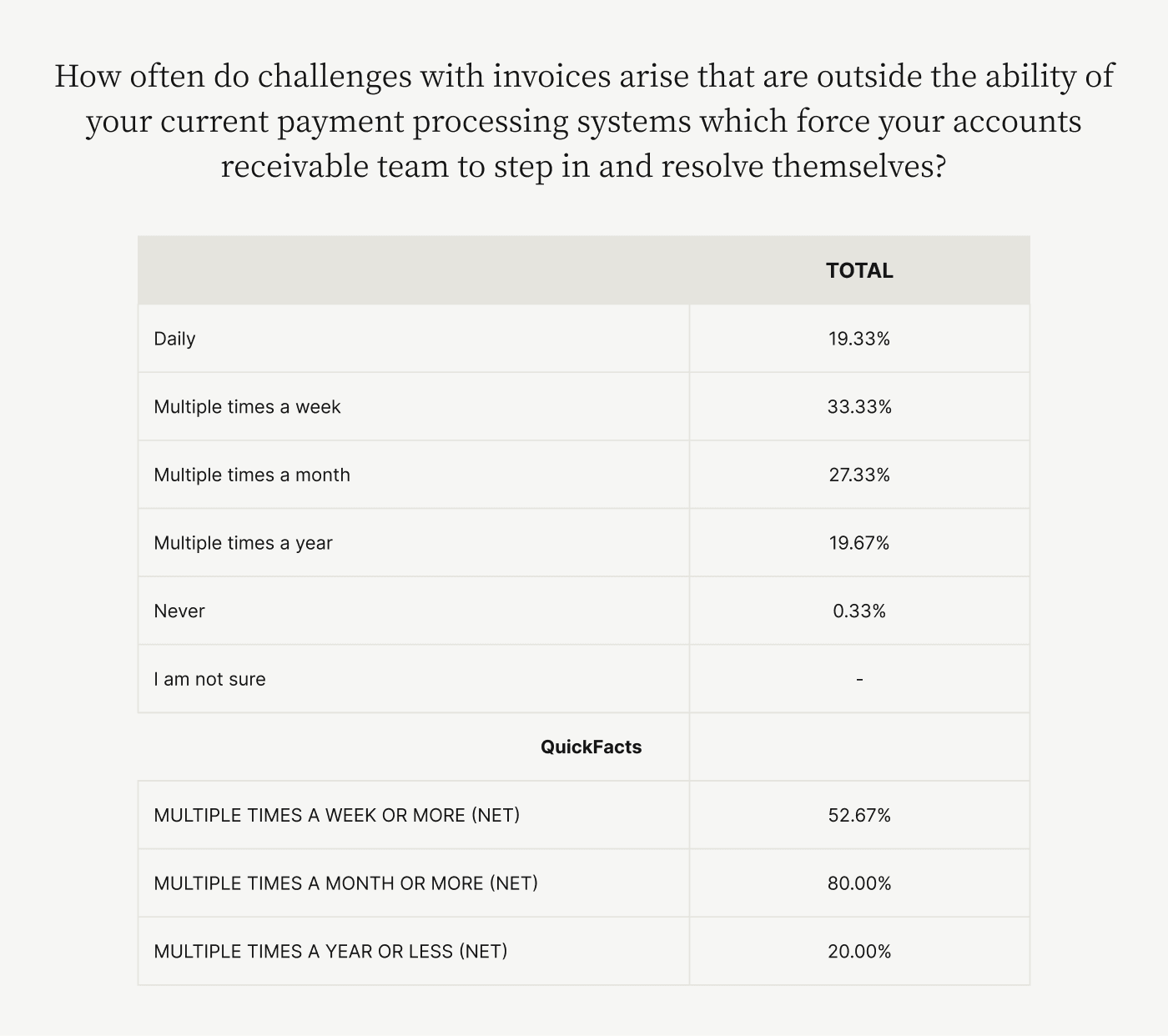

In a separate study of 300 CFOs that quantified the negative impact of manual (aka inefficient) accounts receivable workflows, Wakefield Research and Versapay found that delays in invoice processing, especially at companies with high invoice volumes, create a compounding problem month-to-month.

And with 77% of CFOs reporting that they’re not yet caught up on invoice processing—or are extremely behind in catching up—companies are in a serious cash flow crunch.

Take, for example, a typical mid- to upper mid-sized company with revenues of $250 million or more. Our research shows that businesses like these have nearly $4 million worth of monthly invoices that their existing accounts receivable processes can’t automatically resolve.

This all-too-common scenario is forcing AR teams to step in and manually rectify themselves; and businesses to stretch their human resources and survive with less cash on hand.

Beyond the impact manual accounts receivable processes have on cash flow, nagging payment delays are frustrating for customers, too. Because of what we like to call the “AR Disconnect,” more than 80% of CFOs are concerned that their accounts receivable departments aren’t customer-oriented enough. This concern is another factor in the perception that automated workflows are needed.

As Lester says, “Many finance cycles today are driven by technology and data-processing limitations… Digitization reduces the slippage or the friction points that can occur in accounts receivable. It’s also an opportunity for the AR team to be viewed as part of what can delight the customer.

“Real-time data allows you to move into the upper echelon of being relevant and proactively persuasive with your insights,” Lester continues. “If you can arm your AR team with a tool that allows them to be very fast with those insights—even surface insights that the business was not aware of previously—that puts them in a position of being a strategic advisor.”

It’s clear that leveraging the many benefits of accounts receivable automation can do wonders for the overall financial health and performance of your business. The powerful combination of robotic process automation and artificial intelligence will dramatically transform your processes related to invoicing, payments, and cash application.

Robotic process automation can address the challenges of today—and tomorrow

With AR automation software, complete digitization of virtually all routine accounts receivable tasks—those processes that slow down your ability to collect payments—is achievable with the right partner.

Here’s how automating accounts receivable can positively impact three crucial collections activities today:

1) Payment acceptance: A digital payment process helps you quickly collect billing information and encourages your customers to pay securely using their preferred methods. See how this worked for Sharp Electronics Canada.

2) Invoicing: Automation will allow you to satisfy the invoicing needs of your customers and save you a lot of time manually preparing and delivering invoices. See how this worked for TireHub.

3) Cash application: Acquiring the ability to automate payment matching will allow you to capture and reconcile payment data and eliminate data entry errors. See how this worked for a leading healthcare service provider.

Companies that don’t automate now risk missing out on opportunities to apply emerging artificial intelligence technologies. According to Doug Hathaway, Versapay’s VP of Engineering and a leading practitioner of robotic process automation and artificial intelligence, AI is becoming a game-changer for AR teams.

“When you’re looking for information, you usually have a specific question and you’re turning to charts and graphs looking for answers,” Hathaway says. “AI will allow you to skip that middle layer… You can just ask it the questions you’re looking for, very specifically, and it will be able to formulate a response.”

In addition to conversational interfaces applied to AR workflows, Hathaway envisions a world where AI acts as a transformative analytical layer between legacy finance systems, reducing infrastructure costs and extending system life.

“AI can transform AR and make it ‘more human’ by removing much of the legwork needed to apply payments,” Hathaway says. “AI helps an AR team focus on solving complex customer issues that require empathy, imagination, and creativity, while AI handles document-heavy and time-consuming manual tasks like cash application.”

The downsides of do-it-yourself robotic process automation

Some companies are tempted to build their own accounts receivable automation solution, thinking it could give them greater control and save some money.

While DIY RPA may be appropriate for very simple tasks, AR automation (and the necessary system integrations—like those involving your ERP) are too complex for most companies to implement, maintain, upgrade, and support on their own. After spending months—or even years in some cases—on bot projects, many Finance leaders find out the hard way that internally built bots don’t work as intended, can’t scale easily, and end up creating more manual work for their teams.

Here are the main reasons why going it alone is a bad idea when it comes to accounts receivable automation:

Bots take time to build, implement, re-build, and re-train.

Expensive customizations are usually required to transform generic RPA platforms into solutions that are applicable to accounts receivable.

Generic RPA platforms from unscrupulous vendors often use “hidden bots” from additional third parties that can infect your system.

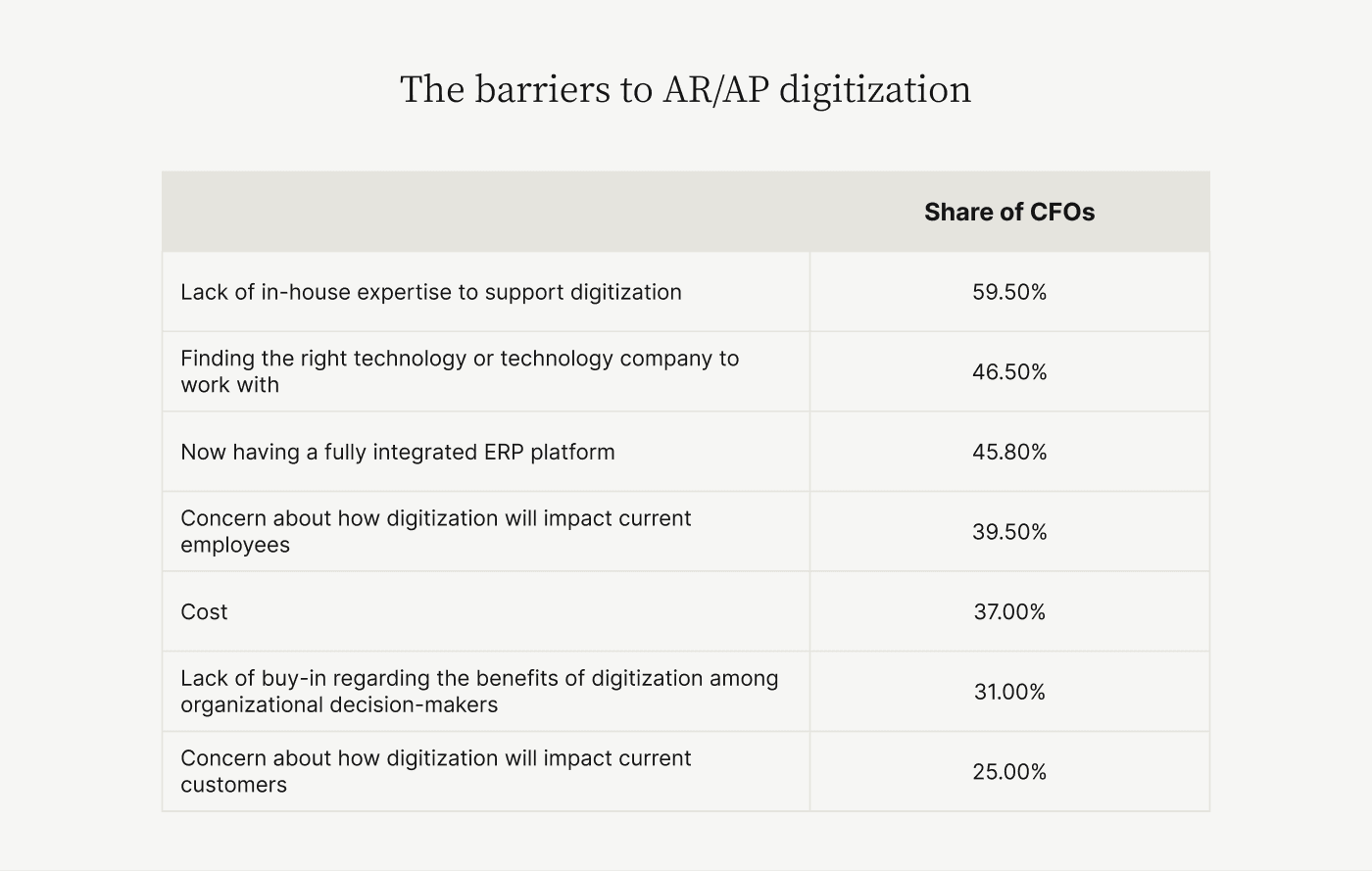

Even if you could do all your accounts receivable RPA yourself, it’s unlikely you’d also be able to integrate the automation with the next generation of AI tools. This is no small task, especially because CFOs admit that their biggest barrier to AR digitization is a lack of internal expertise.

Get your accounts receivable automation up and running fast

While lack of expertise is the primary barrier to adopting robotic process automation and artificial intelligence in accounts receivable, 46.5% of surveyed CFOs say that finding the right technology provider is also problematic.

Already overworked, most Finance teams don’t have time to do the due diligence required to sort through all the different solutions out there and find the right automation provider with knowledge and experience in accounts receivable.

The partner you choose can make all the difference in the world, so it’s important to spend a little time up front to find the best fit. Use the handy checklists in this guide to determine your exact accounts receivable needs across the following 12 key capabilities:

Invoicing and statements

Payments

Collections

Deductions and dispute management

Customer analytics

Cash application

Collaboration and communication

Customer experience

Customer adoption

Ongoing support

Security

Cost

While you’re at it, see how Versapay stands out from other accounts receivable automation vendors:

—

Versapay is currently helping 1.2 million companies buy and sell with proven automation and artificial intelligence technologies. Contact us for a demo today and learn how we can automate your AR as quickly and effectively as possible.