Accounts receivable automation for professional services

Professional services firms managing billable hours, retainers, approvals, and client retention pressures can take control of their invoice-to-cash processes.

Traditional collections weren’t designed to solve professional services challenges

Managing receivables demands accuracy, flexibility, and trust. But unique billing models and client expectations make maintaining cash flow and efficiency difficult.

Delayed payments

Project-based billing and approval cycles extend payment times

Invoice disputes

Scope changes, billing errors, and client questions slow collections altogether

Irregular cash flow

Retainers and billing on milestones create unpredictable revenue timing

Complex invoicing

Hourly rates, projects, retainers, and blended models add operational strain and friction

Manual processes

Invoicing, capturing remittances, and reconciling payments consumes valuable time

No collaboration

Client communication gaps and poor account visibility confuse and lead to follow-ups

Security risks

Sensitive financial and client information requires strict controls

Disconnected tech

Data spread across ERPs, spreadsheets, and other systems causes delays and errors

Connect your customers, invoices, and payments in one platform, so your cash flow never gets stuck between projects

less time managing receivables

faster payments

fewer past-due invoices

Automation built for how professional services firms operate

You balance client trust and complex billing structures. When AR is manual, surging invoice volumes slow collections. You need a platform built for project-based billing, secure data handling, and client collaboration.

Why accounting, law, and consulting firms choose Versapay

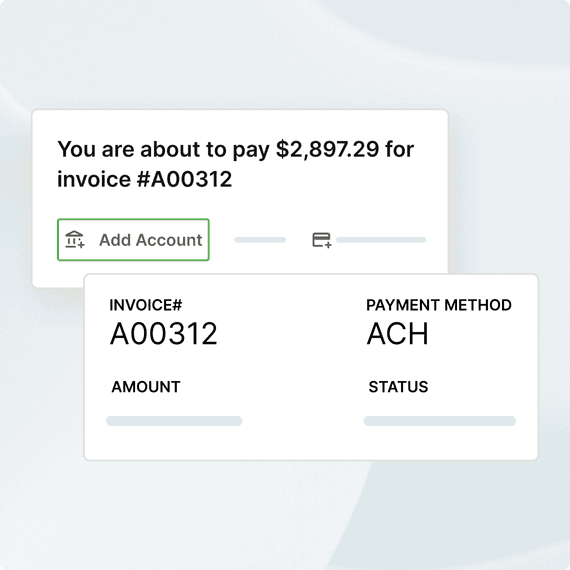

- Make payments for multiple accounts for a smoother payment process

- Automate capturing, gathering and documenting remittance advice

- Save payment and remittance files for archiving and future reference

Automate and simplify the invoice to cash process, from invoicing to reconciliation

Fully unified AR automation software helps professional services firms remove friction, accelerate cash flow, and take control, so cash flow keeps pace with your projects.

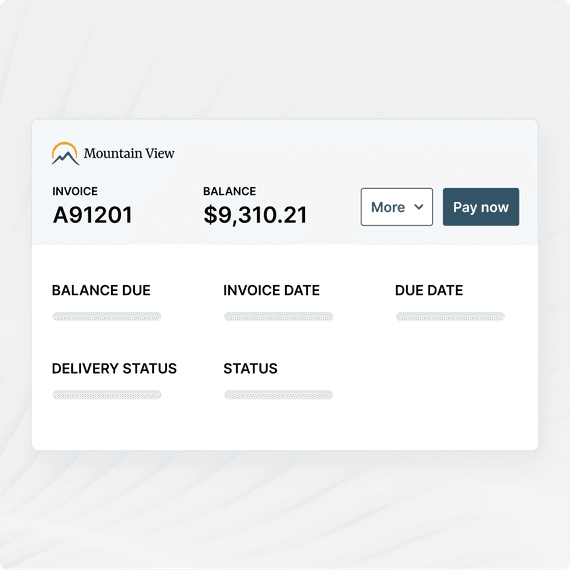

Automate billing and get your invoices paid faster than ever

Let customers view, pay, and manage invoices freely while streamlining collections with automated invoicing.

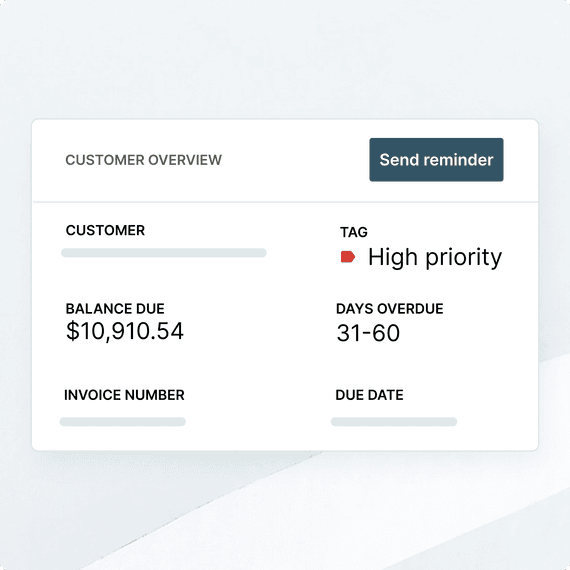

Collect with confidence and stop chasing overdue invoices manually

Automate collections, predict delinquencies, prioritize high-risk accounts, and maintain visibility.

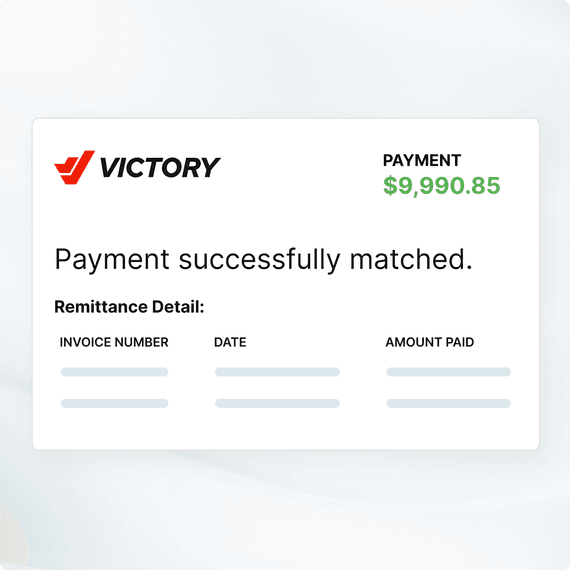

Reconcile payments automatically, with zero guesswork

Automatically match payments to invoices, no matter how or where customers remit.

Accept and process digital payments without disruption

Accept ACH, credit cards, and wire payments in an integrated payments platform.

Experience the future of financial flow

Cash flow shouldn’t be a challenge—it should be a catalyst. Versapay’s fully unified accounts receivable automation platform helps cash flow uninterrupted by letting finance teams collect smoothly and operate without constraints.

The tools financial services firms need to stay efficient and financially stable

Complex billing structures and rising client expectations aren’t going away. Every delayed invoice and manual reconciliation ties up working capital and staff resources. Digitize AR to improve cash flow, security, and client experiences.

Automate generating, updating, and sending electronic invoices

Capture remittance data from a variety of sources automatically

Built for flexible billing models

Support hourly, project-nased, retainer, and blended structures

ERP and practice management integrations

Real-time syncing with systems like Aderant, NetSuite, and other leading ERPs

Secure client self-service portal

Give clients access to invoices and documents. Export PDF files daily and store in archives.

Automation that scales with your firm

Handle growing client volumes without adding headcount

Meet the professional services firms whose complexities we turn into cash flow

From managing complex billing structures and client communication to overcoming irregular cash flow and manual reconciliation, we help professional services firms automate accounts receivable and accelerate payments.

Law firm streamlines cash application amid growing payment complexity

“Versapay has drastically improved our ability to perform cash flow forecasting and budgeting.”

— Ed Aguero, Chief Financial Officer, Cole, Scott & Kissane P.A.

Madison Resources saves money and grows business by replacing lockbox services

“Because of less time spent manually processing payments, we've been able to focus more on strategic work and accomplish more with the same resources.”

— Sara French, Cash Application Manager, Madison Resources

Save time and effort, improve cash flow, and fuel growth

1. What is accounts receivable automation for professional services firms?

Accounts receivable automation for professional services streamlines the full invoice‑to‑cash cycle. Instead of relying on manual billing, follow‑ups, and reconciliation, professional services AR software automates tasks such as invoice creation, delivery, tracking, and collections workflows.

Firms that bill hourly, by project, retainer, or milestone benefit from invoicing and payment automation that ensures invoices go out correctly and on time while clients receive frictionless ways to pay. Many platforms also include cash application automation, which automatically matches payments to open invoices, reducing errors and accelerating financial close.

2. How can accounts receivable automation improve cash flow for professional services companies?

AR automation directly strengthens financial performance by helping firms improve cash flow through predictable, timely payment cycles. By automating reminders and offering easy digital payment options, professional services firms can reduce DSO, shorten billing cycles, and eliminate bottlenecks that slow down revenue collection.

Automated workflows also accelerate payments for professional services because customers receive accurate invoices, clear backup documentation, and self‑service payment options. Additionally, collections automation ensures follow‑ups happen consistently and strategically, freeing teams from repetitive tasks and reducing payment delays.

3. Is AR automation secure for professional services firms handling sensitive client data?

Yes.

Modern AR platforms prioritize security, making them suitable for professional services firms that handle confidential client, financial, and project data. Secure AR automation software employs encryption, role‑based access controls, and audit trails to protect sensitive information throughout the billing and collections process.

Because professional services organizations often manage confidential contract details, invoices, and PII, solutions with professional services data security billing safeguards ensure compliance with standards such as SOC 2, GDPR, and industry requirements. Firms should also look for compliant accounts receivable software that offers secure portals, authenticated client access, and detailed visibility for auditors and internal controls teams.

4. What features should professional services firms look for in an accounts receivable automation software?

The ideal professional services accounts receivable software should support complex billing structures and offer tools that simplify client communication and cash management. Core features to look for include:

- Automated invoicing and electronic invoicing

- Client collaboration tools and a client payment portal

- Automated collections workflows

- Integrated payment processing

- AI‑driven cash application automation

- Role-based security and compliance capabilities

- Dashboards and analytics for forecasting and aging insights

- Seamless data syncing through ERP‑integrated AR software

These features help professional service firms reduce administrative workload, shorten billing cycles, and improve the client experience.

5. Can AR automation integrate with professional services ERPs and practice management systems?

Yes.

Leading AR solutions, like Versapay, are built to connect with core financial systems. Many platforms offer native connectors or APIs that support AR automation ERP services, allowing real‑time synchronization of invoices, payments, and client records.

This integration ensures that accounts receivable software works in harmony with time‑tracking, project accounting, and billing tools. It also strengthens forecasting and month‑end close by improving data accuracy and eliminating duplicate entry. Modern solutions also support end‑to‑end workflows through cash application automation and broader professional services financial systems integrations, creating a single source of truth across all billing and revenue processes.