What’s Account Reconciliation and Why Does It Matter?

- 9 min read

In this article, you'll learn everything there is to know about account reconciliation. We cover what accounting reconciliation is (with examples!), why it's necessary, the differences between manual and automated processes for reconciling accounts, and much more!

In accounting, account reconciliation is the process of comparing and contrasting two sets of records to make sure the figures match. The source documents for reconciliation are often:

Internal: records generated by the company

External: records received from a third party

This process ensures that entries in your company’s general ledger are consistent with the corresponding subledgers. Unexplained discrepancies in a company’s financial records can point to serious problems like fraud or theft. It’s important that your accounting team balance the books accurately, lest you miss out on spotting issues early.

Every company has its own rules and regulations regarding the frequency of its account reconciliations. Depending on the number of transactions there are to compare, this process can happen daily, monthly, or annually.

Reconciling accounts can be a tedious and time-consuming process. That's why many organizations turn to accounting software to handle this so they can instead focus on more strategic priorities.

Read on to gain a better understanding of:

What is account reconciliation (with examples)

Account reconciliation looks different from business to business. However, most businesses use double-entry accounting. This means they enter transactions in the general ledger in two parts, as required by generally accepted accounting principles (GAAP): the credit and debit accounts.

For example, when your company makes a sale, it will debit cash or accounts receivable (AR) on your balance sheet and credit revenue on your income statement. Conversely, when your company makes a purchase, the cash used would then be recorded as a credit in the cash account and a debit in the asset account.

There are five primary types of account reconciliation:

1. Bank reconciliation

This type of account reconciliation refers to the process by which a company compares its bank account balance as reported in its books to bank statements from its financial institution. Companies can perform bank reconciliations as often as needed to ensure consistency between these documents.

2. Customer reconciliation

Here, a company will compare its outstanding customer balances to the accounts receivable captured in the general ledger to unveil any irregularities in customer-level accounting. Companies typically perform customer reconciliation before issuing their monthly financial statements. The customer reconciliation statement serves as proof that there’s no material inaccuracy in the accounts.

3. Vendor reconciliation

In this case, a company will compare the accounts payable captured in its books with the balance provided in documentation from their vendors. This ensures there are no major discrepancies between the amount a vendor charges and the goods and services the company actually received.

4. Intercompany reconciliation

This type of reconciliation happens when a parent company unifies all the general ledgers of its subsidiaries to eliminate intercompany flows and minimize bank transaction fees. This process helps identify inconsistencies between subsidiaries and unrecorded transactions or balances on the books of group companies.

5. Business-specific reconciliation

This refers to any additional reconciliations a company needs to make based on particular needs. For example, businesses with a field sales team might reconcile employee expenses payable with individual expense reports.

How account reconciliation works

The goal of the account reconciliation process is to ensure cash inflows and outflows (debits and credits) always correspond.

Finance teams can reconcile accounts directly by updating cash flow statements with individual transaction details. More often though, they’ll reconcile accounts indirectly by looking at the aggregate of these transactions in their income statements and balance sheets.

There are two main ways of going through the process of account reconciliation. Whichever is best for you will depend on your specific accounting reconciliation needs.

1. Documentation review

This is the most popular method of reconciling accounts. It involves reviewing each individual transaction to see if the amount captured matches the actual amount spent. Documentation review tends to be more accurate because it’s based on real information instead of estimates.

2. Analytics review

This method of reconciliation involves using estimates of historical account activity levels and other metrics. This is a statistical approach that will help you find out if discrepancies between accounts are because of human error or potential theft.

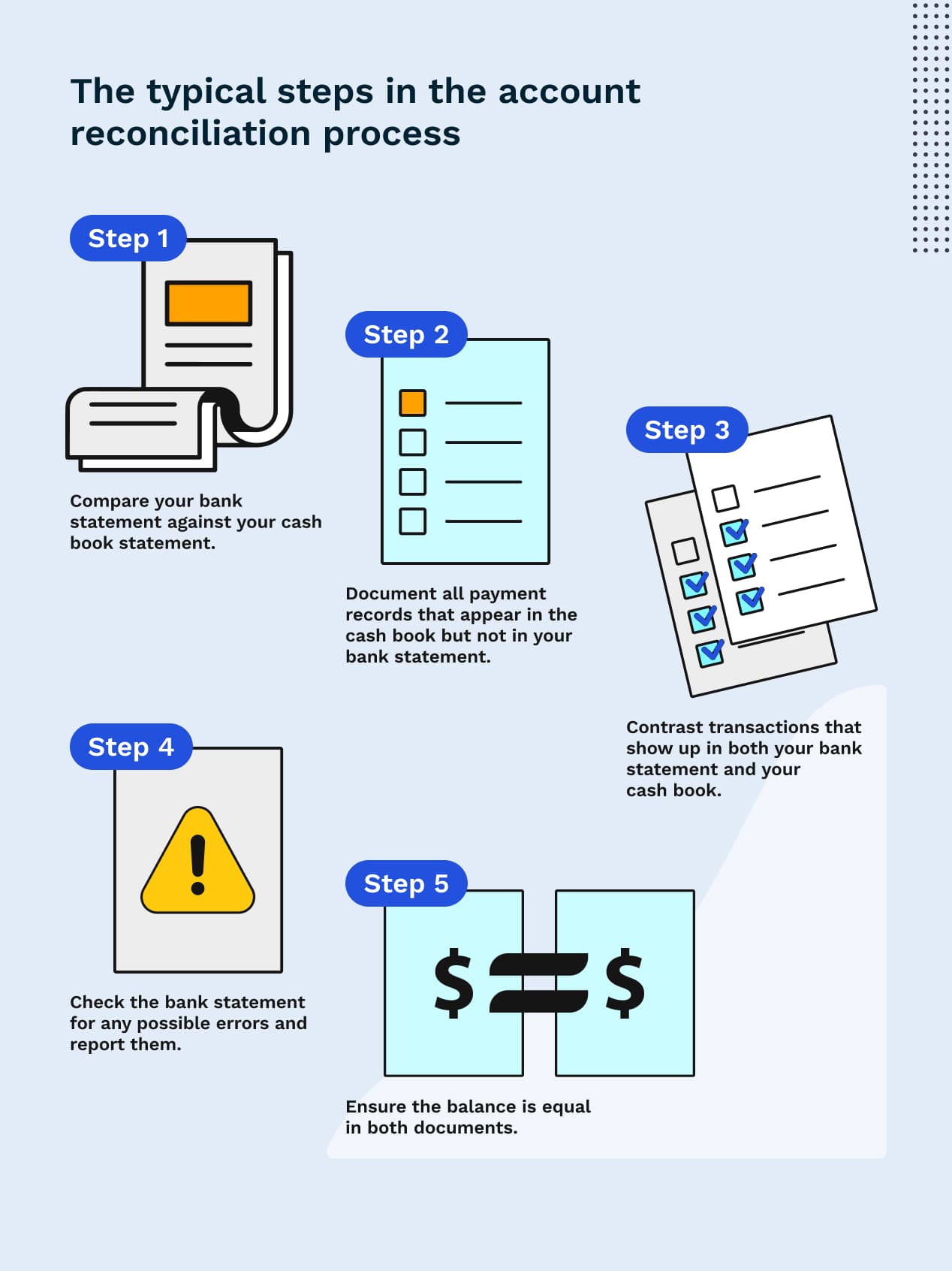

The typical steps in the account reconciliation process

The account reconciliation process helps certify the accuracy and integrity of your financial records. The vast majority of companies nowadays use accounting software to record all their transactions and moderate any discrepancies between their books and supporting financial statements.

When reconciling accounts manually, accounting teams have to take great pains to minimize errors. Here's a breakdown of what the steps in this process might look like:

Compare your bank statement against your cash book statement.

Document all payment records that appear in the cash book but not in your bank statement.

Look out for any inconsistencies between transactions that show up in both your bank statement and your cash book.

Check the bank statement for any possible errors and report them.

Ensure the balance is equal in both documents.

5 reasons why account reconciliation is necessary

Without account reconciliation, businesses would have a hard time identifying and preventing balance sheet errors, which could raise concerns in the event of an audit. They would also have more difficulty flagging potential instances of fraud or theft.

Companies can perform the accounting reconciliation process as often as they want, but most prefer to do it on a monthly basis following financial close.

Here are five reasons why account reconciliations are a necessary part of the accounting process:

1. Eliminating accounting errors

Account reconciliation allows you to identify potential errors like misapplied payments and take action.

2. Making all business deposits when due

When all your information is correct, you’re less likely to miss deposits or mistakenly overdraft an account because of a lack of funds. You’ll know exactly how much money you can budget for vendors, operating expenses, and other payments.

3. Spotting unauthorized transactions

Knowing where your business’ funds are going at all times will help you identify any odd transactions. Neglected accounts could allow people on your team or even third parties to perform deceptive transactions.

4. Keeping track of spending

Reconciliation in accounting is an important means of keeping an eye on how much money the business is spending each cycle and avoiding any surprises.

5. Deducting bank fees and other taxes

In some cases, your bank fees and taxes can cause issues in the balance sheet. Reconciliation lets you identify these scenarios and handle any mismatches.

3 common causes of account reconciliation discrepancies

Some level of exceptions is to be expected in your accounting ledgers. But, if they happen too often and can’t be explained, this may indicate something's not right with your books.

When you identify significant discrepancies in your company’s financial statements, it’s time to dig in deeper. Look for any missing information and errors before you jump to conclusions. If there are still discrepancies after you’ve made the necessary adjustments, you might need to consider an audit to rule out fraud or hold the responsible parties accountable.

Here are the three main causes of reconciliation discrepancies:

1. Timing differences

These reconciliation discrepancies happen when timing issues make you capture supporting data for a different reporting period than its corresponding activity in the general ledger.

2. Missing transactions

These reconciliation discrepancies happen when you neglect to capture a few entries in the general ledger but include them in other statements.

3. Mistakes

These reconciliation discrepancies happen when human error (like incorrectly keyed information) causes there to be differences between the general ledger and the subledgers.

Manual vs. automated accounts reconciliation

Some companies use manual methods to complete the account reconciliation process. However, the effectiveness of this approach may vary. Manual reconciliation is more susceptible to human error. This leaves companies unable to pinpoint if all the transactions in their statements are accurate or if they require further revision.

Also, depending on the size of your business, the frequency of your reconciliations, and the number of transactions running through your business, reconciling your accounts manually could take anywhere from a couple of business days to several weeks. That's why manual reconciliation in accounting is less than ideal in most cases.

How collaborative AR automation software simplifies account reconciliation

Automation software spares you the inefficient and tedious work involved in account reconciliation.

When it comes to reconciling cash inflows from accounts receivable, integrating your payment acceptance with your enterprise resource planning (ERP) system can effectively automate the cash application process for you. This eliminates the need for manual data entry, saving you valuable time and effort.

Even with an online payment portal, you’ll still get payments coming in from outside of the platform via checks or electronic payments. With an AR automation platform that has built-in image recognition and AI-enabled matching capabilities, you can automate the majority of those applications too.

But oftentimes when you receive a payment, the customer may have neglected to send remittance advice telling your accounting staff where to apply the payment. In these cases, you’ll need to get in touch with the customer, which could delay the reconciliation process.

In these situations, accounting teams greatly benefit from having a collaborative accounts receivable solution, which allows them to communicate directly with customers in a single platform.

Versapay's collaborative AR automation software combines powerful automation capabilities with tools for collaborating with team members and customers, all in one cloud-based platform.

Versapay integrates with your ERP to automatically apply payments made within the platform to their respective invoices. With our advanced cash application tools, we use optical character recognition (OCR) and AI to automate matching for payments outside the platform too.

Effective collaboration is vital in creating exceptional customer experiences while simultaneously achieving your efficiency goals—like improving the account reconciliation process.

Learn more about how you can streamline your accounts receivable processes with automation here.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.