9 Common Accounts Receivable Problems (and How To Improve Your Processes With Automation)

- 16 min read

We examine nine of the most common accounts receivable problems that AR teams contend with, the impact they have on your business, and how to solve them with automation.

Most articles will tell you that the biggest challenges for accounts receivable (AR) departments are things like late payments and excessively high days sales outstanding (DSO).

Those articles are wrong. 👀

While these are certainly accounts receivable pain points that many finance and AR teams contend with daily, they’re symptoms of what’s wrong with traditional AR processes, not the actual root causes or challenges to overcome.

It’s easy to apply band-aid fixes to these problems, like optimizing your dunning letters or increasing team headcount. But long-term, those solutions aren’t sustainable or scalable. Without addressing the core of your challenges around AR management, your struggles will persist.

Those root causes tend to be things like miscommunication during the payment process, insufficient rails in place for supporting electronic payments, and frequent errors due to highly manual work. And these are issues that are best solved through transforming your AR processes with digitization, not through snappily worded collections emails or by throwing more employees at the problem.

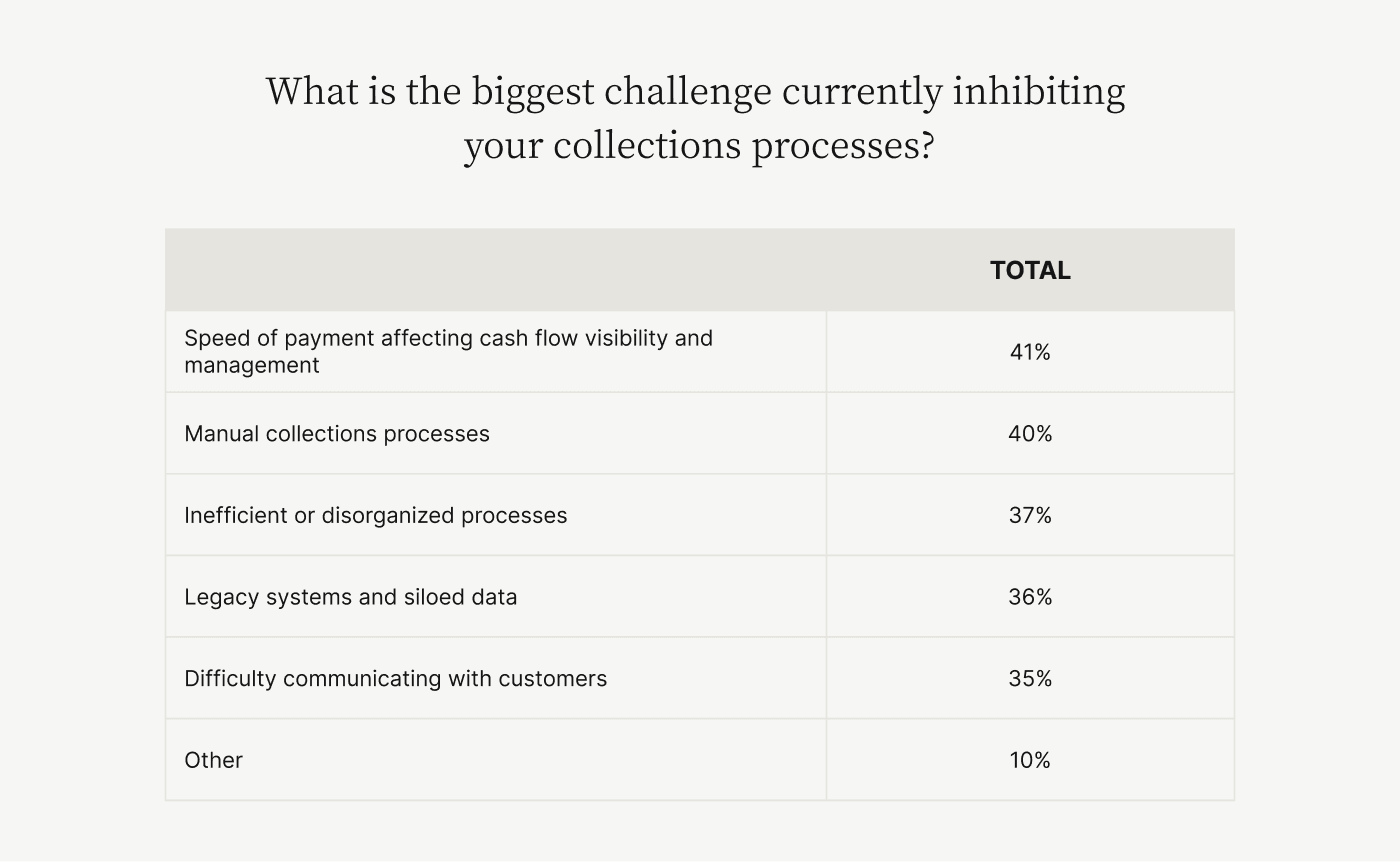

We recently surveyed 100 finance leaders on the biggest accounts receivable challenges currently inhibiting their collections processes. Here’s what they had to say:

In this blog, we’ll:

- Take a closer look at these—and more—accounts receivable challenges

- Examine the consequences of poor accounts receivable processes

- Explore how AR automation software can help solve these common challenges

- Demonstrate how accounts receivable can be an important driver of positive customer experiences and cash savings

—

🚨 Or, take our six-minute assessment and get a personalized diagnosis of the challenges you face in your accounts receivable process. You’ll get a customized accounts receivable transformation roadmap to learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success.

9 accounts receivable management problems and solutions

Below is a list of the most common accounts receivable management problems finance teams face.

Click on your most pressing challenge to be brought directly to it.

Jump to a problem:

1. Compiling and tracking information across siloed, legacy systems

2. Securely accepting electronic payments

3. Getting paid in a timely manner

4. Data entry errors and mistakes on invoices

5. Resolving payment disputes with customers

6. Inconsistent collections processes

7. Maintaining good relationships with late-paying customers

8. Frequent misapplication of payments

9. Manual reconciliation of financial statements

1. Compiling and tracking information across siloed, legacy systems

💡 TLDR: Siloed systems make it difficult to work efficiently and accurately track the status of collections. They also compound miscommunications that might require intervention from senior leadership down the line.

—

Many AR teams use a patchwork of systems to get their work done (multiple reports, spreadsheets, and software tools). Documentation is siloed and difficult to retrieve, and communication with customers is taxing, taking place across multiple channels like email and phone.

All this makes collections difficult to track.

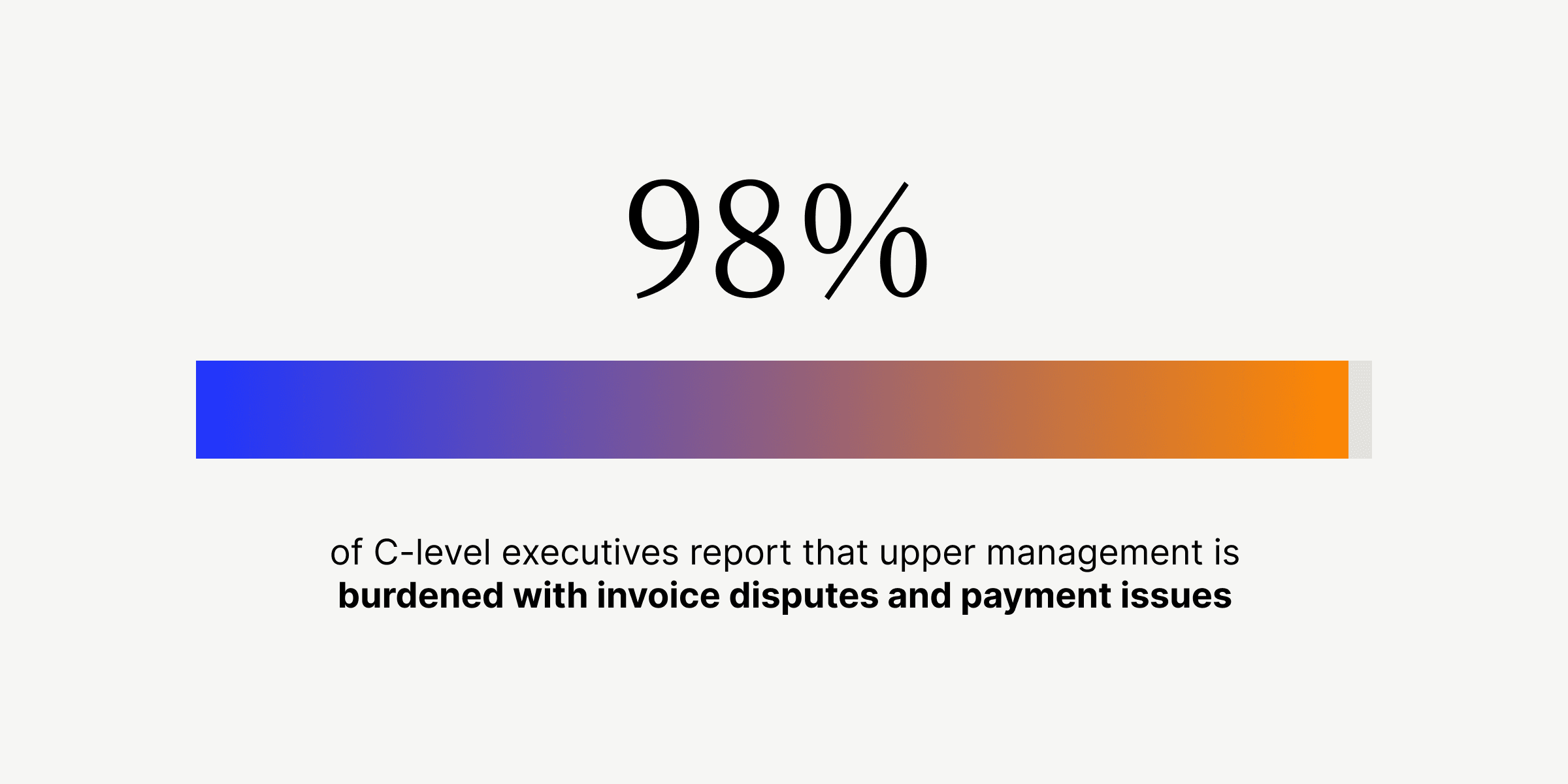

Time spent gathering information is time not spent servicing customers and collecting payments. This leads to breakdowns in communication, which forces upper management to step in and remedy the situation.

Unfortunately, this is a very common challenge in AR circles: 98% of C-level executives report that upper management is burdened with invoice disputes and payment issues.

How AR automation software solves this problem

Accounts receivable automation software enables AR departments to work more efficiently by consolidating all important information—like account statuses and payment histories—in one place.

With integrations for popular enterprise resource planning (ERP) software, you can get your systems talking to one another and work out of fewer places. Some of these tools even include customer-facing portals, ensuring everything is accessible by your AR team and customers alike.

2. Securely accepting electronic payments

💡 TLDR: How customers pay is changing. A common issue for AR teams is not being able to accept digital payment methods securely and seamlessly. This results in you forfeiting improvements to business efficiency and neglecting your customers’ experience.

—

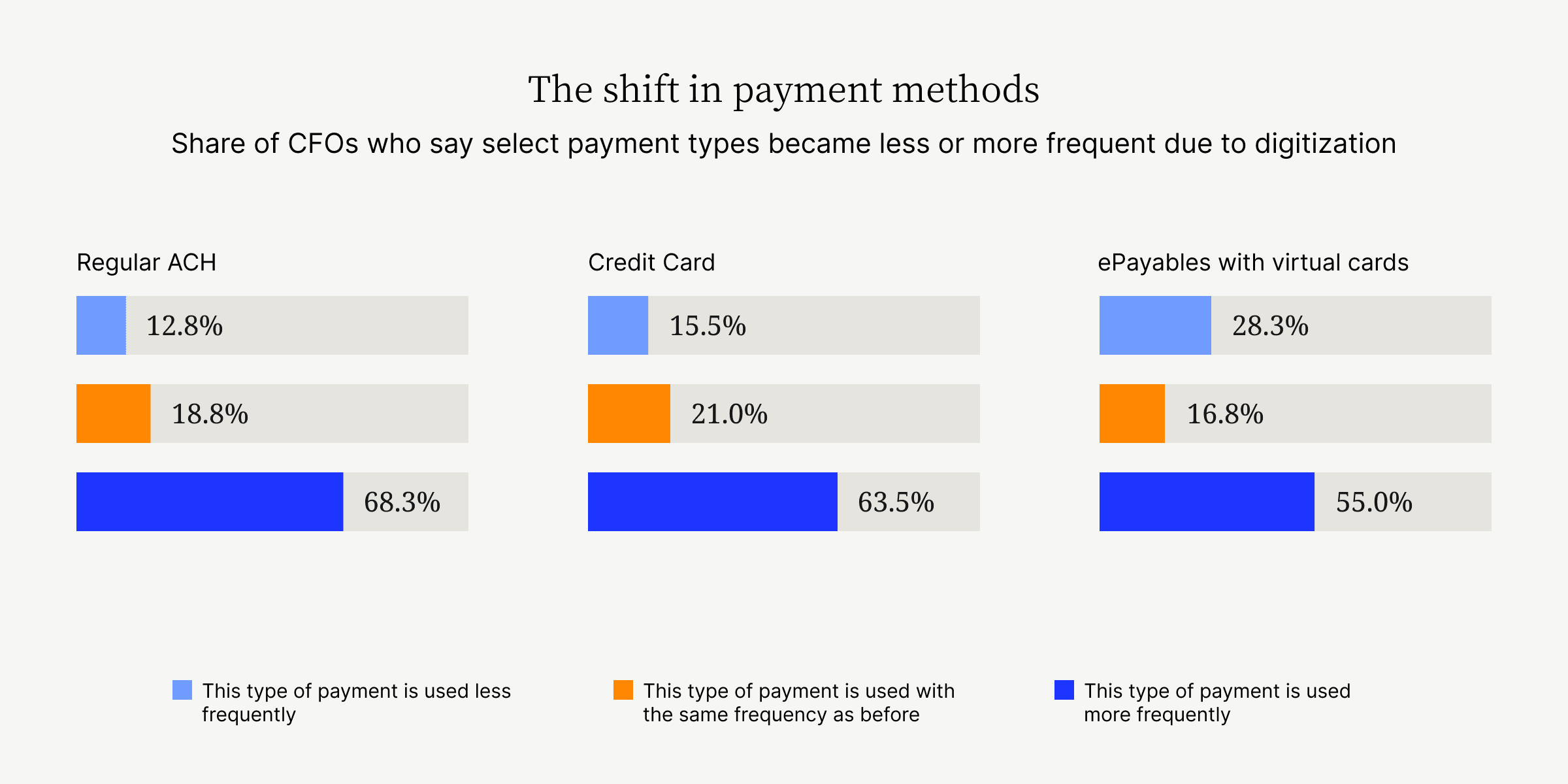

Check use is dying. Forty percent of CFOs report that their business is using checks less often because of digitizing accounting operations. These same businesses are readily adopting digital payments, with 68% using ACH more often, 64% increasing their use of credit cards, and 55% leaning more on virtual cards.

But the reality is, even though B2B check use is declining, paper checks are still very much in use. Ninety-one percent of B2B organizations still receive check payments from their customers.

Manually processing checks is expensive, prone to errors, a waste of your AR team’s time, and a major impediment to cash flow. Not to mention, checks are highly susceptible to fraud.

When your business can't securely accept or process electronic payments—either due to a lack of payment processing technology or restrictive cash application processes forcing continued reliance on checks—you do a disservice to both your team and your customers. Your team has to spend time on tedious and manual check processing and your customers aren’t able to use the convenient digital payment methods they prefer.

Plus, checks take days to arrive, leaving your team uncertain as to when payments will be settled. What’s worse, some customers inevitably use this flaw to delay payment when possible.

How AR automation software solves this problem

AR automation solutions support a variety of payment options and integrate seamlessly with popular ERPs, avoiding the need to move payment information from one system to another. These solutions might also leverage machine learning and AI to capture and reconcile the check payments you’ll still inevitably receive.

3. Getting paid in a timely manner

💡 TLDR: Sluggish collections effectively provide customers with free financing at the expense of your business’ bottom line. When it’s easy for them to pay, your customers’ busy accounts payable (AP) teams are more likely to prioritize your invoices.

—

Forty percent of finance leaders cite manual processes as the biggest challenge straining their ability to collect payment. This is because AR teams that handle collections manually often have no centralized system to see which customers should be reminded about upcoming payments and at what time.

This makes it difficult for your collections specialists to follow up on overdue invoices promptly, reducing the likelihood of a speedy payment. This makes other ventures that are dependent on collections more difficult too.

For example, money that your business would otherwise be able to invest in capital improvements, boosting shareholder dividends, or launching new products or services is instead captive on your balance sheet.

Getting paid quickly via manual processes equates to relying on dunning letters and other disjointed outreach efforts like phone and email. These processes aren’t ideal and are difficult to scale. Companies’ usual course of action for solving this is increasing AR headcount or embarking on a significant team restructuring, which isn’t sustainable.

How AR automation software solves this problem

To solve this problem, you’ll need an accounts receivable automation tool that delivers timely notifications and prompts that help your AR team stay on task and focus on collections priorities. You’ll also want a solution that goes beyond simple automation tactics and integrates the customer as a core tenet of the collections process.

And the best way to do that is to directly connect your customers with your AR team in a shared, online portal to encourage real-time engagement and discussion. This type of functionality empowers customers to offer input on their invoices and make more timely payments.

Fostering customer engagement is crucial during the payment stage, and AR automation software should prioritize this.

4. Data entry errors and mistakes on invoices

💡 TLDR: Invoice errors caused by manual data entry can lead to disputes and ultimately financial losses. Frequent billing errors can also make customers lose confidence in your company’s effectiveness.

—

Businesses are prone to incorrectly listing information on invoices. It’s one of the most common mistakes made in accounts receivable—especially when invoice to cash processes are highly manual.

When AR teams send lots of invoices daily, they’re more likely to input incorrect dollar amounts, use the wrong invoice numbers, omit discounts, and exclude policies. These errors are compounded when dealing with large customers who require invoices to be manually keyed into AP portals.

And when invoices and bills include errors, this can delay payments as it takes time to respond to customers’ requests for clarification and apply revisions.

If you’re still mailing your invoices out to customers (which you’re not alone in, as less than half of the respondents in our survey with Wakefield Research—44%—said they’re currently using a tool for sending out invoices electronically) this timeline is likely even longer.

You won’t get word back about an invoice error until the bill has arrived in the mail and landed on the right person’s desk. And until the invoice has been corrected, the customer won’t pay. The more this happens, the higher your DSO.

How AR automation software solves this problem

AR automation software can integrate with your ERP to automatically send invoices once you’ve generated them in your main accounting software. This ensures no manual intervention or invoice re-creation takes place, reducing the possibility of data entry errors.

And with support for multiple invoice formats (be it email, AP portal, or electronic data interchange), you can be sure to deliver customers’ invoices in the method that’s most convenient for them.

5. Resolving payment disputes with customers

💡 TLDR: When your AR team and your customers have minimal visibility into the status of open receivables, this can lead to misunderstandings that cause payment disputes. Traditional means of communicating with customers during the invoice to cash process (phone and email) make it hard to resolve these disputes quickly.

—

Thirty-five percent of finance leaders cite difficulty communicating with customers as the biggest challenge currently inhibiting their collections processes. When there’s misalignment and miscommunication at any point during the payment stage, customers are likely to raise a dispute and can even forgo payment altogether.

Unfortunately, the same fragmented communication that leads to disputes makes them equally hard to solve.

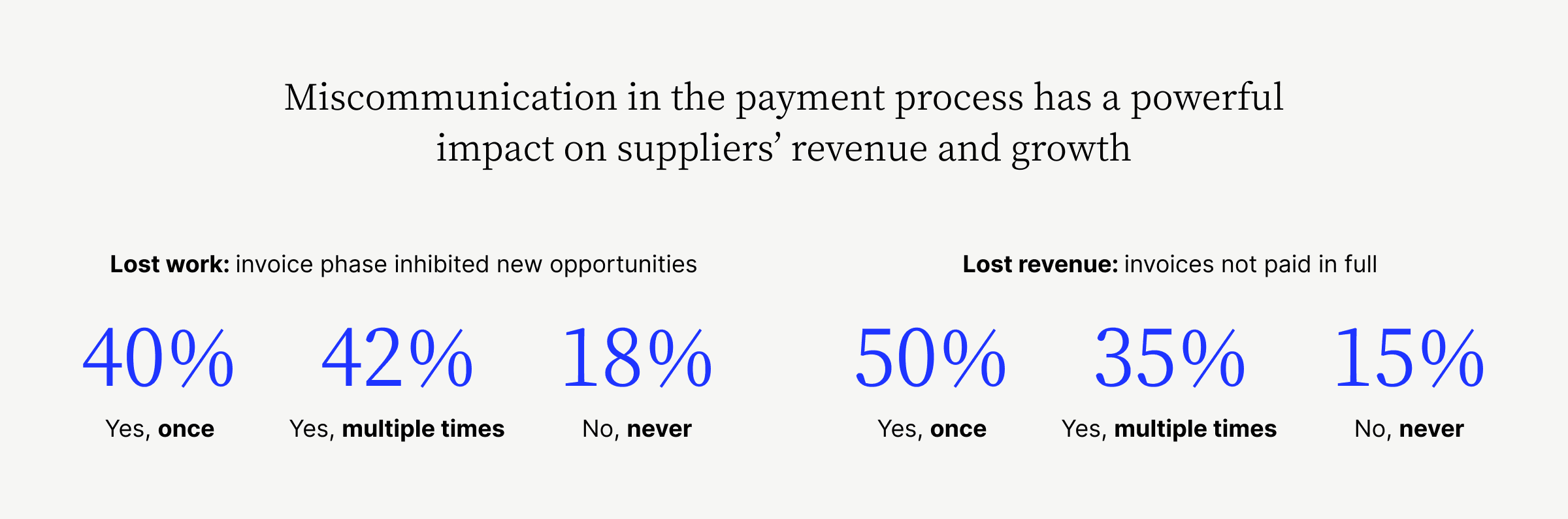

In fact, according to a separate, larger research study, 82% of companies report having lost future business due to miscommunication in the payment process. More than half of those companies (42%) say they’ve lost business multiple times as a result of poor communication.

Traditional channels AR departments use to communicate with customers like email, phone, and paper correspondence are largely to blame.

These channels give AR teams minimal insight into the root causes of disputes and no streamlined way of collaborating with their customers. Emails get lost in people’s inboxes, important stakeholders get left off email chains, and the contents of phone calls don’t get shared to the wider team.

How AR automation software solves this problem

The right AR automation software can help transition your AR function into one that bolsters customer experience instead of hurting it.

Disputes are best handled when members of the AR department can collaborate with internal teams and customers easily. AR automation software can make the dispute management process significantly easier by consolidating all information related to the payment in question in one place that your entire team can see.

Platforms that include a customer-facing online portal can also allow customers to self-serve when they need to access their invoices and important documentation, helping avoid disputes before they happen.

6. Inconsistent collections processes

💡 TLDR: Finance teams with a highly manual accounts receivable process will have a harder time standardizing their collections outreach. This makes it easier to miss important milestones for following up on outstanding invoices.

—

One of the most crippling accounts receivable problems is inconsistent collections. Companies that rely on manual processes for prioritizing collections take 30% longer to follow up on overdue payments than those that use automated processes, a PYMNTS and American Express report finds.

Too often, collections activities are reactive and built on processes that are difficult to scale, like relying on AR staff to send out collections notices ad hoc.

And when you have more overdue payments than your number of employees can feasibly work on, they’ll have to prioritize their outreach to the most important cases, leaving money on the table.

Without a system to track the status of customer payments in one place, your team might also unknowingly double their efforts. If a customer has already paid but your collections staff has no clear visibility of this, they might mistakenly reach out to inquire about the payment. Not only does this waste your team’s valuable time, but it also frustrates your customers.

How AR automation software solves this problem

Digitization and advanced automation technologies stamp out inconsistent ad hoc processes, giving AR teams a better chance of collecting payments quickly.

Automated payment reminders, prioritized collection activities, real-time invoice status tracking, and access to robust backup documentation are all features found in top-of-the-line AR automation solutions.

7. Maintaining good relationships with late-paying customers

💡 TLDR: When your accounts receivable process fails to consider the customer, any attempts at improving efficiency are undermined. The human element of AR—managing relationships with your customers—is just as vital as the behind-the-scenes work of securing and recording revenue.

—

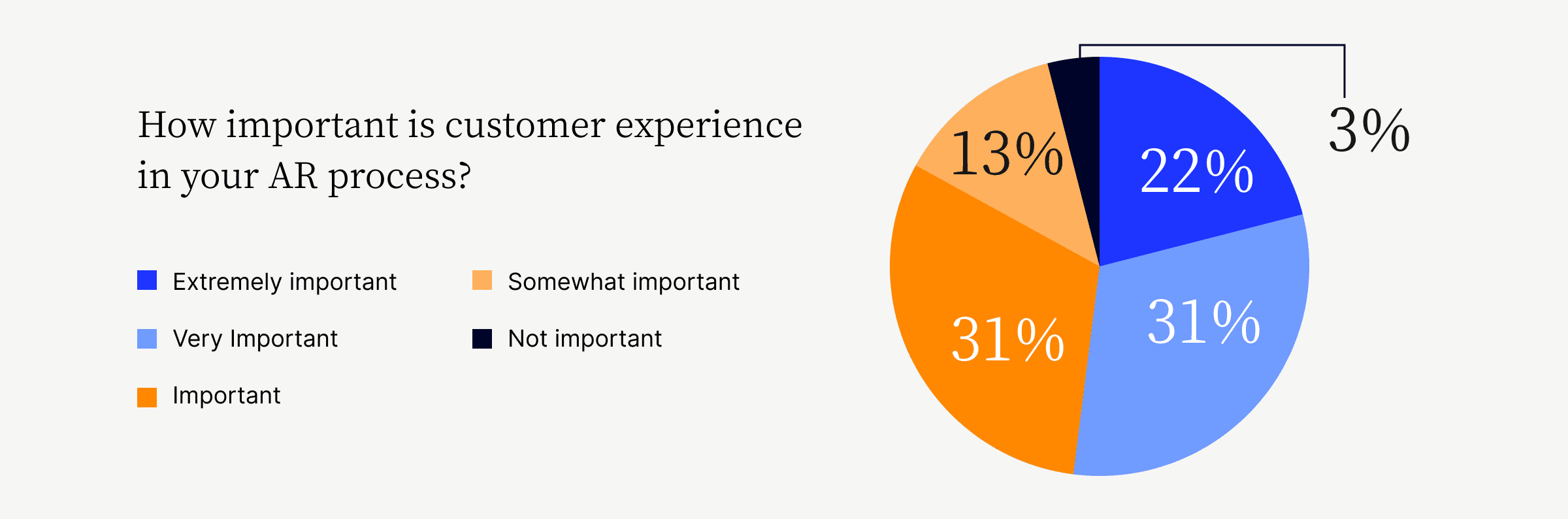

Ninety-seven percent of finance leaders consider customer experience (CX) an important part of their AR processes.

And yet, the same research finds that only 10% report communicating with their customers via cloud-based customer portals—tools that give customers self-service options for making payments and communicating with AR teams directly, online.

This indicates that most AR teams are still wasting time digging through inboxes to manage customer relationships—an unfortunately common accounts receivable problem.

This makes it hard to maintain good relationships with late paying customers, which can have a significant impact on your likelihood of getting paid.

Our research shows that unresolved disputes—a leading indicator of late payments—are a source of ongoing major headaches for AR teams. In fact, 64% of c-level executives note that they’ve had to involve Legal to resolve invoice disputes in the past. Worse, nearly a third of executives (32%) report that full litigation has been required to resolve difficult invoice issues.

Legal involvement comes at a high cost, but none more damaging than the blow to your customers’ experience and your relationships with them.

How AR automation software solves this problem

AR automation software can provide customers with early warnings on upcoming payment dates and better communication from the outset of the invoice to cash cycle.

It can also grant your customers a direct line of access to their accounts, invoices, and your team. This helps eliminate the barriers that would prevent them from paying on time and helps establish trust on both sides.

8. Frequent misapplication of payments

💡 TLDR: With a manual cash application process, the risk of applying payments incorrectly is much higher. Posting a payment to the wrong invoice means your team will spend more time doing account reconciliation and can impact customers’ credit availability.

—

Until you've formally recorded an incoming payment in your accounting system, you can consider that cash non-existent. That’s why being able to quickly—and correctly—apply incoming payments is so important.

Traditional cash application processes, however, compromise this, as they’re error-prone, time-consuming, and resource-intensive. And rather than isolate and remedy the root cause of these challenges, many businesses opt for employing multiple full-time accounting specialists to work exclusively on cash application due to the effort involved.

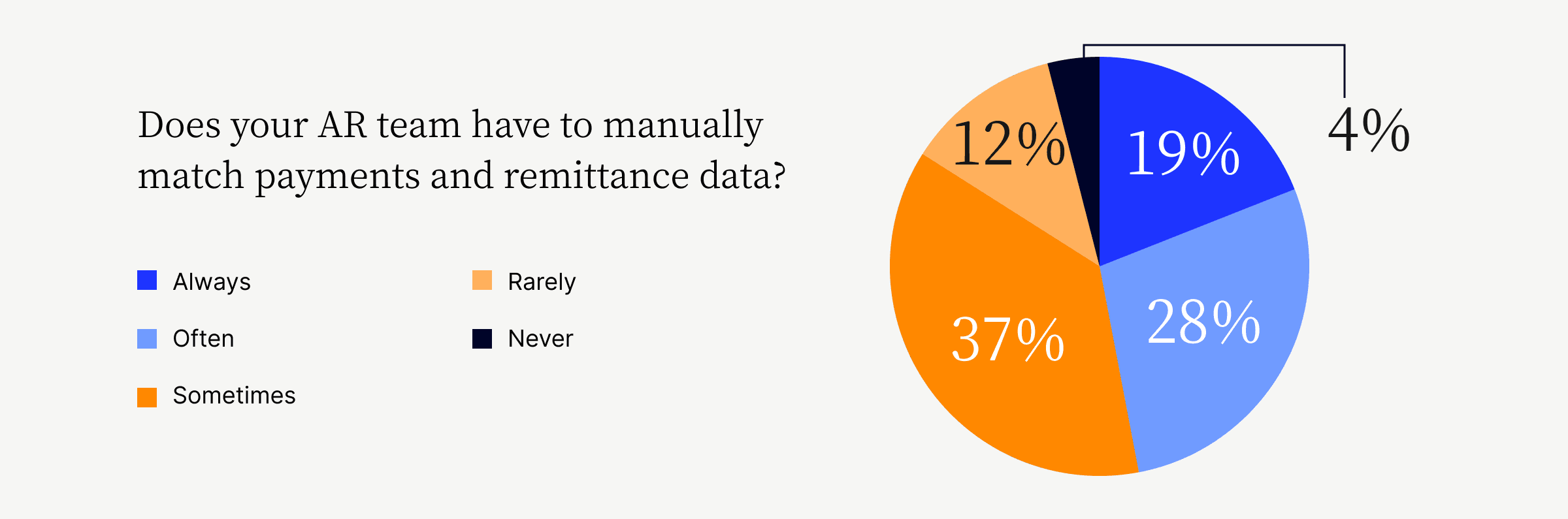

Did you know that approximately 85% of finance leaders are still manually matching payments with remittance information? Nearly 20% claim this is their process for all their payments.

Applying a customer’s payment to the wrong invoice could mean their balance remains open when it shouldn’t. If the customer has surpassed their allowed credit limit, this error could prevent them from making any more purchases from you.

Frequent misapplication of payments also means your AR team will be forced to seek clarification from customers on what to do with their payment on a recurring basis. Much of this stems from having no clear way to manage short payments, payments lacking remittance information, or payments covering multiple invoices.

Plus, highly manual cash application processes mean updating journal entries involves unnecessary flipping between multiple Excel spreadsheets, payment systems, and your ERP—which introduces numerous opportunities for data entry errors.

How AR automation software solves this problem

AR automation software can use advanced technologies—like artificial intelligence (AI) and optical character recognition (OCR)—to dramatically reduce the effort involved in matching payments to their related invoices. These advancements help AR teams parse remittance information from disparate sources and match payments with their corresponding invoices automatically.

What’s more, AR automation tools that support integrated payments can reduce errors from manual data entry by populating payments in your ERP automatically as they come in.

9. Manual reconciliation of financial statements

💡 TLDR: Difficulties reconciling financial statements are often a result of having too many disparate, fragmented systems. Companies with manual AR processes often rely on multiple payment processors to accept payments, creating multiple data sources for AR specialists to record cash inflows from.

—

When performed manually, reconciling financial statements is highly susceptible to human error. This leaves finance teams unable to pinpoint the accuracy of the transactions in their statements, or if they require further revision.

Also, depending on the size of your business, the frequency of your reconciliations, the number of invoices you send on a monthly basis, and the number of transactions running through your business, reconciling your accounts manually could take anywhere from a couple of business days to several weeks. That's why manual reconciliation is less than ideal in most cases.

How AR automation software solves this problem

The best way for finance teams to streamline their work, stay organized, reduce errors, and produce financial reporting swiftly is by managing more of their accounting processes directly in their ERP.

AR automation software can spare you the inefficient and tedious work involved in manually creating journal entries creation and completing account reconciliation. Integrating your payment acceptance with your ERP effectively automates the cash application process for you. This eliminates the need for manual data entry, saving you valuable time and effort when reconciling cash inflows from AR.

An AR automation tool that lets you accept payments from all your sales channels means you won’t need to use multiple processors, either.

Overcome challenges and help your AR team thrive with digital transformation

Any combination of the above challenges makes it difficult to reliably manage accounts receivable, preventing your finance team from reaching their full potential. Unfortunately, many of these challenges are exacerbated by traditional AR processes. The results are delayed cash flow, reduced team efficiency, and poor customer experiences.

Luckily, each problem can be directly solved through some level of automation—and, based on the solution you proceed with, you could eliminate several or all your challenges with help from just one tool.

—

It's time you put these accounts receivable challenges to rest. Take our six-minute assessment to see for yourself which gaps exist in your AR practices, where you have room to grow, and how to achieve your goals and ideal outcomes.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.