12 Strategies to Successfully Prevent and Handle Non-Paying Clients

- 10 min read

In this blog, we’ll discuss the reasons why customers might neglect to pay their invoices, the impact this has on your business, and strategies for dealing with non-paying clients.

Missed invoice payments are irritating to say the least. What begins as a headache can quickly spiral into a nightmare unless you put prevention strategies in place to handle non-paying clients.

There’s a reason you were hired in the first place: your business is the best provider for the job. With all the hard work your team does to deliver what you promised on time, wouldn't it be nice if customers extended that same courtesy to you when it comes time for payment?

Jump to a section:

The impact of non-paying clients

The consequences of an unpaid invoice may seem obvious. And yet, the ripple effects could spread further than you anticipate. Here are just a few negative repercussions of clients not paying invoices:

- Unreliable cash flows make it difficult to ensure you’re covering overheads

- Team morale can nosedive if staff feel their efforts are all for nothing

- If it comes to it, court proceedings are not only stressful but extremely expensive

5 Reasons why clients are unable to pay

1. They’re not happy with the product or service provided

A common reason given for unpaid invoices is that the product or service failed to meet expectations. Whether this opinion is justified or not is less important than the customer service methods your company employs to address the complaint.

A natural reaction to a customer refusing to pay for work done might be to hit back with impatience and simply insist on immediate payment. However, flexibility and empathetic de-escalation are crucial in avoiding formal litigation as well as reducing customer churn. A polite and patient approach to managing customer dissatisfaction will contain disaster in terms of possible reputation damage, far outweighing any immediate financial loss.

2. They are experiencing cash flow issues

It’s likely the non-paying customer is withholding funds owing to their own cash flow issues, as opposed to any legitimate issues with the service or product you delivered. Perhaps the client is awaiting payment on their own invoices, triggering a snowball effect that prompts their accounts payable (AP) team to stall on outgoing expenses.

A sensible strategy for approaching customer conversations like this would be to express concern early on alongside a clear reminder of terms and potentially work together to determine a payment plan.

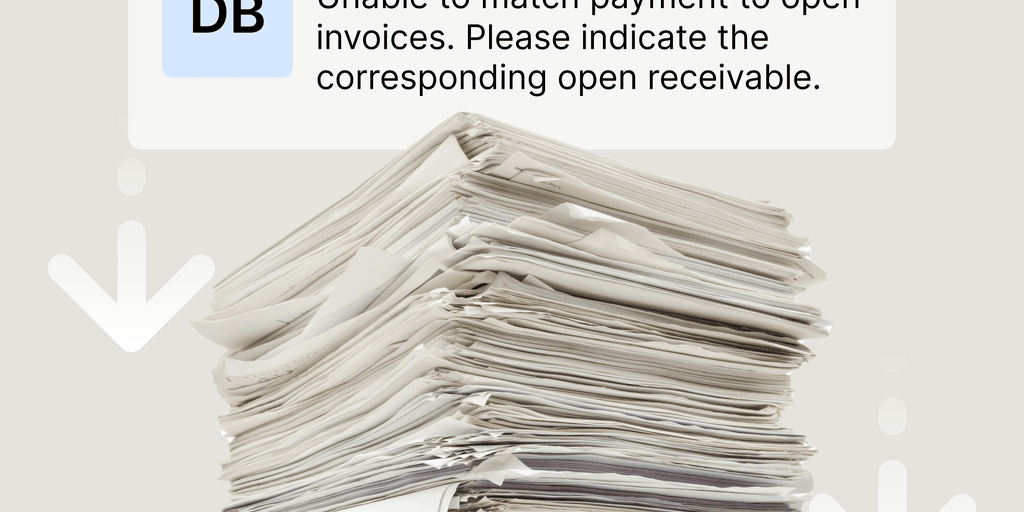

3. Your paper-based invoicing processes are deterring timely payment

While many companies favor online invoicing as part of their digital customer experience strategy, paper invoices are still the norm for many industries. Companies can waste a staggering 50 hours a week manually preparing invoices when automated systems could easily free up this time.

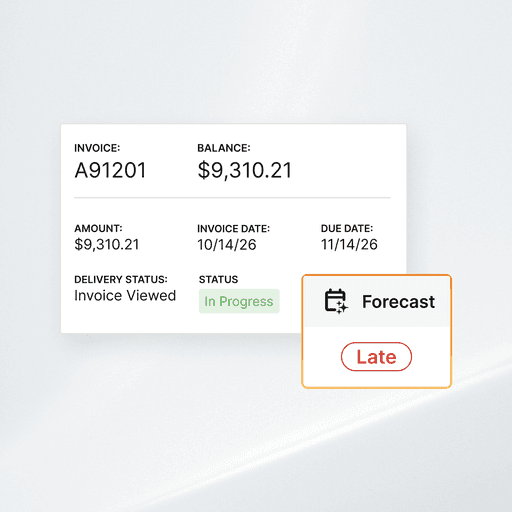

An electronic invoicing system allows you to more easily track whether customers have successfully received and opened their invoices. In the absence of this, here are some questions you should consider to get to the bottom of why a customer might not have paid their invoice.

- Who exactly is the invoice addressed to and is it the right person?

- Has the client recently moved premises?

- Does the client accept paper-based invoices or do they operate on a digital-only basis?

- Is the local postal service experiencing service disruptions?

Answering the above can lead to quicker resolution of non-payment. After all, your invoice will never get paid if it was sent to the wrong place or failed to arrive at all. If you’re unsure, it’s best to phone the client and speak to their accounting team to confirm invoice receipt.

While this can help in the short term, transitioning to electronic invoicing is the best way to prevent these delays in the future.

4. The payment methods you support aren’t most convenient for customers

Another factor worth considering is the range of payment options you’ve made available to the client. Companies expect a broader set of options than simply mailing a check—which is a not the most secure method of payment anyhow.

When surveyed, 87% of finance tech leaders said their buyers are ready to move from checks to digital payments. Consider broadening your payment horizons to support the types of payment methods your customers are already using to pay their other suppliers. Offering payment methods like ACH, credit cards, and virtual cards can make payment easier for your clients, leading to faster collections.

5. You’ve extended credit to customers you maybe shouldn’t have

Things can get tricky if some clients are allowed to get away with behavior that goes against standard company policy. If a customer is at risk of non-payment, ensure your accounts receivable staff is well-aware before deciding whether to continue offering them credit.

While extending payment terms can strengthen a client relationship, you open yourself up to the risk of non-payment. To prevent overdue accounts, be sure to clearly communicate the credit policy to clients (including any applicable late fees) and provide a clear audit trail of all customer communications.

Strategies to prevent non-payments

As the saying goes, prevention is better than cure. Here are a few ways to avoid late or non-payments in the first place.

1. Have a legally binding contract

If a matter of non-payment were to reach court, the judge would want to know the specifics of the initial contractual agreement. While certain actions and verbal commitments will go some way to supporting your case for pursuing remuneration, it’s far better to have a signed and dated document outlining contractual obligations agreed to by both parties prior to the work taking place.

Two hours with a solicitor to draft a robust contract ahead of a substantial project could prevent enormous legal fees further down the line if a customer refuses to pay their invoice.

2. Ask for a deposit or upfront payment

While some companies fear that asking for payment upfront or a deposit can put off potential business, there are multiple benefits to this strategy.

Firstly, it projects confidence and draws a line in the sand that shows your company is serious about receiving payment. This could weed out any bad actors who never intended to pay at all before doing business with them.

Secondly, in the event of unforeseen circumstances like client bankruptcy, your company has at least minimized losses by recouping a portion of the bill amount in advance.

Finally, requesting some level of payment upfront clearly sets expectations and should in fact inspire trust in your customer that you will deliver on your half of the deal.

3. Reward early payments and allow installments

A financial incentive such as a discount for early payments can grease the wheels for speedy invoice remuneration. If it can work for parking fines and mortgages, it could work for your accounts receivable. For instance, if your payment terms are that invoices should be paid within 30 days, a discount of, say, 3% could be offered to clients who pay within 10 days.

Plus, offering to accept payment by installments—such as three equal interest-free payments—would be a modern and flexible approach to providing financing options. Some businesses that otherwise don’t accept a great deal of credit card payments (owing to the high cost of processing them) allow customers to pay with a card if paying early, as a means of speeding up cash flow.

4. Offer payment convenience

How many times has your AR team heard “your check is in the mail”? Put an end to that old adage by incentivizing customers to pay digitally. With the rise in remote work in the last two years, buyers are becoming increasingly comfortable with making large purchases online. In fact, a McKinsey survey found that over a quarter (27%) of B2B decision makers are ready to spend over $500,000 via remote purchases.

While electronic payments can conjure concerns over high processing fees and data capture for cash application, there are software solutions that can put these worries to rest. Using a payment processor with interchange optimization can minimize credit card processing fees, meaning now is as good a time as any to embrace digital payments.

5. Charge late fees

If carrots aren’t enticing enough, it’s time for the stick. Late payment fees can be tricky to claim – particularly if your client is reluctant to pay—but hopefully the threat alone will be enough to convince your customer of the gravity of significantly delaying payment.

If planning on introducing a late fee, just be sure to communicate it clearly in your initial agreement or contract with a customer and on all your invoices. If customers aren’t made aware of the existence of a late fee, then it cannot be enforced.

6. Leverage automation software

Sooner or later, manually tracking the status of every invoice and dunning notice becomes unfeasible. At this point it makes sense to automate how and when you interact with customers.

Collections automation software can relieve you from inefficient and tedious tasks like manually emailing and calling customers to check in on the status of their payment. When you automate and move all that communication to the cloud, you can significantly increase AR productivity and accelerate cash flow–and effectively say adios to non-payments.

How to handle non-paying clients

When determining what to do when clients don't pay, it’s best not to go in guns blazing and demand payment aggressively. A polite phone call, kindly-worded email, or even face-to-face meeting could help both parties gain clarity.

If the above approaches fail, the next steps to attempt to collect on that cash are:

1. Introduce better processes and workflows

Without an organized way to track the status of all your open receivables, it’s easier to miss following up on a client's lack of payment. And the longer a debt goes unpaid, the less likely it is you’ll collect it.

If missed invoice payments are a recurring problem for your company, consider if your billing and payment process could be the culprit. Automating the way you update your AR aging schedule is one way to ease the process of tracking overdue payments.

2. Seek legal advice

Overdue invoices must be addressed as soon as possible in order to prevent non-payment. The implications of late payments for your cash flow are surely no joke: a worrisome 25% of bankruptcies are due to unpaid invoices, according to Coface. If polite reminders continuously yield no payment, promptly contact a trusted legal expert.

3. File a civil lawsuit

Before beginning legal proceedings, it’s advised that you issue your non-paying client with a final demand letter. After this, you can engage legal professionals to prepare litigation on your behalf.

Of course, it’s wise to calculate the potential legal costs versus the debt amount to weigh whether pursuing this course of action is worth it. But, bear in mind, you can also litigate for interest accrued on the debt, attorney's fees, plus court costs.

It should be noted that even if a judge rules in your favor, you still might not be able to recover the overdue payment, requiring further legal action.

4. Enter formal dispute mediation

A trained third party can be brought in to facilitate discussion in a process called mediation. This may or may not be recommended as part of court proceedings. Structured meetings take place with a neutral professional who will seek to clarify the arrangement and help both sides to find a resolution.

5. Hire a collection agency

The next stage in proceedings is to engage a debt collection agency (DCA) to pursue the overdue payment on your behalf. It’s worth asking detailed questions about the collection agency fee structure, as it may turn out that the final sum your company receives may be smaller than the amount owed.

6. Focus on delivering better customer experiences

If legal proceedings and formal mediation fail to collect on an outstanding debt, it’ll have to be written off as bad debt. You may find it’s more worth it to write off the bad debt before proceeding with any legal action or external collection agencies.

If your business is encountering non-payments often enough, consider the possibility that your company bears at least some responsibility for the dissatisfaction of the client and their subsequent refusal to pay. Reflect on how you might improve your customer service to prevent future non-payment. After all, a great customer experience is the best way to receive payments from clients and streamline your collections process.

Shape up your debt collection

Nobody relishes a court battle. Following the above guidance will help give you the best chance of avoiding one if an invoice unfortunately goes unpaid. By automating your collections workflow and customer communications, you improve your chances of collecting payment before the risk of non-payment occurs.

About the author

Jenna Bunnell

Jenna Bunnell is the Senior Manager for Content Marketing at Dialpad, an AI-incorporated cloud-hosted unified communications system that provides valuable call details for business owners and sales representatives. She is driven and passionate about communicating a brand’s design sensibility and visualizing how content can be presented in creative and comprehensive ways. Check out her LinkedIn profile. Jenna has written articles for domains such as CEOBlogNation and Vmblog.