Why Manual AR in Heavy Industries Threatens Financial Stability

- 7 min read

Still using manual AR? You’re not alone, but more CFOs are automating AR to fix hidden inefficiencies and protect against the next disruption.

Key takeaways:

- Manual AR puts your business at risk. Operations-heavy industries face devastating cash flow disruptions when manual processes fail during critical moments.

- There are four critical failure points: crippling decision delays during disputes, destructive cascade effects when payments stall, dangerous recovery gaps after disruptions, and strategic blind spots from poor cash flow visibility.

- Smart companies treat AR automation as essential infrastructure. Leading manufacturers, distributors, and construction companies view automated accounts receivable as critical as backup systems, cybersecurity, or safety equipment.

- The results speak for themselves. Organizations with AR automation maintain financial control during disruptions, while those with manual processes face compounding cash flow crises with each new challenge.

Freight rates are climbing, customer payment patterns have shifted, and supply chain disruptions are now routine rather than exceptional. Clearly, CFOs in manufacturing, distribution, and construction have had their plates full lately.

Cash flow resilience is the solution to weathering these storms, but manual accounts receivable processes can derail that goal. Those manual processes create bottlenecks that freeze cash flow during volatile and disruptive times.

Manual AR is a strategic liability and hidden operational risk

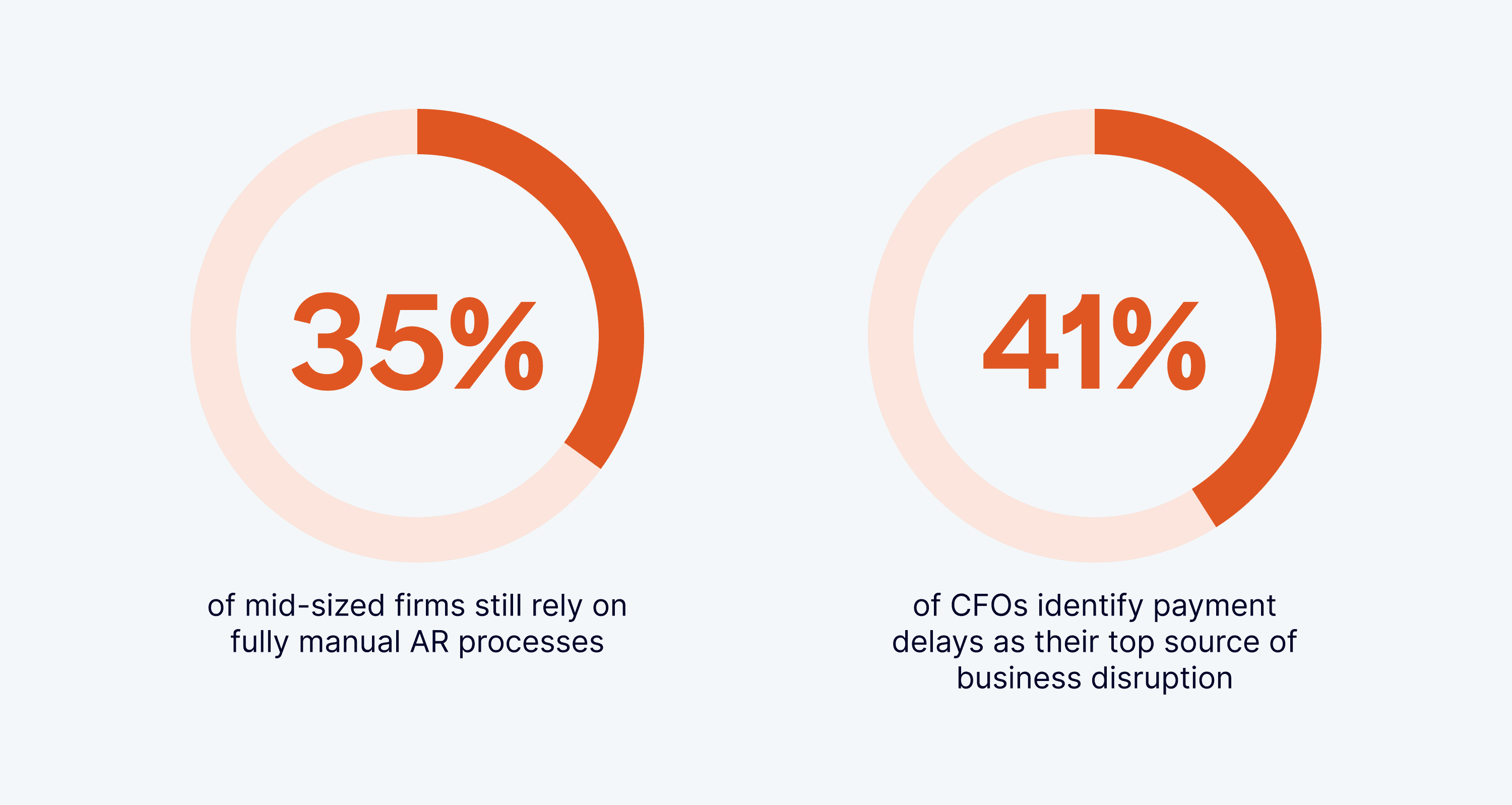

In a volatile business environment, manual accounts receivable processes have transformed from mere inefficiencies into operational vulnerabilities. The statistics tell a sobering story: 35% of mid-sized firms still rely on fully manual AR processes, while 41% of CFOs identify payment delays as their top source of business disruption.

All of this leads to operational inefficiencies, increased liability exposure, lost revenue opportunities, and cascading impacts on supplier relationships and growth investments.

For manufacturing, distribution, and construction companies, these are operational emergencies waiting to happen, not just finance department issues. When invoice disputes can't be resolved quickly due to paper-based processes or disconnected systems, production schedules slip.

When working capital freezes because of payment delays, distribution networks back up. And when natural disasters, supply chain failures, or staffing shortages hit, manual processes create dangerous single points of failure that can bring your entire cash flow ecosystem to a halt.

Consider what happens when a key AR team member falls ill, or a postal service disruption delays check processing. These seemingly minor hiccups can delay supplier payments, force emergency financing, or postpone critical capital investments.

The consequences extend far beyond missed revenue targets or temporary cash crunches. When manual AR processes fail during critical periods:

- Production lines can halt due to delayed materials purchases when supplier payments are late

- Valuable customer relationships deteriorate when repeated billing errors go unresolved

- Emergency loans become necessary, often at unfavorable rates, creating long-term financial drag

- Financial reporting becomes unreliable, leading to flawed strategic decision-making

CFOs who recognize this liability are reimagining AR not as a back-office function, but as critical infrastructure requiring the same attention and investment as production equipment or safety systems.

Four failure modes modern CFOs can't afford

Manual AR processes create four vulnerabilities that threaten business continuity and competitive positioning. These four critical failure points become especially dangerous during periods of economic volatility or operational disruption:

1. Delayed Decision: Disputes that Stall Cash and Credibility

A single disputed invoice can lock up thousands, sometimes millions in unpaid receivables. And with manual AR, your team spends days chasing signatures, digging through emails, or waiting for someone to locate a delivery slip.

Meanwhile, your customer is waiting. Your cash is frozen. Your production schedule is hanging in the balance. For manufacturers and distributors moving high volumes of configured SKUs, that delay isn’t just a nuisance, it’s a breakdown. It holds up supplier payments, halts orders, and drains trust.

Manual AR systems don’t just slow you down. They turn everyday disputes into costly disruptions.

2. Ripple Effect: When One Late Payment Breaks the Chain

In operations-heavy industries, cash isn’t just a finance issue, it’s fuel. And when a major payment gets held up, the entire system starts to seize. Supplier payments are missed. Material shipments are delayed. Preventive maintenance gets pushed. Teams are idled or pulled off projects.

What started as a single late invoice quickly spreads: project timelines slip, penalty clauses trigger, and your forecast falls apart.

In construction, even a few days of cash disruption can stall sequencing, delay inspections, and cost hundreds of thousands in lost time and liquidated damages.

Manual AR doesn’t just delay payments, it creates fragility. One weak link, and the entire chain reacts.

3. Slow Recovery: Manual AR Can't Pivot Under Pressure

Disruption is no longer a question of if, it’s when. A winter storm shuts down a facility. A key team member is out sick. A global shipping delay throws off your entire supply chain.

When that happens, manual AR systems collapse under pressure. Paper checks sit unopened. Files are stuck in one person’s inbox. Collections grind to a halt. You can’t reroute efforts. You can’t shift to digital payments. You can’t even see where the bottlenecks are until it's too late.

Meanwhile, your competitors with automated AR are still moving: resolving disputes remotely, reallocating cash, keeping operations funded.

Manual AR doesn’t just slow recovery, it prevents it.

4. Blind Spots: You Can't Fix What You Can't See

When every decision depends on working capital, manual AR creates a dangerous lack of visibility. Without real-time dashboards or automated reporting, finance leaders are left guessing where cash is tied up, which accounts are overdue, and what’s coming in next.

That uncertainty makes forecasting unreliable. It delays strategic planning. And it means early warning signs like slow-paying customers or shifting patterns often go unnoticed until there’s already a problem.

For operations-heavy businesses with large capital needs and thin margins, these blind spots can lead to missed opportunities, delayed investments, and reactive decision-making.

Automation brings cash flow into focus. With dashboards that show real-time data, teams can spot risks early, respond faster, and make more confident financial calls.

How automation builds a competitive advantage

The most successful CFOs in operations-heavy industries are gaining a strategic edge by treating AR automation as essential infrastructure. When economic pressures intensify or supply chain disruptions hit, businesses with automated AR maintain cash flow visibility and control that manual competitors cannot match.

- Real-Time Dispute Resolution: Picture your team facing an urgent customer dispute over a complex order. Instead of digging through filing cabinets or waiting for colleagues to forward emails, automation gives them immediate access to every invoice, communication, and delivery record. This real-time visibility turns what might have been days of delay into minutes of resolution, transforming frozen receivables into working capital you can quickly deploy.

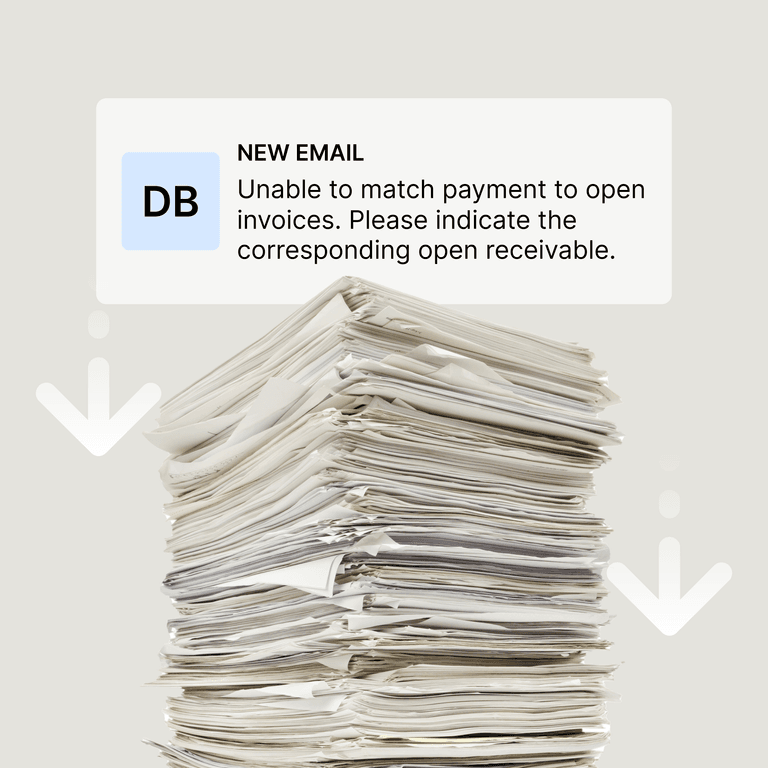

- Seamless Information Flow: Think about those painful handoffs between your sales, operations, and finance teams, where information gets lost and errors multiply. Automation creates digital bridges between AR processes and your ERP, customer databases, and banking platforms. Information flows naturally through your organization, just as materials flow through your production process, eliminating communication gaps that frustrate both your team and your customers.

- Scalable Processing Power: When manually driven AR teams face sudden volume surges, papers pile up, emails go unanswered, and cash flow suffers. Automated systems handle these peaks without breaking a sweat, ensuring your financial operations support growth rather than constrain it.

- User-Friendly Design: Modern AR platforms recognize that finance professionals shouldn't need IT degrees to do their jobs effectively. Clear dashboards and guided workflows mean your team spends less time fighting systems and more time adding strategic value.

- Competitive Financial Agility: While others scramble to determine their financial position, automated organizations make confident decisions based on real-time data. This advantage compounds over time, as financial agility enables faster responses to both challenges and opportunities.

The resilience investment smart CFOs are making today

Economic volatility is the new normal. Smart CFOs are acting now, transforming their AR operations from vulnerability to strategic advantage with automation platforms like Versapay.

Versapay's comprehensive AR automation solution directly addresses the critical failure points in manual processes with capabilities designed specifically for operations-heavy industries:

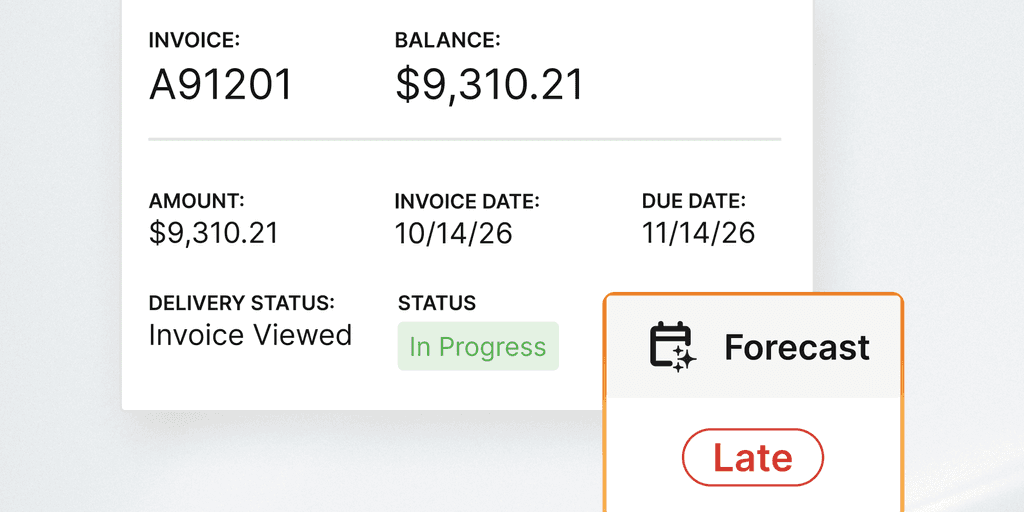

- Automated invoice processing and dispute resolution: When a customer questions an invoice, Versapay provides instant access to all relevant documentation, turning potential payment delays into quick resolutions.

- Real-time payment tracking and visibility: This visibility transforms forecasting from guesswork to precision, enabling confident financial decisions even during volatile periods.

- Integrated ERP and accounting system connections: Versapay's purpose-built integrations eliminate the data silos that create financial blind spots and operational disconnects.

- Digital payment acceptance and processing: By providing customers with convenient digital payment options, Versapay accelerates cash collection regardless of external disruptions.

- Automated collections workflows: These intelligent workflows prioritize actions based on business impact, ensuring your team focuses on high-value activities rather than repetitive tasks.

While competitors struggle with manual limitations during volatile times, Versapay customers maintain the speed, visibility, and control needed to navigate uncertainty successfully.

Discover how operations-heavy industries are building cash flow resilience with Versapay.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.