How Changing B2B Payment Behavior Has Affected Credit Risk

- 1 min read

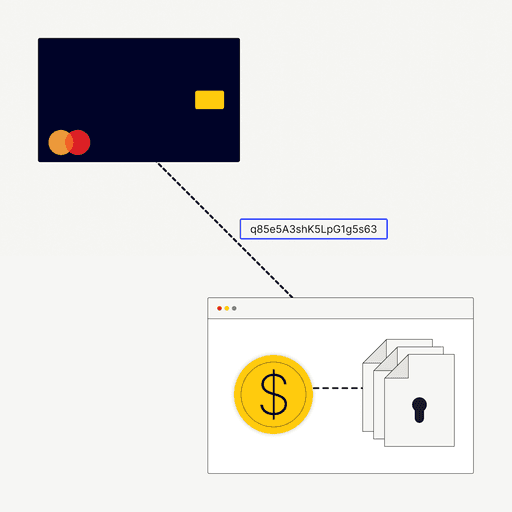

In the fallout from the COVID-19 pandemic, B2B buyers and sellers alike have had to pivot significantly to adapt, migrating to digital channels like ecommerce to survive in a remote world.

But as businesses have been grappling with COVID-19, many have also had to deal with increased fraud activity. Research from the Credit Research Foundation shows that 30% of professionals in the credit management community have experienced more instances of fraud since the pandemic began, payment fraud and synthetic identity issues chief among them.

In this session, you’ll come to understand the intersection of payment digitization and credit risk and learn about strategies and technologies supporting fraud detection and risk management.