How to Reduce Chargeback Risk by Modernizing Your Payments Process

- 13 min read

We’ll examine what a chargeback is, the steps in the process, common causes, how to lower chargeback risk with an integrated solution, and more.

Credit card payments have become increasingly common in B2B transactions—and so have the risks that accompany them. According to a recent eNews poll, for example, 59% of credit professionals say customers have fraudulently disputed credit card charges.

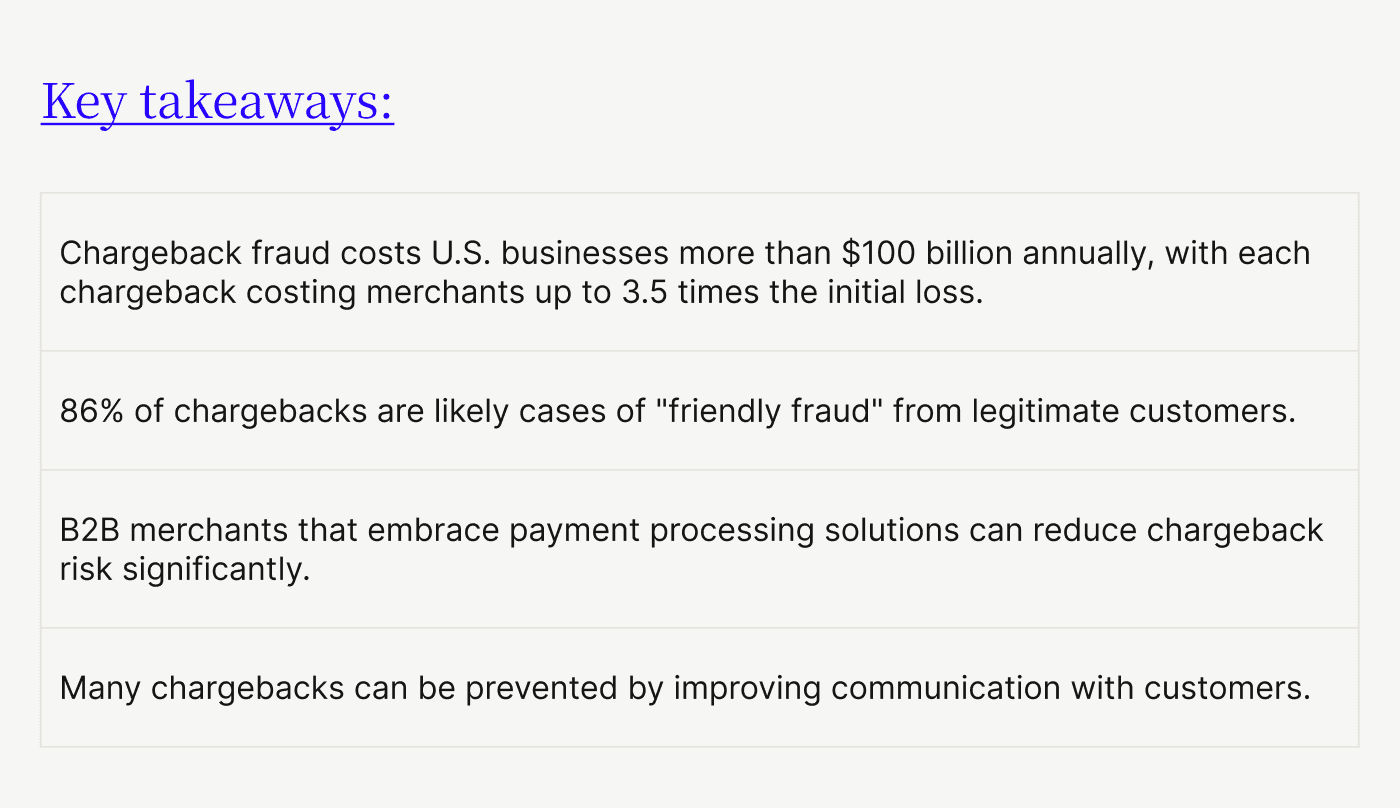

Welcome to the world of chargebacks: A $100 billion problem for U.S. businesses that shows no signs of slowing down. But what is a chargeback, you ask? It’s when a customer disputes a credit card charge and the merchant has to reverse the transaction.

Mastercard data predicts that the number of chargebacks will reach 337 million annually by 2026. And research from Justt revealed that three-in-four consumers (U.S. and England) filed a chargeback last year. Unfortunately, lots of customers use chargebacks because they’re easier than asking a merchant for a refund directly.

In this short guide, we’ll paint a fuller picture of the chargeback landscape and share valuable tips to reduce your chargeback risk. We’ll also explain why one of the best strategies is to implement an integrated payments solution that proactively identifies fraud, reduces data entry errors, and improves communication with customers. With these three components in place, you’ll go a long way towards reducing chargeback risk while empowering your customers who prefer to pay with credit cards.

Table of contents:

What is a chargeback? An overview:

A chargeback is a payment that’s reversed after a customer disputes a transaction with their bank. A customer can file a chargeback for a transaction that was made on a debit card or credit card.

Chargebacks vs. refunds

When a buyer disputes a transaction, they typically have two options: a chargeback or a refund. While these terms are sometimes used interchangeably, the two serve different purposes.

A chargeback is initiated by the customer, who works closely with the issuing bank. A refund, on the other hand, is performed by the merchant, who will then work directly with the customer who’s disputing the transaction. Often a customer will initiate a chargeback if they’ve already approached the merchant for a refund and couldn’t get one.

With a chargeback, the process can take anywhere from a few weeks to a few months. A refund, however, is generally completed in a couple of weeks or less.

Chargeback risk: A $100 billion problem for U.S. businesses

Chargebacks are more than just a nuisance, they're a threat to your bottom line. In 2023 alone, U.S. companies wrote off an estimated $117.47 billion in revenue due to chargebacks. But that's just the tip of the iceberg.

You're not just losing a sale when a chargeback occurs—you're also facing a barrage of fees, fines, and countless work hours to resolve the disputes. The true cost of a chargeback can balloon to 3.5 times the initial loss. With chargeback fees ranging from $20 to $100, plus shipping and interchange fees, the costs can add up quickly.

These financial impacts are part of a larger, more complex issue. While chargebacks were originally designed to protect consumers from unscrupulous merchants, the rise of ecommerce and online banking has inadvertently tilted the playing field against sellers.

A well-intentioned consumer protection mechanism has become a double-edged sword, opening up new avenues for fraud and abuse. Today, chargebacks have become a useful tool for bad actors committing card-not-present (CNP) fraud. Even more concerning, many legitimate customers now use chargebacks as a shortcut to quick refunds, bypassing merchants' established return processes.

While credit card issuers are charged with investigating disputed transactions, the chargeback process has become much easier for consumers. Today, a cardholder can get a chargeback approved from their credit card company in just a few clicks. This forces a refund from the merchant, who can’t contest the chargeback until after it’s taken place.

What is the chargeback process?

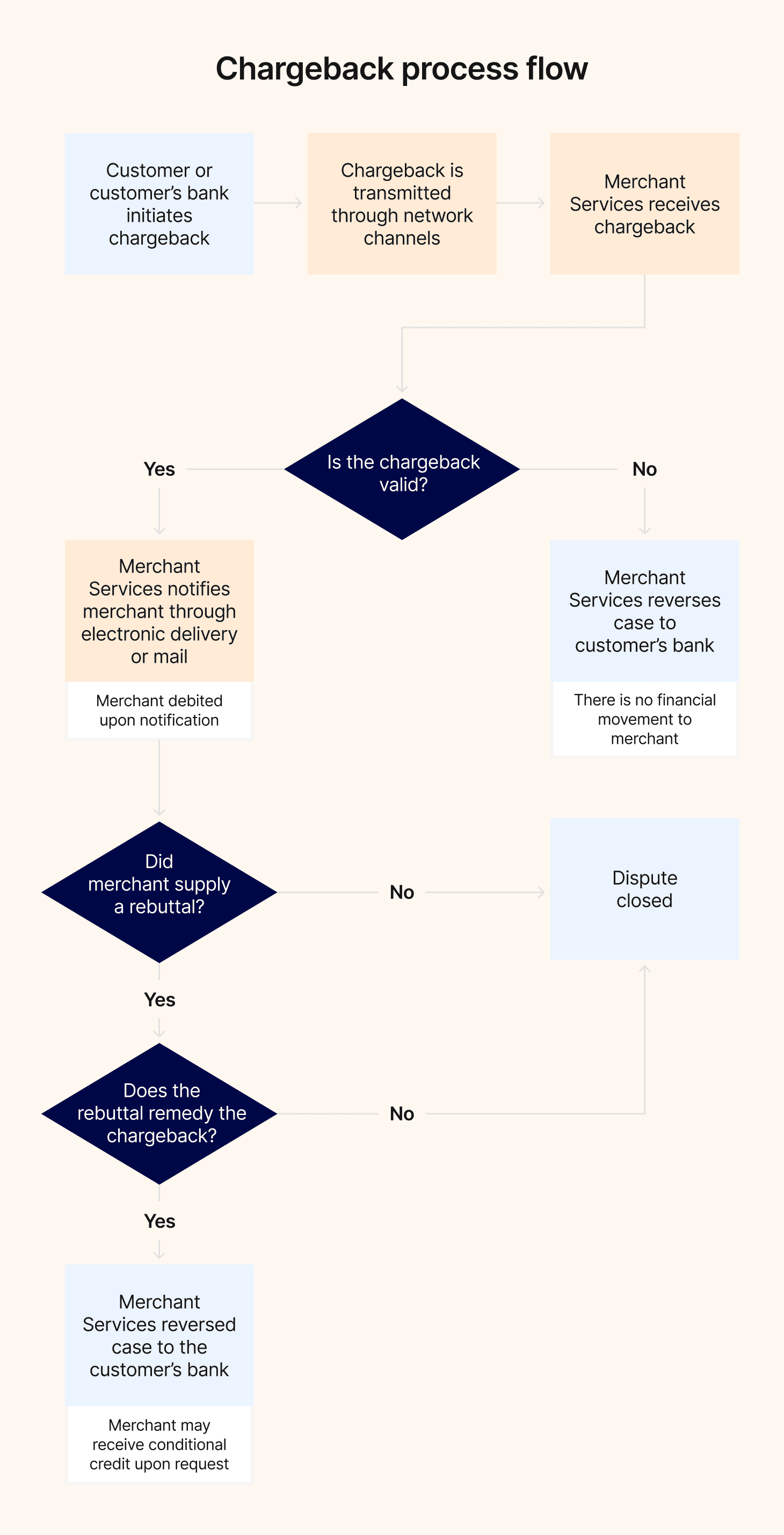

While it isn’t difficult for buyers to file a chargeback, there’s a lot that happens behind the scenes. The entire chargeback processing workflow can take weeks or even months. Here are the different steps involved in chargeback processing:

1) The cardholder disputes the debit or credit card transaction.

2) The issuer (the cardholder’s bank) sends the transaction back to the acquirer (the bank that the merchant is associated with) electronically. At this time, the cardholder’s account is temporarily credited for the amount of the charge.

3) The acquirer receives the chargeback and notifies the merchant. At this time, the amount in question is temporarily debited from the merchant’s account.

4) The merchant then accepts or disputes the chargeback. If fighting the chargeback, the merchant must provide compelling evidence that they fulfilled their obligations. For example, let’s say you have an ecommerce store that sells office furniture to companies. Documentation like a proof of delivery would be compelling evidence in this case.

5) Once the merchant sends the acquirer evidence that the product or service was legitimately purchased and delivered to the buyer, the acquirer will pass this information on to the issuer.

6) The issuer then reviews the evidence and makes a decision in favor of the merchant or buyer on the chargeback case.

7) The cardholder and merchant are notified of the case decision. If the issuing bank rules in favor of the cardholder, the temporary credit to their account and debit from the merchant’s account are made permanent. If the issuing bank rules in favor of the merchant, the temporary debit from their account is reversed, along with the temporary credit to the cardholder’s account. If either party disagrees with the decision, they can go into arbitration.

Clearly, chargeback processing is no walk in the park.

And even after all that effort, there's no guarantee of success. With an average win rate of just 32%, it's no wonder that at least 40% of all chargebacks go undisputed.

But giving up isn't the answer. Too many chargebacks can lead to additional fines, higher processing costs, and a loss of card processing rights in severe cases. Most card networks set a threshold of around 1% of all transactions, a limit that's easy to exceed without proactive measures to reduce chargeback risk.

The “friendly fraud” phenomenon

While sophisticated fraud techniques are part of the chargeback problem, the biggest source of chargebacks is something called "friendly fraud." This occurs when real customers initiate chargebacks unnecessarily.

Imagine a B2B buyer who wants to return an item but finds your return process too complicated. Instead of contacting you, they might file a chargeback. Or consider a customer who doesn't recognize a charge on their statement and immediately disputes it instead of investigating. Shockingly, 86% of chargebacks are likely cases of friendly fraud. Even more alarming, more than three-quarters of customers admit to filing a chargeback out of sheer convenience.

Clearly, better communication and collaboration with customers can reduce many chargebacks caused by friendly fraud. The better your relationships with your customers, the less likely they’ll go the chargeback route if they have an issue with your products or services.

Understanding chargeback reason codes

Knowing what causes chargebacks is the first thing you need to do to reduce chargeback risk. While friendly (and unfriendly) fraud account for the majority of chargebacks, other chargebacks occur because of merchant errors, misleading advertising claims, and other issues.

Each credit card issuer has developed a complex list of chargeback reason codes they use when investigating disputes. These codes help categorize the specific reasons for chargebacks and guide the resolution process. While the exact codes may vary between card networks, they generally fall into several common categories:

Fraud — This includes both card-not-present and card-present fraud, where transactions are processed without the cardholder's permission.

Processing errors — These can include duplicate charges, incorrect transaction amounts, or late presentment of transactions.

Authorization issues — Chargebacks may occur when proper authorization procedures aren't followed or when a transaction is processed after a card has been reported lost or stolen.

Consumer disputes — These cover a wide range of issues, including goods not received, services not provided, defective merchandise, or items not as described.

Technical issues — Problems like expired authorization or no authorization obtained can lead to chargebacks.

By familiarizing yourself with these reason codes and the specific requirements for each, you can better prepare your business to prevent chargebacks and successfully dispute those that do occur. For instance, knowing that "goods not received" is a common reason code might prompt you to implement better tracking and delivery confirmation processes.

Other specific, positive steps you can take to reduce chargeback risk include:

Implementing internal fraud protection procedures

Eliminating manual data entry

Clearly defining refund and return policies

Reaching out to customers if goods or services can’t be delivered as promised

Each chargeback reason code has specific time limits, required documentation, and procedures for resolution. Staying informed about these details can improve your ability to manage and reduce chargebacks effectively.

12 common reasons for chargebacks

1) Card-not-present fraud — Customer claims the transaction was processed without permission, or with a fake account number.

2) Card present fraud — Customer claims the transaction wasn’t authorized.

3) Data entry errors — Customer claims that a data entry error (e.g., the wrong transaction amount) was made at the point-of-sale.

4) Defective or misrepresented products / services — Customer claims goods or services were damaged, defective, or otherwise unsuitable.

5) Undelivered goods or services — Customer claims they never received the promised goods or services.

6) No-show billing — Customer claims that a no-show transaction was billed to their account or that a charge was added to an original valid transaction.

7) Canceled recurring transactions — Customer claims the merchant billed a transaction to the same account number after the recurring payment plan expired or was canceled.

8) Duplicate processing — Customer claims that a single transaction was processed more than once to the same card number, at the same merchant location, for the same amount on the same date.

9) Late presentment — The customer’s bank claims the transaction wasn’t processed within the required time frame.

10) Paid by other means — Customer claims the transaction was paid by another payment method.

11) Invalid authorization — The customer’s bank claims that the transaction was processed without sufficient electronic authorization or account verification.

12) Unprocessed credits — Customer claims a credit wasn’t issued, even though the merchant issued a credit transaction receipt or promised a refund.

Many of these issues can be addressed proactively through automated internal processes and better customer communication.

Which businesses face the highest chargeback risk?

While any business accepting credit card payments can fall victim to chargeback fraud, some industries and business types are particularly vulnerable. Understanding your risk profile is critical if you want to develop an effective chargeback prevention strategy. High-risk industries include:

E-commerce and online retailers — The nature of card-not-present transactions makes these businesses prime targets for fraudsters.

Travel and hospitality companies — Airlines, hotels, and travel agencies often deal with high-value transactions and complex booking systems, increasing their chargeback risk.

Subscription-based services — Recurring billing models can lead to confusion or forgotten cancellations, resulting in chargebacks.

Digital products and services companies — Software companies and digital content providers may face challenges in proving delivery of intangible goods.

High-ticket item sellers — Businesses dealing with expensive products are attractive to fraudsters looking to maximize their illicit gains.

Adult entertainment and online gaming companies — These industries are often considered high-risk due to their nature and the frequency of disputed charges.

Cryptocurrency exchanges — The volatile nature of cryptocurrencies and the irreversibility of transactions can lead to increased chargeback attempts.

Small and medium-sized enterprises (SMEs) — Often lacking robust anti-fraud measures, SMEs can be seen as easy targets by fraudsters.

Even if your business doesn't fall into these categories, you're not immune to chargeback risk. The rise of friendly fraud means that any business accepting credit card payments must be vigilant and proactive to reduce chargeback risk.

For B2B merchants, the increasing volume of credit card transactions means that chargeback risk is becoming a more pressing concern. As more buyers opt for the convenience of credit cards, B2B sellers need to be prepared to handle the associated risks.

Regardless of your industry, implementing a comprehensive chargeback prevention strategy is no longer a luxury. This is where anintegrated payments solution can make a difference, providing tools and safeguards to protect your business from the financial and reputational damage of excessive chargebacks.

How an integrated solution can reduce chargeback risk

While there are multiple strategies to reduce chargeback risk—such as deploying fraud detection tools, reducing human error, and improving customer communication—implementing these separately can be complex and time-consuming.

A more efficient approach is to adopt a fully integrated payments solution that addresses all these aspects in one package. At Versapay, we offer a state-of-the-art payment processing and accounts receivable automation platform that helps address the major causes of chargebacks—fraud, human error, and poor communication—all in one.

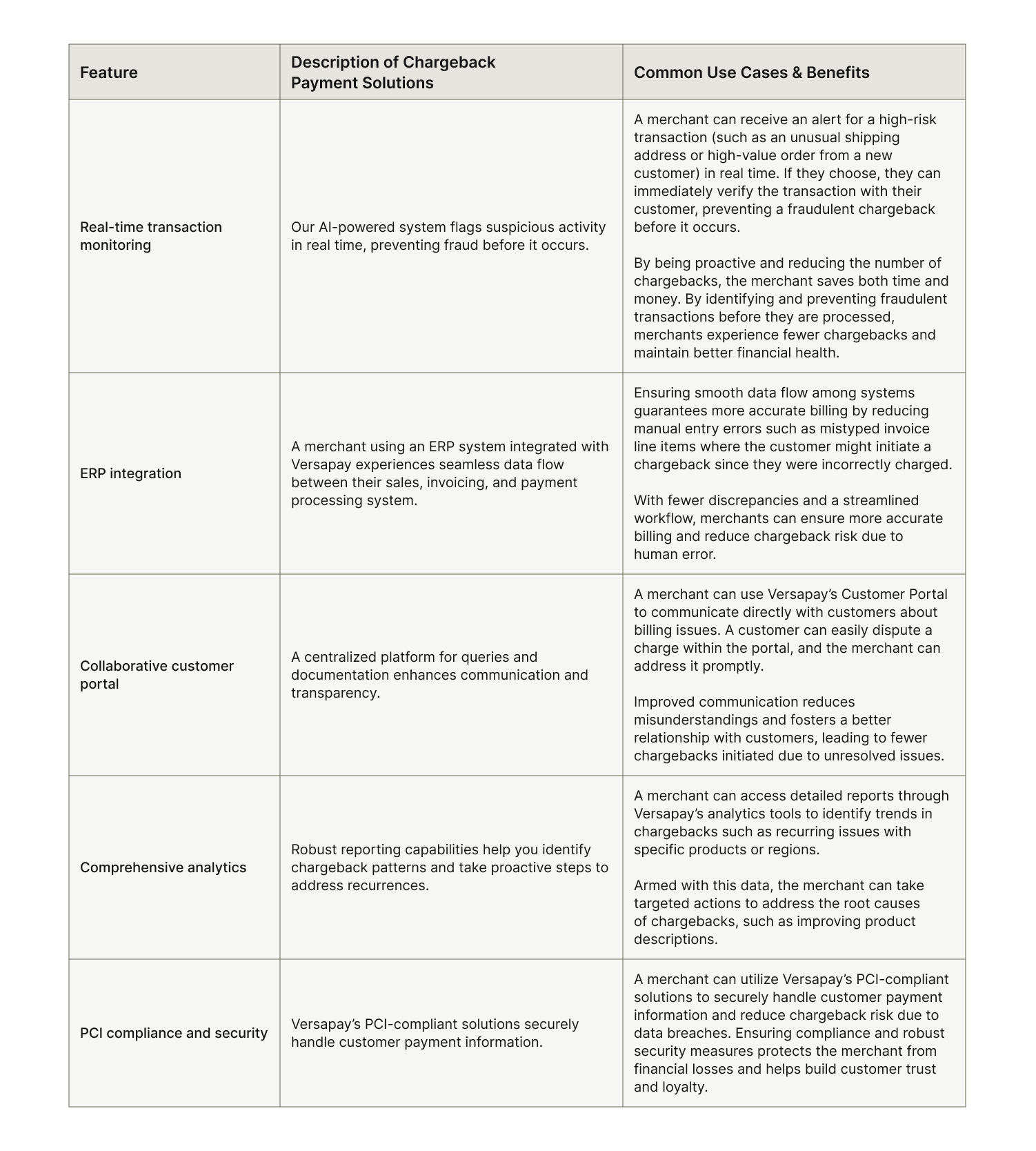

Versapay's payment processing solutions incorporate five key features designed to reduce chargeback risk:

By leveraging these chargeback payment solutions, Versapay helps you preemptively identify and prevent fraudulent transactions, automatically improve compliance and security, and reduce data entry errors. The result? Fewer chargebacks, improved financial health, and strengthened customer trust and loyalty.

Reduce chargeback risk today

While chargebacks pose a threat to B2B merchants, they're not an insurmountable challenge. With the right chargeback payment solutions, you can reduce chargeback risk and protect your bottom line.

Versapay's integrated payments solution offers a comprehensive approach to chargeback prevention. With automated fraud detection, seamless ERP integration, a collaborative customer payment portal, detailed reporting analytics, and robust security measures, you can turn the tide against chargebacks and focus on growing your business.

Ready to reduce chargeback risk and streamline your payment processes? Talk with a Versapay expert today. Our team can protect your business from chargebacks while transforming your entire invoice-to-cash experience for better cash flow and greater efficiency. Don't let another dispute eat into your profits—take charge of chargebacks before they take charge of your business.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.