Guide to Cash Application Automation Software

- 14 min read

This comprehensive guide explores how automated cash application software works, and how it helps AR teams drive efficiencies and accelerate cash flow.

—

🎥 In a rush? Watch Versapay's cash application automation software product demo.

Receiving payment is great, but the buck—literally—doesn’t stop there; you still have work to do. You may think you know what the payment is for, but your accounting records likely do not, and unfortunately, that discrepancy is going to cause a lot of problems.

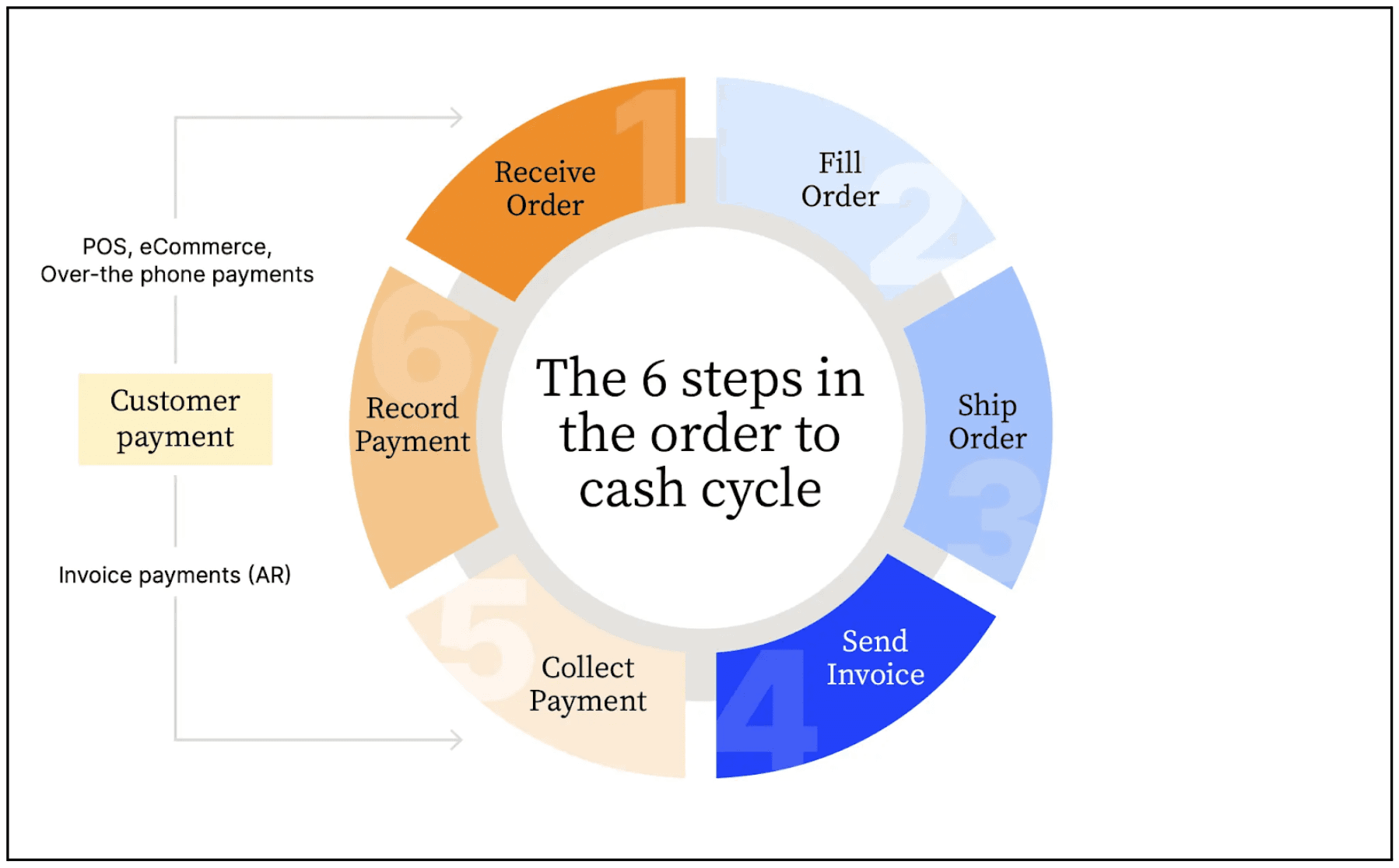

That’s where the cash application process comes in. It takes place during the sixth and final stage of the order-to-cash (O2C) process—nine o’clock in the illustration below—when you need to record payment.

Cash application involves formally matching payments with open invoices and customer records. Given the volume of invoices and payment methods and channels a modern organization deals with, the cash application process can be quite challenging and complex. And that’s before factoring in customers making partial payments, or covering multiple invoices in one lump sum.

The good news? Cash application automation software can make matching payments with invoices easier and deliver more accurate results in much less time. And with the cost of capital rising and economic growth slowing, finding new efficiencies in existing processes is more critical than ever.

Jump to a section of interest:

How cash application automation software streamlines remittance capture →

How cash application automation software digitizes remittance using OCR →

How cash application automation solutions handle complex matching →

How cash application automation solutions handle exceptions →

What is automated cash application software? (And why do finance teams love it?)

As we know, the cash application process involves recording revenue once a payment has been received. This typically includes tasks like gathering payment and remittance advice, matching that information to outstanding invoices, and posting it to your enterprise resource planning (ERP) system.

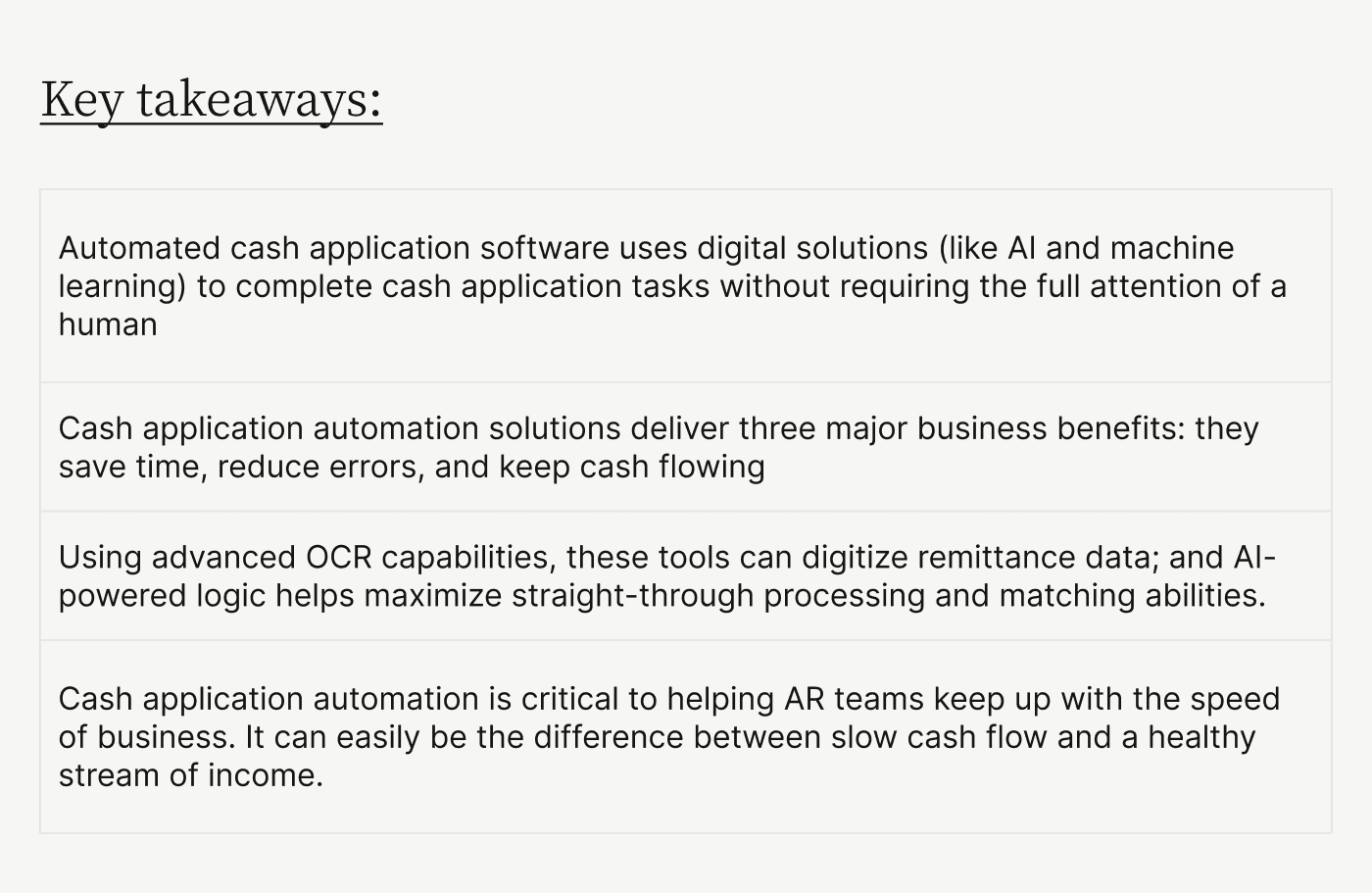

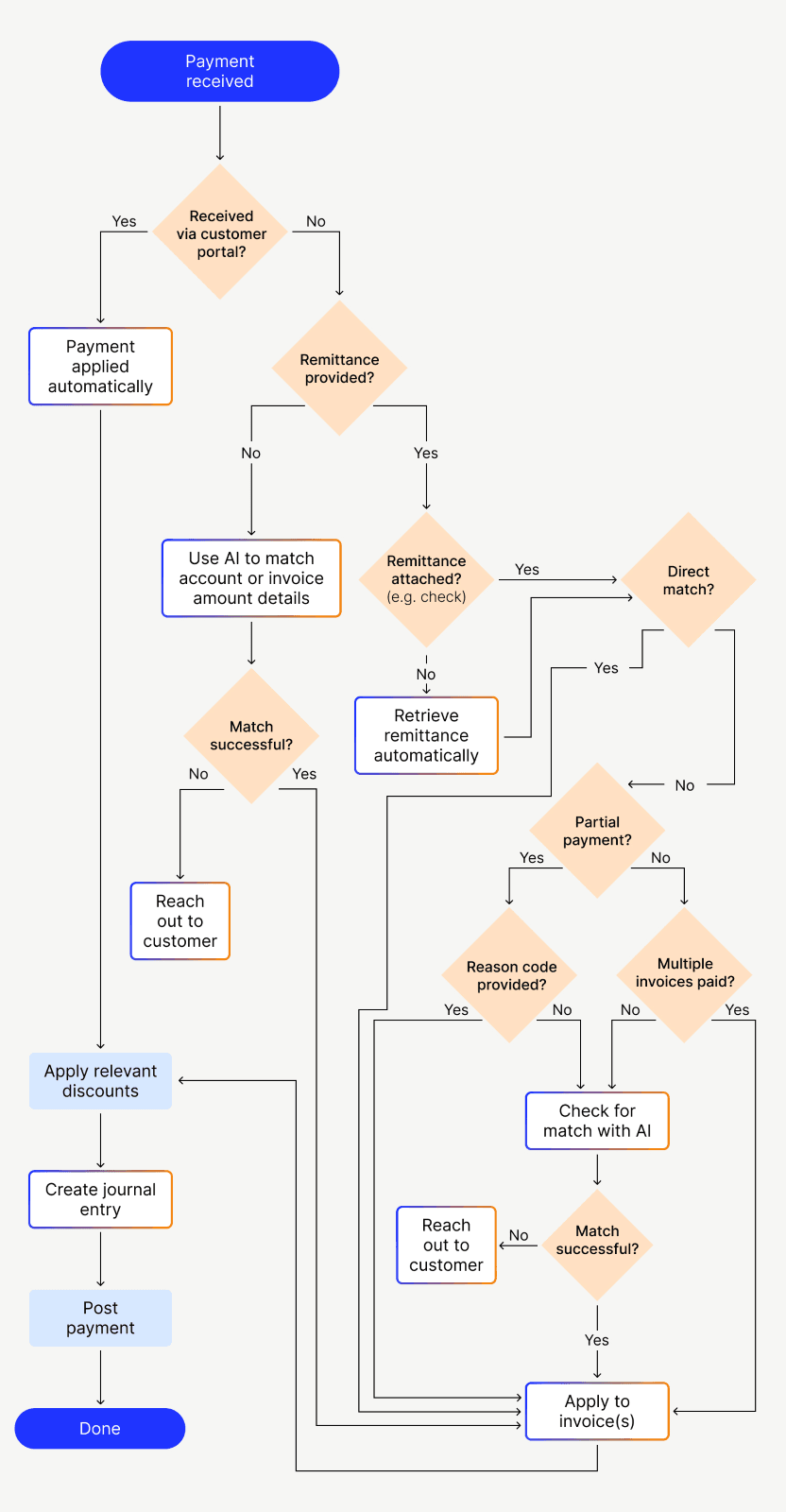

An automated cash application system uses digital solutions (like AI and machine learning) to complete cash application tasks without requiring the full attention of a human. And as the following chart demonstrates, there are a significant number of activities within the typical cash application process that could benefit from automation.

Note that the boxes outlined in blue and orange represent cash application tasks that automated cash application software can handle itself:

There are many reasons finance teams find automated cash application software helpful. That’s because these solutions ensure the cash application process is:

Accurate — The cash application process shouldn’t cause errors that can lead to delays and poor customer experiences.

Speedy — When cash is applied more rapidly, you’re able to reduce days sales outstanding (DSO) and processing costs, and give your enterprise quicker access to its cash.

Standardized — By having standardized, consistent cash application processes, you eliminate inefficiencies and remove compliance issues.

Here are three ways cash application automation delivers on those promises:

1. Cash application automation saves time

Completing cash application tasks like matching remittance data to payments manually can require a significant amount of work. An automated cash application system handles this task much faster by leveraging tools like artificial intelligence, optical character recognition (OCR), and machine learning.

In fact, there are (at least) six ways cash application solutions help accounts receivable teams streamline remittance capture, and ultimately accelerate revenue recognition. These solutions can:

Capture all incoming payment types

Extract remittance data automatically

Digitize incoming remittance advice

Automatically match remittances with open invoices

Identify unapplied payments

Investigate complex remittance situations

You can learn more about how cash application automation solutions streamline capturing remittance and payment data below.

2. Cash application automation reduces errors

Between documents like invoices and remittance advice, and delivery and acceptance channels like email, EDI, and AP portals, the cash application process is packed with data. Sorting through all of it can feel like putting together a puzzle without a picture of what you’re creating.

With automation, you can accomplish all your retrieval, matching and application tasks without human error—which, coincidentally, C-suite executives say is the greatest cause of invoice disputes.

3. Cash application automation keeps cash flowing

Because humans cannot complete application tasks as quickly as automated cash application software, the time between an invoice being paid and the recording of that payment is longer without automation. This gap makes it difficult to see which accounts are truly delinquent, slowing your collections and potentially creating awkward situations with customers.

Customers are rarely pleased when you call to tell them they’re past-due on an invoice they already paid. (And are even less pleased when you mistakenly place credit holds on their account.) Cash application automation tools help you avoid these scenarios while also reducing that gap in time, ensuring you have the cash on hand you need to keep your operations running smoothly.

Much of this is made possible by cash application automation’s capacity for straight-through processing. Straight-through processing is defined as “payment processing that is completely free of human intervention.” Given all the human involvement required in manual payment processing, you can imagine why this is something finance teams aim for. With the right automated cash application software, you can achieve straight-through processing rates upwards of 90%.

—

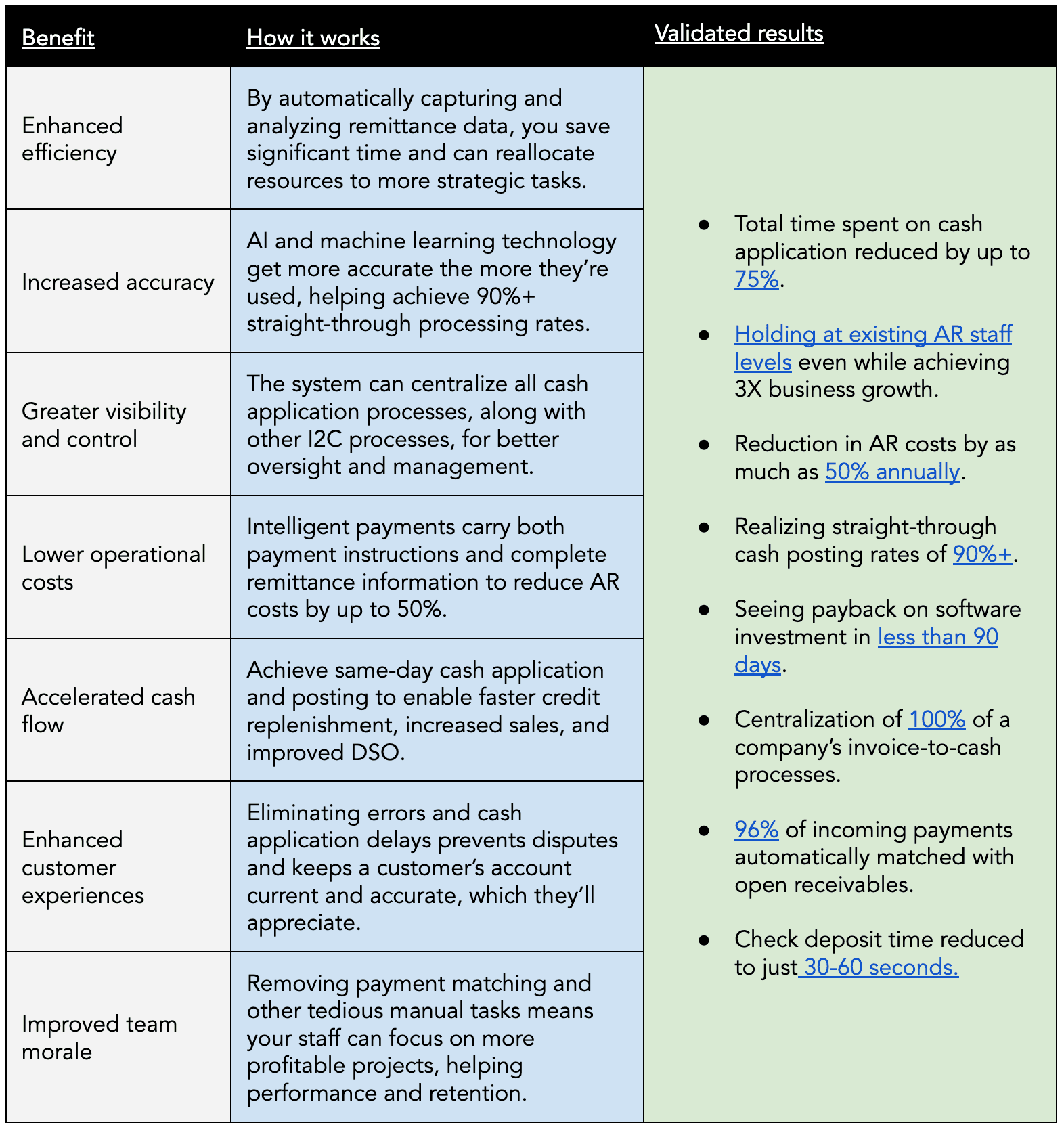

Beyond the above broad benefits, cash application automation tools can deliver a long list of improvements and tangible returns. And it bears mentioning: The longer these solutions are in use—particularly those leveraging AI and ML—the smarter they become, with corresponding effects on the benefits they bring:

How does cash application automation software streamline capturing remittance data and payments?

Typically, cash application automation software captures remittance information and payments through integrations with ERP and payment processing systems. This process can prove challenging as customers and internal accounting teams rely on many different systems, meaning that each one may capture different types of data and format it in unique ways.

Smart payments are a powerful solution to this issue, which cash application solutions can enable. These payments carry critical business information alongside the payment itself. That means as businesses transact with each other, data flows alongside the money, giving it context and helping accounts receivable and accounts payable (AP) teams fully understand and assess the purpose of each payment. (This is especially helpful for payment types that don’t require or typically include remittances, like ACH.)

Smart payments make the entire B2B payment process faster, more cohesive, and less labor-intensive.

But, smart payments are only part of the equation. For cash application automation software to automatically capture payments and uniquely formatted data types, there are other considerations and capabilities the solution must possess. This includes proficient optical character recognition capabilities to digitize remittance data, and AI-powered complex matching logic to maximize straight-through processing and matching abilities. Both of these elements are covered below.

How does cash application automation software digitize remittance data using optical character recognition?

Before a cash application automation solution can begin matching incoming payments with the correct invoices, it first needs to read, digitize, and import remittance data. That’s where tools like optical character recognition come in.

What is remittance data?

First, the basics: Remittance data is the clarification a customer provides along with their payment that tells their supplier what invoice the payment is for. Without it, determining which open receivable to match a payment to requires more manual effort. Remittance advice can also act as confirmation that a payment is on the way. Some companies call this a remittance slip, or even a payment voucher.

❗️❗️Note that even when you set guidelines for how remittance data should accompany payments, it is often structured improperly or with critical details missing❗️❗️

Why is disorganized remittance data so common?

Traditional, paper-based payments like checks generally include information in the memo line about how they should be applied. Even modern electronic payments–like eChecks—possess complicated remittance data. And when dealing with ACH, EFT, wire transfers, and virtual cards, remittance data often arrives separately in an array of possible formats.

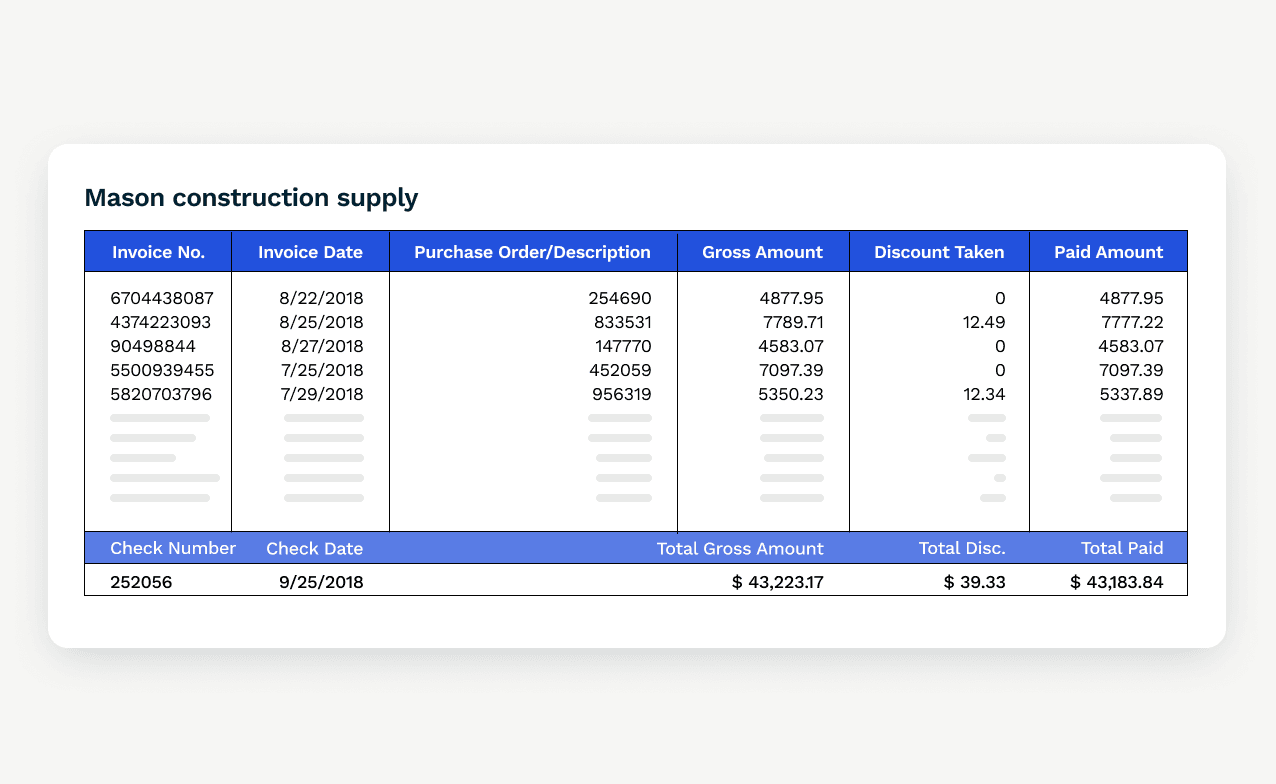

Also, remittance data is technically a courtesy, meaning that there’s no requirement for your customer to send any at all. Here’s an example of a remittance slip. Notice it shows commonly included elements like invoice numbers, discounts, paid amount, and more:

What is optical character recognition and how does it ingest and digitize remittance information?

Optical character recognition (OCR) tools convert text images into machine readable text formats. In the context of cash application automation software, OCR is the technology that auto-extracts check stub information easily and accurately. It does this by either using templates to identify the parts of an image that contain needed data, or with AI that searches for specific items indicating areas of interest. And when paired with AI, it’s able to do so faster and more accurately the more frequently it’s used.

Beyond ingesting and digitizing physical checks, optical character recognition technologies can also interpret data and remittance advice from a variety of sources, including lockbox files and AP portals and emails. It can also configure payment application rules and match buyer codes with supplier codes.

How do cash application automation solutions handle complex matching scenarios?

Cash application is rarely as easy—or as straight-forward—as matching invoices with payments of the exact same amount. Buyers frequently submit single, large payments to cover a number of individual items, or make partial payments, covering line-items, but not full invoices. (Some customers will make large payments that seemingly cover multiple invoices, but never align neatly with any one invoice.)

The good news is that cash application automation solutions can handle complex situations like these.

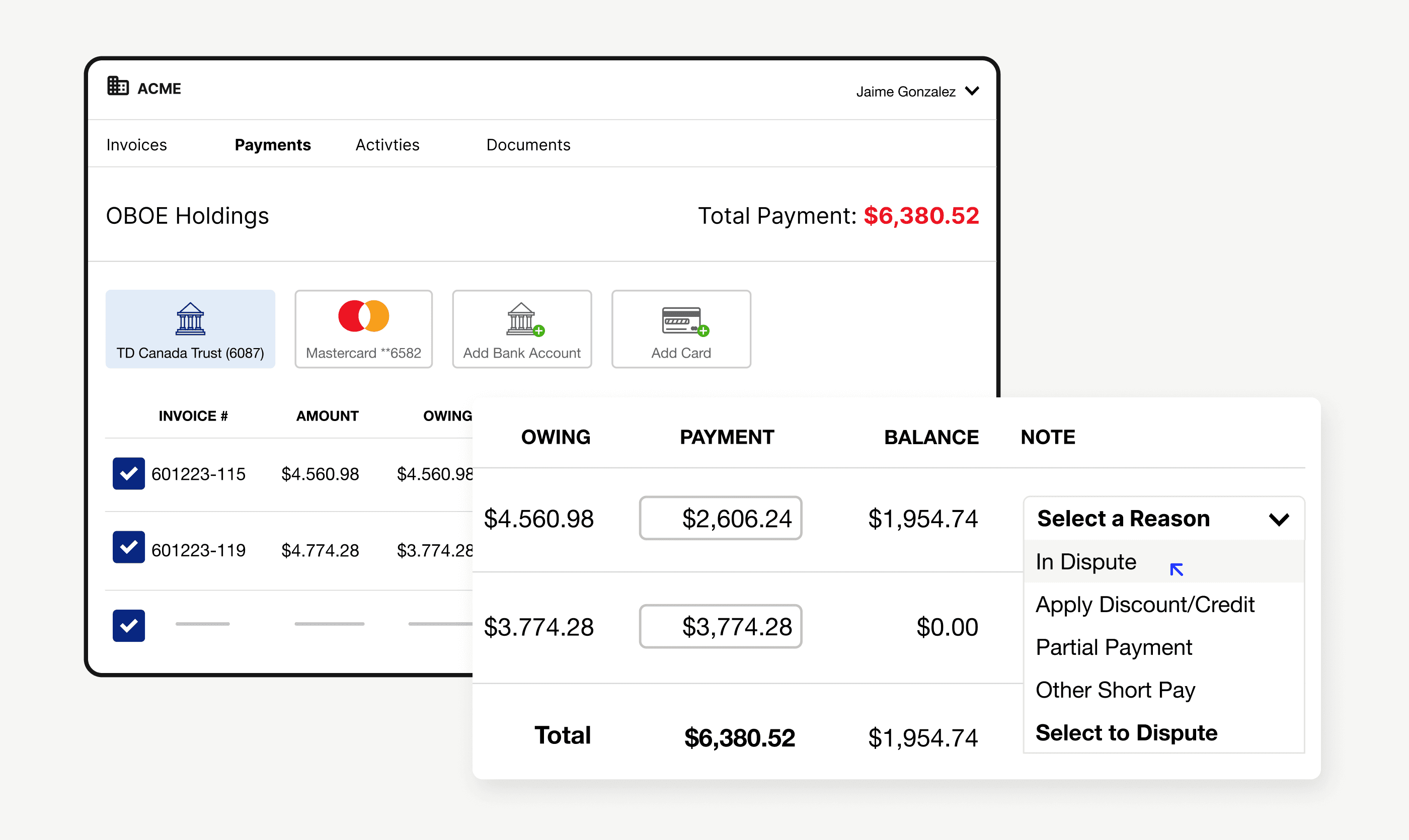

There are a few reasons a buyer may short-pay. Perhaps they were promised a discount yet that information was never relayed to the accounts receivable team; or perhaps they did not receive all the items they ordered. Regardless of the reason, when paying invoices through a payment portal (that includes a cash application automation tool), customers can flag a short-pay and select a reason code.

These reasons often include the aforementioned missing items, as well as things like damaged goods or unrendered services. From there, cash application automation solutions can search for the reason code and use that to find the matching invoice amount. And when you use a solution like Versapay’s, comments can be made directly in the platform to further explain those short payments.

And what about those single, large payments, you ask?

When buyers purchase significant amounts of items from you, it’s often easier for them to send payment for everything in one lump sum. When this occurs, built-in AI tools within cash application automation software kick in and do the math to determine that the amount paid is equal to a unique combination of outstanding invoices.

It then applies the payment accordingly. This saves your team the time it would take to search for all these invoices and attempt to solve the puzzle.

How do cash application automation solutions handle exceptions?

Even the most advanced cash application tools are bound to encounter situations where straight-through processing simply isn’t possible. After all, AI and ML can’t figure out how to solve a problem until they’ve encountered it at least once.

While exceptions come in many different shapes and sizes, they frequently involve things like short-pays or payments severely lacking in critical information. When this happens, a cash application automation solution’s exception handling capabilities should kick in.

When setting up and using automated cash application software, users should be able to create routing rules that determine where—and to whom—information about exceptions should be sent. From there, an employee can review the information and take the appropriate action.

And because so many other tasks have already been taken off their hands by automation at this point, these employees are able to focus fully on solving these problems, rather than having it sit for days.

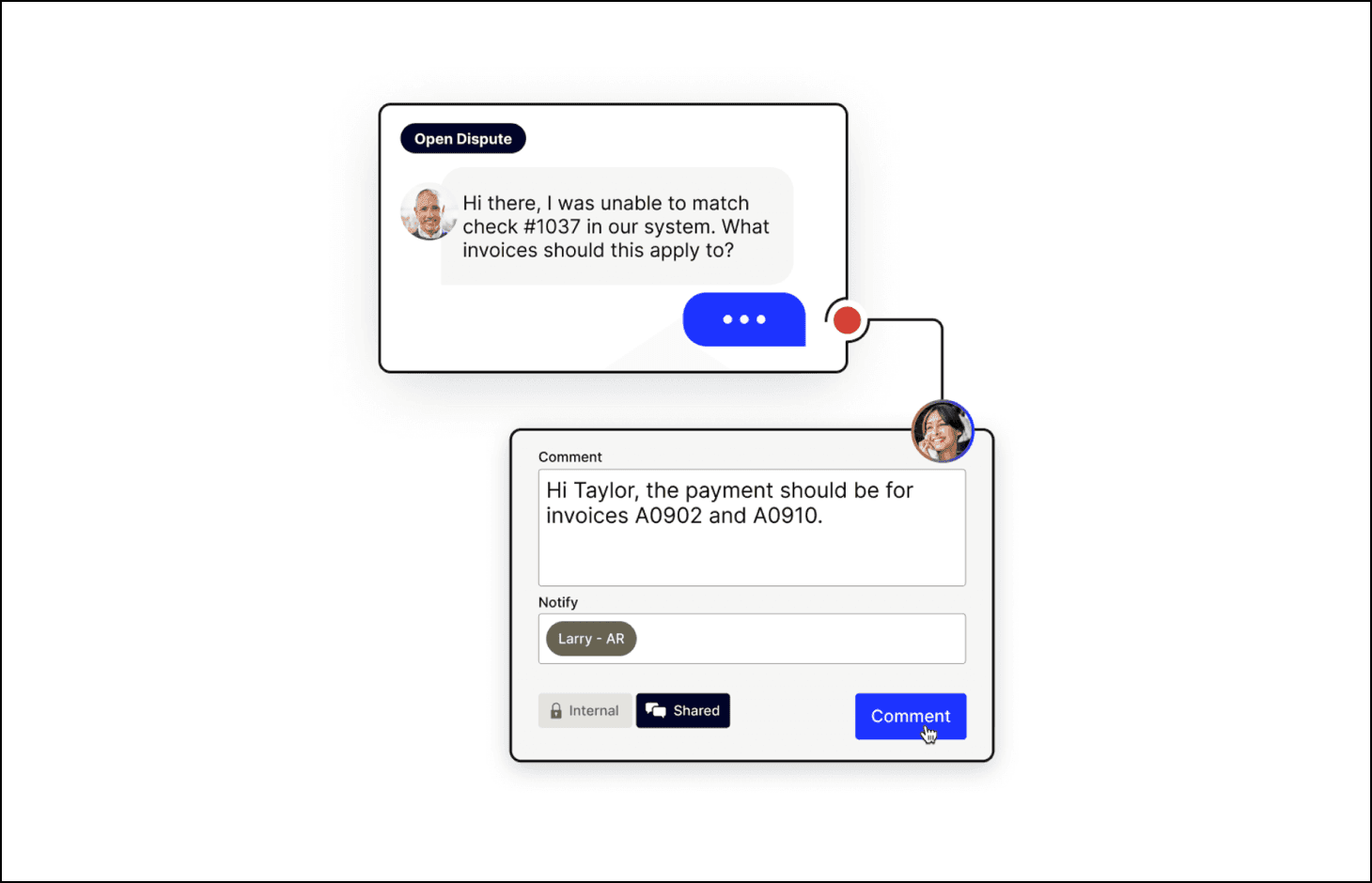

On top of that, some cash application automation software—like Versapay’s—provide a collaborative accounts receivable payment portal where you can connect with customers in real-time, over the cloud to resolve the dispute directly within it. That means you don’t have to worry about endless email chains or games of phone tag that take up valuable hours of your team’s time.

Get an even deeper understanding of cash application automation

Cash application automation is critical to helping accounts receivable teams keep up with the speed of the modern business world. It can easily be the difference between slow cash flow and a healthy stream of income.

It’s also important to remember that automated cash application software doesn’t just affect your day-to-day life—it has a major impact on customer experience. And in times like these, holding on to every customer you can is critical. Plus, who doesn’t want their customers to have great payment experiences?

To get an even better understanding of cash application itself, check out our finance leader’s guide to driving efficiencies with AI-powered cash application automation software. This guide will walk you through the steps in the cash application process and detail the key challenges finance teams face.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.