A Finance Leader's Guide to AI-Powered Cash Application

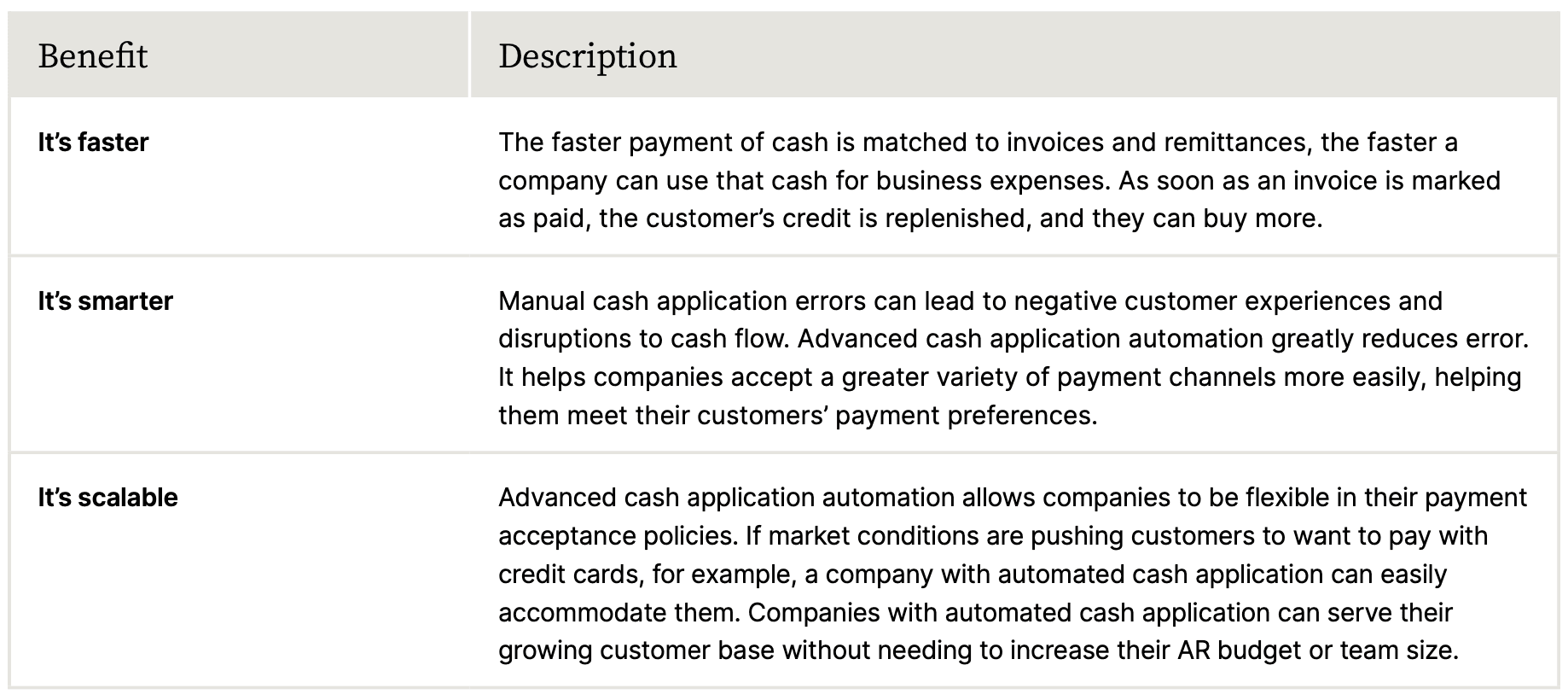

With advanced cash application automation technology, you can harness powerful, high-tech tools to make your cash application process smarter, faster, and stronger.

Drive Efficiencies with AI-Powered Cash Application Automation Software

October 17th, 2023

This guide for finance leaders explores how advanced cash application automation can:

→ Transform your accounts receivable

→ Drive efficiency and reduce manual labor

→ Make matching payments with open receivables simple and easy

Plus, get tips on selecting the right partner for your advanced cash application automation solution.

What's inside this guide?

With advanced cash application automation technology, you can harness powerful, high-tech tools to make your cash application process smarter, faster, and stronger. Here's what you'll find within:

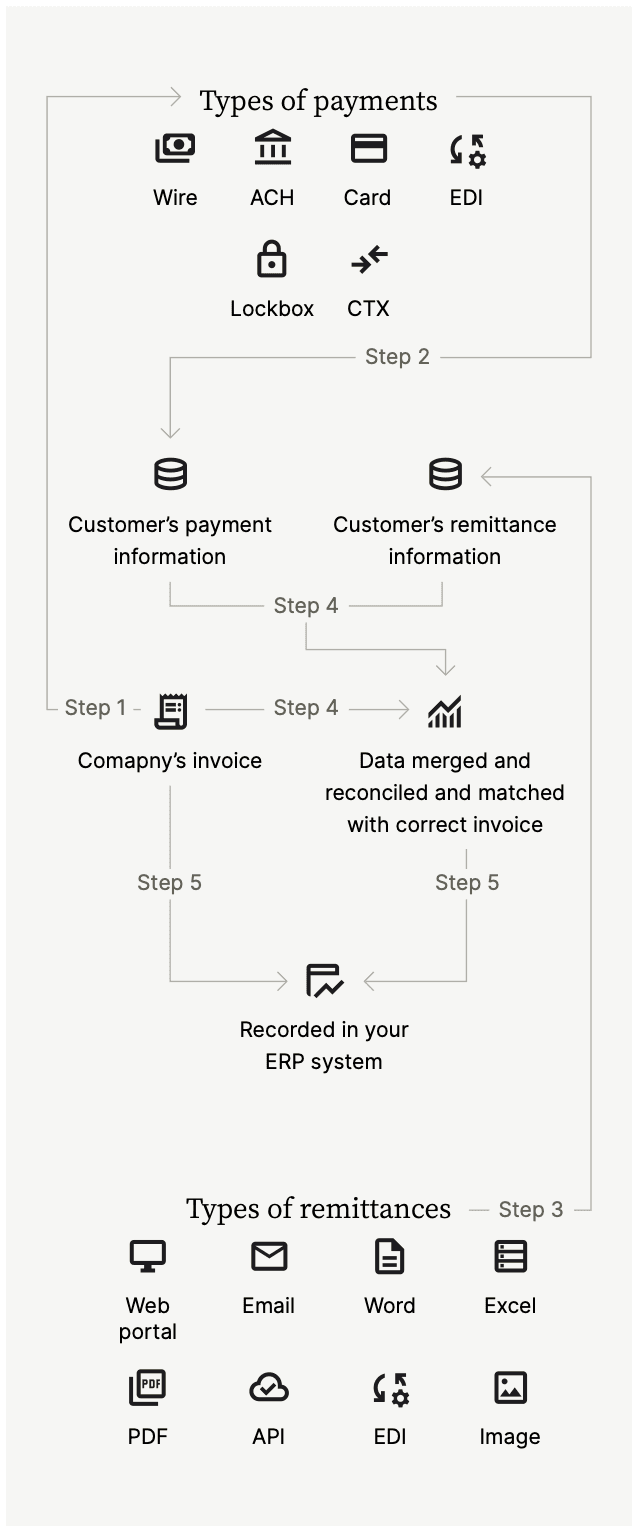

- What cash application is and how it works

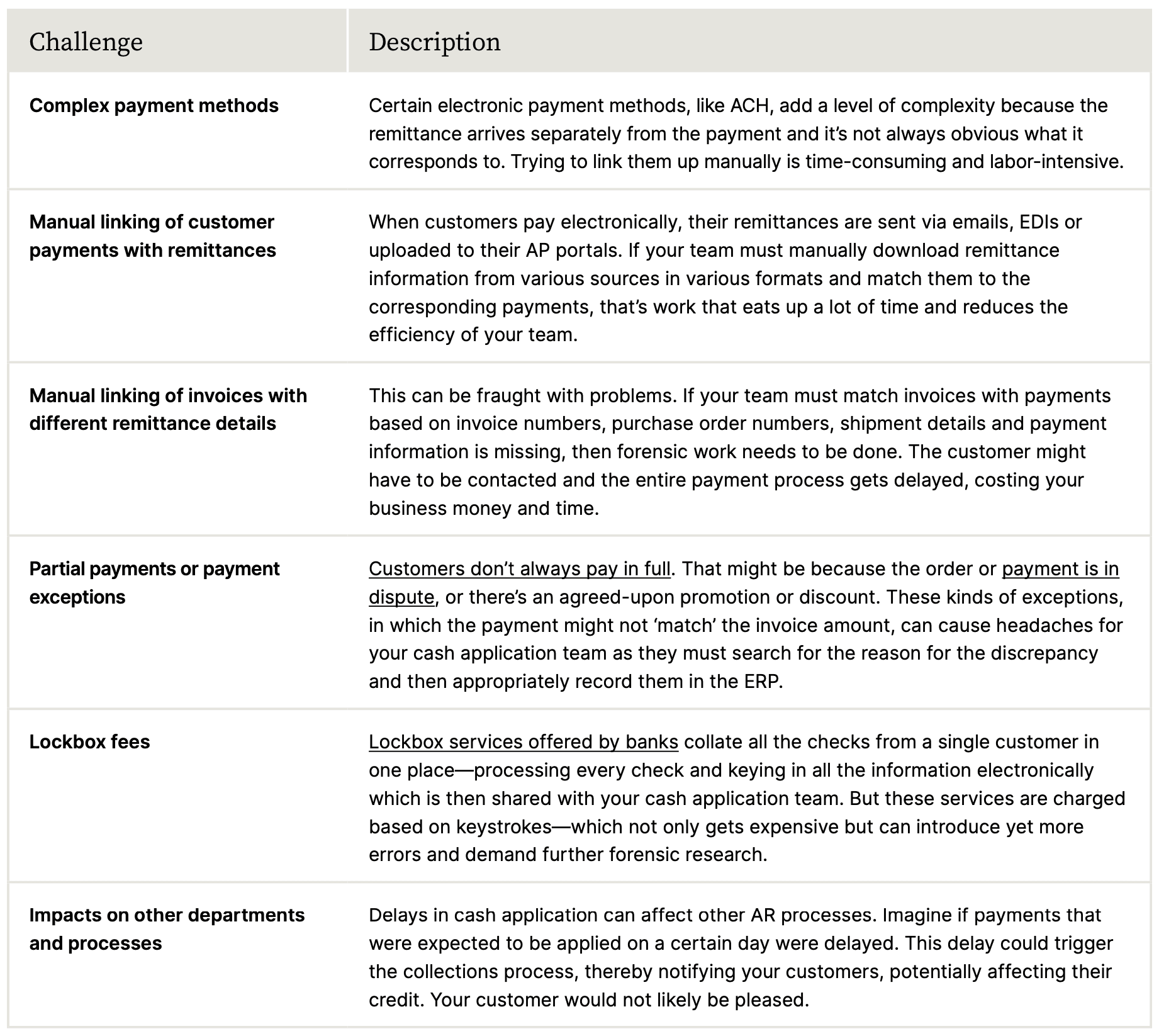

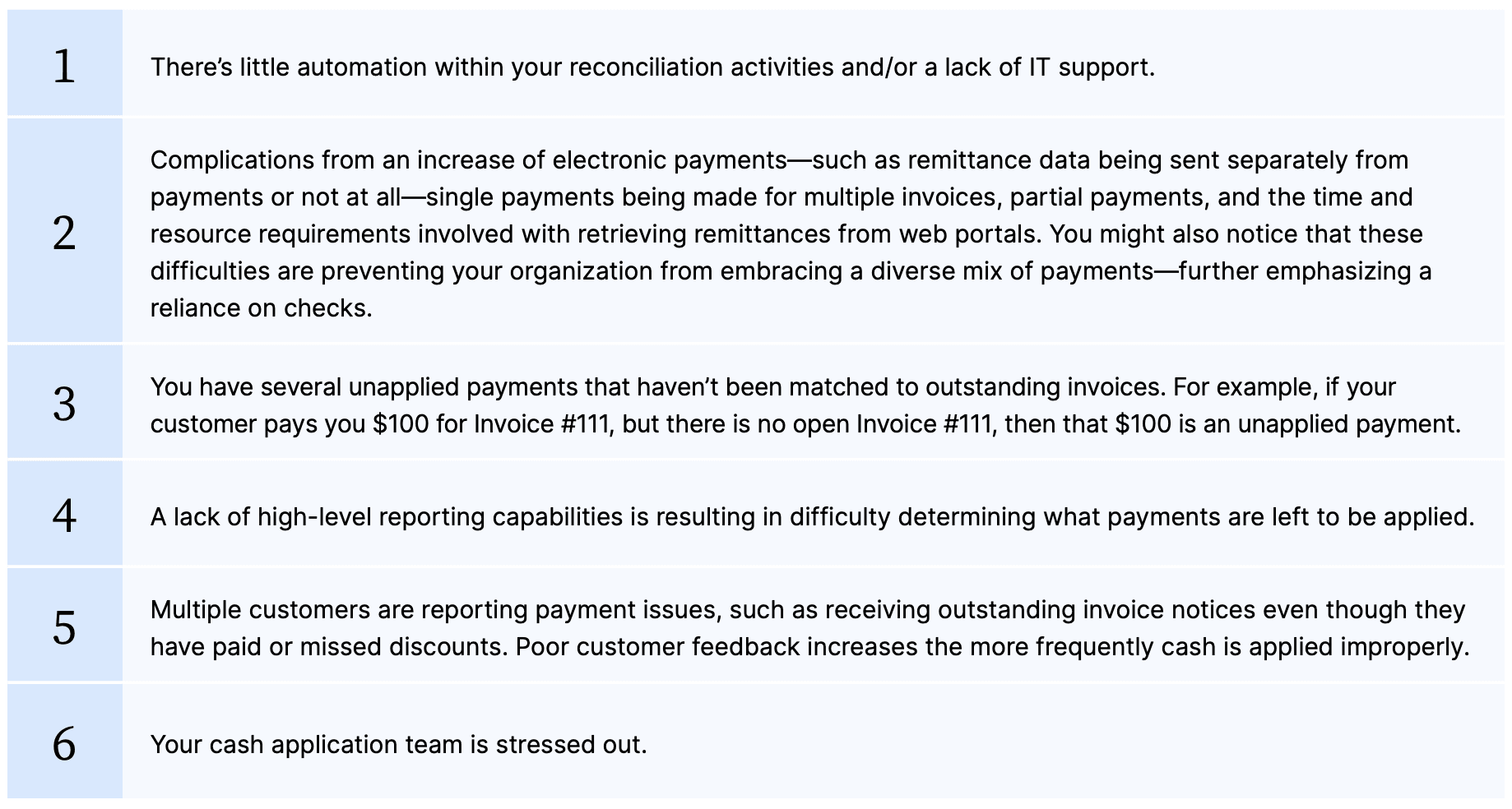

- The risks of manual cash application and applying payments incorrectly

- How to accelerate cash flow with advanced cash application automation

- Real-world cash application automation success stories

- And much, much more