How Suppliers can use Trade References and Accounts Receivable Data to Build Strong Customer Relationships

- 10 min read

Trade references offer historical transaction information, helping a company prove its creditworthiness. Beyond valuing their utilitarian features, however, suppliers can also use trade references to build strong customer relationships.

In this blog, we’ll cover the basics like what trade references are and how suppliers should evaluate them. We’ll also explore how accounts receivable payment portals assist with credit evaluations and more.

Key takeaways

Credit evaluation is a critical part of accelerating cash flow, increasing collection efficiency, and boosting CX. Trade references play a role in helping you evaluate credit quickly.

Trade references help you evaluate a customer’s suitability for more credit.

You can help customers build credit by submitting trade references to credit monitoring agencies.

Accounts receivable automation platforms play a role in streamlining credit evaluation by making critical data available to finance teams.

Here is a scenario every business faces: Your customer has requested a credit extension, and you're wondering if granting it is a good idea. Asking for and evaluating a trade reference is one way of solving this problem.

But what does a trade reference mean, and what should you look for in one?

In this article, you'll learn:

What is a trade reference?

A trade reference is a source that offers historical transaction information, helping a company prove its creditworthiness. For example, if a customer requests Net 90 terms, another company that has extended that customer credit in the past can help you decide whether you can safely extend credit.

While single references might work for you if your company operates in a small niche, the best way to evaluate creditworthiness is to check resources like Experian or Dun & Bradstreet (D&B) for business credit reports.

—

💡 Definition: A credit report summarizes a company's trade references, giving you a score between zero to 100, with higher scores indicating more creditworthiness.

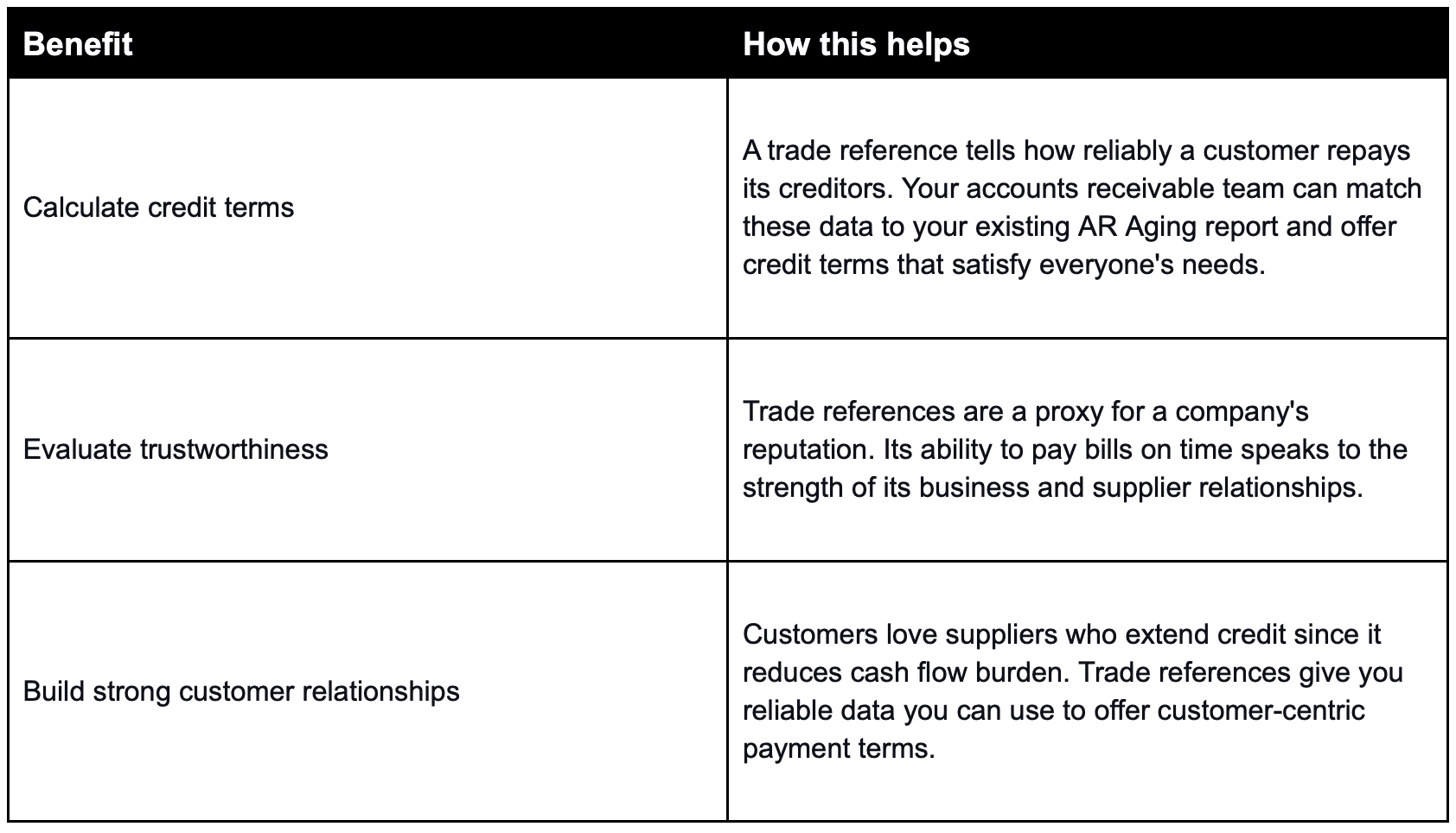

3 benefits of trade references for suppliers

Why should you care about a customer's trade references? Here are some important benefits of seeking and evaluating trade references when a customer requests credit.

Helps you calculate credit terms

Helps you evaluate trustworthiness

Helps you build strong customer relationships

What important information is in a trade reference?

Trade references contain the following information at a minimum:

Reporting date—The date a transaction occurred.

Payment channel—How the buyer paid the seller.

Identifying information—Business names and addresses.

Payment terms—Credit information such as Net 30, Net 90, etc.

Opening balance—From AR reports, before payment.

Closing balance—From AR reports, after payment.

Rolling 12-month credit high—The most credit used over the past 12 months.

Balance past due—Details of payments past due

Number of credit transactions—The number of transactions carried out using credit.

Total number of transactions—The total number of credit and cash transactions.

Trade references and accounts receivable data

From the list above, you can see that data commonly found within accounts receivable payment portals is central to helping you evaluate a customer's creditworthiness. Accounts receivable data plays another critical role, too: Your AR team must analyze existing cash flow and aging tables before offering a customer terms.

Ensuring that your AR data is centralized and accessible to your finance teams is critical when evaluating credit applications.

3 ways suppliers can help buyers create a trade reference

Suppliers play a critical role in helping their customers create a trade reference. Typically, customers request suppliers to submit transaction information to credit monitoring agencies like Experian and D&B. These submissions help customers establish business credit and secure good terms with new suppliers.

Helping your customers establish a trade reference is good business. You can proactively offer a trade reference to customers who pay on time, gradually extending their credit and helping them build a reliable credit profile. These actions lead to healthy business relationships and loyalty during challenging times.

Here are a few other ways you can help your customers establish a trade reference:

Proactively grant short credit terms

Automatically submit trade references

Educate your customers

1. Proactively grant short credit terms

Depending on your AR aging picture, you can be proactive and offer credit terms before customers file a request. This approach communicates a desire to establish a long-term relationship and shows empathy for your customer's situation.

New companies will appreciate this move immensely since it helps them establish business credit quickly. Over time, based on your customers' track record, you can create a credit policy that fulfills your and your customers' needs.

2. Automatically submit trade references

Customers establishing business credit will request you submit a trade reference to D&B or Experian. Both agencies offer portals for vendors to submit references with the information we previously listed.

Familiarize yourself with their processes since they differ a bit. For instance, you can automate D&B trade reference submissions by registering, obtaining a DUNS number, and submitting references through D&B's CreditBuilder application.

Without this automated process, D&B will have to contact you to verify transaction information—a time-consuming process. Automate trade reference reporting, and your customers will appreciate it immensely.

Experian's process is different, but you can automate it, too. The company requires trade reference providers to get in touch and establish a profile before it accepts that data.

3. Educate your customers

Establishing business credit can be intimidating to new companies. Help your customers through this process by educating them about what you can do for them.

For instance, a small business owner might be unaware of D&B's automated processes. By letting them know, you can empower your customers to request automatic trade reference submissions from other suppliers, helping their business grow.

4 best practices for suppliers evaluating trade references

What should you look for when you receive a trade reference? Here are four key points to evaluate:

Check trade reference relevance

Check relationship duration

Check supply frequency

Check business credit reports

1. Check trade reference relevance

While several trade references are great, a few relevant references are the best. This is because sector economics vary and affect credit cycles. Relevance in this context refers to the industry, company size, and payment terms.

For example, references for Net 15 terms with tire suppliers are irrelevant if your customer requests Net 30 and you operate in the food and beverage sector.

If a customer lacks relevant references, you can mitigate risk by offering short credit terms or requesting payment in cash.

2. Check relationship duration

The longer a trade relationship, the more reliable the trade reference. Long relationships prove payment consistency and supplier trust. Typically, new businesses lack these kinds of references.

In such situations, you can help them establish credit by gradually extending longer terms once they've proved their reliability.

3. Check supply frequency

Duration isn't the only time-based factor to look at. Order frequency also plays a role. For example, a company might submit two trade references from the same supplier spread a year apart. While the duration is long, the order frequency is low.

In contrast, a company that submits six references from a single supplier over three months is more reliable, even if the duration is shorter.

4. Check business credit reports

Back trade reference analysis up with credit reports from Experian and D&B. Both companies offer easy ways to request a credit report.

How accounts receivable payment portals assist credit evaluation

Accounts receivable data plays a central role in helping you evaluate credit applications. Here's how an AR payment portal simplifies the process.

Centralize transaction history

AR payment portals centralize a customer's transaction history, giving your finance team a handy resource. For instance, your AR team can view past invoices, dispute statuses, and outstanding credits per customer.

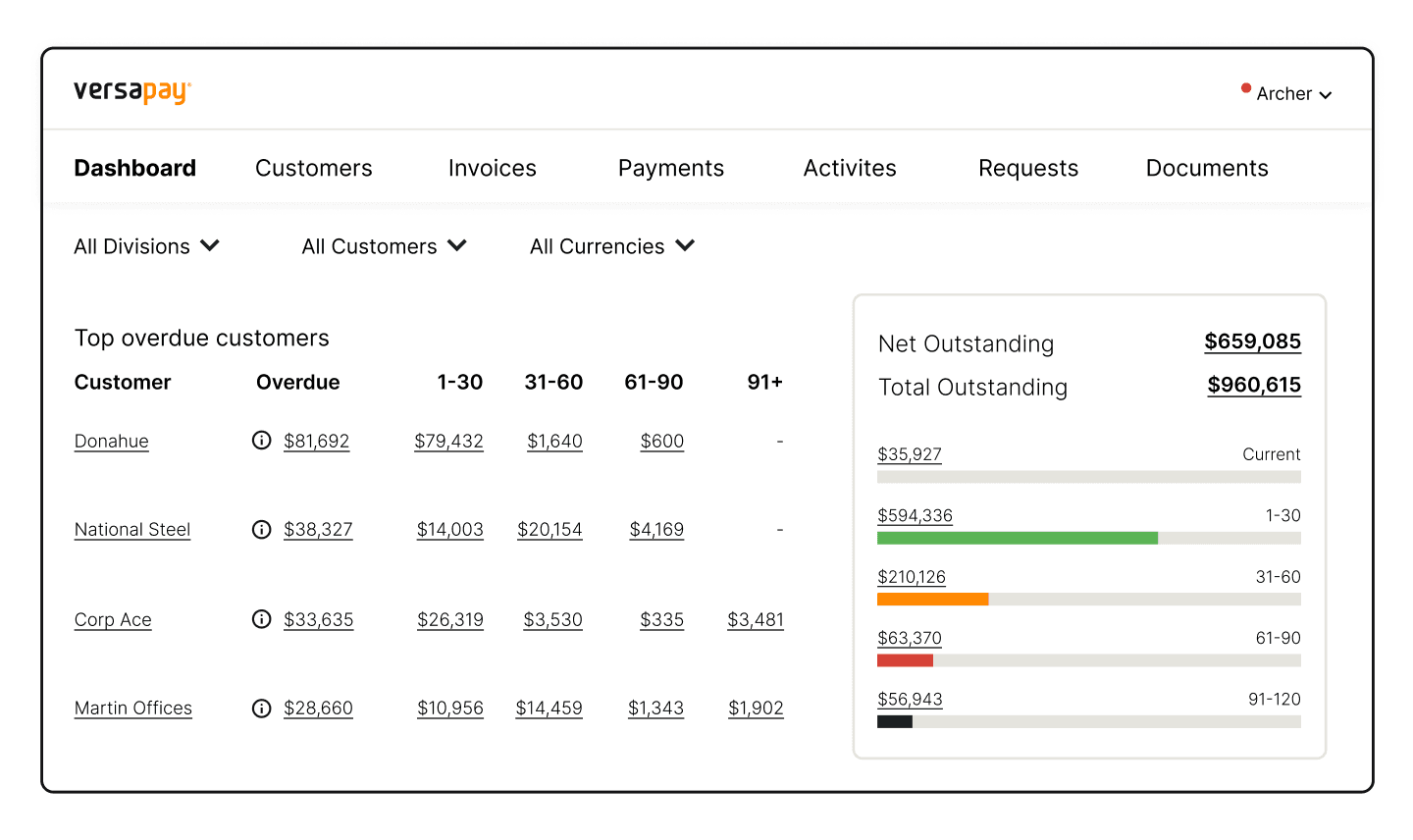

You can also attach relevant documents to each workflow step, creating an audit trail. The result is a single dashboard that gives you everything you need to make an intelligent decision.

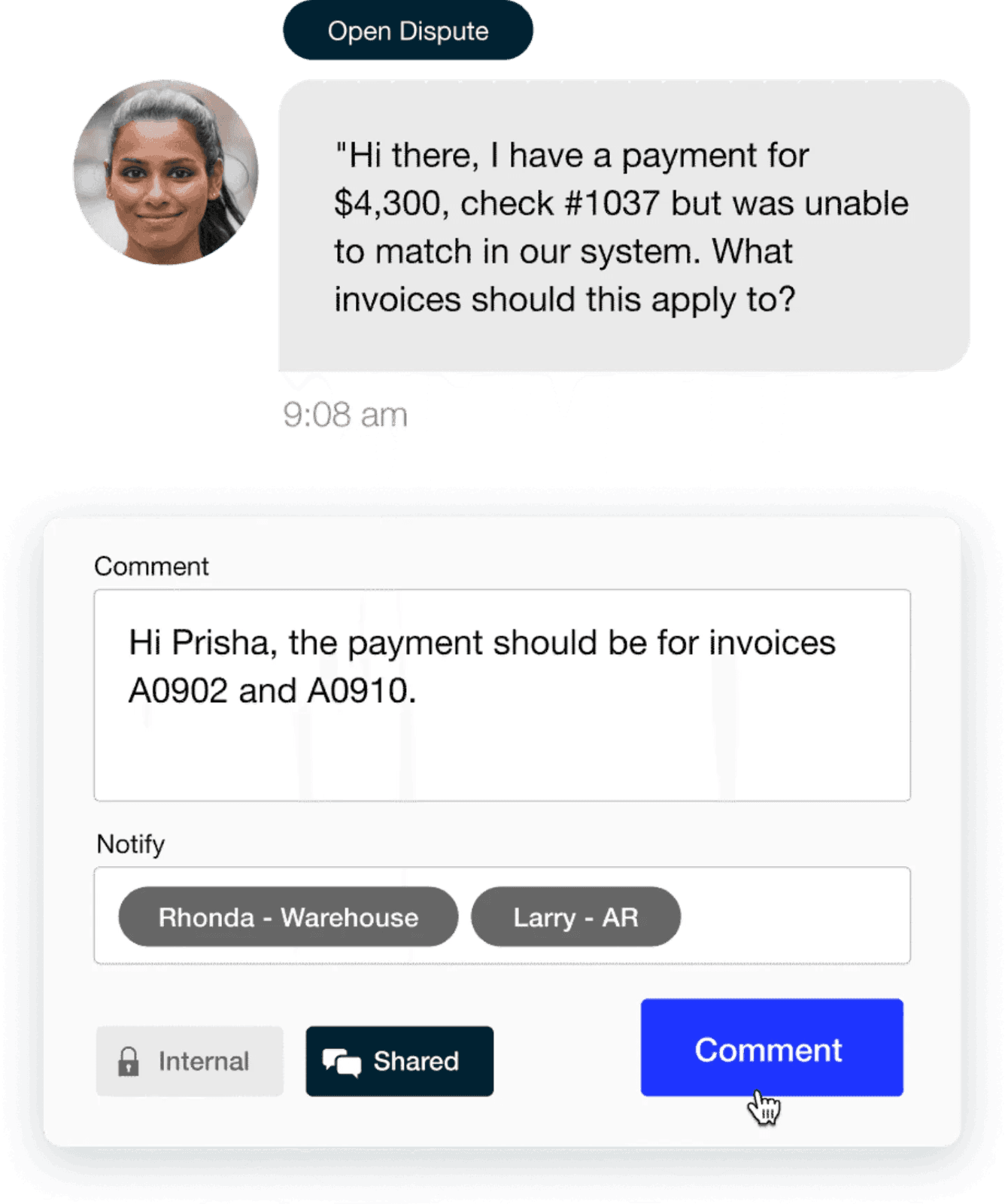

Simplify communication

Collaborative AR portals help you communicate with customers quickly. Instead of relying on emails or phone calls, where information can get lost, collaborative AR portals centralize communication and offer data-backed context to each conversation.

Through these portals, your customers can clarify questions quickly, and your finance teams can make credit decisions faster, helping you improve CX.

Display AR aging summaries

Analytics play a central role in financial efficiency. Collaborative AR portals summarize aging data accurately, helping you view upcoming cashflow in buckets across all customers or per account.

With these types of payment portals, analyzing cash flow and figuring out an ideal credit policy is simple, resulting in accurate decisions that do not take excessive time.

Aside from the benefits above, AR portals also automate several processes like invoice delivery, cash application, and data archiving that give your teams more time to conduct value-added analysis.

—

Learn how accounts receivable automation software can help you create robust credit policies, generate more cash flow, and deliver memorable CX.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.