How Collaborative Payment Portals Improve Invoice Processing

- 9 min read

Inefficient invoicing processes kill customer satisfaction, staff productivity, and cash flow.

In this blog, learn why only collaborative accounts receivable payment portals are capable of resolving invoicing challenges brought about by manual practices.

Inefficient invoicing processes kill customer satisfaction, staff productivity, and cash flow. Yet many companies maintain outdated invoicing systems that rely on inadequate technology, operational blockades, and disorganized data management.

It’s past time for businesses like yours to radically improve their accounts receivable (AR) processes, and the best and fastest way to do so is to start using a collaborative accounts receivable payment portal. There are vanishingly few instances where such an upgrade would not be an improvement on how a company is currently managing invoicing and payments.

To explore the value these payment portals bring, we conducted a survey in partnership with Wakefield Research of 300 CFOs at mid- to upper-midsized enterprises. The findings revealed the depth and breadth of CFO’s pressing challenges in invoicing, and lead to the conclusion that only collaborative payment portals are truly capable of resolving them.

Jump to a section of interest:

What are accounts receivable payment portals?

What is a standard payment portal?

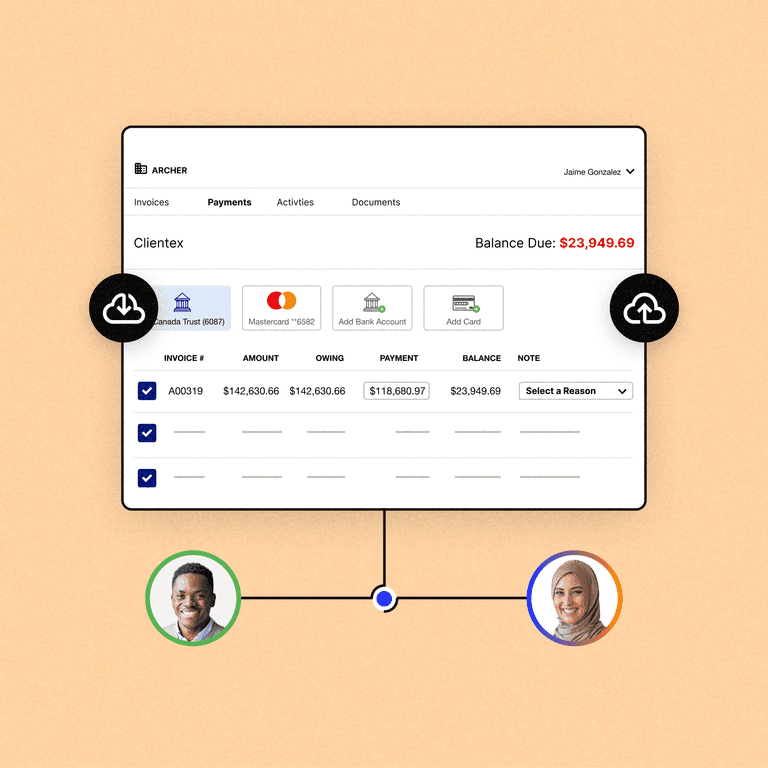

Standard payment portals are defined as business-to-business (B2B) invoice delivery and payment acceptance technologies that do not allow for two-way communication between your AR team and your customers’ accounts payable (AP) teams in-application.

What is a collaborative payment portal?

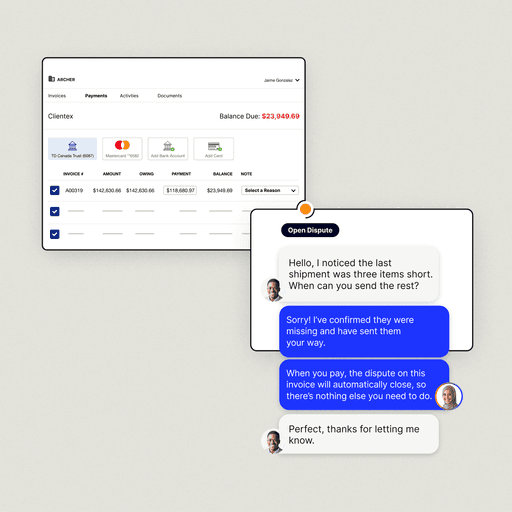

Collaborative payment portals are defined as B2B invoice delivery and payment acceptance technologies that allow for two-way communication between your AR team and your customers’ AP teams in-application, allowing you to share invoices with customers but also leave questions and comments directly on invoices for internal and external teams to review and answer.

📚 Learn more about the differences between standard and collaborative payment portals.

Why aren’t traditional accounts receivable invoicing processes good enough?

One of the clearest and simplest messages that emerged from the survey is that CFOs are not satisfied with their current accounts receivable processes. They want their payment and invoice processing systems to do more of what they need without requiring as much intervention from them or their teams.

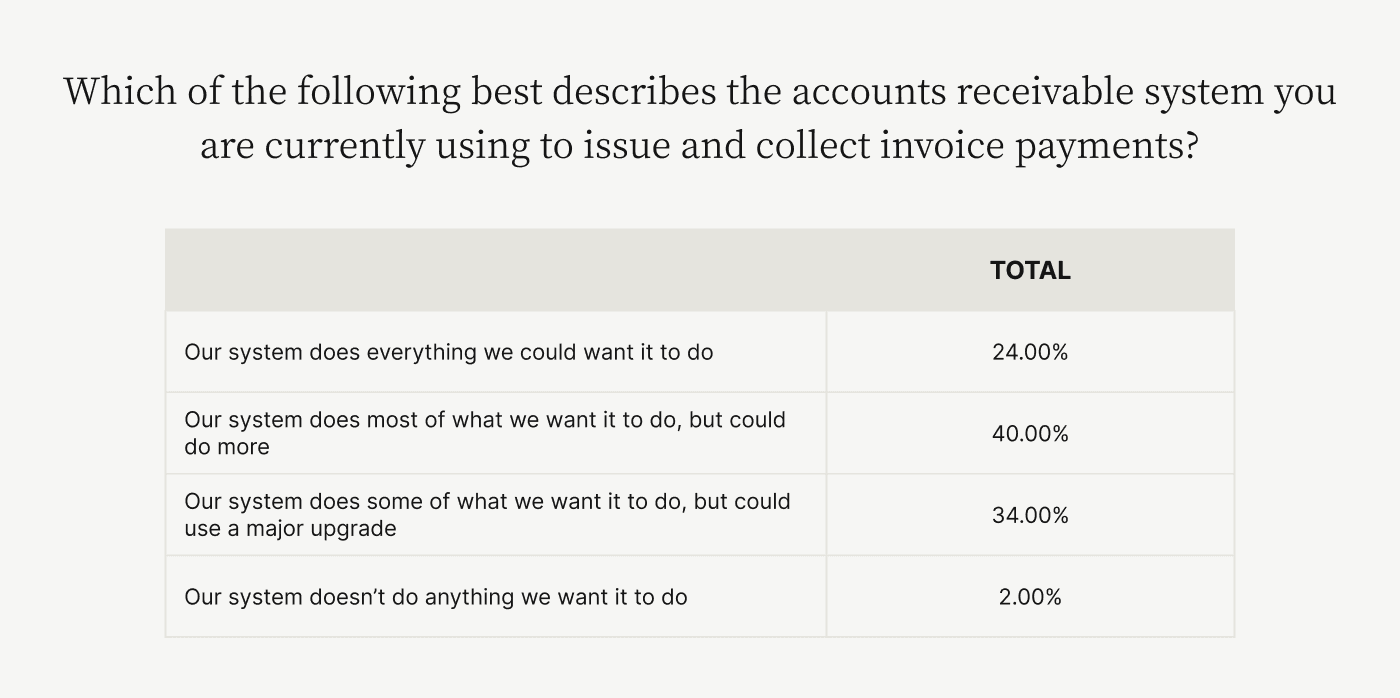

Case in point: More than three-quarters (76%) of CFOs say that the current technology they’re using for invoice processing does not do everything they need it to, with 34% saying their system needs a “major upgrade.”

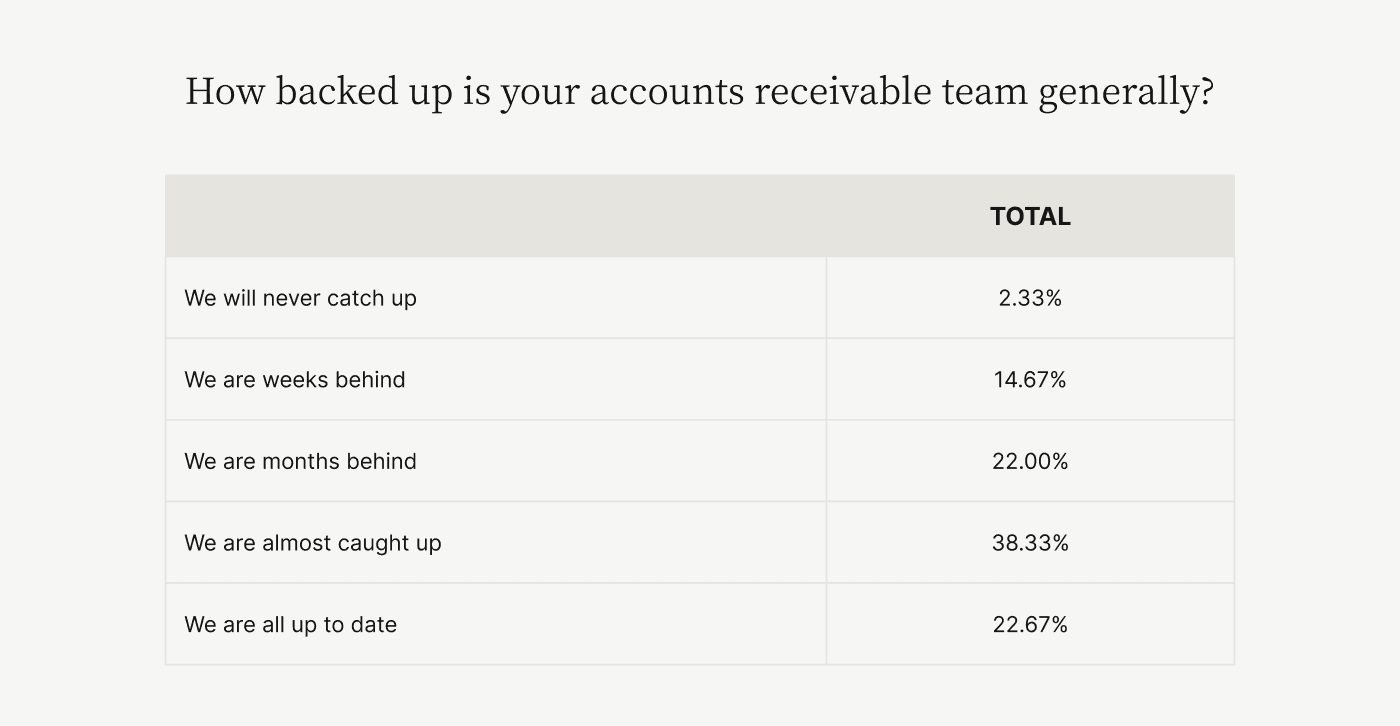

As a result of deploying inadequate invoice processing technologies—or relying on traditional, paper-based invoicing processes—many CFOs report that their workers can’t keep up with invoicing and processing payments. In fact, 88% of CFOs who say their accounts receivable systems aren’t up to their standards also say their AR teams are weeks or months behind, or will never catch up.

These invoicing complications are significantly more pronounced for this cohort, especially when compared to the average mid- to upper-midsized AR team (who is already demonstrably behind):

In short, being this delayed poses a significant threat to businesses' bottom lines, with traditional invoicing systems serving only to exacerbate the issue.

Traditional invoicing processes worsen the challenges CFOs already face

Our survey sought to reveal why CFOs find their current invoicing systems insufficient. Here’s what we found:

More than two-thirds of respondents (69%*) cite communication as a top challenge their AR teams currently face. This makes sense considering one of the major weaknesses of traditional invoicing processes is unwieldy, outdated methods of communication such as email and phone calls.

Collaborative AR payment portals notably remove the need for such fussy back-and-forth by enabling real-time communication between AR teams and their customers’ AP teams directly within the portal.

Beyond communication, there are a range of other challenges CFOs report their AR teams currently face. Coincidently, traditional invoicing processes compound these:

- A lack of relevant data transparency (47% of CFOs)

- Errors with data reconciliation (47%)

- Internal communications (44%)

- Pressures to see ROI (42%)

- Communications with customers (42%)

- Dispute management (37%)

* Note that the 69% citing communication as a top challenge includes respondents who cite internal communications and/or communications with customers.

Only collaborative accounts receivable payment portals deliver what CFOs want

When considering what functions an automated accounts receivable invoicing solution needs, 69% of CFOs said that they would prioritize over-the-cloud communication. This includes the ability to communicate over-the-cloud with internal stakeholders (43%) and with customers (41%).

All surveyed CFOs say that they want at least one of the following features in an accounts receivable payment portal. Unlike their standard counterparts—not to mention paper-based invoicing processes—collaborative payment portalsdeliver across the board:

41% of CFOs want full transparency and access to relevant data and documentation

36% want a customer-friendly user interface

36% want custom invoice delivery options

35% want secure payment acceptance options

33% want invoice line-item dispute management

How do collaborative payment portals bridge the AR Disconnect?

The “AR Disconnect” that often stymies accounts receivable processes is a result of miscommunications between a seller’s AR team and their customer’s accounts payable team. Inadequate technology, operational silos, poor communication, and other issues that both fuel and stem from this disconnect ultimately put these teams in a position where they’re unable to effectively collaborate.

This misalignment often causes invoice processing logjams, slow payments, disputes, and frustration on both sides.

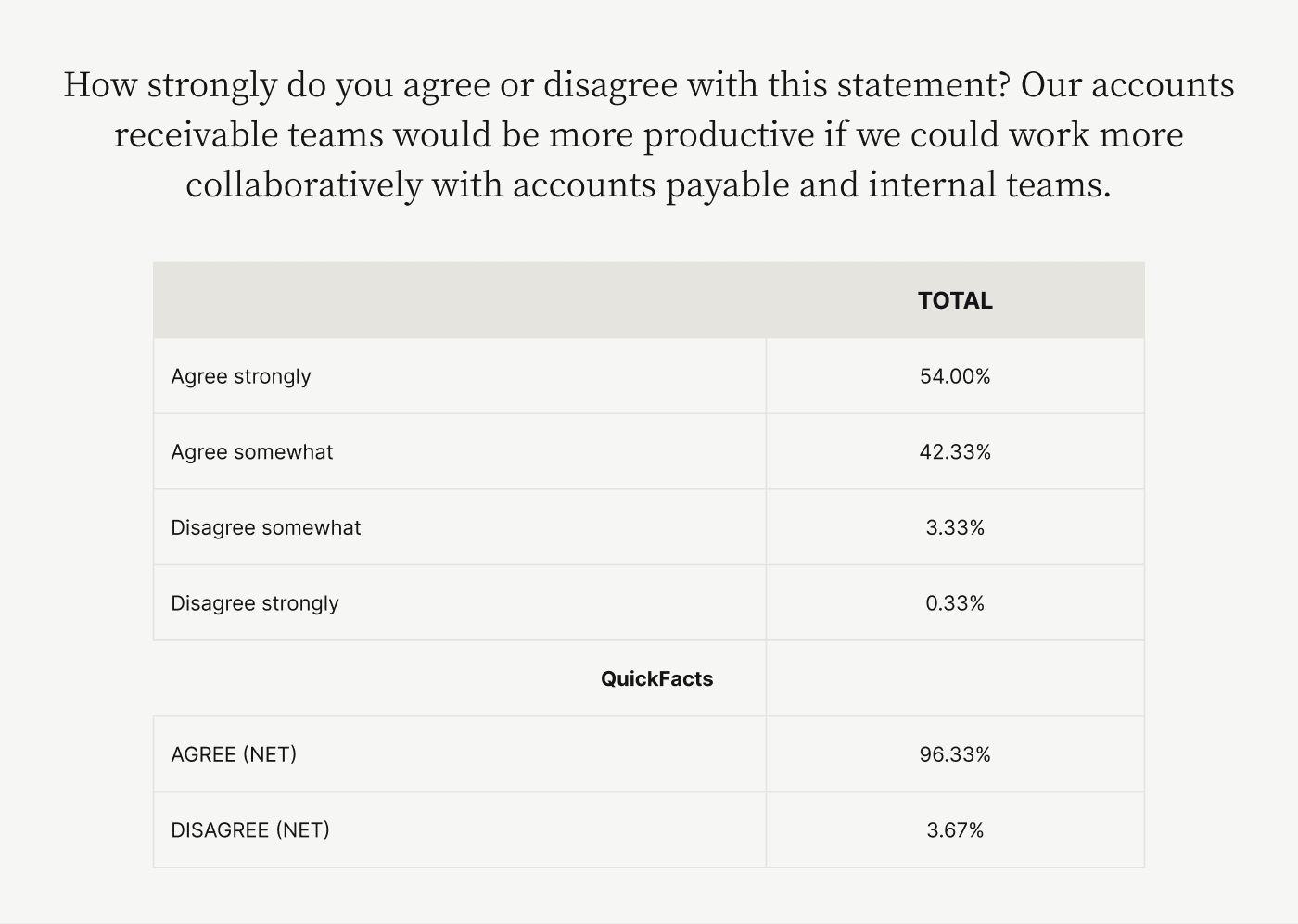

One of the core functions of collaborative payment portals is enabling these teams to work together as one over-the-cloud. This functionality aligns with what CFOs see as a priority, too:

- 96% of survey respondents said that their accounts receivable team would be more productive if they could work more collaboratively with customer accounts payable teams and other internal teams.

- More than half (54%) strongly agree with that sentiment.

This overwhelming response also implies that traditional invoicing processes and standard payment portals aren’t capable of encouraging suitable collaboration; and that CFOs need collaborative payment portals to break down invoicing logjams that are so detrimental to their businesses’ success.

Why else the collaborative element in payment portals is so important

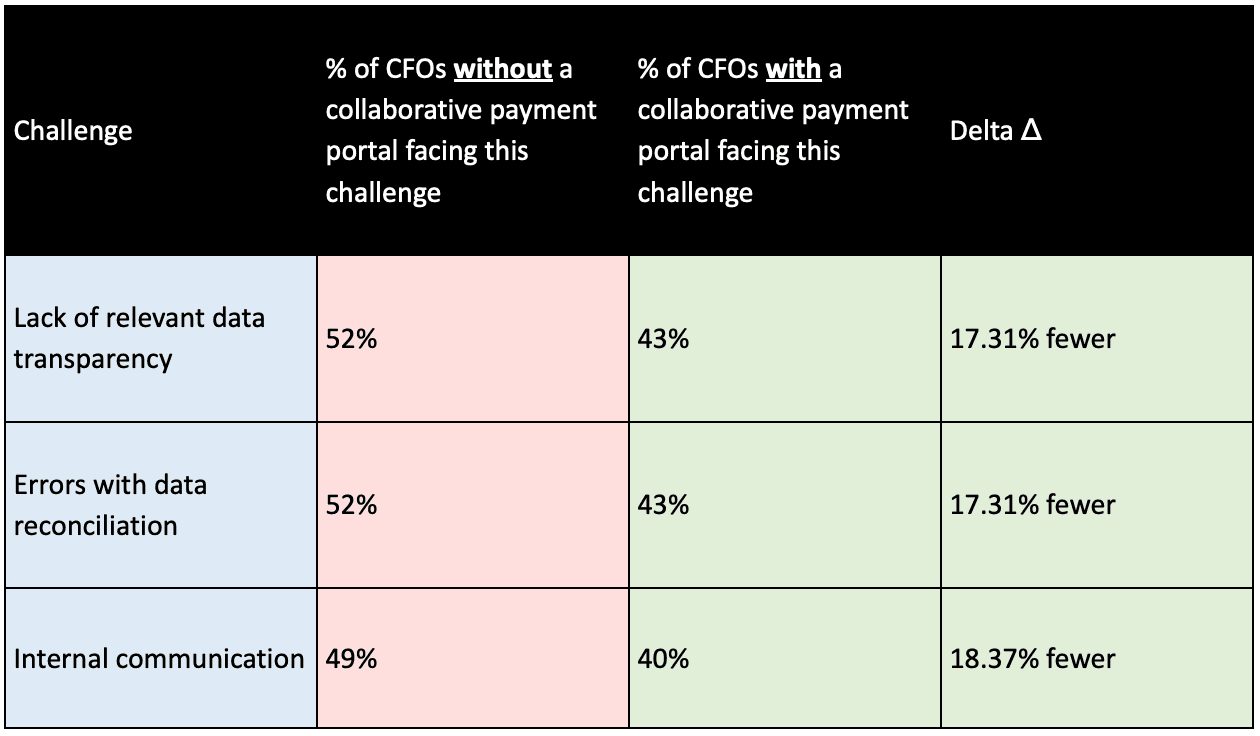

Companies work with a range of accounts receivable invoicing solutions, including payment portals that do not enable collaboration over-the-cloud. Those businesses that lack this interactive element in their payment portals say they have greater challenges in key accounts receivable areas than those who have a portal that enables collaboration.

For example, 52% of those without a collaborative payment portal report a lack of relevant data transparency, while only 43% of those with one have this problem. Similarly, 52% of those without a collaborative payment portal find that data reconciliation errors are a greater problem, compared to 43% of collaborative payment portal users. And 49% of those without a collaborative payment portal have issues with internal communication, compared to 40% of those with one.

It’s time to adopt collaborative accounts receivable technology

Despite all of this data showing how collaborative accounts receivable payment portals can outperform standard payment portals—or traditional invoicing processes—companies are slow to adopt the modern communication methods most commonly found in these technologies.

Companies know that improving their invoicing process hinges on promoting and maintaining connectivity between sellers’ AR teams and buyers’ AP teams. Yet 43% of CFOs say email remains the leading method of contact to resolve invoice errors, followed by phone (22%) and re-printing and mailing invoices (21%). Only 14% say their teams use cloud-based collaborative communication tools for this important activity.

While intricacies abound when transforming operations, failing to act aggressively on this front is a mistake. Companies lose money and time by not implementing collaborative accounts receivable payment portals. And it’s important for CFOs to realize that standard, static payment portals simply aren’t good enough to fix the profound problems that many companies have with their invoicing processes. Only collaborative payment portals are truly capable of resolving these ongoing challenges.

—

Read our new research to learn more about how CFOs handle accounts receivable and why collaborative payment portals are the path to better invoice processing.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.