21 Customer Experience Statistics That Reveal CX Is Crucial in Accounts Receivable

- 9 min read

The billing and payment cycle is one of the most critical parts of the customer journey but often gets overlooked for digitization. These 21 customer experience statistics reveal the critical role of CX in accounts receivable.

Customer experience (CX) is a hot topic these days and with good reason. CX refers to the stem-to-stern experience customers have when engaging with your company. This experience includes first seeing your marketing to getting help from customer service. Good CX = happy customers = high loyalty and referrals = a thriving business.

Businesses may be surprised to learn the extent to which accounts receivable (AR) is a core part of delivering exceptional customer experiences.

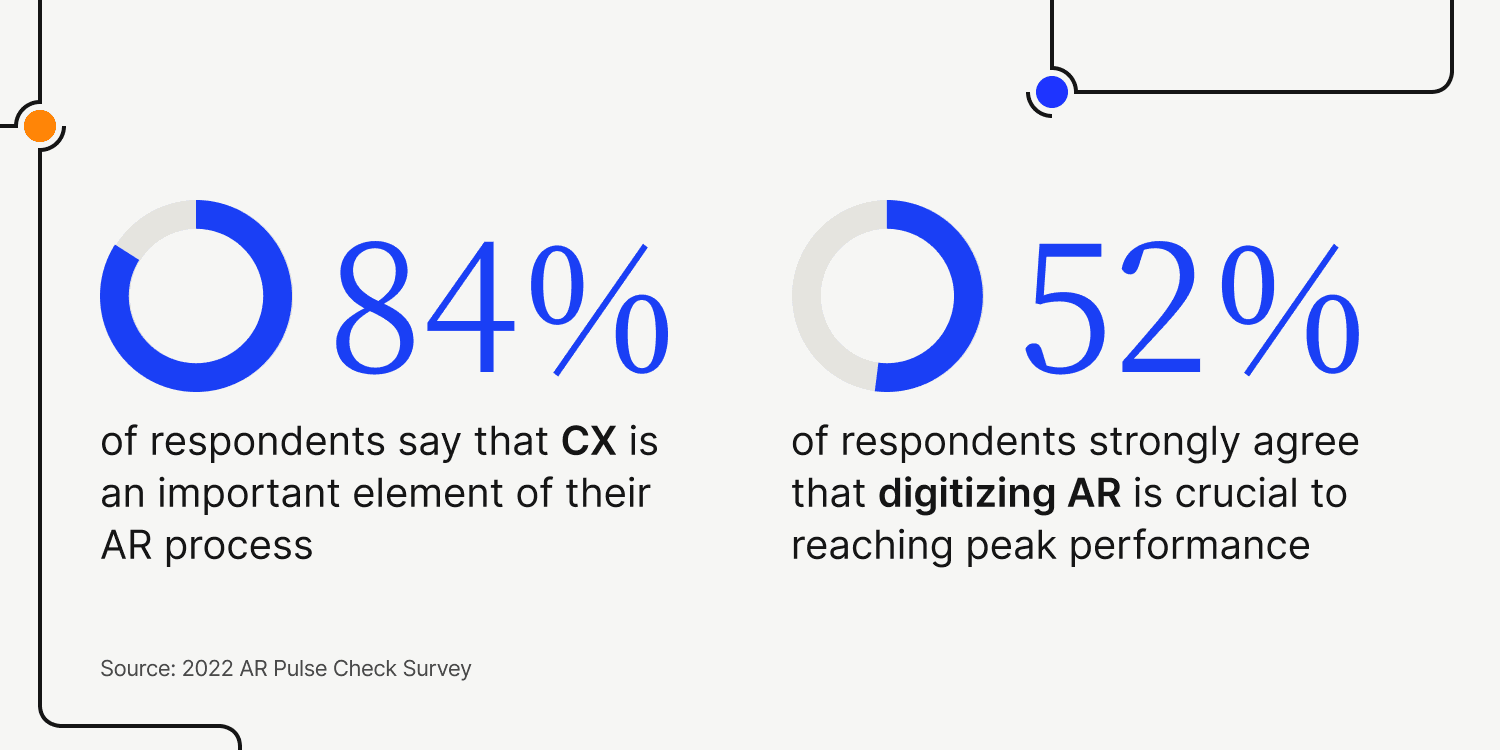

84% of respondents to SSON and Versapay’s 2022 AR Pulse Check survey of 103 finance and business services leaders say that CX is an important element of their AR process. 52% of respondents also strongly agree that digitizing AR is crucial to reaching their organization’s peak performance.

The logic is sound: AR staff are among the people your customers will engage with most, from initial contracts to recurring payments.

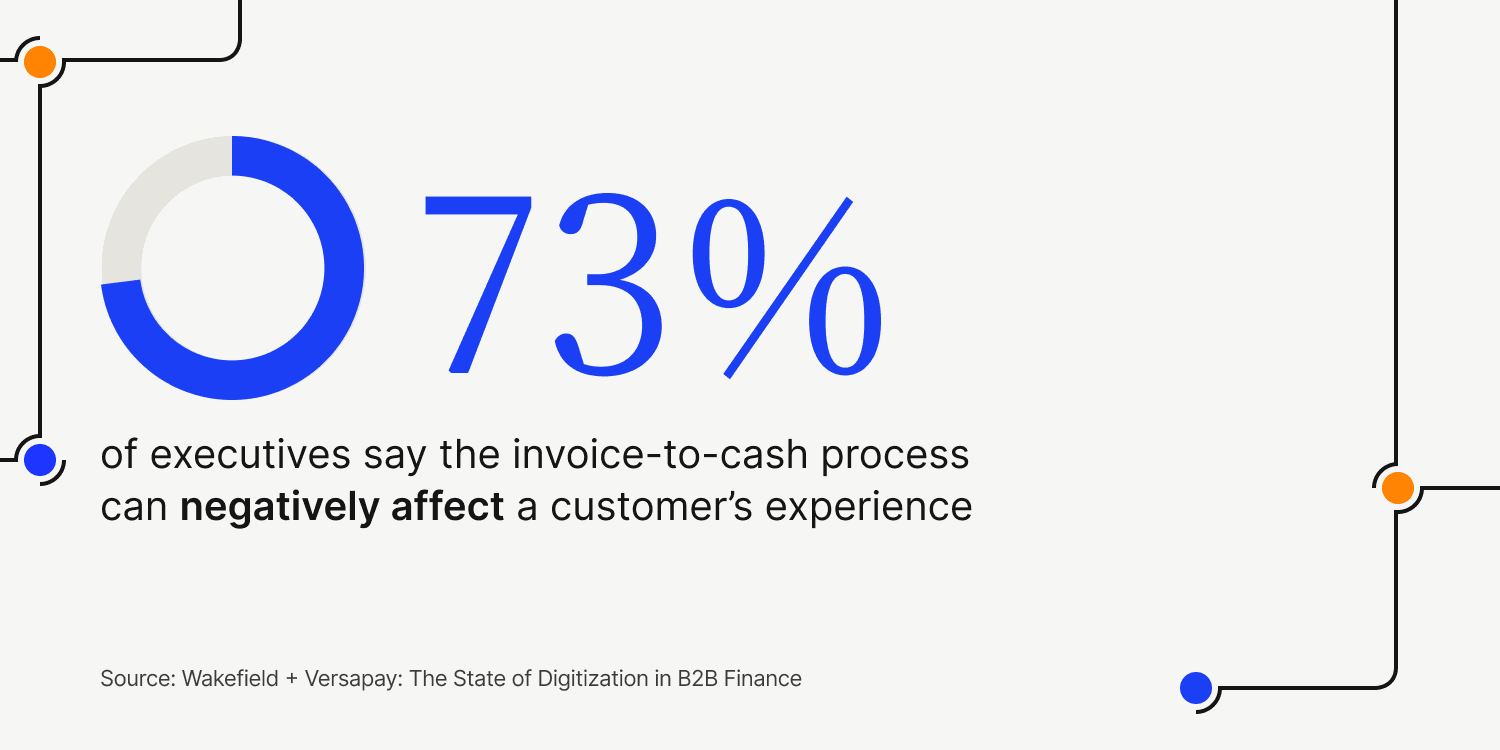

Customer relationships are also particularly vulnerable during the payment stage, cementing the importance of a CX-informed AR department. According to a joint survey of 1,000 U.S. c-level executives by Wakefield Research and Versapay, 73% of executives say the invoice-to-cash process can negatively affect a customer’s experience.

In this article, we'll examine 18 more accounts receivable and customer experience statistics that reveal why AR is more than just a back-office initiative. Finance leaders like CFOs will also understand why they should make customer experience a priority.

Communication is among the greatest challenges for accounts receivable

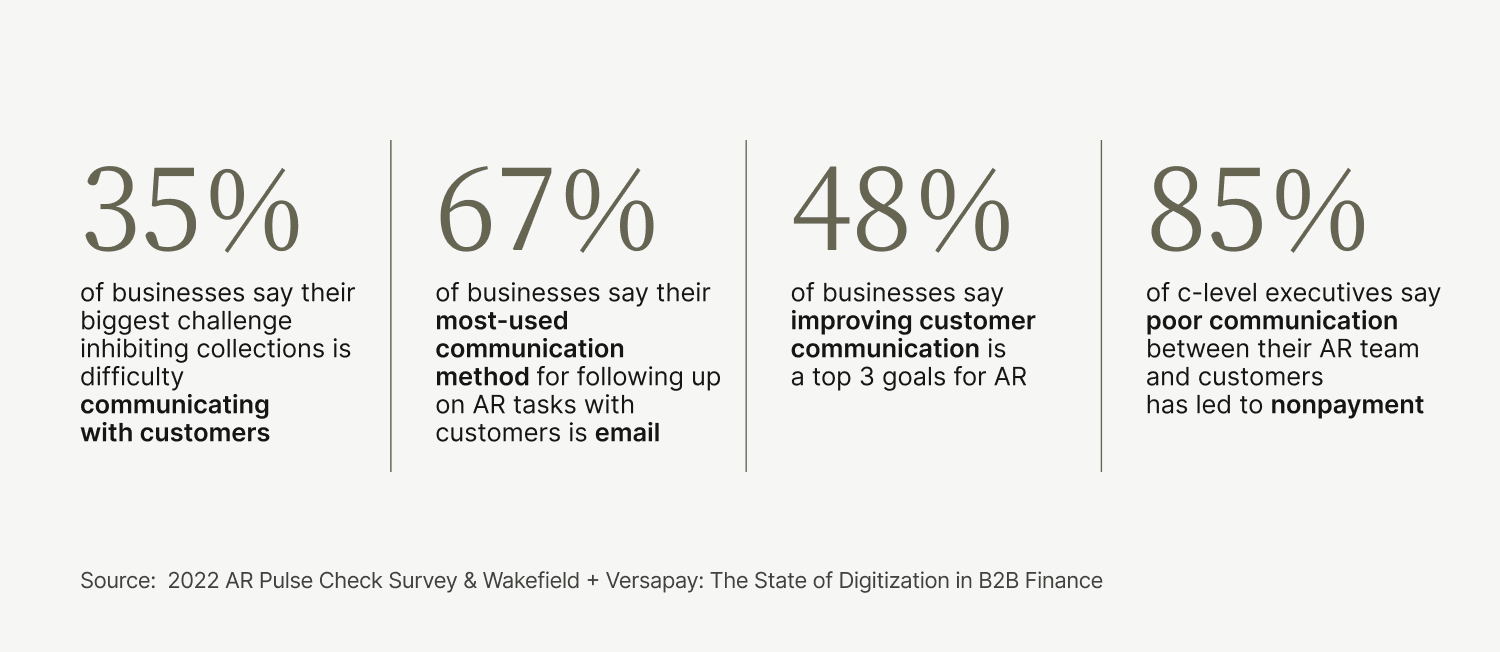

By the numbers:

35% of businesses say their biggest challenge inhibiting collections is difficulty communicating with customers (SSON and Versapay)

67% of businesses say their most-used communication method for following up on AR tasks with customers is email (SSON and Versapay)

48% of businesses say improving customer communication is among their top 3 goals for AR in 2022 (SSON and Versapay)

85% of c-level executives say poor communication between their AR team and customers has led to nonpayment (Wakefield and Versapay)

AR departments communicate regularly with customers who have questions or concerns about billing. But, this part of the AR's role doesn’t receive the same prioritization as other aspects of their work like invoicing and reconciliation.

AR teams are usually expected to communicate with customers however they feel like—typically by email or phone—and without any type of tracking in place.

As a result, the back and forth with customers is difficult to track because important information lives across multiple email threads between customers and members of the AR team.

35% of respondents to SSON and Versapay's survey said the biggest challenge preventing them from collecting payments is difficulty communicating with customers.

The vast majority of those communications (67%) seem to be happening over email. With no centralized source for tracking customer communications, it’s no wonder that 48% of respondents said improving customer communication is one of their top goals for AR in 2022.

The quality of the AR department’s communications with customers also has clear implications for the bottom line. 85% of respondents to Wakefield and Versapay's survey said poor communication between their AR teams and customers has resulted in nonpayment.

While finance teams might not see themselves as a key player in ensuring customers have a great experience, research shows they are.

—

It's clear that accounts receivable is critical to customer experience. Learn why collaboration is the secret ingredient to creating an AR experience customers love.

Better communication in invoice-to-cash prevents customer disputes

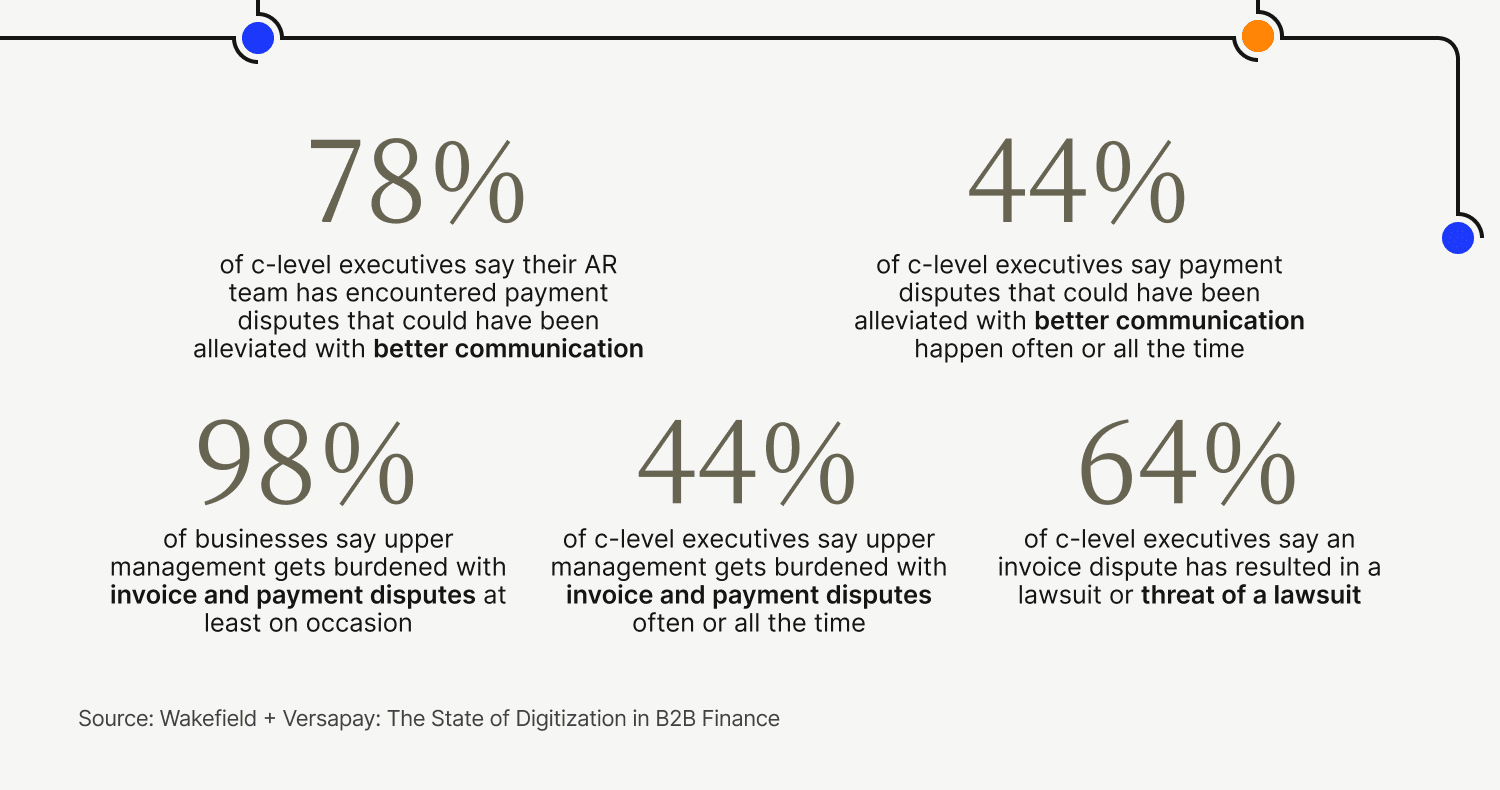

By the numbers:

78% of c-level executives say their AR team has encountered payment disputes that could have been alleviated with better communication (Wakefield and Versapay)

44% of c-level executives say payment disputes that could have been alleviated with better communication happen often or all the time (Wakefield and Versapay)

98% of businesses say upper management gets burdened with invoice and payment disputes at least on occasion (Wakefield and Versapay)

44% of c-level executives say upper management gets burdened with invoice and payment disputes often or all the time (Wakefield and Versapay)

64% of c-level executives say an invoice dispute has resulted in a lawsuit or threat of a lawsuit (Wakefield and Versapay)

Clumsy communication methods create challenges not only on the AR department’s end but also on the customer’s end. Because customers’ accounts payable (AP) staff have to search through email threads and records of phone calls to find important information about their bills, this often leads to misunderstandings.

More transparency between your AR team and customers can significantly reduce disputes before they escalate. Considering disputes are one of the main reasons for late payments, reducing their frequency is an important goal.

78% of c-level executives, according to Wakefield and Versapay, say their AR team has encountered payment disputes that could have been alleviated with better communication. Nearly half (44%) say that these kinds of disputes happen often or all the time.

If permitted to escalate, disputes might need involvement from senior leadership or even legal counsel.

Nearly all businesses surveyed by Wakefield and Versapay (98%) report upper management has had to get involved in invoice disputes and payment issues on occasion. 44% say senior leadership has to get involved often or all the time.

64% of c-level executives also say that a dispute over an invoice has at some point escalated to a lawsuit or a threat of a lawsuit.

Any positive interactions customers have had with your brand are quickly forgotten when faced with an unpleasant dispute-resolution process. Customers should always leave a dispute interaction feeling like they were given priority attention and that the AR team did its utmost to resolve the problem quickly. Traditional communication methods like email, phone calls, and dunning letters make this hard to accomplish.

The billing and payment experience impacts customer loyalty

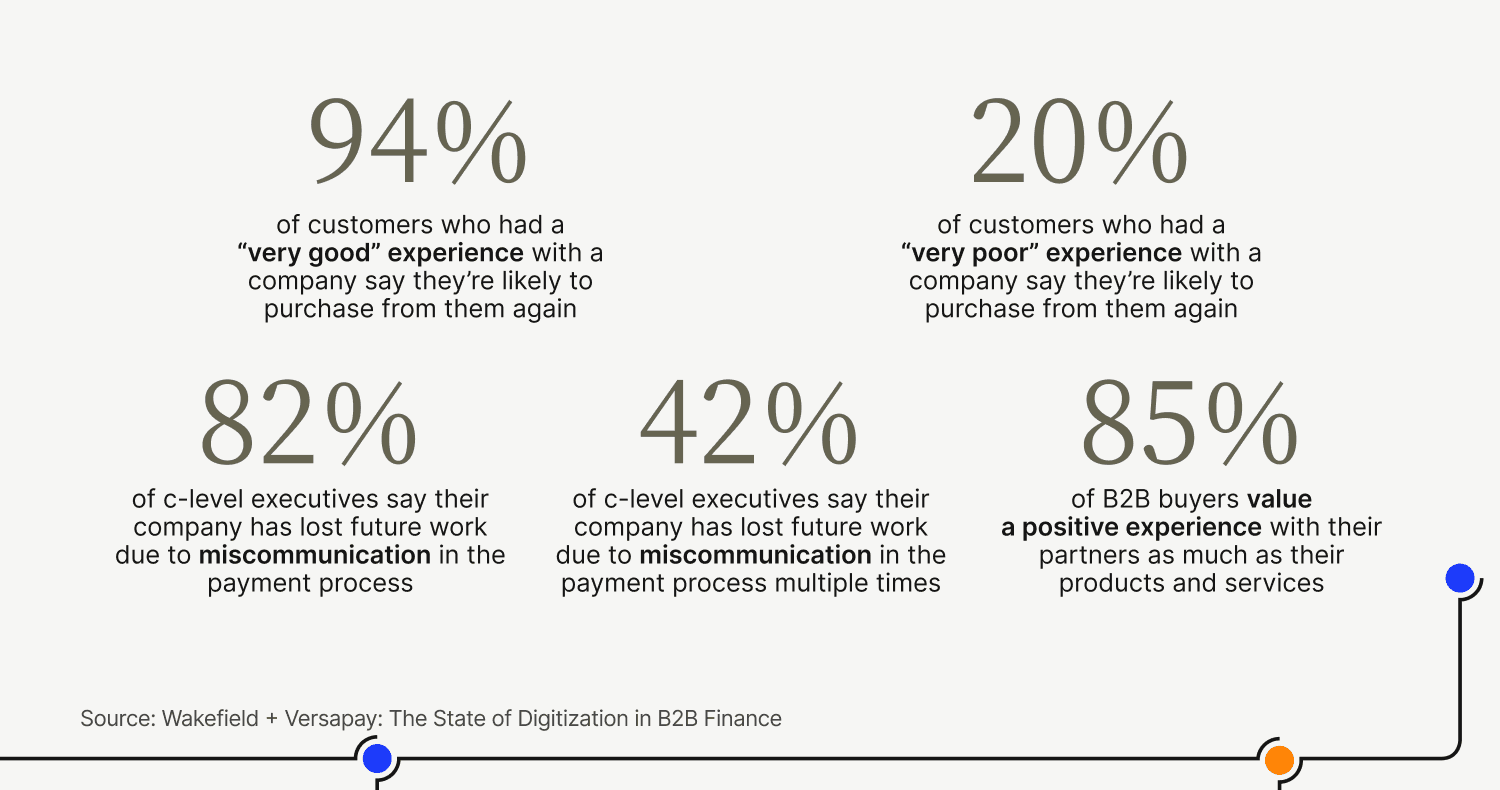

By the numbers:

94% of customers who had a “very good” experience with a company say they’re likely to purchase from them again (Qualtrics)

20% of customers who had a “very poor” experience with a company say they’re likely to purchase from them again (Qualtrics)

82% of c-level executives say their company has lost future work due to miscommunication in the payment process (Wakefield and Versapay)

42% of c-level executives say their company has lost future work due to miscommunication in the payment process multiple times (Wakefield and Versapay)

85% of B2B buyers value a positive experience with their partners as much as their products and services (PYMNTS and Worldpay)

One major outcome of a strong customer experience is higher rates of customer loyalty. Customers who have a good experience with your company are far more likely to return.

According to data from Qualtrics XM Institute, 94% of customers who had a “very good” experience with a company say they’re likely to purchase from the company again. Meanwhile, only about 20% of customers who experienced “very poor” CX would say the same.

Our research with Wakefield uncovered how accounts receivable plays into this dynamic. 82% of respondents say their company has lost out on a contract or future work because of miscommunication during the payment process. What’s more, 42% of respondents say this has happened multiple times.

Customer loyalty suffers when customers have a negative experience during the billing and payment stage, just as it does if there are problems with the actual goods or services they’re purchasing. A joint report by PYMNTS and Worldpay found that 85% of B2B buyers value a positive experience with their vendors as much as their products and services.

The billing and payment experience is an area that many businesses overlook when working to improve customer retention.

It’s time to digitize AR for better customer experience

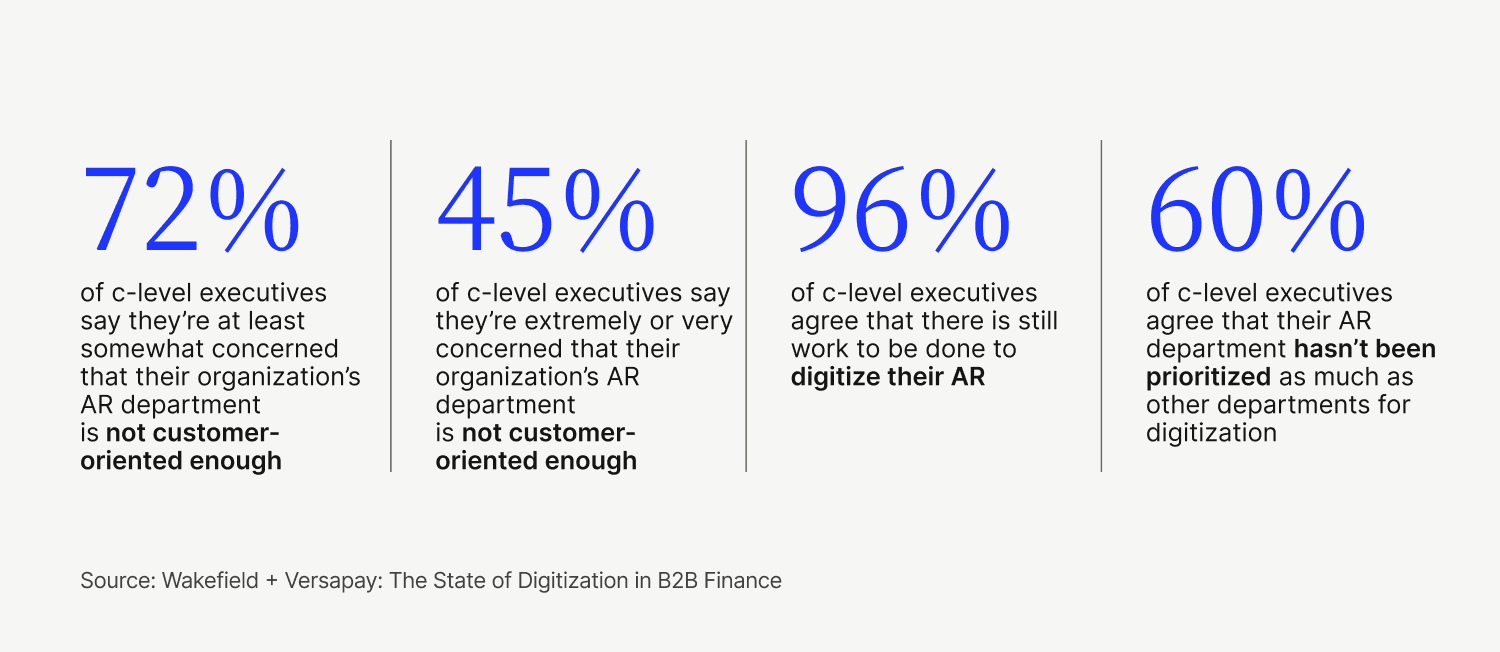

By the numbers:

72% of c-level executives say they’re at least somewhat concerned that their organization’s AR department is not customer-oriented enough (Wakefield and Versapay)

45% of c-level executives say they’re extremely or very concerned that their organization’s AR department is not customer-oriented enough (Wakefield and Versapay)

96% of c-level executives agree that there is still work to be done to digitize their AR (Wakefield and Versapay)

60% of c-level executives agree that their AR department hasn’t been prioritized as much as other departments for digitization (Wakefield and Versapay)

The statistics we discussed earlier make a solid case for AR being an essential part of overall customer experience. Yet, the majority of businesses have yet to make the necessary changes to ensure their AR function is delivering on this priority.

72% of respondents in Wakefield and Versapay’s survey say they’re at least somewhat concerned that their AR department is not customer-oriented enough. 45% say they are extremely or very concerned about this.

When you look at the fact that most businesses (self-admitted by 96% of executives) haven’t digitized all their AR functions yet, this makes sense. Many of the CX improvements needed within the invoice-to-cash cycle can be achieved with greater technology use among AR teams.

One of the issues behind this is that AR routinely gets overlooked in businesses’ planning of digitization projects. 60% of c-level executives admit that they have continually prioritized cloud technology for other departments ahead of AR.

But as global challenges like inflation force budgets to tighten, companies will want to do everything they can to shore up customer lifetime value. Given the role the accounts receivable department has in driving CX, companies shouldn’t hesitate about—and should in fact prioritize—investing in AR digitization.

The collaborative AR difference

When it comes to solving the communication challenges inherent to invoice-to-cash, traditional AR automation isn’t enough.

To solve the disconnect that arises between your AR teams and your customers, you need a platform built with collaboration in mind.

Versapay’s Collaborative AR platform combines industry-leading accounts receivable automation with intuitive collaboration tools. This helps you manage all your team’s invoice-related communications with customers in one place.

In their own online portal, customers can access their invoices and ask questions on specific line items they take issue with. Your team can then quickly respond and loop in any necessary team members (like Sales) to resolve potential disputes early. As a result, you:

Reduce your AR team’s time spent managing disputes

Speed up payment times, and

Secure much-needed cash flow for your business.

—

Want to see how collaborative AR helped commercial real estate company InvenTrust give their tenants a more efficient payment experience? Check out our on-demand webinar, “Collaborative AR: Building Better Experiences Beyond Automation.”

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.