Is Cryptocurrency a Viable B2B Payment Method? 6 Pros and Cons

- 9 min read

Cryptocurrencies are becoming increasingly mainstream.

In this article, we’ll help you understand—and come to your own conclusion—if your business should accept cryptocurrency payments on outstanding invoices.

From coins to NFTs, crypto technology is becoming increasingly mainstream. And despite crypto’s recent crash (the digital currency industry lost nearly $1.4 trillion in 2022), it’s difficult to see it going away entirely.

As cryptocurrency use continues, it raises the question: Should business-to-business (B2B) organizations accept cryptocurrency as payment on invoices?

Currently, there are more than 2,000 distinct types of cryptocurrencies, and around 15,174 businesses worldwide accepting Bitcoin. In this article, we’ll help you understand—and come to your own conclusion—if your business should be one of them.

Jump to a section:

- Why B2B companies should accept cryptocurrency payments on invoices

- Why B2B companies shouldn’t accept cryptocurrency payments on invoices

- Evaluating cryptocurrency at the individual business level

Why should B2B companies accept cryptocurrency payments on invoices?

There are certainly reasons businesses should consider accepting cryptocurrency as payment. As you’ll see, they tend to be primarily tailored to businesses with unique payment needs. Here are 3 primary benefits for accepting cryptocurrency on invoices:

1. Cryptocurrency provides access new industries

As cryptocurrencies have risen in popularity, several complementary industries have risen alongside it. This includes businesses with a direct connection to cryptocurrencies, such as exchanges that facilitate their transfer. There are also industries that are somewhat connected by their use of blockchain technology, such as NFTs and Web3.

If you’re doing business with a company in these industries, it’s reasonable to believe that they may prefer receiving or giving payment for invoices in a cryptocurrency. The success of these businesses is connected to the success of these technologies, and therefore welcome seeing other businesses act in ways that support them. Essentially, you’re shaping how your company operates based on an industry you’re hoping to find success in.

2. Cryptocurrency allows you to conduct business beyond banks

Some industries, such as mining, and oil and gas, regularly conduct businesses in countries with much less established banking systems. As such, they’re faced with the challenge of figuring out how to transfer and manage payments beyond the typical banking environment.

Cryptocurrency presents an opportunity to complete these transactions without having to utilize cash or more complicated methods like payment-in-kind. However, in cases like this, businesses need to be careful not to violate their local regulations. There are often restrictions on which foreign governments you can do business with, and simply using cryptocurrency does not absolve you of responsibility should you violate these regulations.

3. Cryptocurrency can help you get paid faster

With ACH transfers taking one or more days to settle, there’s no doubt that traditional B2B payments can be rather slow. These delays can easily cause disruptions to cash flow, interfering with how the rest of the business operates.

Cryptocurrencies complete transactions on the blockchain, meaning settlements are near instant and approved by you. And unlike banks, it doesn’t close at night or on weekends and holidays. With faster access to cash, businesses have superior access to capital in order to fund their operations and support growth.

Why shouldn’t B2B companies accept cryptocurrency payments on invoices?

Given that cryptocurrency is still in its infancy compared to traditional payment methods, there are several factors that will cause B2B organizations to be hesitant to adopt it. Below are the 3 most significant reasons for businesses to approach cryptocurrency with caution.

1. Cryptocurrency makes Treasury and Tax tasks more complex

Before you begin accepting payments in cryptocurrency, you need to consider: Once you’ve accepted cryptocurrency as payment, how do you plan to process and store it? There are generally two paths you could take.

The first is a “hands off” approach. In it, you immediately convert the cryptocurrency to your chosen fiat currency through a third-party vendor. While this greatly simplifies the process (as you don’t need to choose how to store the cryptocurrency), it results in high fees that eat into every single transaction.

The second approach is “hands on”. Here, you’ll store the cryptocurrency you’ve accepted for future use. This approach is typically chosen by businesses who anticipate making—or currently are making—payments using cryptocurrency.

Because this approach requires you to actually add cryptocurrency to your books, accounting for it becomes much more complicated. Your Treasury must now learn about and deal with an entirely new asset. From a financial perspective, that means different bookkeeping techniques, risk regulations, volatility factors, and more. From a technological perspective, they’ll need to understand how digital wallets work, and learn how to integrate this new asset type into their existing processes.

Regardless of which approach a business chooses, they’ll need to be prepared for the tax implications. Crypto transactions may be treated as barter transactions. That means the company must establish the readily ascertainable fair market value of the asset at the time of receipt. It’s an extra calculation that must be made with each transaction, further increasing the complexity of corporate taxation.

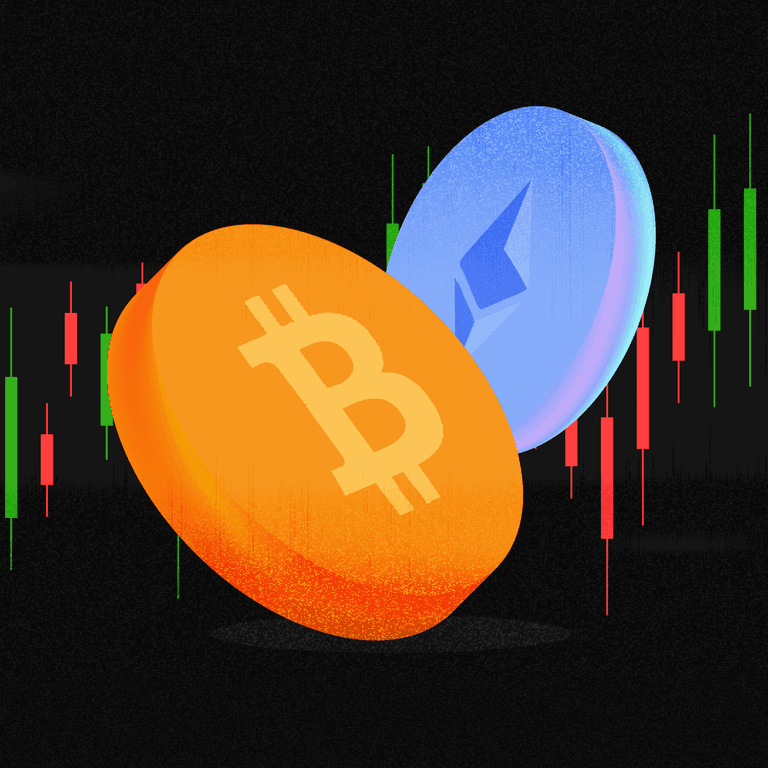

2. Cryptocurrency is highly volatile

About this time in 2022, crypto was everywhere. Turning on the Super Bowl meant seeing crypto ads with Matt Damon telling you that “Fortune favors the brave”, or Steph Curry saying he was “no [crypto] expert” and that he “didn’t need to be [because] with FTX, he had everything he needed to buy, sell and trade crypto safely.”

Less than one year later, Bitcoin, frequently seen as the most mainstream of cryptocurrencies, has fallen nearly 50%. LUNA, a well-regarded crypto coin, lost more than 90% of its value within hours. Across the entire industry, cryptocurrencies have plunged in value. And the exchanges that support them, such as FTX and Celsius, have encountered legal issues and near-total collapse

Simply put, when conducting transactions using cryptocurrencies it’s almost impossible to know how much to charge for a crypto payment using US dollars.

The cryptocurrency market is based on speculation. If you charge a client Bitcoin at a certain value one day, the value of the same Bitcoin could fall drastically by the time you receive your payment, making your business vulnerable to huge price fluctuations.

The same thing applies to your buyers. Given that it can take weeks, or sometimes even months, for buyers to pay an invoice, the market value could rise substantially. Not only does this create a negative customer experience and damage your working relationship, but a large enough decrease in value could also make it difficult for them to pay the invoice in full.

So regardless of which cryptocurrencies you choose to accept, you’ll need to be prepared for volatility—and a lack of general knowledge on how to manage it within this sector.

3. Cryptocurrency offers low security and limited recourse

Throughout its history, cryptocurrency has been extensively tied to criminal organizations. In 2021 alone, criminals laundered $8.6bn of cryptocurrency.

Due to its focus on anonymity, cryptocurrency lacks many of the details that would normally be provided in a B2B transaction, such as Level 1, 2, and 3 Data. However, businesses are still required to follow the know-your-customer and anti-money laundering regulations that apply in their region. Doing so with limited data is extremely difficult, especially if you’re processing large, international transactions.

At the same time, crypto has been plagued by high-profile security breaches. In some cases, hacks have resulted in hundreds of millions of dollars being lost. And because crypto is not covered by Financial Deposit Insurance Corporation, businesses do not have access to tools to deal with these losses.

Accepting cryptocurrency should be evaluated at the business level

Looking at the pros and cons, it’s reasonable to say accepting cryptocurrency as payment on invoices should be approached with each business’ unique needs in mind.

The reasons to accept cryptocurrency are highly specific, and likely would not apply to most businesses. The industries it helps you access are currently in serious decline. Needing to complete transactions without a bank is not a challenge organizations come across often. And while getting paid faster is great, there are other means, such as through AR automation and payment integrations, that can do so without opening the door to so much risk.

Meanwhile, the risks of accepting cryptocurrency are substantial. It creates many challenges for your Finance team, and its volatility has the potential to quickly cause significant losses. And with security being so critical to modern businesses, it’s difficult to justify adopting a currency that is both frequently stolen and near impossible to recover.

Ultimately, it’s up to each business to understand their needs and priorities and decide if the risks of accepting cryptocurrency as payment on invoices are worth the rewards.

If your focus is cutting down on the time it takes to collect on outstanding invoices, check out The CFO’s Guide to Accelerating Collections for insights, tips, and all sorts of helpful information.

About the author

Joe Crawford

Joe Crawford is the Senior Copywriter at Versapay. While currently focused on Fintech, he’s written extensively across industries including automotive, telecom, and communications technology. Coming from a background in comedy, he welcomes any chance he can to introduce some levity to world of Accounts Receivable.