What Is a POS Transaction? A Short Guide for B2B Sellers

- 9 min read

B2B businesses (especially in industries like wholesale distribution and manufacturing) will often accept payments at a point of sale system in addition to their other channels like ecommerce and accounts receivable.

Learn more about POS transactions and how sellers can ease their acceptance and reconciliation of them.

Point of sale (POS) transactions are a familiar sight for consumer purchases, but many B2B sellers also use them as part of a broader set of sales channels. Because business transactions are more complex, reconciling B2B point of sale transactions can be more challenging.

In this article, we’ll define POS transactions and take a closer look at them from a B2B seller’s perspective to explain:

POS meaning: What is a point of sale (POS) transaction?

A point of sale transaction is a payment for goods or services, usually made in a retail setting. POS transactions can be conducted in person or online.

A business uses a POS system to process card payments or other forms of electronic payments at a physical location. A POS setup includes both hardware and software. POS hardware consists of a credit card reader and a cash register, or more often nowadays, a tablet that runs cloud-based POS software. This software collects data about the transactions and captures these sales in a company’s books.

Point of sale payments are typically completed using credit or debit cards, but can also be done with cash.

Benefits of POS systems

There are many benefits of POS systems for B2B sellers. The most notable is the positive impact POS systems have on helping them manage the retail operations of their business. POS systems streamline and simplify much of the day-to-day transactional activities and further support sellers by tracking important sales data.

Beyond how POS systems can transform your retail operations, they also allow B2B sellers to:

- Increase efficiency and reduce AR processes—Accepting payments via point of sale means not having to process payments over the phone or—in many cases—having to manually key information into adjacent ERP systems. This saves you time and eases security concerns. Better yet, if you possess an integrated payment solution—one that’s embedded directly in your ERP—your AR staff won’t need to depend on third-party systems to process a single transaction made through your POS.

- Accelerate cash flow—Having a POS system lets you capture and process payments from an additional channel. More channels often equate to more revenue, as you can meet your buyers where they are. Supporting more sales channels also increases your chances of being able to do business with companies who have strict AP requirements.

- Deliver exceptional payment experiences—When facilitating payments through your point of sales system, you give your customers a more convenient payment experience. Suppliers that give their customers more flexibility both in how they pay and where they pay will reap the benefits of a more enjoyable commerce experience. Also, suppliers who give their customers greater payment flexibility tend to achieve a competitive advantage by enabling lower point of sale payment processing fees and speeding up payments.

Additional benefits of POS systems for B2B sellers include:

- Better inventory and order management

- More accurate customer data (and greater access to it)

- Greater security against payment fraud

- Enhanced operational improvements

- Fewer human errors

- Automated operations report creation and delivery

How POS transactions work

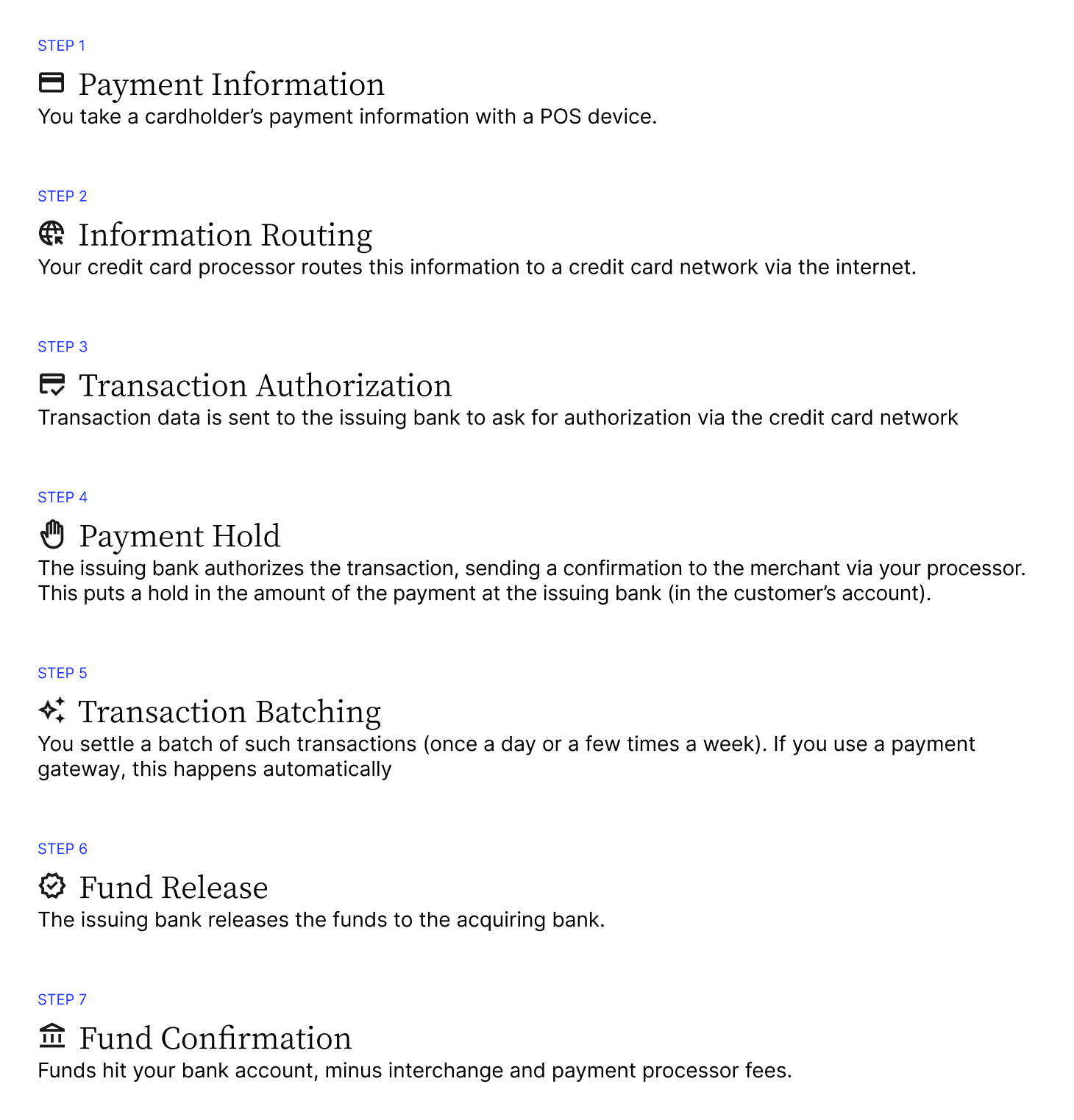

Here's how a POS transaction occurs, from the moment of the point of sale purchase right up to the funds landing in the business’ account:

- Step 1: You take a cardholder’s payment information with a POS device.

- Step 2: Your credit card processor routes this information to a credit card network via the internet.

- Step 3: Transaction data is sent to the issuing bank to ask for authorization via the credit card network

- Step 4: The issuing bank authorizes the transaction, sending a confirmation to the merchant via your processor. This puts a hold in the amount of the payment at the issuing bank (in the customer’s account).

- Step 5: You settle a batch of such transactions (once a day or a few times a week). If you use a payment gateway, this happens automatically

- Step 6: The issuing bank releases the funds to the acquiring bank.

- Step 7: Funds hit your bank account, minus interchange and payment processor fees.

When a customer pays for their purchase using a credit or debit card, their bank will send out a notice to the merchant indicating that the funds have been transferred. If the customer pays in cash, the merchant will need to deposit the cash into their bank account and then notify the accounts receivable department they have received payment.

How can merchants accept point of sale transactions?

Getting started with point of sale transactions is relatively simple.

If businesses want to accept POS transactions at a physical location, they’ll need:

- A card reader

- A receipt printer

- An internet-connected cash register, tablet, or mobile device, and potentially

- A barcode scanner

Countertop and mobile POS systems provide the means for your customers to make fast and easy transactions. Receipt printers help keep track of those transactions, and payment processing software ties it all together so your accounting team can record all these sales in their financial management system.

Card and POS terminals capture card data and securely transmit it through a payment gateway via your payment processor. Card terminals can integrate with your point of sale systems in different ways. You can choose a:

- Standalone POS terminal, where your card terminal is separate from the POS system

- Semi-integrated POS terminal, where the POS software is connected with the card reader, but the actual payment data bypasses the software and goes directly to the payment gateway or processor

- Or a fully integrated POS, where both your POS software and card terminal access card data

Your choice of POS system depends on the level of investment you're able to make to ensure PCI compliance.

3 types of POS transactions

Just as there are some differences among POS terminals, there are also key differences among POS transaction types.

Here are three common POS transaction types:

1. Online sales (card-not-present)

Online POS transactions often happen through an ecommerce website. Customers visit your business’ online store and purchase goods. These transactions can be synced with your POS system as if the card payment was made in person.

2. Offline sales (card present)

Offline POS transactions, where buyers make a payment in person, are less common in the B2B world. But, they can be useful for wholesale providers, such as food import businesses, hardware stores, and other construction industry suppliers. Customers can pay for goods at these businesses during site visits if the seller has a POS terminal on-site.

3. Returns

Occasionally, customers are unhappy with the goods they’ve purchased. For wholesale providers, that may mean a customer requesting a refund or credit note. A refund can be done through the POS terminal, essentially as a ‘reverse payment’ that returns the funds to the customer’s credit card.

What is POS reconciliation?

POS reconciliation is the process business owners or accounting staff undertake to match transactions from POS systems—as shown on a company’s bank statement—to the company’s own books. They do this to ensure that their financial records are accurate and that cash on hand matches up with expectations.

To reconcile POS transactions, businesses need to know the payment method, product code(s), who facilitated the payment, and sales tax information for each transaction.

Here’s what the process of POS reconciliation looks like:

- Reviewing the list of transactions (both sales and refunds) in your POS system

- Referencing this list against credit card statements and checking for any discrepancies

- Investigating the source behind any discrepancies that emerge

- Recording when the reconciliation was completed

A merchant might reconcile POS transactions as often as daily or monthly depending on the business.

Benefits of POS reconciliation

Frequently performing account reconciliation can be advantageous for B2B sellers. Here are five benefits of POS reconciliation:

- Fewer accounting errors—Human error is inevitable in accounting; especially during periods of high growth or when manual processes are commonplace. POS reconciliation allows you to identify errors earlier so you can act quickly.

- More timely business deposits—Having correct financial information makes it more likely you’ll make your deposits and not mistakenly overdraft your accounts due to a lack of funds. POS reconciliation ensures you’ll be able to accurately budget for vendors, operating expenses, and other payments.

- More stable cash flow—Habitual reconciliation means you’re always aware of how much your business is spending each cycle.

- Greater theft identification—Account reconciliations are necessary because they allow you to quickly spot unauthorized transactions and rectify them before suffering any consequences.

- More accurate balance sheets—Bank fees and taxes can cause issues in your balance sheet. POS reconciliation will help you to identify these issues and handle any mismatches.

More frequently asked questions about POS transactions

What are common POS transaction costs?

POS fees are typically charged per transaction and vary based on the transaction type and POS solution used. The three most common transaction types are online transactions, credit or debit card transactions, and keyed transactions.

What's the difference between POS systems vs point-of-sale?

Point-of-sale, also known as POS, pertains to the action of purchasing and selling goods or services using a computer and software solution. POS systems, on the other hand, are used to manage all the consumer purchase and sales aspects of a business.

How does point-of-sale differ from point-of-purchase?

Point-of-sale refers to a transaction of goods or services from a business’ perspective. In contrast, point-of-purchase (POP) refers to the consumer’s perspective of the goods or services that a business offers to them. POP can be broadly defined as an entire store or more specifically as the particular items that a business sells.

Accept POS transactions more easily with integrated payments

Integrated payments software helps by automating the reconciliation of POS transactions (among any other sales channels you support) with your enterprise resource planning (ERP) system. Because your ERP manages other tasks like inventory management, it's incredibly convenient for a retail business to use integrated payments.

As a result, your business eliminates hours of manual work and potential errors, helping to boost AR team efficiency, cash flow, and customer satisfaction.

With Versapay’s integrated payment solutions for Netsuite, Microsoft Dynamics 365, and Sage Intacct, merchants can carry out POS transactions and reconcile them automatically with their respective systems.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.