Sage Intacct Payment Processing: Maximize Your ERP Investment With Streamlined Payments

- 18 min read

Processing payments externally adds layers of complexity and manual effort to your accounts receivable workflow.

Learn how you can extend the capabilities of your Sage Intacct ERP with an integrated payment processing solution built specifically for it.

Sage Intacct is a popular choice of accounting software among finance professionals, because it helps their teams manage a broad range of activities across HR and payroll, and financial planning and analytics. If finance teams accept and process payments outside Sage Intacct, however, it’s likely they'll get frustrated carrying out important accounts receivable (AR) tasks.

That's because when processing payments outside of your primary accounting system, you add more manual work to your AR workflow as you must spend time updating customer records and reconciling multiple sources of information.

But this doesn’t have to be the case. Integrated payments technology let’s finance teams embed payment processing capabilities directly into Sage Intacct, helping them reduce manual receivables tasks, speed up collections, and save on credit card processing fees.

In this article, we’ll explore what Sage Intacct payment processing looks like when done manually versus with an integrated payment solution. You’ll learn:

Table of contents:

7 reasons why Sage Intacct users need integrated payment processing

Processing payments manually in Sage Intacct—or relying on external, third-party payment acceptance solutions—creates inefficiencies that can be felt throughout your entire order-to-cash cycle. Here are 7 challenges that accounts receivable teams often experience if they haven’t yet integrated their payment processing with their Sage Intacct instance.

- 1) Delayed payment processing and no ability to accept digital payments

- 2) High payment processing costs

- 3) Frequent human error and customer miscommunications

- 4) Inability to capably report on financial performance

- 5) Exposure to payment fraud or heightened security vulnerabilities

- 6) Inability to keep up with evolving payment regulations

- 7) Lack of support from existing payment processing vendors

1. Delayed payment processing and no ability to accept digital payments

Manually accepting and processing payments is flat-out time-consuming. In fact, we found that our customers who accept check- and phone-payments stand to save nearly 35,000 administrative hours yearly.

But without an integrated payments solution, Sage customers aren’t empowered to shed these shackles, as accepting digital payments isn’t a possibility—or if is and you’re using a third-party, then reconciling those payments is likely a hassle.

Your customers have varied payment preferences. Some will invariably want to continue using checks, but many others want to digitize. They’d prefer using credit cards, ACH, or virtual cards. If your payment processing systems aren’t deeply connect to Sage, however, capturing these payments and syncing them back to your ERP isn’t always straightforward. And not being able to manage those payments in one place delays how quickly you’re able to capture and apply payments to outstanding invoices.

2. High payment processing costs

Not using an integrated payment processor for Sage Intacct—or using a third-party, external processor—means you’re likely paying more to accept payments than you should be. That’s because manual payment processing—or non-integrated processing—deprives you of interchange optimization, and the significant cost savings it delivers.

Interchange fees are what your bank pays to your customer’s bank. They’re designed to cover any costs associated with the risks involved in approving payment. While there are many ways to boost your margins when accepting digital cards, partnering with a processor that offers straight-through processing to your ERP will streamline your financial operations and optimize your costs.

3. Frequent human error and customer miscommunications

Our recent study found that more than four-fifths of C-level executives report having lost business because of miscommunication in the payments process. That's because “legacy systems are cumbersome and hinder effective communication between buyers and suppliers” (PYMNTS, when citing our study), leading to invoicing errors and missed follow-up opportunities that delay payments.

Manually accepting payments, then matching and applying them to open invoices significantly increases the likelihood of errors, which takes time to fix. This negatively impacts your collections efforts. Without an integrated payments system, your team is at a distinct disadvantage because of the innate difficulties of manual processing

4. Inability to capably report on financial performance

For accounts receivable teams to be effective, they require access to reliable, real-time account and transaction data. This allows them to manage and monitor outstanding invoices, accounts and individual contacts, and preferred payment methods. But when this data exists outside your Sage Intacct environment—in spreadsheets, or some third-party system—you’re unable to maintain an accurate, realistic view of your accounts receivable.

This lack of transparency or disjointed reporting limits your ability to fully understand your business’ financial health, lessening how valuable Sage could be.

5. Exposure to payment fraud or heightened security vulnerabilities

Manual, or third-party payment processing systems aren’t as secure as integrated ones, and often provide inadequate protection of sensitive financial data. Poor security controls are dangerous, as they can expose you to data breaches, compliance violations or financial loss due to fraudulent activities—like chargebacks.

Without an integrated payments system for Sage, you’re more likely to physically engage with sensitive payment data, and remain in PCI DSS cope. It’ll be harder to tokenize and encrypt payments across your sales channels, and harder to eliminate fraudulent activity without compromising your customers’ experience.

6. Inability to keep up with evolving payment regulations

Speaking of PCI DSS... Keeping up with changing payment regulations is challenging without an integrated payment processing solution to centralize data, automate security protocols, and streamline transactions. A solution purpose-built for Sage, however, could strengthen those numerous weak points.

7. Lack of support from existing payment processing vendors

Generic payment processors—that aren’t deeply embedded in your Sage environment—don’t understand the unique requirements of Sage users. That’s why there are only a handful of preferred payment partners for Sage. When processing issues arise, inadequate support could disrupt your ability to transact and further slow down cash flow. You may already be seeing first-hand how consequential not being able to resolve issues quickly is.

4 benefits of a Sage Intacct payment integration

Having a Sage Intacct payments integration can go a long way toward solving the problems we’ve just outlined above, and accelerating your cash flow. After integrating their payment processing with Sage Intacct, accounts receivable teams can expect notable improvements across the following key areas:

- 1) Streamlined invoicing and increased efficiency

- 2) Better cash conversion and lower processing costs

- 3) Lower risk and heightened payment fraud prevention

- 4) More satisfied customers and empowered staff

1. Streamlined invoicing and increased efficiency

Increased efficiency comes from usability. Often, payment solutions that are integrated with Sage Intacct limit the need for training, as accounts receivable teams are able to collect payments directly within Sage, and make it part of their native ERP workflows.

This would mean all payments activities—from invoicing to reconciliation to posting cash receipts to journal balancing to research payment data—all takes place within Sage. It all takes place within an environment you’re already deeply familiar with.

2. Greater savings on processing fees

With a Sage Intacct payment integration, spend management becomes easier too, as you can accept and process payments across all your sales channels—like ecommerce, retail, or back-office—in one tool. Plus, this integration invariably minimizes payment processing costs with interchange optimization and Level 2 and Level 3 data processing—the highest level of data you can send to qualify for lower rates.

An accounting system like Sage Intacct is already home to data that’s helpful for interchange optimization. This includes data such as what industry your customer is in, where a product is shipping to and from, invoice numbers, etc. A payment processor that can access that information through integration with your Sage Intacct instance makes supporting Level 3 processing very easy.

3. Heightened payment fraud prevention

With Sage Intacct integrated payment processing, sensitive cardholder data is tokenized, encrypted, and passed through one system, limiting the amount of hands that information needs to go through. With fewer entry points for potential bad actors, this helps you protect your customers and business from payment fraud.

An integrated payments solution that has additional security measures like optional checkout solutions for your ecommerce page can also help with limiting fraudulent chargebacks. Plus, some integrated processors ensure PCI validation, or retain transaction data for future or repeated authorization and settlement.

4. More satisfied customers and staff

Rightly or wrongly, customers often judge vendors on their billing and payment experience. Some Sage Intacct integrated payments providers give you the tools to accept customer payments online, right when they receive their invoices, making for a more convenient payment experience. When customers can settle bills upon receipt, using their preferred digital payment methods, that’s when they’ll be happy.

And because a Sage Intacct payment integration means ledger entries are updated automatically as payments come in, your team spends much less time on manual cash application. Customers win. And your team wins.

Get more from your ERP: What Versapay’s Sage Intacct payment integration looks like

With Versapay, you don't need to move mountains to process payments within your Sage Intacct environment. That’s because our integrated payments solution improves your existing workflows and extends Sage Intacct’s capabilities. We’re simply taking something good, and making it even better. Check out the following video, or read on below.

Here’s another preview of what processing payments might look like within Sage Intacct, when using Versapay’s integrated solution:

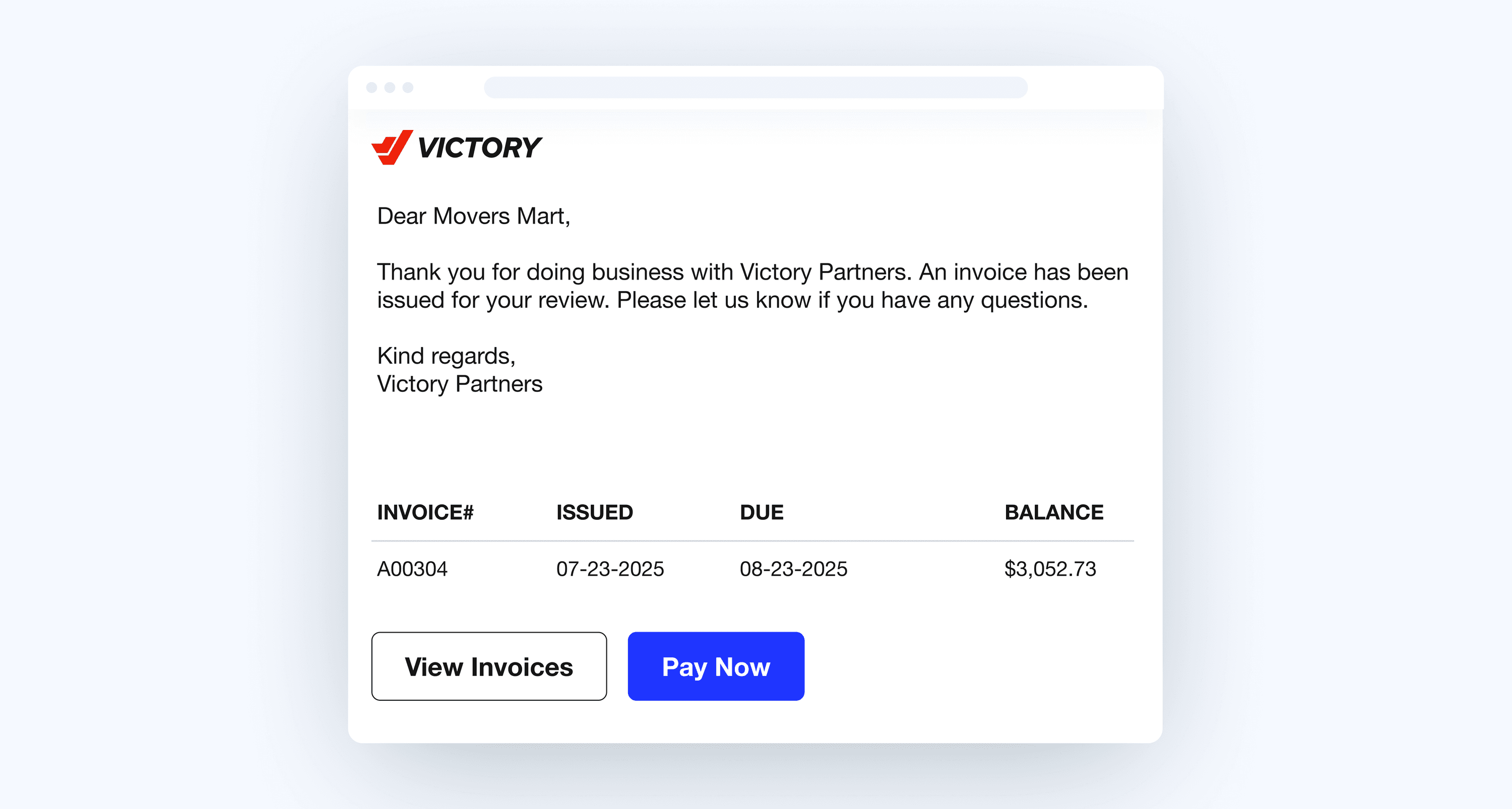

- Step 1. Email click-to-pay invoices

- Step 2. Accept recurring payments

- Step 3. Auto-apply customer payments

- Step 4. Get paid across all sales channels

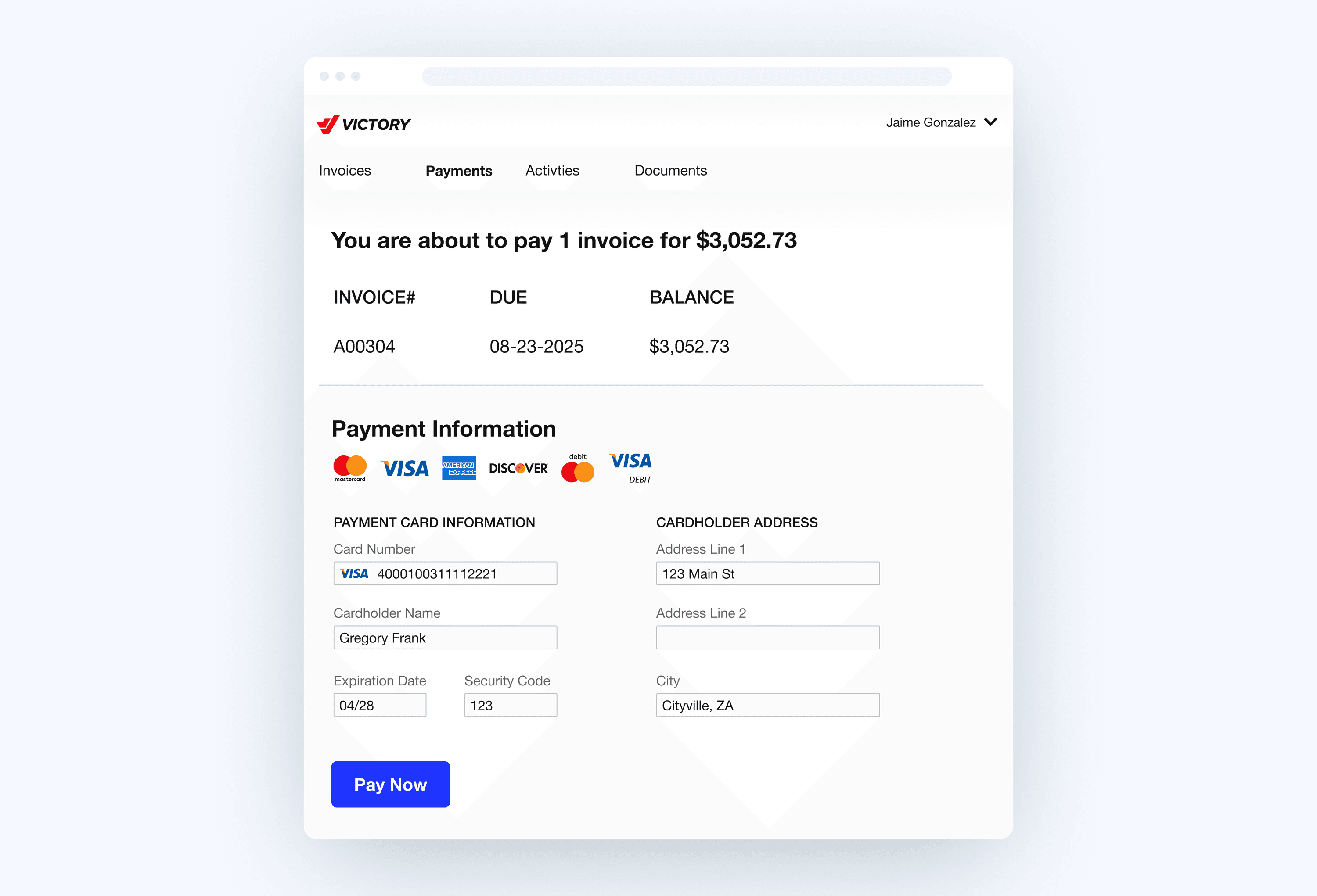

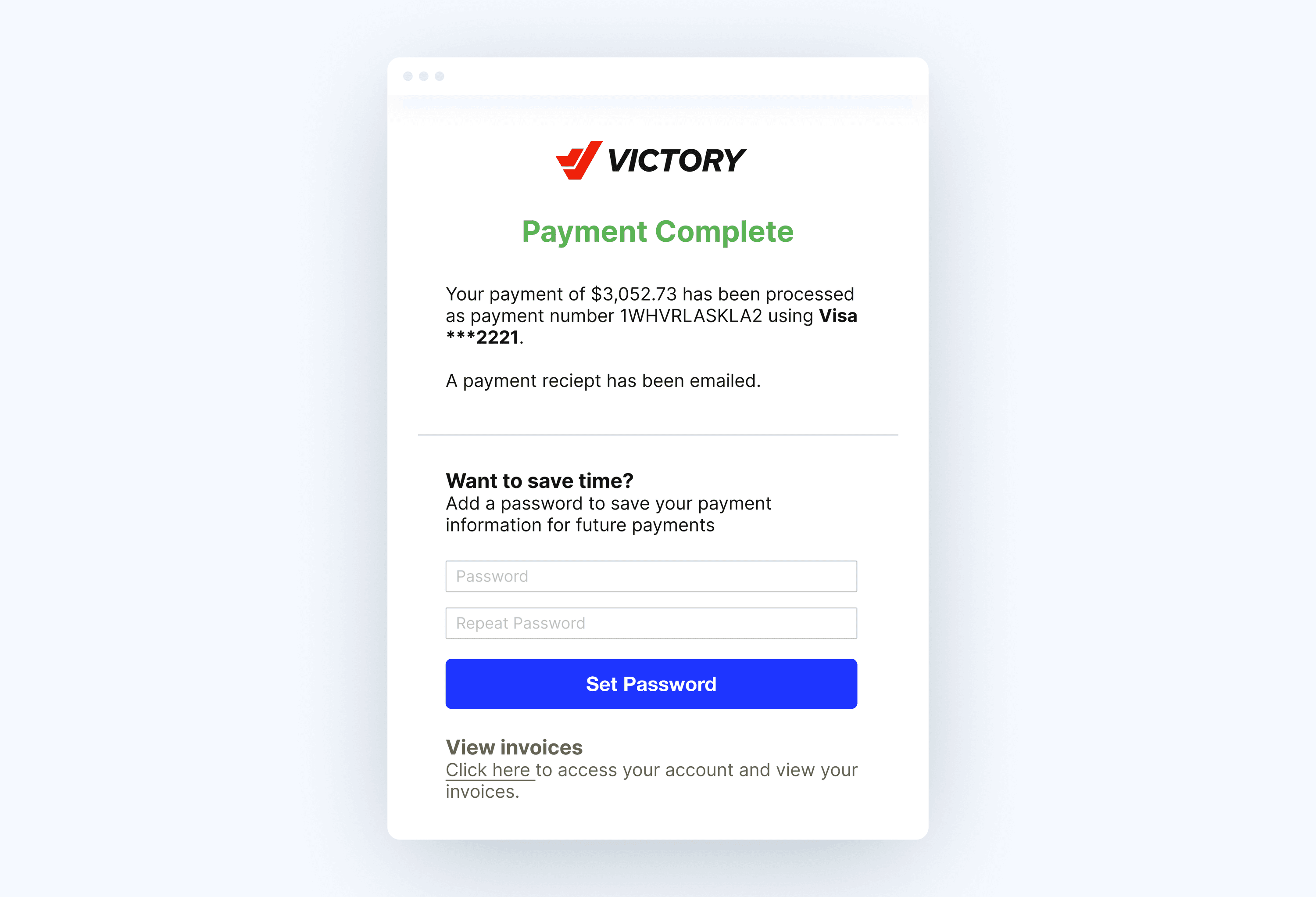

Step 1. Email click-to-pay invoices

Before processing payments through Intacct using Versapay, you can send invoices to your customers via an email containing a ‘Pay Now’ button. Once you create that invoice in Sage, your customers will automatically receive an email containing the secure link where they can pay online right away. They don’t even need a login to do so. Your customers can also choose to pay one or more invoices in full using their preferred payment methods, or opt for viewing all their invoices to tailor their payment amount.

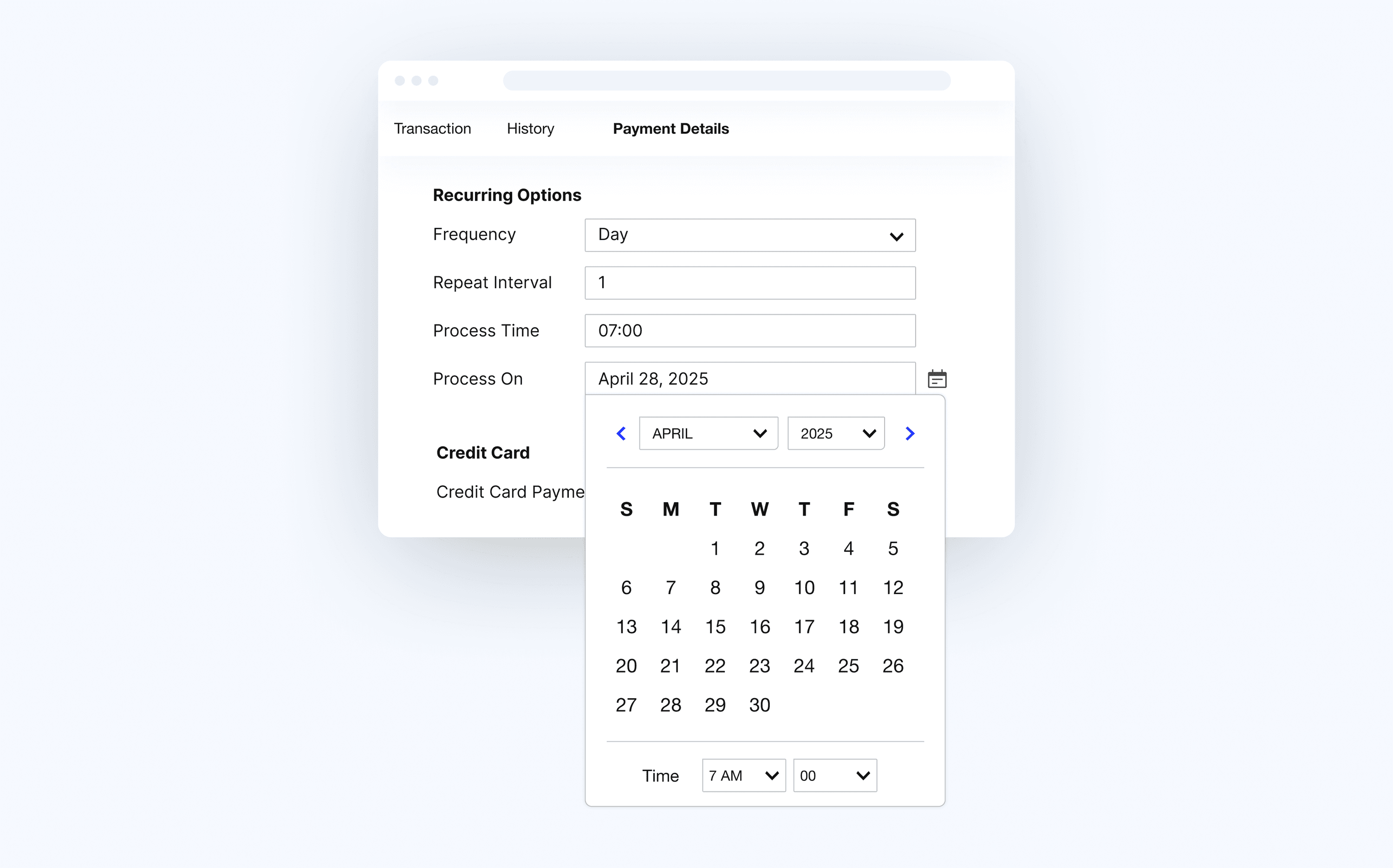

Step 2. Accept recurring payments

With Versapay’s Sage Intacct payment integration, you can also handle recurring payments, and let your customers automatically pay invoices in daily, weekly, or monthly batches via credit card or ACH. This can greatly streamline collections and subsequent reconciliations. It’s especially great for your business if your revenue model revolves around subscription billing.

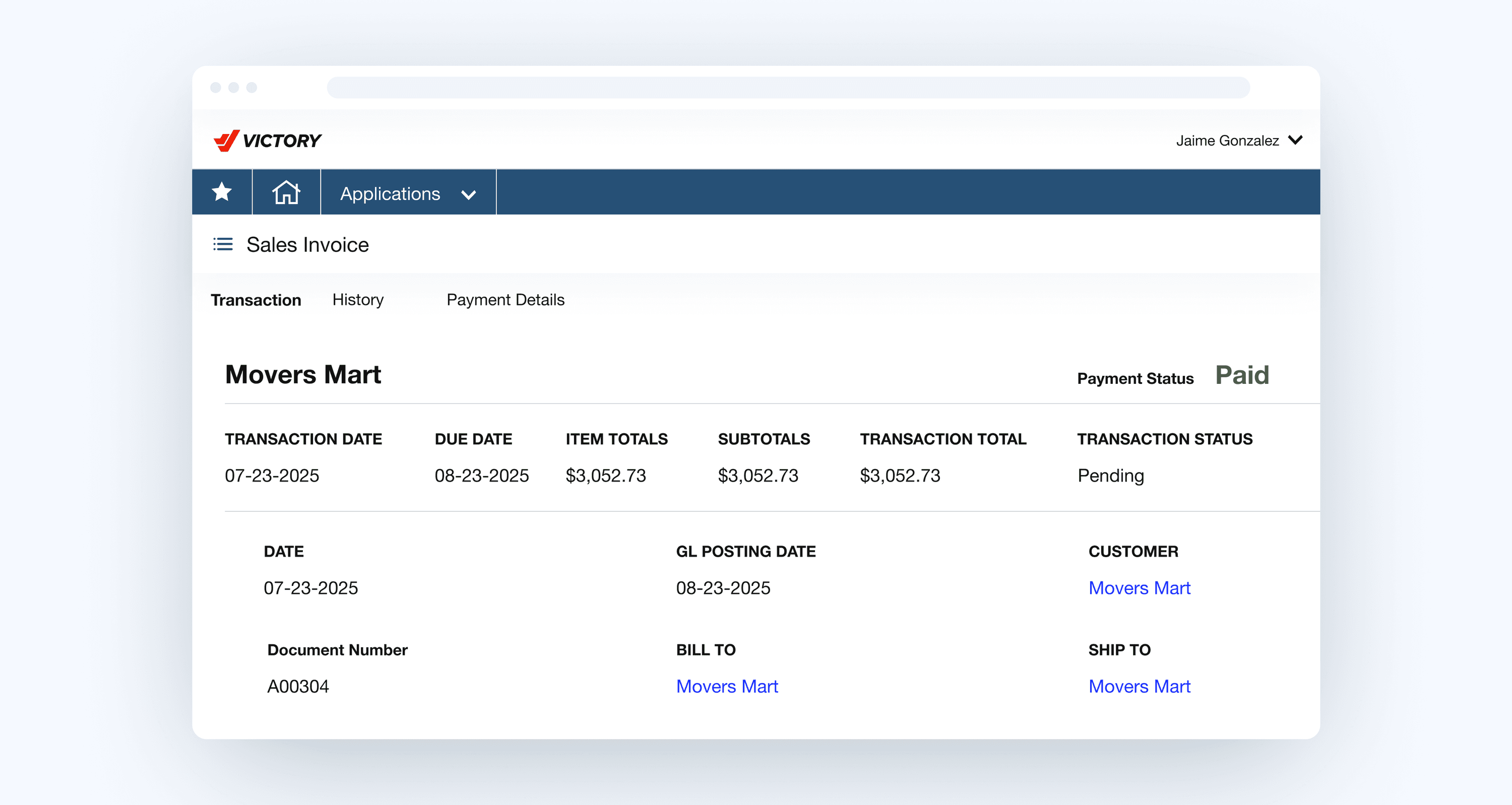

Step 3. Auto-apply customer payments

Perhaps the greatest time saver of integrated payments is that payments automatically get posted to the sales invoice list in Sage Intacct, which can then be posted to the customer ledger. This makes applying incoming payments to corresponding invoices much simpler for your accounts receivable team. You can choose which accounts the payments should go to, making settlement flexible.

Step 4. Get paid across all sales channels

Versapay’s Sage Intacct payment integration allows you to accept credit cards, debit cards, ACH, virtual cards, and bank payments across your sales channels, such as invoices, payment gateways, and ecommerce carts. Card refunds can also be handled with ease directly inside Sage Intacct. Customers’ payment methods can be saved—with all card data tokenized and encrypted—to make future payments easy.

Sage Intacct payment processing: How one transportation logistics business streamlined invoicing and payments

Sage Intacct user, North Atlantic International Logistics (NAI), had a manual, disjointed accounts receivable and payments process that was holding them back. Their staff spent tens of hours weekly chasing down payments and information from customers to ensure payment and accurate bookkeeping. Customers and staff were annoyed, and it became a particularly sticky problem when NAI expanded into shipping via rail, where payment timeframes were tighter.

So, NAI looked for a streamlined invoice presentment and payment acceptance solution that would provide the precise functionality it needed, including:

- Being integrated with Sage Intacct

- Transparency in the invoice process

- A portal to share invoicing and payment information

- A portal to share invoice and payment statuses with customers, and

- The ability to have customers prepay for services.

While integrated payments was only one part of a larger solution ultimately implemented, it contributed to NAI serving new customers, making better use of staff time, having better payment and invoice management, and improving customer experience.

“Versapay has improved our bottom line, and allowed us to focus on productive business” says Anthony Mestroni, CEO. “Instead of fighting nickel and dime with our customers, we can build relationships that are constructive.”

Why choose Versapay for processing payments in Sage Intacct?

While there are a handful of Sage Intacct payment integrations, not all offer the same level of depth and flexibility. Versapay is the go-to integrated payments solution for Sage Intacct users. And as Lisa deLeon, Senior Director of Finance at CompuData suggests, “... once you've been onboarded onto Versapay's ERP Payments for Sage Intacct, it's a set-it-and-forget-it solution. It simply works and requires no intervention by collecting payments and posting them to invoices.”

Here are three key things that make our solution stand out:

1. Superior integration and scalability

- By being directly embedded within Sage Intacct, Versapay ensures seamless payment processing and reconciliation, without ever needing to leave the ERP. This simplifies the process, and improves your customers’ experience.

- This integration means we’ll sync invoices, payments, journal entries, and credits in real-time, putting an end to manual data entry errors and keeping your financial data accurate and up-to-date.

- Whether you’re processing $5 million or $2 billion in transactions, our integration can be configured to handle even the most complex use cases.

- We act as the merchant service provider, meaning we offer a unique integration with banks, delivering real-time transaction data such as daily batches, chargebacks, retrievals, ACH returns, and rejects. And you guessed it, this is all synced neatly within Sage.

- We don’t outsource anything. We’ve got an in-house team of developers, product managers, and QA specialists working around the clock, with deep experience in payments and Sage-specific developments.

2. Data accuracy, reconciliation, and security

- It’s important your data remains accurate. That’s why Versapay automatically reconciles your general ledger with bank settlement batches nightly, minimizing manual intervention and keeping those financial records tidy.

- Sage Intacct is a great solution, but it’s not exhaustive. Our solution supports lockbox payments and automates bank reconciliation for you, while parsing remittance advice from ACH and wire payments using artificial intelligence. These tools are essential for automating reconciliation.

- Our integrated payments solution has shared wallet functionality, which tokenizes card data and shares it between Versapay and Sage Intacct. This cuts out the need for asking customers their card information each time. It also lowers PCI compliance risks and boosts security for recurring billing and auto-payments.

- Payment matching is a major time-suck. We automate matching invoices with payments in your ERP, cutting manual work and improving your efficiency. Less time matching payments means more time for strategic, fun, impactful work.

3. Customer experience and payment processing

- Your customers are on their own digitization journey, and some are further along than others. So, it’s important your Sage Intacct payment processor supports all payment methods, such as mailed checks or digital payments. We let you meet your customers where they are, making their payment experience more satisfying.

- Speaking of digital payments, Versapay supports a wide range of them, including EMV card-present, ecommerce, and shopping carts like WooCommerce and Magento. This makes processing payments across all sales platforms a breeze. And no matter where those payments are accepted, with Versapay’s Sage Intacct payment integration, all are processed uniformly within your ERP.

- Got refunds? We’ll handle those without delays, keeping your refund workflow simple and your customers happy.

Choosing the right payment processing solution can be difficult. A good solution can help you scale your business and offer your customers a memorable experience while helping you capture cash more efficiently. A poor solution... well, those don't fix your system fragmentation or manual processing woes.

Here are 3 bonus reasons why Versapay’s ERP Payments solution is the best for Sage Intacct businesses looking to streamline their payment workflows:

- 1) Sage recommended solution — We’ve earned Sage’s highest certification, guaranteeing reliability, performance, and seamless integration.

- 2) Multi-entity payment support — Sage Intacct’s out-of-the-box functionality requires custom logic for multi-entity processing. We’ll manage and payments across multiple entities without any manual set up.

- 3) Custom logic and event hooks — With Versapay, you can adapt our solution to your exact business needs. For example, we support customizable event hooks, letting you add functionality like tax calculations.

Learn more about Versapay’s integrated payments solution for Sage Intacct here.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.

Sage Intacct

Get more done in one place by integrating payments with your Sage Intacct.