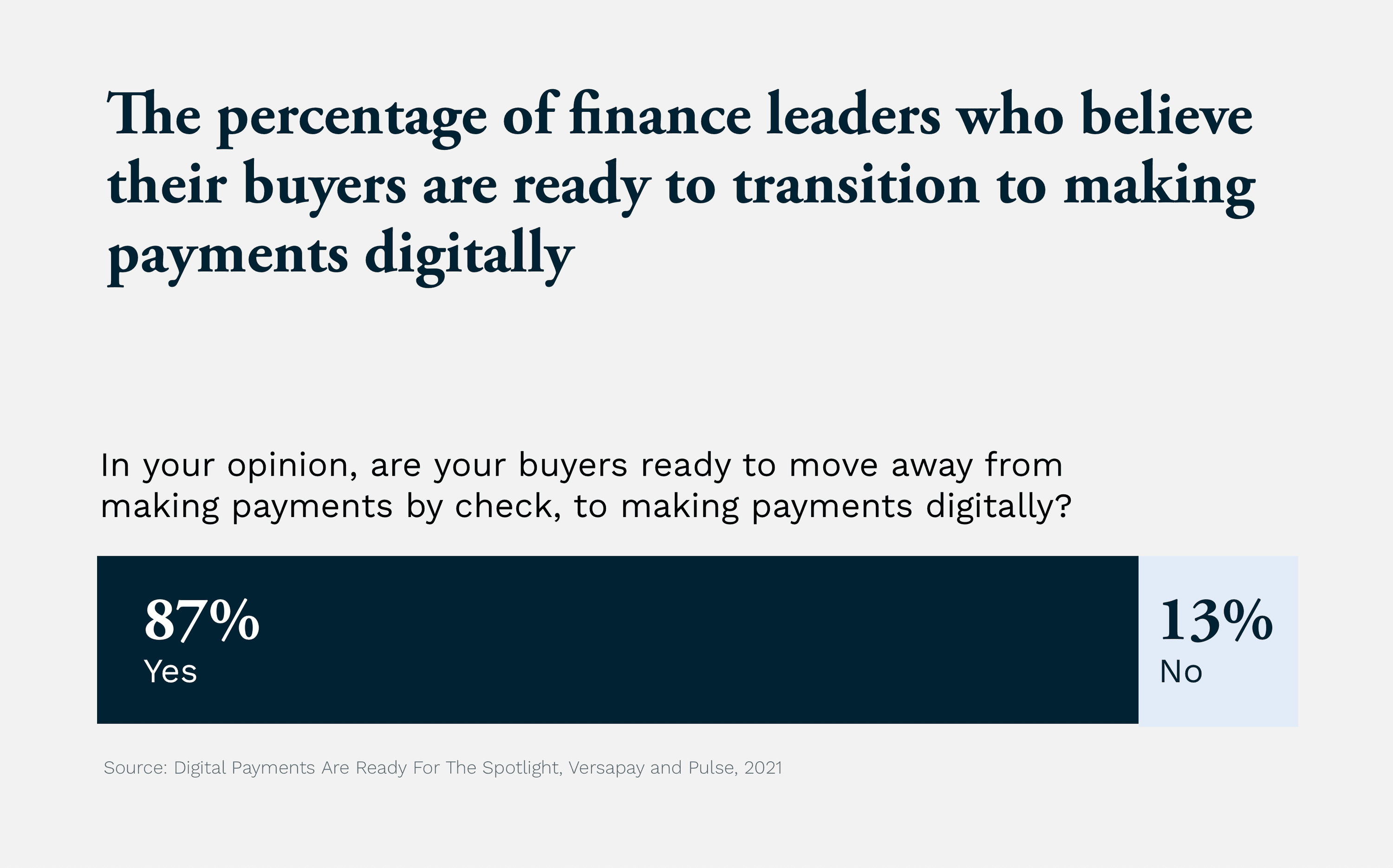

Digital Payment Fraud Prevention

Learn what digital payment fraud is, effective strategies to prevent online payment fraud, and how to provide customers a secure payment processing experience.

How to Fight Fraud and Maximize CX

Payment fraud is ever evolving. Make sure you can process payments with peace of mind.

This guide explores:

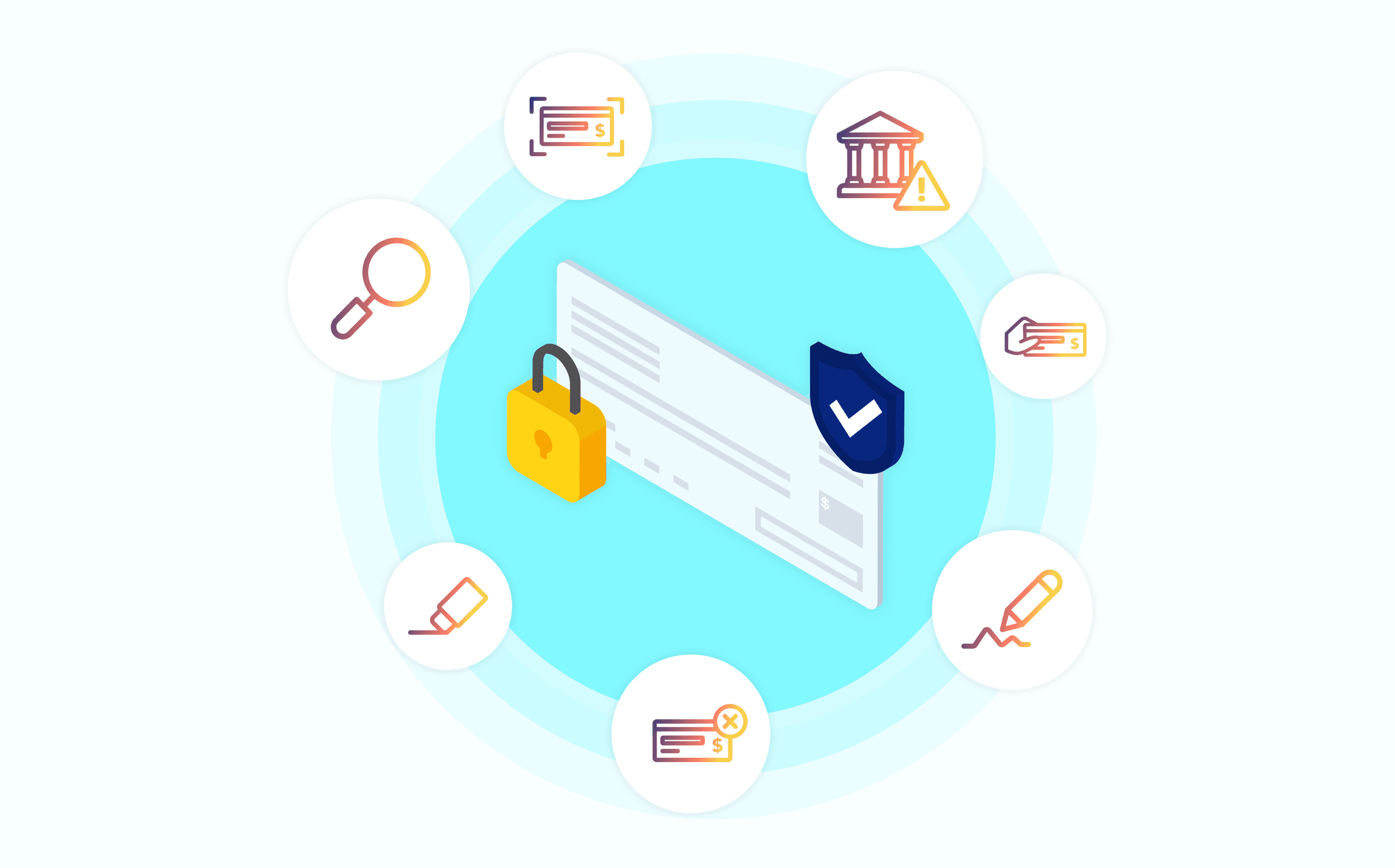

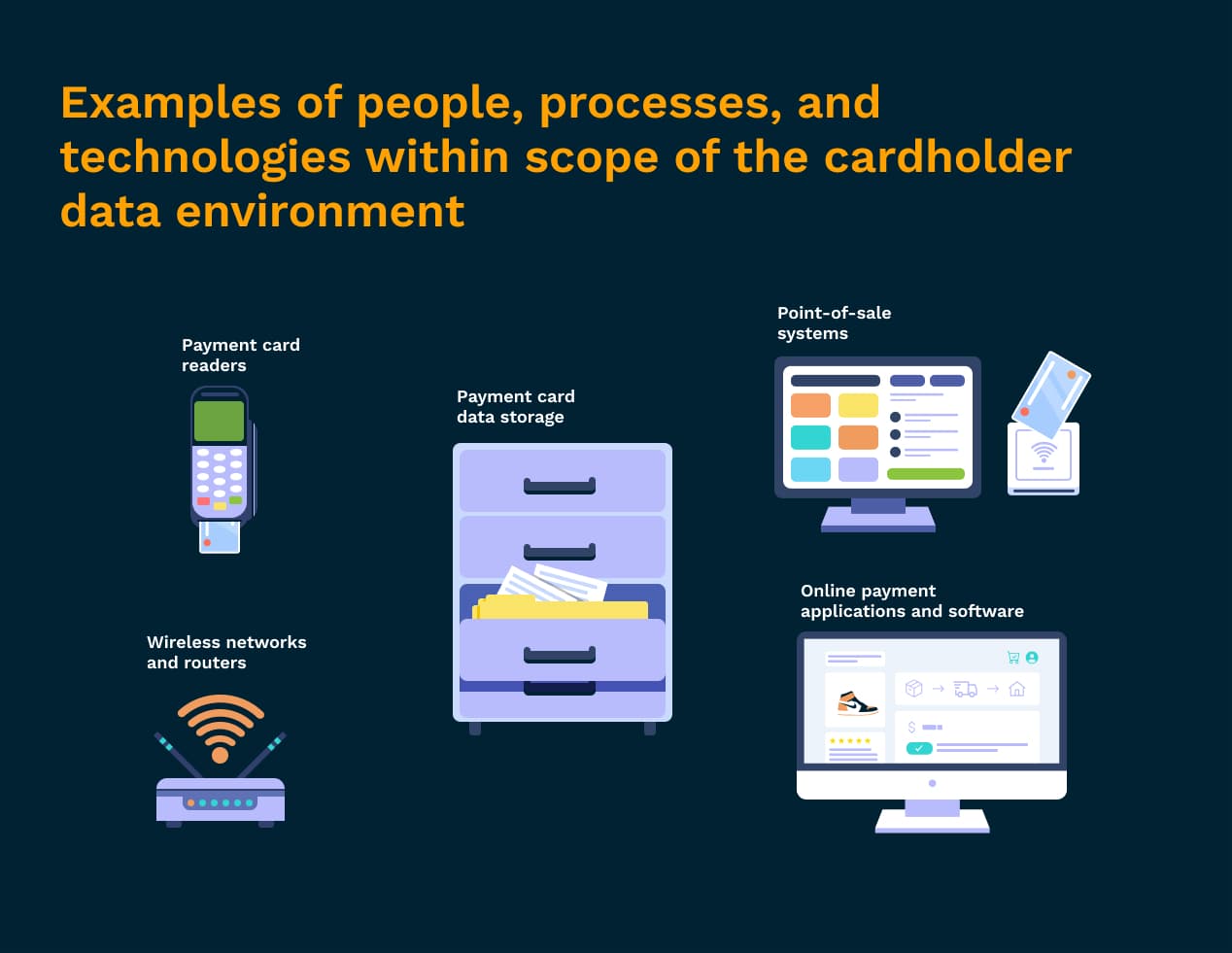

→ The different types of payment fraud

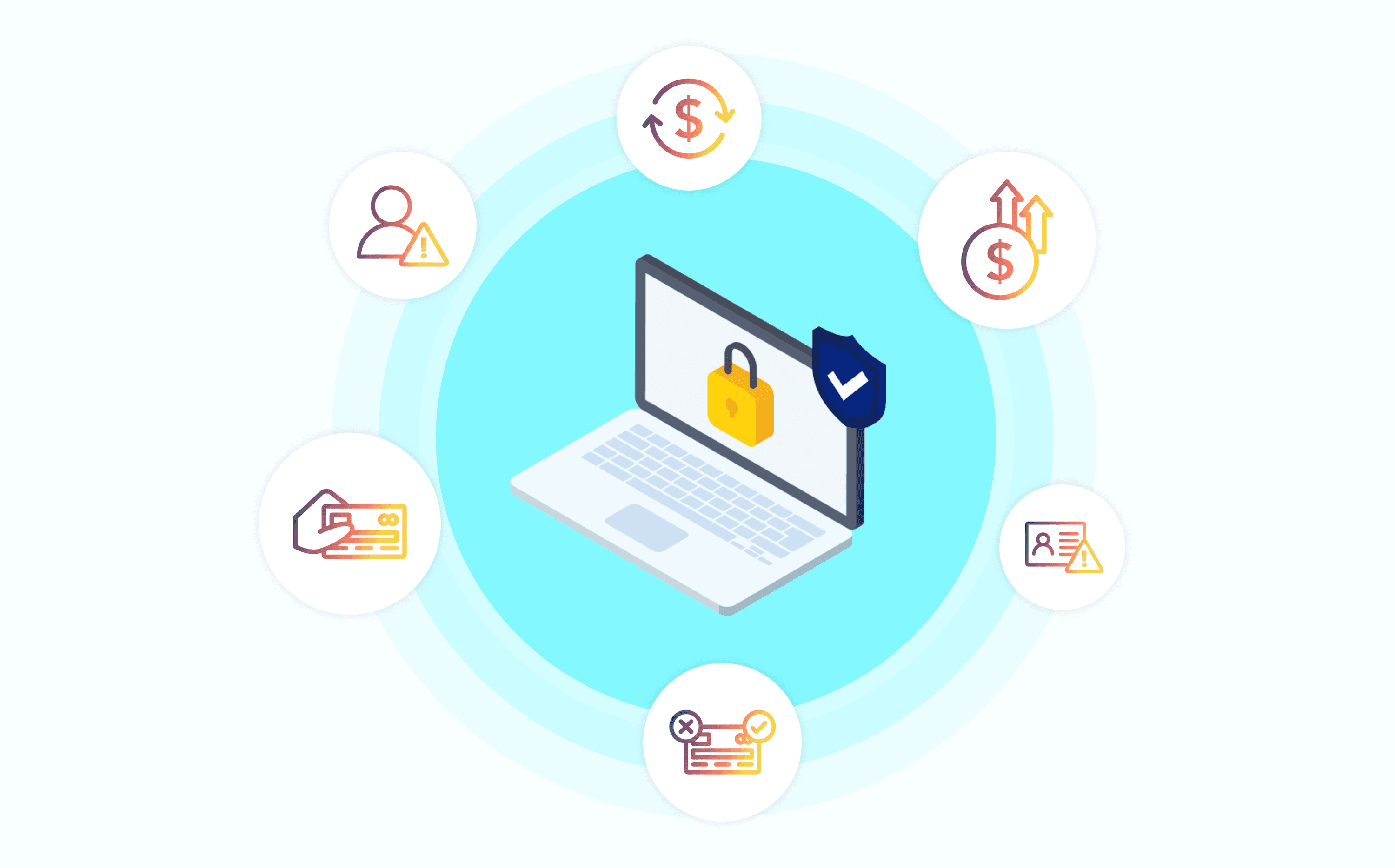

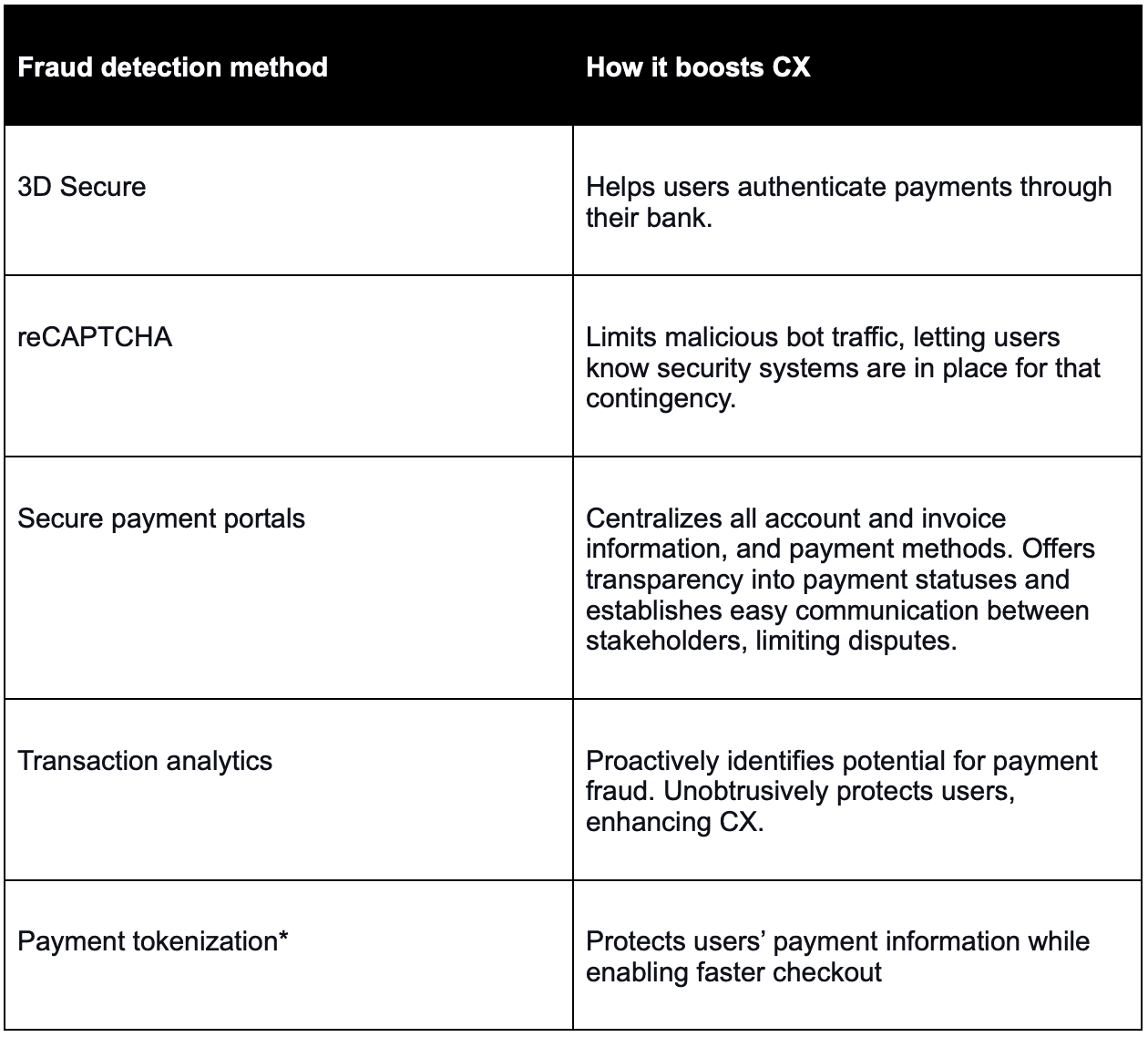

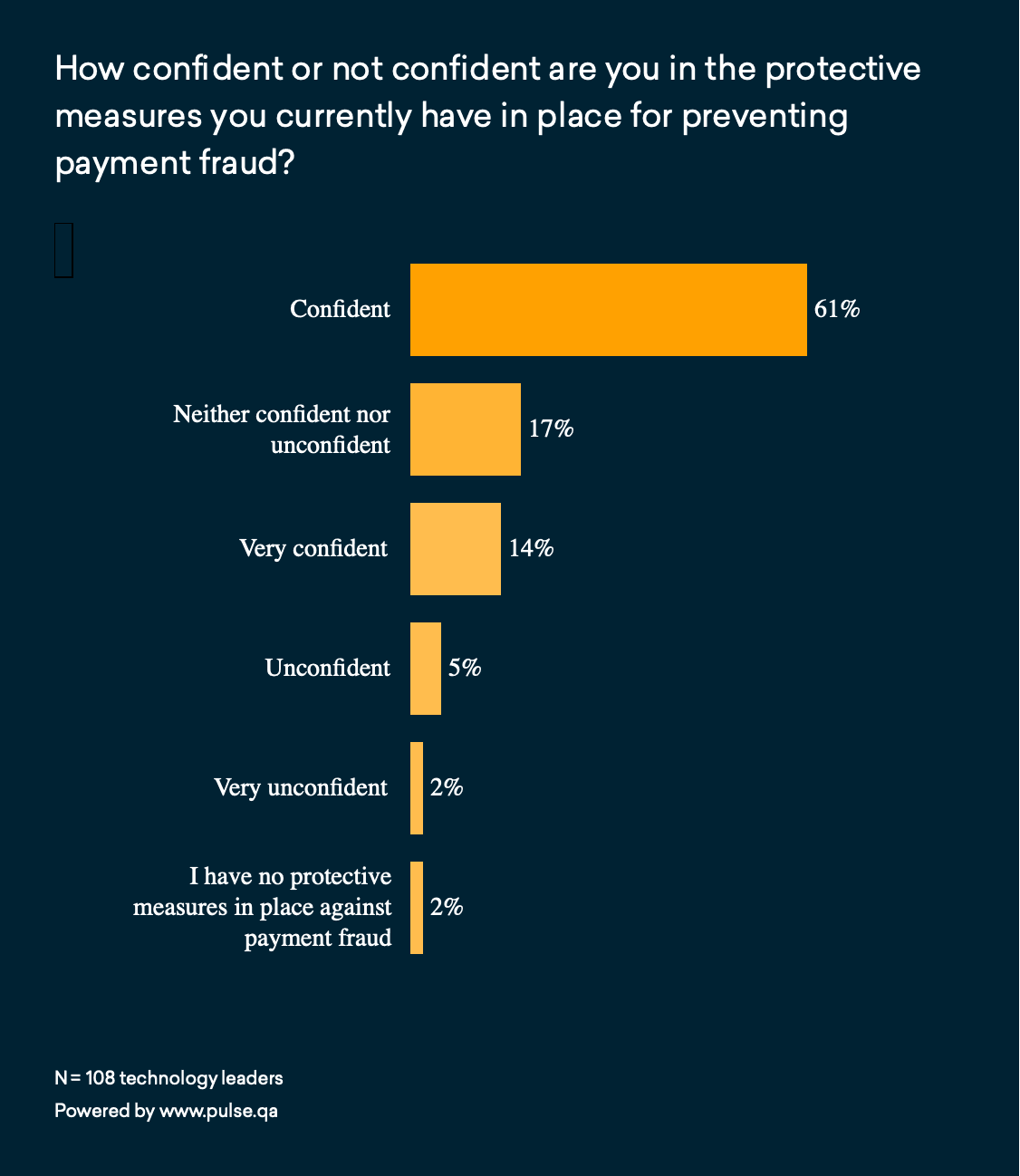

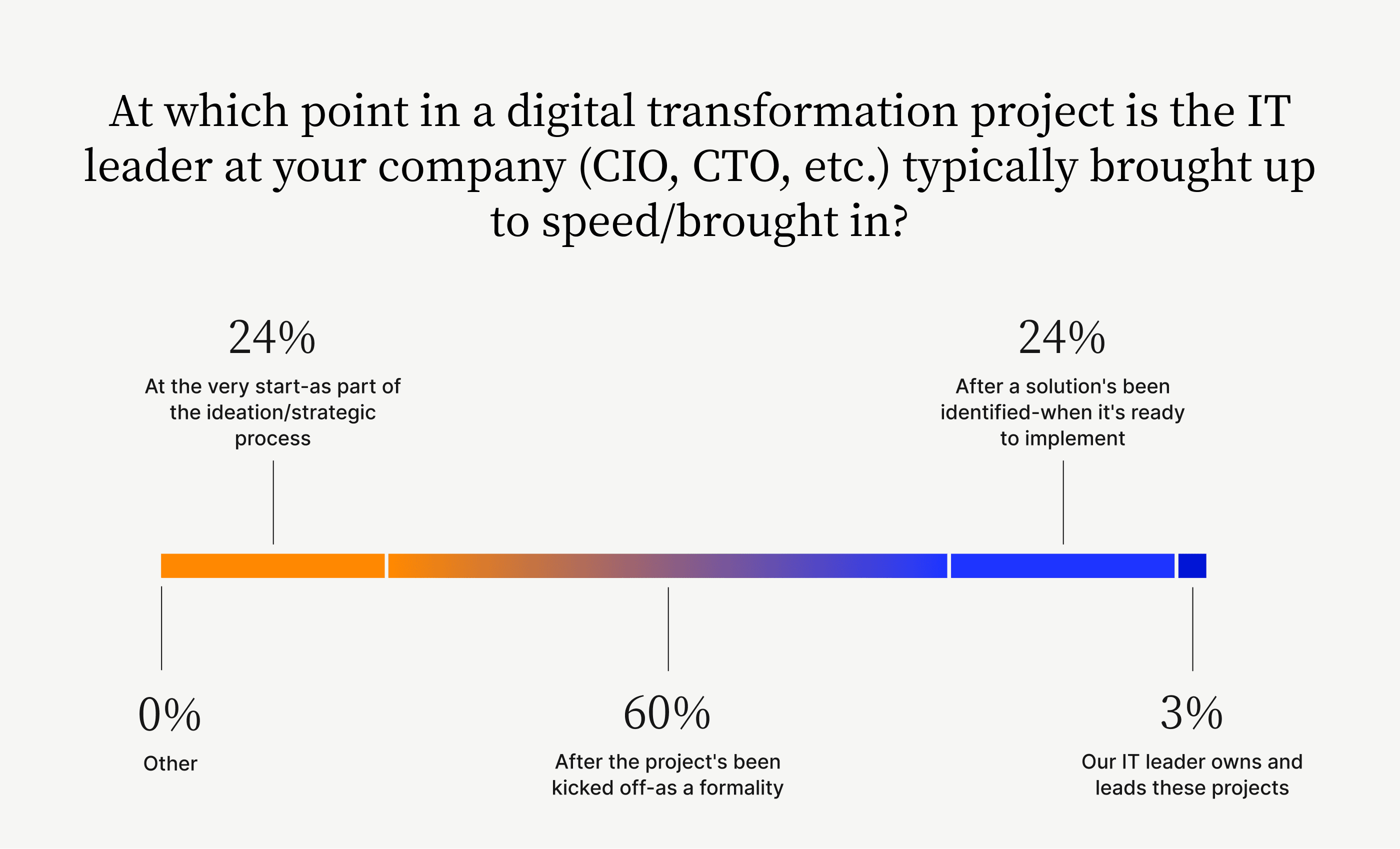

→ How it can be detected and prevented

→ How to process payments while maximizing CX

→ And more

All payment fraud prevention resources

Staying vigilant against payment fraud is critical. Understand what to look for, and how you can keep your company secure from bad actors looking to cash in:

Payment Fraud Explained: How B2B Merchants Can Fight Fraud and Maximize Customer Experience

Payment fraud is ever evolving. This guide explores the different types of payment fraud, how it can be detected and prevented, how businesses can process payments while maximizing customer experience, and much more.