Accounts Receivable: Asset or Liability? What To Know About AR

- 8 min read

Accounts receivable is much more than a number. In this article, learn the difference between assets and liabilities and why AR is a central business asset.

Accounts receivable is a critical part of any business. As a number, it shows up in your financial statements, and from an operations perspective, accounts receivable is a critical customer-facing department.

However, many companies treat AR as a cost center or liability and merely list it as an asset on their financial statements. In this article, we explore whether accounts receivable is an asset, the nature of an asset vs. liability, and the following:

- What is accounts receivable?

- Why accounts receivable is much more than a number

- Critical performance metrics connected to AR

What is accounts receivable?

Accounts receivable or AR is the money a company is owed by its customers for goods and services rendered. Accounts receivable is a current asset and shows up in that section of a company's balance sheet. When a customer clears an invoice, the amount of AR recorded decreases, and cash increases.

Accounts receivable also refers to a team executing processes to turn invoices into cash. We explain why AR is much more than a number on your balance sheet in the next section.

Is accounts receivable an asset?

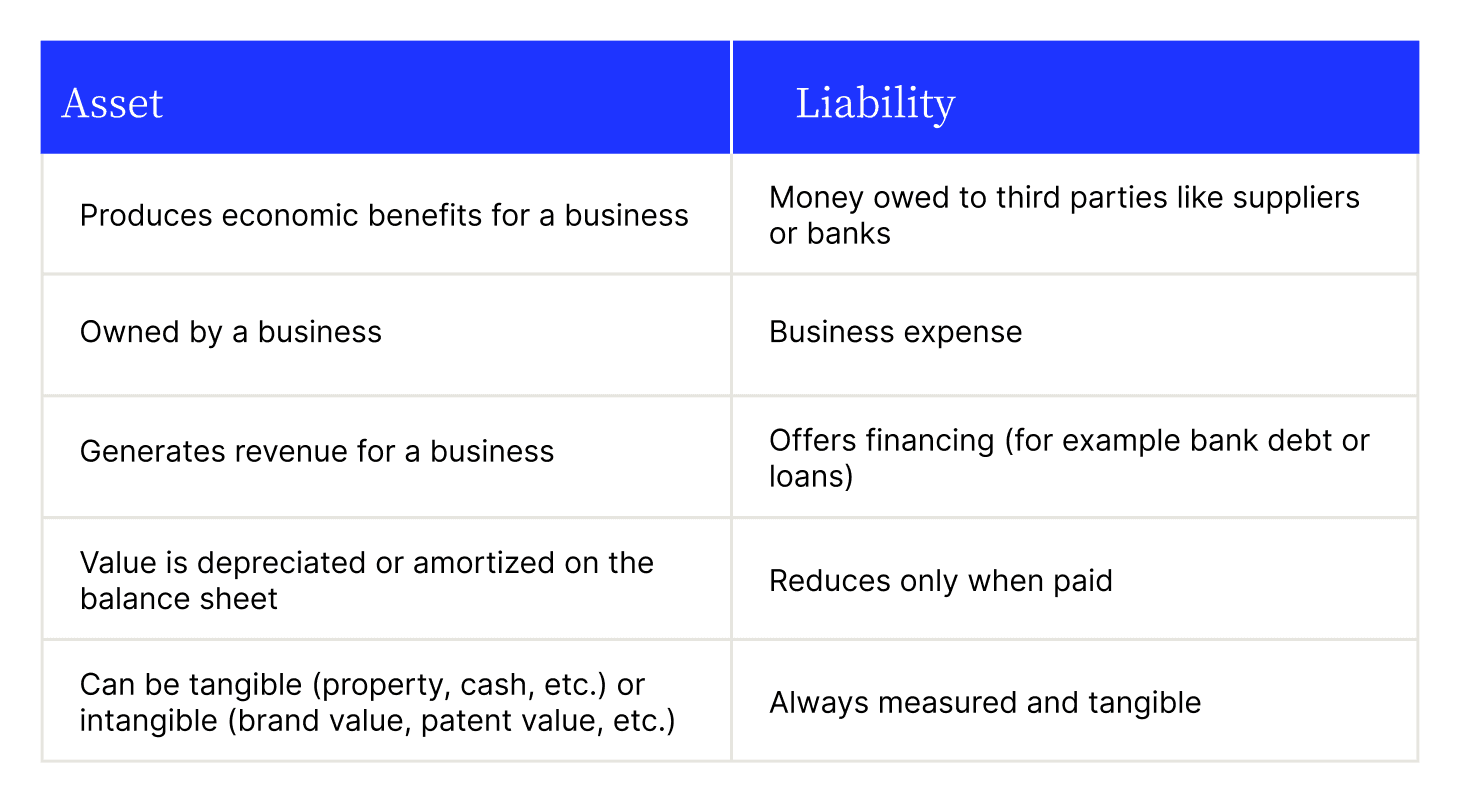

Accounts receivable is an asset recorded on your balance sheet. Accountants categorize it as a current asset. To understand why AR is an asset, we must define what assets in accounting are—alongside what liabilities are. Here are the high-level definitions of an asset vs. liability:

- Asset—An asset is anything that offers a company economic rewards.

- Liability—In contrast, a liability costs money and is paid for over time.

For instance, a company's property, cash, accounts receivable, and inventory are examples of assets. Salaries, money to be paid to suppliers, and interest owed on debt are examples of liabilities. The table below further summarizes the difference between assets and liabilities:

Assets and liabilities are categorized as "current" or “long-term”. Current assets are items that a company can use to generate cash reasonably quickly.

For example, cash, AR, and inventory are current assets. Property, plant, and equipment (PPE) take a while to sell and are considered long-term assets. Similarly, liabilities due within a year, like salaries and upcoming debt payments are "current." Anything due outside a year is “long-term”.

When you issue an invoice, it becomes a part of your accounts receivable and becomes cash once your customer pays. Accounts receivable is typically classified as a current asset because it produces cash (and revenue) reasonably quickly, giving your business tangible economic rewards

How to treat accounts receivable on your books

AR is considered an asset account, not a revenue account per accrual accounting principles. Accounts receivable does not exist as an entry within cash accounting methods since you will record revenue only when you receive cash.

Per accrual accounting principles, you must record revenue the moment your company has delivered a service or product and can reasonably expect to collect on the invoice. Since your customer hasn't paid yet, accounts receivable captures the outstanding amount.

Business is unpredictable, and with a large enough volume of invoices, you'll likely fail to collect on a few. Companies account for a reasonable rate of failure via the Allowance for Doubtful Accounts (AFDA.) This is a contra-asset on the balance sheet, listed within the current assets section, that reduces the amount of AR you record.

For example, if your receivables total $1M and you believe you won't collect $100,000, your accounts receivable will be $900,000. Note that AFDA is how much you "think" you won't collect.

If you actually fail to collect on an invoice, you will record it as a bad debt expense on your income statement and reduce AFDA by that amount.

Accounts receivable is much more than an asset on your balance sheet

Accounts receivable is a critical business differentiator that places your company in a strong position. AR is also a measure of the efficiency of your business because of the unique role it plays in defining customer experience. This role is unique because AR performs both front and back office functions.

Your AR department issues and handles invoice payments (back office functions) and also interacts with customers when handling disputes and collecting payments (front office functions.) When executed efficiently, AR workflows tie your front and back office together, giving you an overview of how aligned your business is.

Here are three reasons AR is a major asset to your business and how it could increase your company’s efficiency when executed well.

1. Accounts receivable removes uncertainty in cash and working capital levels

CFOs routinely turn to accounts receivable reports to calculate and forecast the cash they expect to earn. AR reports offer significant input to monthly closes. If your AR aging reports, for example, do not offer enough context or do not integrate automatically with your accounting platform, you'll receive a flawed cash flow picture.

An efficient and automated AR workflow removes this opacity. As Craig O'Neill, CEO of Versapay, says, "Mid-market companies can use rich data harvested from fully digital AR systems to improve their resource planning, identifying seasonal and cyclical patterns in revenue, average payment times, and delinquency rates."

2. Accounts receivable builds stronger customer relationships

Better AR equals better customer experience and healthier customer relationships. Most companies view disputes as a problem, but they're a great way to bridge the AR Disconnect. This term refers to the communication gap between AR teams, customers, and other stakeholders in customer relationships. It produces inefficiencies such as invoicing errors and incorrect payment terms, creating disputes.

Wakefield and Versapay's report on the State of Digitization in B2B Finance revealed that C-level executives believe better customer communication is a key benefit of digitized AR processes.

Collaborative payment portals are great tools for aligning all stakeholders and giving customers visibility into their payables. These tools position your AR department as a key business driver, forging strong customer relationships.

3. Accounts receivable reduces collection costs

Research conducted by APQC in December 2022 revealed that companies spend a median of $2.80 to process an invoice. This cost includes chasing customers for past-due invoices. If executed poorly, collections can become tedious, and remedying its challenges must be handled carefully. Done incorrectly, collections can damage CX and negatively impact your brand perception.

A digitally transformed AR workflow reduces the manual labor your team performs within collections. For instance, automated payment reminders, self-service payment portals, and open communication channels eliminate the time your AR team spends sending emails or calling customers. The result is reduced AR costs, accelerated collections, and a healthy cash stream.

Critical accounts receivable performance metrics

You can track a range of accounts receivable KPIs to measure the efficiency of your AR team. Here are some of the most important ones, along with what they indicate from a business perspective:

- Day sales outstanding (DSO)—Measures how long it takes to collect payment after issuing an invoice.

- Collection effectiveness index (CEI)—Measures how efficient your collection efficiency is.

- Average days delinquent—Measures how long the average past due invoice remains unpaid.

- Percentage of high-risk accounts—Lists the percentage of accounts likely to pay invoices late.

- Bad debt to sales ratio—Lists the ratio between the invoice amounts you fail to collect and overall sales.

Accounts receivable is a central business asset

Accounts receivable is an important number on your balance sheet, but it is so much more than an accounting entry. A healthy AR department is the result of efficient digital processes that enhance customer value and relationships, while introducing more efficiency in cash collection and accelerating cash flow.

By treating AR as a business asset and digitizing it, you'll reap the benefits we listed above and take a critical step in future-proofing your business.

—

Learn more about how Versapay can help you get paid faster by automating accounts receivable with a collaborative edge.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.