What Is Days Sales Outstanding (DSO): The Lifeline of Accounts Receivable

- 12 min read

Days sales outstanding (DSO) is a metric that every finance team should watch closely. But what is DSO? Why is it so important? And how is DSO calculated? You’ll learn everything you need to know about DSO in this blog.

It’s the job of the accounts receivable (AR) department to keep track of a company’s cash inflows and make sure the business is getting paid on time. You can think of AR as a business’ lungs: always ensuring that fresh cash is coming in and that it gets to the right places.

After all, cash is like oxygen to a business. It’s what keeps it alive.

That’s why it’s important for businesses that make most of their sales on credit (which a great majority of B2B companies do) to have a solid understanding of their available cash and overall financial health. Because if the lungs aren’t operating at maximum efficiency, neither is the rest of the body.

Days sales outstanding (DSO) is one of the best indicators of your business' well-being. Keeping a close watch on your DSO and how it’s trending helps you and your AR team identify potential issues preventing the business from collecting on its receivables as efficiently as possible.

In this article, we’ll explain what days sales outstanding is, the value of tracking it, and how to calculate DSO. We’ll also explore the average DSO values across industries to help you benchmark your performance and provide strategies for improving your DSO accounting methods.

Jump to a section:

- DSO meaning

- DSO tracking

- DSO formula

- DSO calculator

- What is a good DSO?

- Causes of high DSO

- Strategies for improving DSO

What is DSO?

DSO stands for days sales outstanding. Days sales outstanding (also known as average collection period or days receivables) refers to the average number of days it takes for a company to receive payment after making a sale on credit.

A low DSO number means that it takes your company a reasonably short time to collect payment from customers paying on credit terms. A high DSO number means that it takes your company longer to collect from these customers and could potentially signal inefficiencies in your collections processes.

Why is tracking DSO important?

Not only is days sales outstanding a measurement of how long it takes your company to receive payment, but it's also a reflection of customer satisfaction, customers' creditworthiness, and the effectiveness of your collections team. By tracking DSO proactively, your AR team will have a reliable pulse on how the company is maintaining these priorities.

Since the onset of the pandemic, C-suite leaders have leaned on their finance teams more than ever to inform their decision making. In 2020, 65% of CFOs reported engaging with their CEOs about company performance more often, according to a McKinsey survey.

With this increased pressure to supply analytics and insights on working capital, you’ll want your finance teams to have easy access to this data. You can track DSO automatically with accounts receivable collections software, meaning less work for you.

How to calculate DSO

If you want to calculate days sales outstanding manually, here's how to do it.

To do a DSO calculation for a given period (a single month for instance) you’ll need to know your total receivables and total net credit sales. To determine your net credit sales, take your total sales made on credit terms and subtract any returns or sales allowances.

Here we're only interested in sales made on credit and not cash sales. It’s assumed sales made on cash are collected upfront (and would have a DSO of 0 as a result).

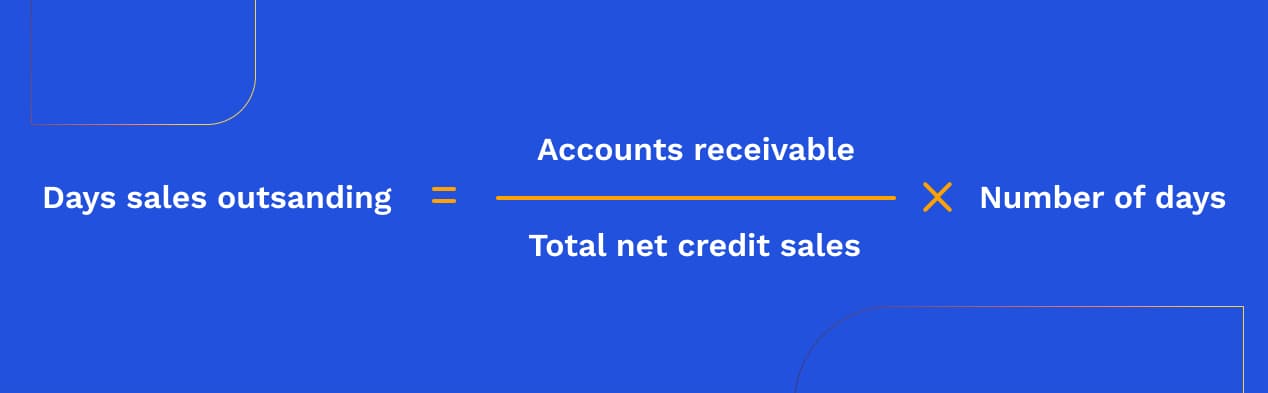

DSO formula

To do a DSO calculation, you'll divide total receivables due by total net credit sales and multiply this by the number of days in the period you’re calculating. The DSO formula looks like this:

For businesses with seasonal sales or sales that fluctuate month-over-month, calculating your DSO over the course of a quarter instead of a month is a great way to normalize your data and see trends over time.

If you want to do a DSO calculation for the quarter, take your total receivables for those 3 months, divide them by your total net credit sales during that period and multiply the quotient by the number of days in the period. For instance, if you were calculating your DSO for January to March, your DSO formula would have you multiply the quotient by 90 days.

For example, let’s say a business had the following values:

- $80,000 — In total net credit sales over the course of three months (from January through March)

- $45,000 — In total accounts receivable over that same period

In that case, they would have a DSO of 51 ([45,000 ÷ 80,000] × 90 days). That means it takes the business on average 51 days to collect on their invoices.

DSO calculator

What is a good DSO?

According to the Credit Research Foundation's (CRF) National Summary of Domestic Trade Receivables, the median DSO for companies across a variety of industries in Q3 of 2021 was 37.69 days.

In general, a DSO value below 45 days is considered good. But since DSO ranges wildly from industry to industry and from business to business, it's a good idea to look at companies that are within your industry and have similar payment terms to see how you compare. To get a full picture of your company's operations, it's best to look at trends in your DSO rather than focus only on the number itself.

Average days sales outstanding by industry

This same survey from CRF found the following average DSO values for a variety of industries:

What causes a high DSO?

There are a couple of reasons your days sales outstanding could be trending higher. It could be an indication that customer satisfaction is low and as a result, customers are taking their time to pay you. Alternatively, it might be that your customers aren't paying. In that case, your sales team is likely extending credit to customers they shouldn't.

A higher DSO could also be a result of inefficient collections processes. Getting away from highly manual AR processes in favor of automation improves your ability to collect on receivables quickly.

A survey by PYMNTS and American Express found that businesses that rely on manual AR processes tend to have 30% longer average days sales outstanding compared to those with medium to high levels of AR automation.

6 strategies for improving days sales outstanding

Here are some strategies you can use to lower DSO:

1. Make it easy for customers to know what they owe

Giving customers visibility into their current and past invoices makes it much easier for them to know exactly what they owe and when payment is due.

With an AR automation solution that gives your customers their own online portal, you can allow customers to access all their invoices and supporting documents, so they never have to wonder what they owe you.

2. Accept payments online

Are you still accepting most of your payments via check? Transitioning away from checks in favor of digital payments can help you collect payment faster, as you won’t have to deal with unpredictable mail delays.

B2B customers also increasingly prefer to pay online as it’s more convenient. In a recent Versapay survey, the top reason finance leaders said they were offering their customers digital payment methods (cited by 76% of them) was that they’re simply easier for customers to use.

3. Incentivize early payments with discounts

Discounts for early payments are a great way to incentivize customers to pay faster. But because managing discount eligibility and applying those discounts to invoices properly can be a nightmare, teams are often hesitant to use them.

An accounts receivable automation platform can make it much easier to track discounts and credits, assign them to the right customers, and reconcile the changes in your financial management system.

4. Automate payment reminders

Just like you, your customers’ accounts payable teams get busy. Increase the likelihood of your getting paid on time by nudging customers with friendly reminders as a payment date approaches.

With automation software, you can even automate and personalize these notifications, saving you the trouble of sending out dunning letters. Prompting your customers to pay in this way can also preserve customer relationships by avoiding the need for what could become confrontational collections calls.

5. Set customers up with autopay

You can make the payment experience even more convenient for customers when you introduce them to the option to set up autopay. Some AR automation tools allow customers to make payments from their account on a set timeline automatically. This way, customers have less to think about and you know for sure you'll be paid on time.

6. Periodically evaluate customers’ creditworthiness

If customers have a history of paying severely late, it could be a sign that you should stop extending payment terms to them. Not every customer is going to be the right fit, so it’s important for the health of your cash flow to identify at-risk customers early and take action to bring them back on track—or walk away.

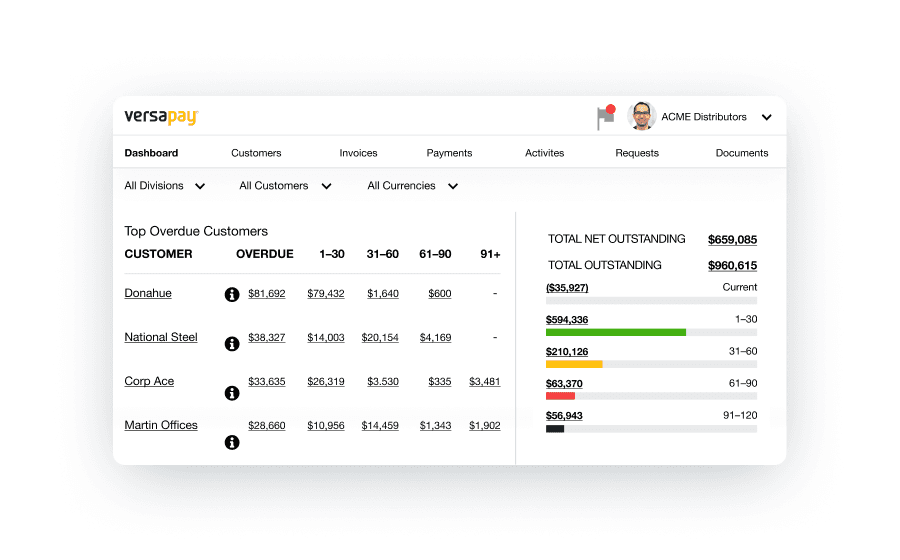

AR automation software can make it much easier for your team to identify these at-risk customers. In the Versapay platform, you can view your top overdue customers at a glance and view all your receivables by aging period.

More frequently asked questions about DSO

What are the benefits of DSO?

DSO is a valuable collections metric because it tells you multiple things about your accounts receivable efforts. It tells you about the effectiveness of your collections teams and it gives your AR teams insight into customer creditworthiness and satisfaction.

What are the limitations of DSO?

DSO is a great metric, however, it’s not infallible. It’s important you use various calculations and metrics when analyzing your cash flow performance. Below are some limitations of DSO:

- DSO only considers credit transactions and does not consider cash sales.

- DSO cannot be used to compare against companies with vastly different credit to cash ratios, as the DSO calculation does not consider cash sales.

- DSO is influenced by revenue, meaning decreases in value might not actually be indicative of improved collections efforts. Instead, changes in DSO could be the result of increased sales while past due invoices remain consistent.

- Seasonality can make identifying trends in DSO difficult.

- DSO is best used when comparing performance against businesses within your industry. Making those comparisons cross-industry can be misleading as different industries often have different DSO benchmarks and targets.

What additional metrics should be analyzed alongside DSO?

No single key performance indicator (KPI) or metric will tell you the full story of how well—or poorly—your collections efforts are performing. While knowing your DSO will tell you how long it takes on average to receive customer payments, we recommend prioritizing these KPIs to unleash the full potential of your accounts receivable:

- AR turnover ratio

- Expected cash collections

- Average collection period

- Days sales outstanding

- Collection effectiveness index

- Average days delinquent

- Number of revised invoices

- Bad debt

- Percentage of high-risk accounts

- Staff productivity

- Customer satisfaction

—

A modern AR automation platform can be your business' lifeline when it comes to staying on top of days sales outstanding and maintaining control of your cash position. Learn more about how you can streamline your accounts receivable operations with automation here.

This blog was originally published in January 2021 and has been updated for accuracy and comprehensiveness.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.