Collection Effectiveness Index: What It Is and How to Calculate It

- 12 min read

Collection effectiveness index is the percentage of receivables a company has collected during a defined period. Learn how to calculate it, how to improve it, and more.

—

Collection effectiveness index is a critical accounts receivable KPI that offers insight into your company’s ability to collect on its receivables.

A higher collection effectiveness index indicates that your credit and collections teams are performing well. A lower collection effectiveness index indicates your collections processes need correcting.

Jump to a section of interest to learn more:

What is collection effectiveness index?

The collection effectiveness index refers to the percentage of receivables a company has collected during a defined period.

It’s important to measure collection effectiveness index for numerous reasons—particularly because it:

- Adds clarity to your collection practices by quantifying how robust your collections processes are and emphasizing the importance of collection efficiency.

- Is useful for assessing the quality of your collection efforts at regular—often monthly—intervals, but also over longer periods of time.

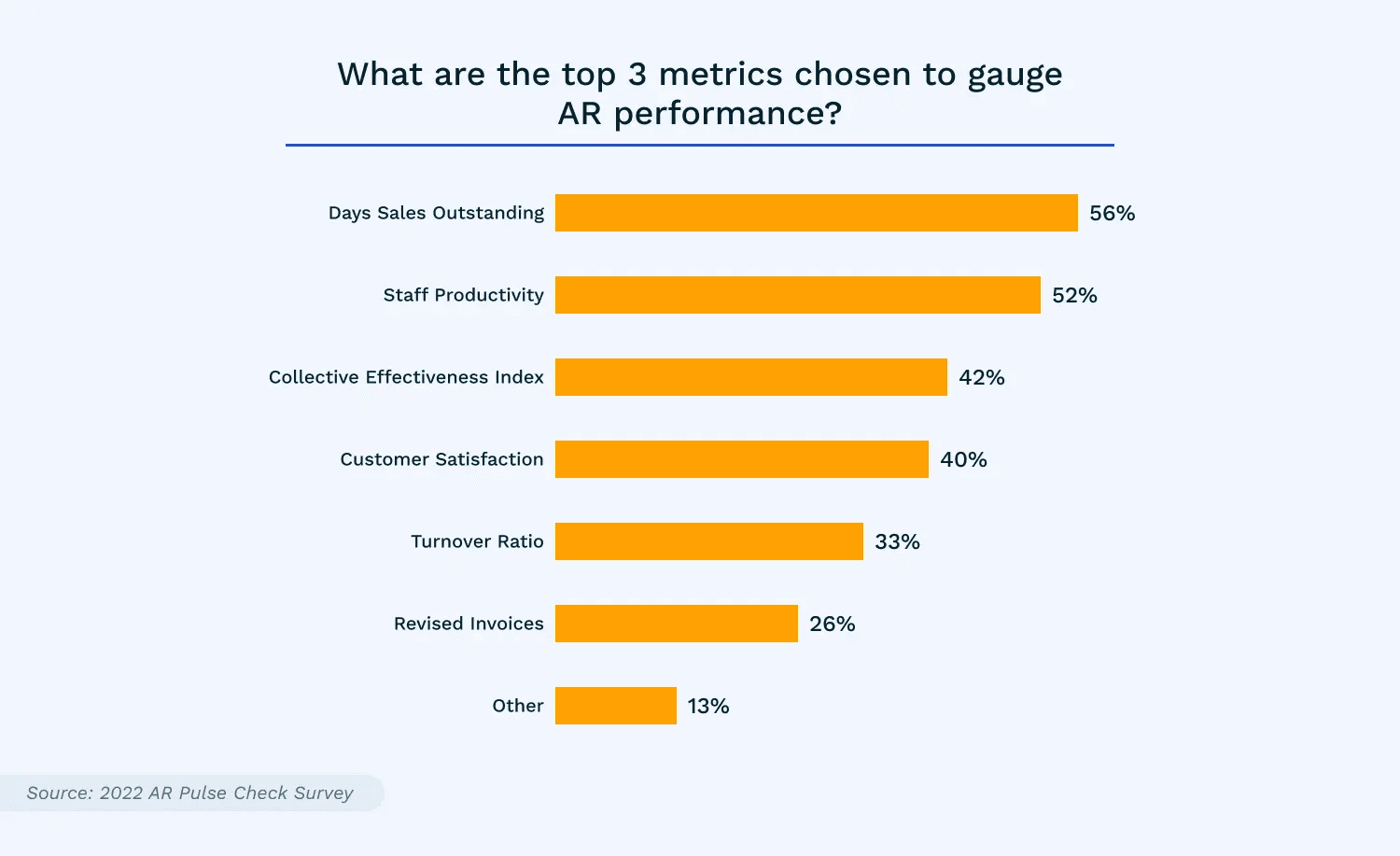

In a recent survey of business and finance leaders, collection effectiveness index was listed among the top metrics chosen to gauge AR performance. Forty-two percent of respondents ranked it as one of the three most important accounts receivable KPIs.

Knowing your collection effectiveness index can help you determine whether there are any practices in your invoice-to-cash process that are preventing you from receiving timely payments. For instance, a lower collection effectiveness index might be indicative of manual invoicing processes, a need for more flexible payment terms, or challenges communicating with customers.

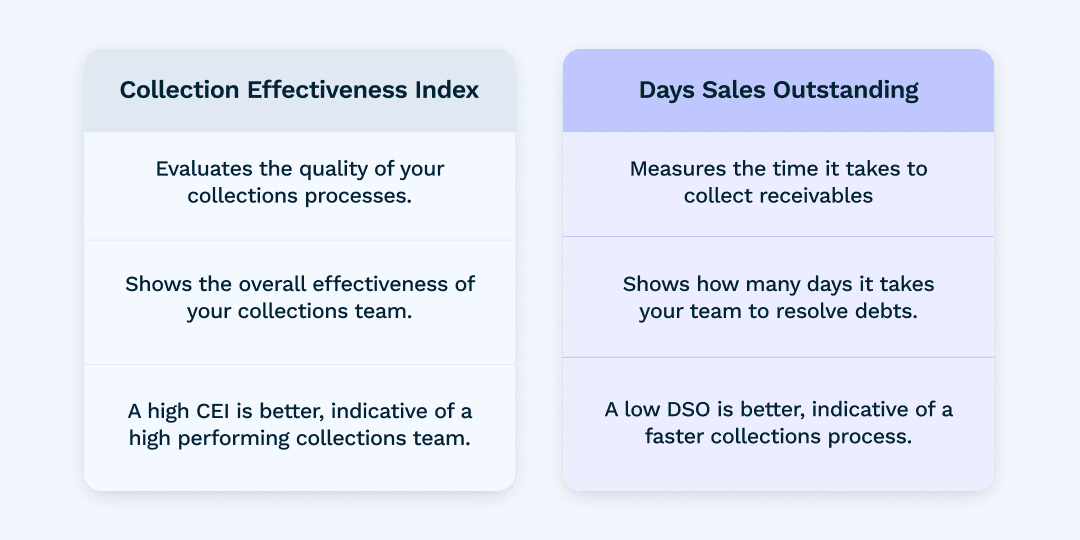

What are the differences between collection effectiveness index and DSO?

Collection effectiveness index is often used interchangeably with days sales outstanding. However, there are significant differences between the two

Collection effectiveness index evaluates the quality of your collections processes and shows the overall effectiveness of your collections team. Plus, with collection effectiveness index, a higher output is better, indicating a higher-performing collections team.

Days sales outstanding, conversely, measures the time it takes to collect receivables and shows how many days it takes your team to resolve debts. Plus, with DSO, a lower output is better, indicating a faster collections process.

Here’s a handy chart for reference:

Collection effectiveness index offers a different perspective for gauging the success of your collections efforts than DSO—or even average collection period. Whereas DSO measures success based on how fast you’re able to collect receivables, collection effectiveness index measures success based on having as few uncollectible receivables as possible. The former is a measurement of time while the latter is a measurement of quality. This is an important distinction, as the two can—and should—be measured together for the most accurate picture of your accounts receivable performance.

—

Collection effectiveness index isn't the only metric to master. Learn even more AR metrics you should be measuring, how to measure them, and what you can do to make the soar in this on-demand webinar.

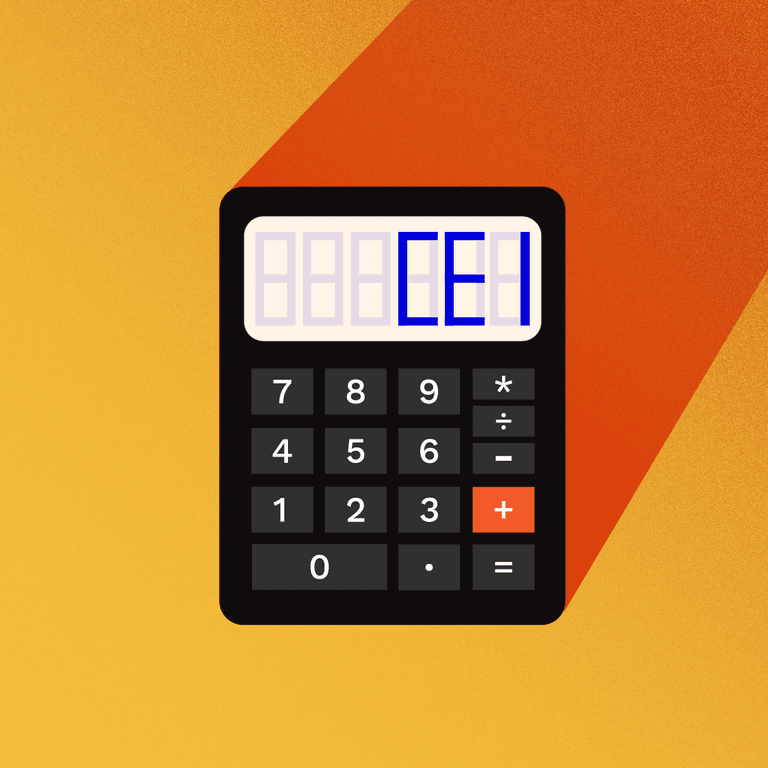

The collection effectiveness index formula

Collection effectiveness index can be calculated using a formula. This formula shows the percentage of receivables that were collected—against what should have been collected. In this section, we’ll:

- Define what inputs comprise collection effectiveness index

- Share a collection effectiveness index example—using sample data and charts

- Share an interactive collection effectiveness index calculator—for you to determine your own collection effectiveness index (plus, we’ll share the written formulas)

Breaking down collection effectiveness index

Collection effectiveness index formula is comprised of 4 inputs that include:

- Beginning receivables—the amount in outstanding AR at the beginning of the time period

- Ending total receivables—the amount in outstanding AR at the end of the time period

- Ending current receivables—the total of all payments received for credit sales made during the time period

- Credit sales—the total amount of sales made on credit during the time period

💡 Note that to calculate your collection effectiveness index, you’ll need to gather these figures, all for the same time period.

Collection effectiveness index example

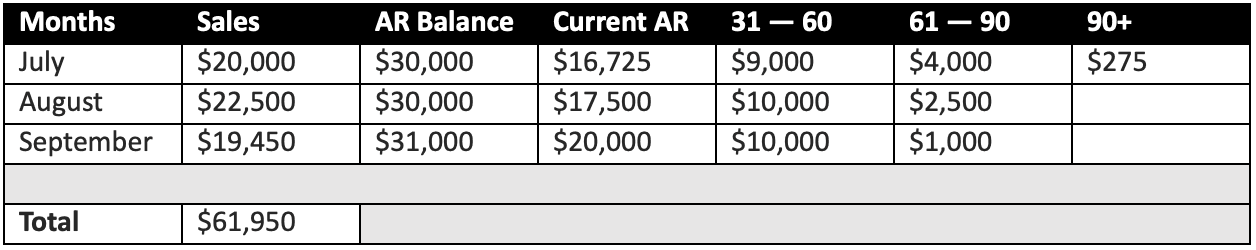

Here’s an example of what your inputs might look like, based on the following sample data:

According to this chart your inputs to calculate collection effectiveness index would be:

- Beginning receivables—$30,000

- Ending total receivables—$31,000

- Ending current receivables—$20,000

- Credit sales—$20,650 (assuming we’re calculating against a one-month period [$61,950 / 3])

Collection effectiveness index calculation

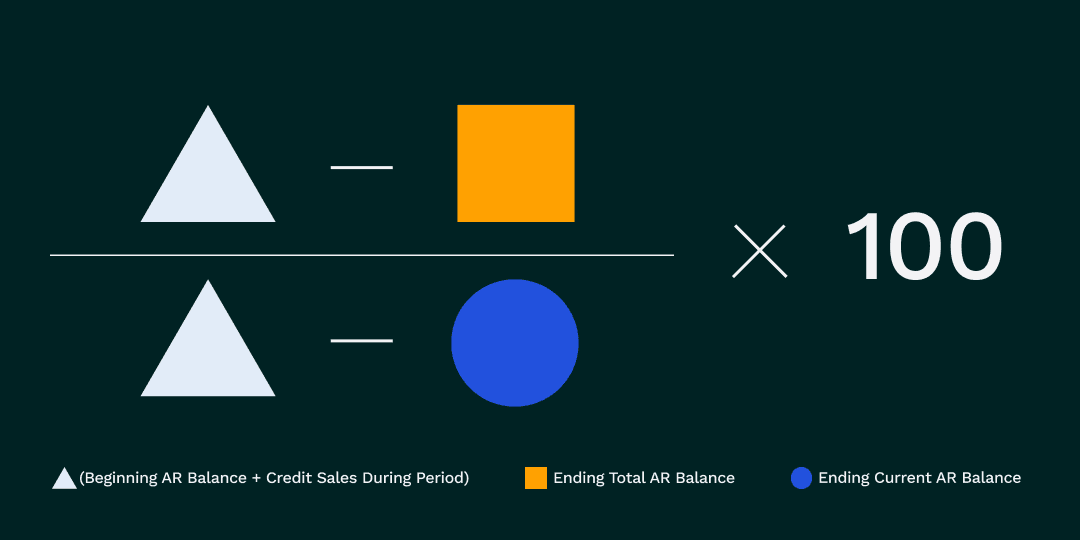

Here’s how you’d calculate collection effectiveness index:

The collection effectiveness index formula consists of the sum of your beginning receivables and monthly credit sales, less your ending total receivables. You’ll then divide that by the sum of your beginning receivables and monthly credit sales, less your ending current receivables. Lastly, you’ll multiply that output by 100 to get the percentage.

Based on the above values, here’s what the calculation would look like:

- (([30,000 + 20,650] - 31,000) / ([30,000 + 20,650] - 20,000)) x 100

- Collection effectiveness index = 64.11%

To calculate your collection effectiveness index, use our interactive calculator:

What is a good collection effectiveness index ratio?

Ideally you want your collection effectiveness index as near to 100% as possible, however in most situations this is an unrealistic goal. Generally, a collection effectiveness index of 80% or above is considered good. Note that collection effectiveness index—like many accounts receivable KPIs—can be subjective. It’s important you benchmark your values against your industry and your historic inputs.

A collection effectiveness index like in our example above—of 64.11%—may indicate some problems in your accounts receivable processes that need to be addressed.

How to interpret collection effectiveness index

If you calculate your collection effectiveness index and find it to be low, it’s important you understand what that means for your business. You don’t want to misinterpret the calculation. There are various factors that could be contributing to low collection efficiency, including but not limited to:

- Too lenient credit or payment terms—Overly flexible credit policies might result in non-payments, resulting in lower collection effectiveness index.

- Delayed or incorrect invoicing—Problems with invoicing processes, including an abundance of manual errors or delays in issuing invoices could be the culprit for non-payments and a lower collection effectiveness index.

- Limited payment options for customers—Your customers demand diversity in how they pay their invoices. Not adequately addressing those needs can negatively impact your cash collection cycles.

- Challenges communicating with customers—Miscommunication is the bane of many AR teams. When there’s misalignment and miscommunication at any point during the payment stage, customers are likely to raise disputes and possibly forgo payment altogether.

There are a host of other challenges that accounts receivable departments face daily, including frequent misapplication of payments, difficulty maintaining good relationships with customers, and manual reconciliation of financial statements. Any of these challenges could be underlying factors of a lower collection effectiveness index.

When you focus on improving your collection effectiveness index, it’s good practice to thoroughly examine your entire AR process to unearth where the root problems may lie.

5 things you can do to improve your collection effectiveness index

There are many ways in which a business can improve their collection effectiveness index. And often the solutions are specific to your company’s individual situation. There are several tactical optimizations, however, that every AR team should consider, including:

- Automating your invoice delivery

- Shoring up your credit and payment policies

- Offering a variety of payment options

- Prioritizing customer communication

- Implementing strong collections processes around delinquent accounts

1. Automate your invoice delivery

Your team manually preparing and delivering invoices to your customers will inevitably create delays for customers' receiving invoices and payment terms initiating.

Consider automating as much of your invoicing process as possible to avoid these delays. With AR automation software that integrates with your enterprise resource planning (ERP) or financial management system, you can set up automatic delivery of your invoices to customers’ email (or whatever format they prefer).

2. Shore up your credit and payment policies

Too lenient credit policies can minimize the effectiveness of your collection efforts, ultimately lowering your collection effectiveness index. You may need to tighten up your lending practices and offer lower credit limits to accounts that could be considered risky.

You could also consider shortening your payment terms, for instance lowering net 60 terms to net 45 terms. By tightening up these policies, you’ll make collections easier on your AR team, and hopefully, weed out a significant amount of bad debt.

3. Offer a variety of payment options

Accepting checks as your primary payment method is likely to inconvenience your customers. With the shift to remote work, among other factors, many business buyers have reduced their reliance of paper checks in favor of digital payments.

By giving customers the option to pay in the way that best suits their needs—whether that’s by credit or debit card, ACH, or virtual credit card—you’re far more likely to receive payments in a timely manner. Having the technology to readily accept and reconcile all these payment methods helps you ensure customers have a positive payment experience.

4. Prioritize customer communication

Overdue receivables are often a result of invoice disputes. These disputes might arise because customers are requesting a correction on their invoice or are denying payment due to damaged goods.

The methods AR teams traditionally use to communicate with their customers—email and phone, according to 86% of business and finance leaders—make it very difficult to resolve these disputes as context can be lost or the right person isn’t looped in.

Collaborative AR—that allows you to communicate with customers through a shared cloud-based portal—takes these challenges out of the equation. In this case, both buyers and suppliers can comment directly on invoices to resolve any issues.

5. Implement strong collections processes around delinquent accounts

Past-due invoices are one of the main contributors to a low collection effectiveness index. Your collections process runs much more effectively when you can easily identify and prevent delinquent accounts.

Target customers before they become delinquent with automated notifications and reminders, and follow up quickly on invoices that become past-due. Intelligent collections software can make it easy for your team to identify customers who are at risk of paying late and prioritize their outreach accordingly.

—

The right accounts receivable automation solution can streamline your collections processes, ultimately improving your collection effectiveness index.

Simplify your accounts receivable reporting with automation

Collection effectiveness index is simply one means of measuring and tracking how your accounts receivable processes are performing. To unleash the full potential of your AR, you'll need to track several AR KPIs, and only when combined, will you have the full story of how your collections efforts are performing.

Moreover, without any means of automating your AR reporting, pulling these numbers regularly can be a tedious—and perhaps, futile—exercise. When evaluating AR automation software, look for a platform with robust reporting capabilities, so you can take as much of the burden off your team as possible.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.