Chargeback Fraud Is Up 25%—Here’s How To Protect Your Business

- 7 min read

Chargeback fraud is up 25% due to COVID-19. This blog explores the cause of chargebacks, how to prevent chargebacks, and why some chargebacks are inevitable.

When retail stores closed as a result of COVID-19 and millions of consumers around the world stayed home for months at a time, it came as no surprise that online sellers enjoyed a surge in ecommerce shopping.

Just in the United States, consumers spent $861.1 billion online in 2020. That’s a 44% increase compared to 2019. Overall, online channels represented 21.3% of total consumer retail spending last year.

Surge in online shopping presents chargeback fraud risks to buyers

Even as brick-and-mortar stores re-open, more consumers are finding that they enjoy the ease and convenience of online shopping, as well as other remote channels like click-and-collect. They now view the online purchasing experience as an integral component of the overall customer experience. That’s great news for digital retailers, but we must remember that new opportunities go hand in hand with new challenges—namely, the advent of chargebacks.

Chargebacks generally occur when a cardholder contacts their issuing bank and disputes a charge. The cardholder could claim that there was an error on the merchant’s part, or that the transaction was unauthorized. 2020 saw a surge of chargeback fraud coinciding with the boom in ecommerce activity.

Chargebacks are an important consumer protection mechanism. Over the last decade, though, more and more cardholders have abused the chargeback process through a practice known as friendly fraud. The recently-released 2021 Chargeback Field Report found that the average merchant noted a 21% year-over-year increase in friendly fraud between 2018 and 2021—in addition to the 25% increase in chargeback fraud due to COVID-19.

But where do friendly fraud chargebacks come from? In effect, any chargeback filed without a valid reason falls under this heading, so it’s important to clarify what constitutes a valid chargeback source. In this blog, we’ll cover:

- The fundamental causes and originating sources of chargebacks

- How merchants can prevent chargeback scams in a post-pandemic marketplace

- Why some legitimate chargebacks might still slip through your defenses

What are the 3 fundamental chargeback sources?

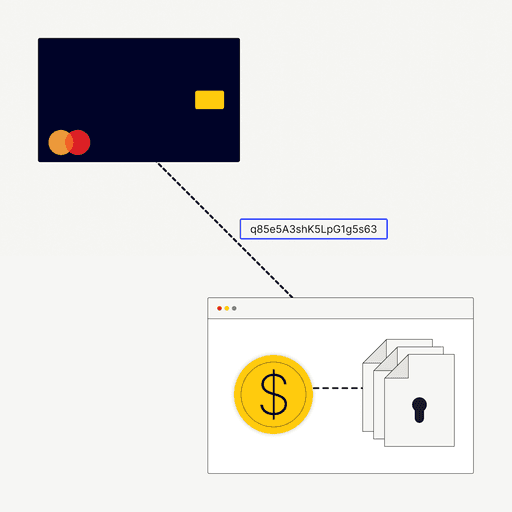

1. Criminal fraud chargeback

A criminal fraud chargeback occurs when a bad actor uses cardholder information to make an unauthorized purchase. They may deploy a variety of tactics, including account takeover, identity theft, phishing, smishing (SMS phishing), or domain squatting to facilitate the scheme.

2. Merchant error chargeback

Alternatively, a merchant error chargeback can occur after a merchant fails to provide the goods or services promised under the conditions agreed upon at the time of purchase. For instance, if the merchandise is not shipped in a timely manner, or if the goods that arrive do not reflect what was promised.

3. Friendly fraud

Chargebacks that fall outside these bounds could be considered friendly fraud. Common friendly fraud sources include buyer’s remorse, transactions submitted by a relative of the cardholder (called family fraud), or confusion on the customer’s part about merchant policies. Still, there are some situations in which cardholders deliberately abuse the chargeback process and file claims to try and “get something for free.” This is a practice referred to as cyber shoplifting.

Regardless of what ultimately triggered the chargeback dispute, the result is the same: you lose revenue and merchandise, and increase overhead costs like shipping and interchange fees. You also get hit with additional fees per every chargeback filed.

Chargeback losses can add up over time and become a substantial drain on your bottom line. Plus, each chargeback negatively impacts your chargeback ratio—the number of chargebacks-to-transactions—which can jeopardize your entire business over time.

Friendly fraud was forecast to cost merchants up to $50 billion in 2020. That projection was made before the COVID-19 outbreak—given that incidents of friendly fraud more than doubled between January and June 2020, the actual total is probably much higher.

How to prevent chargeback fraud in a post-pandemic marketplace

COVID-19 played a major role in accelerating the chargeback fraud problem. But regardless, chargebacks are a larger trend that stretch back more than a decade. Short-term changes adopted by the major card networks can relieve some pressure on merchants. However, outdated chargeback practices are still out of touch with the current state of the market.

That all begs the question: what can you do about this problem? How can you prevent chargeback scams in a post-pandemic marketplace?

You can’t necessarily rely on chargeback reason codes, because friendly fraud relies specifically on hiding behind false reason codes. So, the key is to avoid chargeback activity in the first place and defend your business from fraud by addressing the true source of chargebacks.

You can address criminal fraud by adopting a multilayer fraud management strategy. The following practices are instrumental in reducing the risk of fraudulent chargebacks:

- CVV verification

- Address Verification Service (AVS)

- Geolocation

- Velocity limits

- Fraud blacklists

- 3-D Secure 2.0 technology

- Chargeback fraud protection services

- Secure payment processing solutions

These should all be backed by fraud scoring, which can examine all fraud indicators, gauge the relative risk of each transaction, and provide up-or-down automatic decisioning. You can then choose to subject these transactions to manual review or reject them outright.

You can also work to eliminate merchant error chargebacks by addressing the triggers that commonly cause them. These include:

- Unrecognizable billing descriptors

- Inaccessible or unresponsive customer service

- Policies and terms that are confusing or difficult to understand

- Waiting too long to submit transactions for processing

Again, these are just a few examples. Chargebacks911 has identified dozens of potential triggers that may result in a chargeback.

Can friendly fraud be avoided?

No strategy is foolproof. Some legitimate chargebacks may still slip through your defenses. But, once you’ve addressed criminal fraud and merchant errors, many of your remaining disputes should be cases of friendly fraud.

Unfortunately, there’s no way to reliably eliminate friendly fraud. A friendly fraud case appears to be a legitimate sale until the moment the buyer disputes it. There are some practices, though, which can help prevent friendly fraud chargebacks and minimize long-term risk.

1. Notifying buyers before processing recurring payments

Before processing a first rebill after an initial authorization, you should send an email communication to remind the customer about the upcoming charge. An additional touch, such as an SMS message, is also recommended if that’s an option. This will allow you to avoid a situation in which a cardholder disputes the rebill as an unfamiliar charge.

2. Maintaining organized transaction records

You should keep all transaction information systematized for easy recall. This will help provide a quick response in the event of a customer inquiry and prevent a dispute.

3. Providing tracking information and delivery confirmation

Many customers file disputes because an item fails to arrive in the anticipated timeframe, and so they start to believe it’s not coming. Tracking information, as well as delivery confirmation, can help prevent these situations by giving customers better insight as to where their goods are located at any given time. Delivery confirmation can also be very helpful later in the event of a dispute.

4. Quickly replying to any questions, comments, or refund requests

Fast and responsive customer service can help you intercept inquiries and disputes before they become chargebacks. By simplifying the payment experience and closely collaborating with your customers throughout the entire billing and payment process, you can get paid faster.

When merchants receive friendly fraud chargebacks, they can engage with them through the representment process. The merchant literally “re-presents” the transaction to the bank, along with evidence to refute the buyer’s claim and prove that the original transaction was legitimate and should be upheld. This may include anything from printouts of email conversations to delivery confirmation, or even photographic proof of in-store pickup.

You can’t dispute every chargeback, though. Some legitimate chargeback claims may still slip through your defences. This is why you can't simply automate the dispute process—even though artificial intelligence and machine learning are useful tools, manual review and human oversight in an integral component.

Chargebacks—those resulting from friendly fraud in particular—were a problem for merchants before the pandemic and they’re going to continue to be a problem moving forward. Merchants need to take this matter seriously and start implementing practices to address chargebacks now before the problem gets out of hand.

About the author