How to Leverage Payment Fraud Detection Capabilities to Boost CX

- 9 min read

In this article, you’ll learn what payment fraud detection is, and how focusing on fraud prevention can boost customer experience. Plus, we’ll explore techniques you can use to improve digital payment security.

Key takeaways

- Most payment fraud detection efforts are heavy-handed due to poor infrastructure backed by archaic processes that have not kept pace with malicious tactics.

- Payment fraud detection is an opportunity to boost trust and build great CX—the trick is to strike a balance between collecting information and monitoring compliance.

- Use selective friction by automating compliance tasks in the background and using risk scores to determine what data to collect.

- The right integrated payments partner understands the value of CX and creates a healthy balance between automation and manual intervention.

—

Digital payments have opened new borders for businesses of every size. However, they have also increased payment fraud risk. A data breach or security lapse can sink your business thanks to the negative brand perception, monetary losses, and loss of trust amongst customers.

However, while preventing payment fraud is challenging, it also offers businesses an opportunity to boost customer experience (CX) immeasurably. Security is one of the primary pillars on which modern customers evaluate products.

Here's how you can boost CX by reorienting your views towards payment fraud prevention, turning a potential issue into a strength. In this article, you'll learn:

- What payment fraud detection is, and how it works

- The three challenges of online payment fraud detection

- 4 techniques that boost digital payment security and CX

What is payment fraud detection?

Digital payment fraud occurs when one party in a transaction misrepresents facts, creating monetary or reputational losses for other stakeholders. Payment fraud detection is a series of processes preventing fraudulent transactions from occurring.

These processes protect against common forms of offline and online payment fraud, such as:

- Identity fraud—a malicious actor steals a legitimate credit card and uses it to purchase goods.

- Chargeback fraud—a person buys goods and falsely claims they never received them or claims damage.

- Card testing fraud—attackers steal credit card numbers en masse and use bots to test which ones work, defrauding merchants and cardholders.

- Account takeover fraud—an attacker takes over a legitimate customer account and initiates orders they do not intend to pay for.

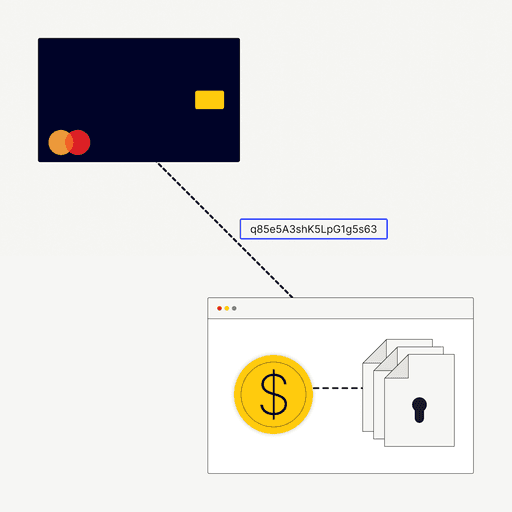

Critical data that boosts payment fraud detection

Online payments rely on technology and data to function smoothly. You can reduce the probability of fraudulent transactions by leveraging data-driven insights. Here are a few critical pieces of data every payment fraud prevention platform analyzes:

- User data—identity information, prior transactions, address data, etc.

- Transaction data—amount, payment method, product information, confirmation data, etc.

- Bank verification data—bank verification codes and authentication keys.

- Payment platform credentials—platform identification information, regulatory information, platform history, etc.

- Login credentials—user IDs, login workflow logs, platform activity logs, login history, etc.

- Network data—IP addresses, network security data, etc.

How payment fraud detection boosts CX

Given the risks payment fraud poses, companies treat fraud prevention as a risk management exercise. As a result, fraud control often impedes CX. For instance, onboarding workflows require customers to verify numerous documents and provide tedious information whose collection can be automated.

Those with fast onboarding procedures impose ongoing compliance on customers, requiring them to upload documents on an ad-hoc basis. These situations protect the company from fraud but leave customers with a bitter taste. After all, they're paying you money and are treated with suspicion instead. Also, customers are forced to repeatedly enter the same information, increasing friction in their payment experience.

Blend payment fraud prevention into your payment workflows seamlessly, and you'll differentiate yourself in every customer's mind. Instead of remembering the hurdles, your customers will recall the seamlessness with which your process ensured payment security.

Technology such as self-service collaborative payment portals helps you ensure such an outcome, as you'll learn later in this article.

The 3 challenges of payment fraud detection

While every executive desires top-notch payment fraud detection capabilities, few companies realize this vision. Here are a few reasons why.

1. Obsolete infrastructure

Payment fraud techniques are changing quickly, and most companies struggle to keep pace because their technology stack holds them back. For instance, legacy on-premise infrastructure offers maximum control but needs regular maintenance and investment.

Some companies lack these resources and lag. Cloud-based technology is a good alternative, offering easy scaling, maintenance, and security updates.

2. Constant regulatory changes

The payment industry is governed by several laws. What's more, these laws change routinely in response to security incidents and other events. Regulatory changes typically involve merchants scrutinizing transaction data more and offering greater user protection.

These changes benefit consumers but place a resource burden on merchants, making it challenging to upgrade infrastructure along the right lines. As a result, cracks in payment security emerge due to infrastructure lagging current needs.

3. Incorrect approach toward fraud detection

Most merchants are aware of the need for payment fraud detection. However, they apply it in a heavy-handed manner that turns users off, reducing revenues. In response, merchants rush to the other extreme, minimize oversight, and open themselves up to more payment fraud risks.

For instance, some merchants simplify onboarding by asking for minimal documentation. However, they compensate by asking for it on an ad-hoc basis when transactions occur (disrupting CX) or neglect compliance (creating risk for themselves and users.)

The right approach is to view online payment security as a CX differentiator and keep the user journey in mind when designing compliance and security checks. This ensures an even-handed approach that balances CX with security needs.

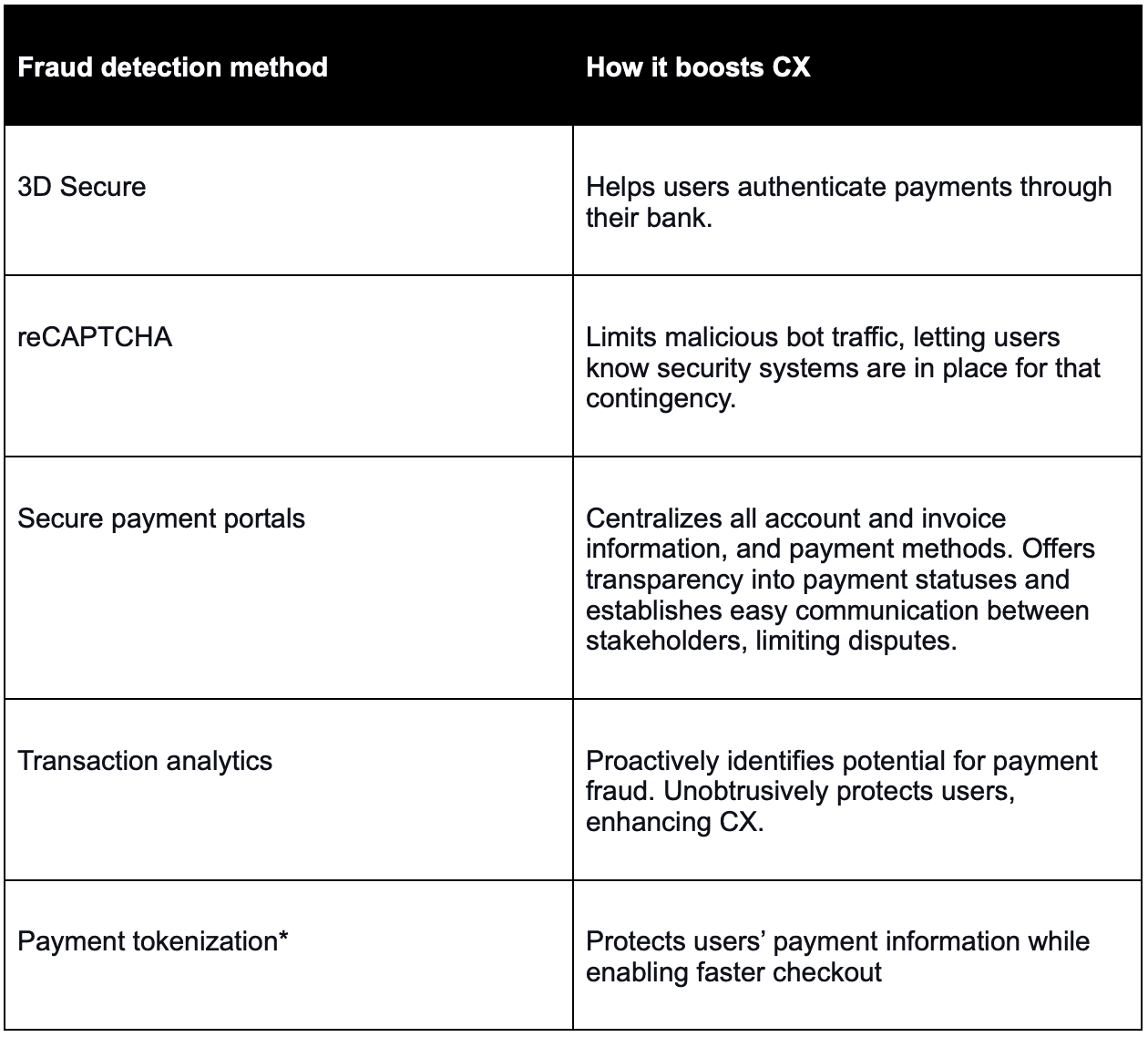

How various payment fraud detection methods boost CX

Here’s how common fraud detection methods improve CX while minimizing payment fraud risk.

4 ways to upgrade payment fraud detection capabilities and boost CX

Here are a few ways you can improve payment fraud detection and give CX a boost.

1. Leverage data to minimize UX friction

Some companies minimize fraud detection efforts for fear of destroying their users' payment experience. However, with modern technology, you can automate fraud detection algorithms and use data to flag transactions that deserve additional checks.

The result is always-on fraud detection running in the background, intervening only in exceptional cases or if regulatory needs demand additional information.

2. Switch to digital payment methods

The era of checks and phone-based payment verification systems is over. Modern organizations must cater to their customers' preferences by offering them several digital payment channels, such as ecommerce shopping carts or payment portals.

These digital payment channels automate fraud prevention tactics and give customers a seamless experience.

3. Integrate the latest technology

Technology is evolving faster than ever, and modern organizations must keep pace with advancements. Artificial intelligence (AI) already has several fraud prevention use cases that you can use, such as monitoring customer payment patterns and predicting the likelihood of fraud from IP address locations.

Best of all, these algorithms help you intervene proactively and inform customers of possible fraud. For example, an algorithm can prompt the user to verify information and explain the reasons (based on historical data) for flagging the transaction. These verifications enhance customer trust, increasing repeat business and your revenues.

You can increase the speed of technological adoption by aligning your IT and finance teams.

4. Choose the right integrated payments partner

Your choice of digital payment partner is critical to enhancing CX and security simultaneously. Most payment service providers focus on the technological aspect of payments, ignoring the impact on CX. For instance, some providers enforce heavy pop-up-based compliance that damages CX.

The right payments partner understands the importance of integrated payments preserving CX and enhancing online payment security as unobtrusively as possible. Thoroughly evaluate your choice of partner, from the quality of its technological updates to seamless payment portal design.

—

Payment fraud prevention offers you an opportunity to strengthen customer relationships and build trust in your products. Instead of viewing these workflows as a risk, leverage them to boost customer experience.

Learn how Versapay's integrated payment processing helps businesses reduce processing costs and streamline payment acceptance.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.