Why CFOs Should Care About—and Take Ownership of—Customer Experience

- 8 min read

In the age of the customer, CFOs have as much a part to play in driving customer experience as the CEO or CXO.

In this blog, we’ll discuss how your finance department—and especially accounts receivable—plays a key role in customers’ overall perception of your company, and what to do to give buyers a better billing and payment experience.

In today’s marketplace, arguably no other entity has as much power as the people who purchase our products and services.

Customer experience (CX)—the full scope of a customer’s relationship with your company—accounts for all the hallmarks of your business’ success, including repeat purchases, recurring revenue, loyalty, and reputation.

Driving CX has not traditionally been part of the mandate of Chief Financial Officers (CFOs) and the finance arm of an organization.

But that’s changing.

One of the most important interactions between a customer and a supplier is the payment process, which rests within finance—specifically accounts receivable (AR). Disorganized billing and payment practices lead to confusion and dissatisfaction from customers, which research suggests can have a real impact on a business’ bottom line.

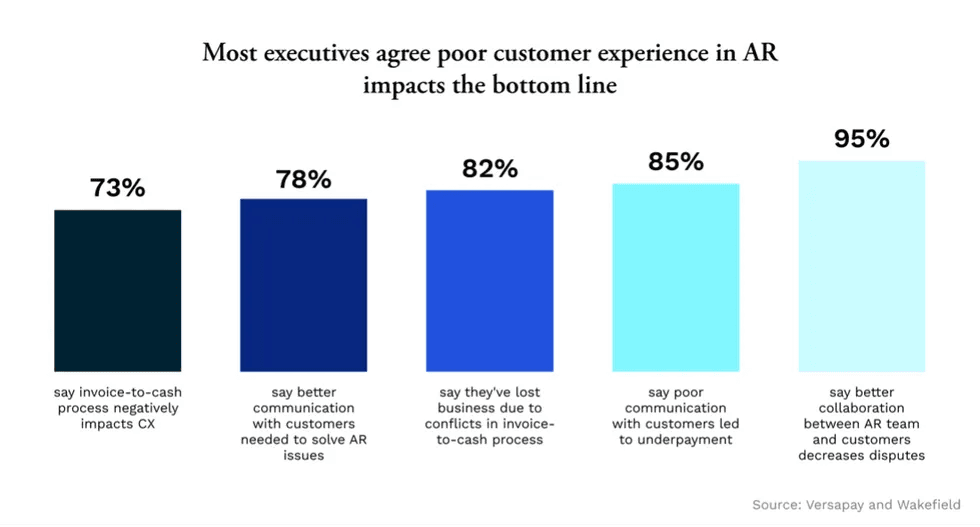

In partnership with Wakefield Research, we recently surveyed 1,000 C-level executives about the status of their AR processes. 82% of them said they’ve lost business in the past due to miscommunications in the payment process. 85% also said these kinds of issues have resulted in them getting paid less than they’re owed.

Clearly, the finance department—and accounts receivable in particular—has a critical role to play in driving CX.

In this article, we discuss why CFOs need to care not just about the balance sheet, but customer experience too. We’ll also discuss what’s at stake for businesses that fail to align customer experience priorities with their AR operations.

Jump ahead:

How the customer experience movement in B2B began

But first, when did customer experience as a concept gain traction?

Versapay’s Chief Customer Officer, Keith Reed, says CX really started to take off in the mid-2010s when customer-facing organizations turned to the cloud in droves.

“With the rise of Salesforce and the proliferation of market automation tools, an ecosystem rose up around the customer’s experience. A lot of what drove this movement was the move to subscription models and Software as a Service (SaaS),” he says.

“The customer voted with their wallet every 30 days and there was a loyalty checkpoint on day 1 of every month. The question quickly became, ‘How do you create awesome customer experiences day in and day out so your customer will re-up every month?’”

While the initial focus of this influx of cloud-based tools was centered on functions like sales and customer support, ultimately, companies started acknowledging that every department of their organization owed it to their customers to pave the way for a smooth, easy experience.

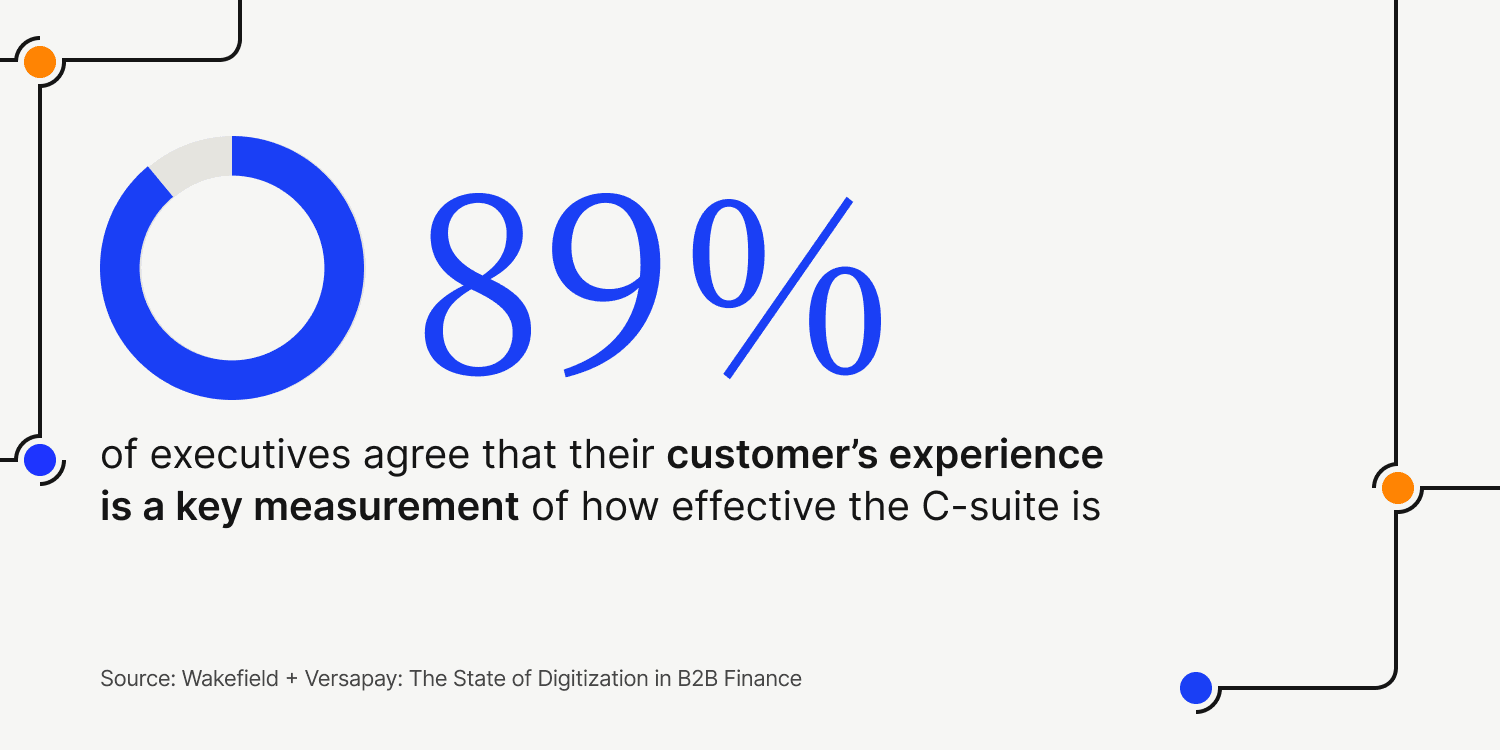

Not surprisingly, this is a sentiment that resonates deeply with the C-suite.

In our survey with Wakefield, nearly 9 in 10 (89%) executives agreed with the statement, “the C-suite is only as good as its customer experience.” Naturally, Chief Executive Officers (CEO) and Chief Experience Officers (CXO) agreed the most enthusiastically at 93% and 91% respectively. But, traditionally non CX-focused roles like the CFO agreed wholeheartedly too, at 90%.

What role does finance play in improving customer experience?

Versapay’s Chief Financial Officer, Russell Lester, says finance departments already play a significant role in customers’ overall perception of their company.

“It’s well understood now by high-growth companies that all of us own CX—including Finance. We directly impact the customer, especially when telling them their bill is due,” he says.

The AR process in particular can often be a point of discord and frustration for customers. Typically, they have to wait until they receive their monthly statement to know what they owe, and if there’s an issue with their bill it can be difficult to get hold of the right person to address it.

“Accounts receivable has traditionally been an out-of-sight, out-of-mind thing that people correlate with a negative experience. But it doesn’t have to be that way,” Russell says. “You can take a part of the customer journey that people like the least and create light in that moment with just a little effort, by connecting AR teams directly with their customers’ accounts payable (AP) teams over the cloud.”

Russell says forward-thinking CFOs should consider other ways their departments can contribute to CX more broadly too.

“The CFO and the people they represent have a unique opportunity to dig into all stages of the customer journey. They have access to data and both qualitative and quantitative insights that offer a greater understanding of what customers are doing and how they’re behaving in funnel stages and across the lifecycle,” he said.

These insights include which customers pay consistently on time (a sign of a healthy relationship with you) and which customers have extremely outstanding credit. When customers churn, finance teams can investigate whether there were any changes in their payment behavior that could be considered indicators of a departure.

“The finance department can be an organization’s trusted advisor, helping leadership see around corners and understand the root cause of customer behavior,” said Russell. “It’s in a unique position to help accelerate the company’s growth by ensuring everyone stays focused on what matters most: the customer.”

The customer experience blind spot

Sales, Marketing, Customer Support, and other arms of an organization are accustomed to creating the conditions for “happy, active, sticky customers”. But Finance, Keith says, so often does the opposite, particularly when it comes to the AR process.

To date, when digitizing their AR operations, customer experience has been a blind spot for most companies. Invoice disputes, a frequent challenge for AR departments, are often due to human error, not issues with a supplier’s goods or services themselves.

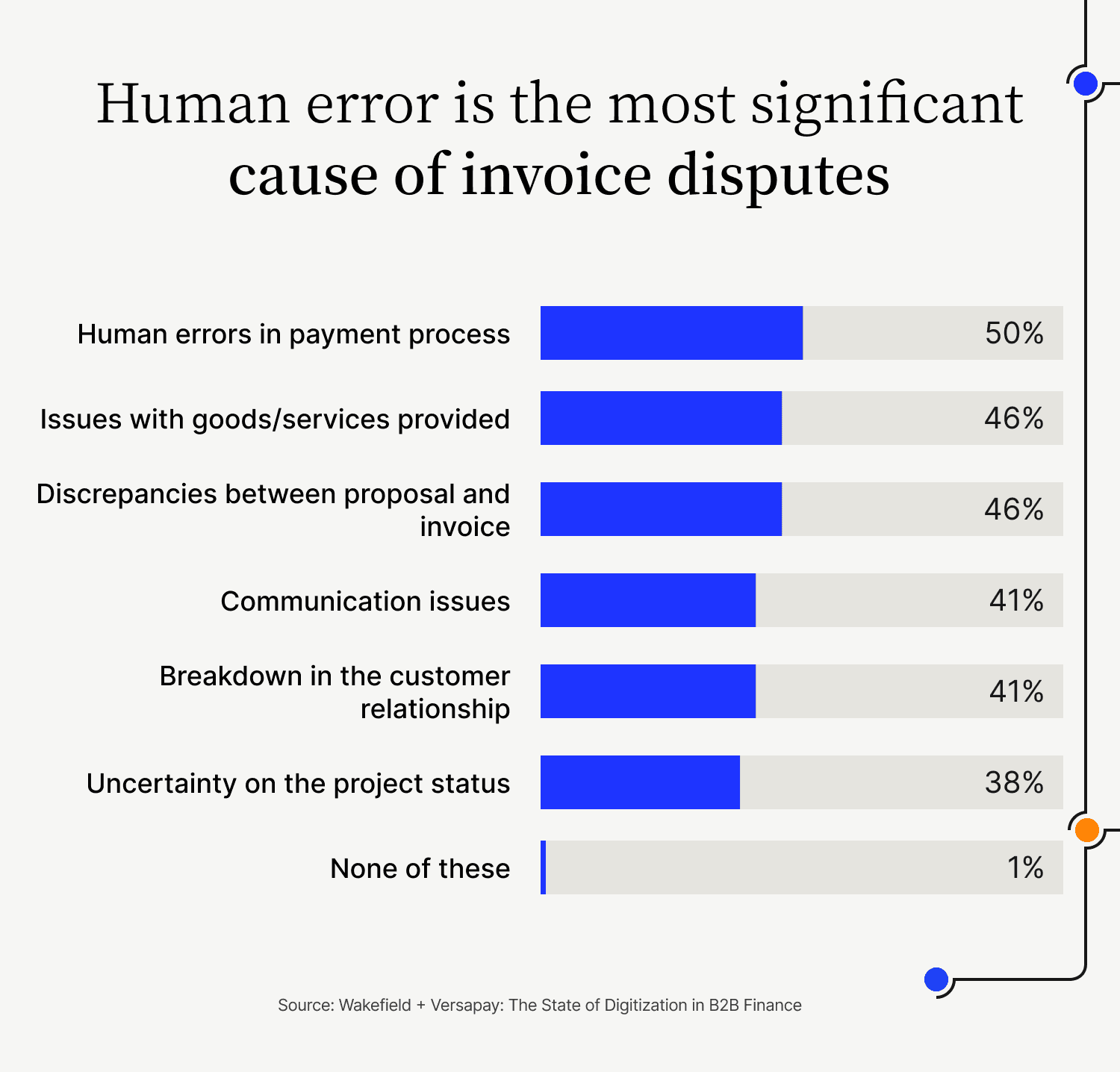

Our research with Wakefield found that human error in the payment process was the top reported cause of payment disputes, cited by 50% of executives. Issues with goods or services and discrepancies between proposals and invoices were cited equally, at 46%. Fourty-four percent of executives also acknowledged that in many or all cases, better communication with their customers would have resolved their payment disputes.

So, it appears that one of the main culprits behind negative B2B payment experiences is miscommunication. But, traditional AR automation solutions don’t seem to solve for this, as they focus only on automating the back-office and non customer-facing side of AR, like invoice delivery.

To give customers an exceptional experience at every stage of their journey—including the oft overlooked payment process—CFOs need to start thinking about AR digitization with a front-office approach.

“When suppliers and customers can get full visibility into all outstanding invoices and credits, and they can ask questions back and forth and collaborate with each other, it creates a bridge between their two companies, eliminating the gap that traditional AR processes leave. That’s a big win for CX,” says Keith.

So what does this customer-centric approach to billing and payments look like?

It means:

Letting customers pay the way they want (I.e., accepting various forms of digital payments)

Giving customers a self-service option for viewing invoices and related documents, checking the status of their account, and making payments

Solving potential miscommunications and disputes promptly and early on

Making the jobs of your customer’s accounts payable team easier by integrating with their systems

What’s at stake for businesses that fail to align customer experience with accounts receivable?

According to Keith, finance departments that aren’t willing to evolve and transform will be unable to compete in the marketplace long term.

“At the end of the day, companies want to do business with other companies that are easy to do business with. The ones who aren’t adopting cloud technology to build exceptional customer experiences will be left behind,” he says.

Invoice-to-cash has been late to party when it comes to digital transformation, with 69% of the CFOs we surveyed in our research with Wakefield acknowledging that AR hasn’t been prioritized as much as other departments for digitization. But the CFOs who are leading out on digital transformation in AR, need to ensure they’re implementing the kinds of tools that will really prioritize customers’ experience of the transaction process.

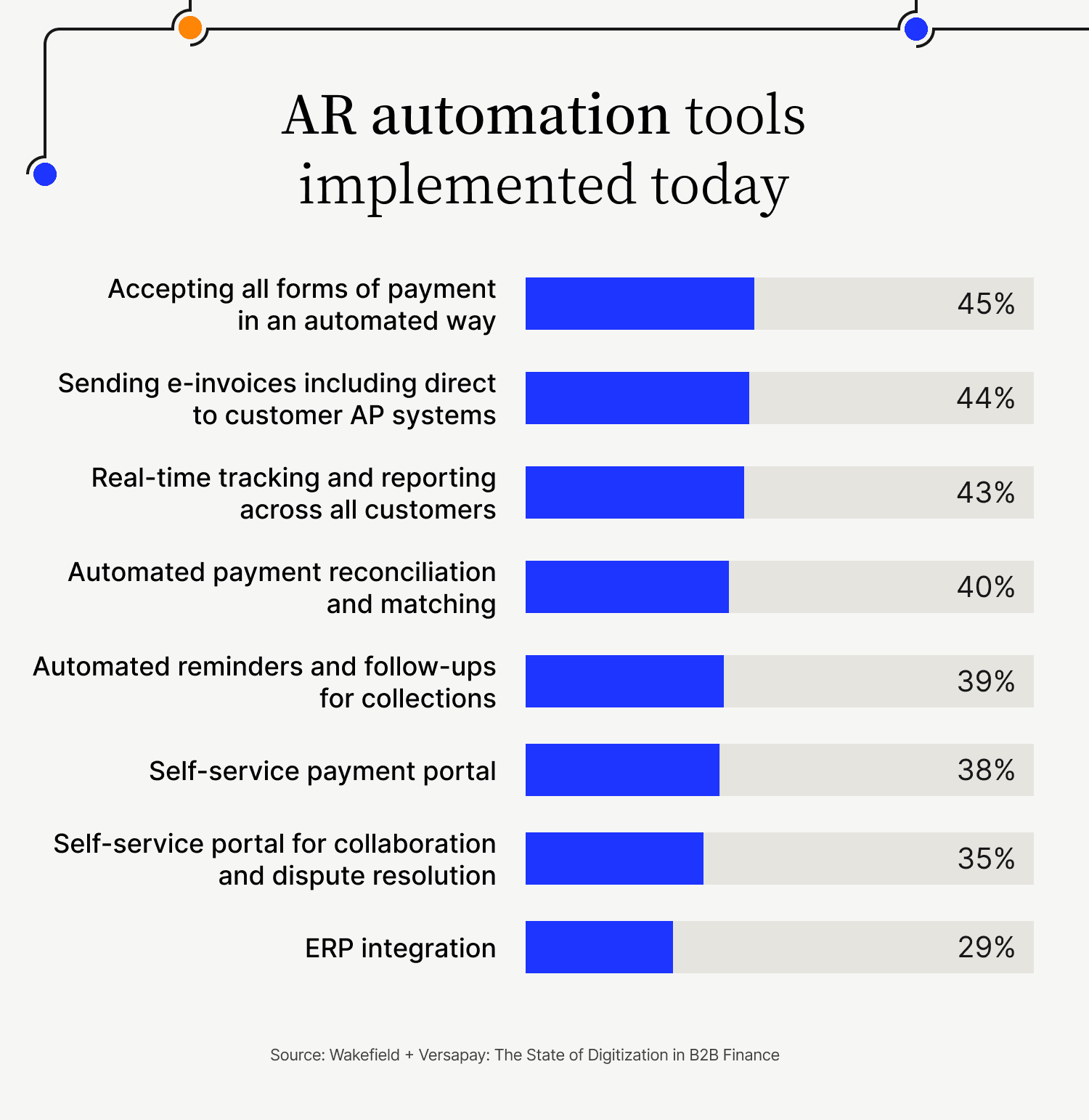

In our research, we found that most AR departments’ digitization efforts have focused on automating payment acceptance (cited by 45% of executives), sending e-invoices (cited by 44%), and reporting on receivables (cited by 43%).

“Simply enabling electronic invoices isn’t enough to create great customer experiences. It’s the bare minimum,” says Keith. “You need to provide the ability to collaborate in real time to get the full benefit of what cloud products can do. The collaboration component is what brings buyers and suppliers together in a meaningful way.”

The CX-focused reorientation of accounts receivable

Accounts receivable software that’s built with collaboration in mind makes all the difference when it comes to improving customers’ experience of the billing and payment process.

Versapay takes traditional AR automation a step further by enabling buyers and suppliers to collaborate over the cloud. This customer-centric approach, Collaborative AR as we call it, results in greater AR efficiencies, faster cash flow, and dramatically improved customer experience.

Wondering what this looks like in practice? See how TireHub used Versapay to take AR from a sticking point in the customer journey to a driver of positive customer experiences.

About the author

Heather Hudson

Heather Hudson is a Toronto-based journalist and writer who specializes in writing compelling content for SaaS businesses, particularly in fintech and personal finance.