A Guide to Temporary Versus Permanent Accounts | Definition, Differences, and Examples

- 12 min read

In this blog, we’ll teach you the differences between temporary vs. permanent accounts (with examples!) and how automation can better help you classify transactions.

Key takeaways

Finance professionals know of the five core accounts used in bookkeeping. You can further classify these accounts as permanent or temporary.

Understanding permanent versus temporary accounts is critical to measuring progress toward short and long-term business goals.

Automation helps finance teams classify transactions correctly and derive insights from their cash flow.

Glance through any financial or accounting statement, and you will see transactions categorized across five core accounts: Shareholder’s equity, liabilities, assets, expenses, and revenues. However, business transactions have a dimension that these core accounts do not capture—time.

Each transaction in the five core accounts can be temporary or permanent, depending on their short or long-term nature. In this guide to temporary vs. permanent accounts, you will learn:

What are temporary and permanent accounts?

Every business transaction impacts company performance differently. Some create a short-term impact, while others have long-term effects. Temporary and permanent accounts offer accountants a method of classifying these transactions appropriately.

What are temporary accounts?

Temporary accounts, or nominal accounts, are used to hold funds for short-term projects with a definite end date or temporarily hold funds before being transferred to a permanent account.

At the end of an accounting period, companies reset a temporary account's balance to zero with a closing entry that offsets its existing balance. You can use these accounts for a quarter or longer, depending on the transaction in the account.

For instance, a company can use a quarterly temporary account for dividend payments. Once the company pays dividends at the end of the quarter, the temporary account's balance is drawn down to zero, and the account is closed.

What are permanent accounts?

Permanent accounts in accounting monitor long-term transactions for projects that serve investment or revenue goals. These accounts are central to recording business health, and companies carry their balances into subsequent accounting periods.

For instance, a company's loans payable is a permanent account. At the end of an accounting period, the company deducts it to reflect loan payments made and carries the remaining balance forward into the next period.

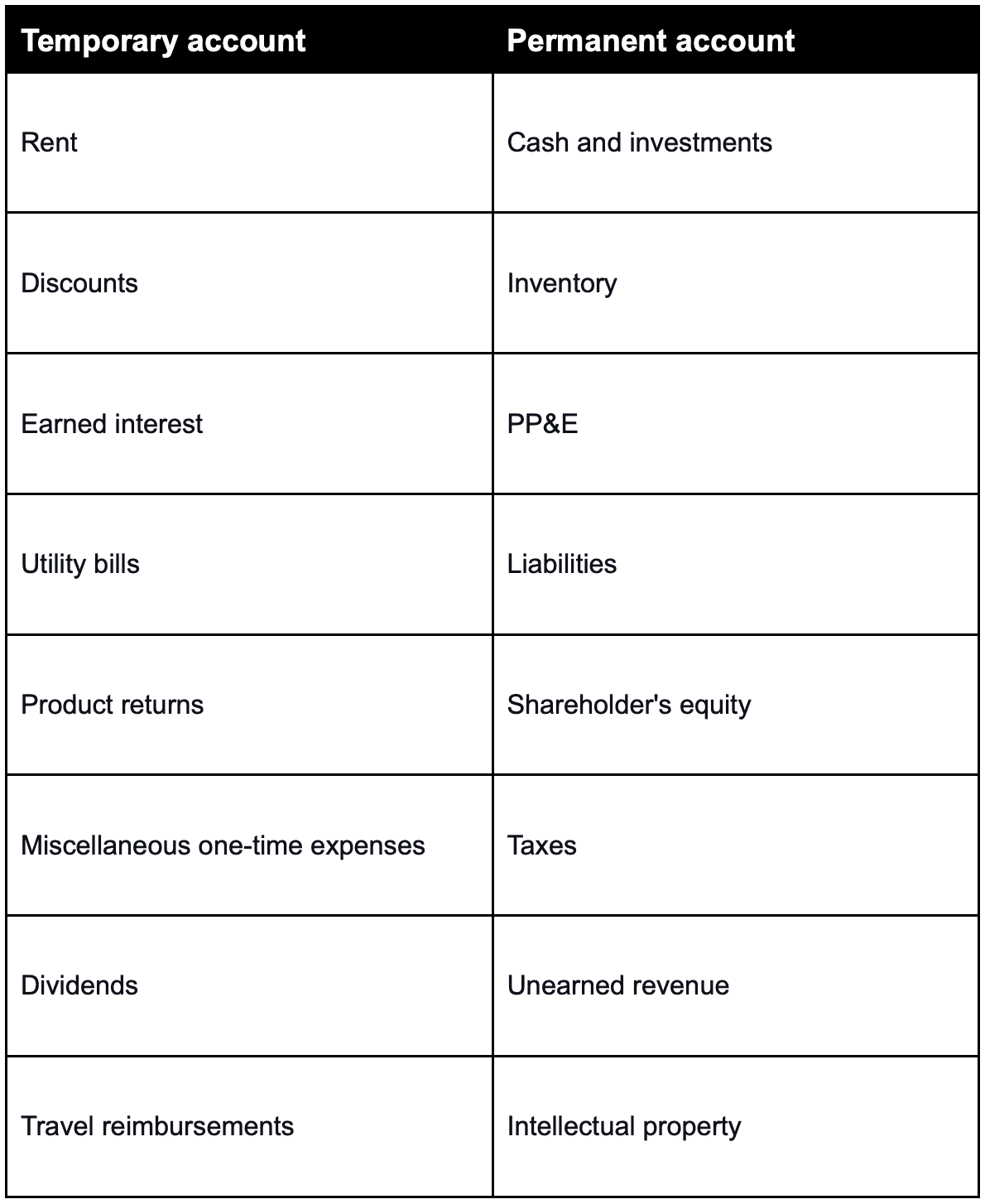

Temporary accounts examples vs. permanent accounts examples

How do temporary accounts differ from permanent accounts?

Here are four important differences between permanent vs. temporary accounts:

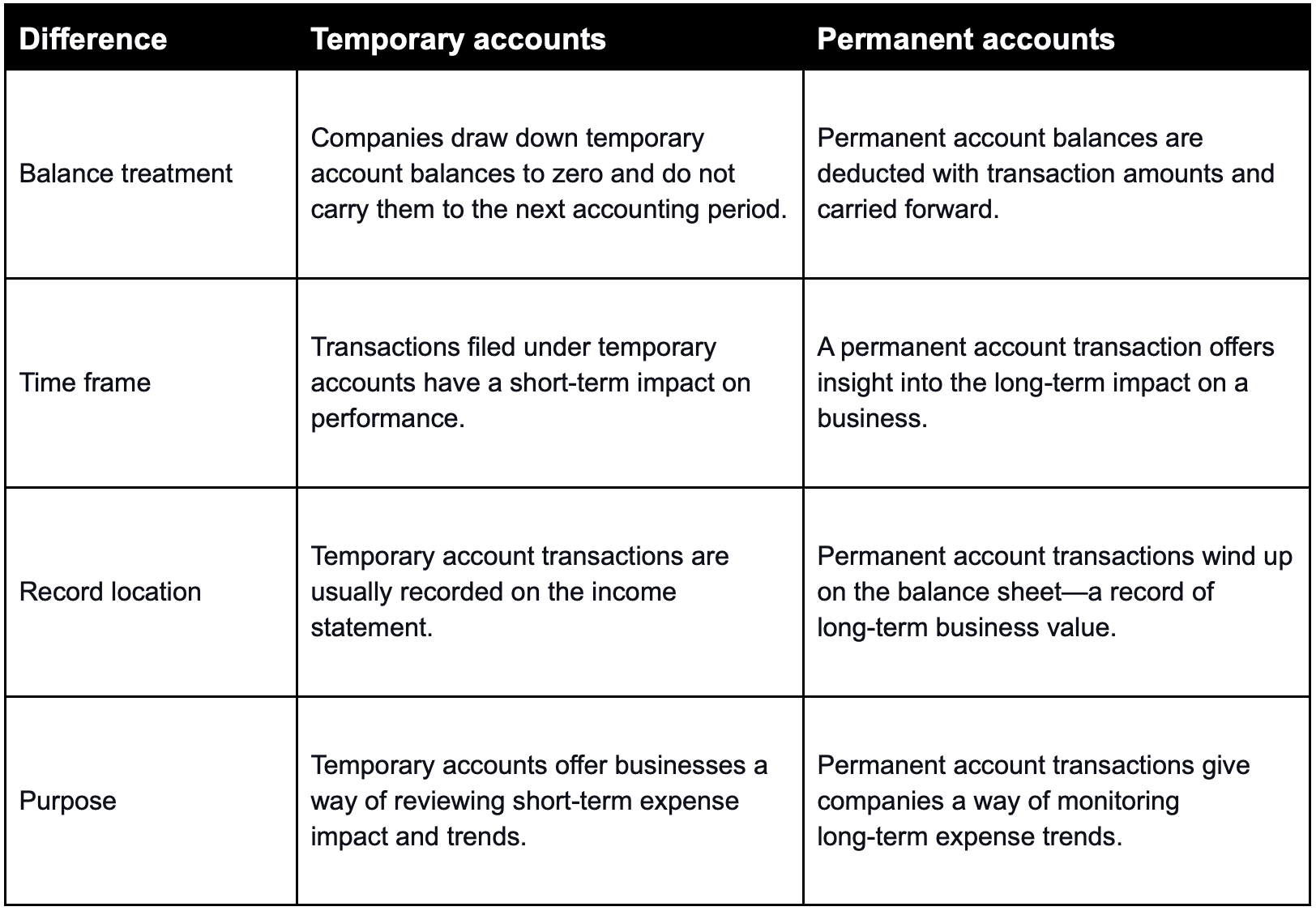

1. Balance treatment

Balance treatment offers the most apparent difference between permanent vs. temporary accounts. Companies draw down temporary account balances to zero and do not carry them to the next accounting period.

In contrast, permanent account balances are deducted with transaction amounts and carried forward. In essence, a temporary account lasts for a defined period, while a permanent account lasts for as long as the business is operational.

2. Time frame

Each financial account on a company's books serves a purpose. For example, the five core accounts illuminate different aspects of a company's performance. Temporary and permanent accounts offer accountants a way of accounting for financial impact in different time frames.

Transactions filed under temporary accounts have a short-term impact on performance. For example, the amount of dividends a company pays each quarter will vary and is relevant for that quarter. In contrast, a permanent account transaction offers insight into the long-term impact on a business.

Asset impairment charges, for example, have consequences for a company's long-term performance. They impact current earnings but also question management's ability to evaluate assets. The latter impacts company valuation in the long run.

3. Record location

Given their short-term nature, temporary account transactions are usually recorded on the income statement. In contrast, permanent account transactions wind up on the balance sheet—a record of long-term business value.

4. Purpose

Temporary accounts in accounting offer businesses a way of recording short-term expense impact. By separating short and long-term transactions (with long-term ones recorded in permanent accounts) businesses have a quick way of reviewing trends.

For instance, spikes in utility payments impact that period's earnings but are unlikely to cause concern for the company's long-term prospects. Spikes in those temporary accounts also alert the company to possible issues it can quickly mitigate.

Running with the utilities example, the company can either relocate if costs are running out of hand or switch to a different work model and reduce office expenses.

Whatever its choice, segregating that transaction into a temporary account puts it in perspective, and lets management know that the issue does not impact an important asset or long-term account.

—

Here’s a summary of the differences between temporary and permanent accounts.

Why you should care about temporary vs. permanent accounts

Managing temporary and permanent accounts is critical to your financial management process. Here are three reasons you should care about temporary and permanent accounts:

1. Ensures accurate transaction records

Aside from giving companies an overview of the timeframe of the impact financial transactions have, permanent and temporary accounts ensure all records are accurately maintained.

To classify transactions into these accounts, a company's finance team must analyze and monitor the impact of each transaction. To write down a temporary account at the end of a period, accountants must establish a journal entry trail of where the money went.

These processes ensure a company's books are current and constantly reviewed for accuracy.

2. Easier progress measurement

Classifying transactions into temporary and permanent accounts gives companies better insight into their progress over time and any trends they should monitor. By classifying cash flow into the correct account, accountants can measure the financial impact of a business decision based on the accounting period.

The result is a time-based map of cash flow impact that assists companies in planning better.

3. Standardizes accounting workflows

Accounting plays a vital role in helping company executives measure performance. By classifying transactions into permanent or temporary accounts, companies can standardize accounting workflows. The result is a framework they can rely on, no matter what business conditions look like.

This standardization also leads to accurate reporting and companies placing more trust in their financial data.

How automation assists classification and reduces expenses

Small to mid-sized companies record high transaction volumes every month. Classifying these transactions manually into the right accounts is time-consuming. These manual processes are also prone to errors that compromise reporting.

Here's how automation simplifies transaction classification, reduces expenses, and saves your finance team time.

Automated reconciliation

Manually classifying every transaction into a temporary versus permanent account is time-consuming. Aside from figuring out where each transaction must go, accountants must verify them and record journal entries appropriately.

An automated solution can reconcile transactions, create journal entries, classify transactions according to preset rules, and present accounting teams with an easy dashboard for approval. The result is an efficient workflow that needs fewer human resources to function.

Fewer errors

Manual cash application and reconciliation processes are rife with errors. These errors come from entering incorrect values or uploading data in the wrong format. Given transaction volumes, accounts receivable (AR) teams relying on manual processes will experience high fatigue levels, increasing the chances of an error.

Automation eliminates these errors and frees finance teams to execute value-added work. For example, AR teams leveraging automation can quickly apply cash to invoices, attach relevant proof, and post transactions to journal entries for further review.

The result is an efficient finance team that knows it can always rely on its output.

More frequently asked questions about temporary and permanent accounts

How long do temporary accounts last?

There is no standard time frame to close temporary accounts. However, a majority of businesses choose to close them on a quarterly basis. Other businesses opt to close temporary accounts at year-end.

Do I close temporary or permanent accounts?

Only temporary accounts get closed at the end of an accounting period. Permanent account balances don’t close at the end of an accounting period. Instead, permanent accounts maintain cumulative balances that get carried over from one period to another.

Why are permanent accounts important?

Permanent accounts are important because they allow businesses to report and track their cumulative financial activities, progress, and health over multiple accounting periods. This includes assets, liabilities, equity, and how they improve over time. Permanent accounts help businesses make better financial decisions.

Is service revenue a permanent account?

Service revenue isn’t considered a permanent account. Service revenue is a temporary account that records revenue generated from key company operations during a specific accounting period. It displays short-term revenue activity rather than a company’s long-term financial performance.

Is accumulated depreciation a permanent account?

Accumulated depreciation is categorized as a permanent account in the general ledger. It is a contra-asset account on the balance sheet, and it doesn’t close at the end of an accounting period. Instead, accumulated depreciation gets carried over into the new year.

More value-added work

Automation removes any need for finance teams to spend time on clerical or rote tasks. For example, you can apply cash to invoices automatically instead of tasking a highly qualified AR team member with manually reconciling transactions.

The result is a lean finance team, lower expenses, and more time to devote to value-added work that boosts cash flow.

—

Temporary and permanent accounts offer accounting teams a great way of classifying transactions based on their long or short-term impact. As with all financial tasks, automation can speed up transaction classification, saving your finance team time and money.

As with accounts receivable processes, classifying accounts is just one of several finance workflows that benefit from greater automation and digital transformation. Curious about how your AR process stacks up? Get your personalized AR transformation roadmap and set your team up for success.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.