Is Accounts Receivable a Debit or Credit? What to Know About AR

- 7 min read

Accounts receivable is a debit, which is an amount that is owed to the business by an individual or entity.

In this article, we explore how receivables work in a business, how accounts receivable processes ensure customers pay promptly, and how quicker payments can benefit your business.

Accounts receivable (AR) is a core business function: collecting the money that customers owe for goods or services they received on credit. Effective AR management is essential for a business to thrive, as it allows for the maintenance of a healthy cash flow, increases customer satisfaction, and boosts profitability.

Many people ask, “Is accounts receivable a debit or a credit?” or “What type of account is accounts receivable?” The short answer is AR is a debit. But let's explore this question in more detail, looking at how receivables work in a business, how AR processes help you ensure that customers pay you promptly, and how prompt payment can benefit your business.

Jump to a section of interest:

- What are accounts receivable?

- The accounts receivable process

- Is accounts receivable a debit or credit?

- Accounts receivable balance sheets

- What are credit terms?

- What a credit balance in accounts receivable tells you

What are accounts receivable?

Receivables are debts that customers owe you for products or services you’ve delivered. These debts are assets for your business; in fact, you can even borrow money against them, using receivables as collateral for a loan. Receivables are the opposite of payables, which are debts your company owes to other entities or individuals.

There are several types of receivables that your business’s accounting team may have on the books. These accounts receivable examples include:

- Trade receivables/accounts receivables,

- Notes receivables, and

- Other receivables

Trade receivables/accounts receivables comprise the bulk of AR; they’re the amount that customers owe for goods and services. A balance sheet may also include notes receivables, which are records of the value of promissory notes that other entities or individuals owe the business. Notes may have a longer payment timeline than typical accounts receivables. Other receivables consist of various assets the company is owed, such as interest, salary advances, and tax refunds.

The accounts receivable process

Accounting and finance teams typically use a standard and predictable process for managing AR debits. Each step in the AR process has its own procedures and protocols, much of which can be standardized and automated to helpful effect. Here are five core steps in the accounts receivable process and their definitions:

- Credit: The accounts receivable process starts with advancing credit to a customer so they can receive goods or services now and pay later.

- Invoicing: The next step is invoicing, in which the AR team sends the customer a notice that the payment is due.

- Payment: If all goes according to plan, the next step is the customer paying the invoice in full. This can be enabled by automated tools that help the customer pay digitally.

- Cash application: After the AR team receives the payment, they move on to cash application, which is matching the payment to the corresponding invoice in the accounts receivable ledger.

- Collections: If the customer does not pay their invoice, the account becomes delinquent and AR takes actions to collect the money, which may include escalating notices, late fees, sending the account to collections, and/or legal action.

The nature of a company’s AR procedures and technology can influence the AR process. Standardization via tools such as collections email templates can reduce errors, increase customer satisfaction, and improve cost-effectiveness. Automation can further improve the above, as well as help boost revenue, increase cash flow visibility, speed up collections, and deliver superior customer experiences.

Is accounts receivable a debit or credit?

Accounts receivable is a debit, which is an amount that is owed to the business by an individual or entity. Examples of debits can include amounts your customers owe you for goods and services they’ve received, compensation for work you’ve done for others, wages owed to you by workers who have received advances on their pay, and tax refunds you expect to get back from the IRS.

A credit is the opposite of a debit. A credit is an amount that the business owes to another business or a person. Examples include taxes you owe, the cost of goods or services you’ve received from other companies, refunds you must give customers for products they’ve returned, promissory notes you are obligated to pay, and wages that you owe your workers.

Accounts receivable balance sheets

To understand how accounts receivables work, it can be helpful to see how they are tracked in the general ledger via accounts receivable journal entries.

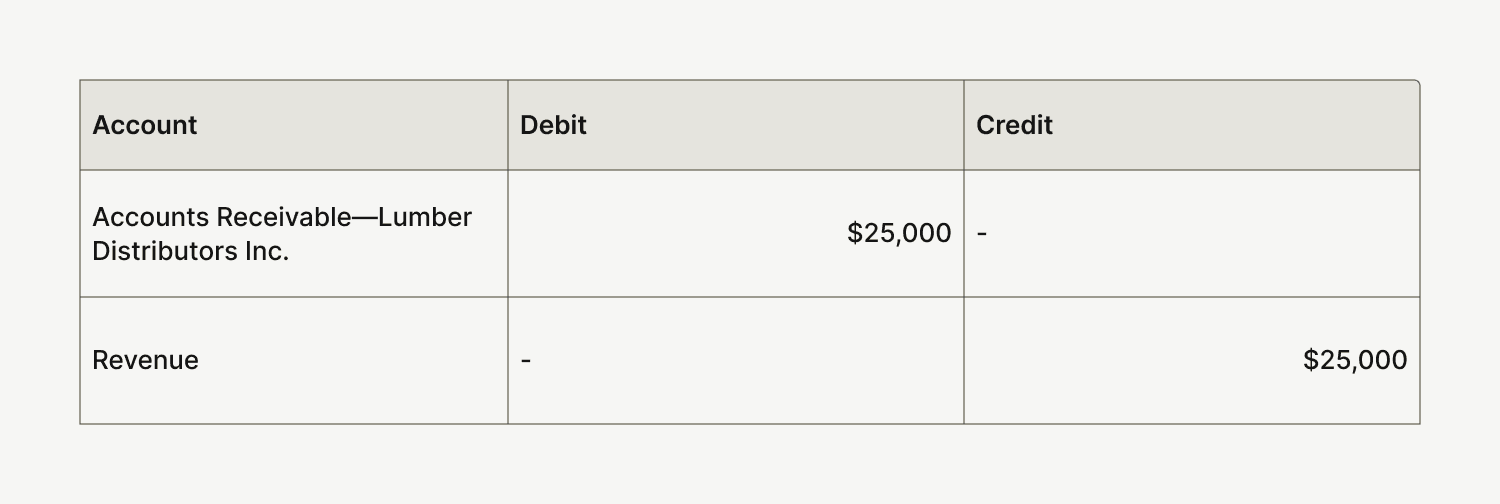

Most businesses use double-entry accounting, which requires two accounts receivable journal entries for every transaction: a debit and credit, each to a different account. Accounts receivable journal entries are recorded as debits under assets and always go on the left side of the entry with all the other debits. Credits are recorded on the right. Your debits and credits should always be equal and balance each other out.

You can see below an example of an accounts receivable journal entry. The company received a payment from a customer—a debit—which the bookkeeper recorded in the left-hand column. Correspondingly, the bookkeeper recorded a credit of the same amount in the right-hand column, assigned to revenue. This is because the customer paid the company for goods or services they received, which is revenue into the company coffers.

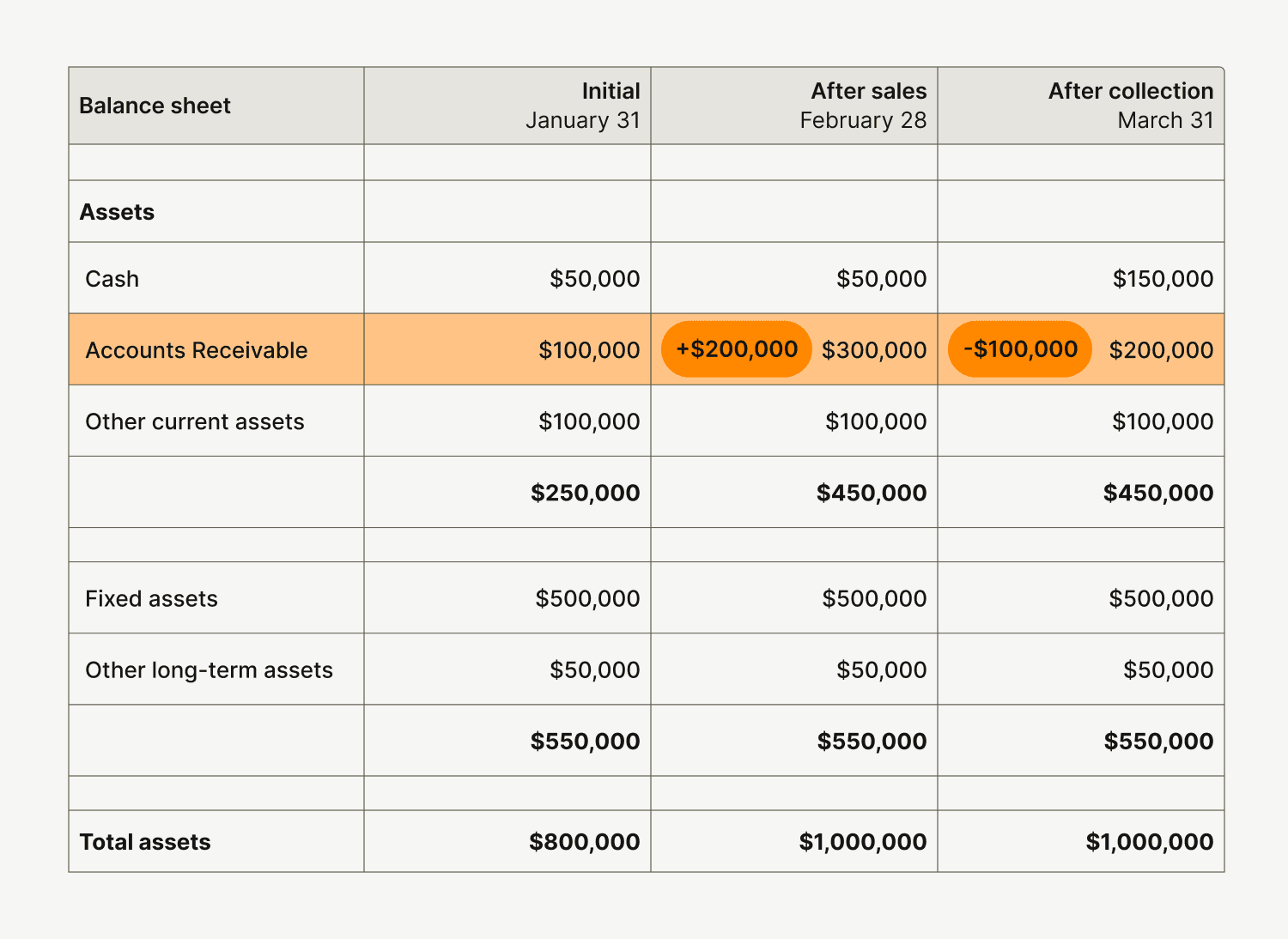

Now let’s look at an example of a balance sheet, which shows the accounts in the company’s books. Accounts receivable increases after the company records sales and then drops after some customers remit payment.

What are credit terms?

While accounts receivable is a debit, it’s important to know what credit terms are since they affect when your business can expect to receive AR debits. When a customer purchases goods or services from a business on credit, they promise to pay at a later day, typically within a particular period like 30 or 60 days. This timeframe is known as the credit terms, and is typically noted as “net 30” or “net 60” as appropriate.

You can incentivize prompt or fast payment using favorable credit terms, such as offering a discount for payments received within 10 or 15 days. Getting payment faster accelerates cash flow, which provides your business more available resources to operate and grow within a given timeframe.

Being strategic about credit terms and incentives is one way that businesses can leverage the AR function to improve business operations and set themselves up for success. Setting up an automated AR system, especially one that includes methods for customers to pay digitally directly from the invoice, can help customers pay faster to satisfy the credit terms.

What a credit balance in accounts receivable tells you

As we now know, accounts receivables are debits, so typically your AR account will indicate money owed to you. However, there are times when credit balances occur in accounts receivable, such that your AR account has more money than it should. This can happen for a variety of reasons, including:

- Overpayment by a customer

- Invoicing errors

- Accidental duplication of payment

- Discounts applied after invoicing

- Returns done after payment is completed

While it’s normal to have credit balances in accounts receivable, having this eventuality constantly may point to a problem with your billing and collection processes. Companies can prevent this problem by developing a credit balance policy to establish organized billing procedures and ensure proper cash flow.

AR automation can help you manage the entire AR process seamlessly, making it less likely that you’ll end up with a credit balance in accounts receivable. You can learn more about the benefits of and process for automating your AR function in our CFO’s Guide to Accelerating Collections.

Accounts receivable is a debit, but there’s much more to know

Wondering whether accounts receivable is a debit or a credit is only the beginning of learning a vital topic in accounting. Understanding accounts receivable balance sheets is the next step to understanding how these debits are applied within business operations.

But to truly comprehend the importance of accounts receivable management, consider how good AR practices paired with automation—or transformation—solutions enable your business to collect payments promptly, reduce bad debt, accelerate cash flow, increase revenue, and improve customer experience.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.