How to Optimize Your Finance Team, Improve Performance, and Build Business Resilience

- 8 min read

Finance teams are a critical pillar of every organization. Learn how you can optimize your finance department's operational workflows and position it as a critical revenue driver.

Finance teams are a critical pillar of every organization. Yet, they continue to occupy back or middle-office roles instead of transforming themselves into customer experience (CX) and revenue drivers. One reason for this state of affairs is the lack of modern infrastructure to power financial insights.

The other is inefficient workflows within finance teams and their interactions with other critical business departments. In this article, you'll learn how you can (and why you should) optimize your finance department's operational workflows along with:

- 3 efficiency killers that hobble your finance team and organization

- How to transform your finance team and position it as a critical revenue driver

3 efficiency killers in modern finance teams

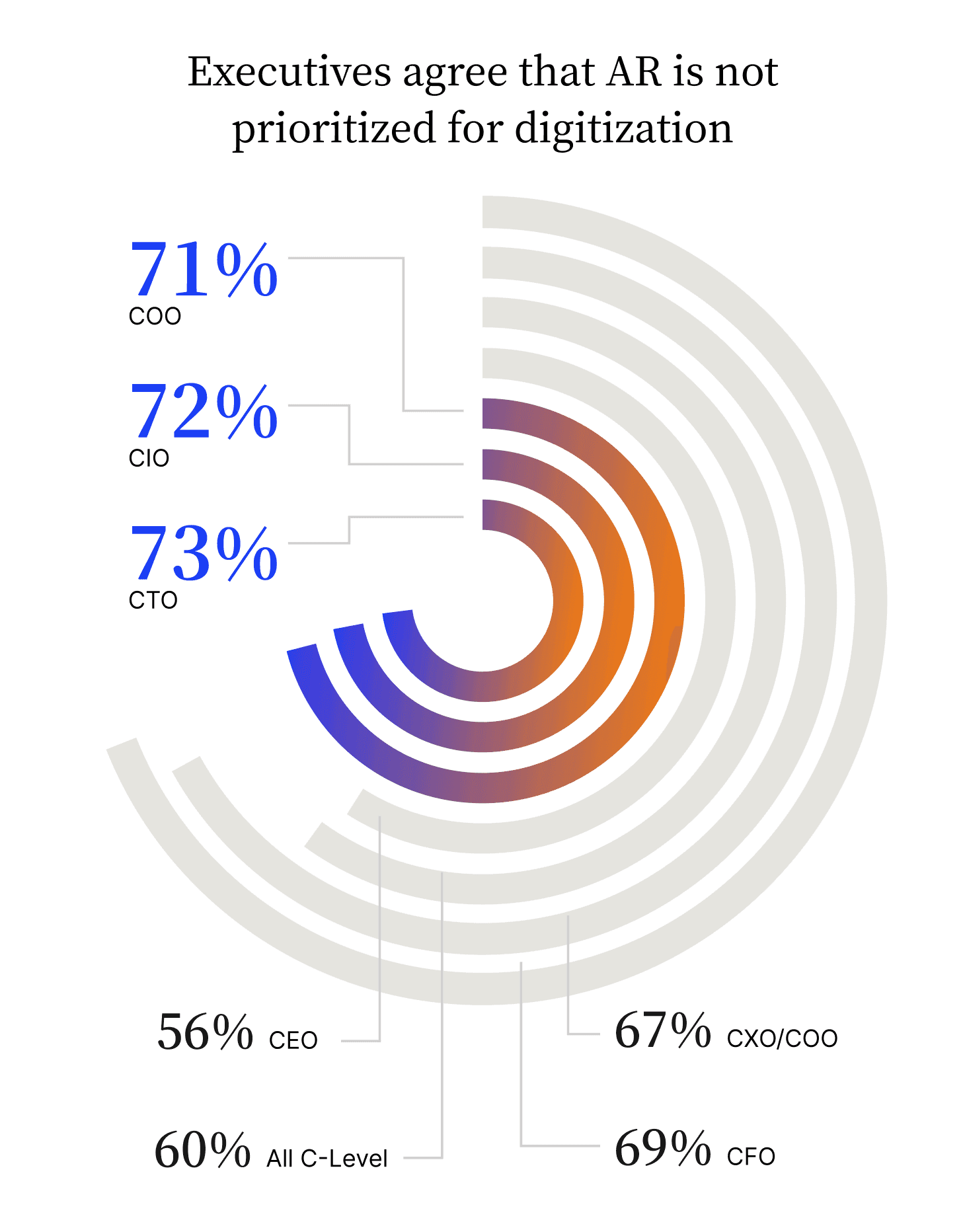

Modern organizations are data-driven and have prioritized digital transformation programs. However, this priority has not extended to finance, as Versapay's State of Digitization in B2B Finance report revealed.

Sixty percent of C-level executives agreed that accounts receivable (AR), a critical part of modern financial departments, is not prioritized compared to other departments for digitization initiatives.

Safe to assume, if the department that secures cash flow for a company is not receiving the transformative attention it needs, the rest of the finance department cannot be receiving much either.

Here are three other efficiency killers in modern finance teams:

1. Suboptimal team structure

Modern finance involves several complex processes, such as projecting IRRs on competing projects to helping CFOs analyze future cash flow through customer credit history analysis. Finance cannot follow a one-size-fits-all org chart since every company is unique.

Unfortunately, most finance teams follow a copy-and-paste org chart that creates mismatches between employee skills and their daily tasks. For instance, an accountant might find themselves modeling future business scenarios (a RevOps task) due to their small company adopting a larger one's structure despite lacking resources to fill all roles.

Structuring a modern finance department is a critical task and is the bedrock on which you can realize greater cash flow.

2. Antiquated processes that neglect digitization

AR departments are a great case study of how finance teams become liabilities instead of assets when they do not receive the technological assistance they deserve. Accounts receivable is plagued by seemingly endemic issues like poor stakeholder communication, lengthy dispute resolution timelines, and poor status visibility for all involved parties.

Technology can solve these issues, but the lack of digitization previously highlighted creates serious business issues. For starters, 82% of executives surveyed in Versapay's report admitted to losing work due to miscommunication during the payment process.

Of these, 42% reported losing business more than once. In addition, 85% of executives say miscommunication between AR and customers led to partially-paid invoices, with 35% reporting multiple occurrences.

These "miscommunications" come from teams relying on outdated or pseudo-digital channels, such as emails or phone calls, instead of leveraging modern self-service payment portals.

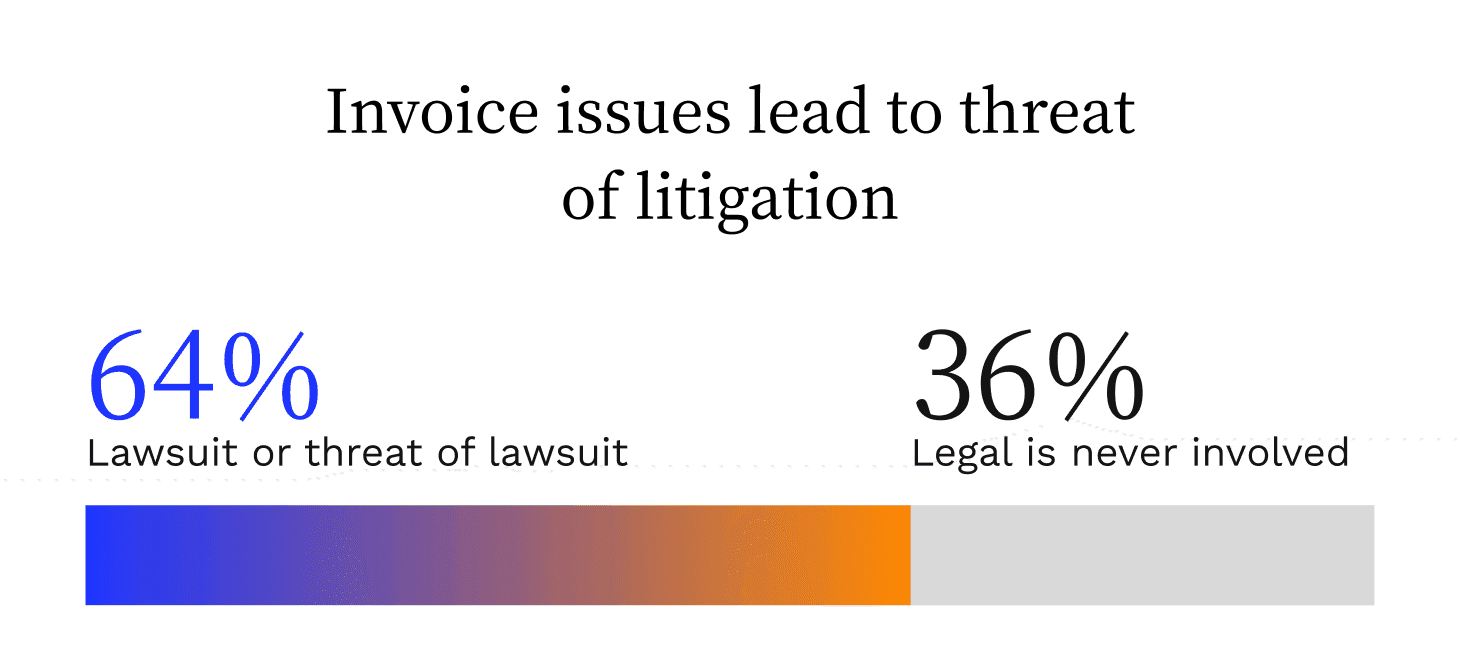

Even worse, some of these miscommunications balloon into litigation threats. Sixty-four percent of executives surveyed in Versapay's report admit that an invoice dispute has resulted in litigation threats, with 32% reporting that lawsuits were needed to resolve them.

Aside from high legal costs, these disputes ensure poor customer relationships and brand reputation, leading to lower revenues.

A business that wishes to outlast its competitors cannot afford such risks, especially when they can avoid them easily with technology.

3. Back-office mentality that neglects business impact

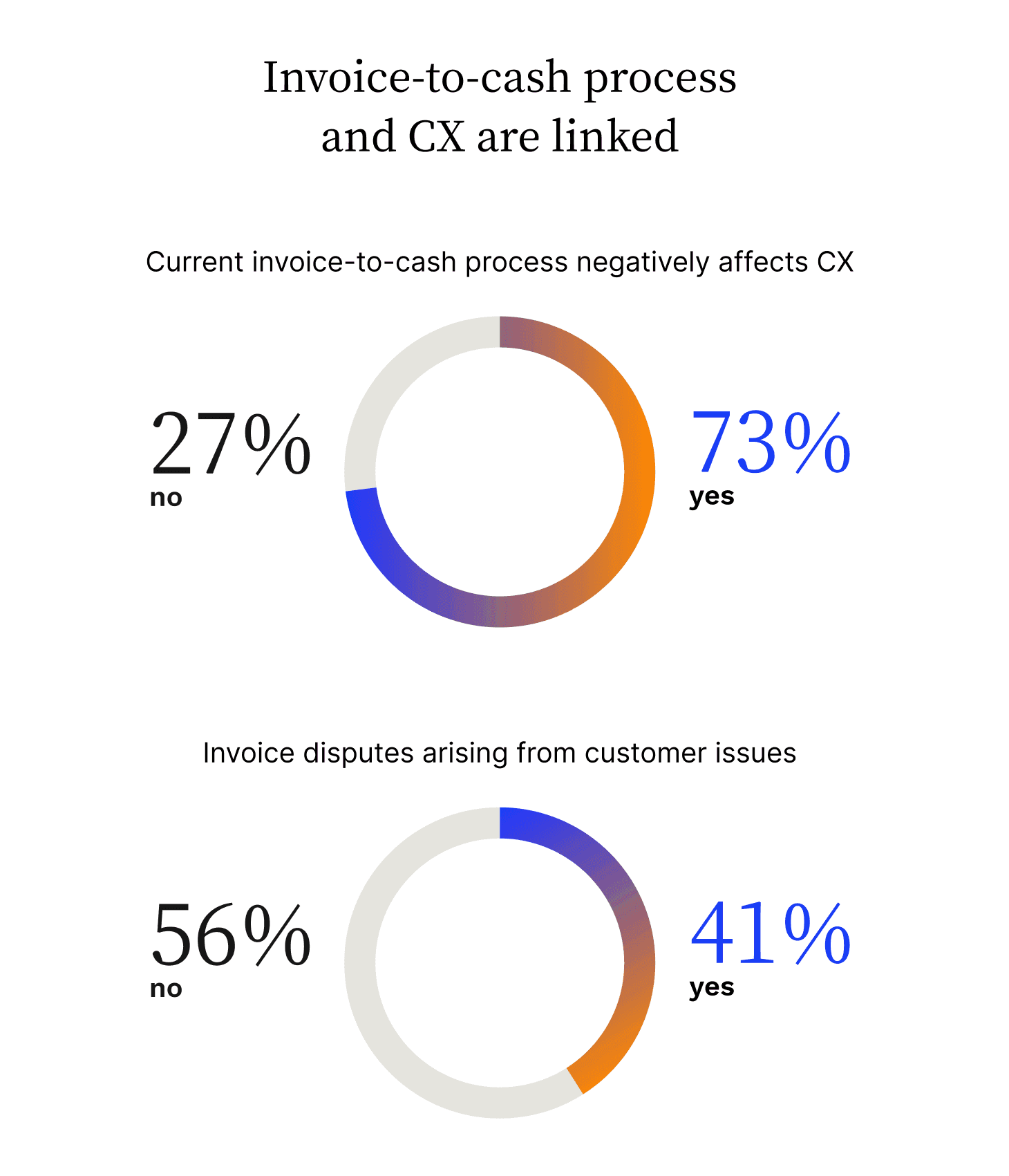

While sales teams play a critical role in elevating CX, finance teams can land a similar impact if given the right tools. Versapay's report revealed that CX and invoice-to-cash (I2C) efficiency are linked.

Seventy-three percent of respondents reported that poor I2C processes harmed CX, with 98% of upper management executives admitting to involving themselves in resolving disputes. Not only does customer satisfaction take a blow, but executives spend time managing disputes instead of steering the company forward.

Finance can be a source of strategic change in an organization. For instance, AR is often relegated to the back-office. However, collaborative AR eases communication between customers and AR teams, helping the latter collect cash faster and the former gain visibility into their invoice and dispute statuses.

The result is an easy payment capture process that strengthens customer relationships, effectively turning a CX risk into a strength.

How to optimize your finance department

Deciding on the right org structure for your finance department is the first step to transforming finance into a key revenue driver. Once done, follow these 4 steps:

1. Revise your hiring models

Finance has gone digital, but companies are yet to hire people with the right skill sets. Gartner reports 66% of finance leaders believe this skill gap is widening. To combat this gap, prioritize digital translation skills during recruiting.

Finance teams must be adept at crunching data and explaining results in business-friendly terms. Gartner recommends hiring finance professionals with data analysis training or familiarity with those concepts to bridge the disconnect between the data you collect and the insights you draw from it.

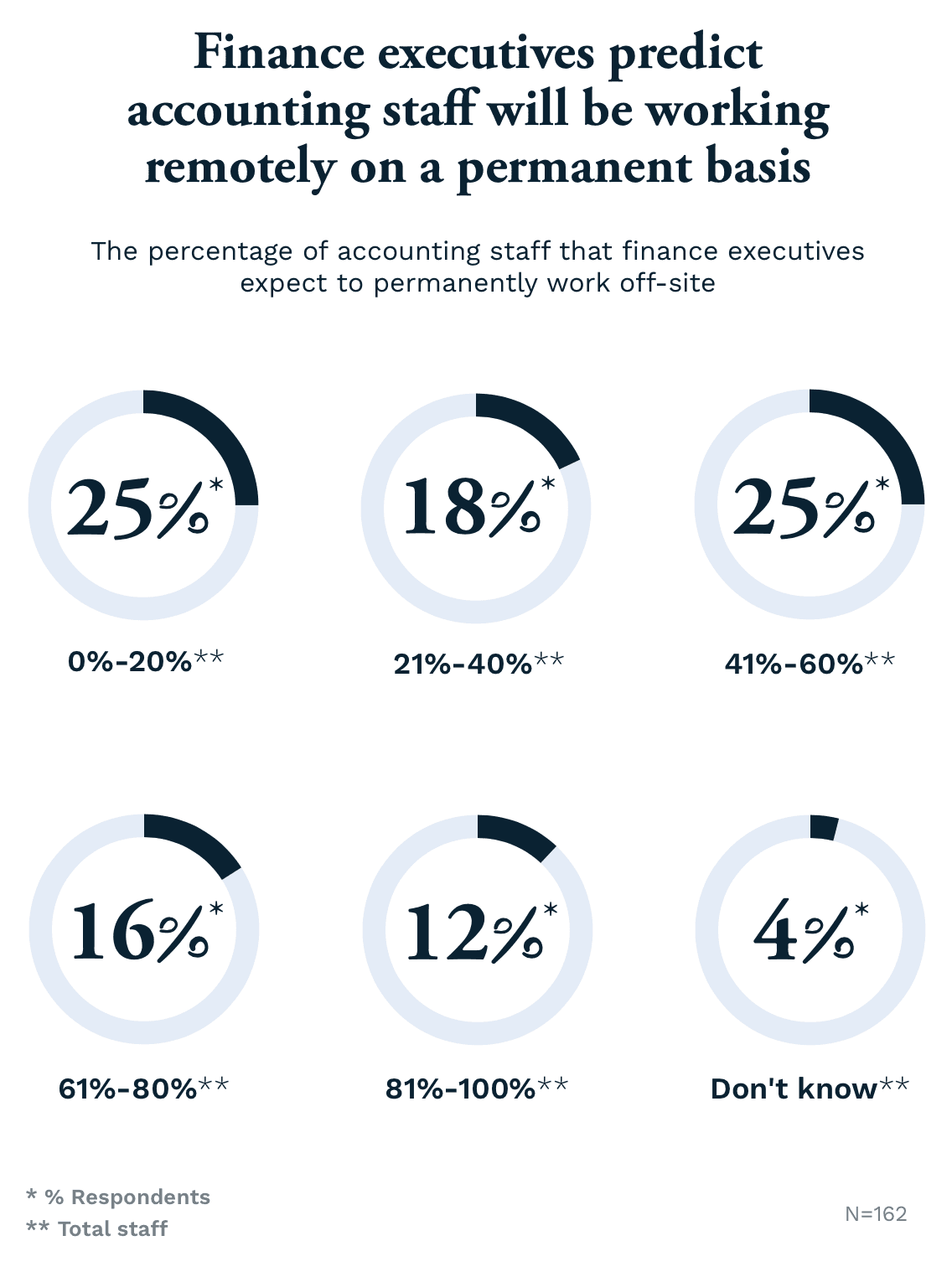

To attract the best talent, embrace modern work structures like remote work and use technology to drive cultural change.

2. Embrace transformation, not just automation

Automation and digital transformation are not the same. The former offers a veneer of electronification over existing processes, while the latter reimagines a business with technology as a pillar instead of an add-on.

For instance, upgrading AR-customer communications to automated email sequences from phone calls is automating an existing process. Using a collaborative self-service AR portal that centralizes all invoice data, offers transparency into dispute statuses, and brings sales, AR, and customers on the same page is digitally transforming AR into a critical CX driver.

💡 Get your personalized accounts receivable transformation roadmap to learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success.

Aside from giving them the tools, encourage your finance teams to collaborate more with customers by demonstrating the advantages of this approach.

3. Prioritize CFO-CIO collaboration

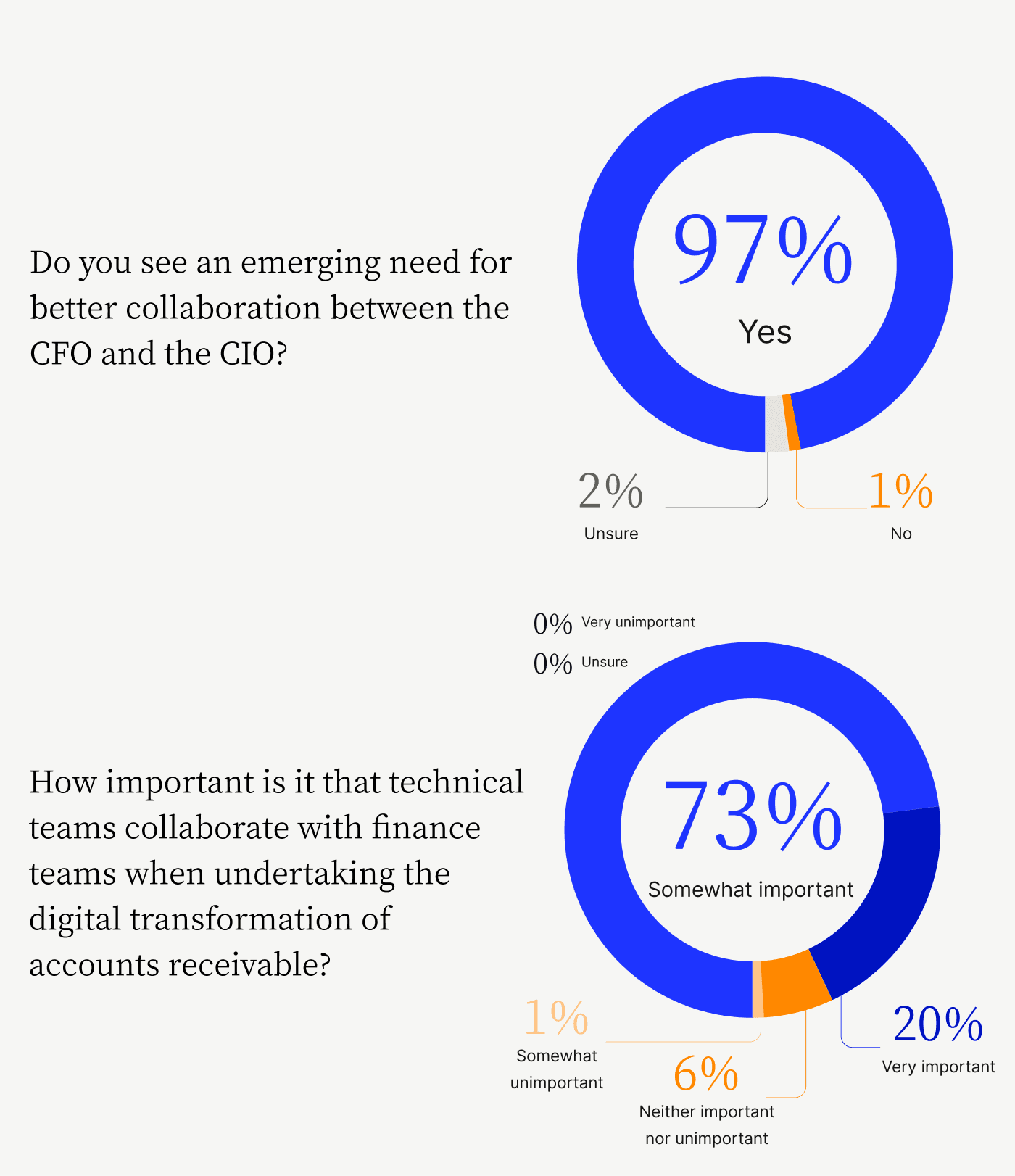

Finance and IT teams view your company's data equally but often have different perspectives due to a lack of collaboration. For instance, finance teams stick to limited front-end dashboards due to lacking technical skill, while IT teams lack context into the business and cannot deliver the insights CFOs need.

Collaboration between the CFO and CIO will facilitate smoother data analysis, leading to better insights. Our report reveals that 97% of leaders agree that CFO and CIO collaboration is critical moving forward and 93% note that technical and finance collaboration is either somewhat or very important to AR’s digital transformation.

Align IT and finance and you’ll access better financial insights while leaning on a scalable tech stack that constantly mines data, creating more resilience.

4. Transform your ERP

AI is revolutionizing ERP platforms by delivering prescriptive insights. Of course, artificial intelligence is only as good as the data it is fed, and your finance team is one of the primary sources of such data. The best approach to follow is to integrate payments into your ERP.

This approach streamlines cash collection and other AR processes. For instance, you can get straight-through processing for over 90% of your incoming payments when you use an automated cash application solution integrated with your ERP.

Digitally transforming your ERP this way helps you streamline workflows, reduce payment processing costs, and account for payments from any sales channel seamlessly.

—

It is time for companies to recognize that finance has the potential to be a major CX driver and develop their finance arm around that core principle. Digitally transforming your finance department will boost your revenues, increase cash flow predictability, and build resilience in the long term.

Learn how Versapay's Collaborative AR platform can help you take the first steps to transforming your finance department.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.