How to Achieve Finance Transformation in 2023 (And Beyond)

- 13 min read

Finance transformation is about fostering communication, relationships, and accessibility so that all divisions of a finance team are better connected to their customers.

This blog explores how you can develop and implement your own finance transformation strategy.

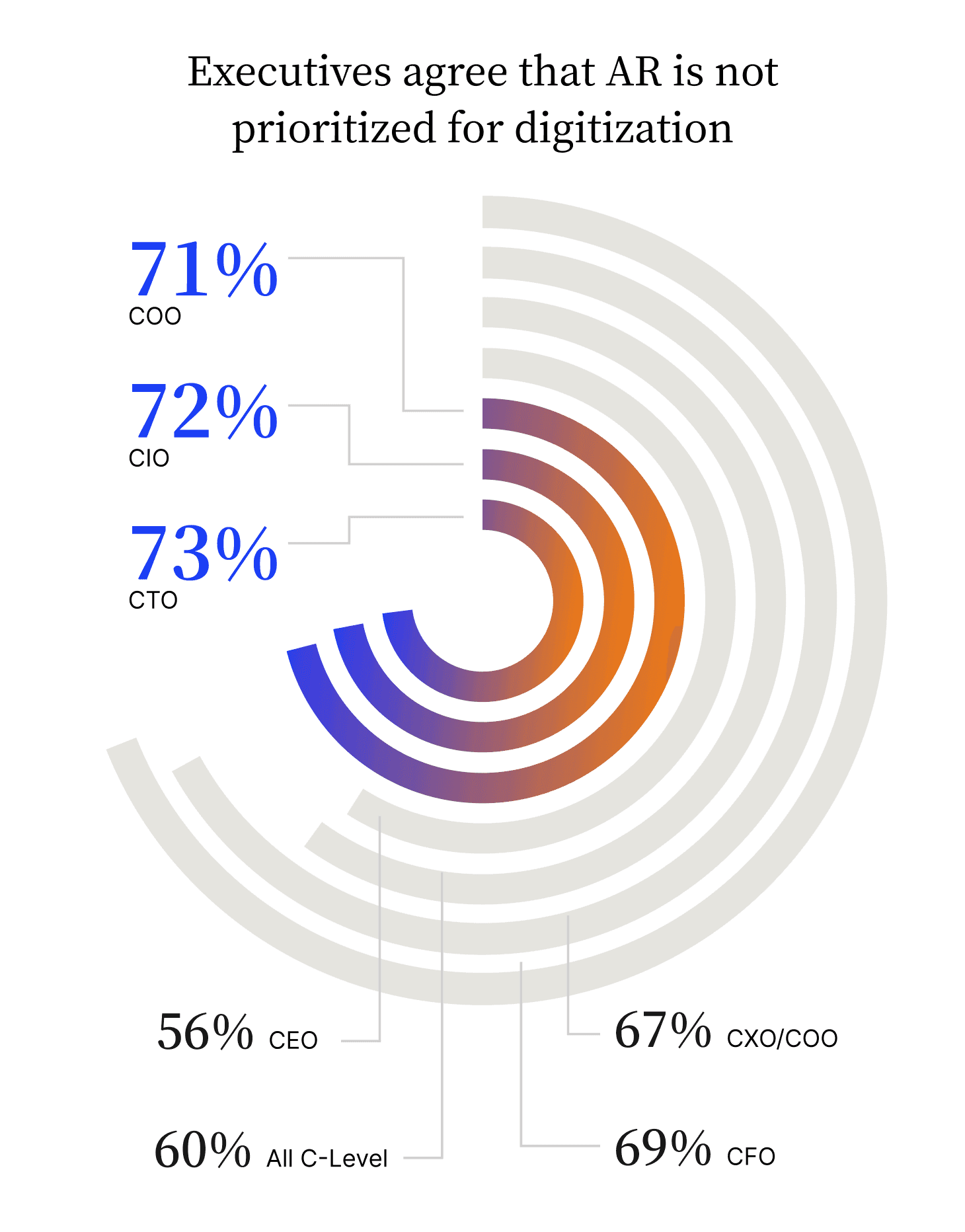

Finance functions are evolving rapidly—and executives know it. According to our survey of 1,000 C-level executives, 92% of them agree that to reach peak performance, every department, including accounts receivable (AR), needs to go digital.

But that’s not happening.

In fact, 60% of executives say they haven’t prioritized accounts receivable as much as other departments.

Why is that? Well, it’s because accounts receivable (like many finance functions) still retains its reputation as an isolated, back-office function despite being crucial to an organization’s success. And the consequences of inefficient AR operations are substantial: miscommunications in payment processes cause companies to lose work; upper management often has to get involved in non-payment issues; invoices issues lead to legal threats; the litany goes on and on.

These breakdowns in AR processes can grind business to a halt and deteriorate the customer experience.

Plot twist: Accounts receivable—and finance broadly—is about customer experience (CX), not just invoicing and collecting revenue. Communicating with customers is key to both CX and AR, yet less than half of executives see the connection between the two. This overlooks the fact that AR is one of the most consistent, vital connection points in the customer journey.

Yet, when planning for finance transformation, businesses often focus solely on automating internal processes. This focus prevents finance from reorienting itself as a customer-focused powerhouse. The finance function is ripe for transformation, and CFOs should set their sights on accounts receivable and other functions that communicate directly with customers.

In truth, finance transformation is about more than automating some processes: It’s about fostering communication, relationships, and accessibility so that all divisions of a finance team are better connected to their customers. Let’s look at how you can develop and implement your own finance transformation strategy.

What is finance transformation?

In its simplest form, finance transformation is the use of digital technology to automate and improve financial processes. This transformation involves a fundamental shift in an organization’s financial services, processes, systems, communication methods, and culture.

For example, instead of manually building invoices and emailing them individually, then handling follow-up or disputes over email, teams can transform their accounts receivable processes by moving their tasks into one central, cloud-based platform. This enables them to focus on developing a collaborative, communicative environment between their AR team and their customers’ AP teams.

The key goals of finance transformation include:

Improved data accuracy and integrity

More strategic decision-making

Positioning the finance department as a strategic business partner and core component of customer experience

These key goals manifest in different ways at different organizations, as we’ll see in some use cases later in this article. Before diving into these examples, let’s first look at why you should engage with the process of transformation in the first place.

The benefits of finance transformation

As with most process improvements, the bottom line is the crux of finance transformation. The desired outcome is (almost) always cost reduction, whether by automating manual processes, reducing human labor, or increasing output.

We say almost because our recent study reveals that the impact software—an important cog in transforming the finance function—will have on customer relationships is the factor that now matters most in finance and business leaders’ software purchasing decisions. Direct ROI is the second most important criteria.

However, finance transformation does not, and should not, stop at the bottom line. Technology can improve many characteristics of finance processes, including compliance, accuracy, time-to-completion, and auditability.

3 reasons to transform your financial operations

Finance transformation is great in theory, but how does it shake out in the real world? Let’s look at a few use cases to assess the impact such transformation can have on organizations:

It improves your invoice-to-cash cycle

It enables accurate financial reporting and forecasting

It enhances the customer experience

1. Finance transformation improves your invoice-to-cash cycle

The invoice-to-cash cycle is a broad process (an important aspect of the even broader order to cash process), but finance transformation can make it more efficient at many stages. For instance, software that encourages finance transformation can support these initiatives by automating manual tasks like issuing invoices, sending payment reminders, and recording payments.

Through automation, you reduce the risk of human error, which is the most significant cause of invoice disputes. Fewer invoice disputes means faster payments, fewer delinquent accounts, happier customers, and a more effective, successful finance team.

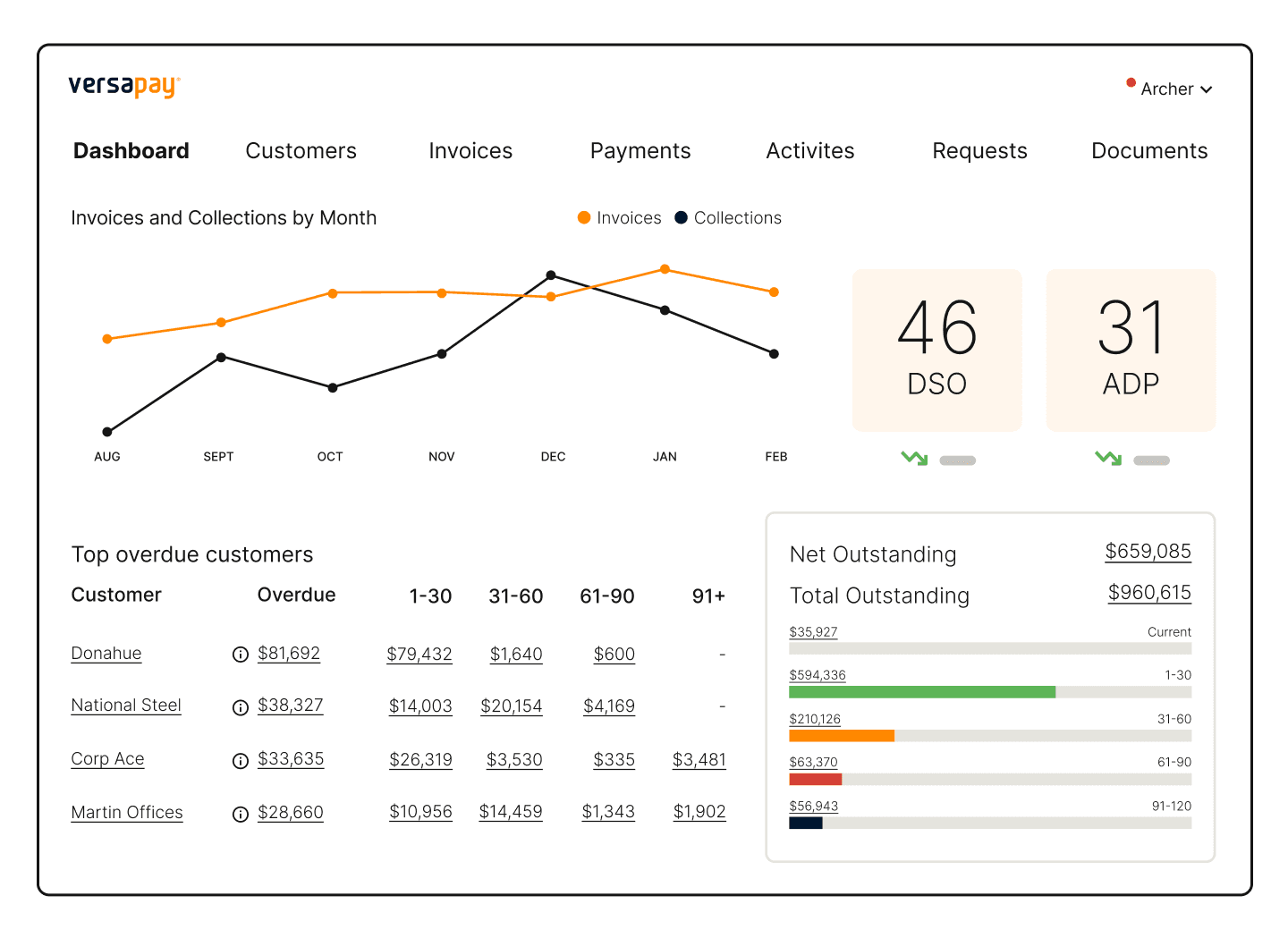

Automating processes frees finance teams—like accounts receivable—to track and analyze the invoice-to-cash cycle in real-time, and make more strategic impacts on it. Automation enables transformation. Such liberation (and heightened access to data) can—for example—reveal payment and behavioral trends, such as customers that are consistently late with payments. This might allow finance teams to take proactive steps to prevent late payments and to identify and resolve bottlenecks or issues more quickly.

2. Finance transformation enables accurate financial reporting and forecasting

When finance transformation includes strategy around data management and integrations, organizations can source and leverage real-time, accurate data from multiple systems, such as ERP, CRM, and financial tools. Eliminating siloed data to provide real-time dashboards keeps executives and stakeholders up-to-date with the financial reports they need to make informed, timely decisions.

Without effective data integration, humans are left to manage and record financial data. This process not only requires large amounts of a person’s time but also increases the chances of error.

3. Finance transformation enhances the customer experience

When assessing potential areas of focus for finance transformation, one area CFOs may choose to focus on is accounts receivable—especially if enhancing customer experience is an important goal. AR is one of the few departments that require direct communication with customers, and its processes can and should be as intentional and seamless as those in customer support.

One of the top requirements customers have for any process? Make it easy and free of erratic, delayed, or unclear human communications. For example, transformation initiatives geared at streamlining the payments process might include implementing technologies that allow your customers to make invoice payments using their preferred payment methods; simple payment options make timely payment easier and more feasible for customers of all financial situations, boosting their experiences.

How to build a finance transformation strategy

Developing a finance transformation strategy involves a number of planned, thoughtful steps that revolve around your organization’s specific needs and goals. Here are steps your organization can take to build a finance transformation strategy.

Define your goal(s)

Assess your current reality

Develop a plan

Monitor and adjust

Deploy communication-focused change management

1. Define your goal(s)

What exactly do you want to transform in your finance processes? Improving operational efficiency or improving financial reporting are great goals, but aren’t very specific.

Do you want to increase the accuracy of your AR data? Perhaps you want to make your existing processes more auditable to meet upcoming compliance efforts. A goal might be to better integrate your AR and finance tools with other internal systems like ERP, CRM, and e-commerce platforms. Perhaps you’ve larger plans and want to cement finance as a core driver of customer experience and shed its stereotype of a back-office, administrative function.

Being specific when defining your goals increases your chances of success and makes implementing changes smoother.

2. Assess your current reality

If your AR processes are all still manual—for example—it’s probably not an achievable goal to use predictive analytics and machine learning technologies to power your cash flow forecasts within a few months.

Instead, look at where you are and assess what’s feasible to achieve over the next six months or year. What existing tools do you have? How can they work together, and what AR tools might work with them?

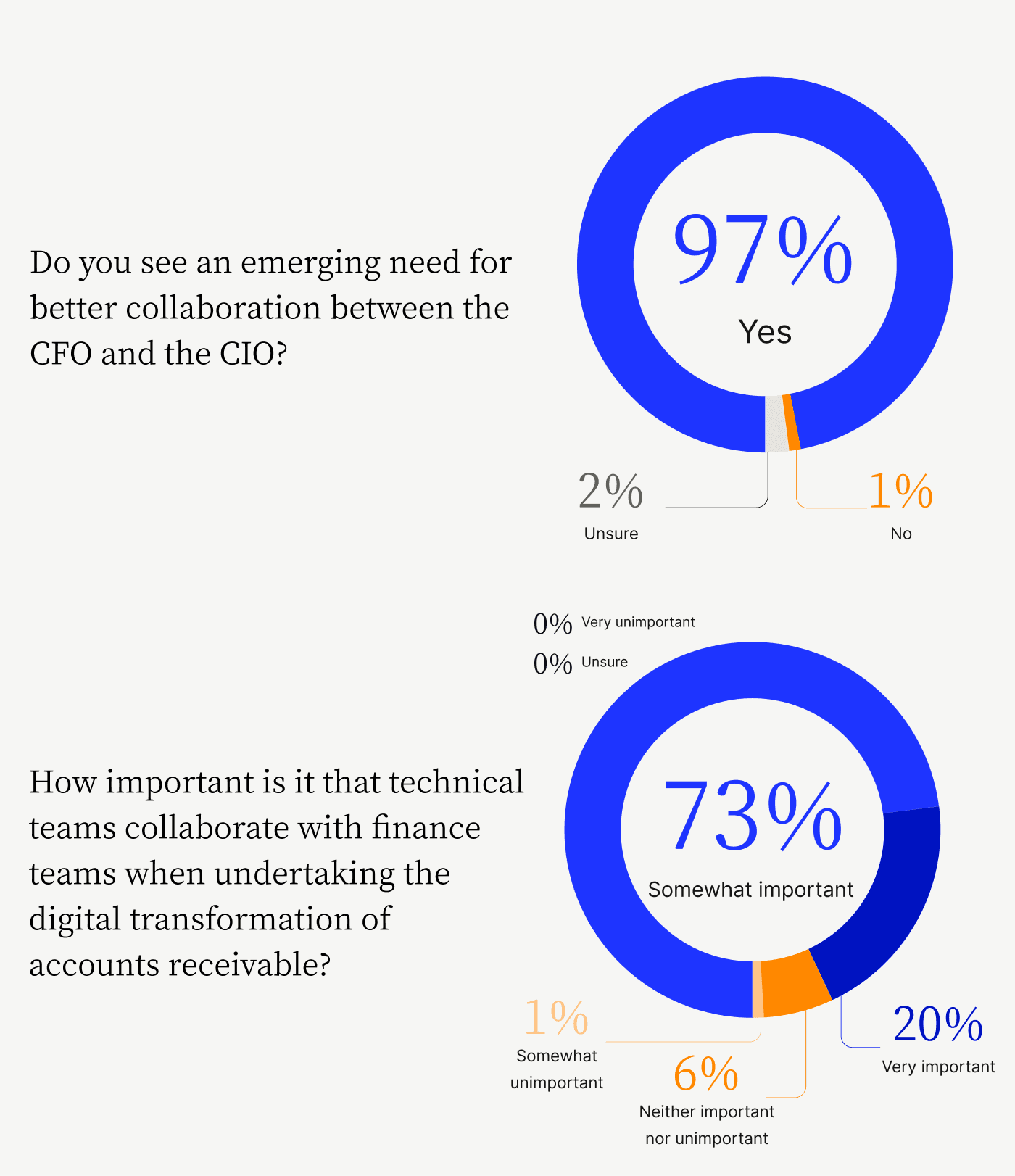

This stage is a good time to become best friends with IT; in fact, your CFO and CIO should be partners in this effort to ensure successful technology implementation and integration.

Next, examine your resources. This examination includes your budget, team bandwidth for implementation and education, and whether your teams have ample technical skills to operate efficiently.

💡 Speaking of AR, take the Accounts Receivable Transformation Roadmap assessment and learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success.

3. Develop a plan

Now it’s time to look at the nuts and bolts of your finance functions to put together a plan. Here are some key areas to consider and plan for:

Redesign and improve processes

Assess which processes you can improve and identify how to do so. For example, you may want to improve your approvals process, but do you want to increase its speed and ensure the correct people receive notifications in a timely manner, or do you want to make sure the approvals process accurately pulls enough data to present for a human judgment call?

Applying this level of specificity ensures you’ll find the correct solutions and make meaningful improvements to your processes.

Determine tech implementation and compliance steps

Will your finance transformation efforts require a solution that integrates with existing tools, or will you start from scratch? What other internal tools must new finance tools integrate with? Now that you’re best friends with IT, work with them to develop plan steps. What do they need from your team to enable tech implementation? How will they offer support?

You should also rope in security and compliance teams to ensure that any technology and processes you put in place meet compliance requirements and provide adequate audit trails.

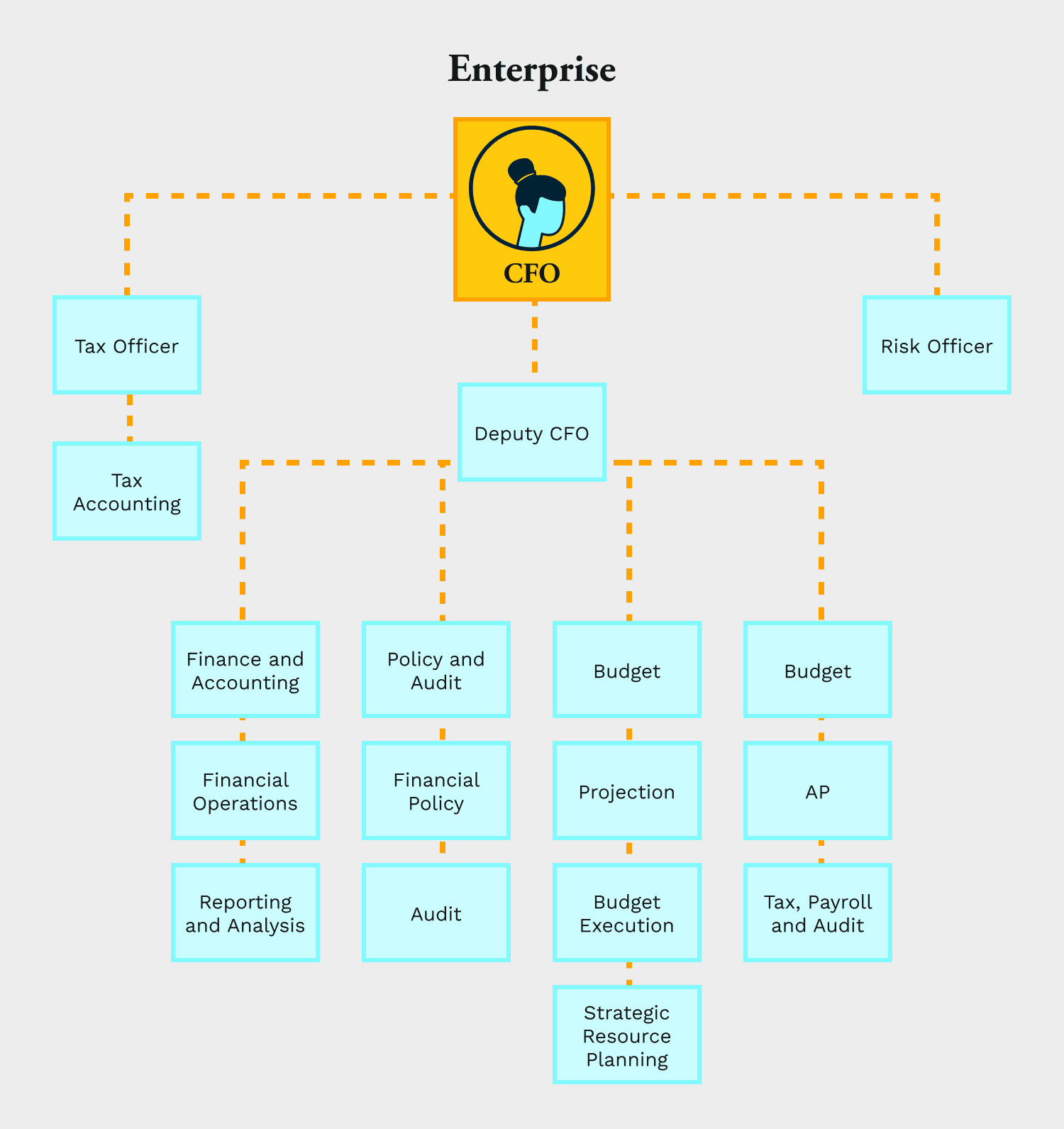

Optimize your finance team

Implementing new technology and improving processes won’t have the maximum impact if your finance teams aren’t optimized for these changes. Optimizing finance teams requires you to think beyond finance. Assess how the data your teams gather can transform the business as a whole.

Next, revise your hiring models to ensure future finance hires have the right skill sets. Ideal hires will have:

Data analysis training

Experience explaining data results in a business-friendly way

Finance skills specific to their area (AP, AR, FP&A, Tax and Payroll, etc.)

A focus on delivering superior customer experiences

Remember, how you structure your finance team is as important as who you hire. Here’s an example of how an enterprise might consider structuring their finance department:

Modernizing finance is about fitting traditional finance into modern mindsets and processes to make your teams more effective, efficient, and data-oriented.

Employee upskilling and customer focus

Determine how you will transform your existing team’s talent. They’ll need training on new systems, ongoing communication, and support to attain their buy-in, spur adoption, and help reorienting from a back-office mentality into a customer-focused one.

Automated systems can only do so much; in fact, automating processes that already create poor customer experiences can make a bad experience worse. That’s why it’s important to support and train finance teams not just in new processes, but new mindsets that focus on CX, data and reporting, and integration with other teams.

Milestone monitoring

Finance transformation efforts geared toward improving processes and creating better customer experiences are meaningless if you can’t measure and report them. As you round out your roadmap, establish KPIs that will indicate whether you’re successful in your transformation initiative and a system to track them. Here are some metrics—some of which are best suited for measuring AR transformations—to consider tracking:

Day sales outstanding (DSO): Lower DSO indicates faster collection and an efficient billing and collection process

Invoice accuracy: Accurate invoices lead to fewer disputes and delays

Customer disputes: Fewer queries related to invoicing, payments, and other finance issues indicate clearer, smoother payment processes

First contact resolution rate: This metric measures the percentage of customer queries or issues resolved at the first point of contact. A high contact resolution rate indicates an efficient smooth, customer experience

Average response time: The shorter your average response time, the faster you resolve your customers’ issues

It is also vital to implement customer satisfaction surveys to measure customer satisfaction. By surveying customers about their experiences with your financial processes, you can directly measure the impact of your finance transformation on customer satisfaction.

4. Monitor and adjust

Careful KPI tracking offers excellent opportunities to monitor, adjust, and continuously improve finance transformation. A successful monitoring and adjustment phase implements:

Regular review meetings within Finance and with other stakeholder teams such as Sales and IT

External audits or consultations to obtain an unbiased perspective on finance transformation’s progress

Pilot testing and iteration to test new processes or tools on a smaller scale. This strategy helps monitor how well a new approach works and allows for time to make adjustments before broader deployment

5. Deploy communication-focused change management

Change is often the hardest part of transformation. An effective change management strategy hinges on regular communications, training, and support to help teams adapt to new processes and tools. A strong partnership between the CFO and CIO will create smoother experiences and ensure stakeholder alignment.

Achieve finance transformation with Versapay

Selecting and implementing the correct finance transformation tools help teams implement customer-focused, efficient processes and mindsets. With Versapay’s transformative collaborative AR platform, accounts receivable teams could spend 50% less time managing receivables, have 30% fewer past-due invoices, and make payments 25% faster.

Determine where you are in your digital AR journey; take our 6-minute AR Transformation Roadmap assessment to learn exactly how you stack up and how to set your AR teams up for success.

About the author

Ben Snedeker