What Is Cash Application and Why Does it Matter?

- 16 min read

In this article, you’ll learn what cash application is, the steps in the cash application process, the benefits of an optimized cash application process, and more.

Included is a glossary of related cash application terms.

The cash application process is a vast, critical step that closes the loop on the order-to-cash cycle, by reconciling customer payments with outstanding receivables. It involves many activities, including:

Allocating a large payment to multiple invoices.

Researching payments with incomplete or ambiguous remittance advice to find the correct customer account and invoices.

Making decisions about overpayments and underpayments.

Unfortunately, traditional cash application approaches put an unnecessary burden on accounts receivable (AR) teams, forcing costly delays that impact cash flow. For many organizations, it’s not unusual to spend a full day to post a single check, or to need extra full-time resources just to manage cash application.

In this article, we’ll discuss what cash application is (and what it isn’t) and how to optimize it.

Jump to a section of interest:

What is cash application?

Cash application is the process of applying incoming payments to the appropriate customer accounts and outstanding invoices. It requires accurately identifying each paying customer, associating each payment with the correct customer account, and matching the payment to the specific invoices or balances being paid.

Cash application isn’t the same as collections, although it can seem just as frustrating and time-consuming. After your AR team pursues and receives full or partial payments from customers for outstanding invoices or balances, then they can start accurately applying those payments to the correct customer accounts and invoices.

Swift and accurate cash application leads to lower processing costs, better straight-through processing rates, reduced days sales outstanding (DSO) and other key accounts receivable metrics, improved efficiencies, and better customer service.

The role of a cash application team

Cash application professionals on your larger accounts receivable team are responsible for matching customer payments to the appropriate accounts and invoices, with the goal of minimizing accounting errors, ensuring accurate customer account records, and facilitating efficient cash flow management.

Effective cash application requires a great deal of patience, organizational skills, investigative acumen, and persistence. Primary cash application tasks include:

Receiving and processing incoming payment information (e.g., lockbox files, electronic payments, checks, remittance advice)

Resolving discrepancies, such as short payments or unidentified remittances

Updating accounts receivable records and generating reports

Collaborating with collections, sales, and accounting teams to resolve payment issues

Maintaining accurate cash flow records and reconciling accounts

The steps in the cash application process

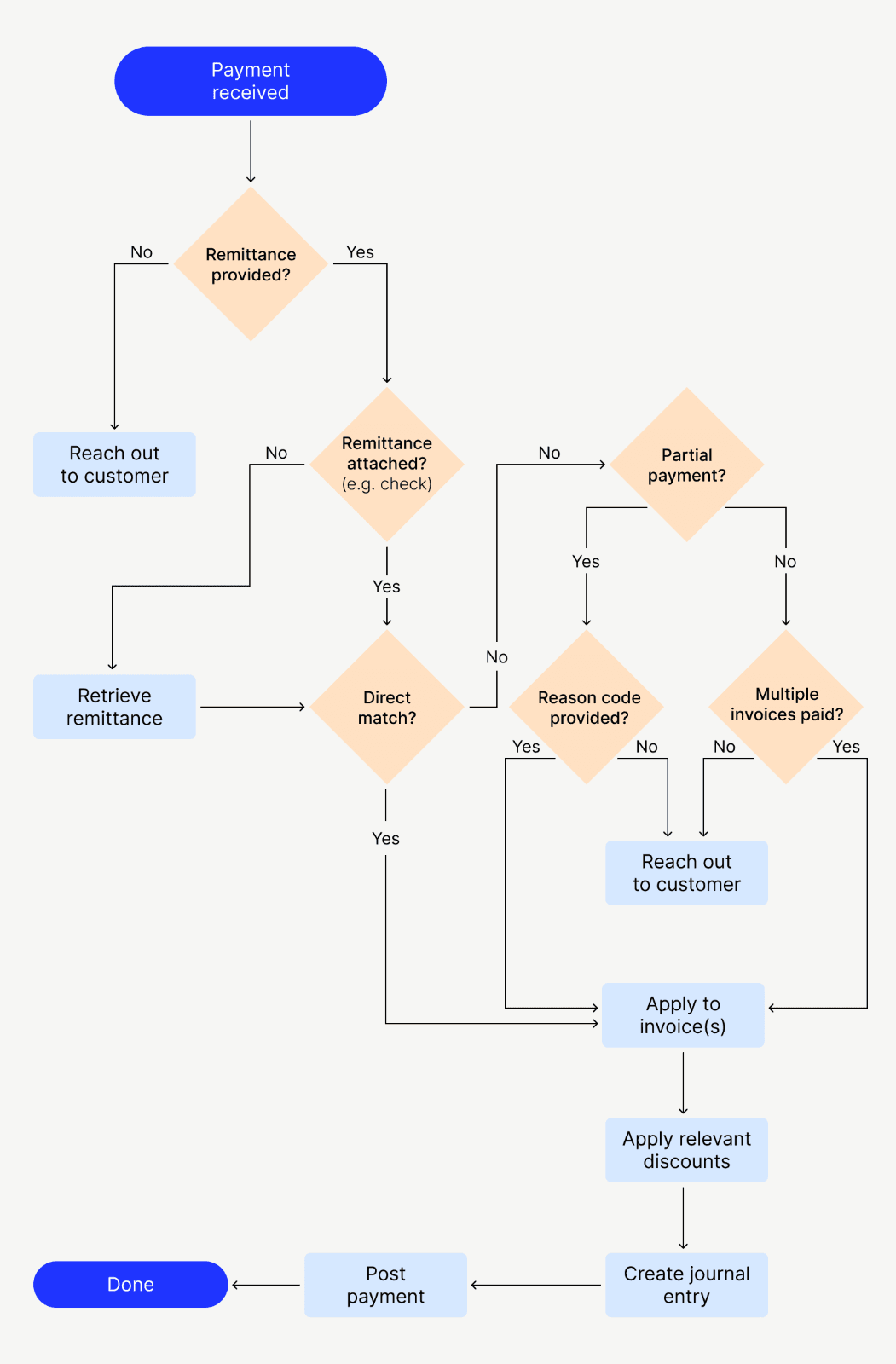

The cash application process really begins when you send an invoice to a customer, since you’ll need that invoice to apply the cash to later in the process. But the actual cash application work begins when a payment is received, so we’ll start there in the following step-by-step rundown (below this flow chart):

Step 1: Receive payments

Payments come from every direction, including lockboxes, electronic fund transfers, and manual payment channels like checks or cash. When the money arrives, the cash application team must collect and organize all the associated payment information, including remittance advice.

Step 2: Batch payments

Batching incoming payments together, based on criteria such as payment method, date, or customer, helps streamline the cash application process and enables easier reconciliation.

Step 3: Capture data

Payment details, such as amounts, customer information, invoice numbers, and remittance data, must be captured and entered into the accounting or cash application system.

Step 4: Match payments

Next, the cash application team matches each payment to the corresponding customer account and outstanding invoices or balances. This step may involve manual research, depending on the available remittance information.

Step 5: Handle exceptions

When payments can’t be matched due to incomplete or inaccurate remittance data, the cash application team investigates and resolves each exception. This may involve contacting customers, reviewing historical records, and collaborating with other departments.

Step 6: Apply payments

Once a payment has been accurately matched, it’s applied to the customer's account and the corresponding invoices or balances are updated in the accounting system or ERP.

Step 7: Process overpayments and underpayments

If a customer overpays or underpays an invoice, the cash application team follows established procedures to handle the situation, such as creating credits, applying partial payments, and requesting additional payments.

Step 8: Manage unapplied cash

Payments that can’t be matched or applied due to lack of information are placed in an unapplied cash account. The cash application team continuously works to resolve and apply these unmatched payments.

Step 9: Reconcile and report

The cash application process includes reconciling applied payments with the organization's bank accounts and generating reports for accounting, collections, and management purposes.

Step 10: Keep improving

If possible, cash application teams should regularly look for bottlenecks and inefficiencies, with the goal of streamlining workflow and accelerating the entire cash application process.

The benefits of optimized cash application

Organizations that optimize their cash application processes improve their financial performance, operational efficiency, and overall customer satisfaction.

Here are some of the benefits that a well-oiled cash application process can deliver:

Improved cash flow management

By ensuring accurate and timely application of customer payments, an optimized cash application process enables better cash flow visibility and forecasting. This helps organizations make more informed decisions about cash management, investments, and financial planning.

Enhanced customer satisfaction

Accurate and efficient cash application leads to up-to-date customer account records, reducing billing disputes and improving the customer experience. By providing accurate and transparent account, billing and payment information, organizations can build trust and strengthen relationships with their customers, leading to increased customer loyalty and potential revenue growth.

Reduced days sales outstanding (DSO)

An optimized cash application process minimizes delays in applying payments, resulting in a shorter DSO metric. When organizations collect payments faster, they increase their working capital and improve their overall financial health.

Increased operational efficiency

By streamlining the cash application workflow, typically by automating processes and minimizing manual intervention, organizations can achieve higher productivity and reduce the potential for errors. This leads to cost savings and improved resource allocation.

Better accounts receivable management

Accurate cash application ensures that accounts receivable records are up-to-date and reflect the true status of customer balances, leading to improved credit risk management, collections efforts, and overall accounts receivable performance.

Improved compliance and audit readiness

An optimized cash application process helps organizations maintain accurate financial records, which is essential for regulatory compliance, audits, and financial reporting.

Better decision making

An optimized cash application process generates more reliable data and reports, enabling organizations to analyze payment trends, identify potential issues, and make data-driven decisions related to cash flow, collections, and customer management.

Why is cash application important?

If it’s not obvious to you already, cash application has far-reaching implications for an organization's financial health, customer relationships, and operational efficiencies. The importance of cash application can be appreciated even more when you look at it through the following business lenses:

Revenue recognition

When customer payments are correctly matched and applied to outstanding invoices, financial statements accurately reflect performance and enable reliable financial reporting and decision making.

Customer experience

Promptly and accurately applying customer payments to their accounts ensures that account balances and statements are up to date. Transparency and accuracy build trust with customers, minimizing billing disputes and reducing the risk of strained relationships due to payment-related issues. No customer wants credit holds placed on their accounts when they’ve already paid.

Labor efficiencies and cost savings

By automating data entry, payment matching, and exception handling tasks, organizations can minimize manual effort—and human intervention—and reallocate resources to more value-added activities. Plus, human error is the leading cause of invoice disputes, so minimizing that risk is a win-win.

Cash flow management

Timely cash application ensures that organizations have an accurate understanding of their available cash resources, enabling better cash flow management and mitigating potential liquidity risks.

Collections and credit management

By maintaining up-to-date customer account records, organizations can identify outstanding balances, overdue invoices, and potential payment issues. This information empowers collections teams to prioritize their efforts, pursue overdue payments more effectively, and make informed credit decisions based on customers' payment histories and patterns.

Compliance and audit readiness

Ensuring that customer payments are properly recorded and applied helps organizations demonstrate adherence to accounting principles and provide auditors with reliable financial records during audits or regulatory examinations.

What are the top cash application challenges?

Being part of a cash application team is not for the faint of heart. To manage the inherent stress in a job that creates a plethora of lingering loose ends, cash application professionals must exhibit incredible patience, organizational skills, and attention to detail.

In a role that demands continuous problem-solving and collaboration across departments, cash application professionals must also possess an investigative mindset, unwavering determination, and the ability to navigate complex customer accounts and payment scenarios with precision and efficiency.

Here are some common challenges that can frustrate cash application team members and slow down the cash application process:

Inaccurate or incomplete remittance information

When customers fail to provide complete and accurate remittance information with their payments, manual research and resolution efforts are triggered and slow down the cash application process.

Payment discrepancies

Discrepancies between an amount paid by a customer and an outstanding balance can arise due to various reasons, such as discounts, deductions, short payments, and overpayments. Resolving these discrepancies requires additional investigation and communication with customers, delaying the cash application process even further.

Complex customer accounts

Large organizations with multiple business units, locations, or subsidiaries may have intricate customer account structures. Applying payments correctly in such scenarios can be time-consuming, especially when dealing with complex payment allocations or inter-company transactions.

Manual processes

Manual processes are inherently slower and more prone to human errors, leading to delays and rework.

Legacy systems and data silos

Outdated or disparate systems and data silos can hinder the cash application process. A lack of integration among payment processing, accounts receivable, and other financial systems can create data reconciliation challenges and require manual interventions.

High payment volume

Organizations that receive a high volume of customer payments, especially during peak periods, may face cash application capacity constraints that lead to backlogs and delays.

Organizational silos and communication gaps

Poor communication or a lack of coordination between departments can lead to delays in resolving payment-related issues and applying cash correctly.

And that’s just the tip of the iceberg. Other risks in the cash application process include:

Dealing with complex payment methods and channels, and remittances

Having to manually link customer payments and invoices with remittances

High lockbox fees and check courier charges

Time delays, error-related costs, opportunity costs, and customer relationship costs

Forecasting and planning challenges

Impacts to employee morale

An introduction to cash application automation

Fortunately, automation can overcome most of these challenges and deliver real business value. Cash application automation is made possible by software solutions that streamline and automate various aspects of the cash application process. These tools leverage advanced techniques such as machine learning, optical character recognition (OCR), robotic process automation (RPA), and intelligent data capture to reduce manual efforts and increase efficiency.

Benefits of cash application automation include:

Increased accuracy

Automated systems can more accurately match payments to customer accounts and invoices, reducing errors and discrepancies associated with manual processes.

Faster processing

By automating data entry, payment matching, and exception handling, cash application automation significantly accelerates the entire process, leading to quicker application of customer payments.

Improved productivity

Automating repetitive and labor-intensive tasks frees up valuable resources, allowing cash application teams to focus on more complex tasks and value-added activities.

Enhanced cash flow management

With faster and more accurate cash application, organizations gain better visibility into their accounts receivable and cash flow, enabling better cash management and forecasting.

Scalability

Automated systems can handle high volumes of payments and complex customer account structures more efficiently, providing scalability as an organization grows.

Consistent application of policies

Automation ensures consistent application of payment allocation rules, deduction handling, and other policies, reducing inconsistencies and errors.

Enhanced compliance

Automated systems provide a clear audit trail, enabling organizations to demonstrate compliance with accounting standards and regulations.

How does cash application automation work?

Cash application automation follows all the steps required in the cash application process, without placing unnecessary burdens on your cash application team. Incoming payment and remittance data is captured and digitized, and additional data sources, such as customer master data and invoice details, can be analyzed to facilitate accurate matching.

Payments that can’t be matched automatically are routed to exception queues, where cash application specialists can review and resolve exceptions more efficiently, aided by automated decision support tools. This happens infrequently, however, as the best automated cash application solutions can achieve straight-through processing rates upwards of 90%.

Once payments are accurately matched, the cash application system automatically updates customer accounts, applies payments to invoices, and generates the necessary reports and accounting entries. What’s more, machine learning models continuously learn from historical data and user feedback, improving matching accuracy and reducing exception rates over time.

Real-life examples of cash application automation in action:

1. A healthcare service provider cut daily cash application time by 75%

One healthcare service provider was spending six hours a day on cash application. Checks sent to lockboxes were bogged down by missing invoice information and custom file formats. Processing electronic payments required pulling remittance information from emails and entering it manually.

With cash application automation, the team cut its cash application time by 75% each day. Nearly all payments (93%) are automatically matched with open receivables and most credit card payments are posted in real time.

2. TireHub saved itself 200 hours a week with cash application automation

TireHub had a small army of contractors who spent days manually matching payments with corresponding receivables and customer accounts. Errors occurred frequently, and customers were getting frustrated. By automating the cash application process, the company cut its reliance on contractors by more than half. Nearly 400% more payments are made digitally and the value of overdue accounts was reduced by nearly 50%.

3. Cole, Scott & Kissane streamlined cash application amid growing payment complexity

Law firm Cole, Scott & Kissane (CSK) is another organization that reduced errors, reversals, and re-billings through payment automation. Before Versapay, the firm received a large volume of checks that had to be picked up at a P.O. box, opened, remotely deposited, and manually entered in an accounting system.

CSK often received payments without accompanying detail and the firm’s accounts receivable team kept having to follow up with customers who had already paid.

With automation in place, same-day cash application is a regular occurrence at the firm, and financial data is always accurate and up to date. Eliminating manual entry misapplications saved the firm and its customers from those unnecessary collection calls, and the firm was able to repurpose existing accounts receivable staff to more strategic roles.

—

Versapay has helped countless organizations benefit from cash application automation. To learn how your organization can benefit from cash application automation in similar ways, talk with an expert today. Not ready for a chat? No problem! Get your free copy of our finance leader’s guide to AI-powered cash application automation software:

Cash application glossary

This glossary covers some of the key terms and concepts related to cash application, helping to establish a common understanding of the terminology used in this essential financial process.

Accounts Receivable: The money owed to a company by its customers for goods or services provided on credit.

Aging Reports: Reports that summarize outstanding customer balances or invoices, based on their age or the number of days they’ve been outstanding.

Cash Application: The process of accurately matching and applying customer payments to their respective outstanding invoices or account balances.

Cash Application Automation: The process of automatically matching and applying customer payments to their corresponding invoices or accounts using software and algorithms.

Cash Flow Management:The process of ensuring efficient movement of funds within an organization.

Collections: The activities and processes involved in pursuing and receiving payments from customers for outstanding invoices or balances.

Customer Experience: The overall impression and level of satisfaction a customer derives from the payment process.

Deductions: Amounts deducted by customers from their payments, often due to discounts, claims, or disputes.

Exceptions: Payments or transactions that can’t be matched or applied to an account or outstanding invoice, due to incomplete or inaccurate information.

General Ledger (GL): The central repository for a company’s financial transactions, including revenue and expenses.

Invoice Matching: The process of associating payments with specific invoices based on relevant details.

Lockbox: A bank-managed service where customer payments are received and processed, before being transmitted to the company for cash application.

Manual Cash Application: A labor-intensive process where AR teams manually reconcile incoming payments from various channels with outstanding invoices.

Machine Learning: A branch of artificial intelligence that enables systems to learn and improve from data without being explicitly programmed.

Overpayment: A situation where a customer pays more than the outstanding balance on their account.

Payment Allocation: The process of distributing a customer payment across multiple invoices or account balances, according to predefined rules or preferences.

Payment Channels: Various methods through which payments are received (e.g., checks, credit cards, and ACH transfers).

Payment Reconciliation: The process of ensuring that payments match expected amounts and fixing discrepancies.

Remittance Advice: Information provided by a customer along with their payment, typically detailing the invoices or account balances being paid.

Robotic Process Automation (RPA): The use of software bots that automate repetitive, rule-based tasks across applications and systems.

Short Payment: A situation where a customer pays less than the outstanding balance on their account. May also be called underpayment.

Unapplied Cash: Payments received from customers that cannot be matched or applied to specific invoices or accounts, due to a lack of information.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.