ERP Payment Integrations

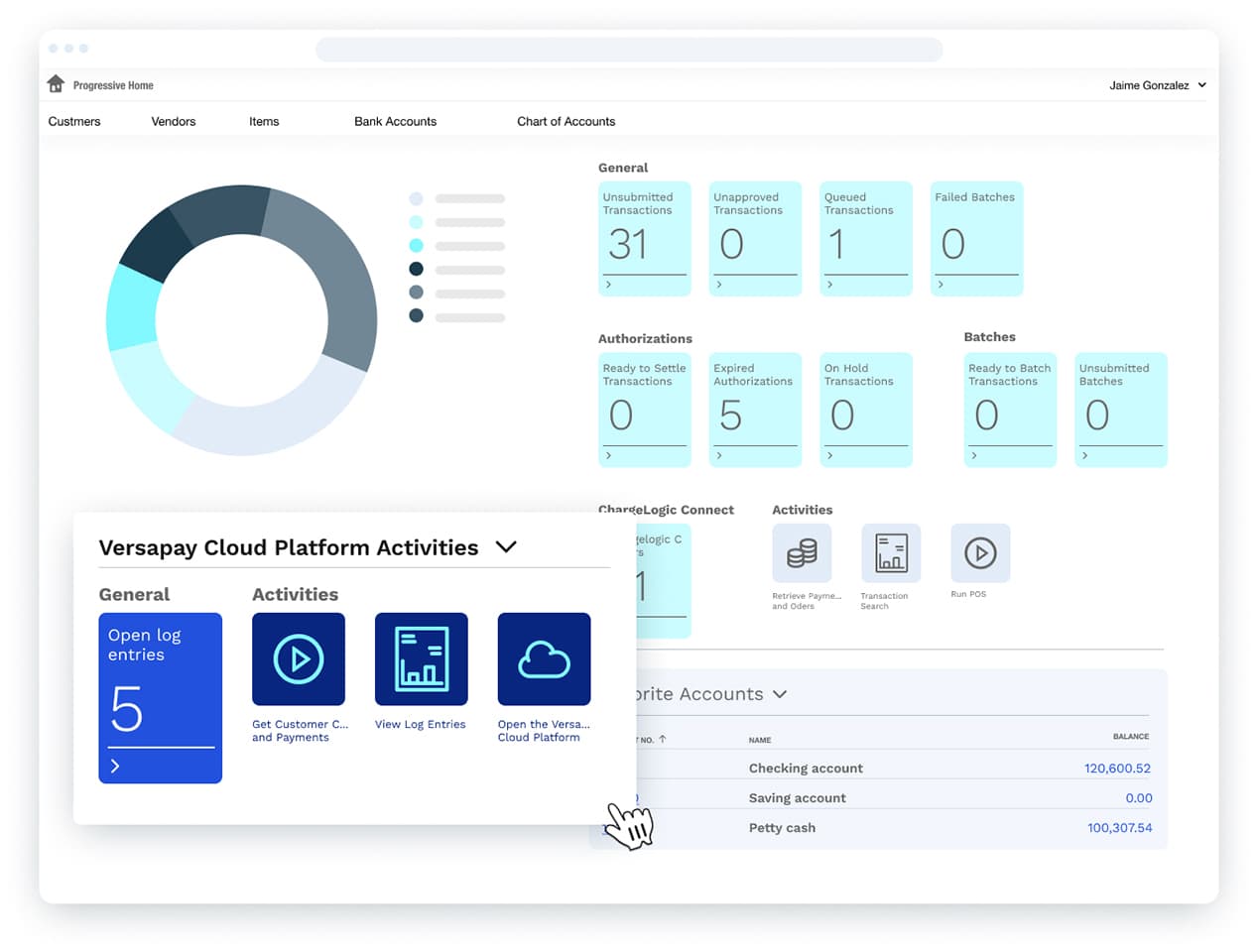

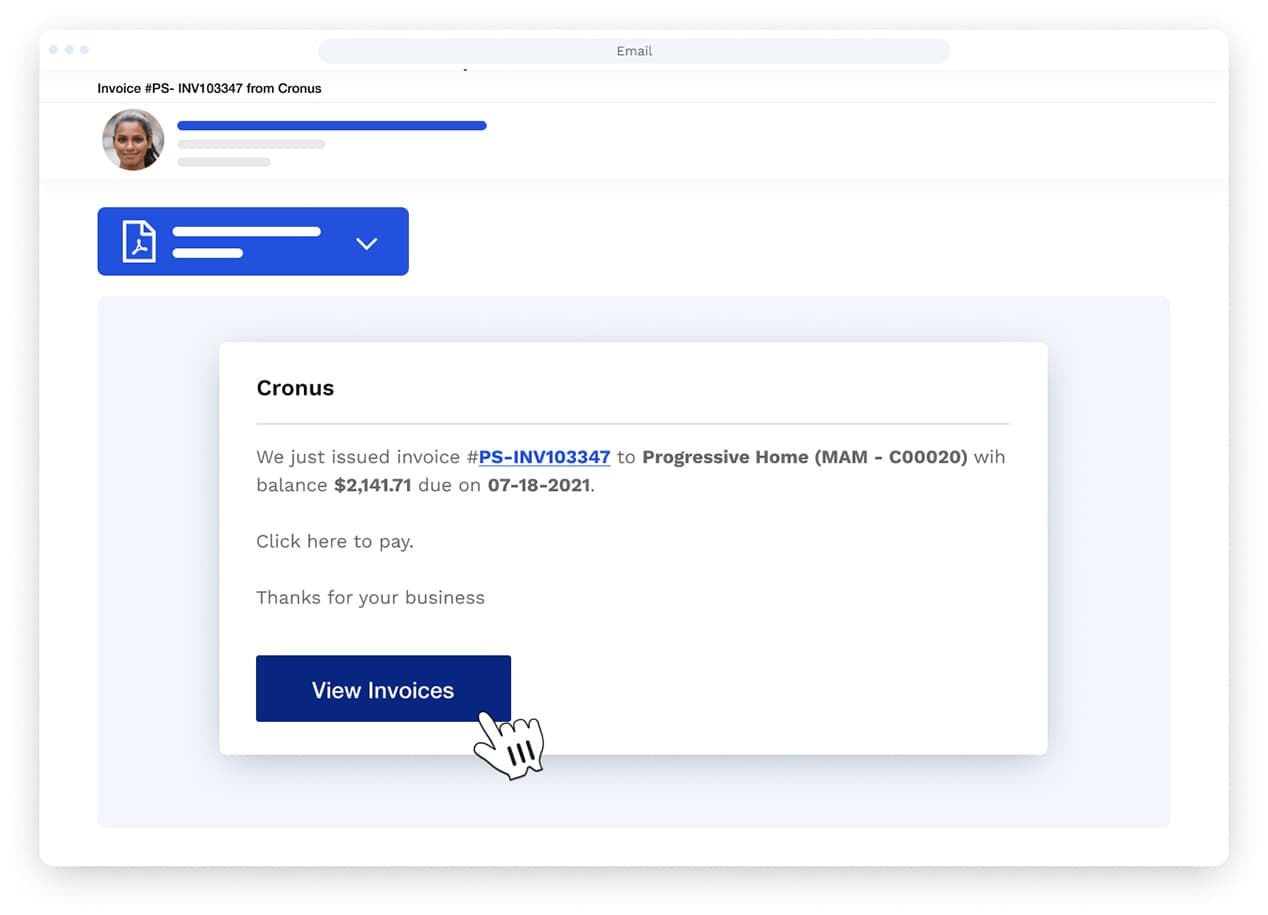

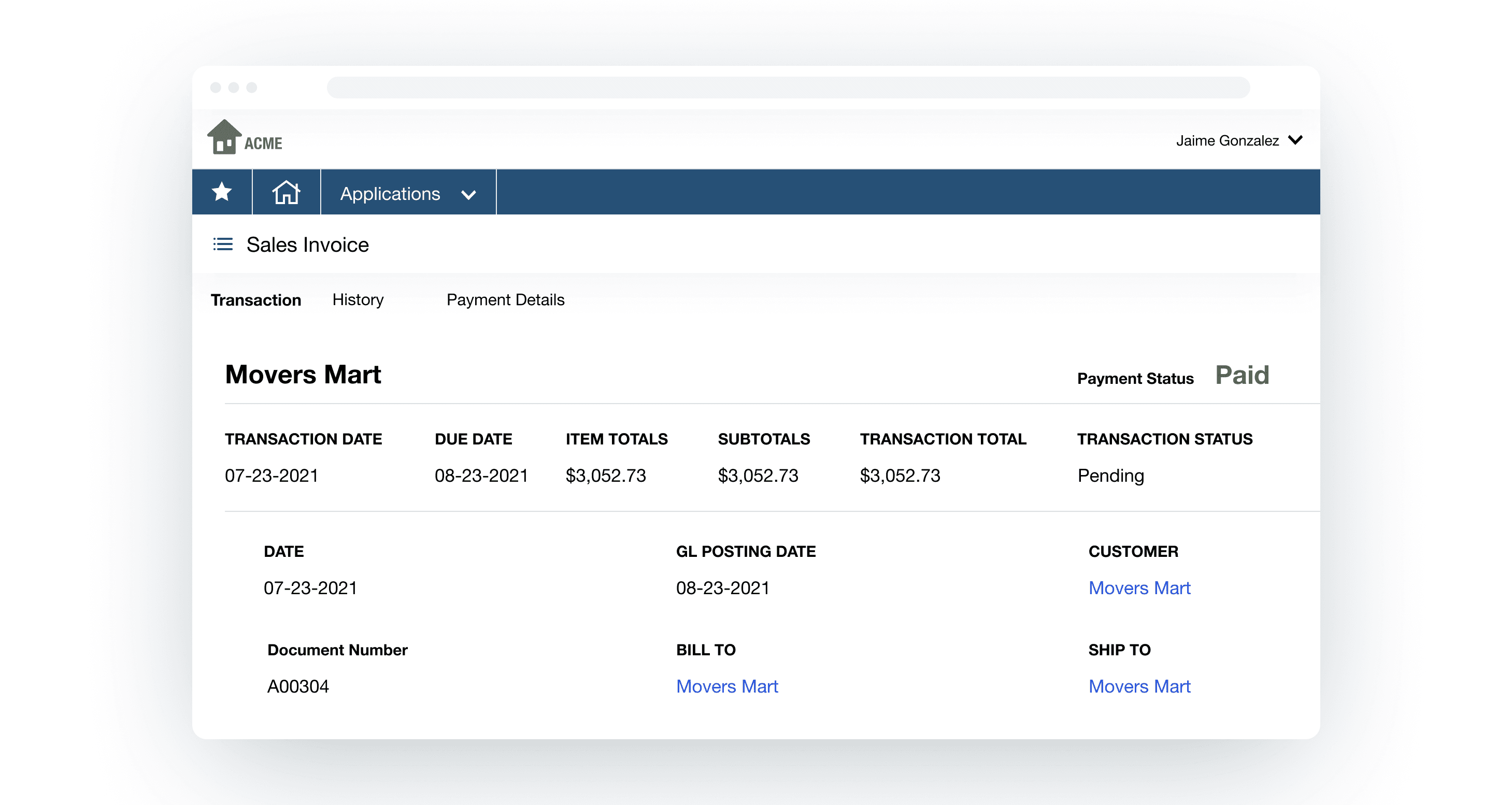

Learn how ERP payment integration solutions can reduce manual work and accelerate how you process payments by directly connecting your ERP to a payment processing system.

How Integrated Payments Gave Skin Script a Lift

In under 15 minutes, you’ll learn:

- Why NetSuite users like Skin Script know now is the time to explore integrated payments

- The day-to-day difference integrated payments make

- What companies looking to make the switch should know