How To Solve Common Cash Application Challenges With Automation

- 8 min read

Manual cash application is time-consuming and error-prone, with accounts receivable professionals often encountering many hassles.

In this blog, we break down:

- The most common cash application challenges your team likely faces, and

- How to solve them with automation and cash application best practices.

Cash application is the process of matching incoming payments with the correct open accounts receivable (AR) and customer accounts.

It involves cross-checking a remittance document (sent by the buyer to advise what a payment is for) with open invoices. The goal is to ensure incoming payments are accounted for so that they can get posted to your enterprise resource planning (ERP) system.

Sounds straightforward enough, right? Payments, unfortunately, don’t always neatly map back to open invoices. This makes the process of posting payments much more involved.

When managed manually, the cash application process is time-consuming and prone to errors. And as the business-to-business (B2B) world increasingly favors electronic payments (commercial check use fell to an all-time low in 2021), cash application challenges have only grown. With more remittance formats to manage and processes ill-equipped to handle them, AR teams are devoting more time to cash application than ever before.

Why is a swift cash application process important for your business?

When a business receives a payment, they need to be sure they have a right to those funds. This is especially important in B2B, where sales are typically made on credit and the payment won’t be received until later. Accurately tracking incoming payments is essential to making proper use of that cash. The longer payments remain unapplied, the longer that cash is unusable for operational expenses and revenue-driving initiatives.

If a payment is tied up in the process of cash application for a long time, your collections staff might think it hasn’t been received yet, even when it has. They might send out an unnecessary dunning notice, creating a negative experience for that customer and even potentially compromising their credit.

By having more efficient cash application processes, you unlock working capital faster and avoid negative customer interactions. You also provide senior finance leaders with a more accurate view of the current state of receivables, which is vital for financial planning and analysis activities.

Yet, most businesses’ cash application processes aren’t particularly efficient. For such a seemingly simple process, why is reconciling payments and invoices so difficult?

Here are five common cash application challenges most AR teams face and how cash application automation software can make them a thing of the past.

1. Dealing with decoupled remittances

Much of the pain around cash application stems from the fact that in many cases, remittance information is supplied separate from the payment. This is especially the case with electronic payments like ACH, EFT, wire transfers, and virtual cards. Because remittance advice isn’t formally required and is technically a courtesy, sometimes there isn’t any information accompanying payments.

Your AR staff ends up spending much of their time sifting through files—sometimes from multiple systems—to find a payment’s matching remittance details or going back to the customer to request clarification.

How can you automate this instead?

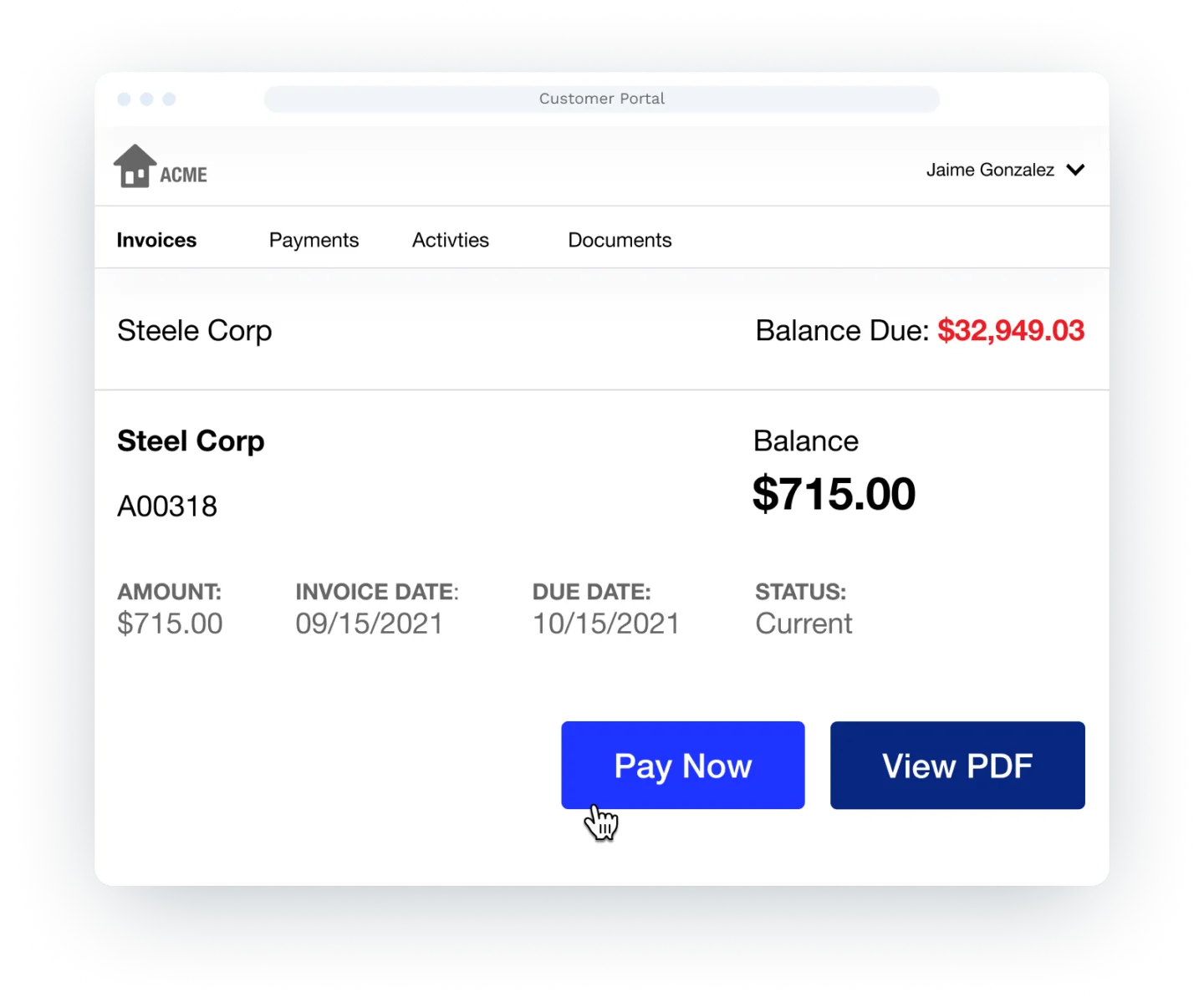

One way you can resolve this challenge—and the task of cash application altogether—is by having your customers pay you through a secure online portal. Whether they pay via credit card or bank transfer, you get reliable remittance information linked directly with the payment because customers are self-selecting which invoices they are paying. Your customers become participants in the cash application process, alleviating some of the work from your AR team.

2. Working with various remittance file types

Remittance files can come in a variety of formats and channels—everything from emails and PDFs to electronic data interchange (EDI) files and AP web portals. The last have risen in popularity more recently, as large customers (the Walmarts and Amazons of the world) have established their own portals to deliver remittance information. Suppliers for these companies, usually much smaller, then have to work around their systems.

Extracting the necessary data from all these sources can be very time-consuming if you haven’t found a way to automate this process. Formatting issues like blurred images, multiple columns and pages, and missing characters add to the trouble, making it difficult to produce a match.

How can you automate this instead?

A cash application tool that automatically extracts and aggregates remittance data from many file types makes working with all these data sources much easier.

While check use continues to decline, it's still one of the most popular B2B payment methods. Our recent research found that 91% of finance tech leaders say their organization still receives checks. To accommodate the volume of checks you’ll inevitably still receive, you’ll want to find a cash application solution that can automate matching for both digital and check payments.

A solution with artificial intelligence capabilities takes your automated matching abilities even further, as the system gets smarter the more you use it. AI-enabled cash application automation software can remember irregular formatting and apply new rules the next time it looks for a match. Optical character recognition (OCR) can analyze messy or illegible remittance information and import it in a format that’s usable.

3. Paying for costly lockbox services

Lockbox services allow businesses to offload the task of collecting check payments to a third-party provider such as a bank. You direct customers’ checks to a special postal box, where the bank will then take them, process them, and deliver the payment and remittance information to you in an electronic file.

While many organizations have improved their back-office efficiency by using lockbox services, these services can get expensive and still aren’t all that fast. Banks charge by the keystroke for the information they compile, in addition to the charges for the actual check processing.

After you receive the electronic remittance files from the bank, your AR team still has to manually reconcile the entries with your ERP software.

How can you automate this instead?

You can transition away from accepting checks and encourage customers to pay you digitally instead. If you continue to use lockbox services, a cash application automation solution that can read these kinds of files can eliminate the need to pay for keying services and automatically reconcile the data with your ERP.

4. Handling short payments, split payments, and other discrepancies

Short payments, deductions, and multiple invoices paid at once make for an added level of complexity during the cash application process. It becomes especially challenging when you have no idea why a customer made a partial payment. A customer might short pay if their goods arrived damaged or they were offered a discount that wasn’t communicated to your accounting team.

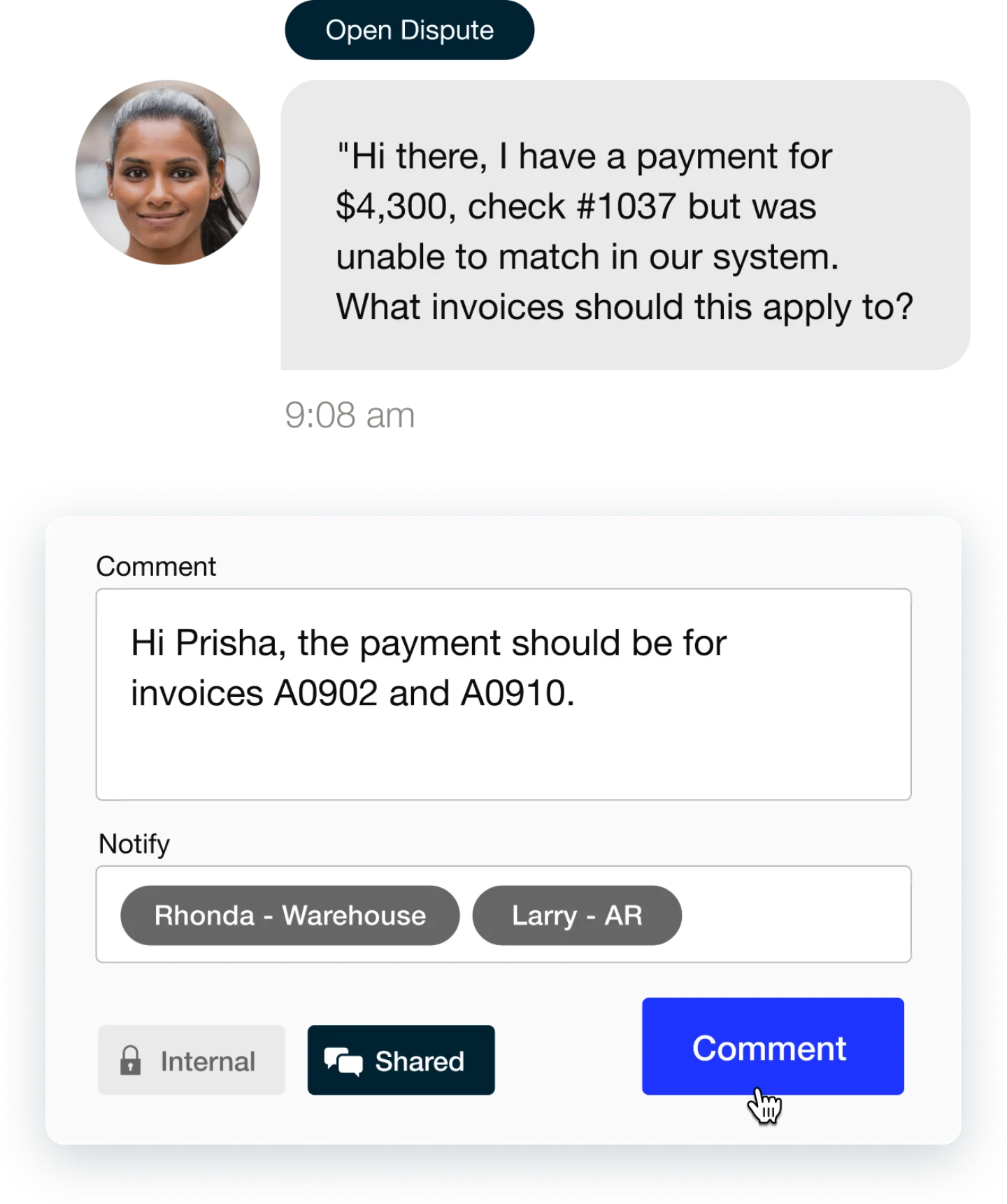

When this happens, your cash application specialist must do their best impression of Sherlock Holmes to uncover the reason behind the discrepancy. They’ll often need to coordinate with the customer and other team members to get their answer.

How can you automate this instead?

Machine learning is a great tool for automatically matching incoming payments with invoices. But, there are some things that will always need human intervention. Look for a cash application automation solution with features that let you easily collaborate with customers to seek clarification on their payments.

When accepting payments online, you can also require customers to provide a reason when making partial payments. Some solutions let you populate your own set of reason codes (matching those set up in your ERP) that a customer can choose from.

5. Using multiple systems to keep track of everything

One of the greatest challenges of manual cash application processes is that all the above-mentioned activities are happening in separate places. No matter how diligent your cash application specialist is, the more information they must manually key into your ERP, the more room there is for errors.

How can you automate this instead?

To ease the final mile of cash application—posting to your ERP—you’ll want to look for an automation solution that will integrate with your dedicated system. With a cash application automation solution that posts directly to your ERP, you’re also getting a much more real-time view of all your receivables.

Resolve cash application challenges and get straight-through processing on over 90% of your incoming payments

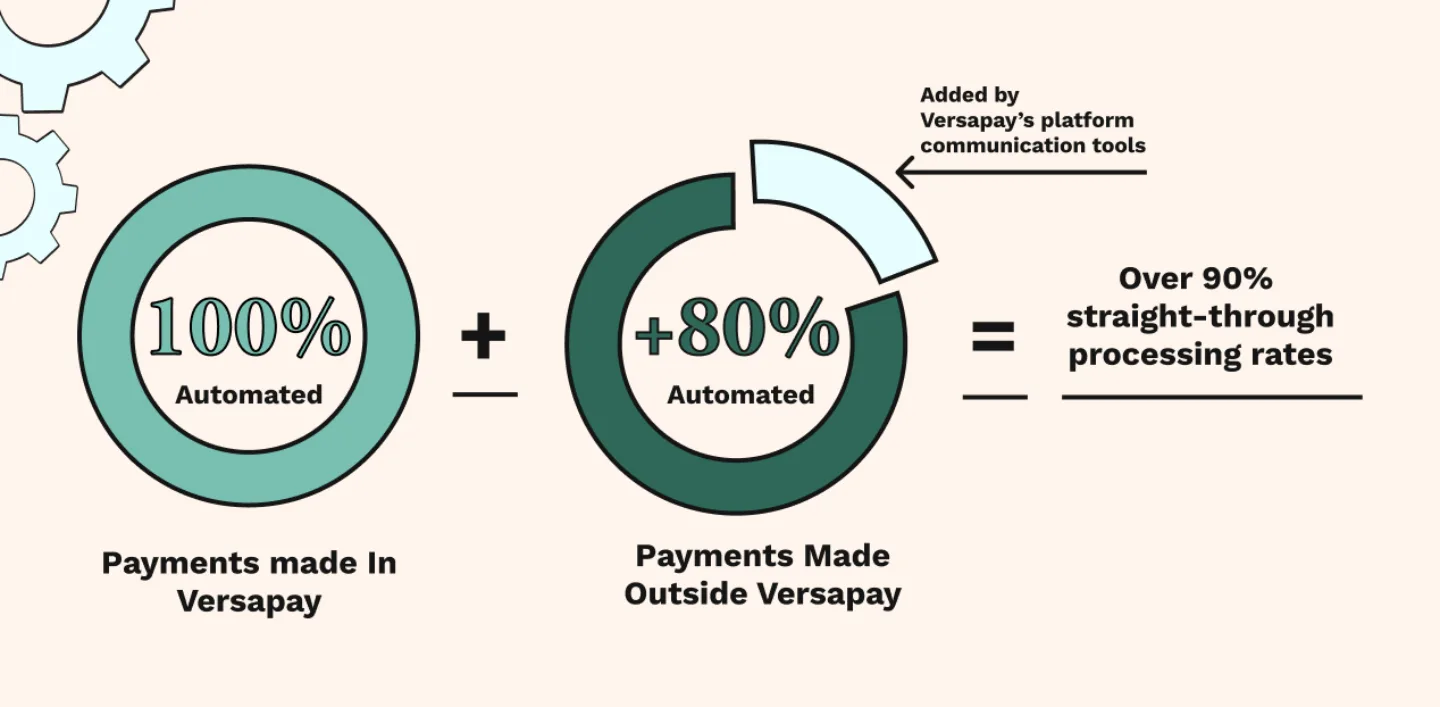

With Versapay, you can accept payments through a dedicated cloud-based portal, where remittance information is captured at the time of the payment. With a direct connection to your ERP, this means the cash application process is 100% automated for payments made through the platform.

For payments you accept outside of Versapay (via check, lockboxes, ACH, or other means), our Advanced Cash Application tool can help. Using AI and OCR technology, we’re able to parse the remittance information from all those sources and match payments with their corresponding invoices.

You can expect to see automatic matches on 80% of payments happening outside of Versapay. For the remaining portion of unapplied payments, our cloud-based collaboration tools help you coordinate with colleagues and customers to resolve them.

Put together, when you use Versapay to accept both your online and offline payments, you’re able to achieve a straight-through processing rate of over 90%. Without requiring human intervention. You'll save your AR team countless hours of manual work and free up their time to focus on revenue-generating activities.

Want to see AI-powered cash application automation in action? Talk with an expert with us today.

—

This blog was originally published in September 2020 and has been updated for accuracy and comprehensiveness.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.