7 Tips for Better Automated Cash Application

- 11 min read

In this article, you’ll learn 7 tips your accounts receivable team can use to automate and dramatically improve your cash application process.

Getting paid makes most businesses happy (of course). But if your accounts receivable (AR) processes—especially cash application—are manual and/or time-consuming, your business will face significant consequences. Optimizing your cash application processes will help reduce costs, increase cash flow, and increase team productivity.

In this article, we’ll quickly examine the benefits of automated cash application and share signs that indicate room for improvement. Then we’ll share our 7 top tips for improving your cash application automation and get your teams back to loving the steady stream of paid invoices.

Jump to a section of interest:

Benefits of cash application automation

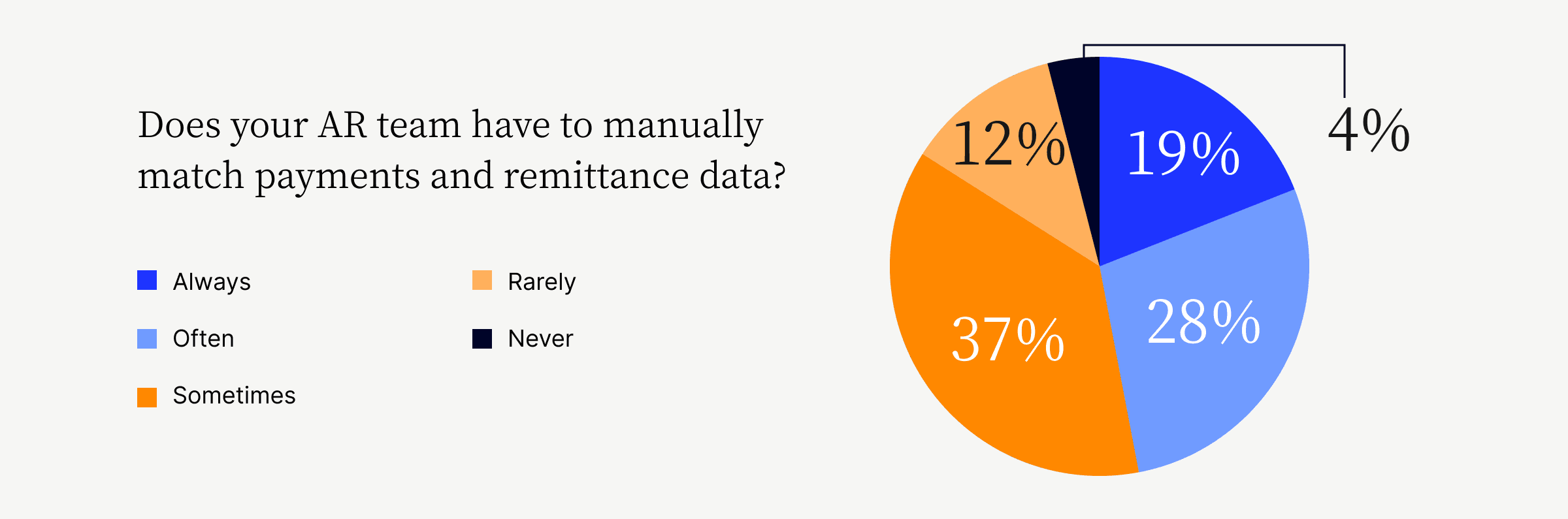

While many companies are using or moving to online payments, a manual cash application process can significantly slow down accounts receivable teams as they try to reconcile payments across platforms and payment channels.

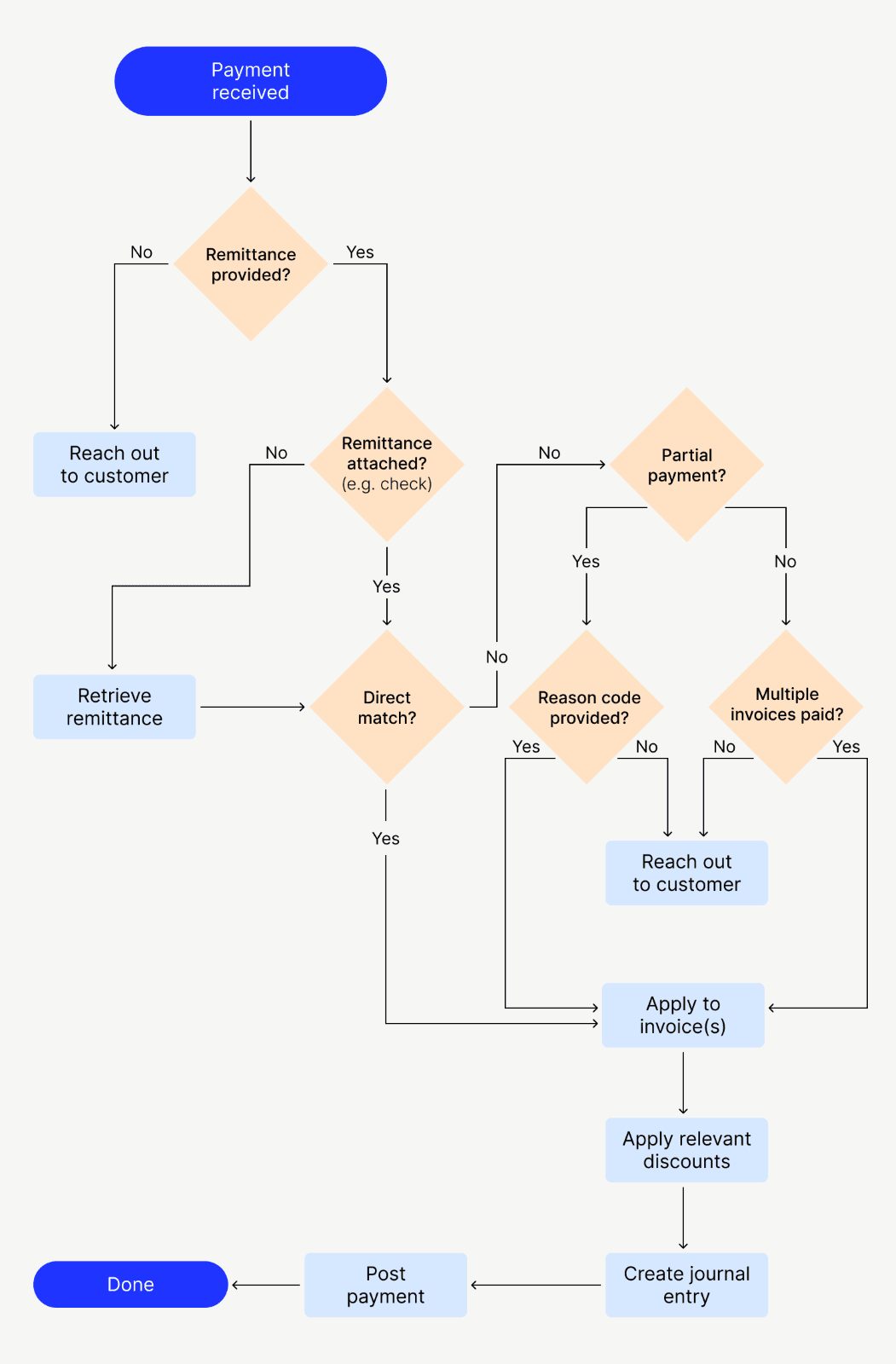

That’s because manual cash application is time-consuming, introduces more errors, and slows down cash flow. Just look at how complex the cash application process is. Performing it manually does you no favors:

Here are a couple core benefits of cash application automation:

Automated cash application increases efficiency

Automated cash application matches payments with invoices and closely integrates with your ERP platform. It also lets you capture incoming payment information across all payment channels and extract remittance data from any source. That means less time manually searching for and matching remittance information, faster cash application, and accelerated cash flow. That saves your teams hours (if not days) of manual reconciliation.

In fact, one healthcare service provider used Versapay to automate cash application and match 96% of open receivables with incoming payments. This yielded a whopping 75% time savings and a 33% reduction in the resources needed to perform cash application.

Saving that kind of time and resources frees up your accounts receivable team to performcritical financial functions like cash flow forecasting and budgeting, alongside more strategic collections work.

Automated cash application reorients teams for higher, more strategic value

With automated cash application, accounts receivable teams save an average of 10 minutes per check. With all that time back, teams are better positioned to support more strategic initiatives, like customer outreach. That provides a huge ROI, as frequent and consistent customer touches earlier in the collections process accelerates payments and reduces uncollectible debt.

Signs you need to improve your cash application

There are plenty of common indicators that signal if your cash application process needs help:

It takes more than a week to apply payments after receiving remittance data

Accepting paper checks is easier than managing digital payments

The process claims 25% or more of your AR team’s time

Outstanding unapplied payments slow down your cash flow

Reporting on your process is difficult because your AR data isn’t streamlined

Your customers are reporting errors

Improving your cash application process with automation will help your teams spend less time retrieving remittances from various sources; automatically match payments with invoices; and carry out cash application in one place by integrating with your ERP.

Top 7 tips for automating your cash application process

Whether your cash application process is entirely manual; or you’ve some level of automation currently in place; or you’re looking to fully automate and transform it; here are our top tips to automating your cash application process to get the best results:

Accept digital payments

Digitize remittance advice data

Employ mobile check deposit

Ensure straight-through processing on electronic payments

Automate team workflows around short pays, deductions, and discounts

Integrate payments with your ERP

Track AR metrics and report on performance

1. Accept digital payments

Check-based payments are notoriously hard to match with open invoices.

This is because checks are rarely sent with accompanying remittance advice; instead, remittance information might—or might not—be included in a memo line or some separately-sent supporting documentation. Not to mention, physical remittance slips accompanying check payments are notoriously illegible; with blurred images, missing characters, and indecipherable handwriting.

While digital payments have their own issues, they’re easier to remedy. Digital payments, especially those made through a payment portal that includes an electronically-issued invoice, are easier to match. The cash application automation that comes with a digital payment platform speeds up the entire process and eliminates the errors common to manual account reconciliation.

2. Digitize remittance advice data

Accepting electronic payments often means your remittance advice arrives separately from the payment and in a variety of formats, including email, web portals, images, APIs, and Word and Excel documents.

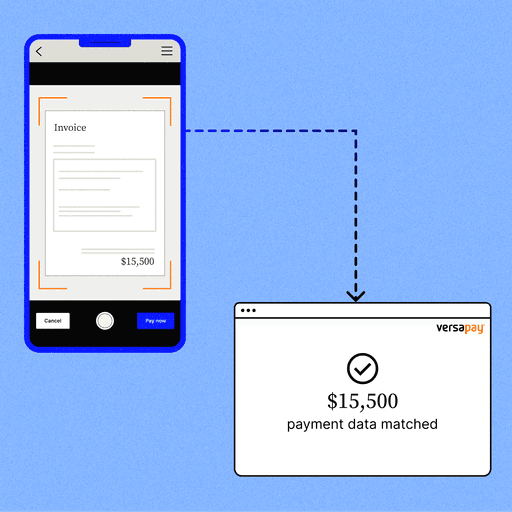

A cash application automation solution that leverages optical character recognition (OCR) can convert an image of text into machine-readable text format. This automatically captures remittance data from all sources in real time and matches them to invoices, saving countless human hours.

An added advantage of cash application automation includes reduced lockbox key-in fees and the time-consuming tedium finance teams still face consolidating incoming check payment information into a single data file.

3. Employ mobile check deposit

Mobile check deposit provides AR teams with substantial advantages, including:

Same-day cash application that reduces day sales outstanding

Reduced manual effort and straight-through processing

Better AR team efficiency and increased customer satisfaction

Productivity gains from mobile check deposits can be substantial. Businesses still collect between 25% and 75% of their payments by physical check, then manually match payments with remittance advice.

Need proof? Just look at Würth Canada. Even though they offered a variety of electronic payment methods, their customers still preferred to pay by physical check, incurring inbound courier costs for every received check. Bank lockbox services didn’t reduce manual reconciliation time—in fact, they made it more difficult.

By automating their cash application, Würth has reduced AR time by 75% and freed up $15,000 CAD in monthly operational cost savings.

4. Ensure straight-through processing on electronic payments

For electronic payments made on electronic invoices, automated cash application can automatically link remittance and payment. That prevents AR humans from having to manually extract and match remittance advice, and reduces errors by allowing them to prioritize strategic, impactful collections initiatives.

The right cash application automation platform can help teams achieve straight-through processing rates of over 90%. And by using a platform with AI and machine learning capabilities, you can increase efficiency by up to 75% by automatically capturing and reconciling payment data, eliminating entry errors, reducing manual effort, and speeding up cash flow.

And if you’re in the stages of choosing a cash application automation platform, consider one with integrated exception handling. That will make it easy for your team to message the customer to solve discrepancies.

5. Automate team workflows around short pays, deductions, and discounts

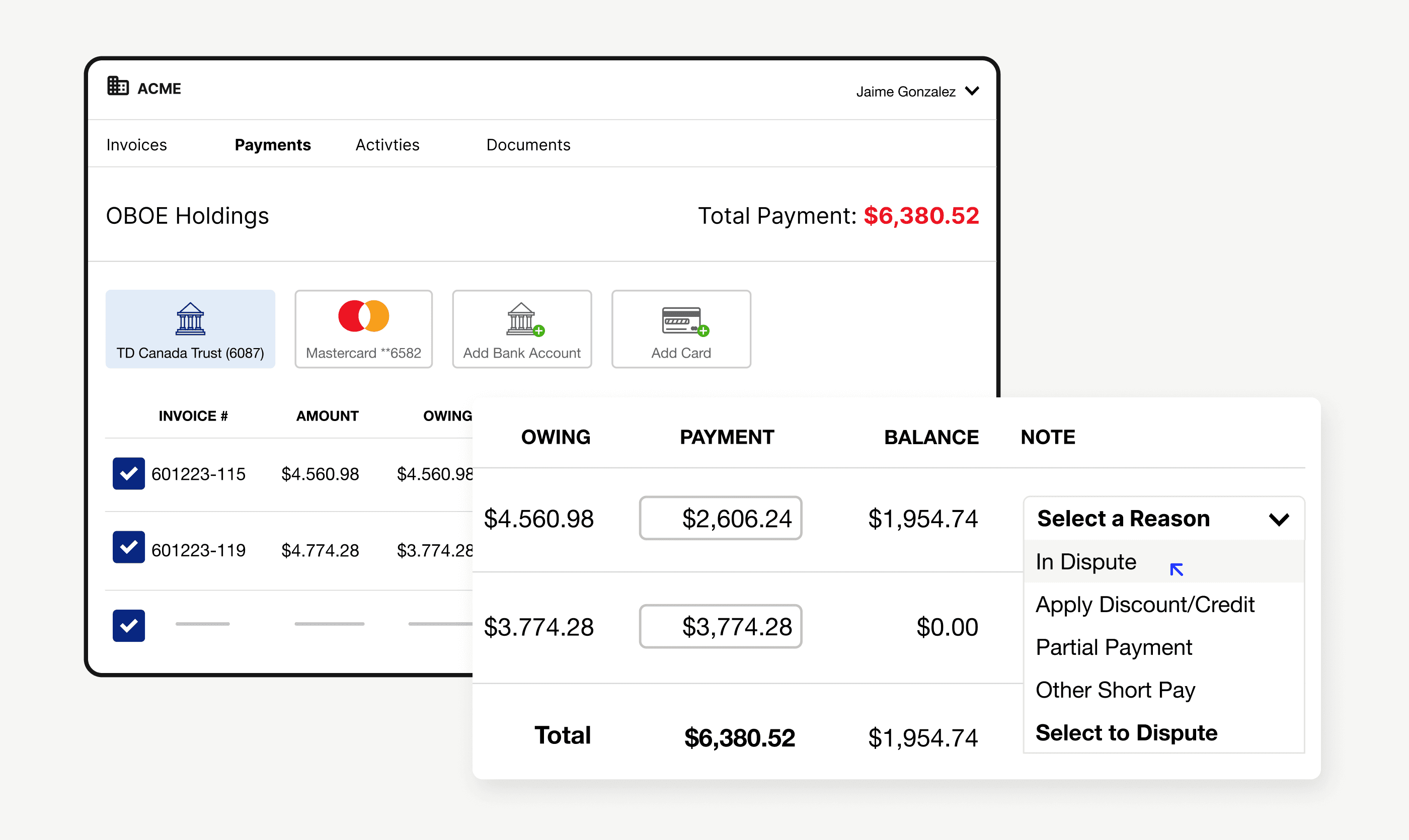

While a customer may have a valid reason for short payment, it causes headaches for AR teams that manually reconcile payments with open receivables. Figuring out the reason for short payment and tracking the follow-up process can be a drag on team efficiency with back-and-forth phone calls and emails. The same drag occurs with manually addressing disputes, deductions, and discounts.

When you automate AR processes overall, your entire invoice-to-cash process will have fewer errors. Cash application automation itself can help identify and apply reason codes and discount codes.

Collaborative payment portals make it easier to deal with short pays, disputes, and deductions. A customer can select a reason for short pay or identify a dispute for a line item. The collaborative payment portal contains all the relevant documentation and also enables in-portal messaging, so it’s easier for buyers and sellers to work together to track and resolve disputes in one place.

Cash application automation platforms may also have built-in AI that can, say, identify that a customer’s lump sum payment may actually cover multiple outstanding invoices and apply the payment accordingly.

6. Integrate payments with your ERP

Without automated cash application, posting payments to your ERP or accounting software is likely a tedious process that includes spreadsheets and manual data entry, introducing opportunities for error and decreasing team efficiency.

An accounts receivable and cash application automation solution can integrate payments directly within your ERP to save your teams time, your company money, and reduce overall errors. With a single platform that streamlines payment processing from start to finish, teams can manage the entire process in one place, automate cash application, improve cash flow, and work more efficiently.

7. Track AR metrics and report on performance

There are many key AR metrics to measure that will indicate the health, performance, and efficacy of your AR efforts. It is possible to track these manually, but will require a significant time investment and could be prone to error with manual data entry or calculations.

Your business will have its own unique KPIs to track, and automated AR and cash application platforms enable businesses to better obtain and report on these important metrics. Generating reports is much faster and more accurate, and automated AR software even allows you to filter down to company division levels to gain granular insight into payment patterns.

—

🎥 Bonus! Hear what Russell Lester, Versapay’s CFO, has to say about measuring accounts receivable performance, taking stock of your current situation, and improving your execution:

Cash application is better when it’s automated

Once you’ve fully automated your cash application, you won’t believe you ever did it manually. Between the time saved, better team efficiency, and cost savings, your AR teams and processes will feel transformed.

Want some more details on how to accelerate your cash flow with cash application automation? Download our guide, How to Drive Efficiencies with AI-Powered Cash Application Automation Software.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.