To add complexity (and confusion) I2C is a subset of the order-to-cash process that encompasses the entire sales cycle, from quote generation to payment receipt and closing of a sale.

Cash Application: The Ultimate Guide

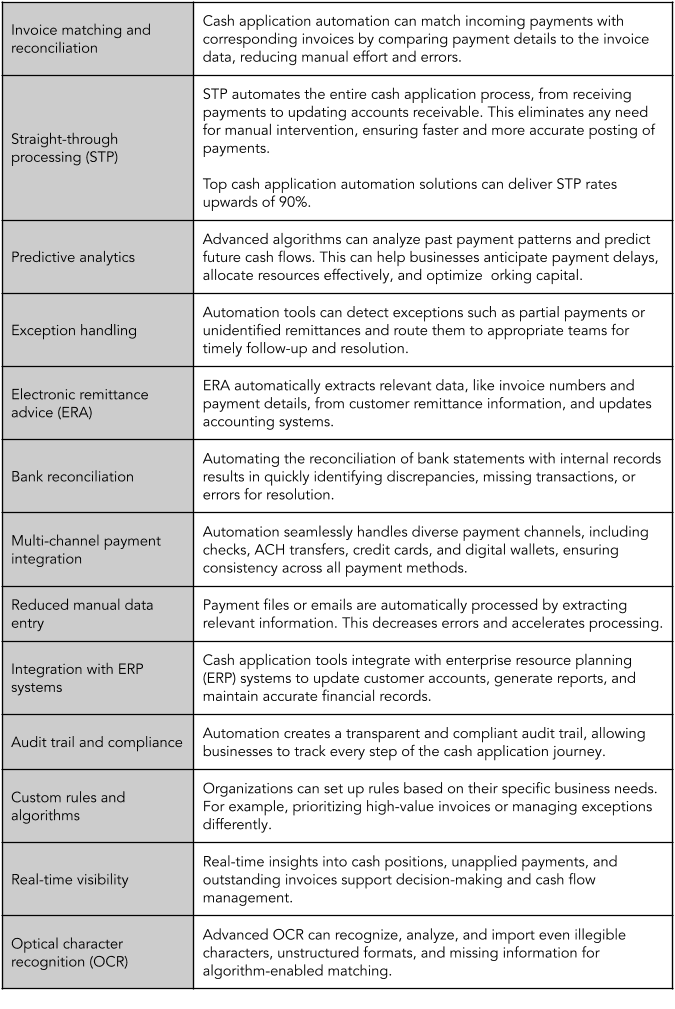

Swift and accurate cash application leads to better straight-through processing rates, lower processing costs, reduced DSO, improved efficiencies, and better customer service.

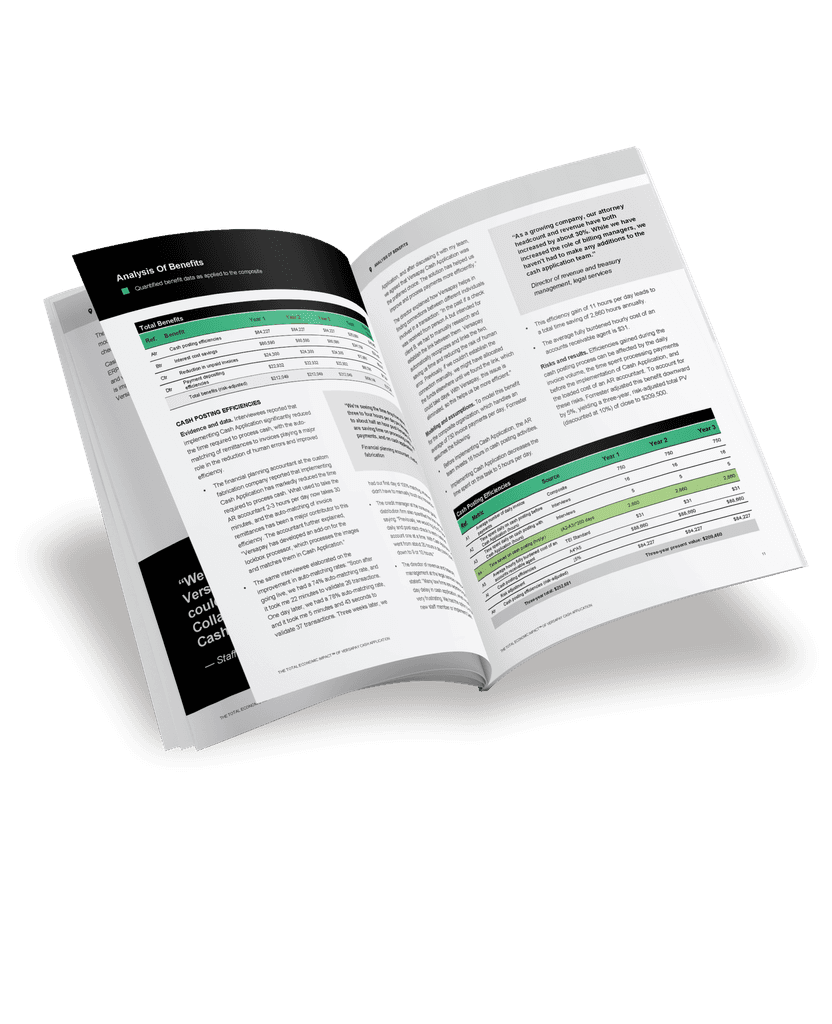

How Versapay customers achieved 138% ROI

When automating cash application, ROI is critical.

In this TEI™ commissioned study conducted by Forrester Consulting for Versapay (May 2024), you'll learn how a composite organization of customers achieved significant ROI.

That includes:

- 69% improvement in cash posting efficiency

- Net savings present value of $306k over 3 years

- Payback of investment in under 6 months

All cash application resources

Keep your books in top shape. Learn about the practices and technologies that help you ensure every payment matches an open receivable.

A Finance Leader's Guide to AI-Powered Cash Application

With advanced cash application automation technology, you can harness powerful, high-tech tools to make your cash application process smarter, faster, and stronger.

Determine the potential financial impact of Versapay Cash Application on your organization.