Virtual Card Processing: What Sellers Must Know About Accepting Virtual Credit Cards

- 13 min read

Thanks to tokenization, spend controls, and a slew of other benefits, more and more buyers are embracing virtual credit cards, and using them for supplier payments.

Here’s everything you should know about virtual cards: from what they are to how to accept them to the role automation plays in reducing costs and driving efficiencies.

Business buyers are rapidly moving away from dated and costly payment methods like paper checks, and embracing digital payment methods like virtual credit cards.

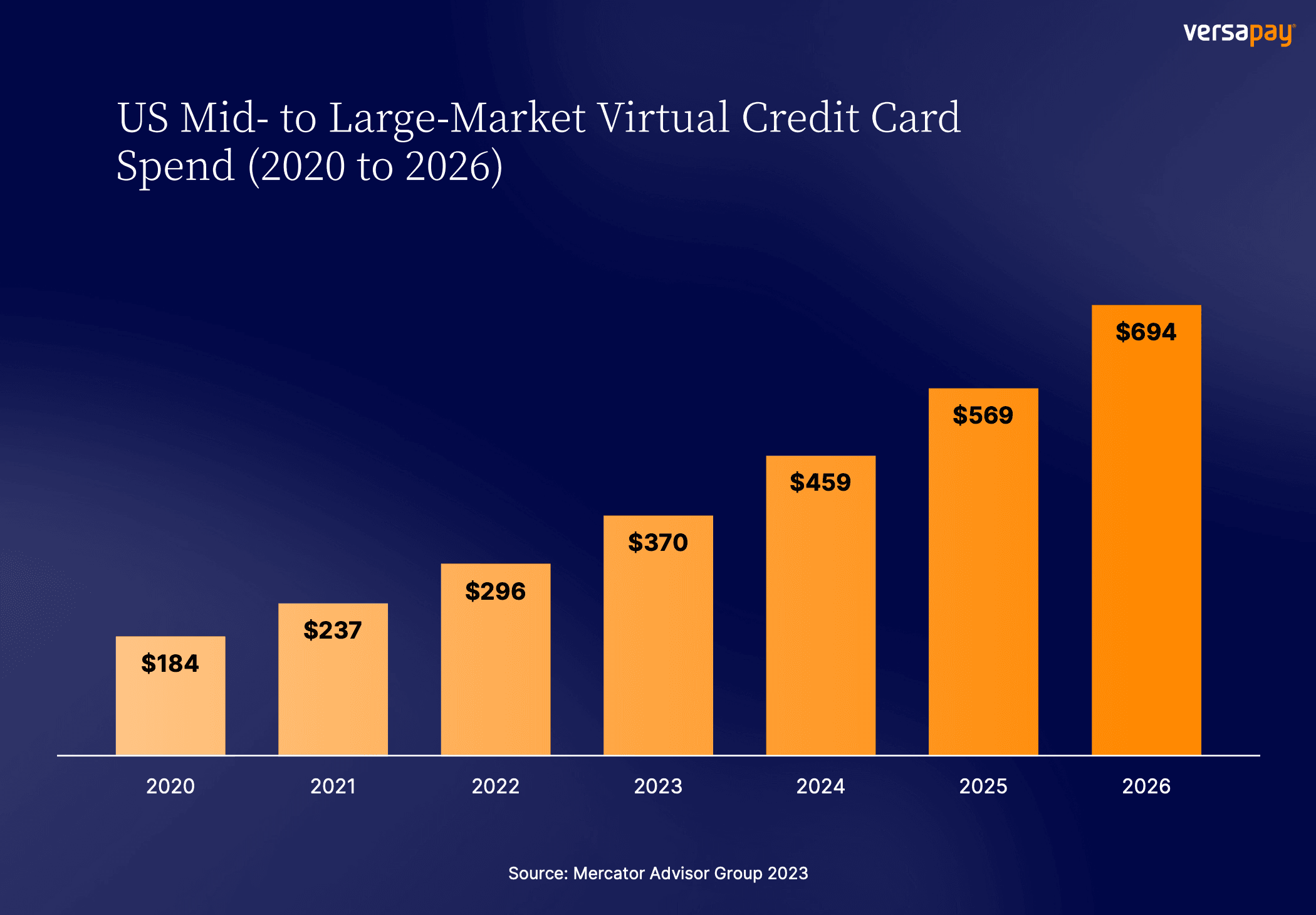

This trend is expected to continue. A few years ago, the global value of virtual card transactions reached $1.9 trillion. By 2026, this number is projected to reach $6.8 trillion, a near 260% increase. And when it comes to US mid- to large-market virtual card spend, that too is expected to grow. Here’s what it’ll look like mid-decade:

Now, the number of B2C transactions still far outnumber B2B transactions—by about 99:1—but when it comes to dollars and cents, B2B payments represent nearly three quarters of the actual payment volume passing through these transactions. Although projected to make up only 1% of virtual credit card transaction volume in 2026, B2B payments would make up 71% of the total transaction value. These numbers are staggering and indicate that virtual card usage within B2B is no longer a novelty.

But what is a virtual credit card and how does it differ from a physical credit card? What’s attracting buyers to this payment method like moths to a lamp? What value is there in accepting virtual credit card payments—and your buyers using them? How can an automated virtual credit card acceptance tool help to ease the process (and the costs)? These are all questions we intend to answer in this guide.

Table of contents:

Virtual credit card processing: 5 common questions answered

1. What is a virtual credit card?

A virtual credit card is a digital payment method intended for online and card-not present transactions. It’s an automatically generated 16-digit card number used in place of the physical credit card number it’s associated with.

Through a virtual credit card provider, a buyer can generate as many virtual card numbers as they want off the same physical card. A buyer will typically use a virtual credit card number only once—however, there are exceptions. They can also put controls on a virtual credit card number that limits its use based on a series of parameters, including:

The types of purchases it’s used for (based on merchant codes)

The time period it’s valid for

The dollar amount it can cover

There are two main types of virtual credit cards: single-use and lodge cards.

A single-use virtual credit card is, as the name suggests, a card whose number can only be used once. This helps buyers track and control their spending and acts as a layer of security preventing the card from being used for nefarious purposes.

A lodge card, conversely, can be used multiple times. While it’s possible to set controls on these cards such as expiration dates and credit limits, the fact that they can be used more than once increases their vulnerability to fraud.

2. What’s the difference between a virtual card and a regular credit card?

The obvious difference between a virtual credit card and a regular credit card is that you can physically hold and touch a regular credit card, whereas you can’t with a virtual card. By this same logic, you can physically lose a regular credit card or have it stolen. This risk isn’t a factor with virtual cards.

The actual experience of paying with a virtual credit card, however, is essentially the same as paying with a credit card online. Virtual cards can be accepted by any seller that accepts regular credit cards, and they’ll be handled like any other card-not-present transaction. Now, while they can be accepted, the vast majority of B2B sellers don’t currently accept virtual card payments. This is primarily because they lack the technology needed to enable virtual card acceptance and accommodate their customers’ preferences.

3. Why do people use virtual credit cards?

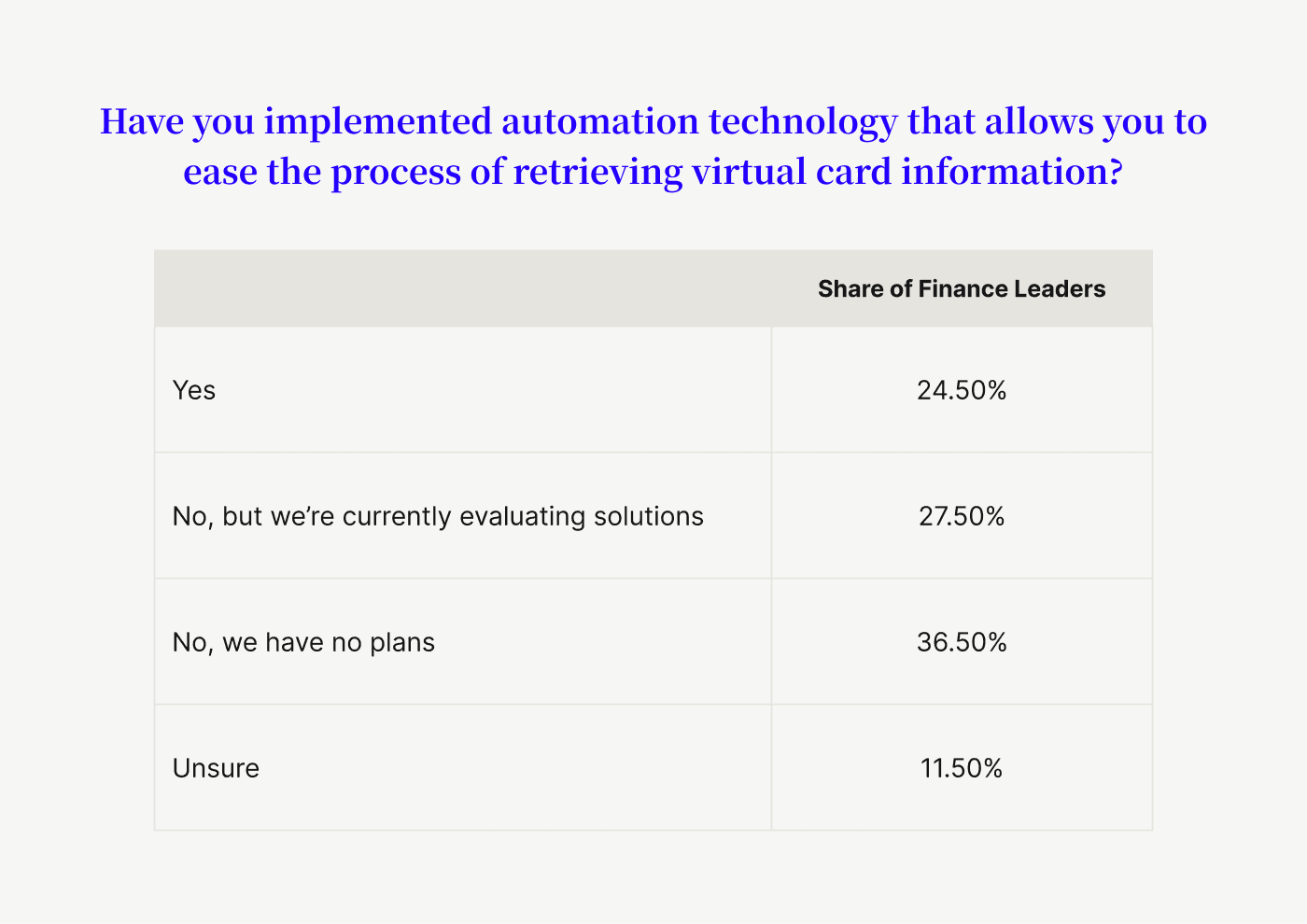

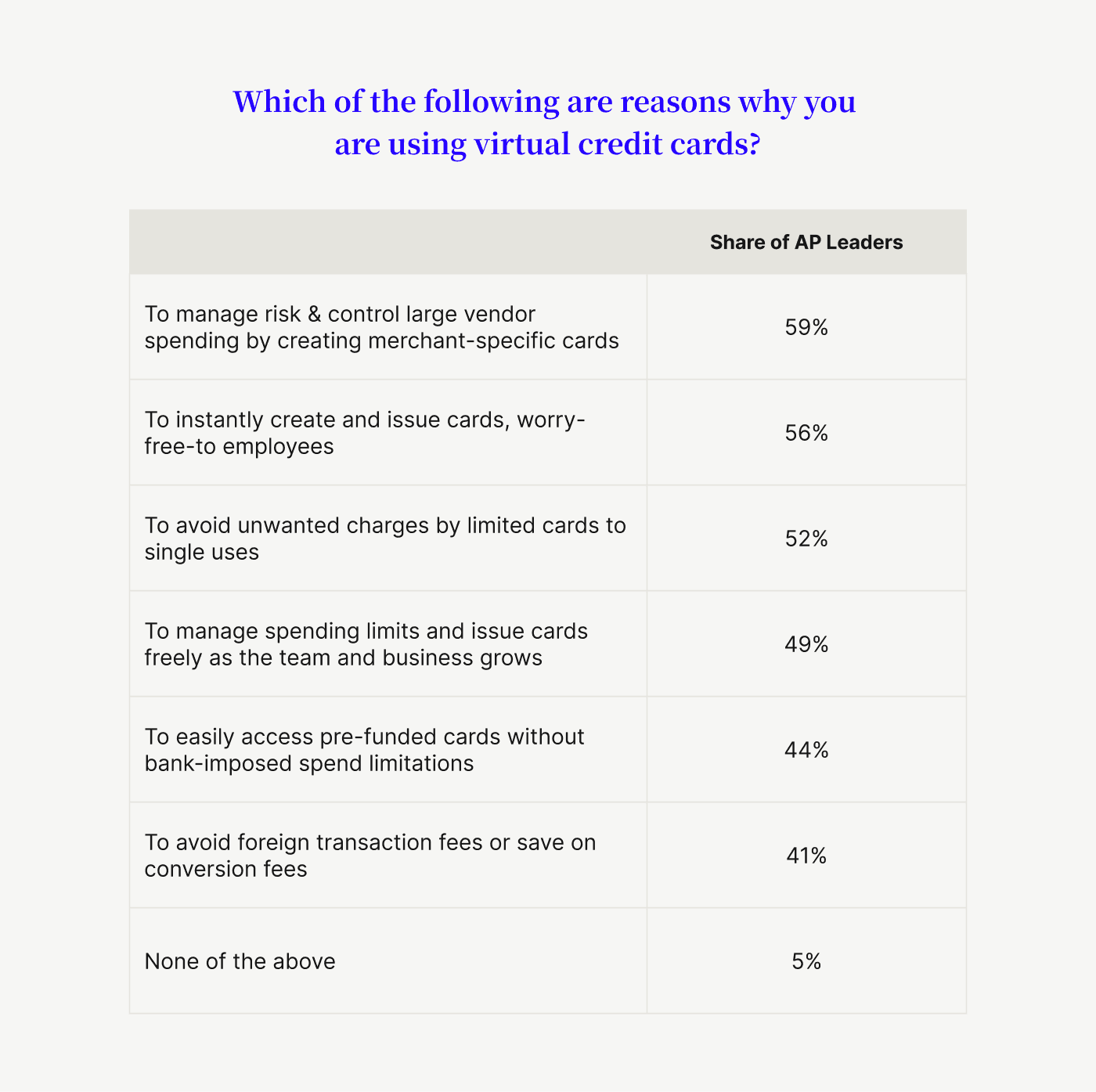

We recently surveyed 200 accounts payable leaders already using virtual credit cards to pay for invoices. We found that business buyers like paying with virtual cards because they help manage and control large vendor spending, mitigate unwanted charges, and help avoid conversion fees—among other reasons:

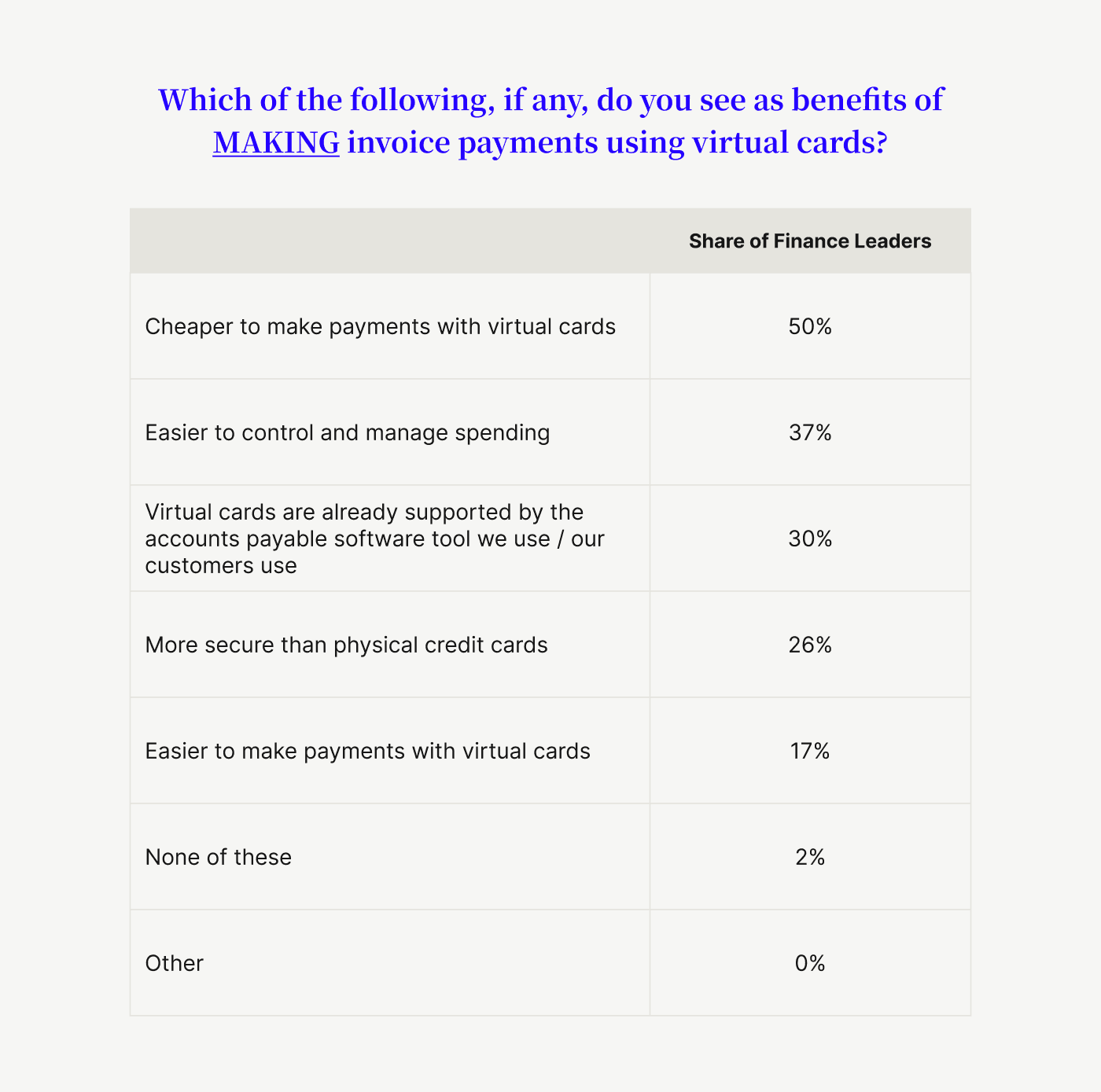

Inversely, we also asked 200 finance leaders faced with the prospect of accepting virtual credit what they believe are the benefits of paying with virtual cards. Here’s what respondents said:

4. How do virtual credit cards work?

Virtual card numbers are generated using tokenization. Tokenization is the process of turning sensitive data (like credit card information) into a unique identifier. Using cryptographic technology, this process helps ensure the original data the token is based on can’t be accessed.

Each virtual credit card number is a unique token. It can be used to make a purchase, but the original credit card number it’s linked to is completely concealed. Many accounts payable software vendors can integrate virtual card issuance into their platform. Virtual credit card solutions allow business buyers to easily generate card numbers intended to pay specific invoices.

5. Are virtual credit cards secure?

Because of tokenization and the potential to place strict controls for spending, virtual credit cards are among the most secure payment methods for B2B payments.

With credit card fraud being significantly higher for card-not-present transactions—happening 81% more frequently compared to point-of-sale transactions—these are added layers of security that no business can afford to overlook. And because buyers will typically generate a new number for each payment, this makes B2B virtual payments less vulnerable (but not immune) to fraud.

When asked what impact they anticipate the growing use of virtual credit cards will have on B2B transactions in the next 5 years, one surveyed CFO suggested that “virtual cards will make payments safer and hassle free.”

If a fraudster does manage to get access to a virtual credit card number, they wouldn’t get much value from it because the number would likely have expired or have controls in place to limit spending. If a buyer finds that their virtual card number was compromised, they can cancel it in just a few clicks. And because their physical credit card number is imperceptible from the virtual credit card number that was breached, this means the buyer doesn’t have to go through the hassle of canceling the actual card.

From suppliers’ perspective—the recipient of the virtual credit card payment—minimized risk of card fraud helps avoid the potential for chargebacks, which can be costly.

The pros and cons of virtual credit cards

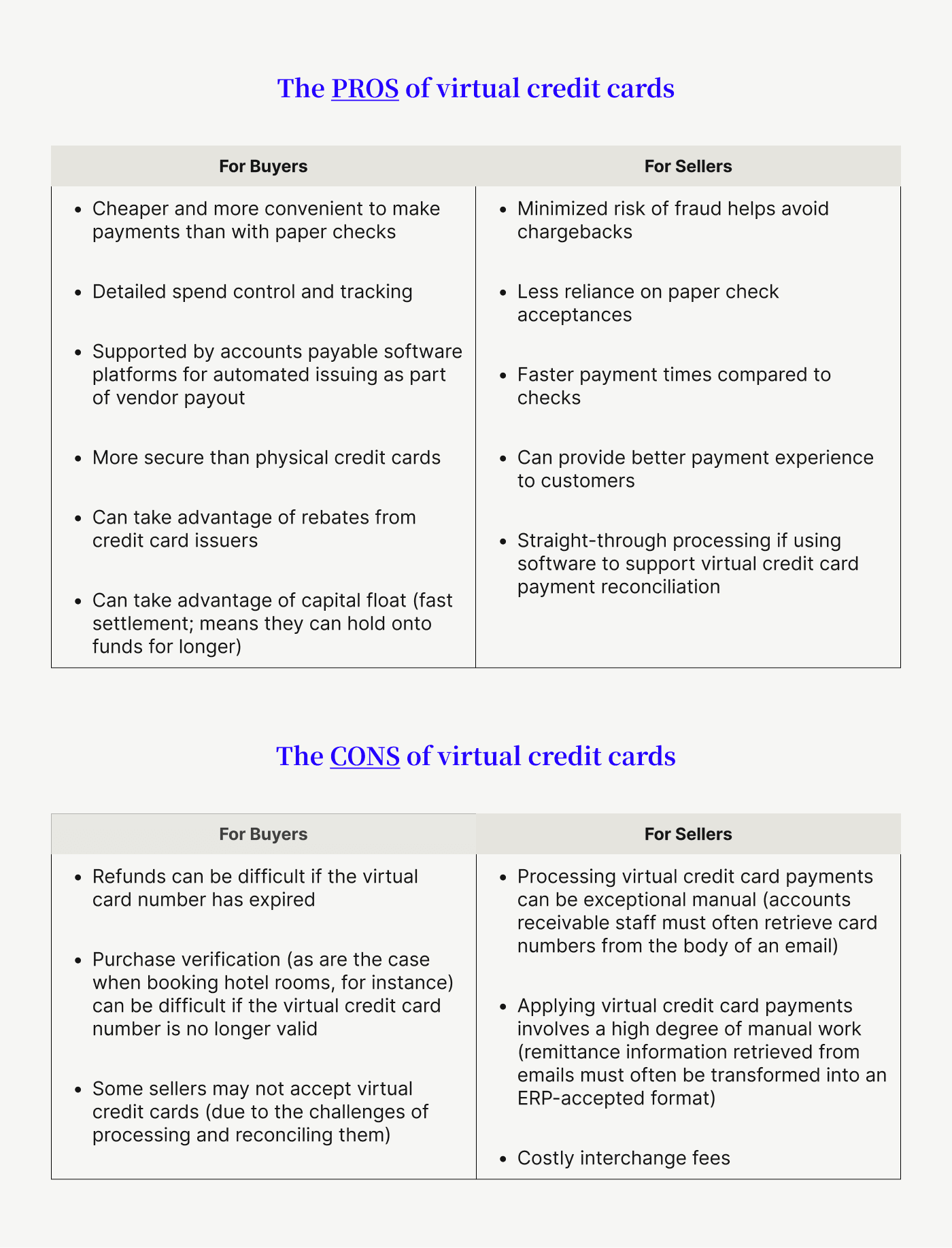

There are numerous advantages to virtual cards for supplier payments—and to accepting payments made with B2B virtual credit cards. There are also some disadvantages. You can read this blog for a full analysis of what those pros and cons are, why businesses shouldn’t shy away from virtual card payments, and how sellers can use virtual cards as leverage for gaining, keeping and satisfying customers.

Here’s a high-level summary:

The cost of accepting virtual card payments

Virtual credit cards cost buyers very little, as issuers charge minimally for their services and the actual creation of cards costs the buyer nothing. For sellers, however, virtual card processing can be expensive.

For many businesses the main barrier to accepting credit card payments is the high cost of interchange fees. Interchange fees make up around 80% of the credit card processing fees merchants pay. The average credit card has an interchange rate of about 1.81% (compare this with the average interchange rate for a debit card, which is 0.3%).

The level of interchange you pay will depend on the conditions of that particular transaction (i.e., the card type and the way it was processed). The “riskier” the transaction, the higher the virtual credit card acceptance fees. Card-not-present transactions (payments made where the cardholder is not physically present, such as online sales) have higher interchange fees because they’re deemed to be higher risk. Virtual credit cards are predominantly used for card-not-present transactions, meaning merchants will pay higher than average interchange fees to accept them.

There are also soft costs to consider with virtual credit card acceptance, including the labor required by accounts receivable teams to process these payments and apply them to invoices.

Typically, when a buyer pays with a virtual credit card, the supplier’s receivables team will receive the card number in the body of an email, which they’ll have to key into their processing system themselves. They’ll also receive the remittance advice in an email—sometimes separately—and typing that information into their enterprise resource planning (ERP) system is equally manual.

How to reduce the cost and labor of virtual credit card acceptance

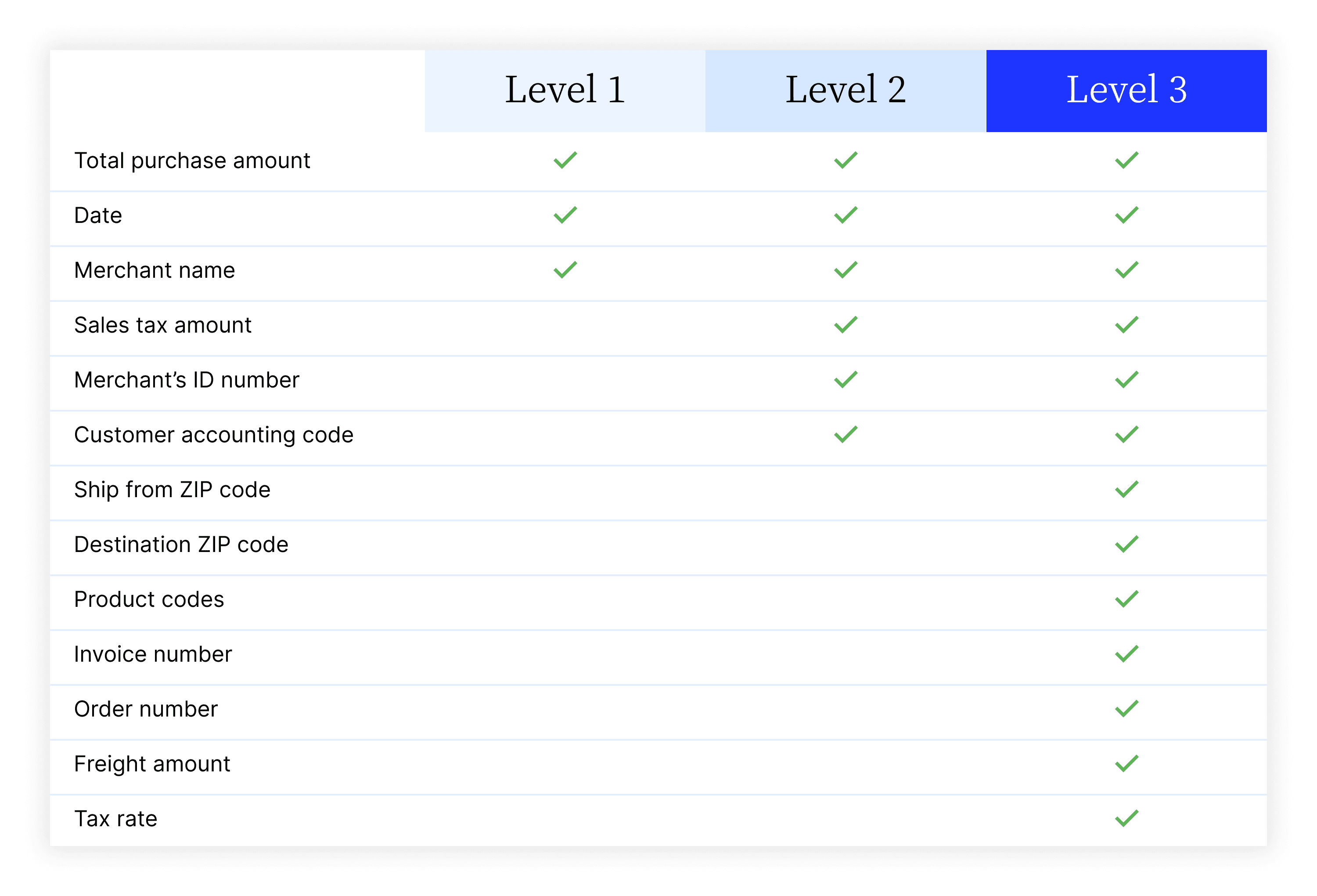

There are steps you can take to reduce the cost of virtual card processing—both the high levels of interchange and staff effort involved. Interchange optimization is one method, which involves fine-tuning the conditions of a transaction to qualify for the lowest interchange rates possible. Lower rates are achieved by sending along more data about the transaction when it’s processed.

The issuing bank—who collects the interchange fees—wants as much assurance as possible that the risk of extending credit is low. The more data you can provide about a transaction, the more secure the bank will feel. The most basic amount of data you can pass along with a transaction is known as Level 1 processing. By passing along more data with the transaction, you can qualify for Level 2 and Level 3 processing, which helps reduce your rates.

When you process payments through Versapay, we automatically send Level 2 and Level 3 data along with every transaction. That’s because we integrate closely with your ERP and can seamlessly pull the information that’s going to help you qualify for lower interchange rates—like invoice numbers, number of items purchased, and customer codes.

How to accept virtual credit card payments with automation

Successful virtual card retrieval and reconciliation hinges on the right automated virtual credit card acceptance tool. That’s because without the right automation technology to assist, accepting, processing, and reconciling virtual card payments is a manual process that comes with a slew of drawbacks.

Transcribing and keying data into ERPs is slow and tedious, and addressing problems with data requires exhaustive detective work and time-consuming customer correspondence. Payment matching errors are common, often leading to disputes causing slowdowns in revenue collection and dissatisfaction among customers. Virtual card processing at scale is difficult and costly, and growing companies tend to find their receivables teams’ capacities stretched to the limit, the pace of collections slowed, and ROI plummeting.

Virtual card acceptance software will help you say goodbye to time-intensive processes like manually extracting payment data from emails, entering it into your merchant processing system, and reconciling it with open receivables. Here’s how:

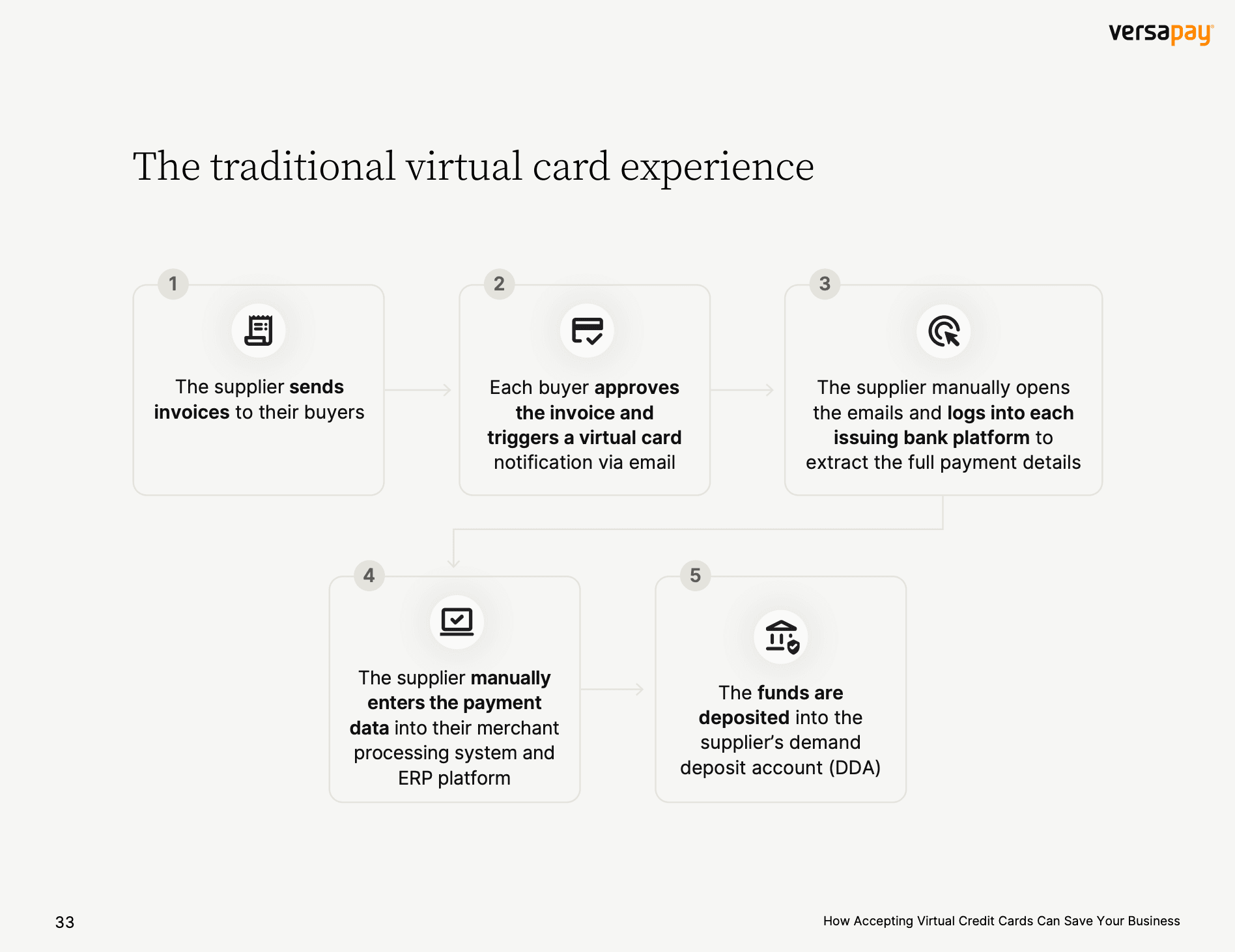

The traditional virtual card experience

Buyers expect a convenient payment experience. However, when sellers typically accept virtual credit cards, the experience is anything but smooth—for both them and their customers. The traditional process is rife with challenges from invoice delivery through payment and card detail extraction to data entry and beyond. It tends to look a little something like this:

Since reconciling virtual card payments with open invoices is often a manual process that takes a large amount of time—especially at scale—many B2B don’t even bother attempting it. They feel the challenges of doing so are simply too big to overcome, even if the opportunity is massive and growing.

With virtual credit card payments, remittance information tends to arrive in an array of formats, often in the body of emails. And accounts receivable staff then must manually input that information into their enterprise resource planning system—a tedious, time-consuming, and error-prone process.

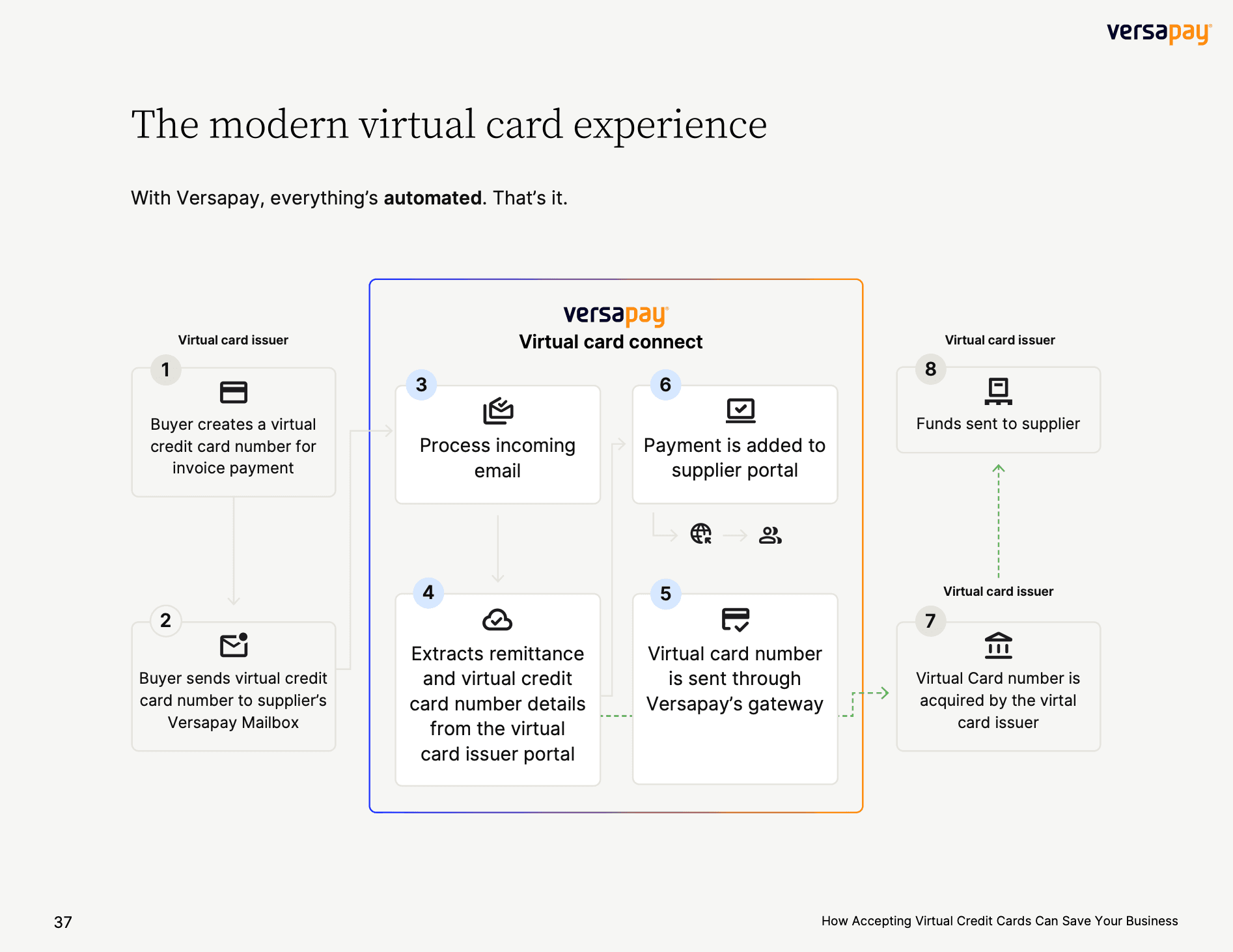

The modern virtual card experience

But automated virtual card acceptance tools change everything. The right processing software speeds up and automates payments, reduces manual processes, accelerates cash flow, and drives more revenue.

Versapay’s virtual credit card acceptance software in particular gives you just what’s needed to drive efficiencies and deliver better payment experiences. Here’s what that looks like:

From parsing and extracting remittance and card number details, to straight-through processing and automated reconciliation, to ERP integrations, Versapay’s Virtual Card Connect is the automation solution for your modern payment needs. By accepting virtual credit card payments using automation, you’ll:

Eliminate manual workflows — Say goodbye to time-intensive processes like manually extracting virtual card data and remittance details from emails, and reconciling with open accounts receivable

Faster processing — Get touch-free, straight-through virtual card processing at rates optimized for B2B transactions

Secure virtual credit card payment processing — Securely collect and store sensitive payment information to remain PCI compliant

Automate reconciliation and reporting — Streamline ERP reconciliation with access to detailed virtual card reporting data, and fully automate reconciliation with our ERP-integrated solutions

—

Simplify the process of accepting and reconciling virtual credit card payments with an automated virtual credit card acceptance provider like Versapay. To get started or learn more about our virtual credit card acceptance and processing software, reach out to our expert Sales team.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.