How AR Automation Prepares Finance Teams to Accept Virtual Credit Card Payments

- 10 min read

Learn what's causing a rise in virtual credit card usage, and how accounts receivable automation helps finance teams successfully prepare for virtual credit card acceptance.

Virtual credit card transactions are on a meteoric rise. Their number is expected to jump 388% globally by 2024, from 36 billion in 2023 to 175 billion in 2028. While traditional credit cards still dominate—racking up 678 billion payments in 2022—soon enough virtual cards will no longer need binoculars to see them out ahead.

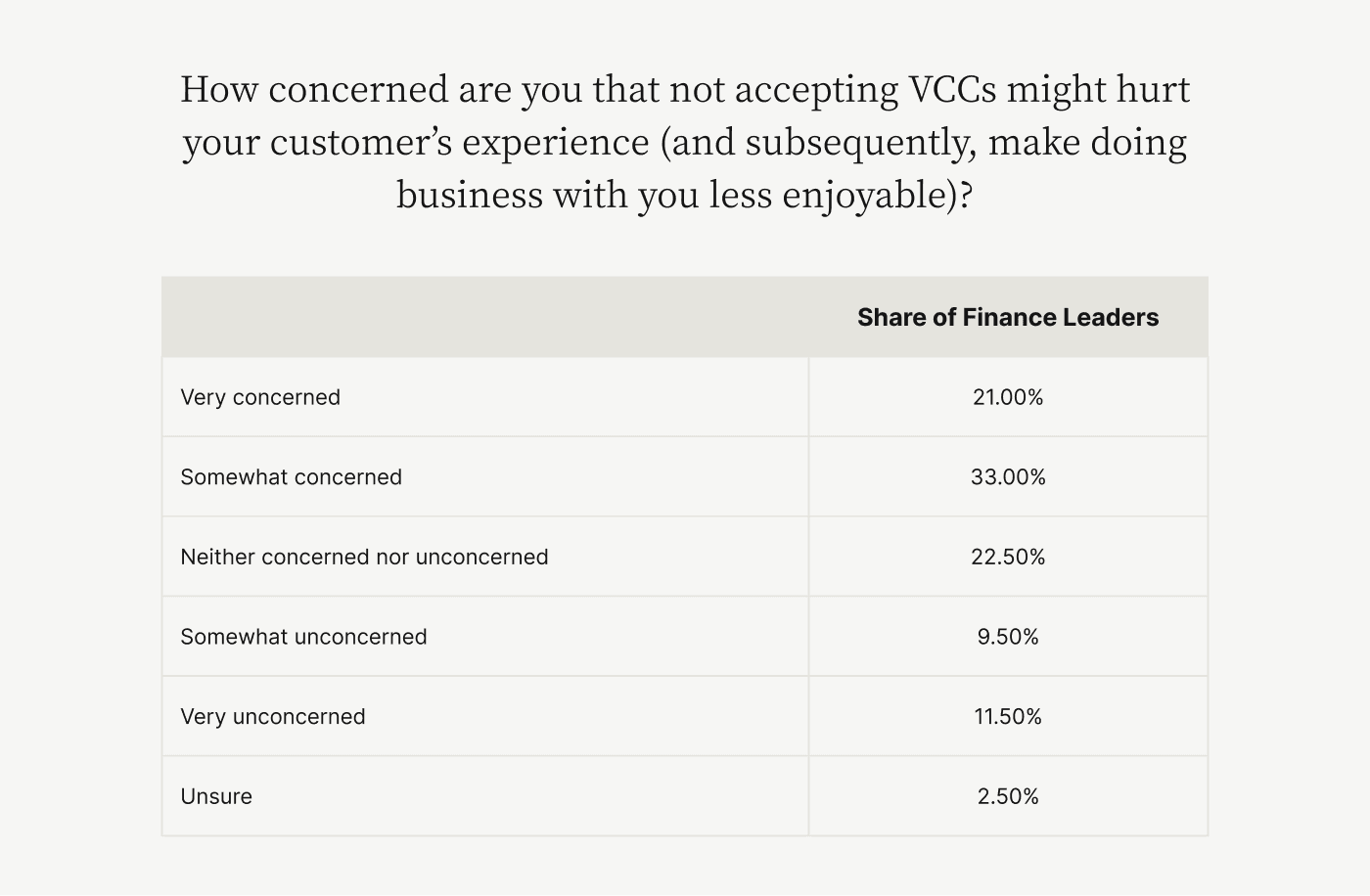

A virtual credit card (VCC) is an automatically generated 16-digit number that takes the place of a permanent credit card number for online and card-not-present transactions. While not as common or widely accepted (yet), buyers love the security and the ease of VCCs, a fact that is not lost on accounts receivable (AR) teams. A Versapay survey of 200 finance leaders found that 98% of them recognize that buyers are eager to make invoice payments this way.

With buyers increasingly enthusiastic about VCCs, sellers have growing motivation to accept these payments. Yet most companies aren’t technologically well-equipped to do so, leaving their AR teams to manually process these transactions.

Adopting AR automation is the key way for sellers to enable seamless, rapid, and accurate VCC acceptance. It’s a critical cog for preparing your finance teams for the inevitability of virtual credit card payments.

What’s in this article:

Businesses have yet to embrace virtual credit card acceptance

Companies facing technological change and ongoing inflation want a way to secure payments quickly and efficiently, a key benefit of accepting digital payment methods.

There are many other benefits of accepting VCCs, such as providing better customer experience that leads to ongoing loyalty, minimizing risk of fraud, and (if done with the right technology) reducing manual workload and improving job satisfaction among AR workers.

Despite the benefits of accepting virtual credit cards and buyers’ enthusiasm for them, many suppliers haven’t yet embraced this form of payment. Often that is because they lack the necessary automation tools to assist in their acceptance. In fact, nearly all the obstacles finance leaders face to accepting virtual cards (like downloading and transforming remittance data, applying payments to the correct invoices, and retrieving full virtual card numbers) could be remedied with AR automation software

AR automation is necessary for businesses to accept VCCs efficiently and sustainably. Yet uptake of this kind of software is puzzlingly slow. More than 70% of respondents to a Versapay survey said they have not yet implemented automation technology to assist in accepting and processing virtual card payments.

And almost 40% didn’t even have the project on their radars, perhaps due to insufficient understanding of virtual credit cards’’ benefits, lack of technological sophistication, or simple overwhelm in the face of change.

With such low levels of preparation to accept virtual card payments efficiently, it’s no surprise that 99% of respondents to the survey reported challenges accepting these payments.

5 reasons businesses need AR automation to enable virtual credit card acceptance

Without the right automation technology to assist, receiving and reconciling these payments is a manual process that comes with a slew of drawbacks.

Manually accepting VCCs:

1. Is slow and tedious

In a manual process, VCC remittance information typically arrives in the body of an email. AR staff must manually transcribe this info into the company’s ERP, which involves searching by hand for the correct invoice to which the payment applies. Additionally, AR staff must address any problems with the information, such as card numbers lacking digits, through time-consuming correspondence with the customer.

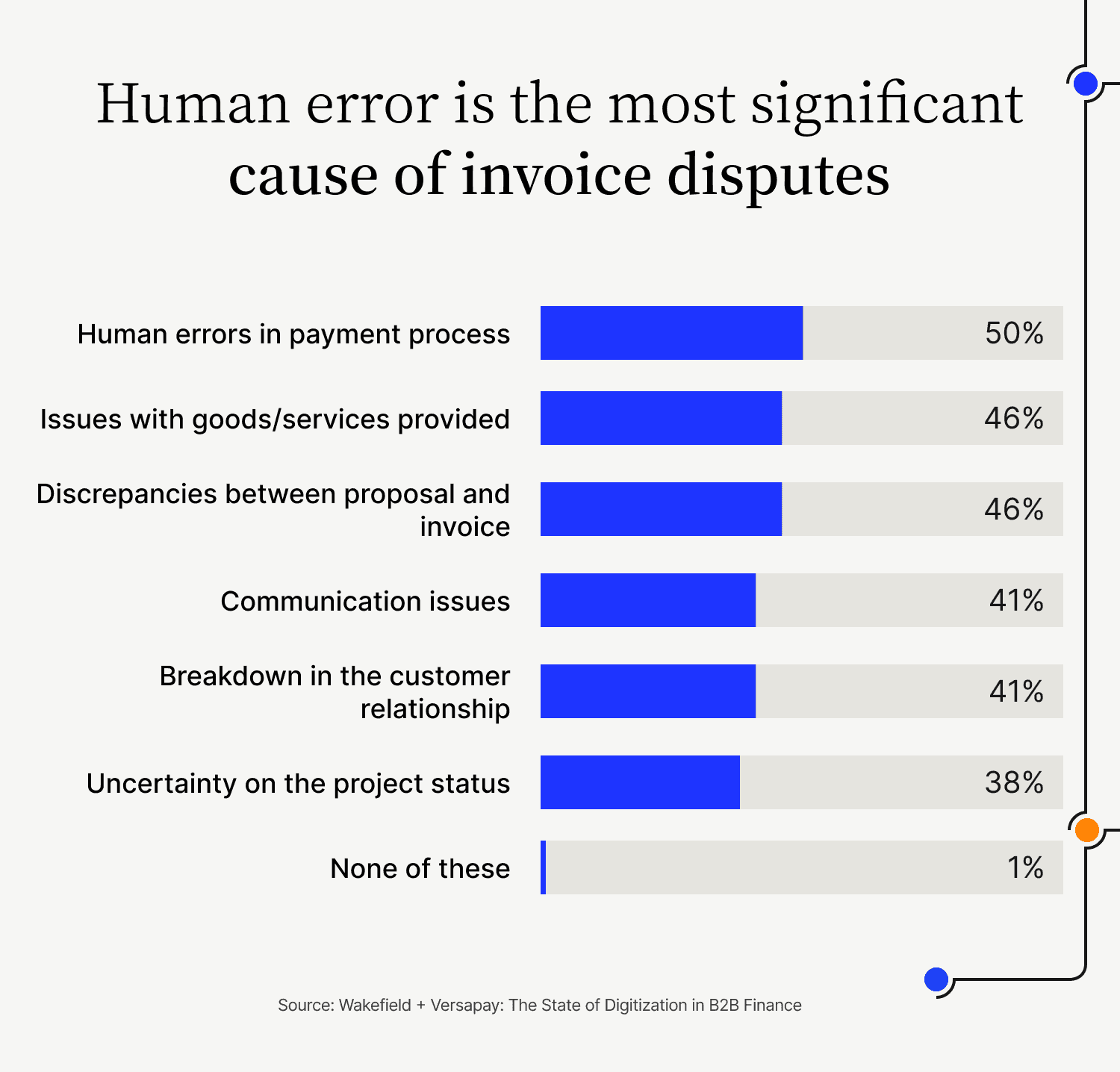

2. Is prone to errors

Manually entering payment data into the ERP tends to introduce transcription errors and mistakes such as accidentally matching the wrong payment to an invoice. As the volume of manual work grows, AR teams’ mistakes multiply.

Errors in data input and payment matching result in disputes (and lots of them), which cause slowdowns in revenue collection and dissatisfaction among customers.

3. Has low ROI at scale

The need for AR teams to manually retrieve virtual credit card numbers and remittance information from emails and to key this info into the ERP makes it difficult and costly for them to process a lot of payments.

The AR teams at half of companies with revenues of $250 million or more process at least 2,500 invoices every month, according to our research. At this rate, growing companies will soon find their AR teams’ capacity stretched to the limit, the pace of collections slowing, and ROI plummeting due to time spent manually processing low-dollar-value transactions.

4. Requires repetitive tasks

AR teams find the process of manually processing credit card payments tedious. And unless the automation tool they’re using achieves high straight-through processing rates, they must look up open invoices in the ERP to apply every payment, even when multiple payments come from the same buyer.

Virtual card numbers may change with every transaction done by a single purchaser (as they’re often generated for unique or individual purchases). This makes matching payments to an account even trickier with VCCs. AR teams quickly tire of this repetitive work, and morale can take a deadly hit if they don’t find relief.

5. Results in high fees

Virtual credit cards carry high interchange fees, as card-not-present transactions are seen as riskier than regular credit card transactions. As a result, manually processing VCC payments does not allow companies to provide Level 2 and Level 3 processing data to issuing banks, which is a way of bringing these fees down.

Without access to that comprehensive data through a payment processor relationship, sellers continue paying high fees that cut into the bottom line.

4 ways AR automation makes virtual credit card acceptance possible and beneficial

Accepting VCCs is made vastly faster, easier, and more accurate—and at scale, even simply possible—with the adoption of AR automation software. An automated receivables process also has other benefits for handling VCCs, such as greater security and lower costs.

Here are 4 ways that AR automation software transforms finance teams’ payment acceptance process in favor of virtual credit cards.

1. Eliminating manual data retrieval

AR automation tools collate all payment and processing activities in a centralized portal that both buyers and sellers can access, making payment data automatically available. Payments are automatically applied to invoices, too, so AR teams no longer need to manually pull card numbers from emails or other sources.

This automation vastly speeds up the process, reduces errors, and makes AR professionals happier. It makes buyers happy, too, as having this process automated equates to them not having to address sellers’ questions or raise as many disputes due to manual errors.

2. Reducing cost of VCC acceptance

VCCs typically carry relatively high transaction costs that suppliers must pay. Luckily, interchange optimization can limit these costs. AR automation software enables this by providing abundant data about each transaction to the issuing bank, which reduces the perceived risk of the transaction and allows for reduced fees.

AR automation software that acts as a payment processor can provide the granular data that can help bring down these costs.

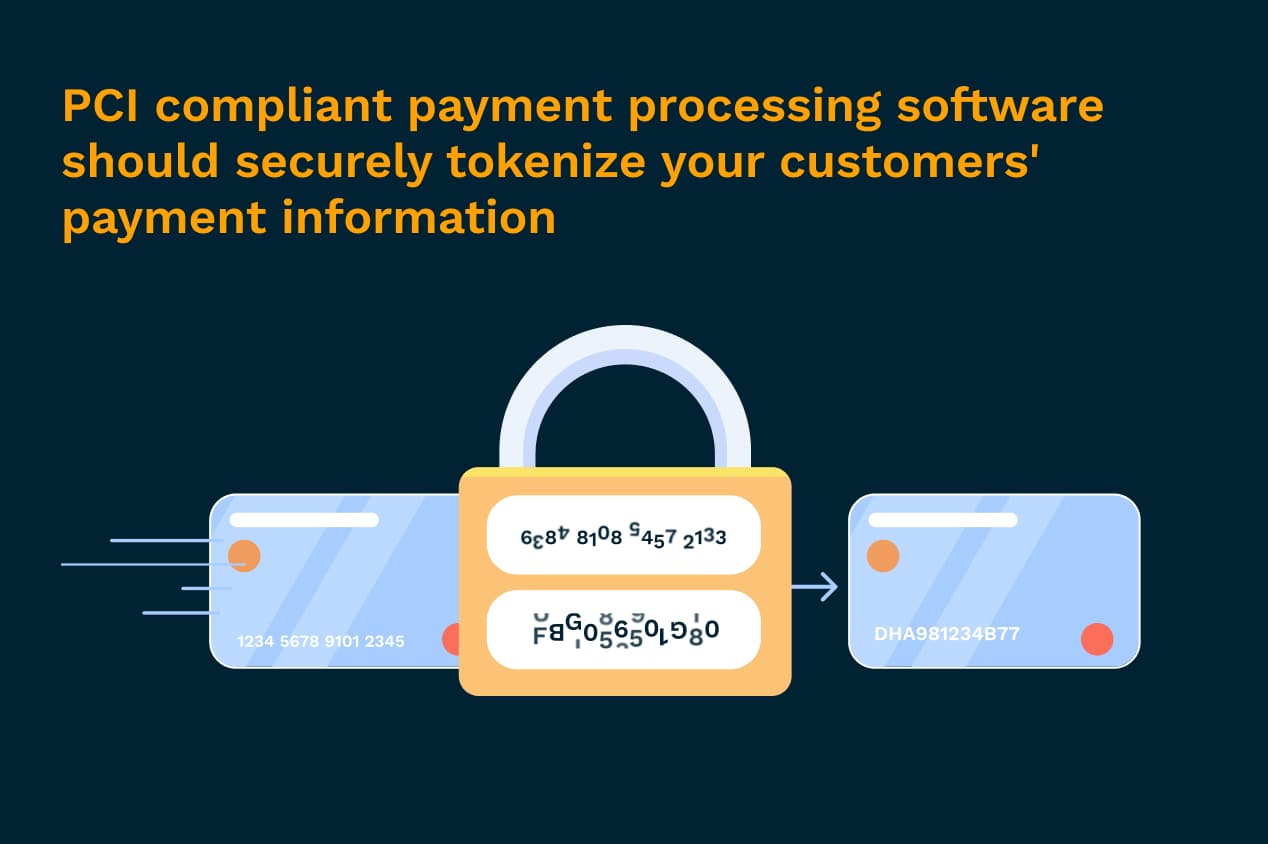

3. Increasing PCI-compliance

Without AR automation, sellers must store credit card credentials for their buyers, which introduces PCI and security concerns. AR automation tools that integrate with ERPs have the capacity to encrypt and tokenize all payments, including VCC payments, eliminating the need to store card data. Companies face fewer security and compliance issues with this system in place.

4. Enabling in-depth reporting

AR automation solutions give finance teams access to real-time data that they can use to generate helpful insights and flexible reporting to guide company decision-making. This information also allows finance leaders to better forecast and manage cash flow, which is all the more crucial when accepting digital payment methods (like virtual credit cards) at scale.

The time is now for virtual credit card acceptance

Virtual credit cards are the future of digital transactions. Companies that process any serious volume of invoices and payments need to think seriously about becoming equipped to accept virtual credit cards.

VCC acceptance becomes possible with AR automation, which allows businesses to simplify and streamline virtual card payment processing and reconciliation. Sellers who resist automating this process risk being left behind by a modernizing marketplace.

Download our study on the state of virtual credit card adoption among finance leaders to learn more about how these transactions work and better understand how you can benefit from becoming equipped to accept them.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.