The Benefits of Virtual Credit Cards for B2B Buyers and Sellers

- 11 min read

Transacting with virtual credit cards comes with many benefits for B2B buyers and sellers.

In this blog, you'll learn what those benefits are, why businesses shouldn't shy away from virtual credit card payments—despite currently doing so—and how you can use virtual cards to gain, keep, and satisfy customers.

Around the world, digital payments have been accelerating in recent years, especially during the pandemic. Two-thirds of adults worldwide now make or receive digital payments, with 40% of those having done so for the first time since Covid-19 appeared, according to the Global Findex 2021 database.

This increase in digital transacting is opening buyers and sellers to new ways of doing business, too, as businesses are using a variety of digital payment methods far more often.

One promising option is virtual credit cards—a randomly generated card number that masks the buyer’s real credit card number. A new study by Juniper Research finds that virtual card usage is growing rapidly, with estimates that the global value of these transactions will hit $6.8 trillion in 2026, a 3.5-fold increase from the $1.9 trillion in transactions recorded in 2021.

Transacting with virtual cards comes with a number of benefits for merchants, but they are still not as widely used as they could be in the business-to-business (B2B) space. This is due largely to challenges in reconciling virtual credit card payments with open invoices, a bookkeeping obstacle that causes many suppliers to discount the possibility of accepting them.

We conducted a survey with Gartner to learn more about why businesses shy away from virtual card payments and the benefits they see in using them.

The 200 respondents are technology and finance leaders with titles of manager and above, with 89% at the VP and C-suite level (70% C-suite, 19% VP, 10% director-level, and 1% manager-level).

Continue reading to learn what they have to say about the benefits—and challenges—of using virtual credit cards.

Jump to a section:

The state of virtual credit cards in B2B

A virtual credit card payment is made with an automatically generated 16-digit number that masks the real card number it’s connected to, affording an extra layer of security, greater control, and other benefits for online transactions.

Virtual cards are often single use, but they can also be used multiple times (usually for a limited number of purchases).

While B2B virtual credit card transactions are less frequent than in B2C—expected to account for less than 1% of transaction volume in 2026, according to the Jupiter Research study—the value of the average B2B transaction is much higher than in B2C.

For this reason, B2B transactions make up the majority of virtual credit card transaction volume despite representing a small portion of overall transactions. In fact, B2B payments will likely account for 71% of the total value of digital card transactions by 2026.

Why are suppliers hesitant to accept virtual credit cards?

Many B2B sellers are hesitant to accept virtual credit cards because reconciling these payments with open invoices is often a manual process that takes a large amount of time, especially if they're doing this at scale.

This is because remittance information arrives in an array of formats, often in the body of an email. The accounts receivable staff has to manually enter this information into the company’s enterprise resource planning (ERP) software, a tedious, time-consuming, and error-prone process.

Considering the high level of effort it takes to reconcile virtual card payments, low-dollar-value transactions can mean that the ROI diminishes quickly for the supplier, leading to a resistance to expanding acceptance of virtual card payments.

Our survey responses reflect this hesitancy to engage with virtual cards. Notably, 64% of respondents say it’s difficult to accept virtual cards because of the work it takes to download and transform remittance data into ERP-accepted formats.

Other problems respondents cite are difficulties in opening emailed card payments, retrieving full virtual card numbers, and uploading remittance data and applying payments to the correct invoice(s).

Suppliers don't even have the tools necessary to make managing accepting digital payments easier. More than 70% of respondents said they have not yet implemented automation technology to assist in accepting and processing virtual card payments, and almost 40% said they have no plans to.

It’s no surprise, then, that 34% of respondents have refused a payment from a customer using virtual cards at least once, and 38% have lost revenue at least once due to not accepting virtual cards or having limits on virtual card payments.

💡 In short: B2B suppliers are hesitant to accept virtual payments because of the time-consuming, manual process of reconciling invoices with payments, which makes accepting this payment type worthwhile only for larger transactions.

The benefits of virtual credit cards for B2B buyers

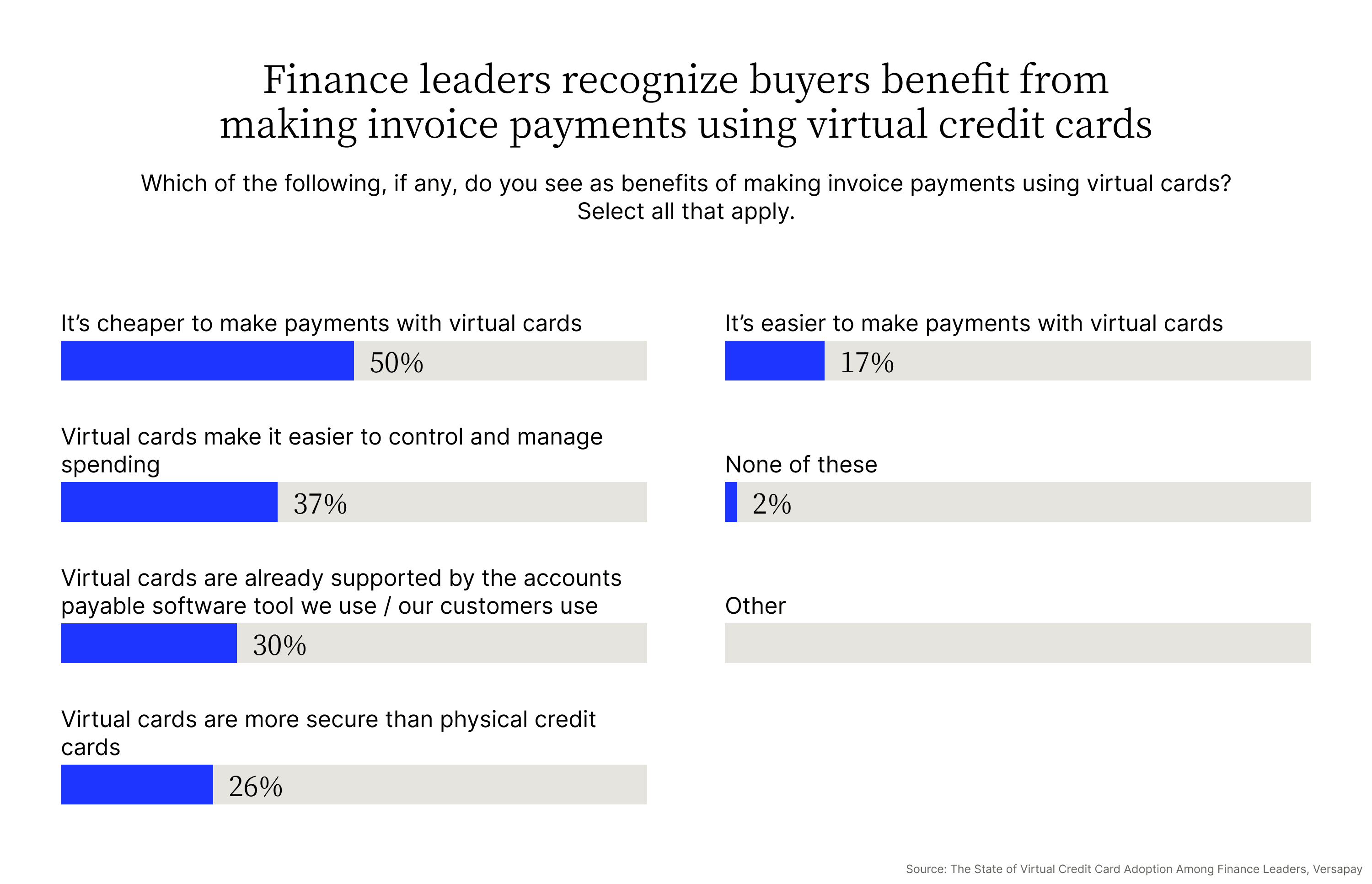

Despite the numerous challenges suppliers currently face accepting virtual credit cards, buyers are clamoring to use them due to the many benefits this payment method offers. Survey respondents identified the following benefits of paying for invoices using virtual credit cards:

- Greater control of spending

- Integration with existing software

- Increased security

- Ease of use and affordability

1. Greater control of spending

Greater control of spending is the top benefit survey respondents cited, with 37% of all participants choosing it as a helpful aspect of this transaction method. Virtual credit cards allow buyers to set specific parameters for each transaction, such as payment limit, date range, and merchant type, which gives buyers greater control over how their staff can use company funds.

💡 In short: Having a better handle on spend and expense management gives finance leaders the ability to better budget for immediate needs and long-term priorities.

2. Integration with existing software

Respondents whose virtual credit card processing is supported by their accounts payable software tools see far more benefit from using virtual credit cards, as such integrations reduce the need for manual reconciliation of invoices and payment.

These buyers can see higher ROI on making use of them. For the 30% of our survey respondents who said that their accounts payable tools can support virtual card transactions, increasing use of this payment option is easy and hassle-free.

3. Increased security

Virtual credit cards offer enhanced security over physical credit cards, as they can be set up to prevent unauthorized usages, such as by specifying the appropriate dollar amount and blocking certain merchant categories.

Virtual credit cards are also often only used one time, after which the number is worthless and not appealing to thieves.

Even so, any card number that is compromised can be canceled immediately without going through a third-party issuer. Using virtual credit cards means merchants need not be responsible for safely storing customers’ banking data. More than a quarter (26%) of survey respondents cited this method’s security as a benefit they appreciate.

4. Ease of use and affordability

Virtual credit cards are a more convenient payment method than checks and provide ease-of-use advantages over physical credit card transactions. Payment with a virtual credit card can be instantaneous with a click; an AP clerk does not have to send a check in the mail.

If there are any security issues with a virtual credit card, the buyer can easily cancel it without the need to consult with any third parties.

Paying invoices with virtual credit cards is also cheaper than using checks. Virtual credit card issuers charge little for services and the actual creation of the card number costs the buyer nothing, while a check costs between $4 and $20 on average to issue.

💡 In short: B2B buyers cite greater control of spending, integration with existing software, increased security, and ease of use and affordability—in that order of priority—as the greatest benefits of paying invoices using virtual credit cards.

The benefits of virtual credit cards for B2B sellers

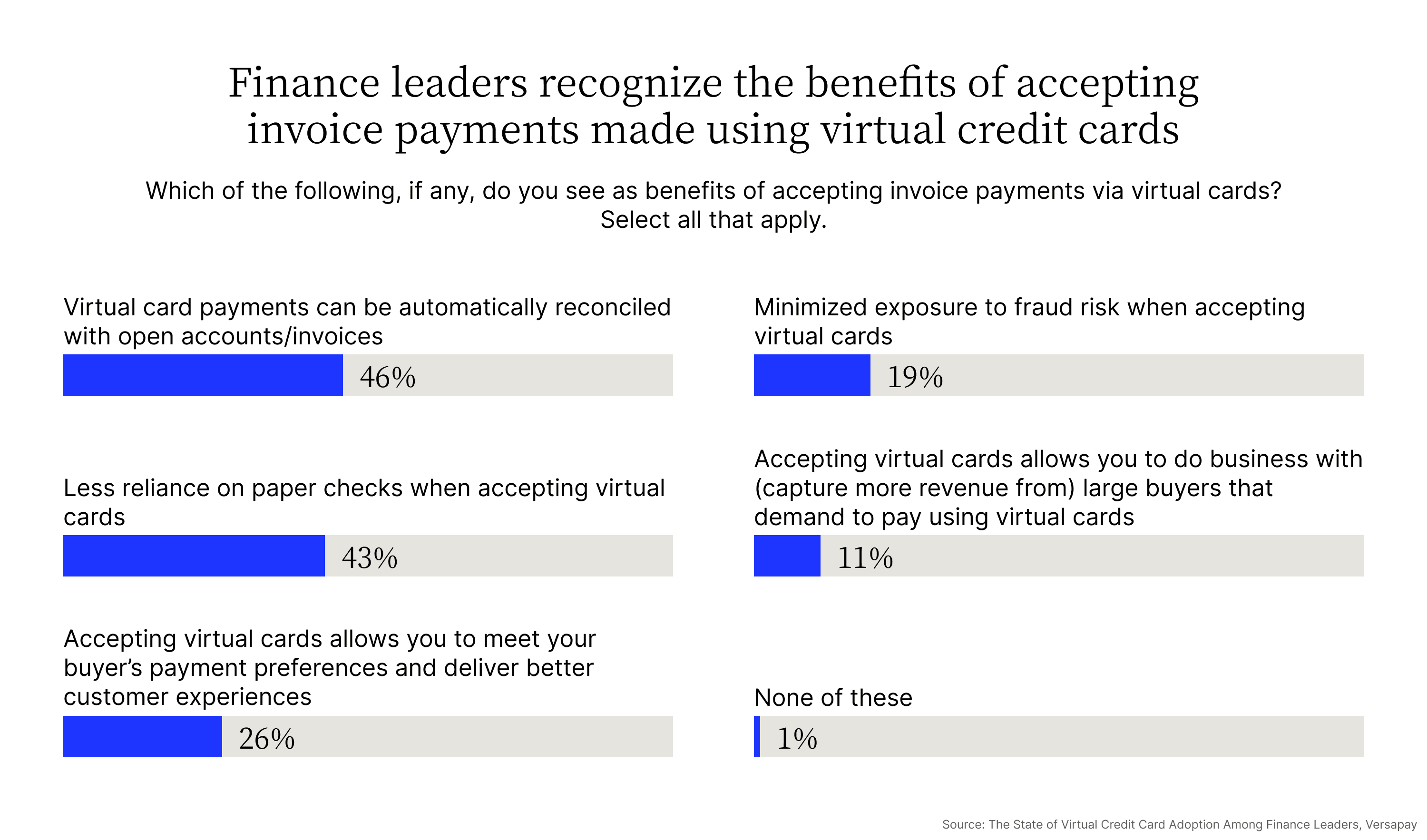

Despite the clear challenges associated with accepting virtual credit cards, there are a number of benefits that suppliers stand to enjoy. Survey respondents identified the following benefits of accepting invoice payments with virtual credit cards:

- Better customer experiences

- Minimized fraud risk

- Customer retention, especially large buyers

- Reduced manual workload

1. Better customer experiences

More than a quarter (26%) of respondents identified the ability to better meet buyers’ preferences and deliver better customer experiences as a top benefit of using virtual credit cards.

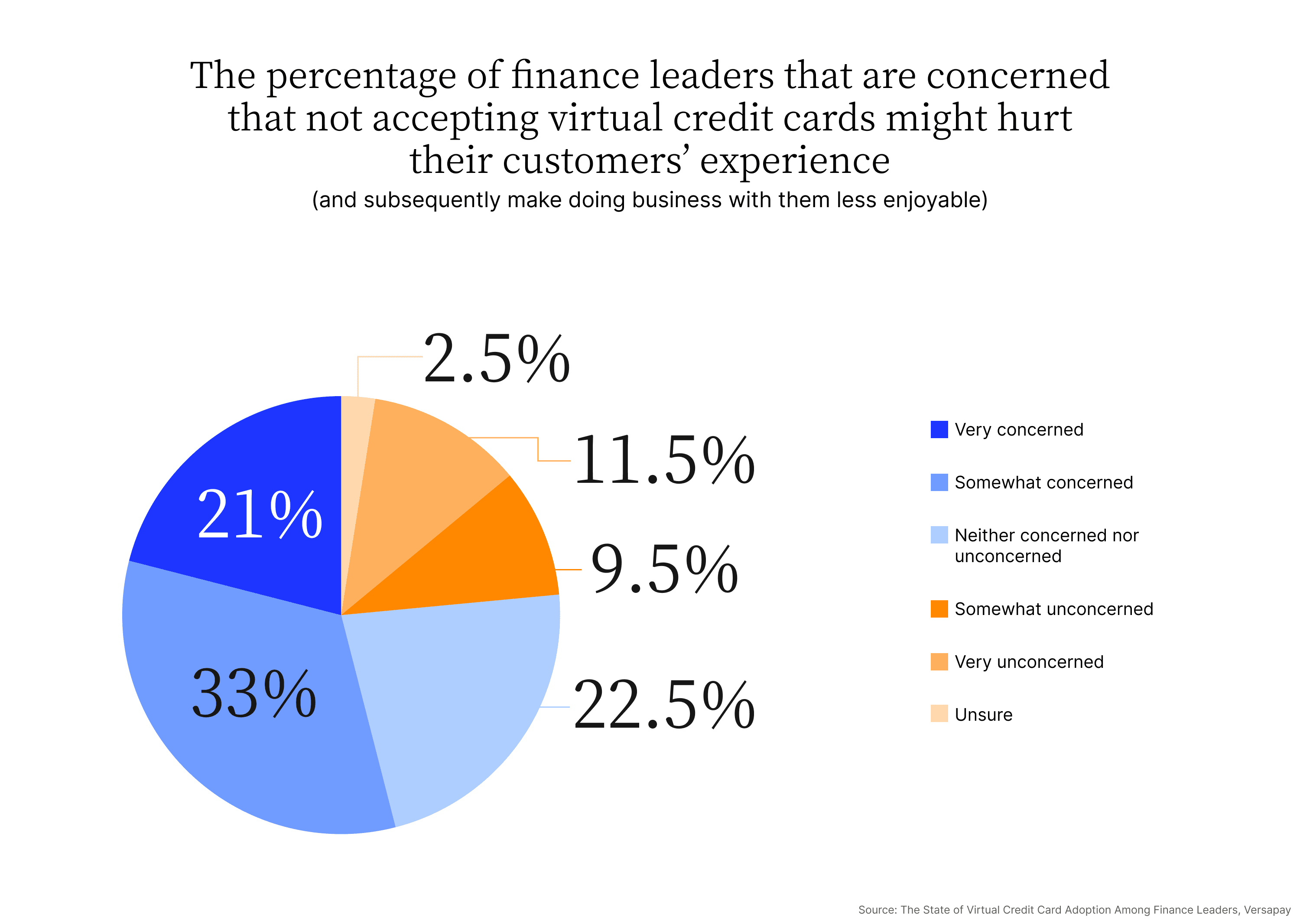

Survey results also show that 54% of respondents are at least somewhat concerned that not accepting virtual credit cards will harm their customers’ experience.

When asked about the impact they anticipate from the growing use of virtual cards in the B2B space, survey respondents identified several advantages that bear directly on customer experience. These include “hassle-free financial dealings,” “frictionless payments,” and improved accountability and trust between parties.

2. Minimized fraud risk

The security features inherent to virtual credit cards reduce the chance of fraud and the associated potential for chargebacks and other fees, which can get expensive for suppliers. This enhanced security is a major benefit of this payment method, and 19% of survey respondents identified it as a particularly beneficial aspect of accepting virtual credit cards.

As our Payment Fraud eBook explains, with the rise of digital transactions, credit card fraud has shifted from in-person fraud to card-not-present fraud. Virtual credit cards—which obscure a credit card’s real number—can help businesses address this growing problem.

3. Customer retention, especially large buyers

Sellers can capture new streams of revenue by accepting virtual credit cards, as some buyers prefer this payment method and may prioritize merchants who accept it. As more and more companies adopt virtual credit cards, sellers who don’t accept them may see attrition among clients who want to pay this way. Losing buyers—especially larger buyers—due to refusing to accept virtual cards can be a significant loss to a B2B business.

4. Reduced manual workload

Almost half (46%) of survey respondents identified the ability to automatically reconcile virtual credit card payments with open invoices within the accounting system as a major reason to use them. This means that companies who have implemented tools to make this possible can easily access all the other benefits of accepting virtual credit cards.

In addition, automatic reconciliation reduces manual workload for accounts receivable, freeing them up to work on higher-value tasks.

💡 In short: B2B sellers cite better customer experiences, minimized fraud risk, customer retention—especially large buyers—and reduced manual workload as the greatest benefits of collecting payment via virtual cards.

Use virtual credit cards to gain, keep, and satisfy customers

Our survey clearly shows that both buyers and sellers see many benefits to using virtual credit cards, and this is especially true when acceptance is paired with a tool like Versapay that can automate the way they process and reconcile virtual credit card payments.

Automation removes the main obstacle to accepting virtual cards—manual workload—and allows B2B transactors to increase efficiency and access the many benefits of this payment method. In this way, Versapay helps these companies boost security, improve customer experience, and attract and retain customers.

Check out our survey results by grabbing a copy of our downloadable report. And reach out to see how we can help you use virtual cards to improve your B2B business.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.