What Is an Invoice? Examples, Best Practices, and Tips

Invoicing is a critical aspect of almost every business. While seemingly simple, there are many factors that business owners and accounting teams need to think about.

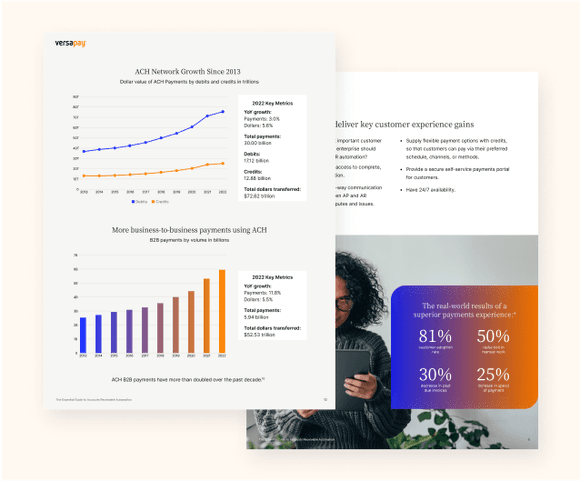

E-invoicing streamlines the invoice to cash process, reduces collections costs, and enhances overall accounts receivable efficiency.

Understand what an e-invoice is and how transitioning from traditional paper-based invoicing to e-invoicing can help your business.

This guide explores:

→ The problems with manual invoicing

→ The fundamentals and benefits of e-invoicing

→ How to evaluate e-invoicing solutions

→ And more

Invoicing doesn't need to be so difficult. Stay current on the best ways to create, manage, and improve your invoicing and billing processes to keep payments arriving on time.

Learn what value there is in automating your accounts receivable and how to choose accounts receivable automation software

Understand how transitioning from traditional paper-based invoicing to e-invoicing can help your business.

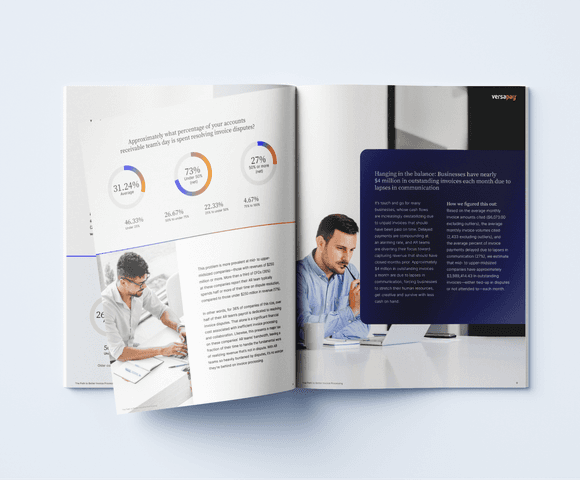

Invoice processing is a mission-critical function for businesses, yet it remains a formidable—and often consequential—challenge for most.

Get the free report to see why collaborative accounts receivable payment portals are the best solution for fixing your invoicing woes.

Automating your manual accounts receivable processes will deliver tremendous benefits across billing, payments, collections, reporting, and more.