5 Cash Application Challenges and the Costs of Ignoring Them

- 8 min read

This article breaks down the top 5 cash application challenges that must be addressed and the estimated costs of ignoring them.

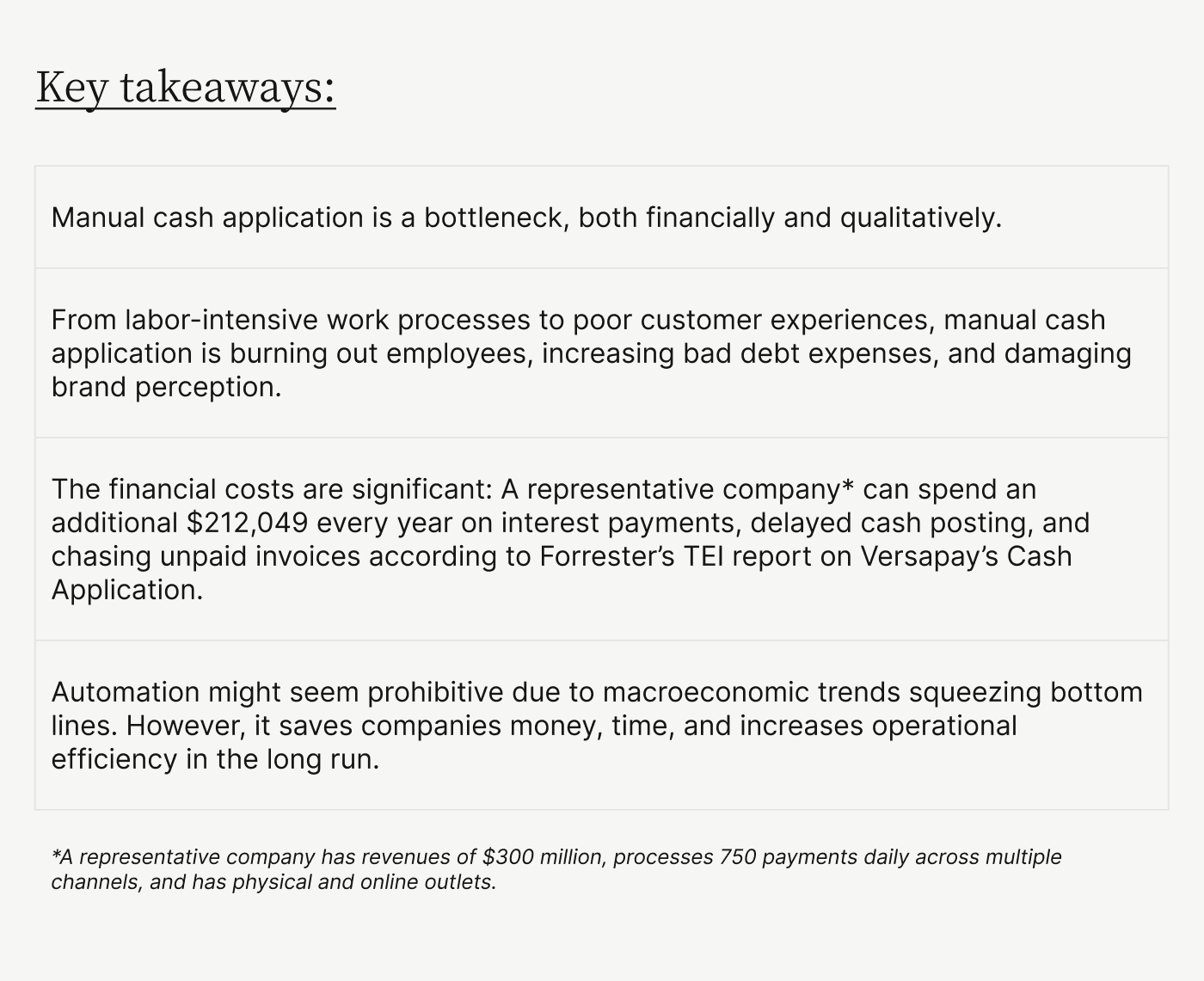

Cash application efficiency is critical to accelerating cash flow and getting an accurate picture of your working capital. Unfortunately, most companies still rely on manual processes despite the existence of automated cash application solutions.

A reliance on manual processes poses significant challenges that are costing companies. Some symptoms of these challenges overwhelming accounts receivable processes are poor customer experience, low efficiency, and even lower ROI.

While cash application might seem like a back office function, it has a tremendous impact on your bottom line. Here are five cash application challenges enterprises face and an estimate of the costs of ignoring them.

Table of contents

Challenge #1 — Cash application is labor intensive

A group of highly qualified accounts receivable teams executing clerical work is no one's idea of an efficient department. For example, having to manually match payments to supporting remittance advice, and then match them to open invoices creates a time sink.

Worse, manually matching payments like this creates errors due to fatigue. Adding more headcount is not a solution since a bloated AR department only compounds issues. Nip these cash application issues in the bud by adopting automation software.

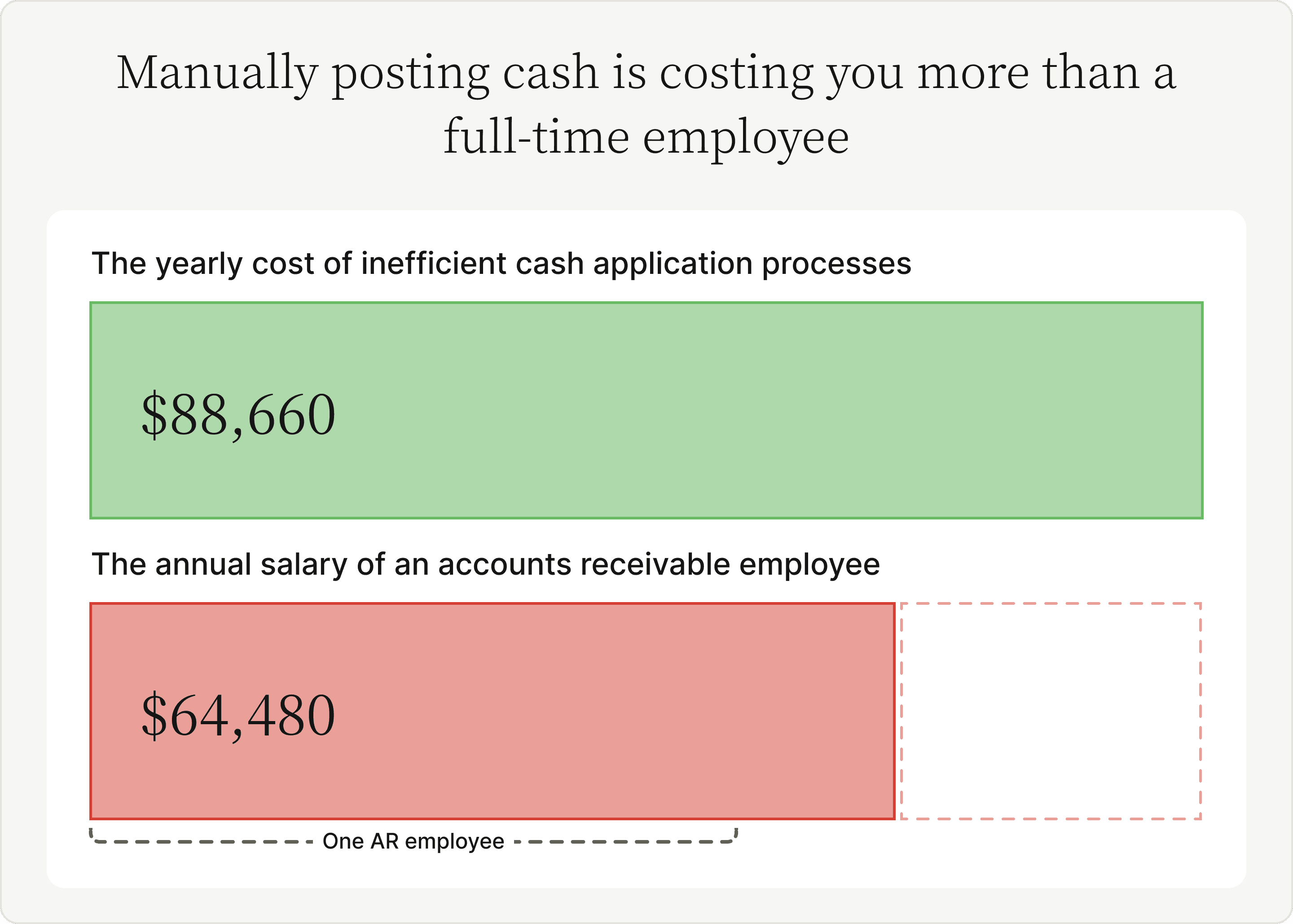

Forrester Research's study on the total economic impact of Versapay’s cash application automation software highlights that a representative organization, on average, spends 16 hours daily posting cash manually. In other words, manual, inefficient processes cost organizations an average of $88,660 annually, effectively costing an additional employee.

The qualitative costs are even higher.

The time your accounts receivable team spends manually posting cash detracts from value-added work that can boost cash flow and solve complex customer issues. Manual cash application also turns growth—a desirable business situation—into a burden.

For instance, this healthcare provider often took days to process single checks containing 60+ pages of remittance information. Automated cash application saves its receivable team 4.5 hours daily and enables them to post twice as many payments.

Challenge #2 — Cash application is full of errors

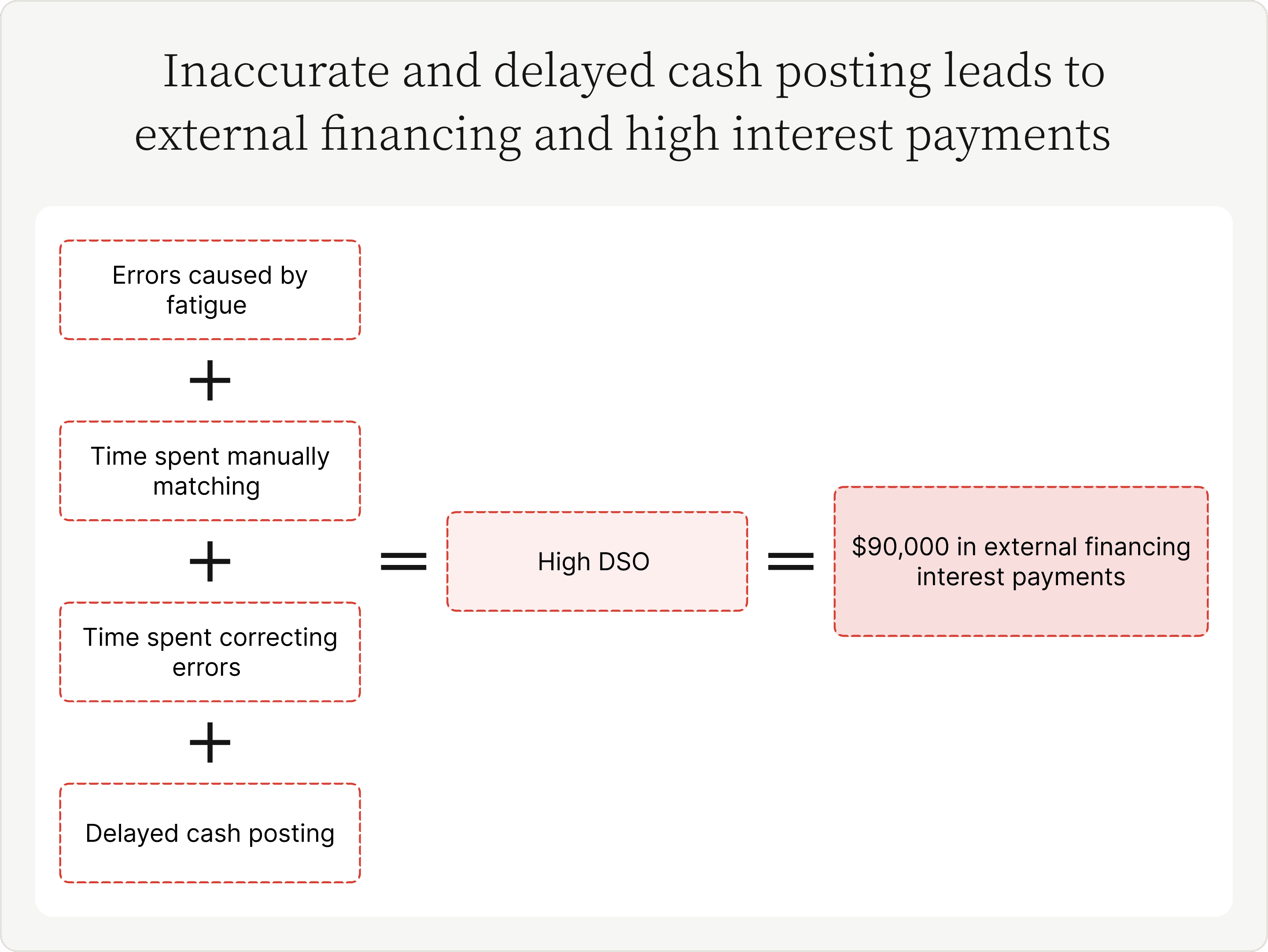

Manual processes often create additional work due to the errors they generate. Fatigued employees understandably create errors that frustratingly create even more work. These errors have bigger impacts beyond damaging employee morale.

Your customers also lose trust in your ability to handle their needs. For instance, error-filled cash application can lead to incorrect credit holds on customers, eroding trust. With companies having to do more with less, hiring more people is not a viable solution.

Per Forrester's TEI report, a hypothetical organization spends almost $90,000 annually on interest caused by inaccurate and delayed cash posting. These interest costs occur due to lengthy DSO times creating working capital holes forcing companies to seek external financing.

Ultimately, manual cash application turns growth into a curse, as Madison Resources discovered. The company has a complex reconciliation process where it must reconcile its and its customers' service payments. As the company’s revenues and invoice processing volumes grew, Madison’s manual processes could not keep pace. Its accounts receivable team spent significant time correcting errors and tracking erroneous payments.

Automating cash application helped the firm phase out slow bank lockbox services. Despite revenue and payment volumes growing, Madison's AR team is lean, helping it squeeze maximum efficiency and ROI.

Challenge #3 — Cash application reconciliation is complex

Growing companies process higher invoice volumes, and manual cash application cannot keep pace. High invoice volumes cripple a company and distort the cash flow picture since accounts receivable teams cannot apply cash soon enough.

In addition, growing companies also attract more sophisticated customers with complex payment needs. Customers can make one payment to cover multiple invoices or raise disputes at the line item level, clearing the rest with a partial, or short payment.

For instance, law firm Cole, Scott, and Kissane grew to 565 attorneys across 13 offices and would receive multiple payments from different payers for a single invoice. Customers switched to electronic payments, but manual cash application hindered the firm's growth.

Forrester's report on the TEI of Versapay’s automated cash application solution highlights some of the high payment volumes companies experience:

A staff accountant at a government software solutions company says, "During our least busy season, we would process around 20 payments [daily], which could be applied to up to 50 invoices. During our busiest season, we could process around a hundred payments [daily], which could be applied to up to a thousand invoices.”

When dealing with these payment imperfections manually, accounts receivable professionals spend more time connecting the dots and searching for data instead of applying cash. Automation removes the manual burden of matching payments to complex remittance data, giving AR more time to remove cash flow roadblocks.

Cole, Scott, and Kissane ultimately automated their cash application process, reducing matching times from two to three days to a few hours. With the time saved, the law firm is repurposing existing AR staff while maintaining high levels of efficiency.

Challenge #4 — Cash application delays payment processing

Picture the typical manual cash application process. An accounts receivable employee trawls through remittance information, reconciles a payment, applies it to an invoice, notifies accounting, and only then does cash appear on your books.

All of this takes somewhere between 16 hours to several days. Ratchet up the complexity like customers paying sales reps in the field and depositing them in lockboxes, as Wurth Canada's customers did, and your DSO rises exponentially. Further complicating this picture is banks asking for supporting documents like purchase orders and sales contracts. Accounts receivable, as a result, spends more time searching for paper—or driving to and from the bank—instead of getting cash onto your books.

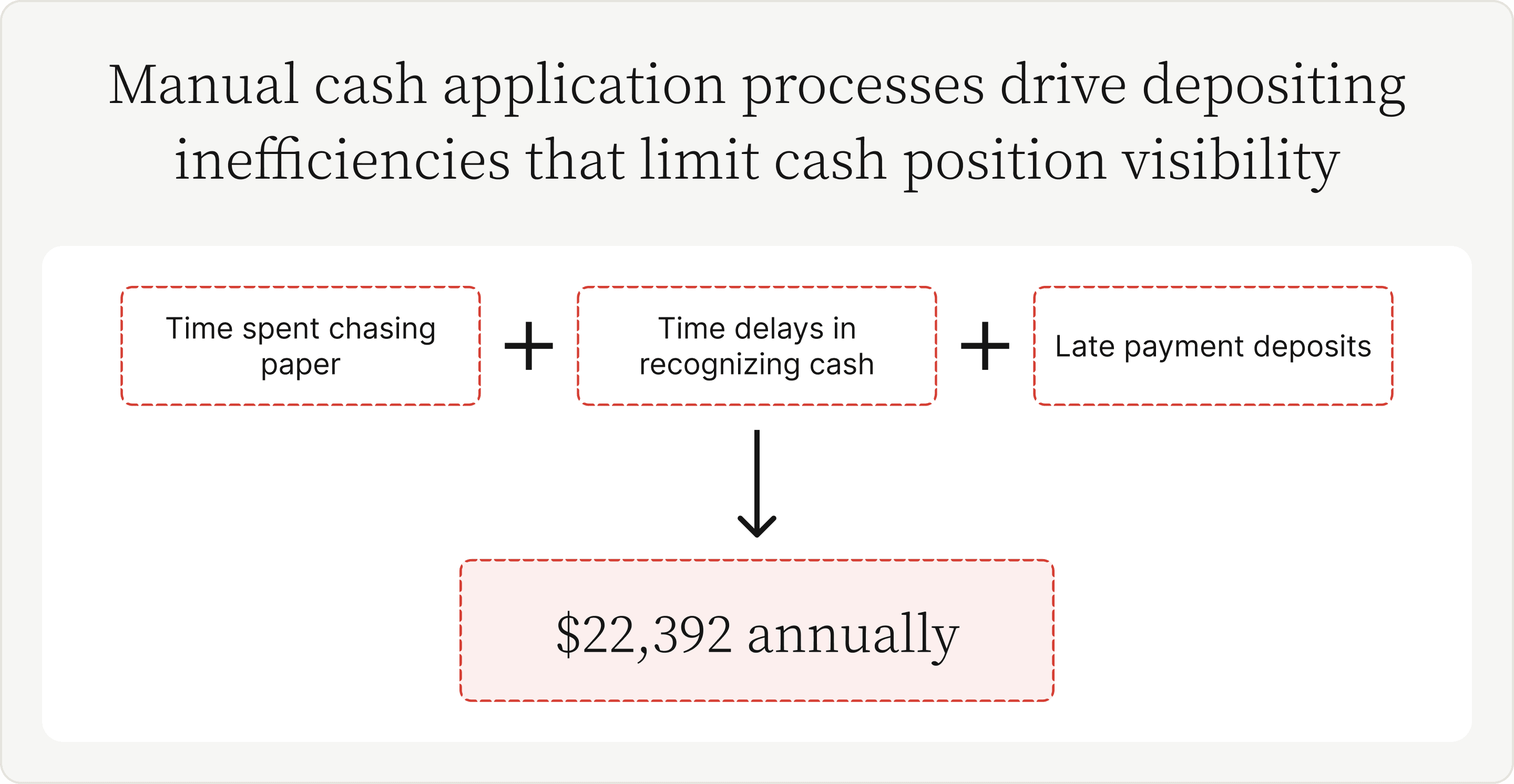

Forrester's TEI report shows that a representative organization wastes $22,392 annually in such payment depositing inefficiencies. These costs do not account for opportunities lost or increased hourly labor costs.

Automated cash application removes these hurdles immediately and gives you a real-time view of your cash position. It's how Wurth Canada increased productivity, slashed payment processing costs, and gave its salespeople more time to deal with customers.

Challenge #5 — Cash application is damaging CX

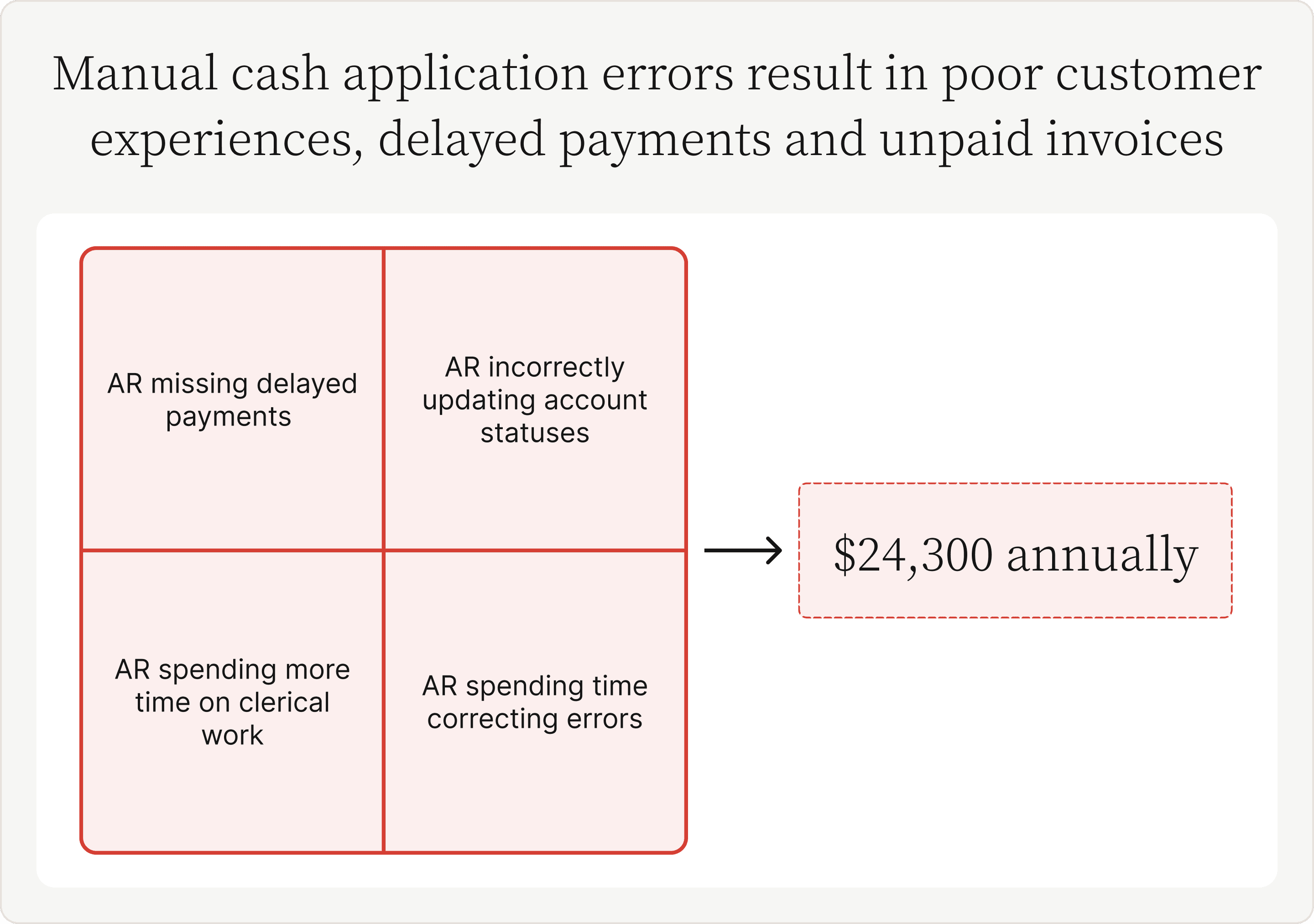

Manual cash application leads to errors, and these eventually frustrate customers. They notice incorrect account statuses and AR teams not responding with helpful information. This leads to poor payment experiences and an unprofessional image of the company in customers' minds.

Internally, accounts receivable misses delayed payments and unpaid invoices due to the sheer volume of clerical work. Forrester's TEI report pegs the damages at $24,300 annually. This number does not account for a poor brand reputation or the effect of lost business in the long run.

Automated cash application—especially when paired with a collaborative accounts receivable platform—keeps customers happy and helps you maintain optimal efficiency. With these tools, you can centralize collections data to help your team respond to customer queries quickly and automate payment reminders to mitigate delayed payments.

These features helpedHaas Door cut cash application times from a day to a few minutes. The company's credit manager now has proactive conversations with existing customers, strengthening existing relationships. Best of all, despite payment volumes doubling over the past decade, Haas' accounts receivable team has not increased in size.

The ROI of automated cash application

The manual cash application challenges we've highlighted above have significant costs. Forrester's report estimates these inefficiencies cost companies $212,049 annually. That number does not account for lost opportunities caused by poor CX or employee attrition caused by overwork and stress.

Modern companies have to do more with less, and manual processes like these have no place in this environment. Add a talent shortage to the mix, and companies relying on such outdated AR workflows will put the brakes on their growth.

Automated cash application might seem like an expense worth avoiding, but the benefits outweigh the costs. The question is: What are efficiency gains and faster cash flow worth to you?

Curious to know how Forrester Research calculated the numbers we quoted above? Read Forrester's Total Economic Impact Study of Versapay Cash Application to dig deeper into the numbers and discover the efficiencies you can gain from automated cash application.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.