Remittance Capture: 6 Ways Automation Can Help

- 12 min read

When done efficiently, remittance capture can have a positive impact on cash flow and customer experience.

In this blog, you'll learn 6 key ways that automation helps AR teams improve and streamline remittance capture.

Remittance capture can be time-consuming and tedious for accounts receivable (AR) teams. If done inefficiently, it can have a significantly negative impact on your cash flow and customer experience.

It has traditionally been a manual process: AR staff receives remittance advice by mail or email, uses that information to match a received payment and an open invoice, and records the match by hand in their accounting system.

This is a lot of rote labor, with a bit of aggravating detective work thrown in. Automating the remittance capture process can be a game-changer for busy accounts receivable teams and the companies that depend on them.

Let’s look at how streamlining this procedure can address some sticky remittance processing challenges and provide many benefits.

Jump to a section:

What is remittance capture and how does it work?

Remittance capture is the process of receiving a payment and related information from a customer and crediting that payment to that customer’s account. Part of this process—called cash application—involves applying the payment to the correct invoice.

Remittance capture is facilitated by remittance advice, which is information the customer provides to indicate what a payment is for. Remittance advice is a key element of the cash application process, as AR teams depend on it to know how to match incoming payments with open invoices.

The importance of streamlined remittance capture

Making the remittance capture process more efficient is extremely helpful, as it allows accounts receivable teams to expend less time and aggravation on the cash application process. Arming accounts receivable teams with easily accessible and identifiable remittance information helps them speedily match payments to invoices.

This faster, smoother process boosts customer experience (CX) and saves staff time by reducing the amount of inquiries AR teams must make of customers whose remittance advice is missing, lacking, or incomprehensible. Streamlining all parts of the remittance capture process also accelerates cash flow since receivables teams can more quickly apply payments and recognize revenue.

Challenges with remittance capture

Conducting remittance capture manually presents a series of challenges for AR teams, from spending time seeking out information to confusion over complex invoicing situations. Here are four common remittance capture challenges:

Difficulty retrieving remittance advice

Missing or illegible remittance data

Introduction of errors

Complex cash application

1. Difficulty retrieving remittance advice

Accounts receivable teams often receive remittance advice in a variety of formats and methods, such as on a check’s memo line or via an email meant to accompany a wire transfer. With no standardized process for receiving this information, AR teams find it time-consuming and tedious to search it out for each transaction.

Making matters worse, AR teams may need to manage log-in credentials for multiple accounts payable (AP) portals if a number of clients use them to transmit remittance advice. In larger companies (and when dealing with larger customers), receivables teams must often log into a number of customers’ portals to get the information needed for remittance capture.

2. Missing or illegible remittance data

Receivables teams may not receive remittance advice for certain payments, as is often the case with ACH payments, since customers are not required to send it. This shortfall forces staff to contact customers for clarification by email or phone—time-consuming and aggravating for staff and customers alike.

In other instances, remittances may be illegible, such as with poor handwriting on a check or blurred ink on a document, and AR staff must revert to the customer to get clarity on the information transmitted.

3. Introduction of errors

Manually matching payments to invoices using remittance information can result in errors, such as mismatching a payment to an invoice. This is especially true with complex invoicing situations, such as when multiple invoices are covered by a single payment. There is also a high likelihood of introducing errors when manually keying remittance data into accounting systems or ERPs.

Errors can be particularly consequential in the remittance extraction process. In one example, a healthcare service provider needed to extract and load data from custom file formats provided by customers’ banks. The process of doing this manually resulted in delays in validating and posting payments and resulted in errors that took even more manual work to unravel.

Such errors may result in false conclusions about customers’ payment status, which can end up hurting customer experience and loyalty when accounts receivable teams reach out with late payment notices on invoices that have already been paid. (Or worse, when AR teams put unwarranted credit holds on customer accounts.)

4. Complex cash application

Matching remittances with open invoices can be a complicated process—even if the remittance advice slip is legible and received alongside payments. This is particularly so in the event of single payments that apply to many invoices, as well as short-paid invoices—those that aren’t fully covered by any one payment.

Such complex situations are made even more difficult for accounts receivable staff to parse when there is insufficient or no accompanying remittance advice, requiring extensive fact-finding, troubleshooting, and communications with customers.

6 ways automation helps AR teams streamline remittance capture

Automation is critical to making remittance capture run faster and more smoothly, which can reduce an AR team’s time spent on this task, improve customer experience, and accelerate revenue recognition.

Here are six ways automation can help streamline remittance capture:

Capture all incoming payment types

Extract remittance data automatically

Digitize incoming remittance advice

Automatically match remittances with open invoices

Identify unapplied payments

Investigate complex remittance situations

1. Capture all incoming payment types

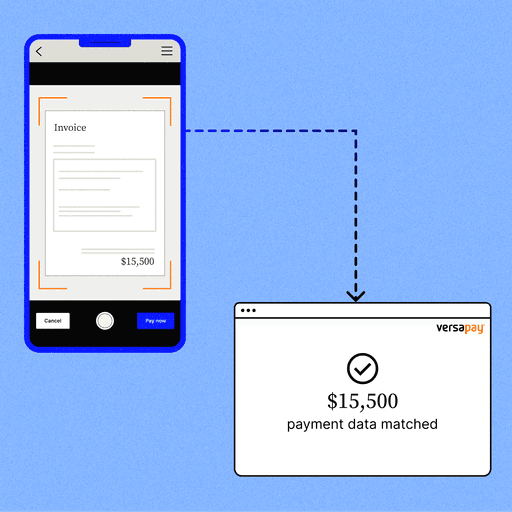

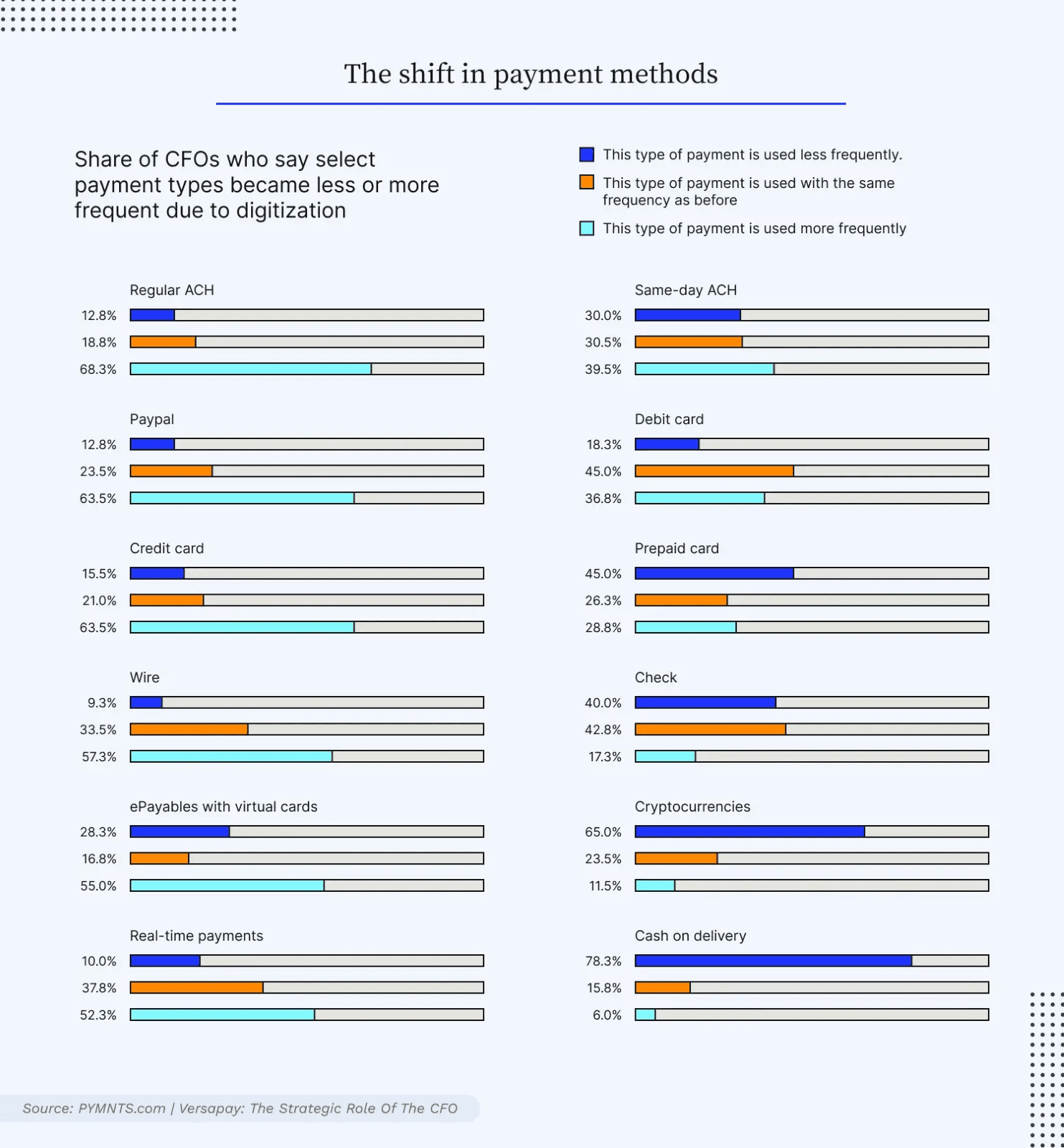

Automating remittance capture enables customers to use their preferred B2B payment methods—such as paying digitally via credit card—and lets AR teams seamlessly and quickly capture incoming payments.

Increasing the diversity of payment methods accepted is a boon to accounts receivable teams, as reliance on check processing involves too much time-consuming manual effort, even when check payments are accompanied by remittance advice. Plus, customers are increasingly looking to pay their invoices using digital means, so having an automated remittance capture process that accounts for this is quickly becoming table-stakes:

2. Extract remittance data automatically

Advanced image recognition and machine-learning technology enable AR automation software to extract remittance data from multiple sources, including vendor portals, bank lockboxes, emails, and PDFs. Since manually finding and hand-copying remittance advice is a major drag on AR teams’ time, automating this task frees them up to take on higher-value work.

3. Digitize incoming remittance advice

Remittance data is rarely tidy or consistent from customer to customer, especially when delivered on hand-written documents via mail. Automation solutions like optical character recognition can help turn missing information into legible information slips, and reliably analyze, normalize, and import them into your accounting system.

4. Automatically match remittances with open invoices

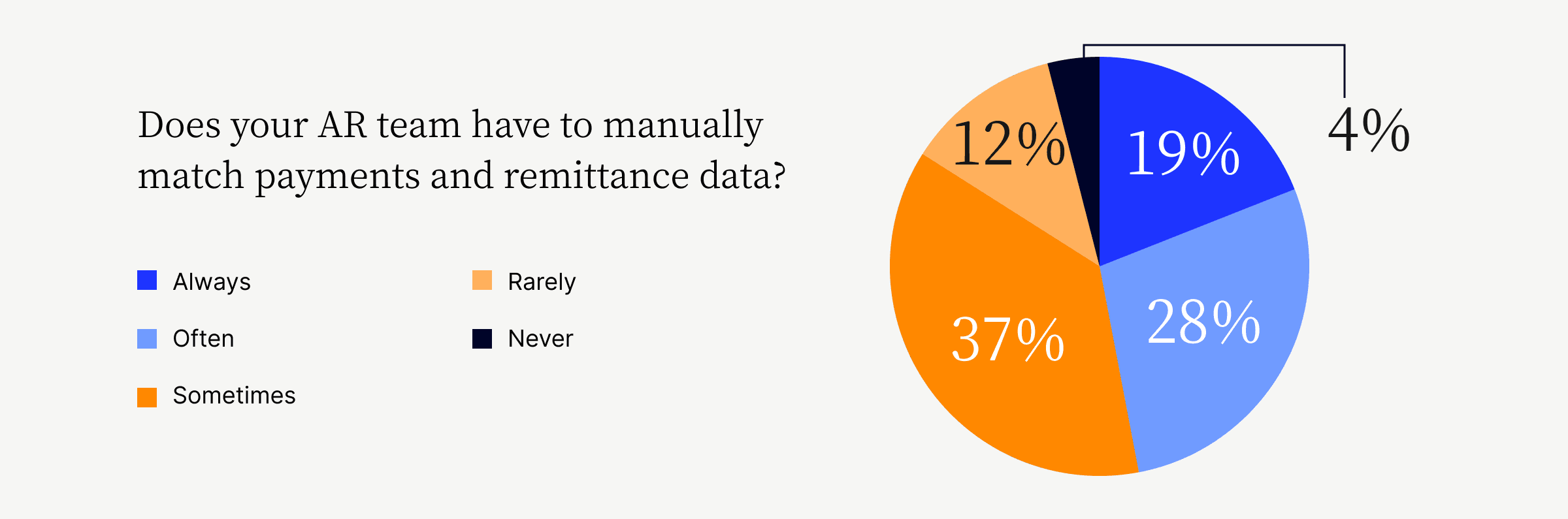

Cash application automation solutions can instantly match all remittances and payments with their appropriate invoices, removing the need for human involvement in this process. The 84% of AR staff who report having to manually match payment sometimes, often, or always can be freed up from this tedious, time-consuming task. They can instead work to add more value to the company.

5. Identify unapplied payments

When payments are made without an accompanying remittance slip, intelligent, AI-powered automation solutions can help sellers identify unapplied payments and seek clarification from customers (or automatically apply without requiring human intervention). Automation systems even allow customers to apply their own payments, a very efficient way of circumventing this common problem.

6. Investigate complex remittance situations

Automated remittance capture software can recognize if incoming payments are meant to cover full invoices, partial invoices (short-pays), multiple invoices, or line items. Importantly, automated remittance capture systems can search for reason codes and find matching invoice amounts, thereby automating the investigative work required for payments that don’t exactly match a single invoice.

Automated remittance capture in action

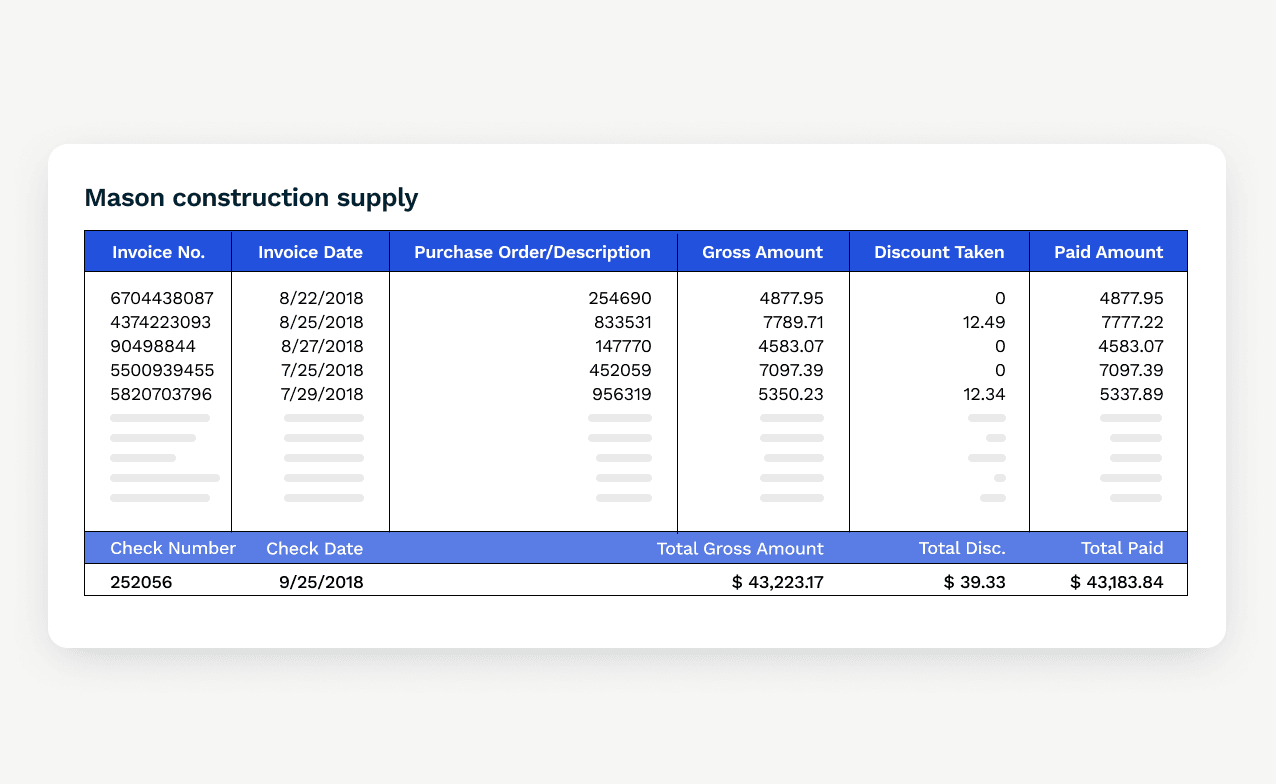

To see the real-world benefits of automating remittance capture, let’s again look at the example of the healthcare service provider that was struggling with manual cash application processes. This company was able to save their accounts receivable workers 4.5 hours of daily rote work with automation.

The provider adopted Versapay’s AI-powered cash application automation software in an effort to streamline remittance capture and cash application. The move was necessary as the provider was drowning in checks, some of them very complex. It was not unusual for the company to receive a $200,000 check payment accompanied by 60+ pages of remittance advice.

The AR team was spending large amounts of time reviewing and keying in all that remittance data, matching checks to invoices, and communicating with customers when questions arose. The situation was simply untenable.

Implementing Versapay’s automation solution allowed the company’s cash application specialists to reduce their time spent on cash application by 75%. Now, nearly 95% of their incoming payments are automatically matched with open receivables. The receivables team has reduced errors, posts payment faster and more frequently, and is able to collaborate directly with customers in real-time when needed.

Automated remittance capture streamlines accounts receivable

Automating remittance capture is a reliable way to streamline your accounts receivable teams’ work and boost your company’s financial efficiency. Accounts receivable automation software like Versapay’s reduces manual work, cuts human errors, and accelerates cash flow. And AI-powered cash application solutions help automatically match and apply traditional payments like checks, ACH, and wire transfers with over 90% straight-through processing.

Learn how in this short video:

Automating the cash application and remittance capture process offers phenomenal benefits to AR teams and their companies, from happier staff to better customer relationships to faster revenue recognition.

Learn more about cash application and how automation can help by grabbing your free copy of our finance leaders’ guide to cash application.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.