Poor Invoice Processing is Hurting Cash Flow and Draining Revenues: What CFOs Need to Know

- 11 min read

Invoice processing is a mission-critical function for businesses, yet it remains a formidable—and often consequential—challenge for most. The process—which begins with creating an invoice and ends with receiving payment—is seemingly simple, yet rife with complexities.

In this blog, learn the quantifiable impact of poor, inefficient invoicing processes, and how collaborative technology reduces losses caused by manual practices.

Key takeaways:

Mid- to upper-midsized companies are failing to collect $2.3M due to poor invoice processing each month.

Poor invoice processing is delaying payments, clouding cash flow projections, and losing these companies revenue.

Inefficient tools and data silos plague AR processes, leading to lengthy customer disputes and more costs.

Collaboration between AR teams and their customers’ AP teams, powered by cloud-based technology, is a solution to this invoice processing logjam.

—

Mid- to upper-midsized companies have stable customer relationships and process a steady stream of invoices every month. According to a study we recently conducted in collaboration with Wakefield Research, these companies process a median of 1,850 invoices every month, with companies earning more than $250 million in revenue processing a median of 2,450 invoices every month.

Numbers like these indicate good business health.

However, inefficient invoice processing is turning these positives into a cause of concern for CFOs and accounts receivable (AR) departments. Right now, poor invoice creation and processing are undoing the hard work the rest of the company does, threatening existing customer relationships and undermining business resilience.

In this article, we examine how poor invoice processing is hurting mid- to upper-midsized companies. We also:

The quantifiable consequences of poor invoice processing

A mid- to upper-midsized company's invoicing process is intricate, involving creation, delivery, dispute handling, and cash collection. Any inefficiencies in these steps compound and have an outsized impact on customer experience (CX) and cash collection cycles.

Here are three quantifiable consequences of poor invoice processing workflows:

Delayed payments

Disrupted cash flow projections

Lost revenue and damaged CX

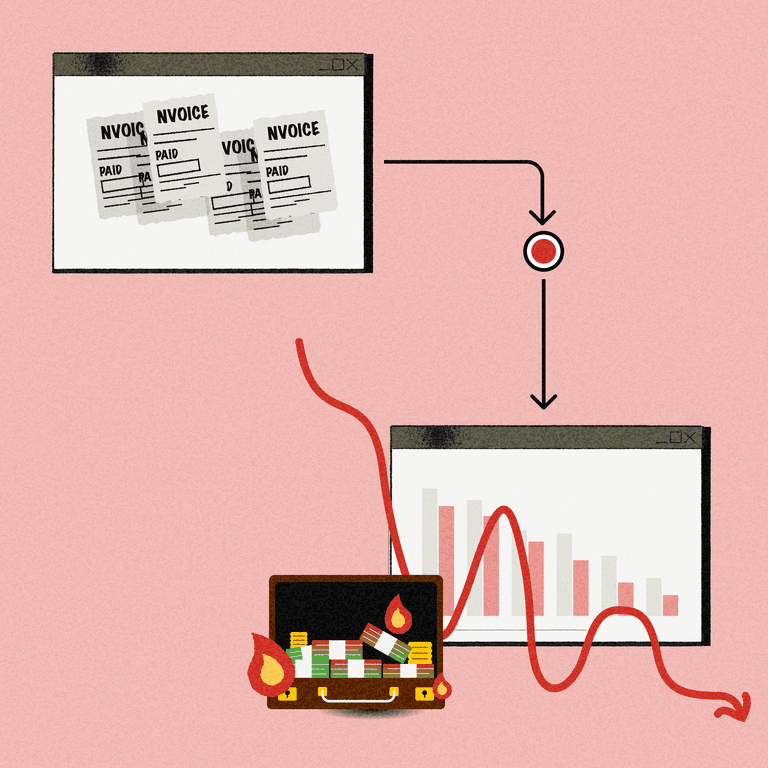

1. Poor invoice processing leads to nearly $1 million in delayed payments monthly

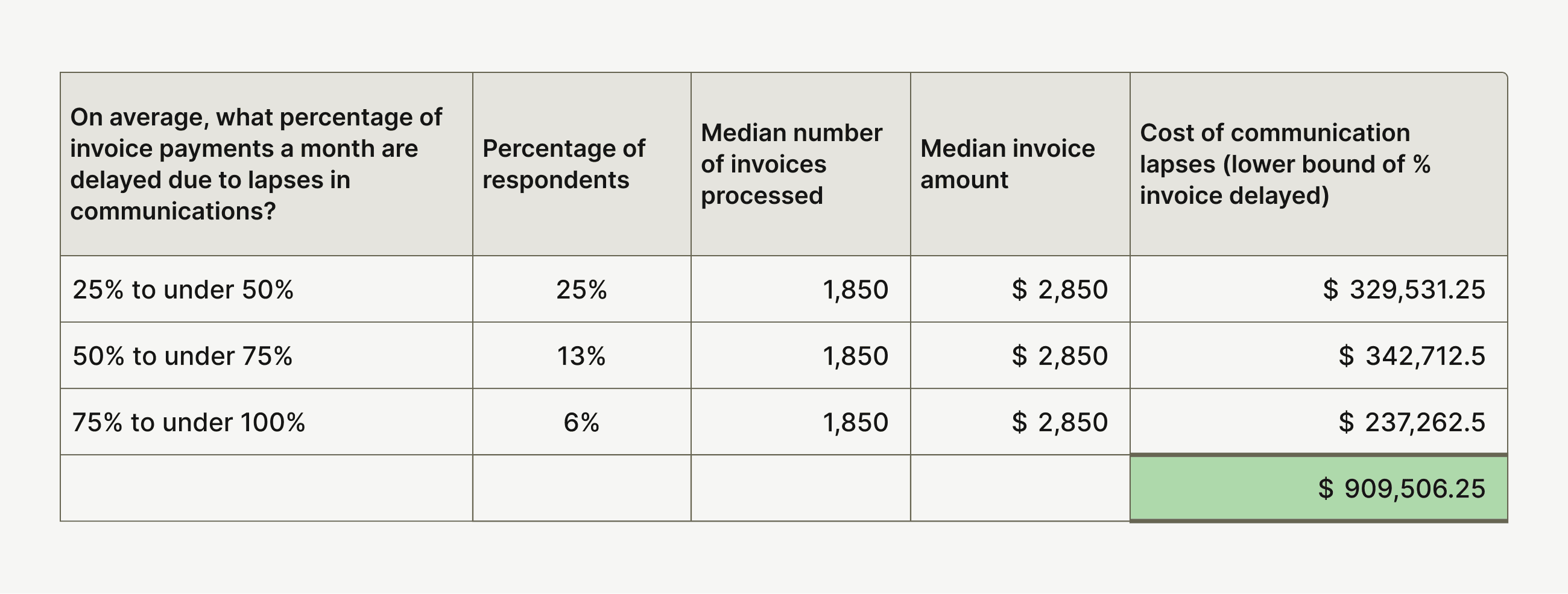

Versapay's research reveals that 44% of mid- to upper-midsized companies report at least a quarter of their invoices are delayed each month, with 6% reporting more than three quarters of invoices are delayed.

These delays are costing these companies at least $909,506 each month.

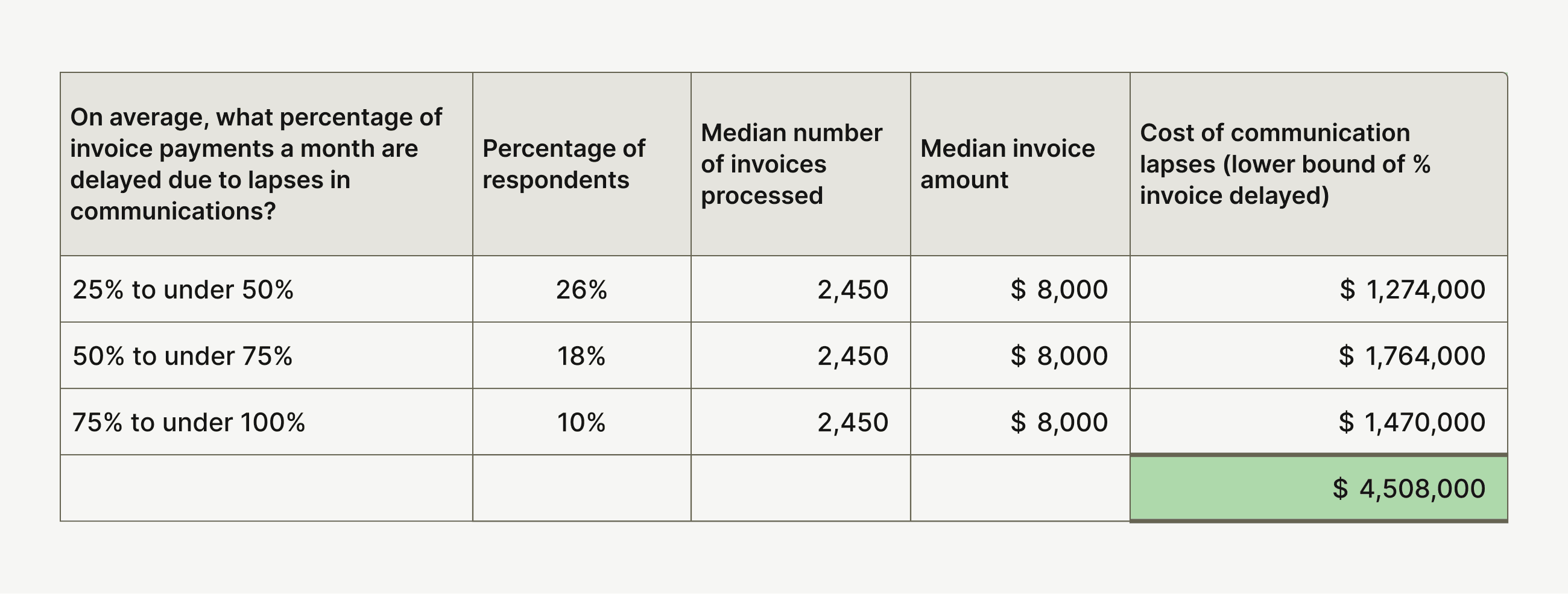

The situation is worse for upper-midsized companies with revenues of more than $250 million annually. Poor invoice processing costs them $4.5M every month.

2. Poor invoice processing disrupts cash flow projections

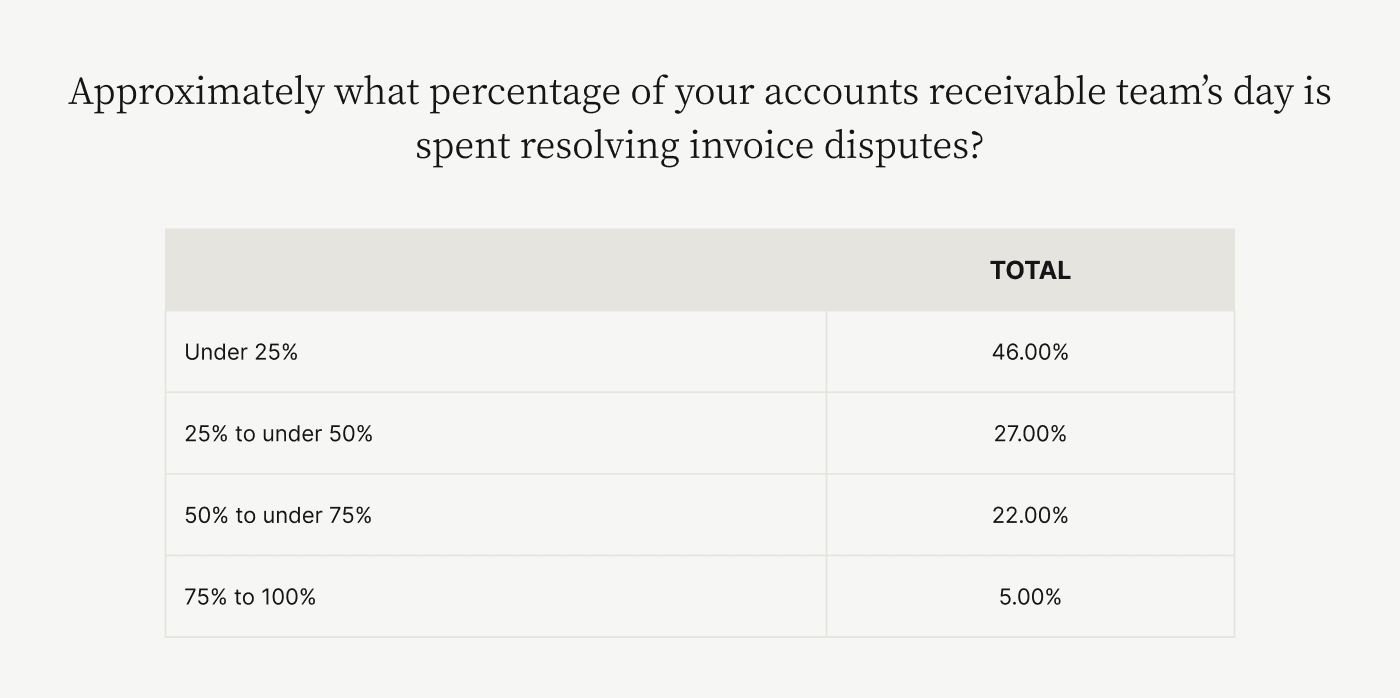

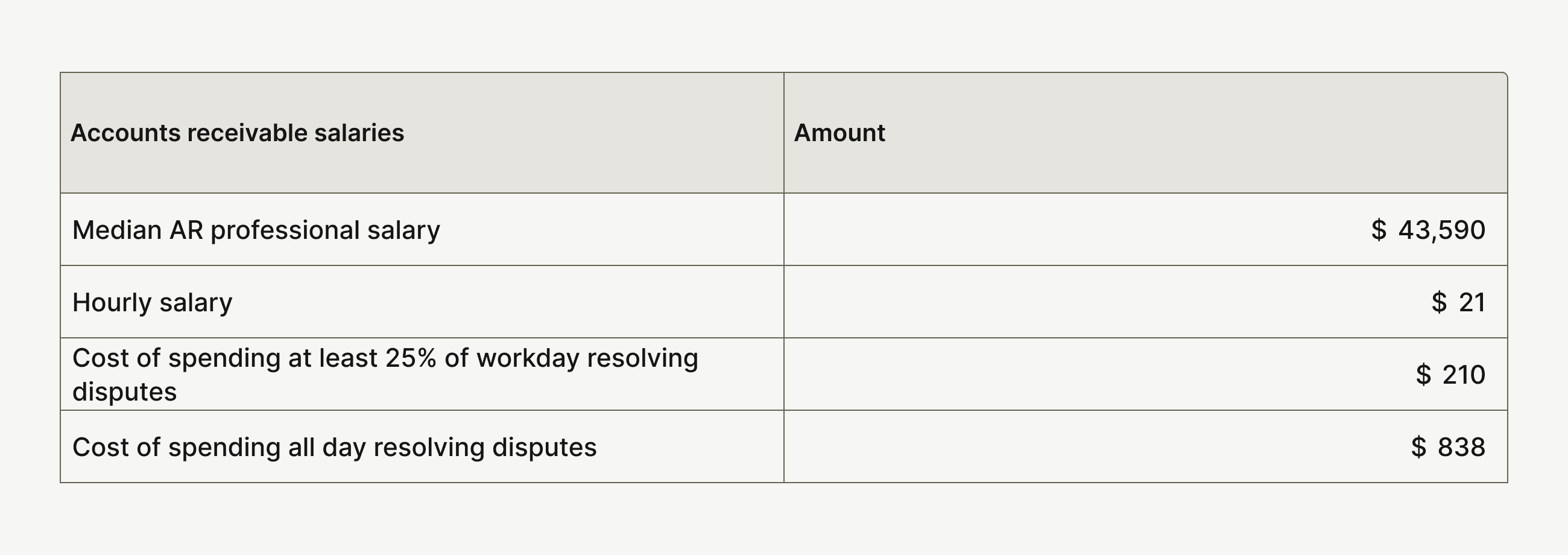

Accounts receivable is a critical cog in building cash flow projections. Unfortunately, 54% of CFOs noted that their AR team spends more than a quarter of their day handling disputes. Twenty-seven percent of survey respondents revealed their AR team spends more than half their workday resolving disputes.

Assuming a standard 40-hour work week, mid- to upper-midsized AR teams are spending at least 10 hours every week, or a little over an entire workday, handling disputes. The result is less time spent giving CFOs critical input into cash flow data—leading to poor cash flow projections.

Worse, all this additional time spent resolving disputes costs money. Mid- to upper-midsized companies spend between $210 (25% of time spent resolving disputes) to $838 (100% of time spent resolving disputes) weekly on easily avoided manual dispute resolution processes.

3. Poor invoice processing loses revenue and damages CX

Versapay's research revealed that 91% of CFOs admit to repeatedly asking customers for more information when handling disputes, with 59% reaching out almost all the time. While constantly reaching out like this detracts an AR team from providing cash flow insights to CFOs, there are significant customer experience impacts too.

Every customer expects a company to understand their issues deeply. An accounts receivable executive constantly asking for information the customer has already provided paints a poor organizational picture, leading to a lack of confidence in the company.

This constant outreach also points to a systemic flaw in invoice processing—that AR teams cannot retrieve critical data because of silos and poor electronification. The result is miscommunication, poor CX, and customer conflicts.

Versapay's State of Digitization in B2B Finance report revealed that 82% of companies lost revenue due to conflicts in invoicing, with 85% reporting underpaid invoices caused by these conflicts.

These challenges compound as a company grows, leaving CFOs without critical cash flow insights. Modern accounts receivable teams have significant concerns around invoicing backlogs, and these issues are harming the entire business. Digitization is a possible solution.

However, mere digitization isn’t having much of an effect as we’ll shortly explain.

Why traditional invoice processing is inefficient

These invoicing inefficiencies are even more glaring when examining the level of digitization in accounts receivable. Every executive we surveyed reported digitizing some portion of their AR flow, yet issues persist. Clearly, mid- to upper-midsized companies are approaching digitization inefficiently.

Merely automating inefficient manual processes—instead of digitally transforming AR—will not solve this invoicing logjam. Instead, this veneer of automation is creating more hurdles that AR cannot overcome.

1. Inefficient tools restrict accounts receivable teams

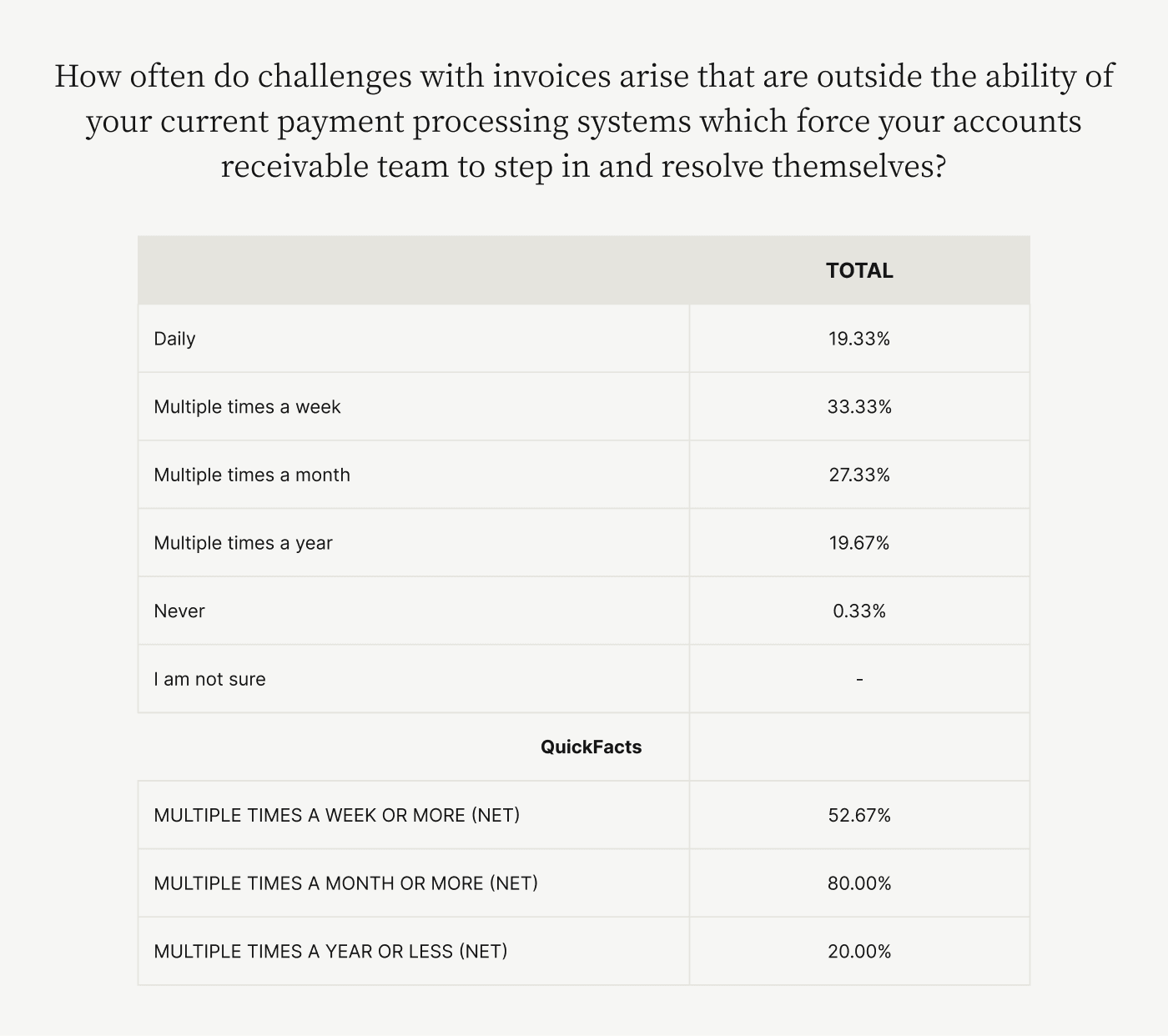

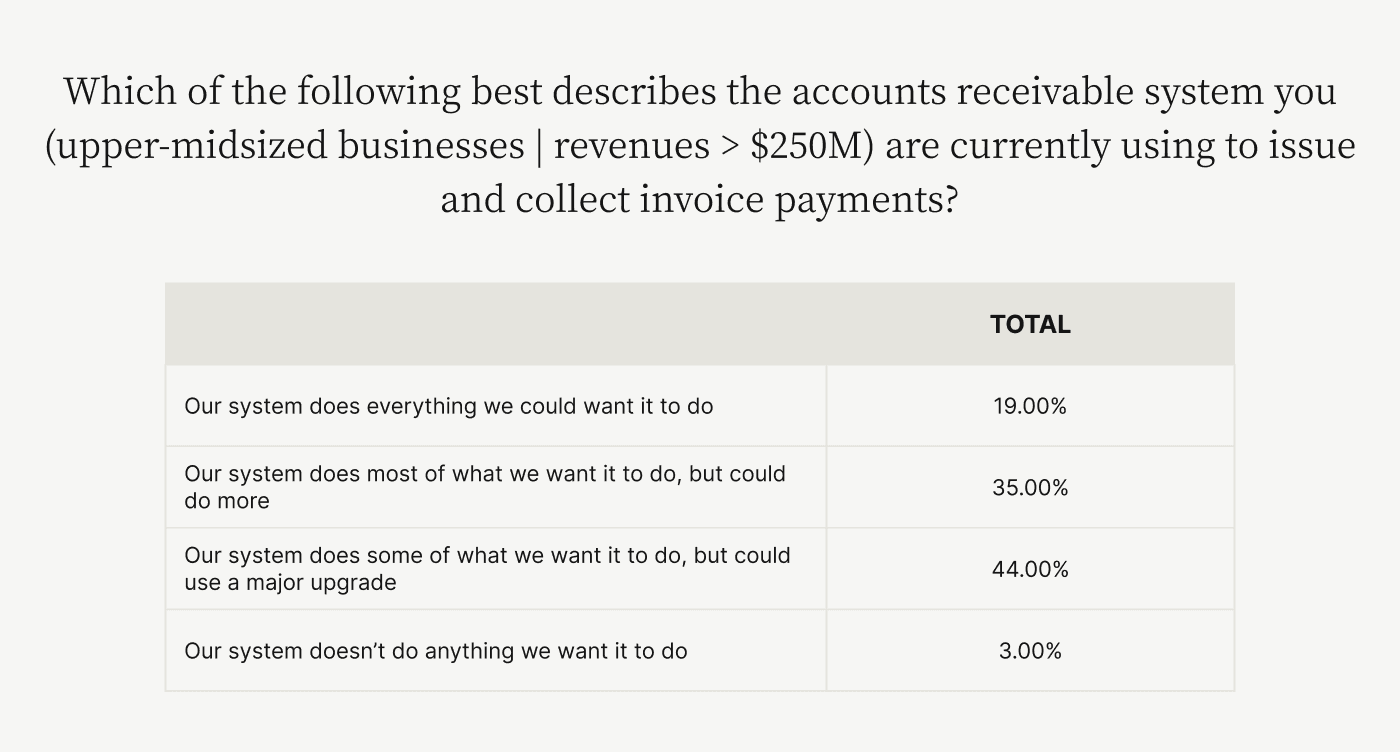

Eighty percent of CFOs admitted that invoicing issues beyond the abilities of their current systems arise several times each month. Also, 86% admit to not having access to cloud-based tools that centralize data.

Comparing these responses, the state of accounts receivable in mid- to upper-midsized companies is clear. Finance teams are automating flawed AR workflows that lead to constant back and forth with customers. The lack of cloud-based tools, a hallmark of digital transformation initiatives, confirms this fact.

Company executives are aware of this issue. An alarming 82% of respondents at companies earning more than $250M annually admit their accounts receivable system could either do more, needs an upgrade, or is ineffective.

2. Accounts receivable teams work in silos and cannot collaborate internally or externally

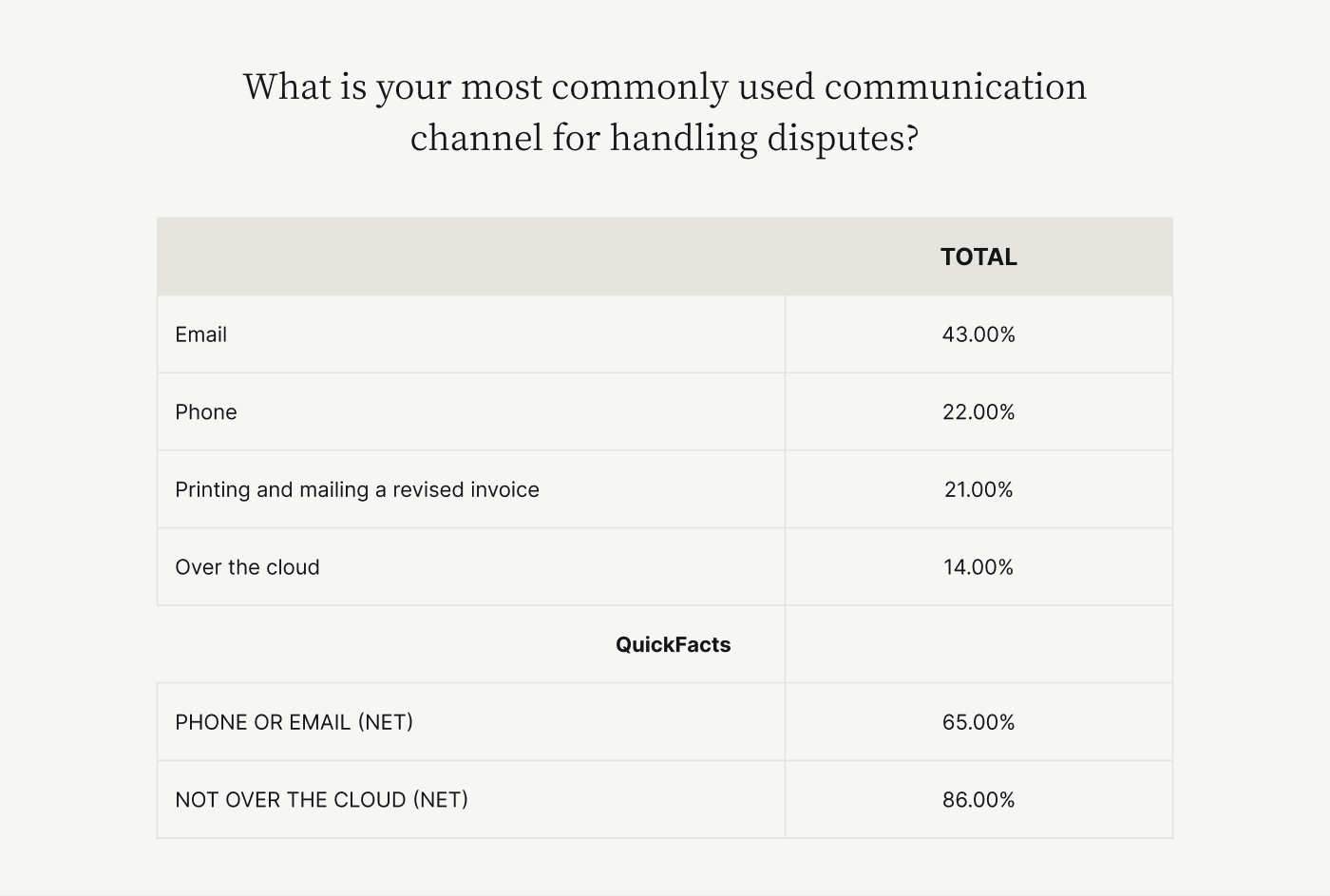

When asked what their AR teams' biggest challenge was, 69% of CFOs pointed to internal and external communication. These communication challenges point to accounts receivable teams not having data they need to resolve customer disputes and being unaware of customer contract terms.

AR teams operating using legacy technology do not have instant access to critical data such as pricing and credit terms—as well as other pertinent supporting documentation. With data siloed like this, invoicing errors arise, leading to disputes. Accounts receivable teams then either reach out to customers for more information or internally for relevant data, delaying dispute resolution and damaging CX.

These silos restrict data transparency, communication, and collaboration while leading to endless email chains and communication gaps. They prevent AR teams from quickly accessing invoice data, aligning with sales and logistics teams, and collaborating with customer accounts payable (AP) teams. The result is lengthy dispute resolution and cash collection cycles. Poor customer experience caused by constant back and forth, as we previously highlighted, further harms a company.

💡While legacy technology restricts AR, paper-based invoicing doesn’t do it any favors either. Learn more about how electronic invoicing boosts CX and accelerates cash collections with the Executive’s Guide to Electronic Invoicing.

How collaborative technology reduces losses caused by invoice processing

Accounts receivable misalignment among stakeholders is symptomatic of a poor invoice processing workflow. The closer AR works with internal and customer AP teams—collaborates, in other words—the smoother invoice processing is.

Ninety-six percent of CFOs believe collaboration is the way forward as well. And to move forward, mid- to upper-midsized companies must prioritize digital transformation by adopting cloud-based collaborative AR tools that foster collaboration. Sixty-nine percent of respondents agree, favoring cloud-based communication tools.

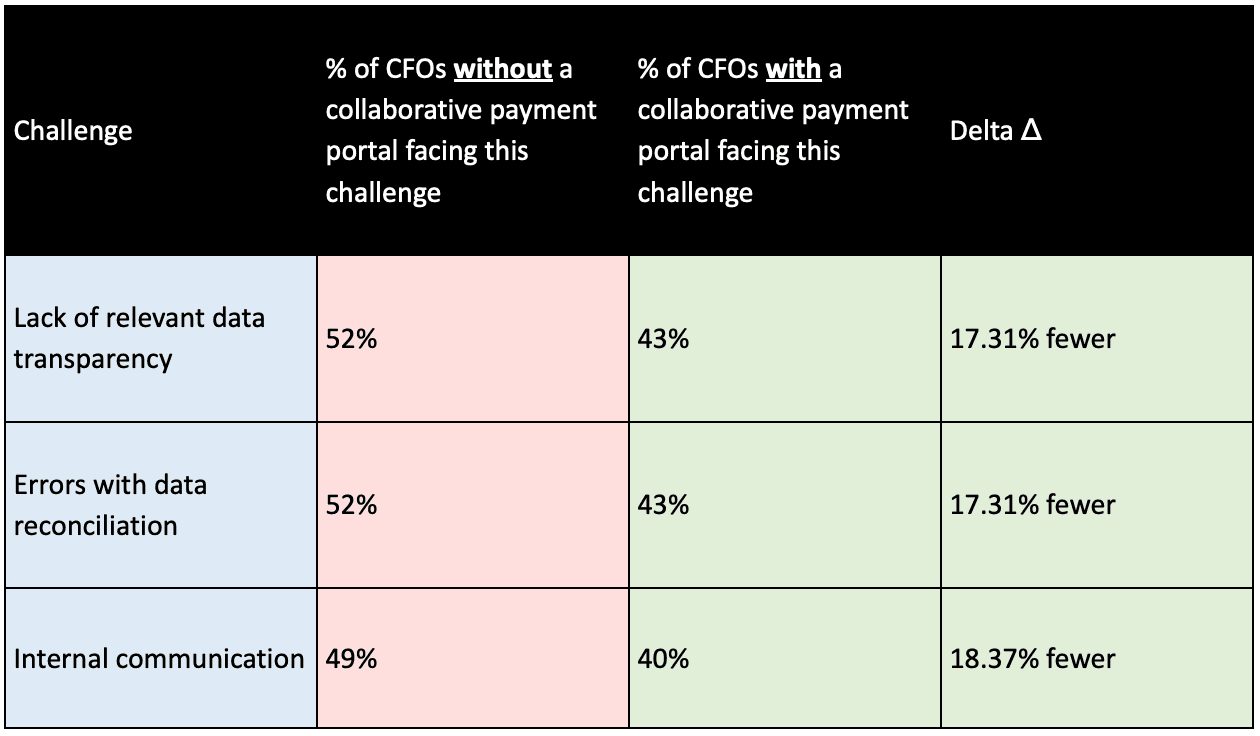

What’s more, CFOs at companies that have adopted collaborative AR portals face fewer issues across the board compared to CFOs at companies that have not.

In general, CFOs without collaborative accounts receivable payment portals report greater delays among their AR team, with 43% saying they’re weeks or months behind or they will never catch up, compared to 35% with these portals.

Here are three ways collaborative technologies benefit invoice processing:

Speeds up cash collections

Ensures great CX

Reduces invoice processing costs

1. Collaborative technology speeds up cash collections

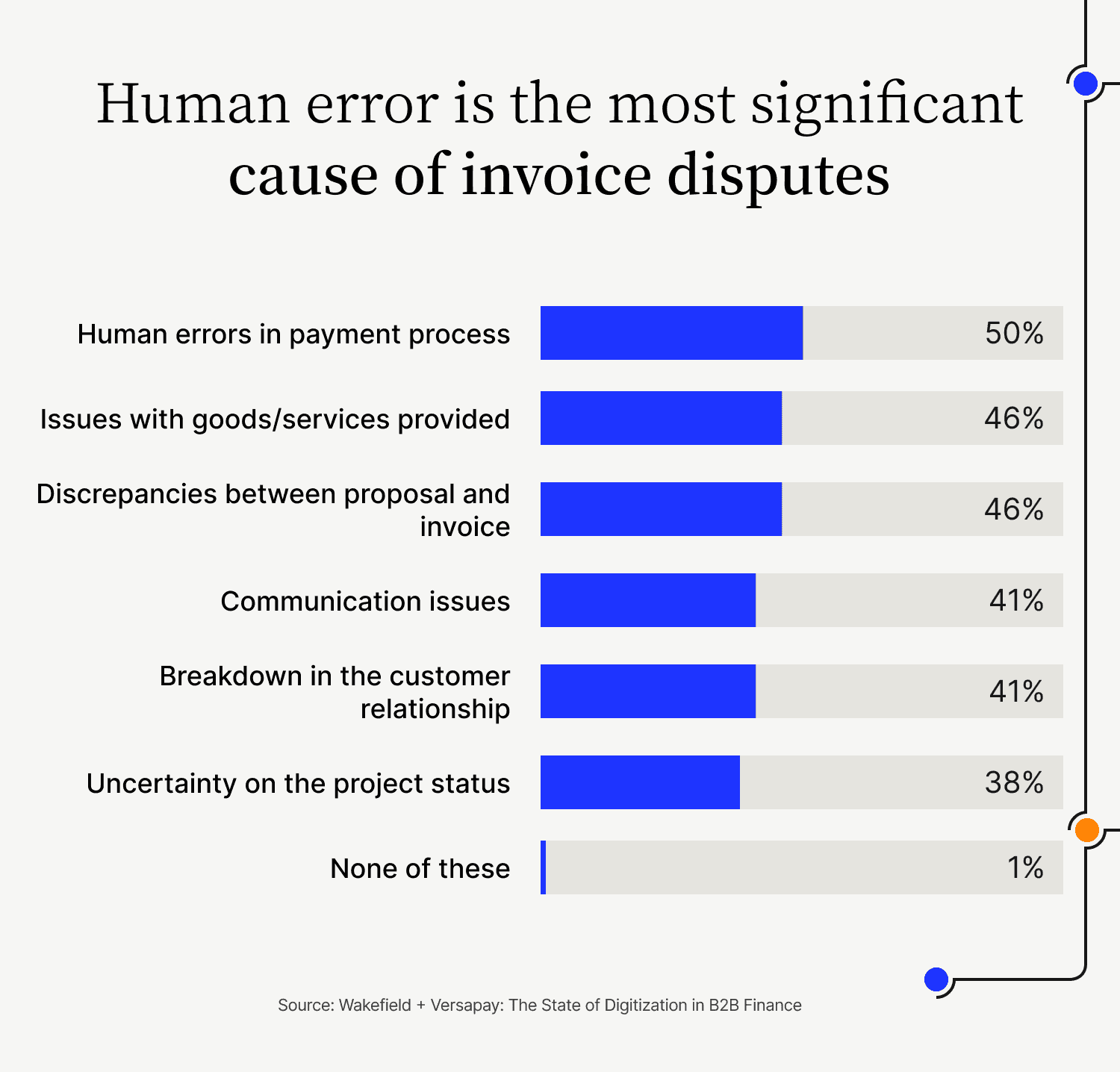

Invoicing inconsistencies caused by human error are one of the most common causes of customer disputes.

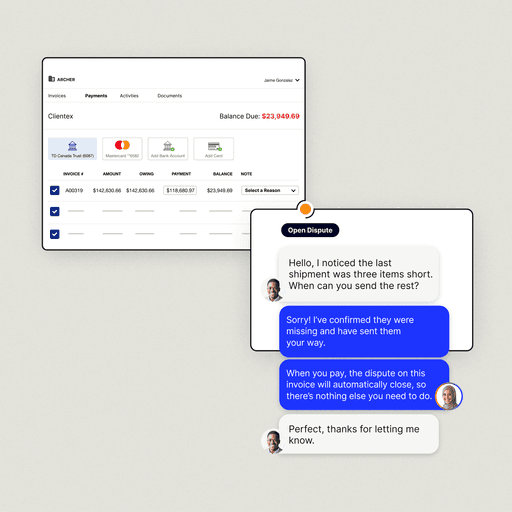

Accounts receivable teams can avoid price, quantity, and credit term errors by integrating cloud-based AR automation technology with their financial management tools. For instance, a collaborative accounts receivable payment portal can ingest relevant invoice data from your ERP, ensuring invoices posted and delivered to customers contain the most accurate customer data.

Once created, these invoices can be delivered to customers via their preferred channel and format, eliminating unnecessary back and forth. For instance, an AR team can use a cloud-based, collaborative payment portal's API to deliver invoices to an AP portal.

The result is fewer hurdles preventing a customer from paying, leading to faster invoice payments.

2. Collaborative technology ensures great customer experience

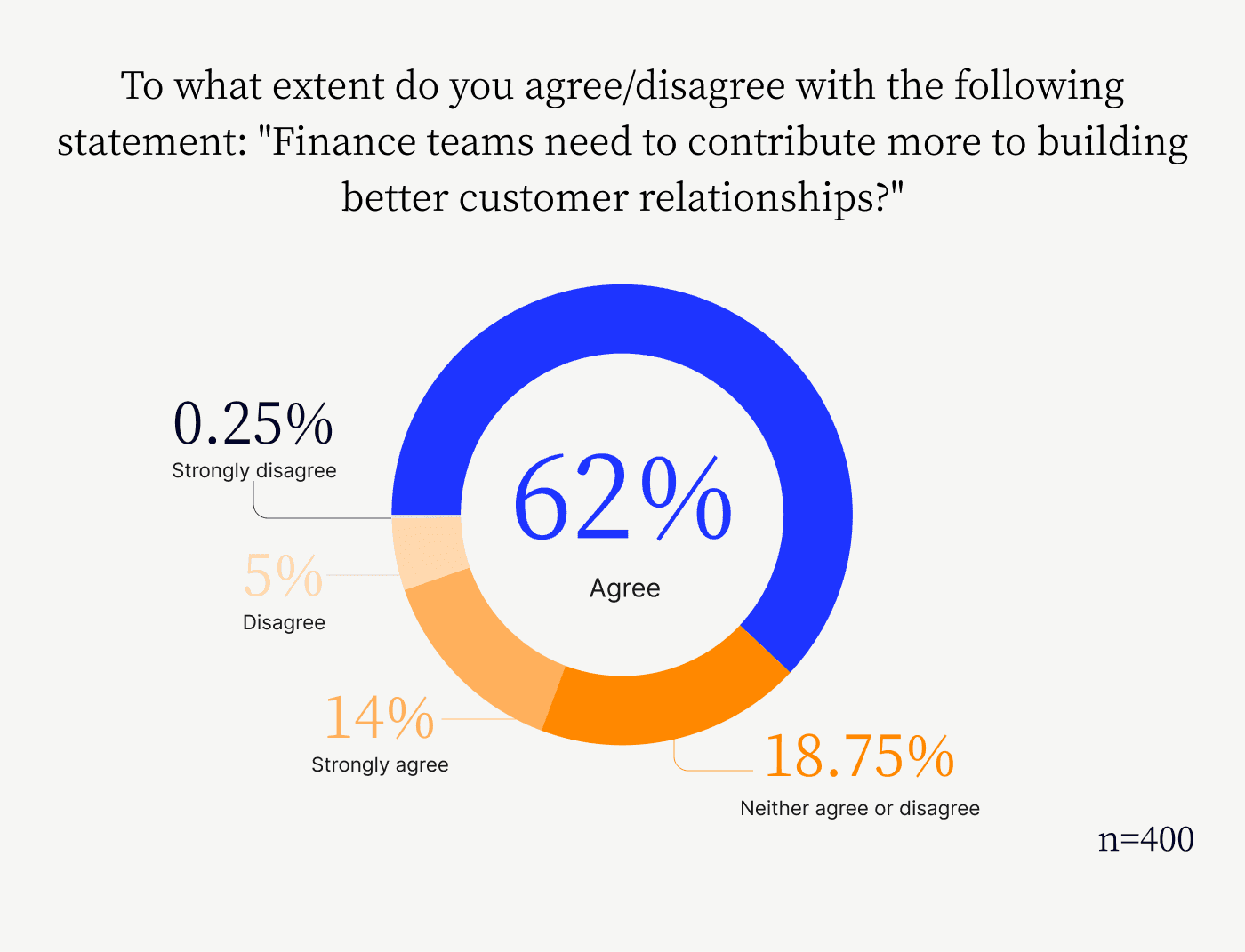

Customer experience in a modern business is a company-wide effort, and finance can lead the charge. Unfortunately, 76% of respondents to our survey admit that finance needs to improve its CX delivery.

Collaboration capabilities delivered through digital transformation initiatives is the solution. A collaborative accounts receivable payment portal for instance aligns AR teams around customer objectives and eliminates friction in communication or invoicing. By centralizing data, a collaborative AR payment portal offers customers visibility into invoice statuses, payments, and disputes.

The result is a well-informed customer and an AR team that quickly responds to any issues.

3. Collaborative technology reduces invoice processing costs

Tools that foster collaboration between AR teams and their customers’ AP teams remove highly-avoidable errors such as price or order quantity issues from the equation. As a result, accounts receivable teams can spend more time applying cash and monitoring significant customer disputes that need personalized attention.

With more of the AR process automated and less manual time spent solving issues, invoice processing costs decrease. Plus, highly-qualified AR personnel can generate more value for their companies by delivering greater CX and offering CFOs critical cash flow insights.

—

Mid- to upper-midsized companies suffer from significant, quantifiable invoice processing issues, creating revenue and customer experience losses. Improved communication and collaboration within all accounts receivable functions—powered by a collaborative accounts receivable payment portal, is the solution to untangling this invoicing logjam.

Learn more about how you can set your organization on the path to better invoicing today.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.