Navigating Visa's Commercial Enhanced Data Program: What B2B Merchants Need to Know

- 10 min read

Visa's Commercial Enhanced Data Program (CEDP) represents one of the most important changes to commercial card processing in recent years, and the time to prepare is now.

The B2B payments landscape is undergoing a significant transformation. Visa's Commercial Enhanced Data Program (CEDP) represents one of the most important changes to commercial card processing in recent years, and it's coming faster than many businesses realize. With full enforcement beginning October 17, 2025, the time to prepare is now.

At Versapay, we've been closely monitoring these developments and working proactively to ensure our customers are not just prepared but positioned to turn compliance into competitive advantage. This comprehensive guide will walk you through everything you need to know about CEDP and how it affects your business.

Understanding Visa's Commercial Enhanced Data Program

Visa's Commercial Enhanced Data Program is a nationwide initiative designed to improve the quality of transaction data on business credit card purchases. Think of it as Visa raising the bar significantly on the Level II and Level III data that merchants submit with each transaction.

Previously, simply attempting to provide enhanced data was often enough to qualify for lower interchange rates. Under CEDP, that approach no longer works. Visa now requires complete, accurate, and descriptive transaction data, not just placeholder information or generic descriptions.

The program centers around robust validation technology that will examine every transaction for data quality. Merchants who consistently meet these higher standards will earn "verified merchant" status and receive preferential interchange rates. Those who don't will face higher processing costs and potential penalties.

Key changes and timeline

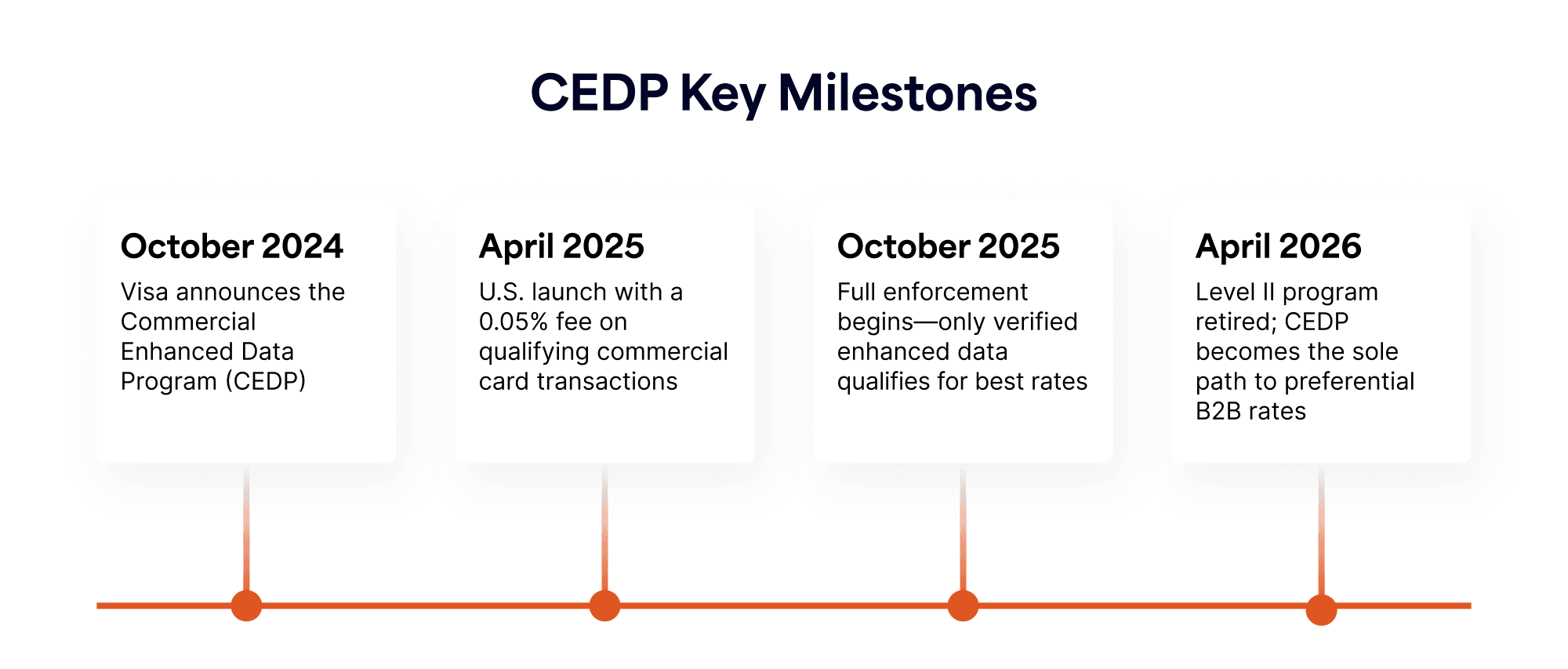

The CEDP rollout follows a carefully structured timeline that every B2B merchant should understand:

- October 2024: Visa officially announced the Commercial Enhanced Data Program, putting merchants on notice that significant changes were coming to data standards and interchange qualification rules.

- April 2025: The program launched in the U.S. with the introduction of a new 0.05% "participation" fee on commercial card transactions that include Level II or III data. This fee serves as an incentive for merchants to comply with the program while Visa begins initial data quality validations.

- October 17, 2025: This is the critical enforcement date. Starting on this date, Visa will fully enforce CEDP standards. Only transactions from verified merchants providing complete, accurate enhanced data will qualify for the best "Product 3" interchange rates. Merchants with poor data quality will see their transactions downgraded to higher interchange categories.

- April 2026: Visa will retire the old Level II program entirely. At this point, CEDP and its stricter standards will be the only path to preferential rates for B2B credit card transactions.

The stakes: verified vs. non-verified status

Under CEDP, merchants will fall into one of two categories, each with dramatically different cost implications:

- Verified merchants consistently submit complete and accurate Level II/III data for qualifying transactions. These merchants earn verified status in Visa's system and become eligible for reduced CEDP (Product 3) interchange rates on all qualifying sales. Importantly, verified merchants don't need a perfect record; minor occasional errors are tolerated if issues are infrequent.

- Non-verified merchants fail to consistently provide the required enhanced data, often because their data is missing, incomplete, or consists of generic placeholder information. These merchants lack verified status and are not eligible for interchange incentives. Their transactions are frequently downgraded, incurring higher fees, and they risk removal from Level III pricing eligibility if problems persist.

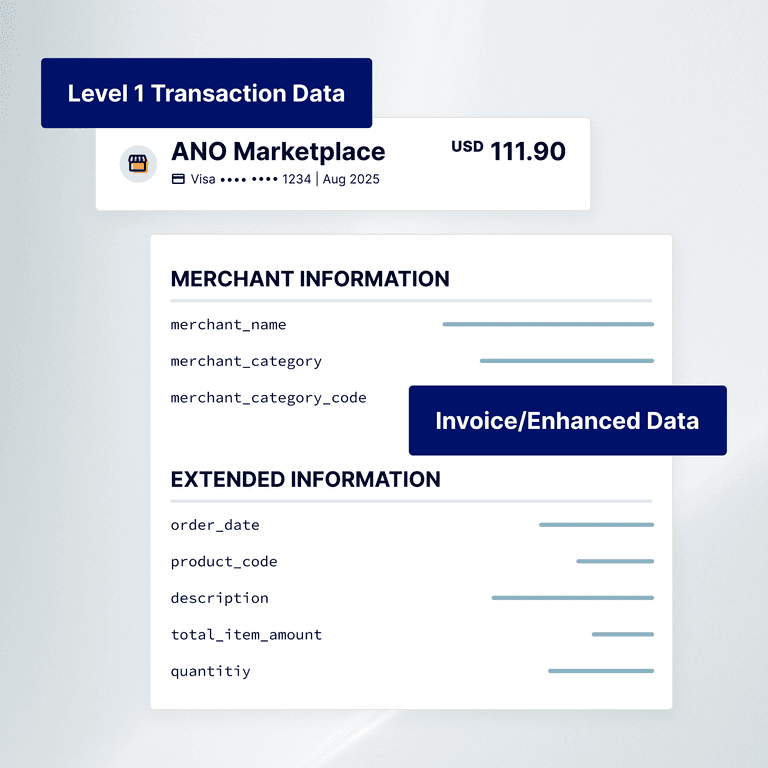

What enhanced data actually means

The enhanced data requirements under CEDP are comprehensive and detailed. They include:

- Product descriptions and quantities

- Unit costs and extended amounts

- Tax information and freight costs

- Merchant and supplier tax IDs

- SKU numbers and item codes

- Line-item details for every product or service

This isn't just about filling in fields with any information. Visa's validation technology will identify generic descriptions, placeholder data, and artificially generated content. The data must be real, accurate, and descriptive of the actual products or services being sold.

The business impact: benefits and consequences

Benefits of CEDP compliance

Achieving and maintaining verified status under CEDP offers several significant advantages:

- Lower interchange rates: Verified merchants qualify for the new Product 3 interchange rates, which are lower than the traditional Level 3 rates. This represents tangible savings on every qualifying transaction, with Visa explicitly offering interchange incentives at settlement.

- Avoiding downgrade fees: Complete, accurate data ensures transactions aren't downgraded to higher-cost categories. Under CEDP, incomplete or non-compliant data automatically triggers downgrades to standard corporate card rates, which carry significantly higher fees.

- Faster settlement: Visa has indicated that providing accurate, detailed data can accelerate settlement by streamlining validation processes. Faster settlement improves cash flow by getting funds to merchants more quickly.

- Reduced chargebacks and disputes: Enhanced data includes line-item details that help resolve disputes before they escalate. When buyers see rich detail on their statements and reports, there's less ambiguity about what was purchased, which can help mitigate chargebacks and make dispute resolution easier.

- Improved customer relationships: Many B2B customers, particularly larger companies, want detailed transaction data for their own accounting and procurement processes. By providing this level of detail, merchants position themselves as easy partners to work with and support the increasing automation of purchasing and finance functions on the buyer side.

Consequences of non-compliance

The risks of ignoring CEDP requirements are substantial:

- Higher processing costs: Merchants who don't provide the required data will pay higher interchange rates. Transactions without accurate enhanced data won't qualify for Level 3 or Product 3 rates and will be assessed at higher tiers, effectively leaving money on the table while potentially incurring the additional 0.05% fee.

- Loss of program eligibility: Visa has made it clear that merchants consistently failing to meet data standards will lose verified status and won't be eligible for Level 3 incentives at all. In extreme cases, acquirers can remove merchants from Level 3 pricing programs entirely due to non-compliance.

- Operational disruption: Merchants who ignore CEDP may find themselves caught unprepared when enforcement begins in October. This could lead to unexpected billing adjustments, customer service issues, and a scramble to implement fixes under pressure rather than in a controlled, planned manner.

- Competitive disadvantage: If competitors achieve lower costs through interchange savings or can offer smoother billing processes to customers, non-compliant merchants may find themselves at a significant disadvantage in the competitive B2B marketplace.

Why Visa is making these changes

Visa's motivation for CEDP extends beyond simply increasing revenue. High-quality transaction data benefits the entire payments ecosystem. Corporations and government agencies using commercial cards get better reporting and easier reconciliation when detailed data is passed through. Card issuers can manage their programs more effectively. Merchants who provide comprehensive data not only earn lower rates but also gain valuable insights into their own sales patterns and customer behavior.

From Visa's perspective, the program aligns everyone's interests: merchants who invest in quality data submission are rewarded with lower costs, while those who don't face higher costs that reflect the additional manual processing and risk their incomplete data creates.

How Versapay is preparing you for success

At Versapay, we've been at the forefront of B2B payments innovation for years, and CEDP represents exactly the kind of industry evolution we help our customers navigate successfully.

- Deep Level 3 data experience: Handling enhanced payment data isn't new territory for us. Versapay's solutions have long supported passing Level II/III data from ERPs through to processors. Our team understands the technical complexities of invoice-level data because we've built integrations for it for years, ensuring our gateways and integrations can capture all the required fields for CEDP compliance.

- Proactive product development: As Visa rolls out CEDP, our product and engineering teams are working to update our platforms. Our payment gateway and merchant portals are being enhanced to comply with CEDP requirements end-to-end, with mapped data fields and updated systems that flag for compliance automatically.

- Unified platform advantage: Many of our customers are leveraging Versapay's Unified Payments platform, which consolidates payment processing with our AR Automation solution. This unified approach provides clear visibility into transactions and data while ensuring that compliance features like CEDP allow you to focus on your business rather than payment plumbing.

- Partnership and advocacy: We're working closely with our partners to clarify requirements and advocate for our merchants. We monitor industry developments and best practices to provide you with the most informed guidance possible.

Immediate steps you can take

The actions you need to take depend on how you're currently processing payments:

- If you use Versapay integrations: We'll be releasing updates to ensure compliant data is passed to Visa automatically. However, you’ll need to review your ERP systems and your current versioning. We also recommend reviewing the data your finance team enters into invoices and customer records to ensure its granular and accurate.

- If you've built your own integration: In addition to reviewing your internal data quality, you'll need to ensure your integration passes all required fields correctly. This means auditing your current data submission processes and updating them to meet CEDP standards.

- For all merchants: Start by reviewing your current B2B card transaction volumes, assessing your enhanced data submission capabilities, and identifying any gaps in your Level 3 data collection processes.

Turning compliance into competitive advantage

Smart businesses don't just comply with new regulations; they use them as opportunities to optimize operations and gain competitive advantages. Enhanced data submission doesn't just help you avoid fees; it provides richer transaction insights that can improve financial reporting, vendor management, and purchasing analytics. This is where Versapay's unified approach truly shines.

Versapay payment platform differentiators: CEDP-ready enhancements

- Delivery: Data is transmitted seamlessly at the point of sale or through our API integrations, ensuring that enhanced fields—such as tax details, itemized line-items, and purchase order information—are delivered with every eligible B2B transaction. This consistent delivery improves data quality across channels and increases your likelihood of receiving interchange savings.

- Compliance: Our system is built to align with Visa’s October 2025 CEDP mandate, providing merchants with peace of mind that every transaction is compliant. By submitting validated Level 3 data, your business avoids costly downgrades, secures preferential interchange rates, and demonstrates adherence to Visa’s Enhanced Data Quality Program standards.

- Format: Our platform ensures that transaction data is sent as captured, in the precise Level 2 and Level 3 formats required by Visa’s CEDP. This reduces errors, and guarantees that each transaction is packaged in the correct structure to maximize interchange.

When you're providing comprehensive transaction data, you're not just meeting Visa's requirements, you're creating a foundation for better business intelligence, improved customer service, and streamlined operations that can drive growth and efficiency improvements across your organization.

Looking ahead: your next steps

CEDP represents a fundamental shift in how B2B payments will work going forward. The merchants who adapt early and thoroughly will enjoy lower costs, better data, and competitive advantages. Those who wait or approach compliance minimally will face higher costs and operational challenges.

At Versapay, we're committed to keeping you ahead of the curve, not just helping you keep pace with it. Our team is already working on platform enhancements that will make CEDP compliance even more seamless for our customers.

For the most current information about CEDP and how Versapay is addressing these changes, visit our dedicated CEDP Resource Center. We'll be updating this resource continuously as new information becomes available and as we roll out additional platform enhancements.

If you have questions about how Visa's Commercial Enhanced Data Program might affect your business, or if you'd like to discuss your compliance strategy, don't hesitate to reach out to your Customer Success Manager or contact our team directly.

The future of B2B payments is here, and with the right preparation and partnership, CEDP can be an opportunity rather than just a compliance requirement. Let us help you turn these changes into competitive advantages for your business.