Why Electronic Invoices (EIPP) Are Best For Your Business

- 13 min read

In this article, you'll learn why invoicing and collecting payments from customers electronically (as opposed to manually) is the best way to create an accounts receivable process that benefits your business.

Are you struggling to create an efficient, accurate invoicing process that serves your customers, your staff, and your bottom line? Invoicing and payment processes are by nature complex and can be the source of many problems for businesses of all sizes.

The problem for business-to-business (B2B) accounts receivable teams often lies in the inefficiencies of manual paper invoicing.

The answer can be found in electronic invoice presentment and payment (EIPP), a solution that is also commonly called electronic invoicing or e-invoicing.

The electronic invoicing process is faster and easier than paper-based invoicing, as well as less prone to error and more apt to satisfy customers. Invoicing and collecting payments from customers online is the best way to create an accounts receivable (AR) process that benefits your business.

What’s in this article

5 reasons why businesses must transform their invoicing process

An efficient accounts receivable process is key to ensuring operational efficiency and driving sustainable cash flow. Not only that, but accounts receivable teams are uniquely positioned to influence customer experience, as a frictionless AR process is a lynchpin of customers’ interaction with your company.

Invoicing is the critical AR function that can enable businesses to accelerate cash flow, increase efficiencies, and deliver a stellar payment and collections experience that keeps customers coming back. But all these benefits can only flow if your invoicing process is optimized for electronic invoicing and payment.

Traditional paper-based invoicing presents many problems, all of which can be substantively solved by taking the process online. These problems include (but are not limited to):

Taking up time and resources, incurring costs

Being slow and cumbersome, slowing down cash flow

Delivering poor and disjointed communications

Introducing errors that cause delays and disputes

Driving staff and customer dissatisfaction

1. Manual invoicing takes up time and other resources, incurring costs

Sending paper invoices and processing payments by hand is very time-consuming and uses a lot of materials such as paper, envelopes, and ink. In one case, a credit management team spent more than three-quarters of its time on creating and mailing paper invoices, fielding customers’ questions over the phone, and processing manual payments such as checks.

The resource-intensive nature of this process is costly, cutting into profits.

Ernie Humphrey—CEO at Treasury Webinars, CEO & Founder at 360 Thought Leadership, and Chief Community Evangelist at The Finance Collective Community—gives finance leaders this advice about the consequences their teams face in not digitizing their invoicing presentment and payment processes:

“Inefficient AR processing costs companies to the tune of thousands, if not tens or hundreds of thousands of dollars, yearly. Unaddressed inefficiencies are an inherent drag on the bottom-line year after year, yet when they are addressed, a company will see a meaningful impact to its working capital.”

Ernie expands on this by saying that, “Inefficient processes create friction with customers, which leads to delayed payments, lost revenue, and in the worst cases, customer churn. Internally, inefficiencies can cause frustration across the receivables department, affecting productivity, increasing employee turnover, and hurting the recruitment of top-tier collections talent as modern professionals expect technology that empowers their productivity; not hinders it.”

2. Manual invoicing is slow and cumbersome, leading to sluggish cash flow

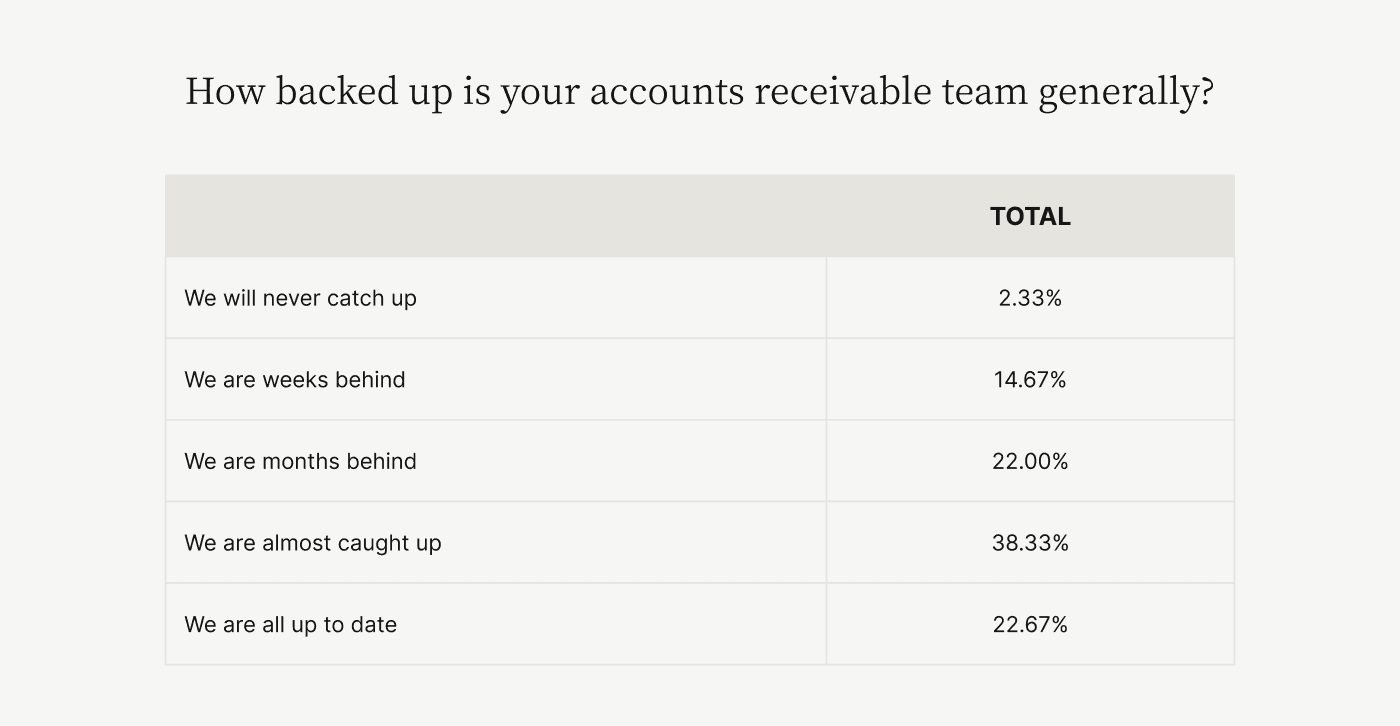

Manual invoicing processes are laborious, leaving AR teams struggling to keep up with the volume of work and causing ongoing slowdowns in receiving payments.

A study by Versapay and Wakefield found that 39% of accounts receivable teams are weeks or months behind on invoicing and collections work.

And at most upper-midsized companies (those with revenues of $250 million or more), 50% of CFOs say their accounts receivable teams process at least 2,500 invoices monthly—a forbiddingly heavy workload to manage manually.

3. Manual invoicing often leads to poor and disjointed communications

Communications associated with manual invoices—between buyers and sellers—are largely conducted by email and phone. This can be time-consuming for accounts receivable teams and frustrating for customers’ accounts payable teams.

Communicating in this way requires teams to discuss questions and disputes with customers without the ability to share supporting data in real time.

According to Humphrey, “Accounts receivable done right by a company, leads to accounts payable done right by the client. Communicating that perspective to a customer can be a game changer.

“If AR teams can work more closely with their customers and align on an invoicing and processing experience, they can mitigate AP processing costs and help deliver predictability to their customers’ payments, boosting everyone’s working capital management.”

“The goal should be to deliver a frictionless payment experience to customers, and to have every communication—from AR to a customer—have a purpose,” says Humphrey. “Communications from AR teams with customers should be classified with a purpose, have a desired action, and the effectiveness in inspiring the action should be tracked. Communications with the wrong tune, messaging and/or frequency damage customer relationships.

“This leads to delayed payments or non-payment of invoices. In addition, AR teams need to collaborate with sales colleagues in managing customer relationships. Misalignment in communications with customers causes friction which can damage the bottom line.”

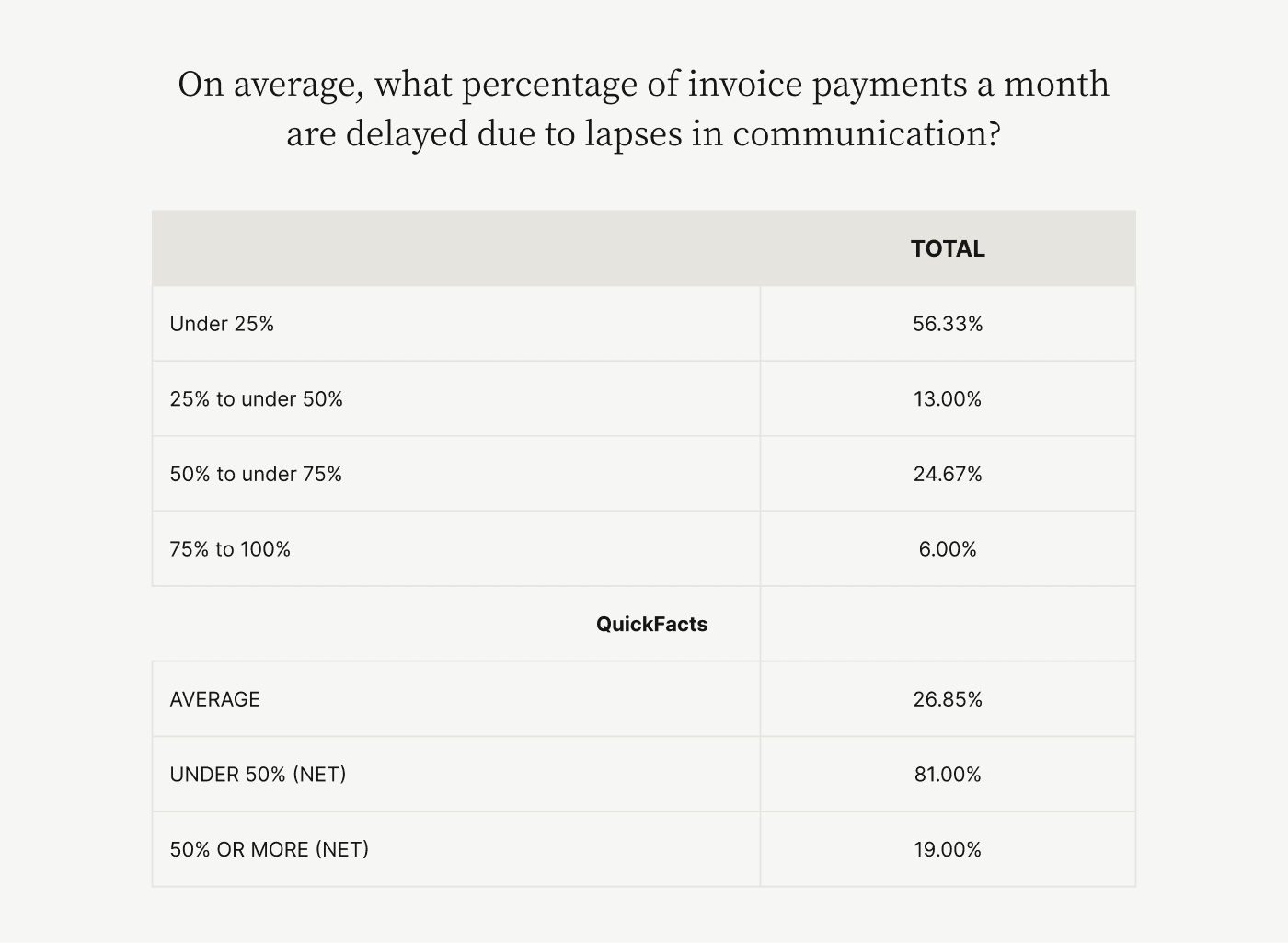

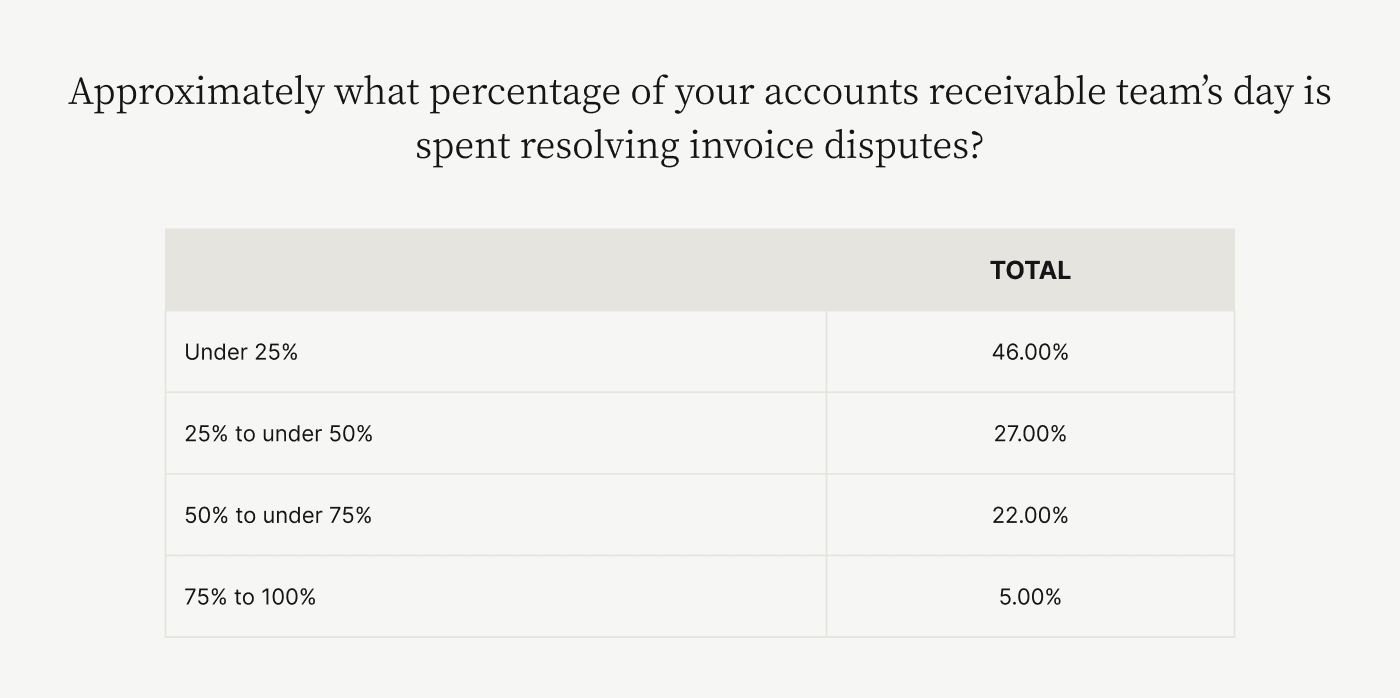

It’s no surprise that 69% of CFOs say communication is a top challenge for their AR teams. It’s also no surprise that a substantial volume of monthly invoice payments are delayed and more than a quarter (27%) of CFOs report that half or more of their AR teams’ workdays are spent resolving invoice disputes as a result of communication lapses.

4. Manual invoicing often introduces errors that cause delays and disputes

Manual invoicing is prone to error at all stages of the process, from billing to delivery to cash application. This is especially the case when an accounts receivable team is processing a high volume of invoices (as most are).

Identifying and fixing errors that have been introduced through manual intervention can be difficult, yet unresolved errors lead to disputes and cause delays in receiving payments—a major problem for business operations.

5. Manual invoicing often results in staff and customer dissatisfaction

Manual invoicing processes are time-consuming not only for AR teams, who become dissatisfied when doing a large amount of rote work and spending a lot of time on disputes. Versapay and Wakefield research finds that 27% of AR teams spend at least half of their workdays on dispute resolution, a type of work that provides little satisfaction.

Cumbersome invoicing processes are also challenging for customers’ accounts payable teams that must process and respond to mailed or emailed invoices. Customers find inefficient, error-prone invoicing processes to be a major strike against a supplier.

What is the difference between e-invoicing (EIPP) and traditional invoicing

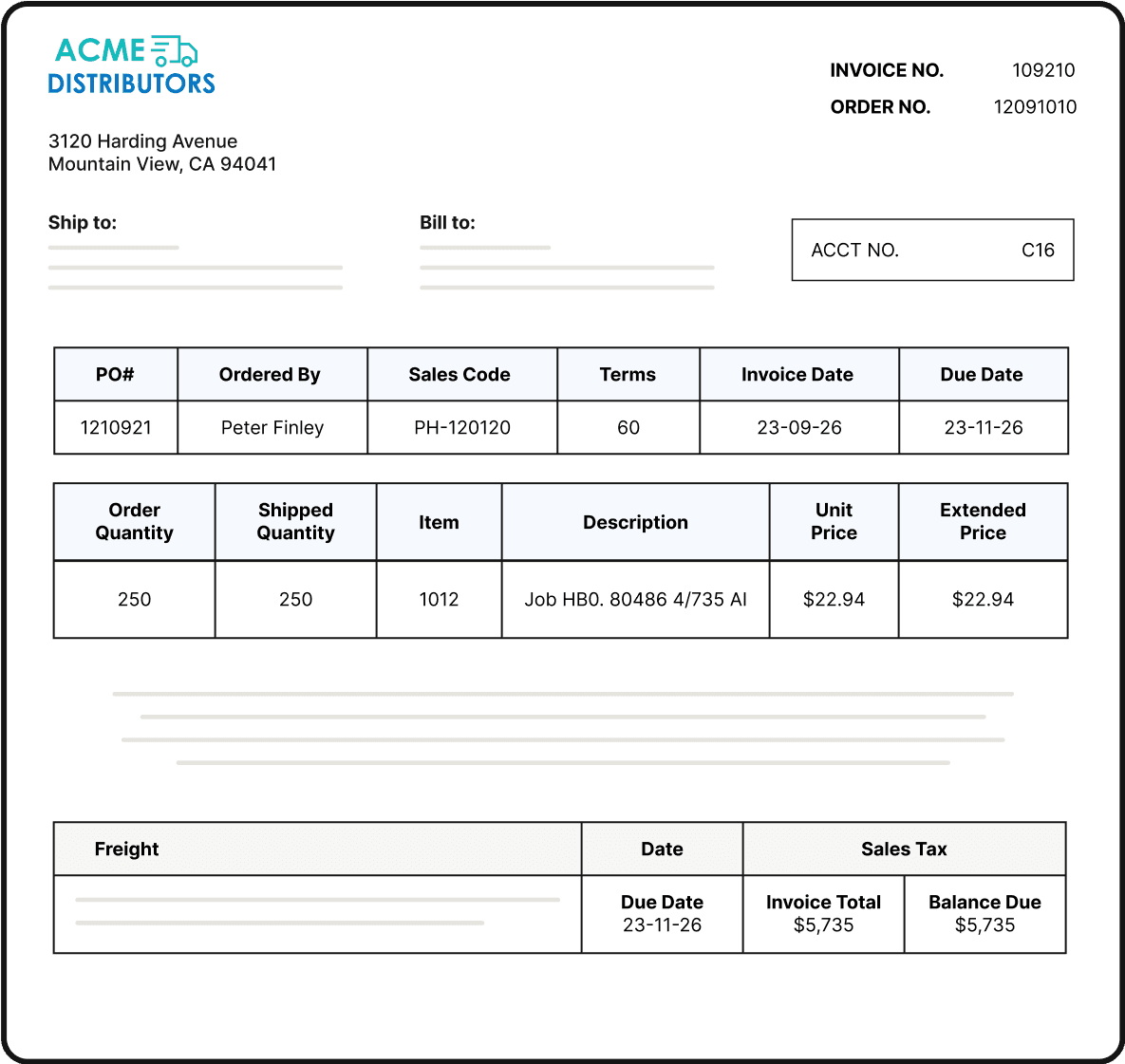

Electronic invoice presentment and payment involves using a software application to generate and send invoices and to receive and record payments electronically. EIPP software is usually integrated with enterprise resource planning (ERP) systems, allowing you to make best use of all of your systems and data in the invoicing and cash application processes.

EIPP software produces and delivers e-invoices automatically with little or no human input, and these invoices are usually received and routed by software on the buyer’s side, where a human staffer will review and transmit payment electronically. (Alternatively, some EIPP solutions will leverage accounts receivable payment portals that let buyers easily review and pay invoices online, accelerating your cash flow and improving CX.)

Manual invoicing, on the other hand, is based on PDF or paper invoices that staff members mail or email as attachments. These invoices must be received and routed by a human on the customer side, where the AP team must manually input its data into their system to process the invoice for payment.

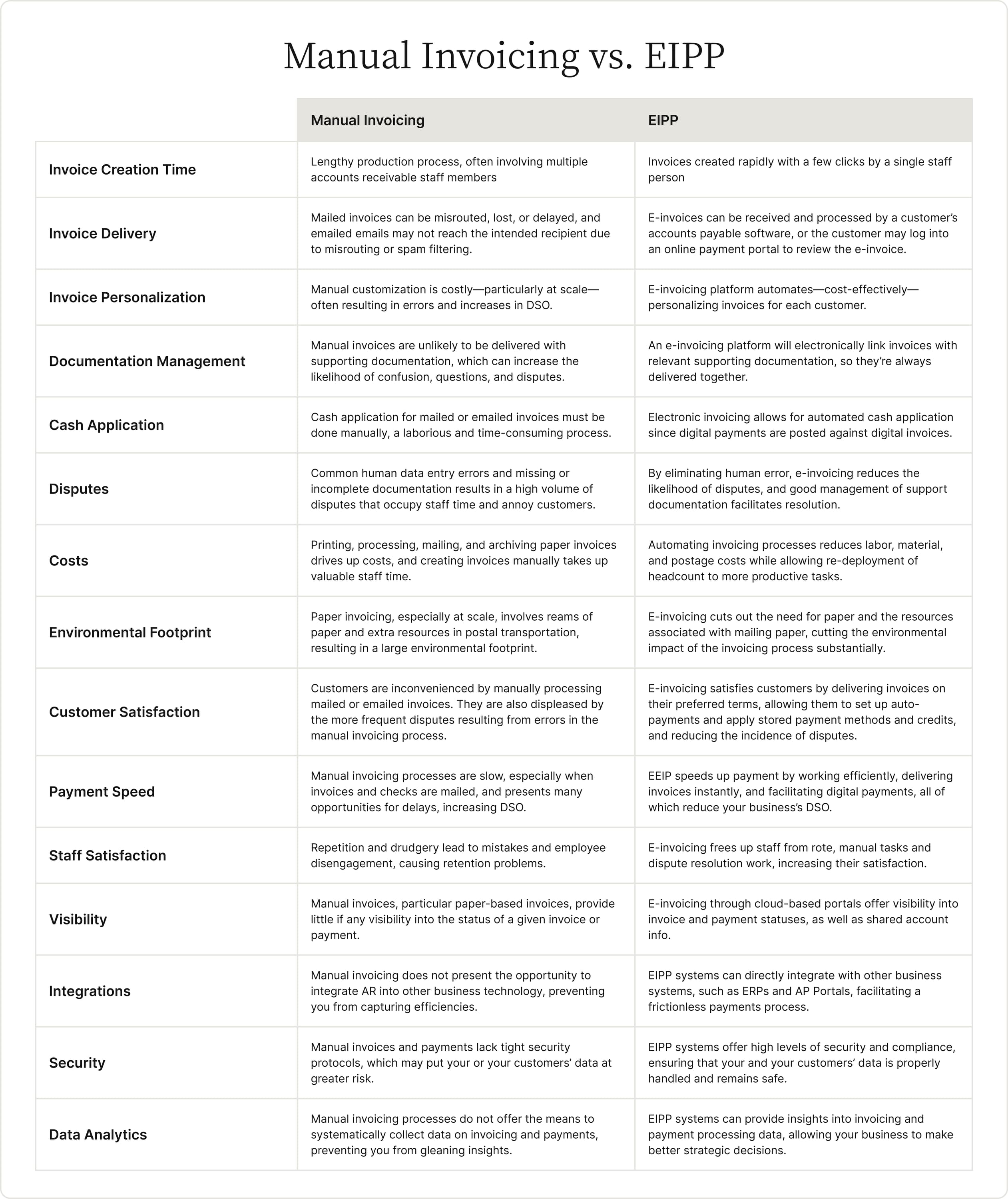

The differences between these two processes are profound and result in notable advantages for companies using EIPP. Here’s a chart that details the differences between manual invoicing and electronic invoice presentment and payment solutions.

8 reasons your business should use electronic invoices

EIPP is the best choice for businesses that process any substantial volume of invoices on a weekly or daily basis. Even midsized companies may see a positive ROI with this technology as a result of greater efficiency, reduced errors and disputes, and faster cash flow.

According to Humphrey, businesses considering digitization as a means to drive efficiencies should closely examine their invoice presentment and payment processes. That’s because EIPP can, “Improve productivity within and beyond accounts receivable, improve customer relationships, lower payment processing costs, improve team engagement, retention and recruitment, and improve working capital management.”

Here are 8 additional reasons why your business should use electronic invoices:

1. Delivery at scale

Electronic invoicing provides you the ability to quickly and accurately send the volume of invoices your business needs to grow and thrive. Conversely, manually processing thousands of invoices monthly is a recipe for accounts receivable staff burnout, bogged down processes, and introduction of error.

An e-invoicing system automates the traditional invoicing time sinks that increase workflow times, allowing you to rapidly create and deliver invoices at scale, through the channels your customers prefer.

2. Cost savings

Traditional invoice presentment and payment mechanisms come with high costs for labor and staffing, printing and mailing, logistics, and more. Electronic invoicing reduces costs, including staff time, paper, ink, and postage. In one example, real estate investment trust, RPT Realty, saved about $9,000 annually on postage for invoices by moving to an EIPP system.

💡 Plus, EIPP solutions deliver the added benefit of newly-freed resources that finance managers can then allocate to more strategic initiatives.

3. Accelerated cash flow

Efficient invoice production and delivery means customers receive their invoices promptly and via channels that facilitate fast processing. The ease of payment via customers’ preferred channels—that e-invoicing enables, like email or through AP portals like Coupa—also leads to faster cash flow and reduced DSO.

After all, your customers are more likely to clear their invoices quickly if they’re received through their preferred channels. Doing so ultimately removes any hurdles they may face when initiating payments, resulting in faster payments.

4. Staff productivity and satisfaction

EIPP is often achieved through using an online invoicing and payments portal, or a collaborative accounts receivable tool—like Versapay offers. And while these solutions deliver innumerable tangible benefits (like those noted above), they’re equally as beneficial by productivity measurements.

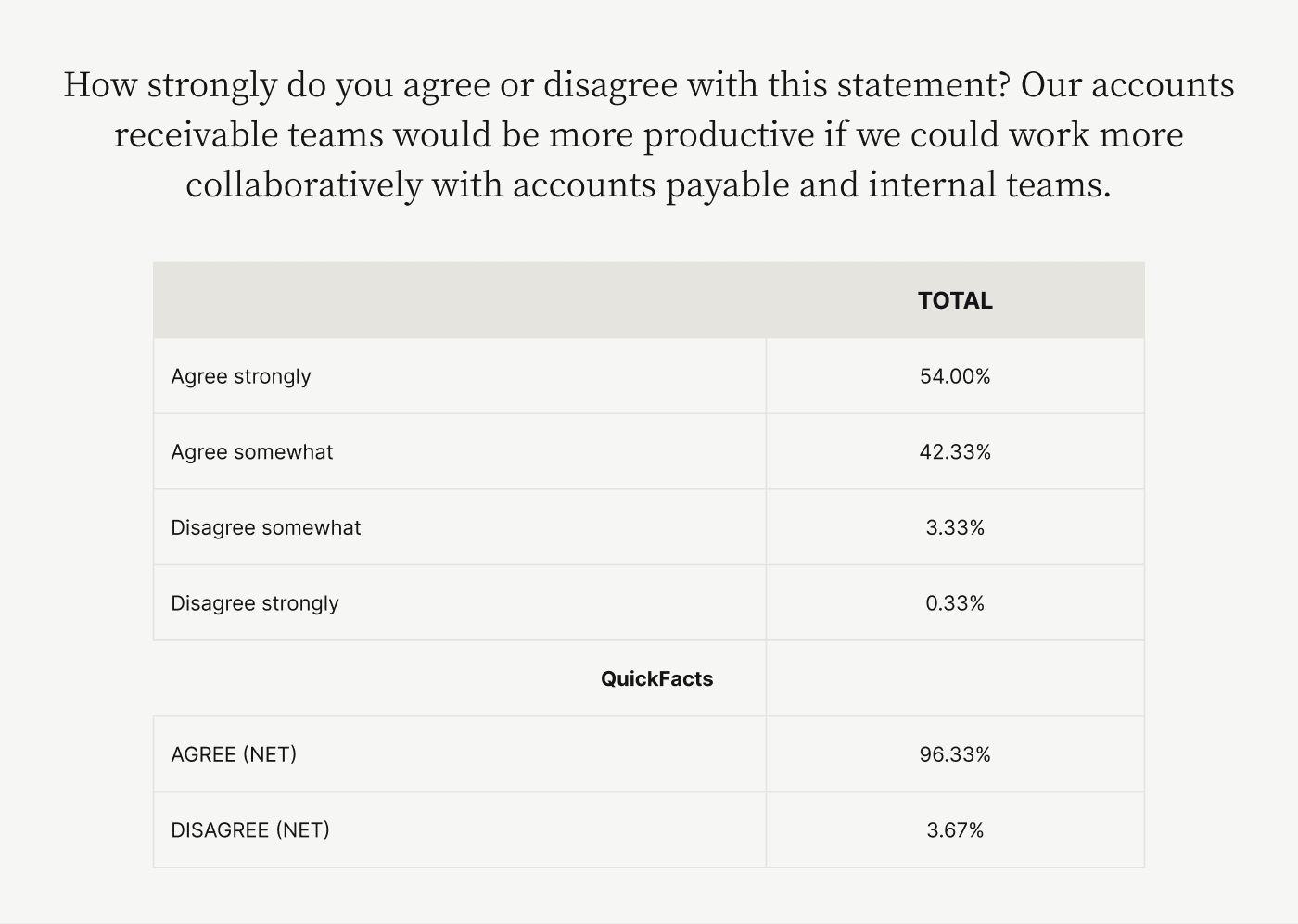

In fact, an astonishing 96% of CFOs say that their AR teams would be more productive if they could work more collaboratively with accounts payable and internal teams—something EIPP enables.

Additionally, more collaboration and less rote work result in staff spending more time on tasks other than invoicing , giving them greater satisfaction in their roles.

5. Better customer experience

Electronic invoice presentment and payment systems allow accounts receivable teams to configure invoices automatically in ways customized to customer preferences, including delivery channels and payment options that customers prefer.

That level of invoice personalization helps you create seamless, branded AR experiences that:

Boost customer satisfaction

Build brand authority and believability

Accelerate cash flow

Optimize invoice delivery

Reduce errors

Mitigate customer disputes

Plus, EIPP enables the ability to make digital payments on digital invoices, which is a major boon to customer experience in the current online-first business environment.

6. Fewer disputes and faster resolution

Good business depends on good customer relationships, and EIPP can help ensure you maintain strong ties with buyers. In fact, 93% of executives surveyed by Versapay said the right technology can strengthen relationships with customers during the invoice-to-cash process.

This is because EIPP reduces manual errors by automating invoice production directly from data sources, like your enterprise resource planning system, resulting in fewer disputes and reducing the cost and aggravation of the AR process to improve customer experience.

7. Enhanced visibility

Collaborative accounts receivable payment portals that facilitate EIPP provide AR teams the ability to see the status of all invoices and payments, along with all documentation for each, in real time. AP teams on the customer’s side can also access invoices, documentation, and communication threads, making invoicing and payment easier and more accurate.

8. Improved invoice approvals process

EIPPis defined by the fast delivery of customized, accurate invoices, as well as their expeditious movement through customers’ approvals processes.

This is because payables teams benefit from better communication and transparency via a collaborative payment portal, customized formatting and preferred payment options, and integration of digital invoicing with their own systems. Their speedy approval means that your company can receive pay faster, accelerating cash flow and benefitting the bottom line.

—

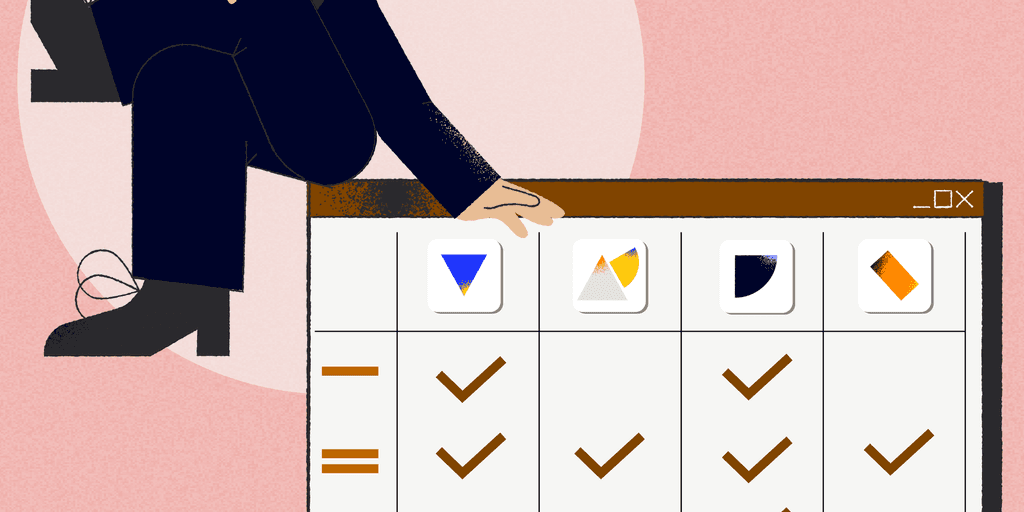

✅ Bonus: Here is a checklist of what to look for in an electronic invoice and presentment solution (note that these checklists use the term portal in place of EIPP; in this instance, the two can be used interchangeably):

Now is the time to adopt EIPP

So, how good is electronic invoicing for your business? Well, judging by the chart we had to make earlier, we’d say pretty good!

And as commerce becomes increasingly digital—particularly with regards to communication, data management, and payment—any company caught in the tangle of paper invoicing will struggle to keep up.

Now is the time to investigate the ways that EIPP can benefit your business. Read more about why EIPP is best for your business in our Executive's Guide to Electronic Invoicing.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.