Paper Check Alternatives: How to Ease Your Transition to Digital Payments

- 15 min read

Checks have all but disappeared from consumer payments. So, why do so many businesses still accept them?

In this blog, you'll discover the top paper check alternatives and best practices to ensure a smooth transition to B2B digital payments.

The paper check's demise in B2B transactions has reached a tipping point. Check and cash payments, which held a majority share as recently as 2019, now account for just 32.1% of B2B transactions in 2024, according to eMarketer. With more than two-thirds of B2B transactions having gone digital, it's only a matter of time before paper checks become essentially obsolete.

This seismic shift in payments presents B2B organizations with a mandate to integrate digital payment acceptance into their accounts receivable processes. Those that take this on will meet customers where they prefer to pay, accelerate payment cycles, reduce processing costs, and keep errors and disputes to a minimum.

Jump to a section of interest

What's wrong with paper checks?

Paper check usage has plummeted over the past two decades for good reason. This antiquated payment method is plagued by numerous inefficiencies and headaches:

1. High costs

Processing a single check costs between $4 – $20 on average, according to the Bank of America. Digital payments like ACH are significantly cheaper, with processors typically charging just $0.25 – $0.75 per transaction or 0.5% – 1% of the total. Exorbitant check processing expenses are compounded by labor-intensive steps like lockbox services, manual data entry, and frequent bank trips—an unnecessary drain for any business handling large check volumes.

2. Snail-paced delivery

If you’re sending paper invoices and receiving paper checks, it can take a long time to get paid. Commercial mail through the US Postal Service takes an average of 4 – 5 days, not to mention the time checks (and invoices) sit in mailrooms or on people’s desks. This inherent unpredictability hinders cash flow forecasting and can cause friction with customers.

3. Ever-present fraud risk

Checks remain the most fraud-targeted payment method, representing 66% of attempted and actual payment fraud cases. While banks work to mitigate these schemes, funds can remain inaccessible during lengthy review processes—a headache no business wants.

4. Office-bound processing

Check acceptance poses a huge logistical challenge. With many teams now working remotely, someone must make the commute just to pick up accumulating check piles. This sporadic physical presence only further delays payment settlement for both sellers and buyers.

Clearly, maintaining a heavy check volume puts a strain on costs, productivity, and security that few businesses can justify any longer. The time has come for B2B organizations to prioritize digital payment modernization and paper check alternatives.

The advantages of digital B2B payment solutions

Fortunately, digital payment software can help you overcome the challenges posed by paper checks. As finance leaders recognize their buyers' readiness to pay for goods and services in digital formats, the tide is turning in favor of these streamlined, automated processes.

By offering digital payment methods to customers, businesses can unlock a host of benefits that can transform accounts receivable and drive efficiencies:

Accelerated and secure transactions

One of the most significant advantages of digital B2B payment methods is the near-instantaneous processing speed. By eliminating lengthy waiting periods, businesses can receive payments more promptly. The reduction in paperwork and manual processes further contributes to the overall efficiency of payment processing. Moreover, digital payments offer enhanced security features, such as encryption and fraud protection, safeguarding businesses and customers from financial losses and data breaches.

Streamlined accounts receivable workflows

Digital B2B payment methods pave the way for streamlined accounts receivable processes that reduce the need for manual work and provide greater visibility and control over cash flow.

Cost savings across the board

Beyond the reduction in staffing costs achieved by minimizing manual AR tasks (e.g., invoicing, payment processing, collections, and cash application), digital payment methods offer B2B organizations a multitude of cost-saving opportunities. Lower mailing and processing fees, decreased administrative expenses, and accelerated payment processing all contribute to a healthier bottom line.

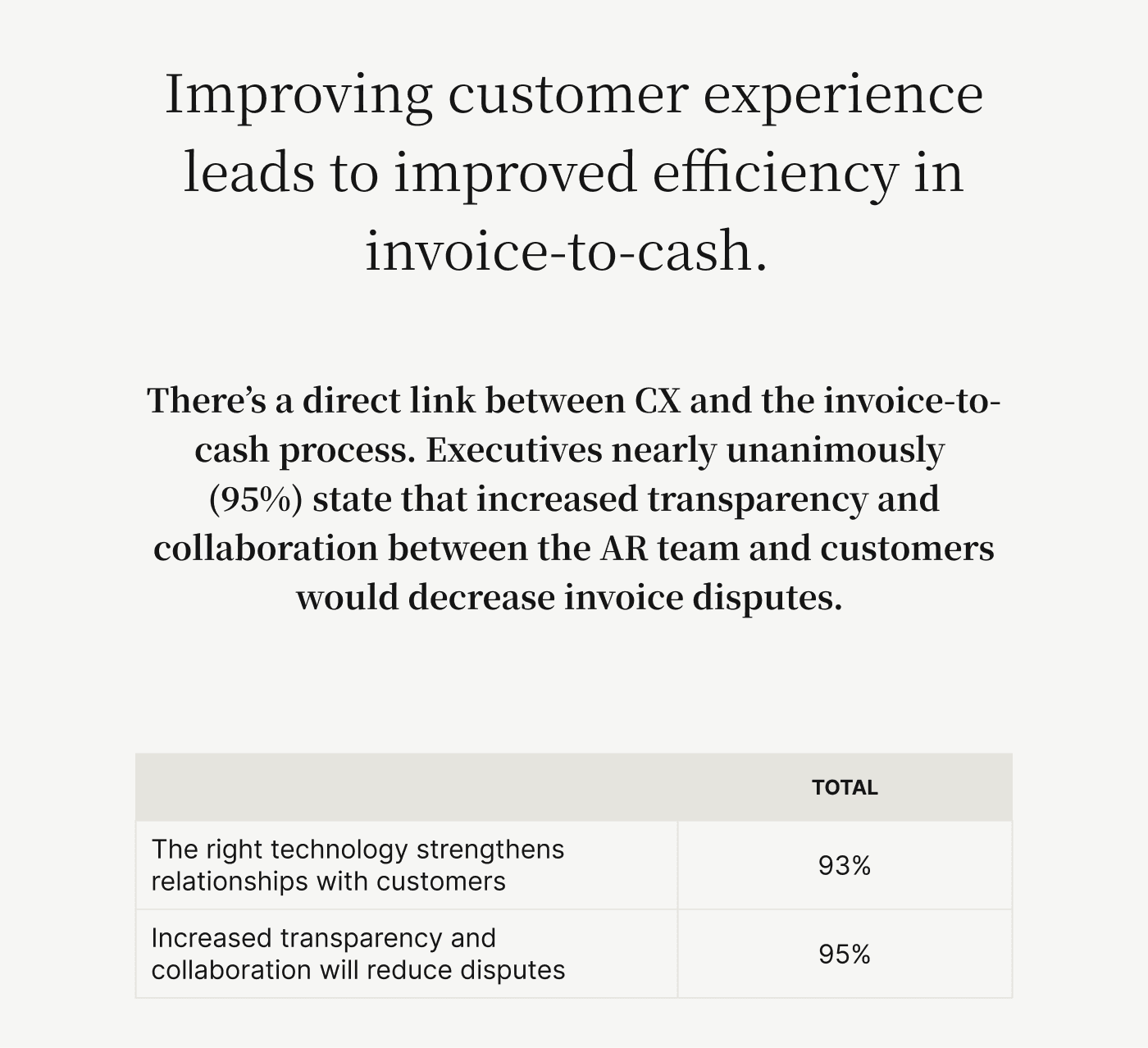

Elevated customer experience

More customers expect the convenience of online payment options, even in the context of large-scale B2B transactions. Digital B2B payment methods cater to this demand by enabling customers to make payments from anywhere and at any time.

Offering a variety of digital payment options allows customers to select the method that best suits their organization's needs, fostering a sense of convenience and control. Furthermore, the enhanced security measures inherent in digital B2B payments help build customer trust and confidence, strengthening the overall relationship between the business and its clients.

Adopting paper check alternatives—like digital solutions—will become a necessity as the B2B payment ecosystem evolves, and those who adapt now will be well-positioned to thrive in the years to come.

Modernize your payments: Top paper check alternatives

Businesses are ditching cumbersome check payments in return for greater efficiency and cost savings. They're turning to a variety of digital payment methods, including:

Electronic funds transfers

Credit and debit cards

Virtual cards

Digital wallets

Electronic funds transfers

An electronic funds transfer (EFT) is any digital transfer of money from one bank account to another, facilitated by computer-based systems with no human intervention required. A popular form of EFT for B2B companies is called an electronic check or eCheck. Electronic checks move through the Automated Clearing House (ACH) network, operated by Nacha (formerly the National Automated Clearing House Association), under the oversight of the Federal Reserve.

Transactions are processed in batches three times per day. Though it used to take 1 – 3 business days for an ACH payment to fully settle,Same Day ACH has allowed for accelerated credit transactions since 2016. ACH payments offer significant cost savings over checks, with transaction fees from payment processors in the $0.25 – $0.75 range.

Credit and debit cards

While more expensive than ACH payments, credit and debit card payments have become prevalent in B2B due to convenience and real-time processing. Unlike ACH, where a transaction can fail even after being submitted if insufficient funds are available, card authorizations ensure payment verification upfront.

Fees from card processors can range from 1.5% to more than 3% of total transaction value. To offset these costs, some B2B suppliers implement surcharges for card payments or use interchange optimization solutions that route transactions through the lowest-cost payment pathways.

Virtual cards

Virtual cards are a specialized form of credit card payment, in which the seller receives a randomly generated, temporary card number linked to the buyer's actual account. This allows for secure, one-time payments without exposing sensitive financial data.

From the seller’s perspective, processing a virtual card payment is just like any other card transaction—the number must be entered manually or processed through a virtual terminal before being recorded in the ERP or accounting system. Automated straight-through-processing solutions are available to streamline this workflow.

Digital wallets

Digital wallets (e-wallets) allow customers to securely store payment credentials and other data like addresses in one convenient app or online service. Popular B2C examples include Apple Pay, PayPal, and Venmo.

In a B2B context, digital wallets enable streamlined checkout experiences, eliminating the need for buyers to re-enter lengthy payment details for each new order: This is especially helpful for recurring payments. Wallets add a strong authentication layer while giving customers flexibility on their preferred funding source behind the scenes.

Sellers that support an array of digital payment options can optimize their receivables operations, reduce costs, improve security, and meet customer demands for a modern, frictionless billing experience.

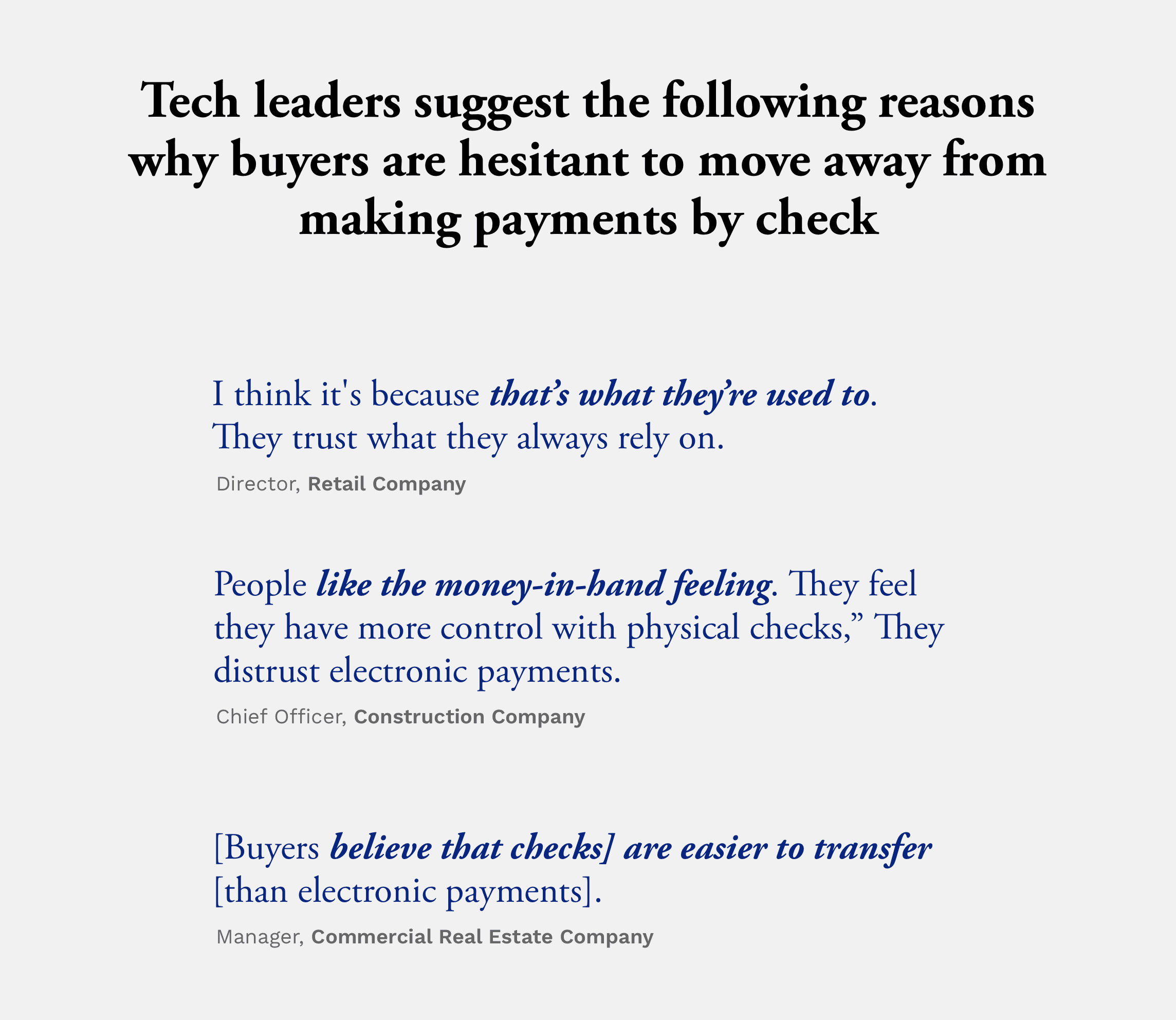

Why do some businesses still use checks?

Despite the abundance of digital payment options, many businesses continue to receive a high volume of physical checks. Much of this stems from entrenched buyer preferences, as some companies are simply comfortable with checks and see no compelling reason to change.

On the seller side, inertia ("we've always done it this way") is a big factor, but other concerns are at play, too: businesses may resist going digital due to worries about updating legacy accounts receivable systems and processes.

For example, ACH payments can create data reconciliation headaches. Remittance details (invoice numbers, amounts, payment methods) often arrive separately from the actual funds transfer and in inconsistent formats, forcing AR staff to waste time on manual matching and data entry.

How to ease your transition to digital payments

Modernizing your payment mix and accepting paper check alternatives doesn't mean abandoning checks entirely. The key is adopting technologies that streamline your acceptance of both traditional and digital payment types. Here are some helpful strategies:

1. Integrate payments with your ERP

In a Versapay survey, 45.8% of CFOs cited concern over their ERP's digital payment capabilities as a top barrier. The solution? A payment platform that embeds directly into your existing systems. Pre-built ERP connectors (or a flexible API combined with implementation services) let you avoid the headache of shuffling data between disparate systems. Payments flow seamlessly into your ledger for automated reconciliation.

2. Automate check handling

For the paper checks you still receive, leverage cash application automation tools that feature capabilities like optical character recognition (OCR) and machine learning to digitize and reconcile them automatically. This eliminates manual keying and matching of check data against open receivables.

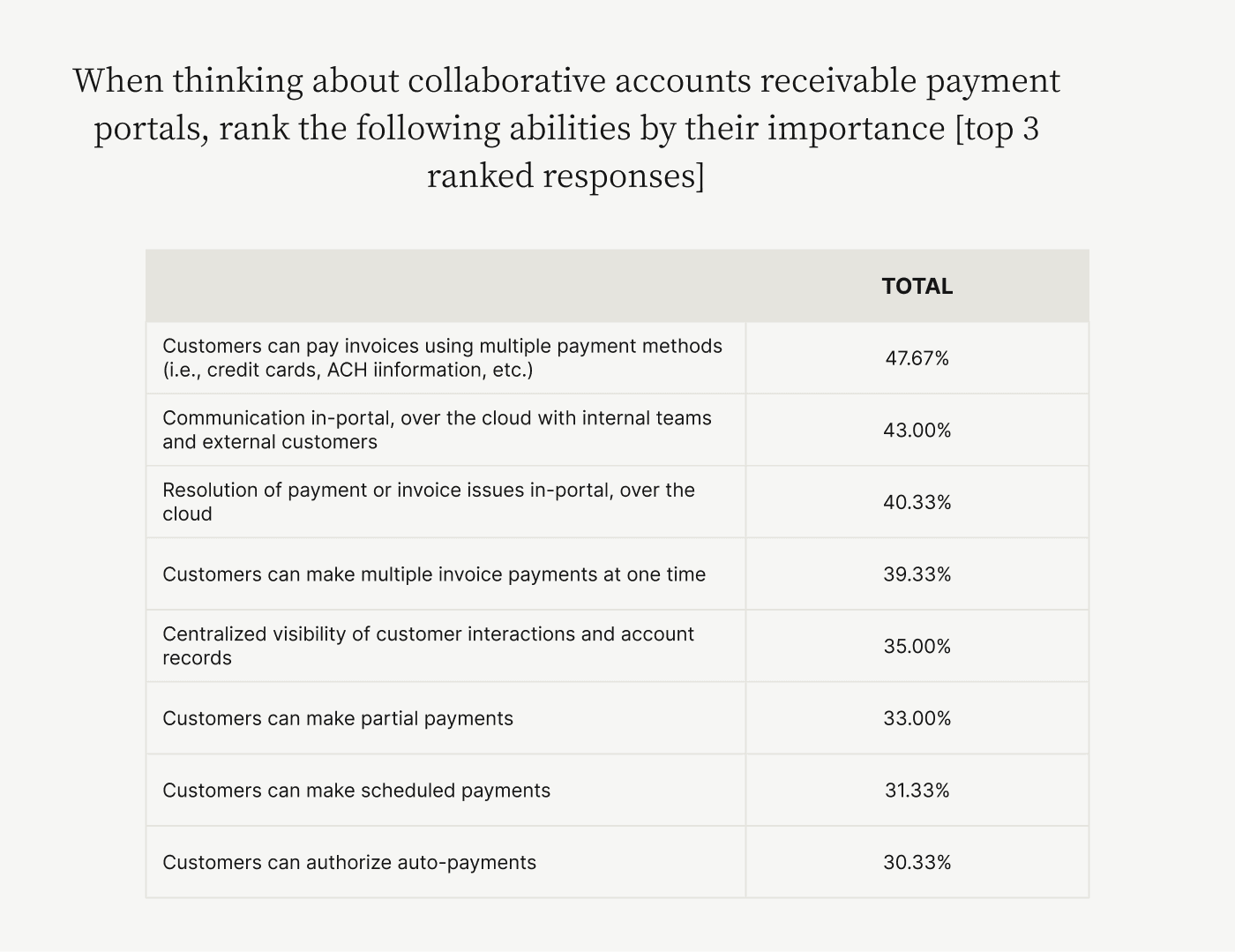

3. Eliminate "decoupled" electronic payments

As we mentioned earlier, a key challenge of ACH is that remittance data often arrives separately from the actual funds. With a collaborative accounts receivable payment portal like Versapay, your customers' digital payments and accompanying remittance data are captured together upfront, eliminating cumbersome reconciliation work.

And for those pesky outliers, advanced cash application solutions can automatically extract this information from emails, accounts payable portals, and other sources, then intelligently match it to corresponding invoices.

4. Deliver a convenient, flexible customer experience

To drive widespread adoption of digital payments, you need to make the process frictionless for buyers. Streamlined workflows like "click-to-pay" invoicing allow customers to quickly complete transactions without the hassle of creating an account or logging in. These thoughtful touches go a long way in encouraging repeat usage.

Start reaping the rewards of digital payments

Shifting to digital payments and embracing paper check alternatives unlocks major efficiency and cash flow gains. You'll accelerate time-to-cash, reduce processing costs, and eliminate complications like check float and non-sufficient funds.

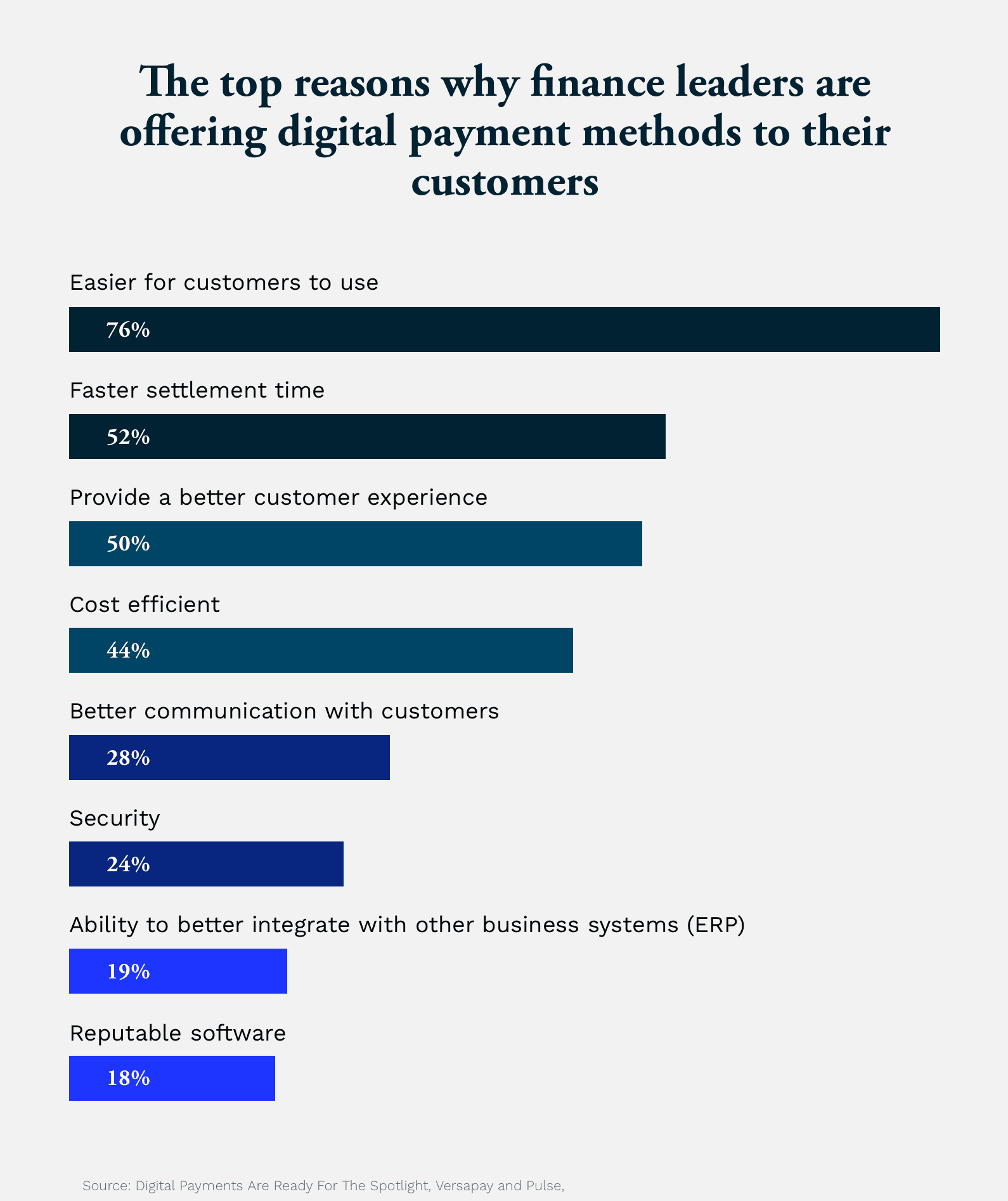

Perhaps most importantly, digital payment options elevate your customer experience. The top reason finance leaders offer these methods is that they're easier for buyers to use, according to 76% of respondents in a Versapay survey.

While check holdouts remain, the majority of B2B buyers now expect the same seamless online payment options they enjoy as consumers. By partnering with the right payment automation provider, you can deliver that modern billing experience without overhauling your back-office systems.

Don't let outdated payment processes hold your business back. To unlock a new era of efficiency, security, and customer satisfaction, talk to a Versapay expert today.

Frequently asked questions about paper checks and paper check alternatives

Are paper checks obsolete?

While paper checks have declined in popularity, they are not entirely obsolete. However, the shift towards digital payment methods is rapidly accelerating, and businesses that don't adapt may find themselves at a competitive disadvantage.

What are the pros and cons of accepting check payments?

Pros: Some customers still prefer checks and accepting them can cater to their needs. Cons: Checks are slow, expensive to process, prone to fraud, and can lead to delays in cash flow. They also require manual processing, which can be time-consuming and error-prone.

What are the top alternatives to paper checks?

The top digital alternatives to paper checks include ACH/EFT payments, credit/debit cards, virtual cards, and digital wallets. These methods offer faster processing times, lower costs, enhanced security, and improved cash flow.

How are e-checks different from paper checks?

E-checks, or electronic checks, are digital versions of paper checks. They use the ACH network to transfer funds directly from the payer's checking account to the payee's account, eliminating the need for physical checks and manual processing.

How can accepting digital payments help my B2B business?

Accepting digital payments can help your B2B business in several ways:

Faster payment processing and improved cash flow

Lower processing costs and reduced manual labor

Enhanced security and reduced fraud risk

Improved customer experience and satisfaction

Greater financial visibility and control

How can my business move away from paper checks?

To transition away from paper checks, consider the following steps:

Adopt an integrated payment solution that connects with your ERP system.

Offer a range of digital payment options to cater to customer preferences.

Automate your accounts receivable processes, including invoice delivery and payment reconciliation.

Communicate the benefits of digital payments to your customers and provide support during the transition.

Continuously monitor and optimize your payment mix to maximize efficiency and cost savings.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.