What Is an eCheck? Your Guide to Understanding How Electronic Checks Work

- 23 min read

Our guide examines what an eCheck is, how it differs from paper checks, its benefits, and the key steps involved in processing electronic checks.

Electronic checks have come a long way since they made their first appearance in 1998. Faster than a paper check and less expensive to process than credit cards, eChecks are great for improving payment experiences, modernizing accounts receivable (AR) processes, and accelerating cash flow.

In this article, we’ll explain what eChecks are, what types of payments they’re best suited for, and why businesses should embrace them with enthusiasm.

Table of contents

What is an eCheck?

An eCheck is a digital payment method that contains the same information as a paper check (i.e., checking account number, bank routing number, and payment amount).

In the United States, eChecks run off the Automated Clearing House (ACH) network. ACH payments are managed by the National Automated Clearing House Association (NACHA), a non-profit electronic network that operates under the Federal Reserve. Other countries like Canada have their own payment clearing systems.

Unlike a direct deposit, an eCheck is a “pull” payment: The payee (seller) initiates the transaction, “pulling” funds from the payer’s (customer’s) account. In contrast, a direct deposit is a “push” payment because the payer initiates the transaction, “pushing” funds from their account to the payee.

Why eChecks reign supreme for big-ticket items and recurring payments

Electronic checks are a popular payment method for high-cost items because they’re not subject to the same costly processing fees as credit card payments. They’re also often used for recurring payments like rent, memberships, and subscription services.

When using eChecks to make recurring payments, customers only provide authorization once when their payment is set up. And because bank account numbers change less frequently than credit card numbers, eChecks reduce the risk of unexpected payment failure.

eChecks vs. ACH: Untangling the web of electronic payments

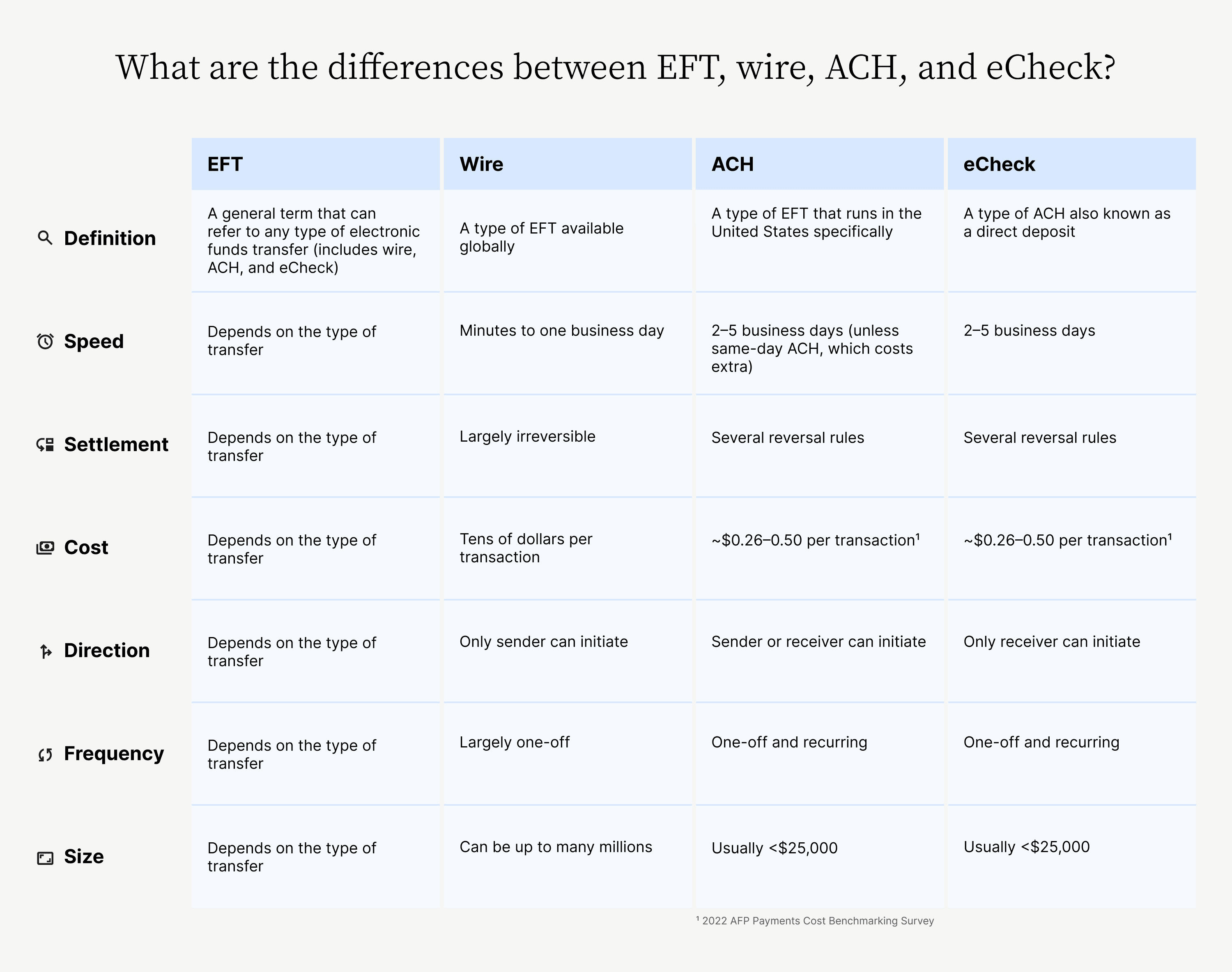

While all eCheck payments pass through the ACH network in the US, not all ACH payments are eChecks. This difference matters because fees and processing channels vary depending on the type of ACH transaction.

ACH payments shouldn’t be confused with wire transfers. The ACH network processes multiple transactions in batches, whereas wire transfers are initiated one at a time. Because of this, wire transfers are more expensive than ACH payments. Wire transfers also can’t be reversed, whereas ACH transactions can (if you catch them in time), making wire payments less secure.

Electronic Funds Transfer (EFT) is a term that gets used interchangeably with ACH, but it’s worth noting the difference. EFT is a more general term referring to any type of electronic fund transfer from one bank account to another.

How does eCheck payment processing work?

While eChecks and paper checks have a similar 2 to 5 business day settlement period, the digital nature of eChecks eliminates the delays of receiving paper checks via snail mail and having to go to the bank to deposit them. Seamless electronic processing makes eChecks a faster way to get paid compared to the hassles of traditional paper checks.

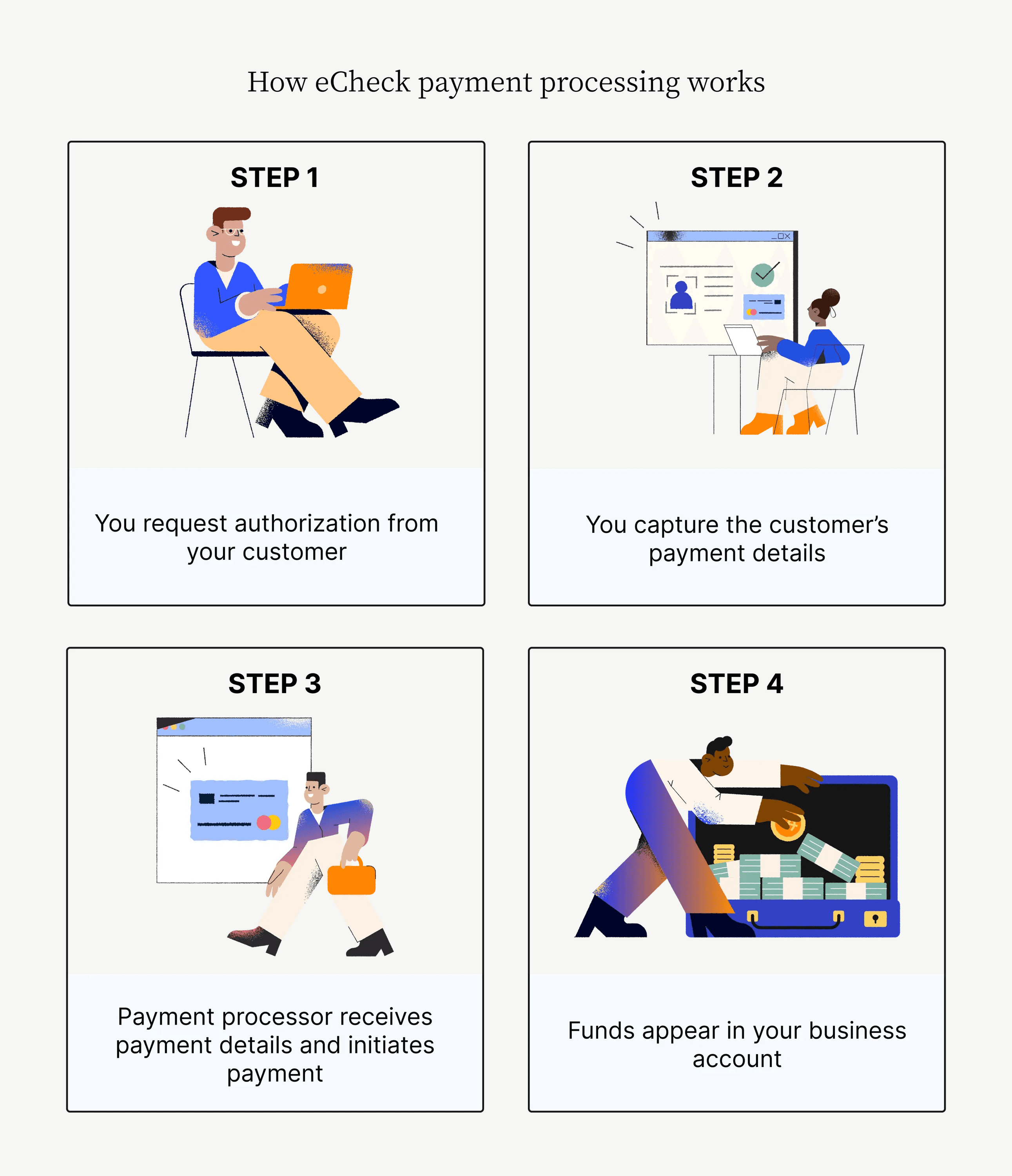

Here are the steps involved in processing an eCheck payment:

Step 1. Request authorization from your customer

Since eChecks are pull payments, your customers must first authorize the transfer of funds through an authorization form, signed contract, or order form.

This documentation can be physical or digital: Even accepting the terms and conditions of a website can count as authorization. Authorization can also be granted by a customer over the phone, as long as the phone call is recorded.

Step 2. Capture your customer’s payment details

At the point of authorization, or at a later time, you’ll ask your customer for the same information included on a paper check, such as company name, bank account number, bank routing number, and dollar amount. For recurring payments, you’ll also gather payment schedule details, such as the 1st or 15th of the month.

Step 3. Send payment details to your payment processor

Once you have the information you need, you provide it to your payment processor for submission to the ACH network. It’s worth noting that an ACH payment can be rejected later if the payer’s account has insufficient funds. A direct debit can appear to go through initially, but because it takes a day or two for a financial institution to verify the transaction, it can still get rejected if the payer doesn’t have enough funds in their account.

Step 4. Receive your funds

The funds will be withdrawn from your customer’s checking account and the eCheck deposit will be made to your business account. You should receive payment confirmation within 24 to 48 hours.

How safe are eChecks?

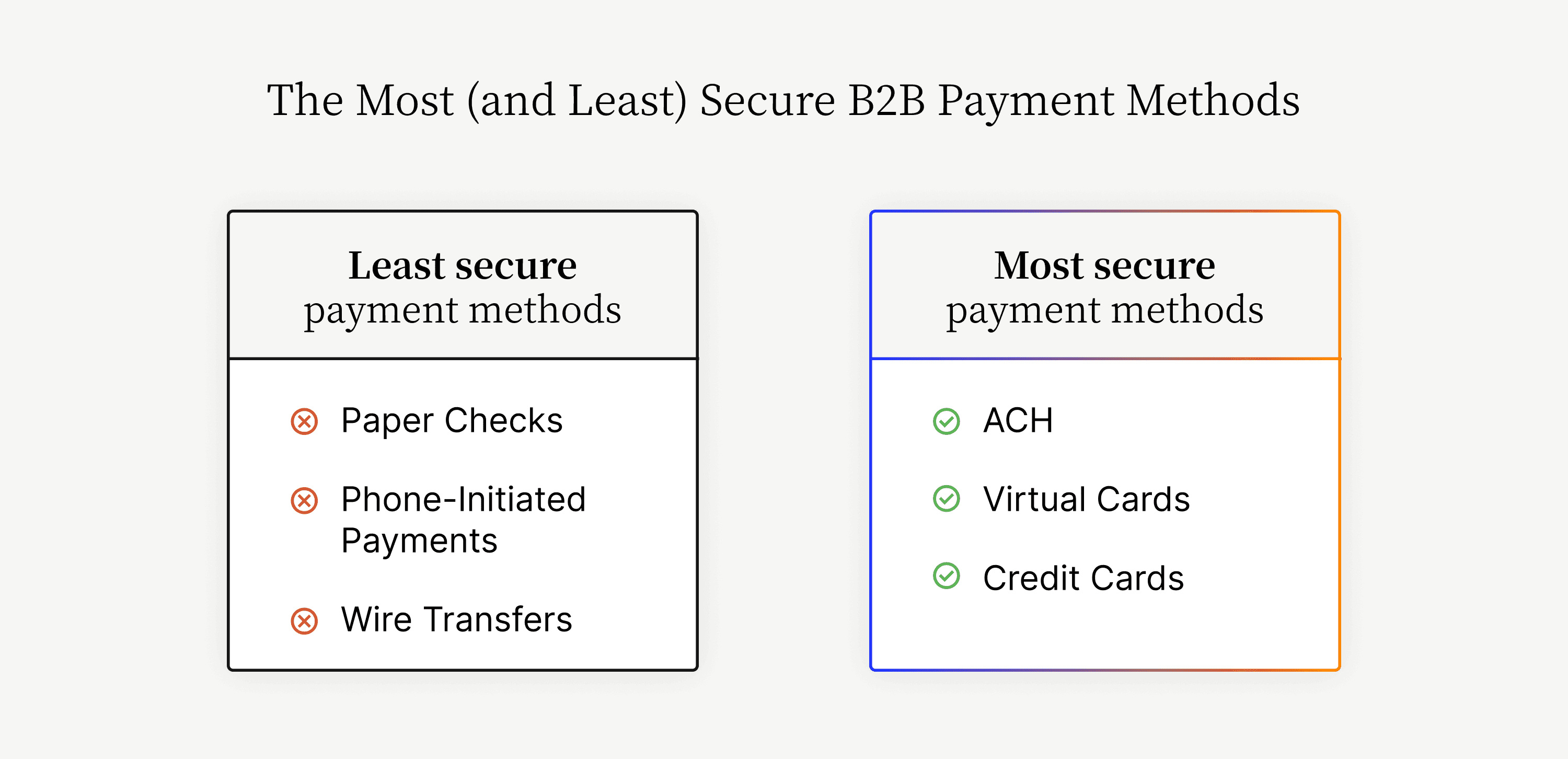

Electronic checks are among the most secure payment methods available for businesses.

Unlike paper checks, you can never lose or misplace an eCheck, and bad actors can’t take them out of the mail or off of someone’s desk. And unlike wire transfers, eChecks and other ACH payments can be reversed within a certain window of time (no later than five business days after settlement), making them less vulnerable to fraudulent activity.

5 reasons why eChecks give businesses greater peace of mind

eChecks provide extra layers of safety that make them ideal payment options for sellers and buyers alike:

Authorization — Sellers must get customer approval to initiate a direct debit, increasing the likelihood that payment details weren’t obtained fraudulently (as can be the case with credit card details, leading to costly chargeback fees for merchants).

Digital signature — Time-stamping vital information reduces the chance of fraud and creates an audit trail.

Duplicate detection — Automatic detection of suspicious activity, such as duplicate eCheck transactions, can alert you to potential fraud.

Encryption — Every transaction that passes through the ACH network is encrypted to hide sensitive data as it moves through different digital networks.

Certificate authorities — eCheck transactions are further protected by entities that use protocols like Secure Sockets Layer (SSL) and Transport Layer Security (TLS) to make online connections private.

9 additional benefits of electronic checks

In addition to extra safety and security, sellers have a lot more to gain from accepting a higher volume of eChecks from customers. Here are nine advantages of offering electronic check payment options:

eChecks are cheaper to process

eChecks have faster processing times

eChecks reduce chargebacks

eChecks create less manual AR work

eChecks expand market reach

eChecks are better for the environment

eChecks provide better CX

eChecks facilitate regulatory compliance

eChecks make recurring payments easier

1. eChecks are cheaper to process than paper checks and credit cards

According to the 2022 Association for Financial Professionals (AFP) Digital Payments Survey, the median cost of initiating and receiving an ACH payment for businesses is between $0.26 and $0.50, compared to $2.00 and $4.00 for paper checks.

And when it comes to credit cards, processing fees can be between 1.3% and 3.5% of every transaction, with the average being 2%. On high-cost items, this quickly becomes very expensive for suppliers.

In contrast, it can cost as little as $0.10 to process a single eCheck payment (although rates will vary depending on your merchant account provider). These low fees make eChecks an appealing option for your business if you accept large or recurring payments.

2. eChecks have faster processing times, leading to faster cash flow

Compared to paper checks, eChecks don’t require the same upfront effort from customers to write and mail them. You also don’t need to wait for an eCheck to arrive in the mail before processing the payment. This cuts down the overall eCheck payment time significantly.

Through the US Postal Service, commercial mail deliveries take an average of four to five days. Add this to the three to five days it takes for a check to settle (without considering any delays due to staff having to prepare and deposit the check) and the overall time it takes to receive the payment is seven days minimum. In contrast, the overall time it takes to receive an eCheck payment is just two to five business days once you’ve received the authorization.

With faster deposits, your business can close out receivables and access its cash flow sooner (a benefit that no one can afford to overlook in the current recessionary environment).

3. eChecks reduce chargebacks

The ACH network has stricter requirements and processes in place that make it more difficult for customers to dispute a payment and initiate a chargeback compared to credit card networks.

First, the payment is pulled directly from the customer's bank account, so there’s less ambiguity about the source of funds and authorization. The ACH network requires that the customer first make a good-faith effort to resolve the issue directly with the merchant before initiating a dispute.

If a dispute is filed, the merchant has the opportunity to provide compelling evidence that the transaction was legitimate, such as proof of delivery or the customer's authorization. The customer's bank must then make a determination based on the evidence from both parties before deciding to debit the merchant's account.

By reducing the likelihood of chargebacks, eChecks help merchants better predict cash flow, avoid unexpected revenue losses, and minimize the administrative overhead of handling chargeback disputes.

4. eChecks create less manual accounts receivable work

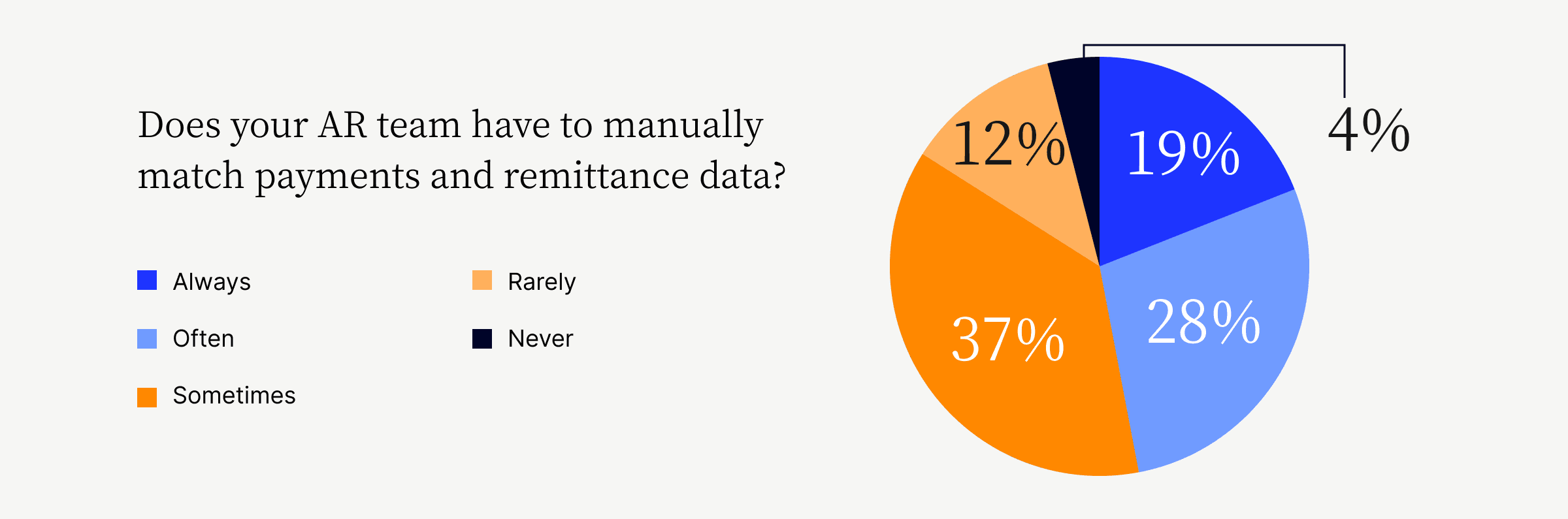

Compared to paper checks, it’s easier to automate the preparation, processing, and reconciliation of eChecks. With 85% of AR teams still matching some degree of their payments with remittance advice manually, any time savings can’t be overlooked.

With the right accounting software, you can arrange for customers’ direct debits to be made on a recurring basis automatically. The account information and authorization only need to be captured once.

You can also automate the reconciliation process for eCheck payments. If you collect customer payment information from an online payment portal, they can identify which invoice(s) they’re paying at the same time and feed that information back to your enterprise resource planning (ERP) system. This takes care of the cash application process for you.

If processing eCheck payments directly with the bank, you can still automate the cash application process with help from cash application software. This technology can take the remittance files from the bank and use artificial intelligence to match the correct payment to the correct invoice(s) in your system.

With more opportunities for automation, accepting eChecks can reduce your team’s manual labor involved with processing payments.

5. Electronic checks expand your market reach

Offering eChecks as an alternative, more affordable method of payment may attract cost-conscious businesses otherwise deterred by credit card fees and the hassles of physical checks and wire transfers.

Digital payments, like eChecks, speed the B2B payment process, making it more convenient for buyers and less costly for sellers. High invoice processing expenses, poor visibility, limited data, and longer payment cycles are all consequences of non-automated payments.

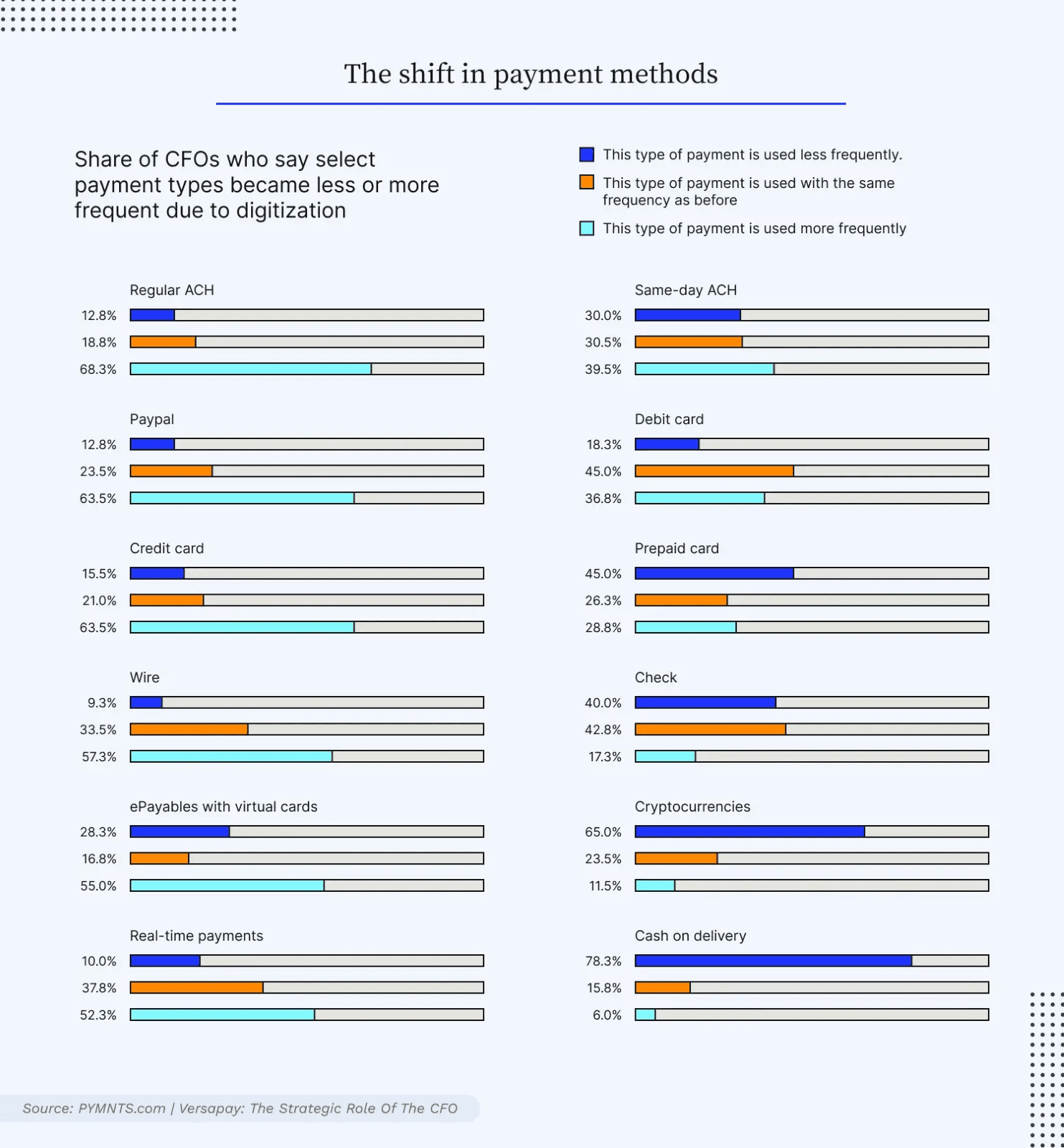

Buyers’ continued quest for convenience has forced a shift towards digital B2B payment methods and is transforming how accounts receivable and payable teams collaborate.

6. eChecks are better for the environment

As a paperless payment method, electronic checks reduce deforestation, cut greenhouse gas emissions from manufacturing and transportation, and prevent waste from ending up in landfills and oceans. They also free up physical space that would otherwise be required to store large quantities of paper records.

For companies looking to operate more sustainably and appeal to environmentally-minded customers, offering eChecks is an easy way to "go green" with payments. Customers are paying closer attention to the environmental impacts of the businesses they patronize, and providing eco-friendly payment options like eChecks demonstrates environmental responsibility.

In addition to attracting eco-conscious customers, adopting eChecks allows businesses to make progress towards their own sustainability goals related to waste reduction, energy conservation, and limiting physical resource consumption.

7. eChecks provide a better customer experience

With the potential for automatic recurring payments, eChecks are not only convenient for your accounting team, but your customers too. Even for one-off eCheck payments, you can give customers a seamless payment experience by allowing them to save their payment details in a digital wallet with help from AR automation software.

Even though checks are still frequently used in B2B payments, customer preferences are increasingly leaning toward digital payments. A survey we conducted of 400 CFOs found that since the pandemic’s onset, 40% of CFOs say they see checks being used less often, due in no small part to digitizing more of their accounting operations.

Embracing digital payment methods like eChecks helps you give customers the payment experience they’re looking for—one that prioritizes convenience and digitization.

8. eChecks facilitate regulatory compliance

Operating a business comes with the responsibility of adhering to relevant laws and regulations. When it comes to financial transactions and payment processing, specific rules are in place to protect companies and consumers from fraud, errors, and disputes.

In the United States, the use of eChecks) is regulated under laws like the Electronic Fund Transfer Act and the Uniform Commercial Code. These establish requirements around authorization, error resolution procedures, disclosure of fees and policies, and defining the rights and liabilities of all parties involved.

By offering eChecks as a payment method, businesses can demonstrate their commitment to following these regulations from the start. The structured legal framework provides safeguards against fraudulent eCheck transactions and outlines clear protocols for resolving disputes fairly.

In contrast, some alternative digital payment methods may operate in greyer legal areas without as much oversight. Choosing the regulatory-compliant path of eChecks helps businesses mitigate risk, avoid penalties for violations, and build trust with customers who appreciate working with a company that prioritizes adherence to consumer protection laws.

9. eChecks make recurring payments easier

We talked about this earlier but it’s worth repeating. Thanks to low fees, robust security features, one-time authorization, and the low turnover rate of bank accounts, electronic checks are ideal for memberships, subscriptions, and other recurring payments.

Best practices for overcoming common eCheck challenges.

While eChecks have many advantages that make them valuable payment options for businesses, they aren’t perfect! However, if you understand the downsides and know how to address them, you shouldn’t have many problems. Here’s a quick rundown of some of the challenges associated with eChecks and how you can solve for them:

Challenge 1. Fraud risk

Bad actors are getting more sophisticated when it comes to stealing account information, so it’s important for businesses to have robust fraud protection in place. Account and identity verification systems with real-time validation of banking data can help spot issues before transactions occur.

Digital payments made through a secure cloud-based payment portal or gateway are advanced ways to protect buyers and sellers against fraud, theft, and other security risks. Payment software can also be configured to protect against internal fraud and data mishandling by allowing authorized users to access sensitive data.

Challenge 2. Process modification

If your current financial software can’t handle eChecks, you may have to update your system, get new software, and train your staff to accommodate different accounting and bookkeeping processes.

Choose a payment gateway and other accounts receivable software that’s flexible enough to handle the continuous evolution of digital payments. As you work with eChecks, you’ll also learn best practices, such as scheduling your processing at off-peak times for faster processing.

Challenge 3. Customer reluctance

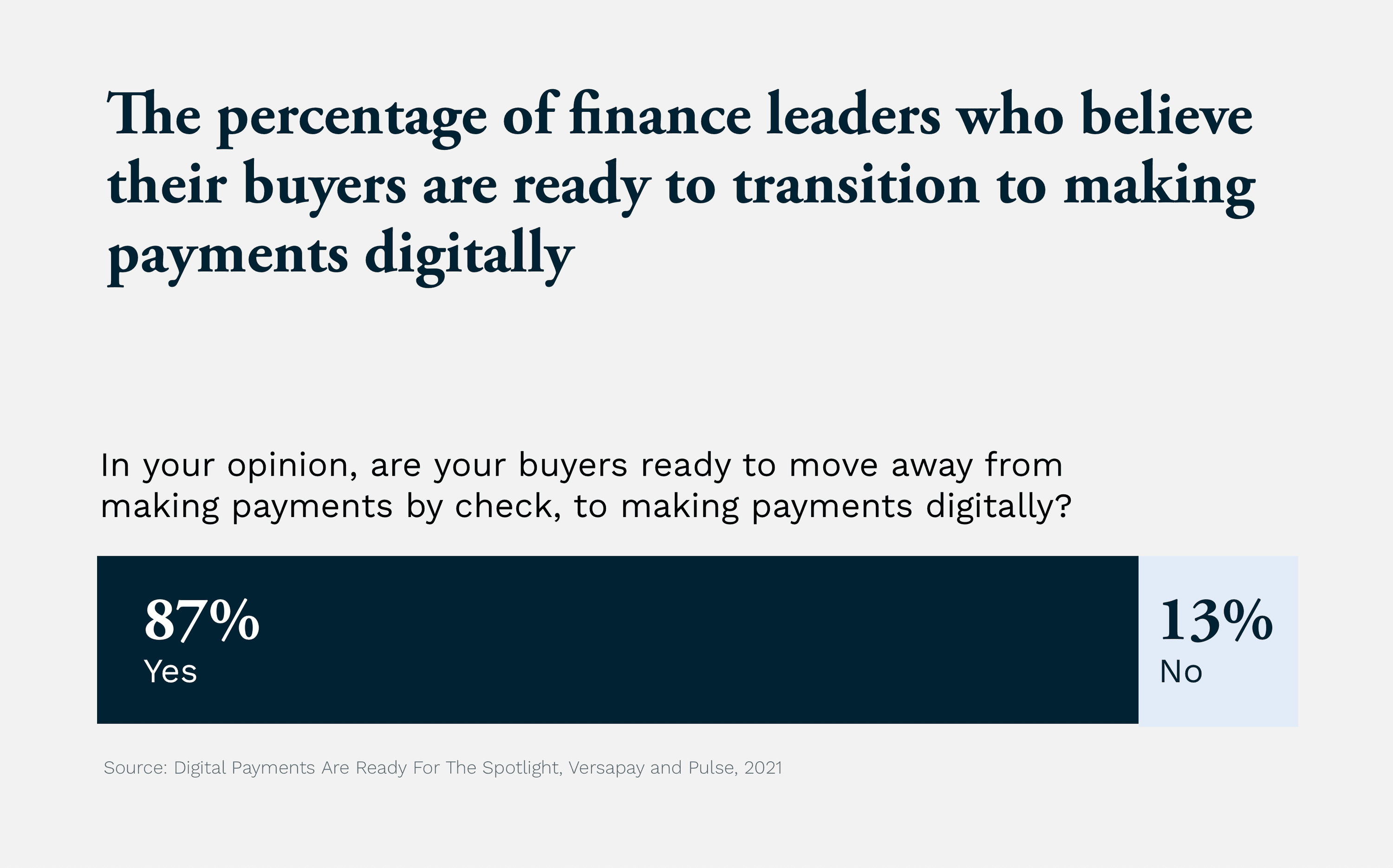

You may have to educate your customers about eChecks for more widespread adoption. The good news, however, is that most buyers want the extra flexibility and security of digital payments. A recent study of ours found that 87% of financial leaders said they believe their buyers are ready to make payments digitally and move away from physical checks.

—

Some of the downsides of eChecks are out of your control, such as a failure to process due to insufficient funds and transaction reversals. While rare, these issues are usually symptomatic of deeper problems with your customers.

Digital B2B payment software can provide a smooth transition to accepting electronic checks and other digital payments. And further optimizing these digital methods through automation generates additional benefits, like improving accounts receivable processes and customer experience.

Versapay can help you accept eChecks

When you offer your customers the convenience of paying by eCheck, you’re also giving yourself the gift of more efficient AR processes, better cash flow, and fewer unpaid invoices. It’s an accounting upgrade that will pay off long into the future.

Versapay allows you to accept eCheck payments, in addition to other types of ACH payments and credit cards. We help you capture payments from all your sales channels including ecommerce, point of sale, and on account. We seamlessly integrate with your ERP so you can automatically post payments as they come in.

To learn more, talk with a Versapay expert today.

Frequently asked questions about eChecks and electronic payments

How do eCheck payments work?

eCheck payments generally follow these three steps:

- Your customer authorizes a transaction

- You set up a one-time or recurring payment through your payment processing system

- You submit payment details to the ACH network

How fast can eChecks be processed?

Because they’re done in batches to keep processing fees low, eChecks typically take three to five business days to process.

Can an eCheck be processed on weekends?

No, electronic checks can’t be processed on weekends because the financial institutions involved typically operate on business days only. If your customer issues an eCheck payment on a Monday, it will likely be authorized by Wednesday or Thursday, but the funds won’t reach your bank account until early the following week.

Can an eCheck be canceled?

Yes, electronic checks can be canceled. You and/or your customer can cancel an eCheck payment depending on which stage of the process it’s in. If the funds are already en route to your bank account, you may have to issue a refund. Your payment processing provider should be able to support you with this.

Can an electronic check be declined?

If your customer has insufficient funds in their bank account, their eCheck payment will bounce just like a paper check would. It’s up to you to decide whether you levy non-sufficient funds (NSF) charges for bounced eChecks.

What are the benefits of eChecks over paper checks?

eChecks are fast, secure, and easy to use. eChecks are processed faster than paper checks and don’t require physical submission for deposit. eCheck fees can be 10X less expensive than those associated with paper checks, and they’re typically lower than credit and debit card fees, too.

Are eChecks secure?

Yes! eChecks are one of the most secure forms of payment. Because they’re processed through the Federal Reserve-regulated ACH network, eChecks must follow strict security protocols. eChecks also provide a digital record for tracking and reconciliation.

How do businesses benefit from accepting eCheck payments?

In addition to being faster and less expensive than paper checks and credit cards, eChecks enable more efficient record-keeping. They can also improve cash flow by eliminating issues associated with expired and reissued credit cards.

Are eChecks good for the environment?

Yes! Switching from paper checks (which require energy for physical transportation) to eChecks can boost your business’s reputation for sustainability.

How much does it cost to process an eCheck?

While rates can vary depending on the type of eCheck merchant account you have, the average fee ranges from $0.30 to $1.50 per eCheck transaction. For large purchases, electronic check payments are much more economical than credit cards for sellers.

How do you get an eCheck merchant account?

Obtaining an eCheck or ACH merchant account is just like getting a credit card merchant account. When you find a provider you like, they’ll ask you for details like your Federal Tax ID Number, years in business, and typical processing volumes.

How do you start accepting eChecks?

To start accepting eChecks, you’ll need to work with a payment processor or payment gateway in coordination with your bank. They should help get you set up with the software and hardware (if you plan on accepting eChecks at your point of sale) needed to collect eCheck payments. You’ll also need to sign up for an ACH merchant account, which your payment processor should be able to support you with.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.