8 Ways You Can Automate Your Collections Process

- 10 min read

In this article, we assess the benefits of automating B2B collections and suggest eight efficient ways to automate your collections process for faster, higher-quality results.

Automation is king in today’s always-on digital world of business. AI and machine learning are advancing. Customers are increasingly dedicated to digital payments and online communications. Businesses of all stripes are watching competitors automate various operations and processes to their advantage.

If you’re still running your accounts receivable (AR) function manually, it’s time to embrace the trends of automation and digitization. Can collections be automated? Yes! Should you automate collections management? Absolutely!

Read on to learn more about why and how to bring your AR into the 21st century with automated collections.

Jump to a section of interest:

Can and should you automate collections?

The strength of a business’s B2B collections process is central to its success. That means it’s essential to make the AR function streamlined and accurate. Automating collections processes allows you to capture a number of benefits for your business.

The benefits of B2B collections automation

Reduce manual labor: Collections automation allows you to cut the time your AR team has to spend on the administrative tasks. Automated collections frees up their time for higher-value work.

Accelerate cash flow: Automate your payment collections to help your cash flow move faster. Automating collections reduces bottlenecks that result from manual processing, such as slow task completion and reissuing invoices with errors.

Drive efficiencies: Automating collections makes the AR process more efficient, as it leverages purpose-fitted digital tools that allow staff to complete both tedious and complex collections steps with minimal waste or time or effort.

Deliver exceptional customer experiences: Automated collections processes facilitate fast and easy payment, simple communication between customers and AR teams, error-free invoicing, and streamlined dispute resolution.

Generate analytics and insights: Automated collections software enables rapid, high-quality reporting of AR metrics such as DSO, ADP, and other relevant information, and gives AR teams the ability to filter insights by customer.

Which parts of the collections process can be automated?

Wondering how to improve your collections process (or which parts even can be automated)? With the digital technologies of today, you can automate collections management, from invoicing to dispute resolution (and nearly everything in between).

Invoicing: Creation and delivery of customized invoices, and access to data and shared documentation.

Payments: Digital payment acceptance with multiple B2B payment methods, and access to payment details and trends.

Payment acceptance directly within your ERP: Enterprise resource planning software payment integrations can reduce manual work and accelerate payment processing.

Collections: Follow-up such as dunning letters, past-dues and delinquent account notices, and audit trails, along with detailed reporting and customer management.

Cash application: Remittance acceptance and payment matching, straight-through processing, data extraction using image recognition and OCR, remittance digitization, and handling of exceptions, discounts, deductions, and short-pays.

Dispute resolution: Real-time communication and dispute management to ensure fast and low-stress resolution of problems as they arise.

Post payments to your ERP: Automatically post payments back to your ERP (when accepted and processed elsewhere, like through an AR automation solution) to eliminate redundant data entry or process management across multiple systems.

Why automate collections? The impact of a manual AR process

With so much of the AR process ripe for digitization, businesses that continue to maintain a manual AR process are working at a disadvantage. Finance leaders list a range of challenges that collections can present, many of which are associated with manual management. A few of the most damaging to your business are:

Wasted staff time and effort: AR staff are spending valuable paid work time on things a digital system could do faster and more accurately.

Sluggish cash flow: Snags in manual workflows and mistakes due to human error can slow down cash flow and affect your business’s finances.

Tendency toward errors:Humans make mistakes, so the more tasks your staff is doing in the AR process, the more chance there is for errors that must then be corrected.

Higher rates of disputes and complaints: Manual AR management’s greater likelihood of errors and the slow processing result in more customer disputes and complaints.

Lack of insight into the process: A manual AR process is opaque, preventing both AR teams and customers from easily seeing details of the process.

Damage to customer experience: Many of the above problems can result in poor customer experience, which can become a major problem for your company.

8 steps: How do you automate the collections process?

Ready to automate your collections process? You can pursue collections automation by following these eight steps for moving your AR function from manual to digital.

Accept payments from any sales channel directly within your ERP

Digitize your invoicing process

Employ a customer-facing accounts receivable payment portal

Automate typical collections activities

Move dispute management online

Automate cash application

Post all payments back to your ERP

Apply insights and analytics

1. Accept payments from any sales channel directly within your ERP

The first step in automating your collections is integrating your ERP software with an external payment processing platform, like B2B collections software, so you can accept payment from any channel directly within your ERP.

Doing this allows customers to pay directly from an invoice, and enables automatic updating of your ERP with the information for that payment. This is the first step to take in automating your collections process because payment acceptance is the foundational function of AR automation on which you can build the rest of your efficiency step by step.

2. Digitize your invoicing process

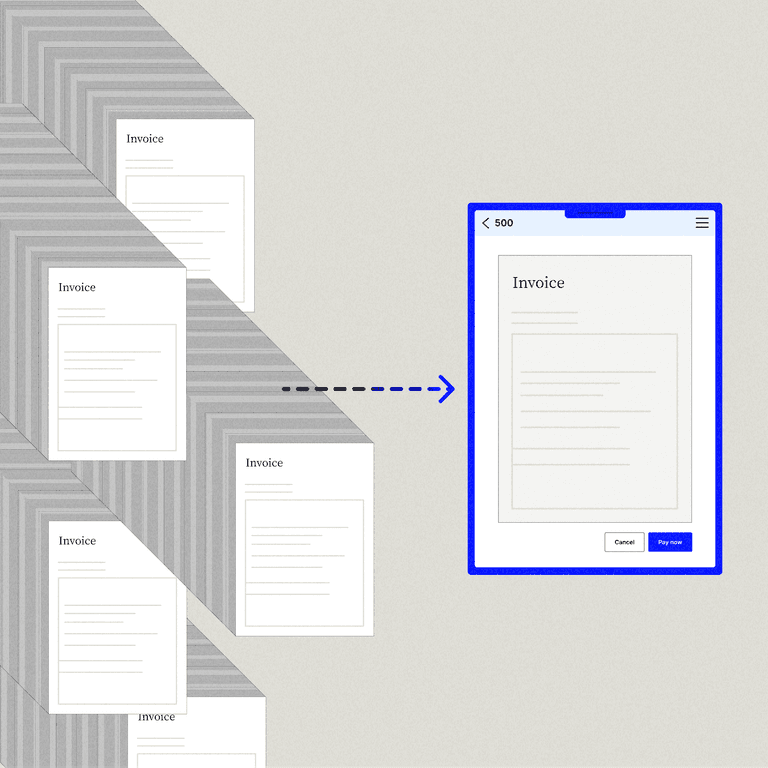

The next step is invoice collections automation, which automates the tasks involved in creating and delivering invoices to your customers. At the very least you should be sending invoices by email instead of mail at this stage. But even better is to use an invoicing function within your payment processing platform or AR automation software.

This allows you to invoice directly from your digital system to your customer’s email or AP system. Sending invoices digitally is an important early step to take in automating collections since doing so facilitates customers making digital payments using any method.

💡 Bonus! Learn the differences between paper and electronic invoices →

3. Employ a customer-facing accounts receivable payment portal

Set up a customer-facing AR payment portal, best done via a B2B collections automation software. This portal allows you to post invoices to the cloud so your customers can access them 24/7, enables easy and reliable communication with customers, and allows for complete data transparency, including access to any necessary supporting documentation for invoices and payments.

A customer portal brings the entire AR process into a single, centralized location that any stakeholder can access at any time.

4. Automate typical collections activities

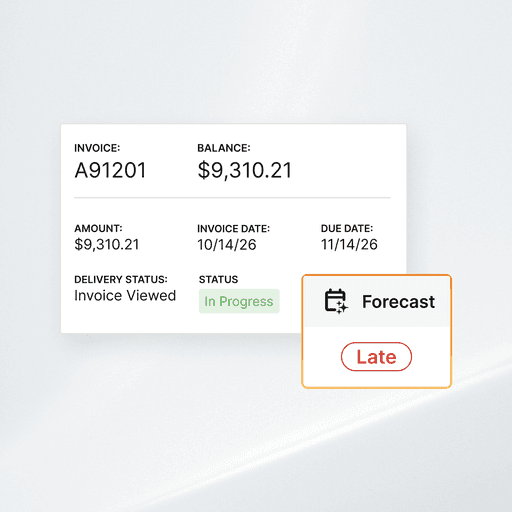

The next step after you’ve automated the fundamentals of payment acceptance and invoicing is to automate other typical collections activities, such as payment reminders, dunning letters, notifications, delivery statements, audit trails, prioritization of collector's efforts through AR aging, and past-due insights.

With all of these tasks automated, your team can work extremely efficiently and spend more time on higher-value tasks that can make your AR process even better, benefiting your company’s operations and bottom line.

5. Move dispute management online

Next, modernize the dispute management process so as to better collaborate with your customers. This means moving the dispute resolution process online via B2B collections software.

The system gives customers a straightforward way to file a dispute, and provides the data visibility and communications tools to help AR teams process each one quickly and efficiently. Fast, low-stress dispute resolution promotes customer satisfaction and loyalty.

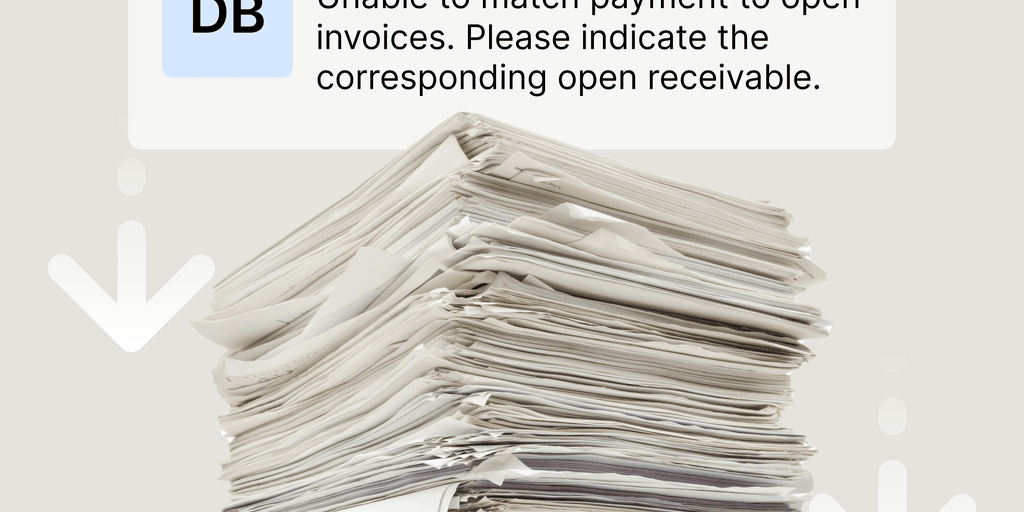

6. Automate cash application

With B2B collections software, AI and machine learning facilitate the automatic application of all payments, including checks, ACH, wires, and remittance data from multiple sources. The system gives you control to execute exception management and approval to ensure full accuracy of cash application.

Automating this process relieves your AR staff of an aggravating and time-consuming manual process, freeing them up to work on other things and making them happier in the process.

💡 Bonus! With AI-powered cash application, you can get way more done with a much smaller team. Learn how in this insight-packed on-demand webinar

7. Post all payments back to your ERP

Configure your B2B collections software to automatically post all your payments back to your ERP so that you can view all of your financial information in one place. Integrating these systems allows you to take advantage of advanced AR automation tools while avoiding the necessity of double data entry, which can sap staff time and introduce errors.

8. Apply insights and analytics

B2B collections software will provide you with a range of insights and analytics that you can apply to improving your collections process even further. Analytics help you see where your system can be made more efficient and effective. You can drill down to see insights at the customer level so you can uncover patterns, anticipate issues, and find ideal solutions to problems.

Think of accounts receivable as a collaborative process

Automating your AR functions can bring major benefits to your company, with two of the most important being accelerated cash flow and increased customer satisfaction. And with cutting-edge automation software available, automating this part of your business is within any company’s reach.

It's important to note that digitizing your processes is not a magic wand: Automating inefficient or illogical processes will compound existing problems or introduce new ones. It’s essential to transform your AR process into its most efficient and effective form before automating it. The first step in doing so is transforming your mindset: Think of AR as a collaborative process between your company and your customers, and shift your way of doing things with a focus on enabling a productive collaboration.

Versapay automates your collections process in a way that assists in promoting that collaborative approach to AR. Check out a demo of our path-breaking tool.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.