What is an ERP System in Accounting and How Does it Drive Value?

- 13 min read

In this blog you’ll learn what ERP systems are, how ERP systems and accounting (especially accounts receivable) are related, which ERP systems are best for modern finance teams, and how accounting integrations elevate ERP systems.

Key takeaways:

ERP systems are applications that automate core business processes across varying departments—from which they provide crucial insights and controls based on a centralized database.

ERP systems are especially useful for growing mid-market businesses and enterprises. The 3 main reasons why companies—and especially finance teams—invest in enterprise resource planning software include data centralization, improved customer relationships, and smarter sales methods.

ERP systems can—and should—be integrated with accounting software (particularly accounts receivable automation software). This integration can streamline payment processing, drive cash flow, save you time and money, and more.

The most common ERP systems all have native accounting and payments integrations with elite accounts receivable automation solutions.

—

Enterprise Resource Planning (ERP) helps companies manage core business processes across Finance, HR, IT, Procurement, and more. ERP systems allow businesses to manage all these processes in a single, centralized system that connects to other key software—through ERP integrations, including ecommerce, payments, and business intelligence—where needed.

In this article, you’ll learn how ERP systems and accounting—and accounts receivable—are related, the pros and cons between the different types of ERP deployments, which ERP systems are best for modern finance teams, and more.

Jump to a section of interest:

What is an ERP system?

We now know that ERP systems help organizations optimize performance by managing and automating core business processes. They do so by centralizing data across multiple departments—and systems—creating a single source of information or truth, ultimately helping employees streamline operations at all levels.

ERP systems have the capability to bring together a company’s financials, supply chain data, sales and commerce activities, manufacturing data, reporting, and human resources activities—all in one platform.

How ERP systems drive value for finance and accounting teams

ERPs do a lot and many would argue are invaluable. But if we had to sum up their value in only two words, it's probably these: organization and systematization.

ERP systems are especially useful for growing mid-market businesses and enterprises. (Although there’s a substantial ERP market for smaller retailers and SMBs.) Here are 3 of the main reasons why companies—and especially finance teams—invest in enterprise resource planning software.

1. Centralized data

An ERP system helps companies eliminate duplicate data. It can collect shared sales, transaction, and inventory data from multiple sources. This way, teams in Finance, HR, and IT aren’t wasting time chasing information across disparate spreadsheets.

Many ERP systems also provide real-time reports about areas like spending, supply chains, and manufacturing. Live data and real-time reports make sure everybody in the organization is looking at the same numbers.

2. Better customer relationships

Most enterprise resource planning systems will allow you to store any important details about an account in its customer records. This includes information like purchase volume, monthly transaction volume, and payment history.

If a customer calls your company for support about their billing and payments—for example—with an ERP system, your staff can go into the tool and have everything they need at their disposal.

3. Smarter sales methods

ERP systems are also useful for notifying your teams about changes in customer sales volumes. For example, these tools could be configured to deliver alerts when a customer's purchasing behavior changes—because they’ve stopped purchasing a specific product or they’ve multiple outstanding invoice payments.

With this intel, your team can prioritize following up with their customers to understand how their needs have changed or if they’d benefit from an extension on payment terms.

4 differences between ERP systems and accounting software

Now what about accounting and financial management systems (FMS)? These are common in most businesses, yet there’s often confusion around how they differ from ERP systems.

Many ERP systems have overlapping capabilities with accounting software and FMS’. So, how can you determine which—or a combination of both—is what you need? Not to mention both technologies have strengths and weaknesses in different places and ERP systems and accounting software also differ in a few key areas.

There are 4 core differences, which include:

1. Payment acceptance

ERP systems are great for automating many business processes, yet are not well-equipped to help you automatically accept and reconcile payments across different sales channels. When using them, it can be challenging to apply transactions across multiple payment channels like credit cards, POS terminals, and ecommerce payment gateways to your general ledger.

Thankfully integrating your ERP systems with more specialized payment acceptance software can give you the best of both worlds—as we’ll explain shortly.

2. Inventory capabilities

On the other hand, accounting software has limited inventory tracking capabilities—especially for manufacturing and distribution enterprises—whereas an ERP system provides manufacturers and distributors with feature-rich inventory management tools.

Most accounting software can’t do this, which is again why integrating your ERP solution with anaccounts receivable automation platform—for example—can be a good idea to get a fuller picture.

3. Manufacturing planning

Another key difference between ERP systems and accounting software—or FMS’—surfaces when you’re managing finances for manufacturing businesses in particular. An ERP system can help these businesses manage production and manufacturing resource planning along with supply chains and shipments. Accounting software, however, is unlikely to provide these types of features.

4. Payment processing costs

Lastly, ERP systems can help businesses gather customer information and pass it along into a third-party payment processor—when accepting customer payments. However, despite possessing that valuable information, the ERP system cannot help you reduce your processing costs along the way—that’s functionality that’s reserved for…

Integrated payments software! (A type of accounting solution that can be wrapped up with other accounts receivable automation capabilities.)

So, if you’re considering accepting and processing payments, it’s best you not rely exclusively on your ERP system, as it’ll require working closely with accounting software for the best results.

💡 PS — Integrated payments solutions can minimize your costs on a per-transactions basis, in some cases, up to 40%!

The 3 most common ERP systems

The enterprise resource planning system market is huge, valued at almost $44 billion in 2020 and projected to reach $117 billion by 2030. And there are hundreds—if not possibly thousands—of different ERP systems available today.

Yet there are a few standouts, especially when it comes to how these platforms support finance and accounting processes. Here’s a quick primer on some of the most popular ERP solutions favored by finance teams.

Oracle NetSuite

Oracle describes NetSuite as ‘an all-in-one cloud business management solution’. It helps organizations operate more effectively by automating core business processes and providing real-time visibility into operational and financial performance.

💡 Learn how Versapay’s NetSuite ERP Payments can bolster your accounts receivable processes.

Microsoft Dynamics

Microsoft Dynamics is an ERP system with many product lines. One of these applications is Dynamics 365 Business Central, which helps small and mid-size companies house all their business operations, including finance, manufacturing, sales, shipping, and more.

Another of these applications is Dynamics 365 Finance and Supply Chain Management (F&SCM). F&SCM is tailored to help midsize and enterprise companies manage product demand, stock, logistics, and manufacturing.

💡Learn how automation can make Microsoft Dynamics 365 Finance work harder for accounts receivable teams.

Sage Intacct

Sage Intacct provides connected solutions across financials, planning, analytics, HR, and payroll. Sage positions Intacct as a solution that can digitize business processes and relationships with customers, suppliers, employees, and banks.

💡 Learn what processing payments looks like within Sage using an integrated payments solution.

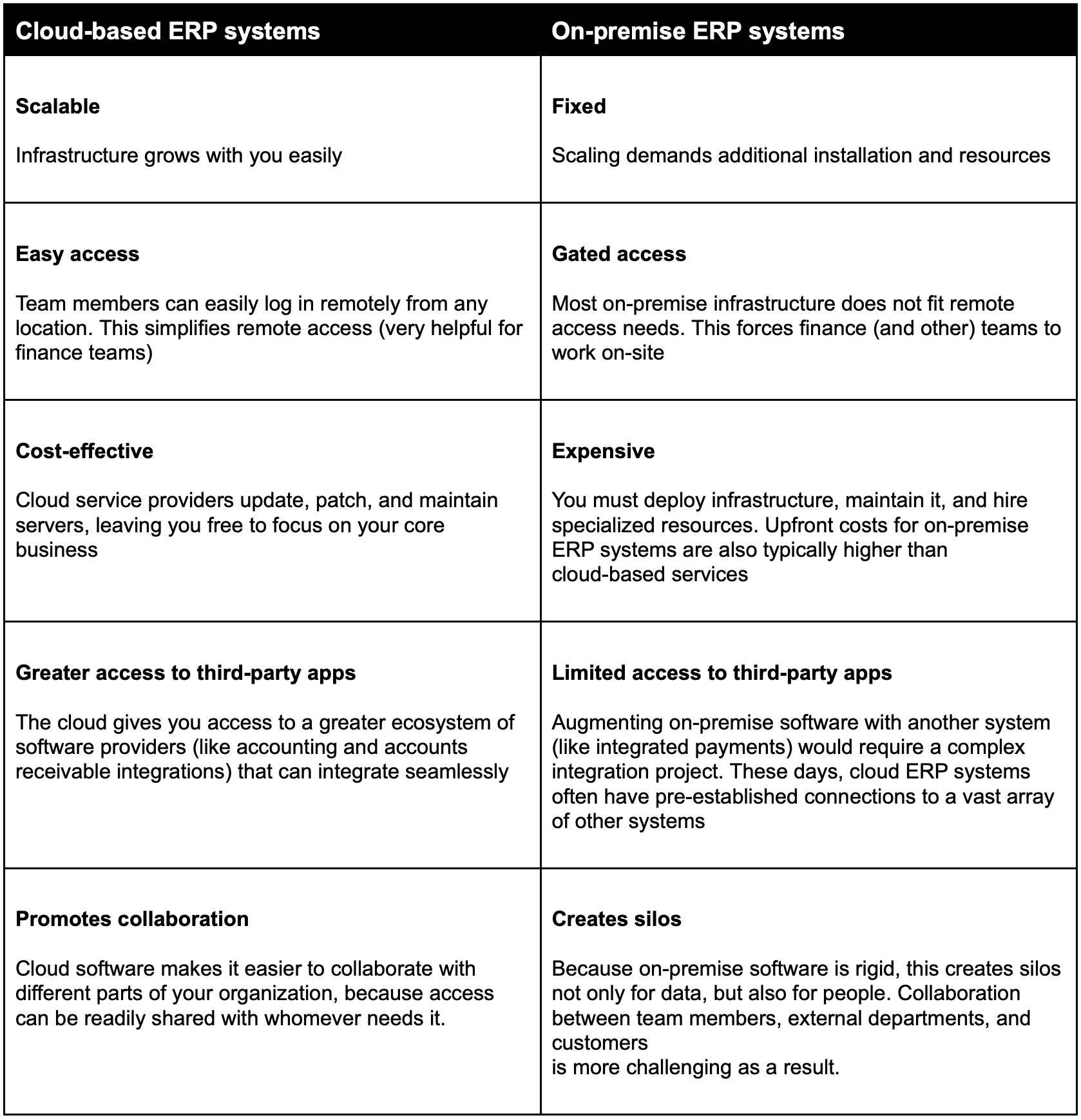

The differences between on-premises and cloud ERP deployments

There are two methods of deployment for ERP systems: on-premise and cloud-based.

An on-premise system requires that you install physical software on each firm server and computer your team uses. With a cloud-based system (usually a software-as-a-service—SaaS—model), everything is run securely online and off-site.

A breakdown of the differences between on-premise and cloud systems:

When talking about bridging ERP systems with accounting software, cloud must be a consideration—on both sides of the equation, ERP and accounting solution. (This is especially important when talking about integrating accounts receivable automation software with your ERP system.) Cloud-based platforms are easier to integrate with ERP systems thanks to APIs.

Can you integrate ERP systems with accounting software?

If you haven’t picked up on it yet, you absolutely can and should integrate your ERP system with accounting—and especially accounts receivable—automation software. If for no other reason than it being difficult to find an ERP system that features everything your accounting team is looking for.

But there are many—many—other reasons why this type of integration is invaluable. Here are 5 reasons in no particular order:

1. Streamlined payment processing

By integrating an accounts receivable payment solution with your ERP system, you effectively create a single platform for receiving payments across your whole business. You can send invoices and get paid, all within the same workflow. That means your entire process can be managed, viewed, and analyzed from one place

2. Improved cash flow

By bringing accounting—and especially payments—into your existing ERP payment system, you can speed up the collections process. You can see exactly what has and hasn't been paid and address late or missed payments faster. This immediately improves your company’s cash flow situation because you get paid faster.

3. Increased security

Integrated accounting payment processing solutions specialize in taking payments securely. This reduces your risk of data breaches and digital payment fraud without giving up control over your processes. And by removing most manual actions from payment processing, it also reduces the risk of insider threats.

4. Customer experience

As well as improving your working lives by streamlining ERP payment processing, accounting integrations for your ERP system make things easier for your customers. The easier it is for them to make payments—for example—the happier they will be. And there's nothing easier than paying directly from an invoice or customer portal (and having that information automatically posted back to your ERP).

5. Save time & money

Automating your payment processes—by way of integrating your accounting software with your ERP system—removes the need for human participation. And by removing manual data entry, you immediately save time (and reduce drudgery) for your employees, and can re-orient them towards more strategic, impactful activities. That’s better for their morale (and retention) but also saves the company money by requiring less workforce to manage the payment acceptance process.

Many of the top accounts receivable automation softwares integrate with well-known ERP systems. By getting both systems talking to one another, you can automate your invoice delivery, post payments to your ledgers automatically, and simplify your acceptance of digital payments.

Learn how Versapay’s integrated payments help you extend the capabilities of your ERP system.

About the author

Nicole Bennett

Nicole Bennett is the Senior Content Marketing Specialist at Versapay. She is passionate about telling compelling stories that drive real-world value for businesses and is a staunch supporter of the Oxford comma. Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed.