5 Reasons to Integrate AR Automation Into Your ERP

- 9 min read

To maximize the value of your ERP, you'll want to integrate an accounts receivable automation solution.

Why? To ensure your AR and payment processing functions work as smoothly, transparently, and informatively as your other business processes.

No business can live without accounts receivable (AR). But not all AR processes are created equal. Far too many companies suffer with (and because of) an inefficient and cumbersome AR function.

In a lot of these cases, company leadership labors under the belief that their enterprise resource planning (ERP) software can take care of this vital element of business operations.

But an effective AR function, especially for mid-size and large companies, goes beyond what ERPs can handle. It’s necessary to automate many (if not most) steps in the AR process to streamline workflows and dial in efficiencies. But most ERPs don’t have the capability to automate work in this way.

To get the most out of your ERP, integrate an AR automation solution that can ensure your accounts receivable and payment processing functions work as smoothly and are as transparent and informative as your other business processes.

What’s in this article:

The difference between accounts receivable automation and ERP

AR automation tools and ERPs are two very different animals.

AR automation involves using software to accomplish much of the work of generating and delivering invoices, and accepting, processing, matching, applying and reconciling payments. The key benefits of AR automation are reduced manual labor, accelerated cash flow, streamlined and accelerated collections processes, improved customer experience, and valuable analytics.

An ERP system is a software application that automates core business processes and uses a centralized database to create insights and set controls. The main benefits of ERPs are data centralization, increased transparency, added efficiencies, improved customer relationships, smarter sales methods, and powerful business insights.

How AR automation software and ERPs can work together

These two types of software are complementary—they are designed to accomplish different functions, and they each do their job extremely well. AR automation tools are smaller in scope than ERPs, handling a specific aspect of finance. As such, AR automation enhances but can’t replace an ERP system. ERPs and AR automation tools can combine to create a 360-degree engine of efficiency and organization.

The reason you need both is that ERPs tend to face challenges in automating the tasks AR automation is designed to do. For instance, ERPs typically do not automate invoice creation and payment reminders, tasks that AR tools accomplish with ease. Such functionality makes AR automation tools essential for growing businesses that need to scale their AR operation sustainably.

5 reasons to integrate AR automation software into your ERP

There’s a lot AR automation can do that your ERP can’t.

ERPs alone typically don’t offer any automated workflows for streamlining collections activities. That’s where AR automation excels. Together, AR automation tools and ERPs can do it all. Integration enhances your finance and accounting operations and procedures.

Here are 5 reasons why you should integrate AR automation with your ERP system.

1. Data centralization and organization

Relying on manual accounting processes is inefficient and impractical. Some teams may use sticky notes, email threads, and Excel spreadsheets to keep everything straight, with disappointing results.

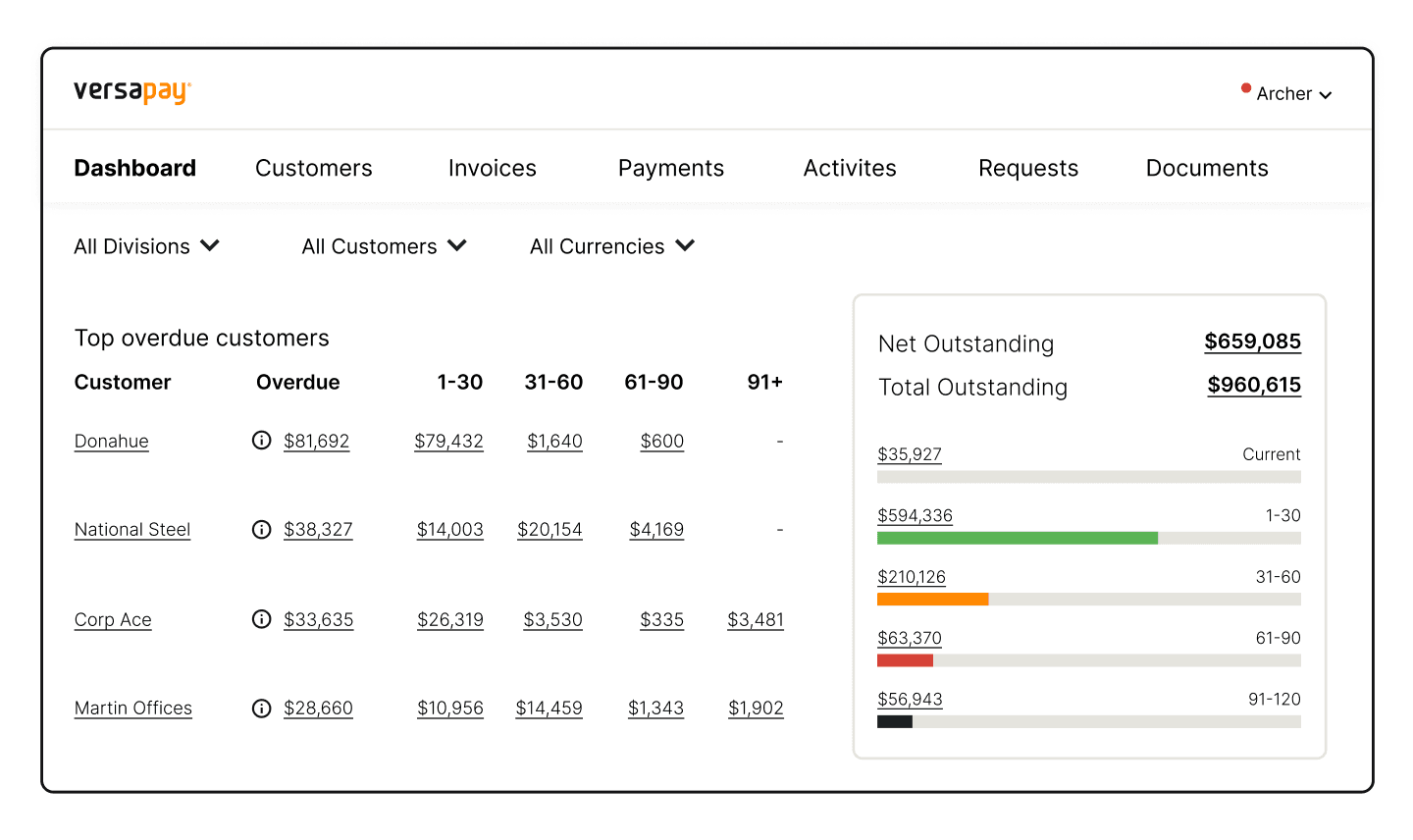

AR automation solutions aggregate and help accounts receivable professionals prioritize collections activities and operate as a source of truth for audit trails and data transparency.

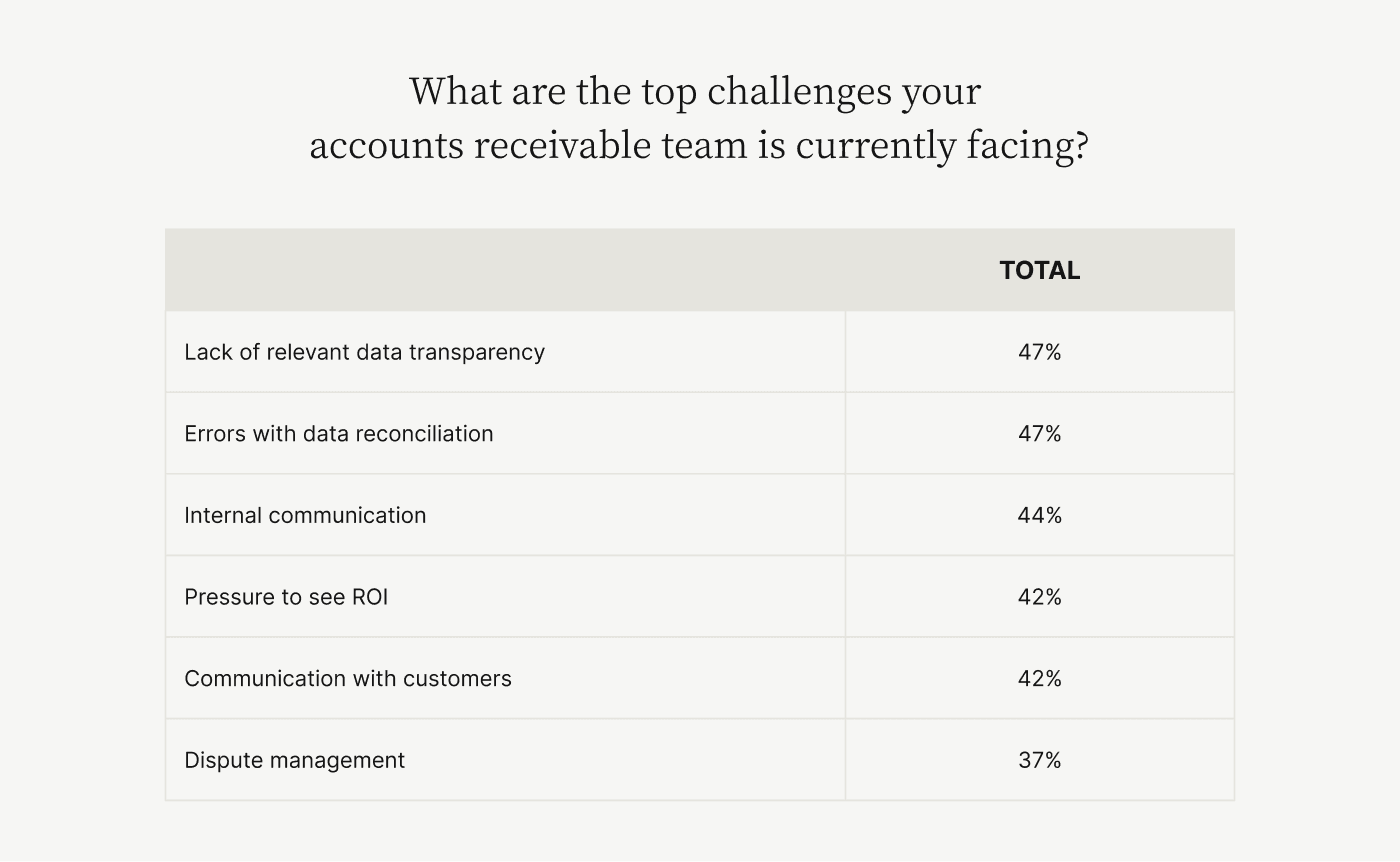

While on that topic, our research on what CFOs want out of invoice processing reveals that data transparency is a major priority for many finance departments. Through an integration, an AR automation tool passes needed information through to the ERP and vice versa.

2. Automated creation and delivery of invoices

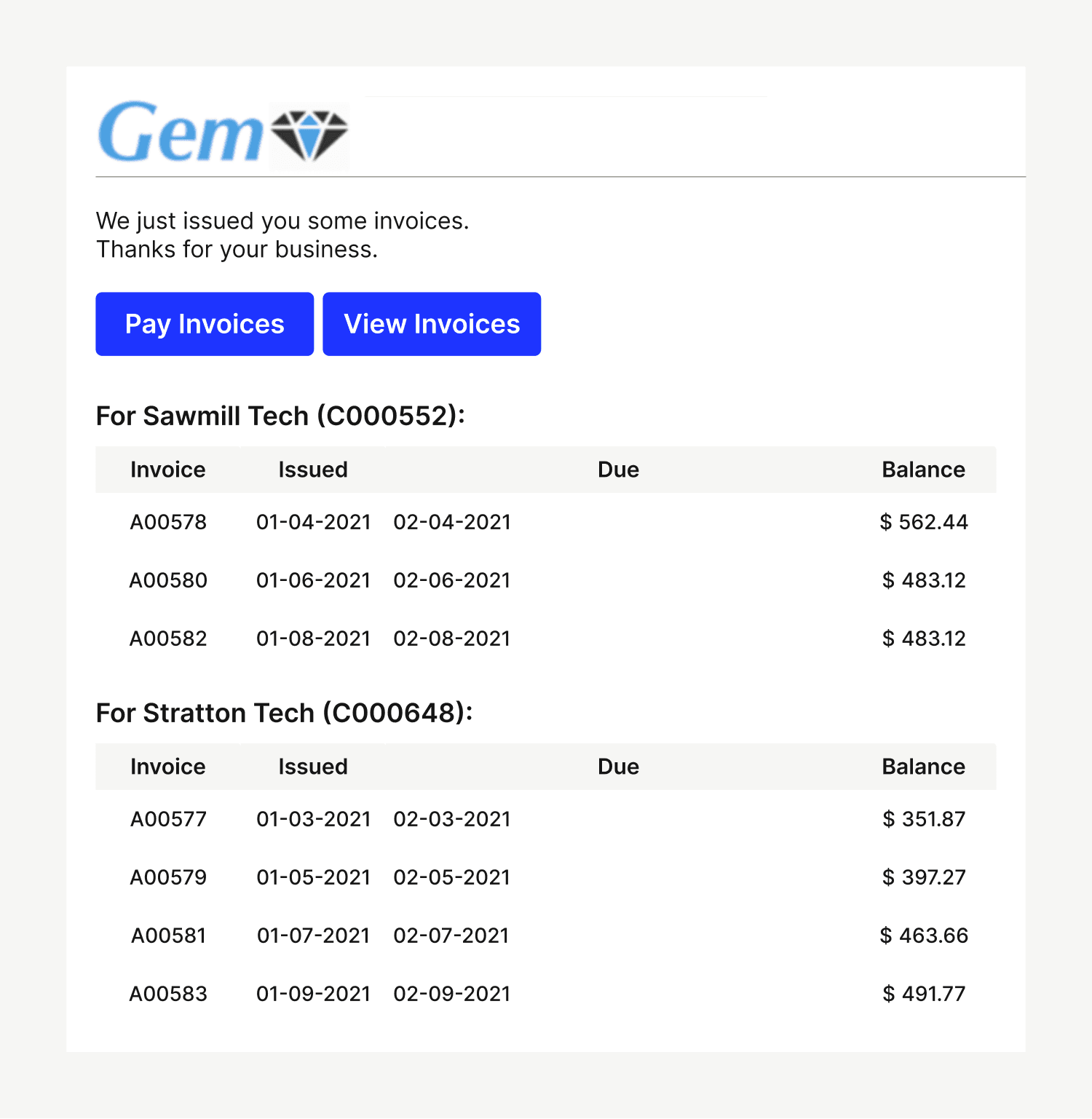

ERPs aren’t equipped to automatically create and send invoices, leaving a lot of manual work to your AR team. This is especially true at scale, when businesses can be sending tens or even hundreds of thousands of invoices every month.

Manually creating and delivering invoices at any kind of scale precludes the option to personalize invoices or delivery channels, as this simply takes too much time. And ERPs aren’t equipped to support this customization.

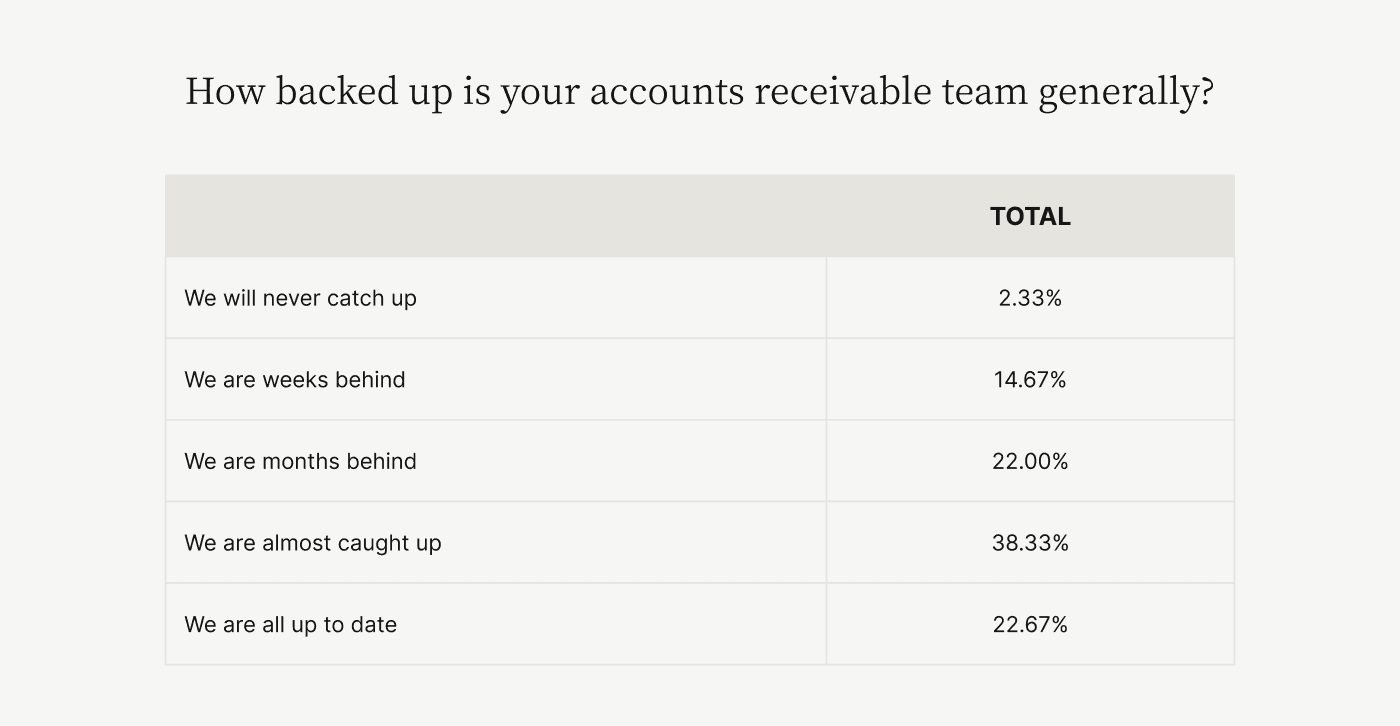

Accounts receivable automation massively speeds up your invoice creation and delivery process, which is a high priority for CFOs, seeing as the vast majority of AR teams face nearly insurmountable delays.

These tools can reduce the rote work for your AR team while also offering higher levels of personalized communication and functionality, even at scale. AR tools also empower teams to include supporting documentation when delivering invoices, which provides customers more information and reduces questions and disputes.

3. Streamlined payment processing

Integration of your ERP with your AR automation tool allows you to accept payments from any channel, so customers pay how they want—including in a self-serve capacity.

In a rapidly digitizing world, it’s important that AR automation allows you to securely accept digital payments. And some AR automation tools can provide the kind of robust transaction data that allows for interchange rate optimization, which makes digital payment acceptance more cost-effective. Just look no further than Sharp Canada, who saw digital payments increase threefold week-over-week (and their efforts at accepting them, significantly decrease), after integrating payment processing with their ERP:

An additional advantage of integrating AR automation with your ERP is that you effectively create a single platform for receiving payments across your whole business. This efficiency allows you to scale your AR process without adding more headcount. It effectively helps you do more with less.

4. Dynamic payment reminders

ERPs don’t include automated workflows for communicating with customers over late payments. AR automation software does, offering dynamic payment reminders that prompt customers to pay and help reduce the number of past-due payments your finance team has to chase down.

5. AR performance evaluation

ERPs can provide AR data to your team, but not at the scale or complexity that AR automation solutions can. AR automation tools provide detailed data and analytics on your collections process, allowing your team to draw useful insights and improve financial decision-making.

Automating your accounts receivable? Ensure ease of integration

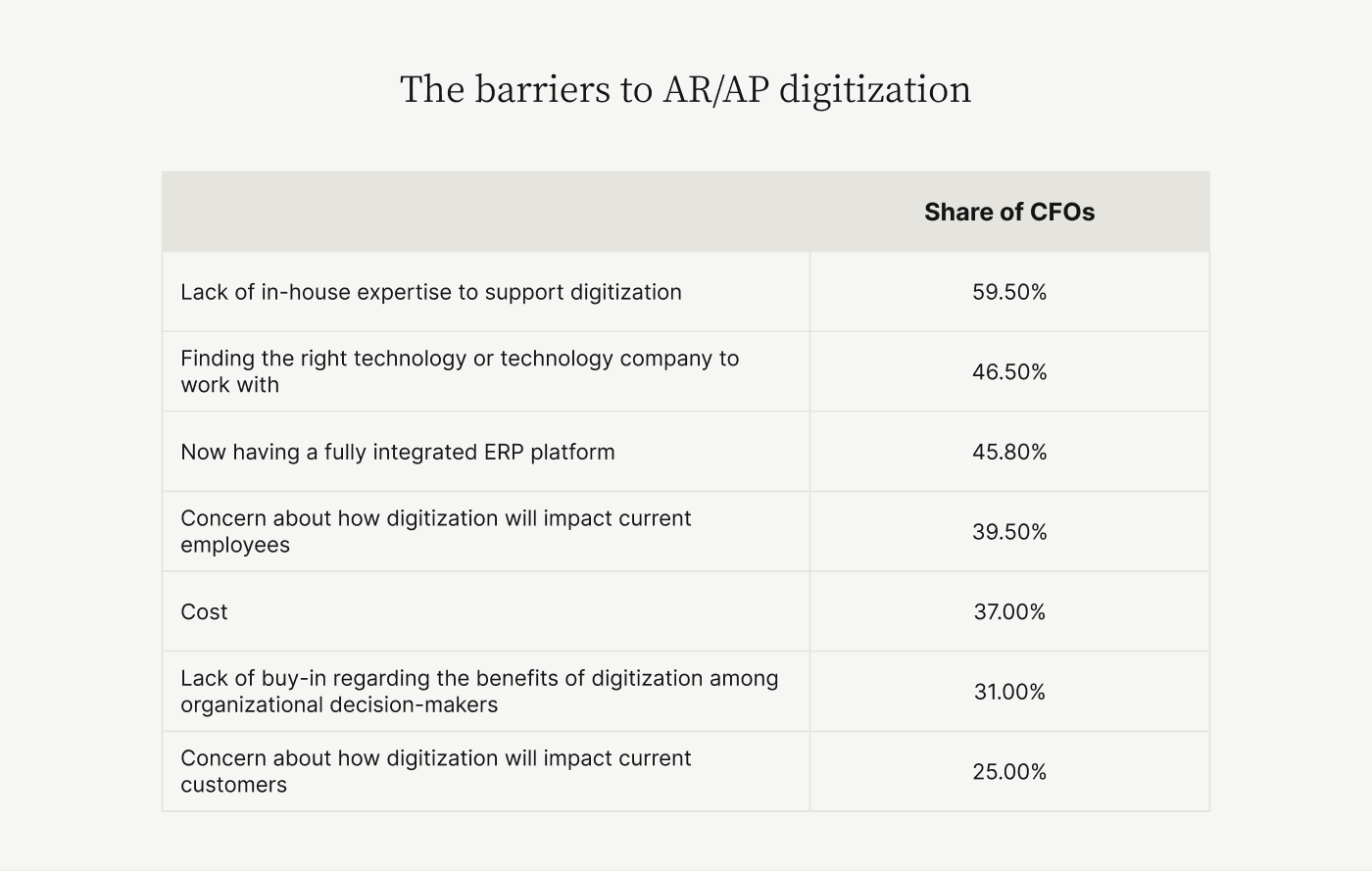

An insufficiently integrated AR automation solution causes problems. In our Strategic Role of the CFO report, we found that the third-ranked barrier to accounts receivable digitization (with 45.80% of CFOs agreeing) was not having a fully integrated ERP platform, which points to the importance of ease of adoption and configurability for digital systems.

Additionally, 37% of CFOs cited cost as another significant digitization barrier.

Integrating AR automation with your ERP is a simple, low-effort, cost-effective mechanism for addressing both those barriers. Ease of integration lets you focus on what’s important. And the native connectivity offered by top ERPs means that you’re likely to find an easy way to integrate AR automation.

While almost half (46.50%) of CFOs say it’s a hurdle to find the right AR tools or company to work with for AR automation, their concern is misplaced. For those ERPs that don’t enable native integration with AR tools, a solution like Versapay can easily establish a connection thanks to simple file-based integrations and API connectors. Versapay’s highly configurable cloud-based solutions allow for set-up without a lot of effort from IT professionals. With Versapay, transactions are tokenized and web-hooks are fully supported, which allows for full communication between the ERP and the AR automation software.

Add AR automation to your ERP

Depending solely on your ERP to handle your AR process is a surefire way to keep your collections moving slowly and your finance staff occupied with rote, manual tasks. Adding AR automation is the key to speeding things up and freeing your workers’ time for more valuable activities.

If concern over the difficulty of integrating an AR automation tool into your ERP is holding you back, rest assured that you’re unlikely to find this a problem. You can be set up with automation and running your AR more efficiently than ever in no time.

Learn how you can streamline your payment acceptance with integrated payments.

About the author

Katie Gustafson

Katherine Gustafson is a full-time freelance writer specializing in creating content related to tech, finance, business, environment, and other topics for companies and nonprofits such as Visa, PayPal, Intuit, World Wildlife Fund, and Khan Academy. Her work has appeared in Slate, HuffPo, TechCrunch, and other outlets, and she is the author of a book about innovation in sustainable food. She is also founder of White Paper Works, a firm dedicated to crafting high-quality, long-from content. Find her online and on LinkedIn.