Payment Gateway vs Payment Processor vs Payment Facilitator | Your Guide to Payment Processing

- 18 min read

Learn the contrasts between payment gateways vs payment processors and payment facilitators. See the role each plays in processing credit card transactions.

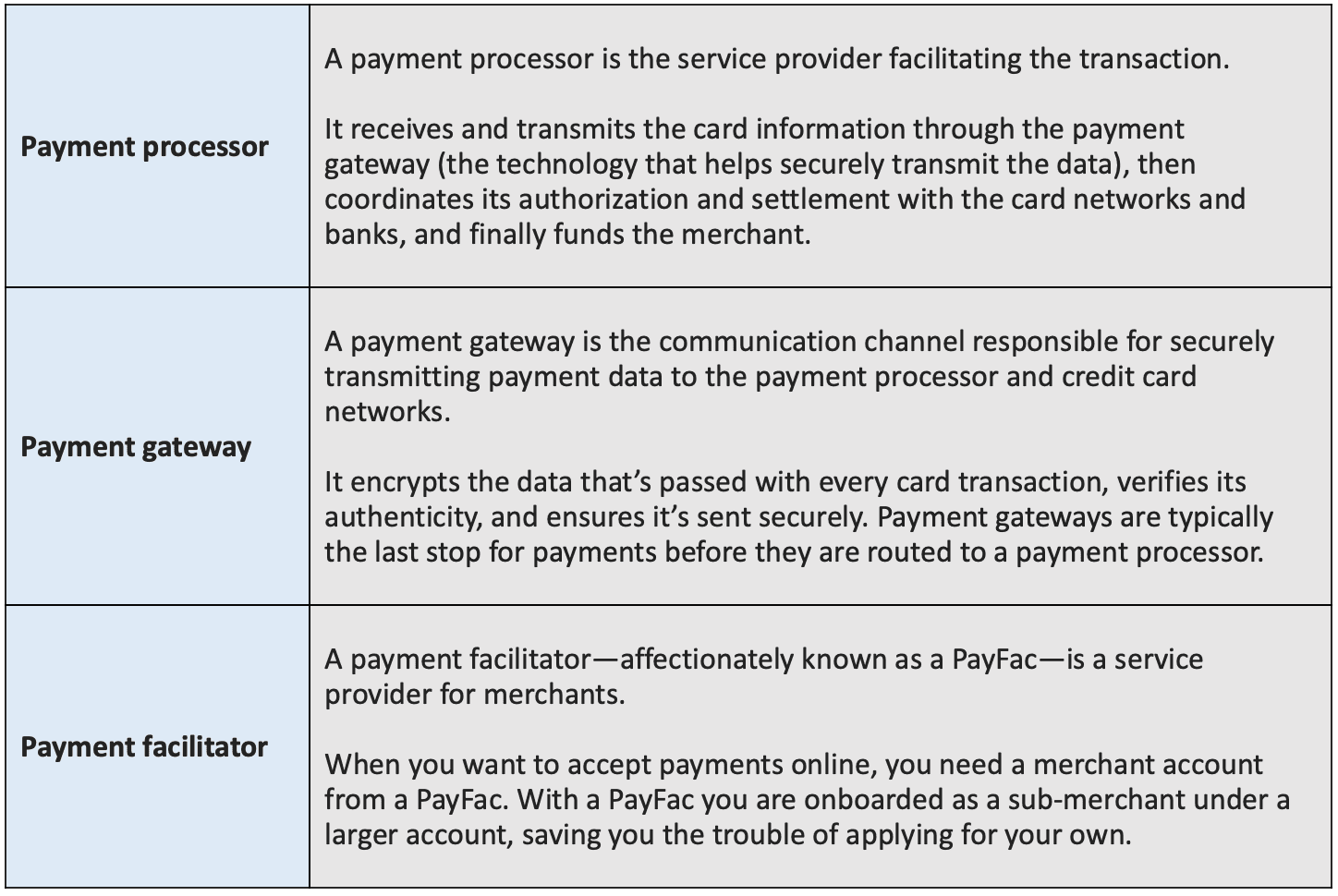

Key definitions

—

The payments ecosystem is complicated. For customers, a credit card payment seems instantaneous, taking no more than a few seconds. But what appears simple on the surface involves a complex set of interactions between several players, resulting from decades-long efforts to streamline, facilitate, and handle the processing of credit cards.

Throw in the many similar sounding terms to get used to—like payment processor and payment gateway and payment facilitator—and it’s easy to get confused. However, knowing these terms and how each financial system relates to the others is important to successfully managing your payments process. In fact, these three elements are arguably the most integral for ensuring the transactions you handle for customers are passed quickly and securely.

In this blog, we’ll help you understand the differences between these core terms and explore what you need to start accepting payments online. For a more comprehensive overview of how credit card processing technology can speed up and automate payments, read The Ultimate Guide to Credit Card Processing.

Table of contents:

Payment processors: everything you need to know

To accept payments online—there’s no better time than now to be doing so—you’ll need both a payment processor and a payment gateway. These terms are often used interchangeably, yet it’s not a case of payment processor vs payment gateway. They’re both deeply interconnected but perform very different tasks.

What is a payment processor?

A payment processor is the actual company that handles card transactions for a merchant, acting as the go-between for them, the banks, and the card networks. A payment processor supports with capturing payment information and forwarding it to the card networks and banks. The payment processor will often also sell or lease payment terminal equipment that’s used by merchants to accept payments at a brick-and-mortar location.

Payment processors can also help merchants accept B2B payment methods beyond credit cards, helping them offer their customers a diverse suite of payment options.

💡Note that not all payment processors are created equally. The best payment processors can not only help accept a broader range of payment types but can also help reduce your cost of acceptance—in some cases as much as 40%—through interchange optimization.

How does a payment processor work?

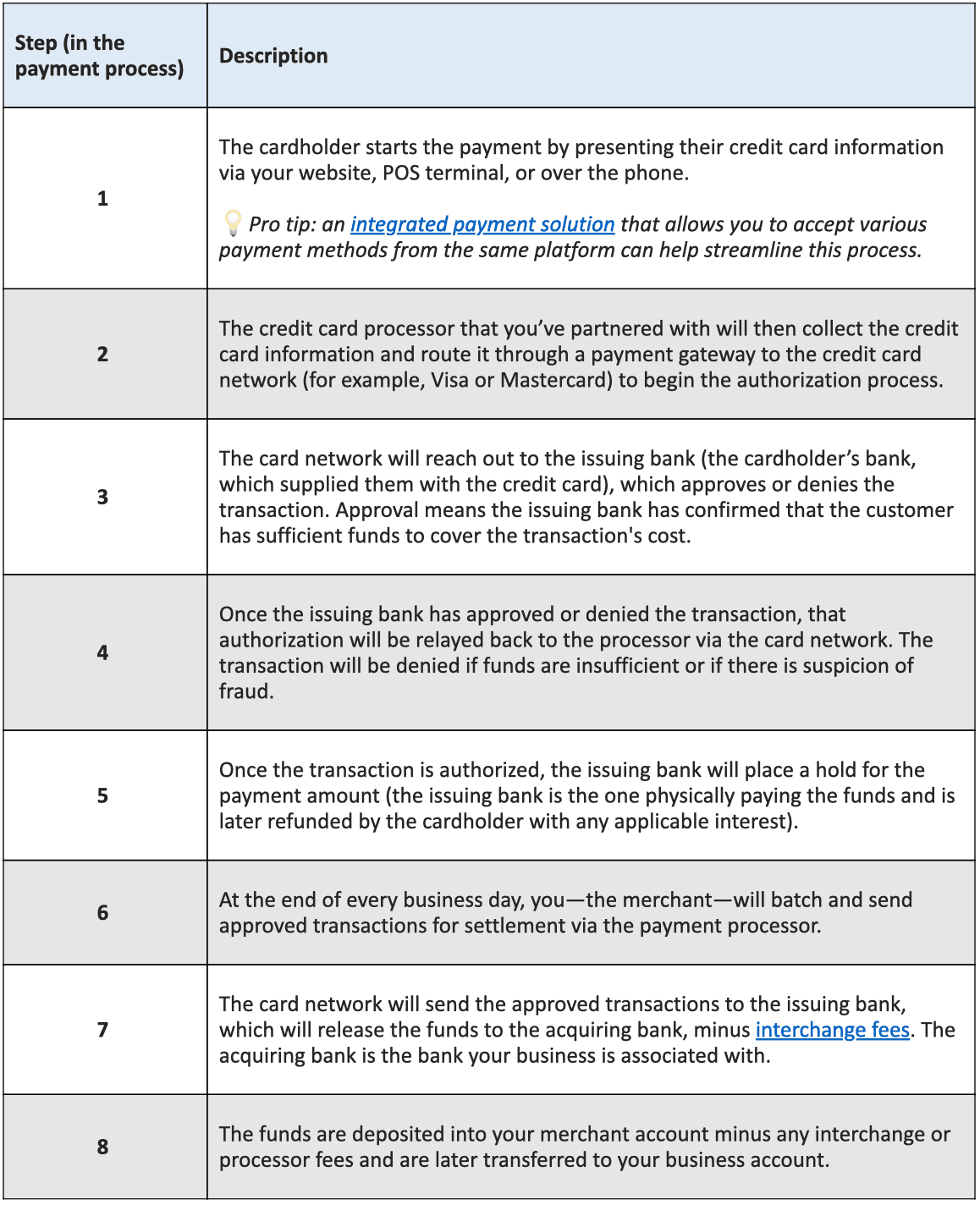

When a customer initiates a credit card payment on your ecommerce site or a point-of-sale transaction, several players are involved in facilitating the transaction and moving the money from the cardholder’s account to yours.

Essentially, the payment processor—the service provider facilitating the payment acceptance—receives and transmits the card information through the payment gateway (the technology that helps securely transmit the data), then coordinates its authorization and settlement with the card networks and banks, and finally funds the merchant.

What does the process look like?

- Step 1: The cardholder starts the payment by presenting their credit card information via your website, POS terminal, or over the phone. 💡Pro tip: an integrated payment solution that allows you to accept various payment methods from the same platform can help streamline this process.

- Step 2: The credit card processor that you’ve partnered with will then collect the credit card information and route it through a payment gateway to the credit card network (for example, Visa or Mastercard) to begin the authorization process.

- Step 3: The card network will reach out to the issuing bank (the cardholder’s bank, which supplied them with the credit card), which approves or denies the transaction. Approval means the issuing bank has confirmed that the customer has sufficient funds to cover the transaction's cost.

- Step 4: Once the issuing bank has approved or denied the transaction, that authorization will be relayed back to the processor via the card network. The transaction will be denied if funds are insufficient or if there is suspicion of fraud.

- Step 5: Once the transaction is authorized, the issuing bank will place a hold for the payment amount (the issuing bank is the one physically paying the funds and is later refunded by the cardholder with any applicable interest).

- Step 6: At the end of every business day, you—the merchant—will batch and send approved transactions for settlement via the payment processor.

- Step 7: The card network will send the approved transactions to the issuing bank, which will release the funds to the acquiring bank, minus interchange fees. The acquiring bank is the bank your business is associated with.

- Step 8: The funds are deposited into your merchant account minus any interchange or processor fees and are later transferred to your business account.

What are examples of a payment processor?

Popular payment processors include:

- Versapay

- First Data Merchant Services

- TSYS

- Global

- Chase Paymentech

- Heartland

- Moneris

- Vantiv

- PayPal

- Square

- Apple Pay

What fees does a payment processor charge?

Merchants processing credit cards will incur certain processing fees charged by the organizations that facilitate the transactions. Of the 5 different transaction fees—payment processor, interchange, assessment, authorization, and other—payment processor fees account for roughly 7% of total processing costs.

These fees include the payment processor moving money from the issuing bank to the acquiring bank, and it varies on a few factors—namely, the amount and value of the transactions processes, and the pricing model chosen.

Payment gateways: everything you need to know

What is a payment gateway?

A payment gateway creates a secure connection between a merchant’s ecommerce site and the payment processor. It encrypts the data that’s passed with every card transaction, verifies its authenticity, and ensures it’s sent securely. Payment gateways are typically the last stop for payments before they are routed to a payment processor.

Payment gateway vs payment processor: what’s the difference?

The difference between a payment processor and a payment gateway lies in the fact that one—payment the processor—is the service provider facilitating the transaction, while the other—the payment gateway—is the communication channel responsible for securely transmitting the payment data to the payment processor and credit card networks.

Another critical difference is that for purchases made at a physical location, the POS terminal supplied by the payment processor is all that’s needed to verify the authenticity of a card, while in card-not-present transactions (like those made online), the payment gateway will authenticate the card before securely sending its details to the payment processor.

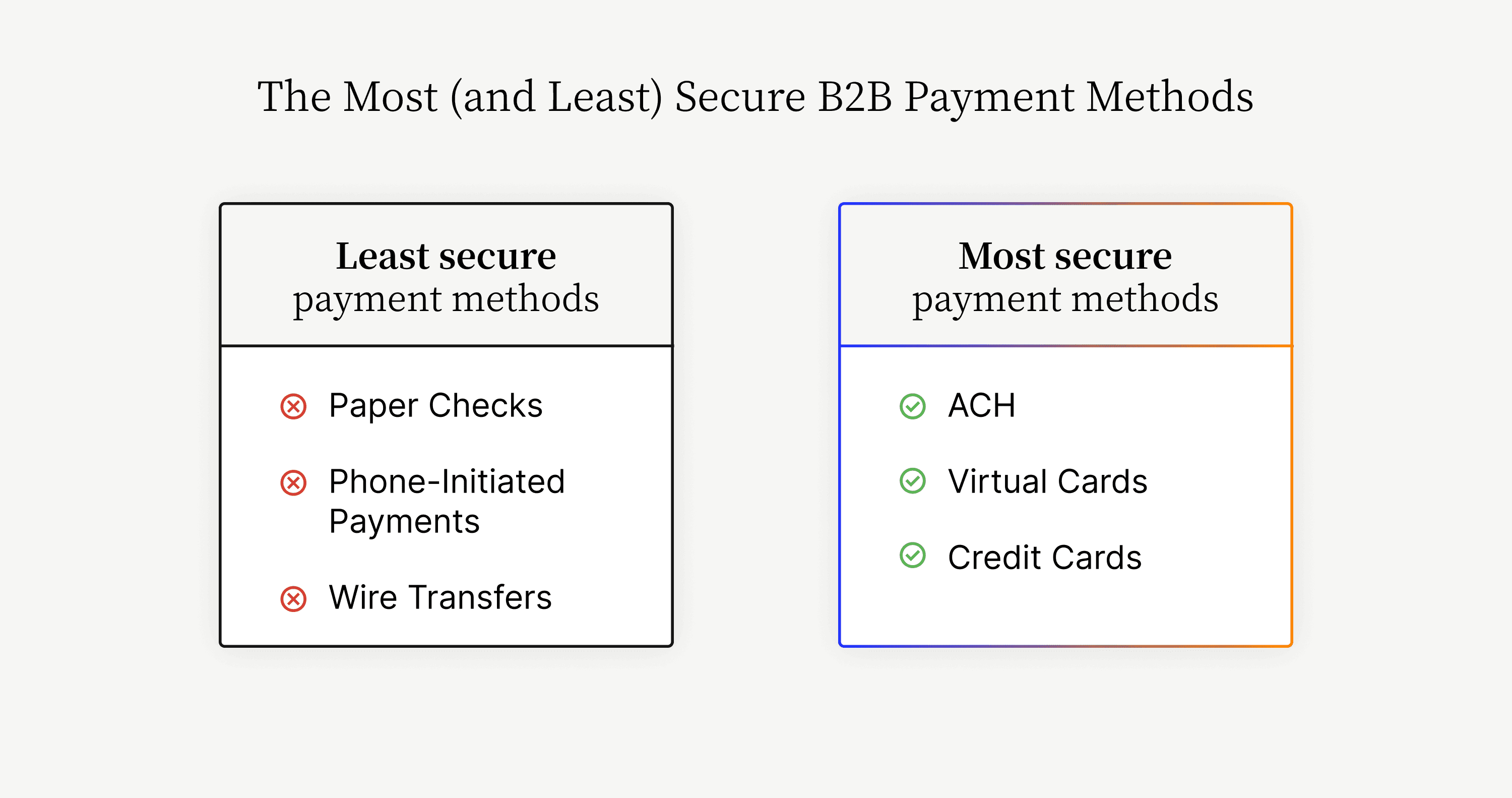

Naturally, the riskier nature of card-not-present transactions makes security an utmost priority when verifying and transmitting card details. That said, credit card transactions are still one of the most secure B2B payment methods.

Should payment processing companies have proprietary payment gateways?

Short answer: yes.

Payment processors should consider bundling all the services a merchant needs to accept payments, including equipment and support for setting up a merchant account. In some cases, the payment processor will also have their own proprietary gateway. The value in this is that the processor can control the entire transaction flow—they’ll facilitate payment acceptance, securely send payment data to card networks and banks, fund the merchant, etc.—rather than bringing in another third party.

Long answer: still yes, but here’s more context.

Merchants rely on third parties to help with their payment processing needs. Commonly outsourced components include shopping cart plugins, customer portals, and of course, payment gateways—some payment service providers even outsource the process of tokenizing transactions to ensure PCI compliance.

The problem with this lies in its impact on the overall customer experience. Customers are at the heart of payments, and payment processors are feeling pressure to create more seamless transaction flows.

When payment information is passed between multiple vendors—many of whom are not privy to the merchant’s business needs or have not built relationships with the merchant—the transaction flow feels fractured and lackluster. The merchant loses a significant amount of control, and the payment processor is unable to oversee the entire customer experience.

Unfortunately, few payment processors supply a holistic suite of merchant services—proprietary payment gateway included. Those that do ultimately perform payment facilitation in-house can ensure a more seamless payment experience for customers and greater back-office efficiencies for merchants.

Payment processors that operate as gateways can control the entire transaction flow without experiencing downtime by having to depend on customer service, onboarding, or any other myriad third parties. Outsourcing degrades the customer experience, and there lies the value of developing and controlling every facet of a transaction.

What are examples of a payment gateway?

Popular payment gateways include:

- Beanstream / Bombora

- Chase Paymentech (Orbital)

- Heartland Payments

- USAePay

- CardConnect

Payment facilitators: everything you need to know

What is a payment facilitator? ISO vs PayFac

When it comes to merchant account providers, there are two options:

- An Independent Sales Organization (ISO) or,

- A Payment Service Provider (PSP), also known as a Payment Facilitator (PayFac).

You may have also come across the term Member Service Provider (MSP), which is simply the term Mastercard uses in place of ISO (these refer to the same thing).

Both types of merchant account providers can help with your payment processing equipment and service needs. The difference between the two is that with an ISO you get your own merchant account, while with a payment facilitator you don’t.

With a PayFac you are onboarded as a sub-merchant under a larger account, saving you the trouble of applying for your own. Payment facilitators also help ensure a more seamless payment experience for customers and greater back-office efficiencies for merchants.

The application process for a merchant account requires considerable paperwork and can take several days or even weeks, which is a key reason many businesses prefer to work with payment facilitators. With a PayFac you can start accepting payments almost immediately and get more opportunities to integrate payment acceptance with other technologies, particularly when the service provider also owns the payment gateway.

Generally, a PayFac is a good fit for businesses that process less than $1 million in payment volume annually, while an ISO is well-suited for larger businesses that process more than this. This is because the per-transaction payment processing rates are typically better for merchant accounts—as opposed to sub-merchant accounts.

What does a payment facilitator do?

A payment facilitator provides the necessary infrastructure for sub-merchants to begin accepting credit card payments online. Beyond that, PayFacs serve a series of core functions including:

- Underwriting and onboarding—PayFacs speed up the merchant account onboarding process by streamlining the underwriting process which is notoriously slow and full of paperwork. Essentially, PayFacs get merchants up and running quicker.

- Transaction monitoring—PayFacs take on the liability for transactions their sub-merchants process; they’re responsible for monitoring transactions and keeping an eye out for suspicious, fraudulent, or anomalous transactions and behaviors.

- Merchant funding—PayFacs handle funding their sub-merchants and reconciling transactions. For merchants not using PayFacs, they’re funded depending on the schedule the acquirer has set; with PayFacs, the funding process is substantially improved.

- Chargeback management—Alongside the acquiring bank, payment facilitators help manage the chargeback process. PayFacs operate as intermediaries between the acquirer and the merchant, submitting necessary documentation and transferring funds back to the cardholder.

Payment facilitator vs payment processor: what’s the difference?

The PayFac vs payment processor is another common misconception. A payment processor facilitates the transaction. The payment facilitator is a service provider for merchants. It is possible for a payment processor to perform payment facilitation in-house. This ensures a more seamless payment experience for customers and greater back-office efficiencies for sellers.

It’s desirable for payment processors to be PayFacs too because traditional payment processors know very little about their merchants’ customers. They tend to be third party financial institutions with little skin in the game, which results in the merchant—you—losing control of your customers’ experience with your brand because you’ve turned the payment experience over. This is not the case with PayFacs.

Merchant accounts vs payment processors

What is a merchant account?

A merchant account is the type of bank account needed for a business to be able to accept credit card payments and represents an agreement between you, your bank, and the payment processor.

You can apply for a merchant account through your existing bank, but it’s often easiest to work with a payment processor to get one, as they can bundle this with the other services they supply and manage the entire application process for you. Different payment channels—in-store vs. online, for instance—will often require their own merchant account, so it’s important to partner with a service provider that can support all the payment channels you need.

What is a merchant acquirer?

A merchant acquirer—commonly called the acquiring bank, credit card acquirer, or simply the acquirer—is the financial institution that enables you, the merchant, to accept credit card payments. The acquirer also settles transactions for you.

What is the difference between a payment processor and a merchant account?

Payment processors act as mediators between merchants, banks, and card networks. They record the payment information and forward it to the card networks and banks. The most sophisticated payment services providers can integrate with your Enterprise Resource Planning (ERP) software. In this case, you’re able to capture any payment, from any channel and house that data in one place.

The merchant acquirer maintains the merchant's account and deposits the funds. The payment processor does much of the heavy lifting by communicating back and forth with the card networks, issuing banks, and acquiring banks.

The acquirer and payment processor are typically two separate entities. In some cases, one entity—usually a large bank—acts as the acquirer and payment processor.

More frequently asked questions about payment processors, payment facilitators, and payment gateways

What are the different types of payment processors?

Five types of payment processors are payment aggregators, issuer processors, acquiring processors, front-end processors, and back-end processors.

A payment aggregator is a third-party processor that enables businesses to accept different types of payment methods without setting up their own merchant accounts. An issuer processor sends customer transaction information from the payment gateway to the card network for the issuing bank to verify and authorize. An acquiring processor connects with the merchant, acquiring bank, and card networks to ensure that the transaction is authorized and settled. Front-end processors collect cardholder information and authorize customer transactions. Back-end processors then accept the transaction settlements and transfer the funds from the issuing bank to the merchant bank.

What do the best payment processing companies have in common?

Features such as ERP payment processing, interchange optimization, self-service enablement, customization options, and user-friendly customer onboarding are highly important when evaluating payment processing companies.

It’s also essential to select a payment processing company that offers advanced levels of security and PCI compliance. The best companies will streamline the payment process by reducing manual labor, and simplifying bank reconciliation and reporting, all while offering various payment methods.

How do payment processors, payment gateways, and merchant accounts work together?

Payment processors, payment gateways, and merchant accounts work together to aid and expedite secure online payment transactions. Once a customer initiates a transaction with a debit card or credit card, the payment gateway encrypts the customer’s card information and sends it to the payment processor. The payment processor receives the encrypted information and communicates with the card issuer or customer’s bank to confirm that sufficient funds are available.

After the transaction is authorized, the payment processor sends the authorization code back to the payment gateway, which then sends the authorization directly to the merchant. The funds get transferred from the customer’s bank account to the merchant account, where it’s held until the payment processor completes the settlement and sends the funds to the business’s bank account.

What are the four types of payment gateways?

The four types of payment gateways are API-hosted gateways, local bank integration gateways, hosted payment gateways, and self-hosted gateways.

API-hosted gateways use an application programming interface that integrates directly with the merchant’s website, allowing custom credit card or debit card checkouts. Local bank integration gateways send customers to the payment gateway’s website, also referred to as the bank’s website, to complete the transaction before being redirected back to the merchant’s website. Hosted payment gateways redirect customers from the merchant’s website to a third-party payment service provider’s website to complete the checkout process. In contrast, self-hosted gateways enable payment transactions to be managed and completed directly on the merchant’s website, offering a more secure and customizable checkout process.

Why should I use a payment facilitator?

Payment facilitators offer many benefits such as advanced security features, flexible pricing structures, and simplified, user-friendly transactions. Facilitators support major credit card networks and create a simplistic onboarding and underwriting process, allowing faster payment acceptance, lower transaction failures, and greater revenue generation.

What do you need to start accepting payments online?

In addition to an ecommerce platform, to accept payments online you’ll need a payment processor, a payment gateway, and likely at least one merchant account. Working with a total merchant services provider like Versapay is the easiest way to get up and running quickly with everything you need to start accepting payments online.

With Versapay you can start accepting payments in as little as 24 hours from all your channels such as invoice, ecommerce, card-not-present, and point-of-sale, all integrating seamlessly with your enterprise resource planning system (ERP).

To learn more about the considerations you should take into account when researching and selecting a payment processor—from transaction speeds to customer support—check out our free resource, The Ultimate Guide to Credit Card Processing.

About the author

Jordan Zenko

Jordan Zenko is the Senior Content Marketing Manager at Versapay. A self-proclaimed storyteller, he authors in-depth content that educates and inspires accounts receivable and finance professionals on ways to transform their businesses. Jordan's leap to fintech comes after 5 years in business intelligence and data analytics.