What Is Merchant Underwriting? How It Works and What To Expect

- 8 min read

In payment processing, merchant underwriting is a risk assessment every merchant undergoes before they can accept electronic payments.

This blog will fully define merchant underwriting and explore how merchants can successfully (and without frustration) navigate the underwriting process.

When a payment processor carries out transactions on behalf of a merchant, they take on a certain amount of risk.

For banks, processing a payment is like providing a business with credit, similar to a line of credit. To ensure a merchant is worthy of this trust placed on them, payment processors will do their due diligence and assess a business’ merchant risk level before going ahead and providing them with a merchant account. This process is called underwriting.

What’s involved in underwriting is not always clear to new merchants from the get-go, making for a frustrating process.

To help you successfully navigate the underwriting process, we’ve put together this guide covering:

What is merchant underwriting?

In payment processing, underwriting (also called merchant underwriting) is a risk assessment every merchant undergoes before they can accept electronic payments. If you want to accept payments online, you’ll need a merchant account. When you complete your merchant account application, that’s when you’ll go through the underwriting process.

Your payment processor or payment facilitator (PayFac) will carefully analyze your application and review the financial risk your business poses to them. The time it takes to get approved for merchant accounts will vary based on your company’s unique financials, but can take as long as 10–14 business days.

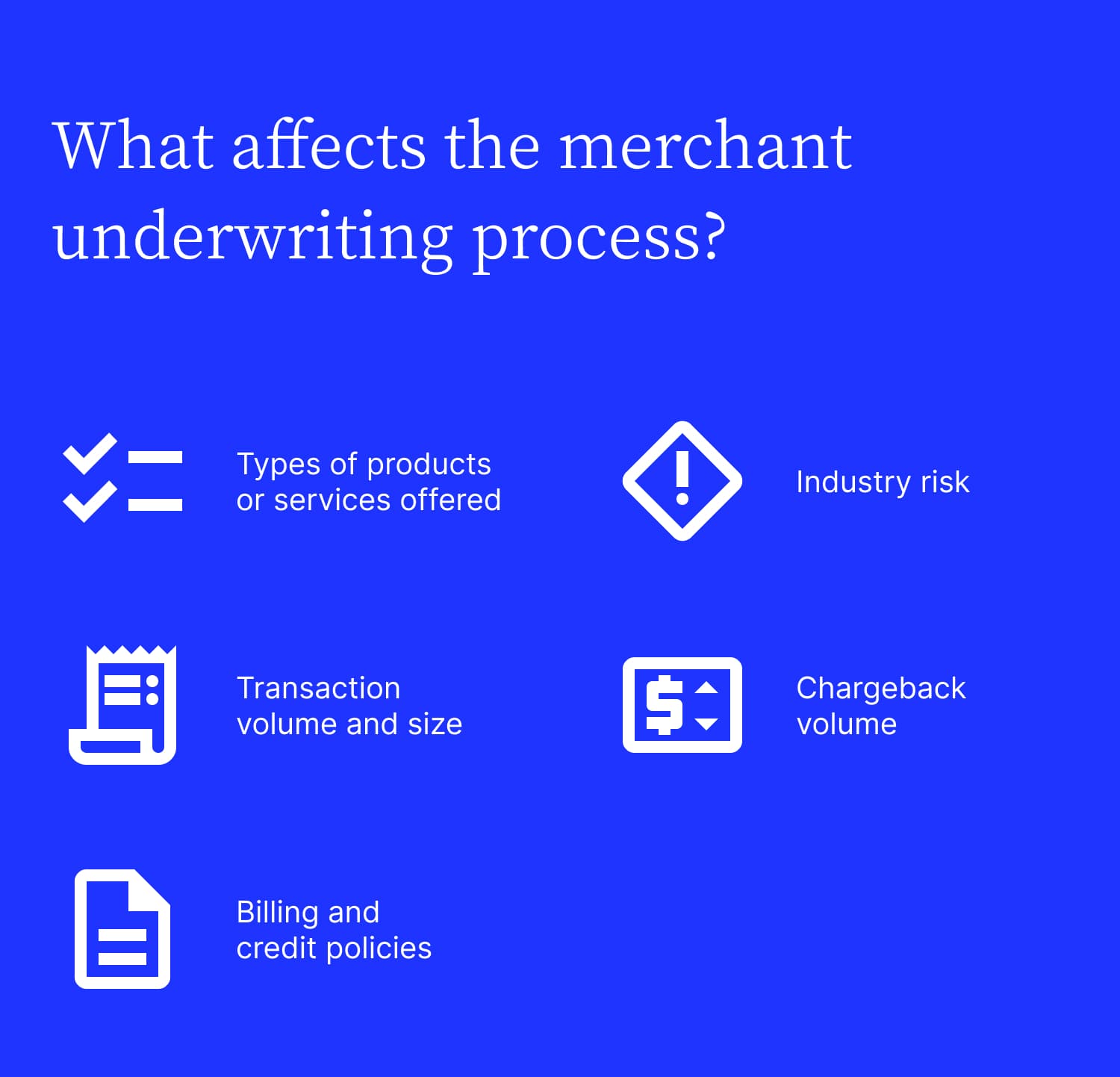

5 factors that affect the merchant underwriting process

Underwriters look at several aspects of your business before deciding on whether to grant you with a merchant account.

Here are five factors that will inform their assessment:

1. The types of products or services you offer

The kinds of products or services you sell will impact your company’s overall underwriting risk profile.

If you're selling services, underwriters will need to determine whether these are clear or ambiguous. For instance, "consulting services” is vague and could set off red flags, whereas “real estate investment consulting services” is well-defined.

Underwriters will also consider the channels you accept payments through. Virtual cards, and bank transfers are considered low-risk channels, whereas cryptocurrencies are considered high-risk.

2. Your industry risk

Some industries like gambling, cannabis, or firearms are naturally considered high-risk. As a result, payment processors might reject merchant account applications from companies in these sectors, or approve them on the condition that the merchant pay higher than average processing fees.

3. Your transaction volume and size

A merchant account applicant with high sales or transaction volumes could signal high risk to an underwriter, especially if the business is small. This is because they’re at a greater risk of experiencing excessive chargebacks. Businesses with high transaction volumes and an established track record and previous merchant account are an exception.

Underwriters will compare your requested merchant payment processing volumes to industry averages to define what is high or low.

Beyond your volume of transactions, underwriters will also look at the size of those transactions. Large or inconsistent transactions are a higher risk signal than small transactions.

4. Your chargeback volume

If you have an existing or previous merchant account, an underwriter will ask you for data about your chargeback history. A chargeback occurs when a customer requests their money back directly from the bank after purchasing from you, because they’re dissatisfied or they suspect fraudulent activity.

A high chargeback rate indicates a poor product or service or ineffective fraud management practices on your end, increasing your business risk in an underwriter’s eyes. Payment processors look to avoid exposure to legal liability from such claims.

5. Your billing and credit policies

Your payment terms for credit sales are also something that a merchant account underwriter will consider.

Underwriters may consider your business to be risky if you offer customers particularly long (over 60 days) credit cycles. Payment processors prefer companies that bill customers before services are rendered, but they’ll accept companies that offer moderate credit cycles as well. Merchant credit cycle lengths might cause underwriters to reject your application if your business poses risks in other areas.

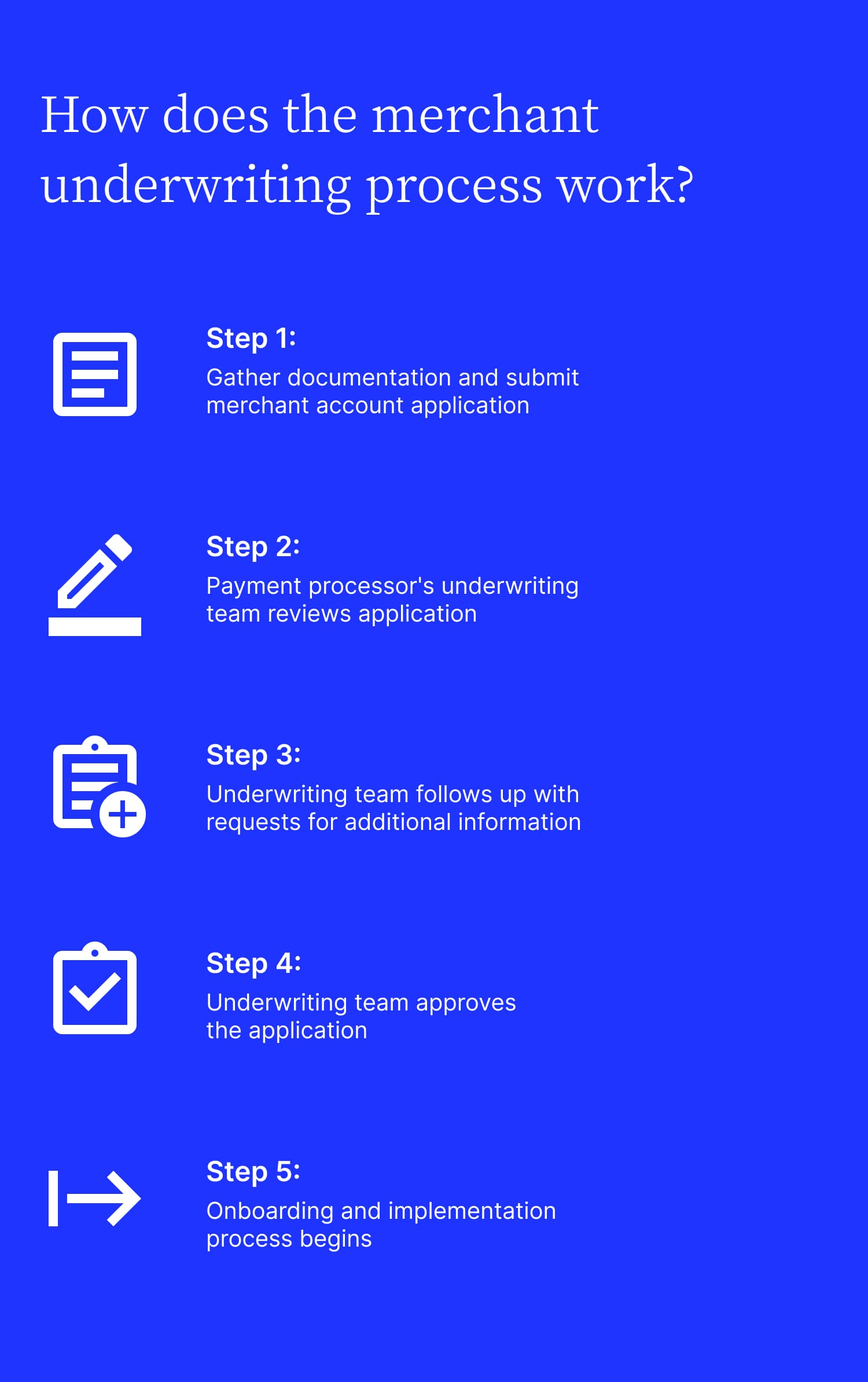

How the merchant underwriting process works

Here is an overview of how you can expect the merchant account underwriting process to go:

Step 1. Gather documentation

You’ll gather all required documentation and submit your merchant account application to the payment processor (you can find an overview of all these documents below). Be sure to submit all documents in the formats the processor requests.

Step 2. Review application

The payment processor’s underwriting team will begin reviewing your application. The time it takes them to get through your application will vary based on your unique business case, but can range from a few business days to a few weeks.

Step 3. Follow up

The underwriting team will follow up with you on any additional information they need. At this point they might ask you for more documentation.

Step 4. Approve application

The underwriting team approves your application. Some processors will approve high-risk merchants with special caveats, like enforcing holding times before funds are deposited (to minimize chargeback risk).

Step 5. Onboarding and implementation

The onboarding and implementation process begins.

The documents you’ll need for the underwriting process

A common source of delays in the underwriting process is when a merchant doesn’t have the correct documentation.

To spare you this frustration, ensure you have all of the following documents ready when kicking off the merchant account underwriting process.

Beyond your application form, for each tax ID or Social Security Number associated with your business, you should provide the following documents:

- Your last three bank statements

- Your last three merchant processing statements

- Income statements and balance sheets for the last two years (if processing over 750K annually)

- A copy of a voided check OR bank letter—if providing a bank letter it must:

- Be on bank letterhead

- Include the registered name of your business if operating under something other than your legal business name (DBA name)

- Include an ACH routing number

- Include and ACH account number

- Be signed by a bank representative and be dated within the last year

To verify your business address, you may also need to provide a utility bill or lease agreement.

If you do business via ecommerce, you’ll want to ensure your website displays the following:

- An https web address (signaling the page is secure)

- A complete description of the goods and services you offer, including prices

- Your business contact information (address and telephone number, which should match the information presented on your merchant account application)

- Any alternate contact information, like an email address

- The currency your transactions will be conducted in

- Your customer service phone number

- Your delivery standards (including delivery method and time)

- Your business’ country of origin

- Clear identification of the card networks you accept

- Terms and conditions and/or any legal restrictions

4 tips for merchant account applicants to avoid unnecessary delays in the underwriting process

To avoid any unnecessary delays in the underwriting process, merchants should aim to:

Tip 1. Have a positive credit rating

Address any late payments or liens you have to improve your merchant credit rating.

Tip 2. Have correct documentation and information

Prepare and gather all necessary documentation in advance. This will help avoid back-and-forths with the underwriting team. Be as detailed as possible when describing your products and services.

Tip 3. Be transparent

Be straightforward about your business’ financial history, such as any previous merchant accounts, bankruptcies, liens, or judgments.

Tip 4. Provide anticipated transaction volumes

Specifying up front the volume of payments you expect to process will help the processor ensure the right transaction lines are set up.

ISO or PayFac: What’s the difference?

There are two types of merchant account providers: independent sales organizations (ISO) and payment facilitators (PayFac), also known as payment service providers (PSP).

With an ISO, you’ll apply for your own merchant account, whereas with a PayFac, you’ll apply to be a submerchant under a larger account. The main appeal of onboarding as a submerchant is that the underwriting process is considerably shorter.

An ISO might be the right fit for your business if:

- You have an annual transaction volume greater than $1 million

- You’re in a high-risk industry (as the likelihood of having your merchant account accepted by a PayFac is lower in this case)

- You have very specific needs, be it customer service or scalability

A PayFac might be the right fit for your business if:

- Your annual transaction volume is lower than $1 million

- You want to get up and running with your merchant account quickly

- You want a flexible agreement, such as a month-to-month plan

With all its complex requirements, the underwriting process can feel daunting. But, working with the right payment processor can make the whole ordeal feel more approachable, with helpful guidance and transparent communication.

Want to learn more about what to consider when researching and selecting a payment processor? Check out our Ultimate Guide to Credit Card Processing.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.