How Pledging Receivables Helps you Meet Financial Obligations and Working Capital Needs

- 10 min read

In this article, you'll learn what pledging is in AR, the advantages of pledging receivables, how it differs from factoring accounts receivable, and more.

Plus, we'll share why AR automation is critical to obtaining receivables financing.

Key takeaways

Accounts receivable is a great way to finance your business, and pledging receivables is one of multiple AR financing options.

Pledging receivables is different from invoice factoring and assignment since collection and default responsibilities vary.

Accounts receivable data like invoice statuses, AR aging, and cash flow data analysis are critical to successfully raising funds from pledged receivables.

AR automation offers several advantages to companies financing working capital using their receivables.

—

Small to mid-sized businesses routinely use their accounts receivables (AR) to finance working capital and meet their financial obligations. Pledging receivables is one such option, but how do you know if this is the right choice for your company?

In this article, we cover what pledging receivables means, how it works, and how AR automation can help you figure out whether this is the right choice.

What's in this article:

What is pledging receivables?

Pledging receivables is placing a portion of your accounts receivable as collateral for a loan with a bank or lender. You can pledge receivables that are not past due as collateral.

Lenders will review your cash flow data and assess default risks before accepting your AR as collateral. This makes maintaining accurate collections and AR data critical when pledging receivables.

What happens when you pledge accounts receivable?

Companies looking to pledge their receivables usually reach out to lenders specializing in this form of financing. These lenders will ask for documents like:

After scrutinizing these data, the lender will offer a loan based on the value of the receivables and an interest rate. The amount the lender offers depends on factors like the probability of collecting on an invoice and the age of a receivable.

Presenting AR data in a well-organized format helps lenders understand your policies easily and increases the likelihood of you receiving more for your receivables. Typically, lenders offer between 70 to 80% of outstanding receivables.

Note that lenders hold your receivables as collateral when you pledge them. You're still responsible for collecting outstanding invoices. You (the company) bear default risk fully when pledging receivables.

How lenders evaluate your accounts receivable data

Loan underwriters review several AR-related datasets before deciding how much to loan a business. Most lenders offer between 70 to 80% of your outstanding receivables, as mentioned previously. However, much depends on the lender's underwriting limits and the state of your accounts receivable.

For instance, some lenders might review your AR aging tables and offer an amount that is a portion of outstanding invoices less than 45 days old. Others might extend that term to 60 days.

Once approved, lenders will charge you a service fee and present interest rates and other terms like the loan's duration. Interest rates depend on your industry and customer credit profile. While no reliable benchmarks exist, you can expect interest rates to track broad business financing rates.

The lender's policies are outside your control, but you can increase the odds of a positive result by ensuring you do the following:

Present AR data in an easily understood format.

Have supplementary evidence like delivery slips or sales contracts on hand.

Organize AR data to show an order-to-cash (O2C) audit trail.

Present customer-level collections data.

Present collection efficiency metrics like days sales outstanding (DSO) and collection effectiveness index (CEI) as part of your dashboards.

Organize trade references and customer credit data in easily understood formats.

An example of pledging receivables

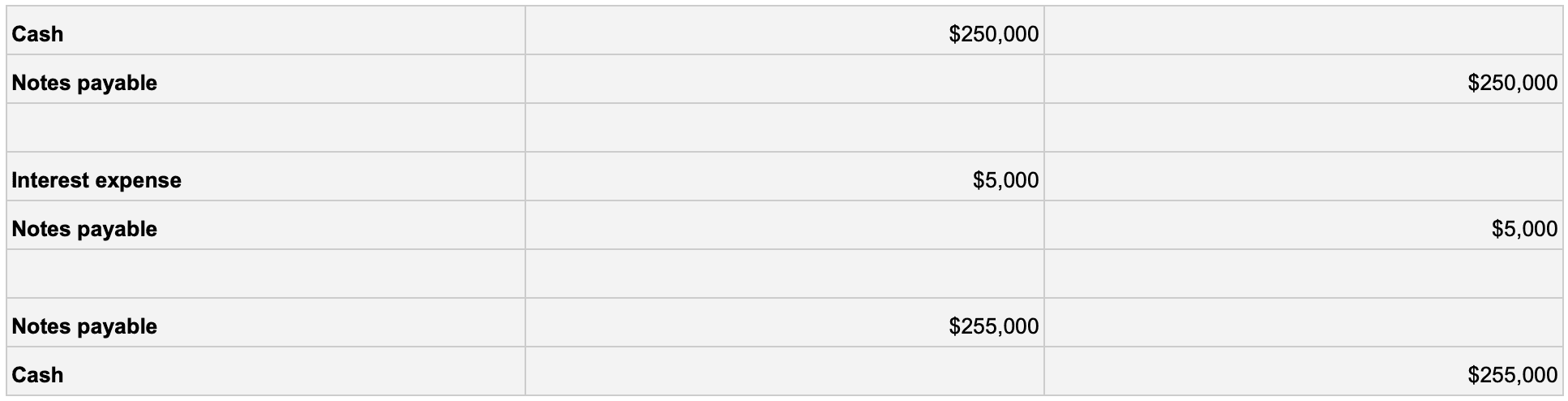

Once the lender approves the loan and you finalize terms, you'll have to record it on your books. Here's an example of the impact pledging receivables makes on your journal entries.

Loan amount—$250,000

Receivables pledged—$300,000

Interest rate—5%

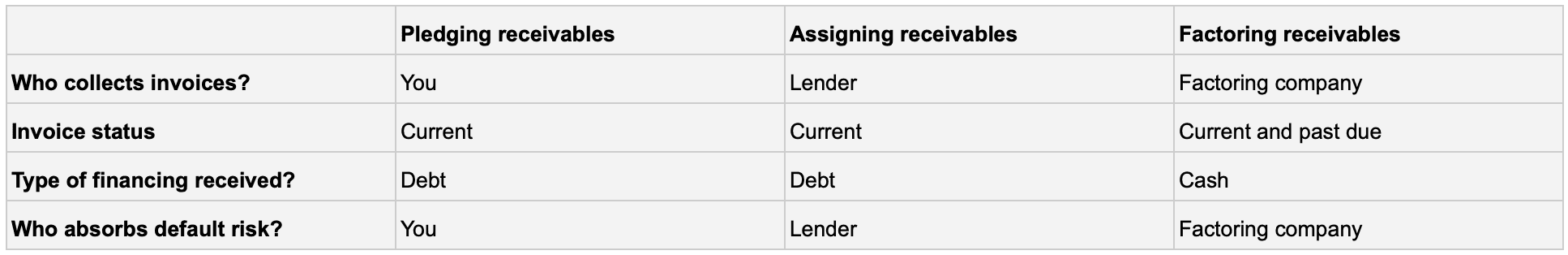

4 differences between pledging, assigning, and factoring accounts receivable

Pledging receivables is similar to assigning or factoring them, but the devil is in the details. Here are the most important differences between these AR financing options you must understand.

What are the advantages of pledging receivables?

Like every financing option, pledging receivables offers your business a few advantages. Here are the most important ones to understand:

Pledging receivables is a relatively easy financing option.

Pledging receivables gives you more cash.

Pledging receivables does not impact customer relationships.

Pledging receivables forces AR process standardization.

Pledging receivables is a relatively easy financing option

Unlike other financing options such as business loans, securing a loan by pledging receivables is relatively easy. A big reason is receivables are assets lenders can quantify with a good degree of accuracy.

For instance, a lender can look at your DSO to approximate when your invoices will clear. They can look at your AR aging record to calculate how much cash your company will receive over the next month or quarter. They can look at your collection effectiveness index and calculate the probability of collecting outstanding invoices.

These numbers give lenders a good deal of confidence when lending money, making it relatively easy for you to secure working capital.

Pledging receivables can give you more cash

Pledging receivables might give you more cash upfront compared to invoice factoring. While much depends on your industry and customer credit quality, the interest rate a lender charges you could be lower than a factoring company's discount rate.

This gives you more cash upfront to finance your business, extending your liquidity runway.

Pledging receivables does not impact customer relationships

When you pledge your receivables, you retain control over collections and customer communication. Compare this to invoice factoring and assignments where a third party absorbs collections risks, and the impact on customer relationships is evident.

For instance, a long-time customer might suffer from a temporary cash-flow hole, preventing them from paying you. A factoring company is unlikely to prioritize your history with that customer, choosing to collect cash as quickly as possible.

This situation could leave a bad impression on the customer, reducing the likelihood of them returning to you when circumstances improve.

Pledging receivables forces AR process standardization

Pledging receivables, like all forms of AR financing, creates debt you must manage well. The process forces your finance department to collaborate and present data in an easily understood format.

For example, you must present customer credit data and your credit policy. Your AR team must work with sales to understand customer credit terms and refer to internal systems to validate invoice statuses and history.

Your team is more likely to rely on standardized processes, as a result, since an ad-hoc process will lead to inadequate or disorganized information, leading to lenders rejecting your application—an outcome no one wants.

Why accounts receivable automation is key to obtaining receivables financing

Accounts receivable data is the key to successfully pledging receivables. If you're processing a good deal of invoices each month—the average mid-sized company processes 2,433 invoices monthly—a manual AR process will likely leave you behind, unable to cope with lender requirements.

Here's how AR automation can help you secure receivables financing:

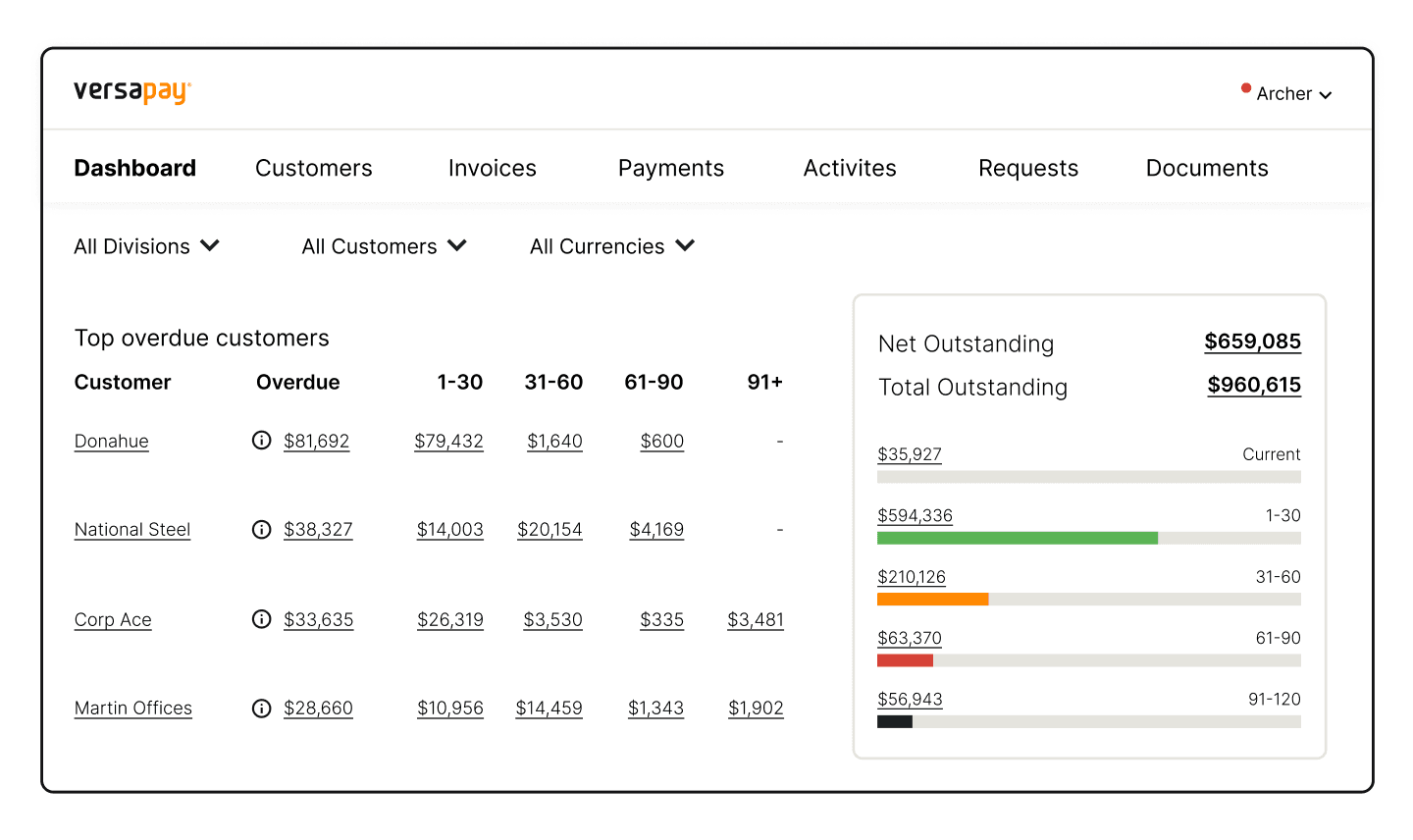

Quick insights into AR data

Lenders need visibility into your AR data to understand aging timelines and credit risk. Automation helps you create these reports quickly and present real-time information. Automation also eliminates errors caused by manual work, reducing the time it takes you to present data and secure financing.

Frees AR’s time to analyze cash flow

Figuring out when you need financing is a critical task. Given the expense associated with AR financing, analyzing your cash flow is a critical AR task. Automation frees your AR team's time, giving them more space to dig deeper into cash flow bottlenecks.

☝︎ Hear from Versapay’s CFO, Russell Lester, on what you can do to enhance AR performance, now and in the future.

The result is greater AR efficiency you can rely on to plan financing ahead of time.

Guarantees AR data accuracy

Automation dramatically reduces invoice processing costs since you'll avoid common errors like incorrect pricing, discounts, or credit terms. You can trust your data and rely on it to create accurate working capital projections.

You'll avoid late payments and always have an accurate cash flow picture.

—

Pledging receivables is a great way to secure financing for your business, but make sure you organize your AR data in an easy-to-understand format.

Collaborative AR automation platforms help you centralize your data for quick cash flow insights and eliminate errors that increase expenses. Learn how Versapay's AR automation platform can help you accelerate cash flow and increase AR efficiency.

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.