4 Risks Manual Accounts Receivable Processes Create—And How to Solve Them

- 12 min read

Manual accounts receivable processes make getting paid quickly very difficult.

This article covers 4 primary consequences of not automating accounts receivable as well as methods for solving inefficient processes.

We’ll also show you what a healthy accounts receivable operation looks like (hint: it’s not manual).

Key takeaways

Manual accounts receivable (AR) processes are more than inefficient—they're downright unprofitable.

In addition to losing money, manual AR processes create accounts receivable risks that alienate customers and jeopardize long-term relationships.

A healthy accounts receivable department is synced with customer issues and has the tools to deliver great customer experience (CX).

By changing the thinking around AR, investing in digital transformation, and planning using a roadmap, companies can transform AR into a CX giant.

—

Every company wants to get paid as quickly as possible. Unfortunately, manual accounts receivable workflows designed for an older state of business are making it impossible for companies to achieve this goal.

For instance, outdated processes such as depositing paper checks and stuffing envelopes with invoices increase collection times and do nothing for customer experience.

This example hints at a deeper issue—the belief that AR is a back-office function and isn't critical to business success. This belief isn't just increasing collection times, it's costing companies in several significant ways. In this article, we look at the most impactful of these costs.

Jump to a section of interest:

The 4 risks of ignoring accounts receivable automation

Technology has changed how companies operate and accounts receivable teams who rely on manual processes are out of sync with this new reality. A lack of modern technology puts AR teams in bad situations where inefficiency and risks are guaranteed since manual processes cannot fulfill modern customer expectations.

Here are 4 primary consequences of ignoring automation / relying on manual processes in accounts receivable:

1. Lost revenue

Accounts receivable might not create revenue, but it plays a major role in efficiently capturing it.

Paper invoices, a mainstay of manual AR processes, get damaged and lost.

Re-issuing or revising them is tedious and time-consuming.

Companies with large volumes of paper invoices cannot track each payment, resulting in incorrect cash application and lost revenue.

The list goes on.

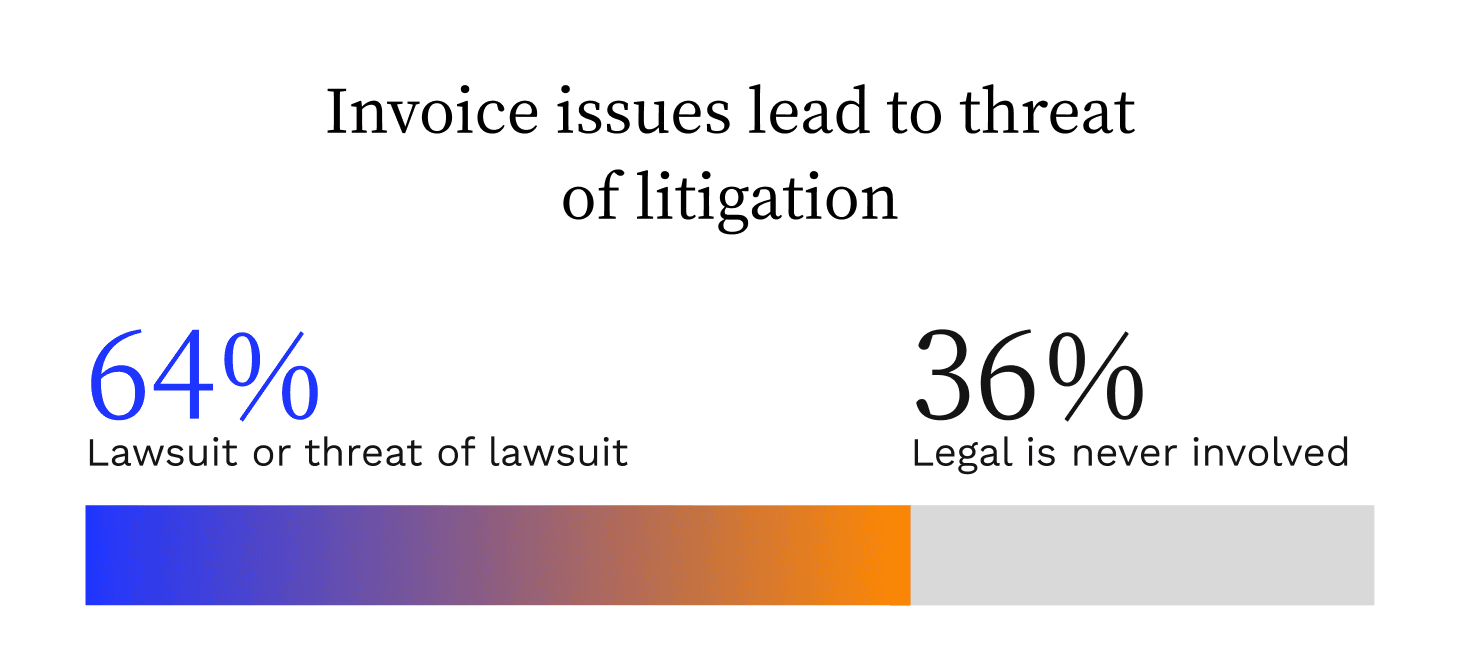

Inefficient manual processes also increase the likelihood of litigation. Our report on the State of Digitization in B2B Finance revealed that 64% of C-level executives report facing legal challenges stemming from invoicing issues.

Even if these legal issues ultimately result in a favorable outcome for the seller, their customers are unlikely to repeat as return customers following that experience. The result is lost business, revenues, and brand trust.

2. Customer alienation

Customer alienation is not quantifiable, per se, but is one of the most serious consequences of ignoring AR automation. Accounts receivable teams using manual processes cannot align themselves with stakeholders in the order to cash (O2C) process, creating a disjointed experience for customers.

For instance, an AR team using manual processes might place credit holds on customer accounts due to lacking visibility into historic payment data. Or, accounts receivable might mistake a single missed payment for a history of missed deadlines, unfairly preventing the customer from placing further orders.

From the customer's perspective, actions like these seem needlessly punitive and unprofessional.

Forrester's report on Versapay’s Total Economic Impact (TEI) highlighted the following activities—all of which manual accounts receivable processes exacerbate—as causes of poor customer experience:

Instances of unfair credit holds

A lack of real-time payment status visibility

Syncing issues between customer service teams and accounts receivable

Unless a company holds a monopoly, these collections experiences are unlikely to get customers positively associating with a company.

3. Rising costs of invoice processing

Manual accounts receivable processes task AR employees with printing invoices, stuffing envelopes, following up with customers, depositing paper checks, and manually applying cash toward each invoice. Tasking highly paid—and highly skilled—AR employees with these clerical processes increases per-hour processing costs.

These tasks are just a fraction of what AR employees have to handle. Dispute resolution, collections, and preparing cash flow reports—and forecasts—for monthly closes are critical tasks that impact a company's growth. Manual processes leave AR teams with little time to address them, causing companies to spend money on tasks with little business value.

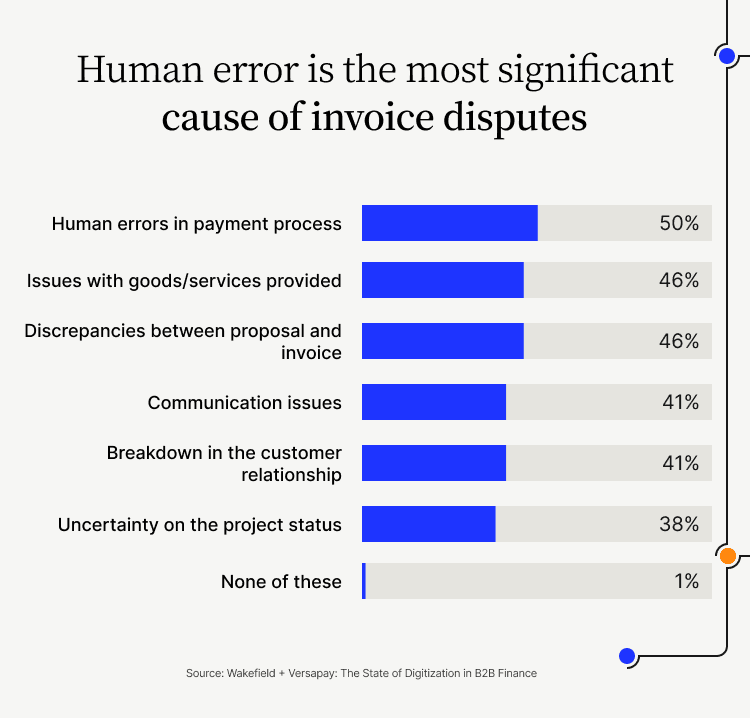

Manual processes also produce errors, leading to even more time spent chasing easily-avoided disputes. A lack of modern customer communication channels forces AR teams to rely on emails and phone calls which also create a time sink.

As a result, companies relying on manual AR workflows end up spending the majority of their accounts receivable budget on clerical tasks instead of ones that boost their bottom lines.

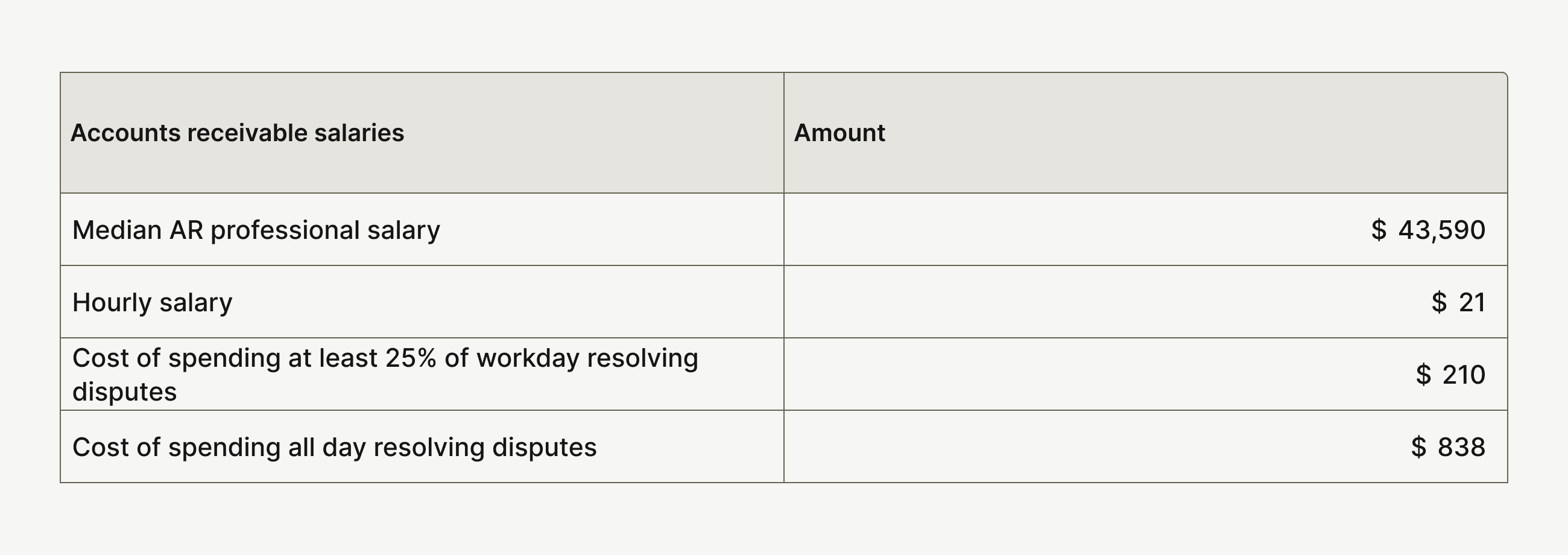

We estimate that mid- to upper-midsized companies are spending between $210 to $838 per employee each week handling easily avoided manual dispute resolution processes:

4. Employee disengagement

The ramifications of manual accounts receivable tasks don't stop with increased per-hour labor costs. A highly-qualified employee is unlikely to remain motivated when forced to perform tasks an intern could accomplish.

In the long run, companies relying on manual AR processes risk employee disengagement and negative workplace culture. Unmotivated employees are unlikely to deliver great customer experiences either, a key driver of business for mid- to upper-midsized companies.

This lack of motivation also leads to attrition, forcing companies to constantly invest in ramping up new employees instead of creating more efficiency—something experienced employees can create in an organization.

—

Despite these risks, why do manual AR processes continue to exist? Inertia caused by the fear of change is the primary reason. While redesigning processes by adopting accounts receivable automation is risky and uncomfortable, these risks pale in comparison to the costs of ignoring the need for change.

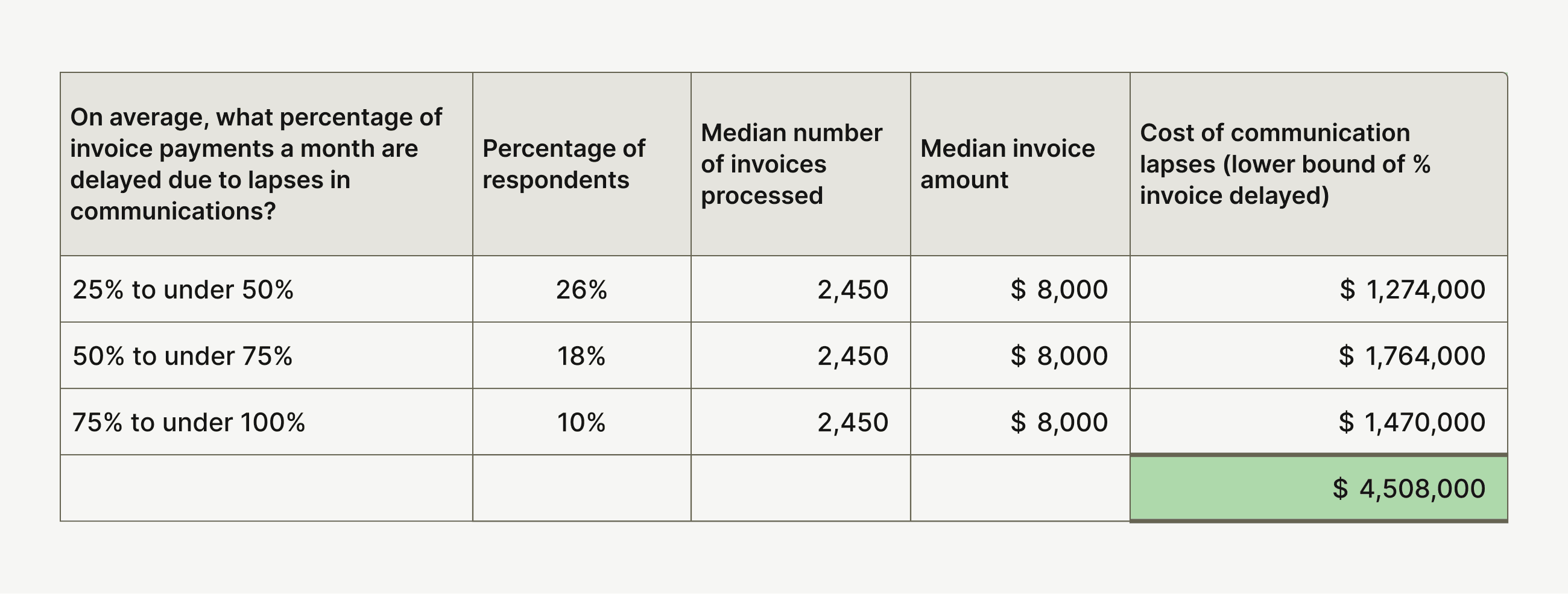

🚨 According to a study we conducted with Wakefield Research, we estimate that upper mid-sized companies are losing $4.5 million every month to poor invoicing processes 🚨

This is the cost of the AR Disconnect—defined as the gap between internal AR and customer AP teams caused by a lack of electronic solutions that foster collaboration. The Disconnect breeds significant accounts receivable risks and manual processes are its root cause. It creates almost irreparable accounts receivable harm, and it’s high time companies solved it.

—

Take our six-minute assessment and get a personalized diagnosis of the challenges you face in your accounts receivable process. You’ll get a customized accounts receivable transformation roadmap to learn exactly where you are in your digital AR journey, how you stack up against peers, and how to set your AR team up for success:

What a healthy accounts receivable function looks like

A healthy AR department does not suffer from the AR Disconnect. But, what does this look like in terms of workflows and daily processes? Most companies rely on accounts receivable KPIs like DSO to measure AR health, but metrics are a result of processes; they’re not the cause.

Here are 3 process-oriented signs of a healthy accounts receivable department that’s aligned with customers and delivering memorable customer experiences:

1. No constant back–and–forths with customers for information

A healthy accounts receivable department is well-tuned to its customer issues and has relevant account, invoice, and payment data at its fingertips. Communication and data centralization are keys to realizing these goals and collaborative AR tools are the vehicle that enables them.

For instance, instant messaging channels in a collaborative accounts receivable payment portal give AR teams an easy method for interacting with their customers’ AP teams, eliminating tedious follow-ups or lost emails. These shared, cloud-based portals centralize all invoice-related and order data, giving AR all the information they need to solve customer issues.

The result is a well-informed AR team that solves issues quickly without disrupting customers. A healthy accounts receivable team has mitigated the communications risks that manual processes pose.

2. A focus on solving complex issues

Disputes are not created alike. Some, for instance, are easily addressed while others need deeper analysis and collaboration with customers to solve. These complex issues in particular offer companies an opportunity to deliver memorable CX through efficient accounts receivable processes.

A healthy AR team is one with credit terms and pricing data at its fingertips, and customers with visibility into dispute statuses. These teams are equipped with technologies—like cloud-based payment portals—to communicate seamlessly with their customers, in real-time, to solve complex disputes quickly.

More importantly, the tools enabling this collaborative accounts receivable environment will eliminate disputes caused by clerical errors. As a result, healthy accounts receivable teams will leverage the freedom that automated AR processes afford them, to focus on value-added tasks and become CX leaders. They will not suffer from the time-sink risks that manual AR processes create.

3. Customers have direct, real-time access to AR

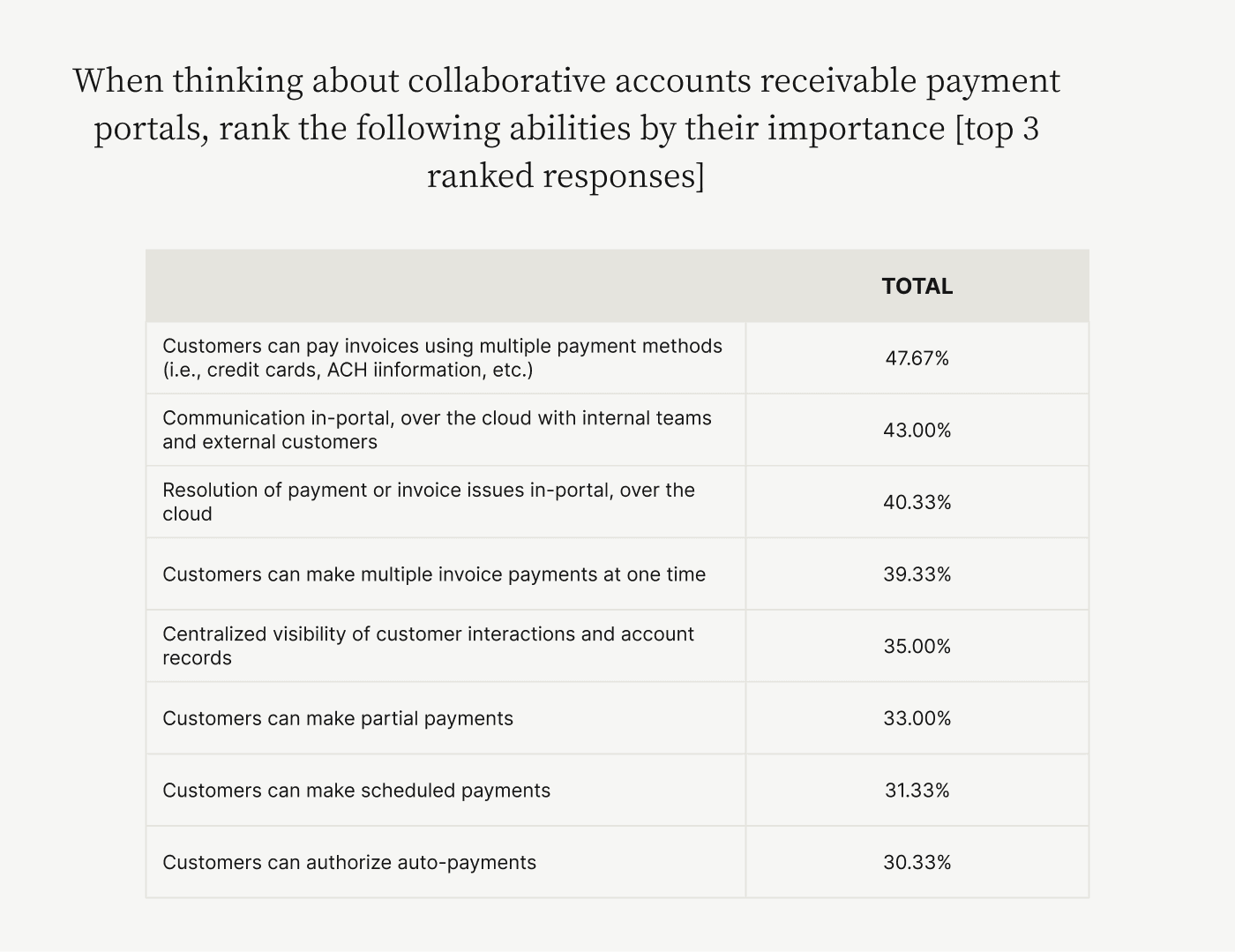

In our survey of 300 CFOs at mid- to upper-midsized companies, 43% of respondents felt a collaborative accounts receivable portal's ability to smooth communication between O2C stakeholders was an important function:

This choice is not surprising. Disputes are the only time when customers interact with AR and they're often met with an opaque process, full of email chains and missed communications. Customers want personalization and transparency, and communication is critical to delivering this goal.

A high-performing AR team relies on established customer communication lines to solve disputes and deliver payment reminders. From a customer's perspective, they receive a consistent experience and interact with a professional team that delivers solutions. By fully connecting with customers, AR teams will no longer risk being out of sync with issues, as is the case with manual accounts receivable.

—

An accounts receivable team experiencing all the healthy signs we've listed above will collect payments quickly and deliver memorable CX, boosting their company's reputation in the long term.

The question is: How can companies fix their accounts receivable departments to realize this vision?

How to fix inefficient accounts receivable

Company executives must shift their perception of AR before investing in electronic tools. Here's how they can begin:

1. Recognize that AR is an asset, not a liability

Companies have treated their accounts receivable and finance teams as back-office entities and the results speak for themselves. The AR Disconnect wouldn't exist if AR was treated as an asset instead of a liability.

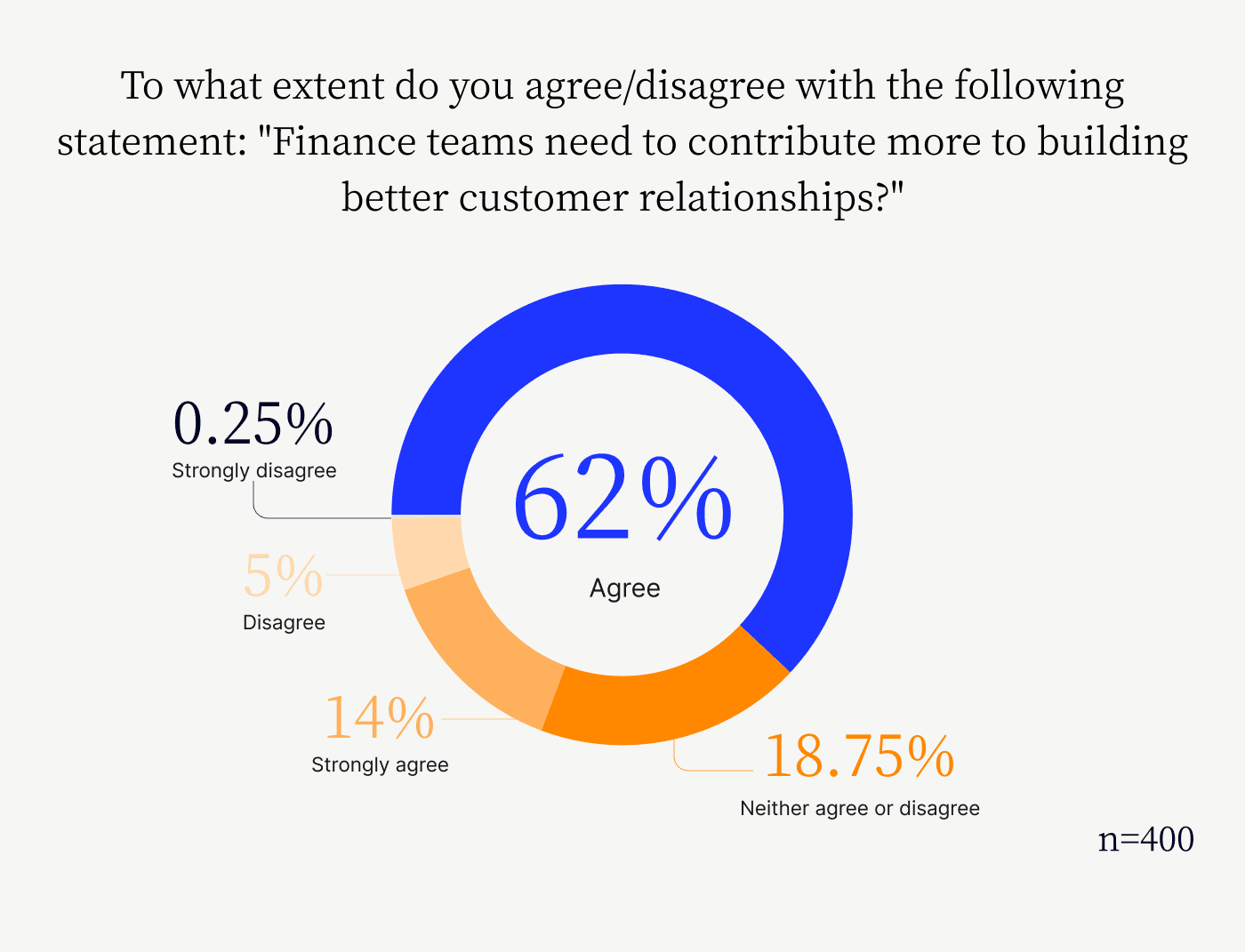

AR disputes offer companies a chance to make a memorable impression. They're an opportunity to deliver customer experiences that future-proof the business; they’re not risks. More executives are recognizing that CX is a company-wide effort and AR is a great function to transform:

2. Invest in transformation, not just automation

Electronification is a great choice, but it won't deliver a company its goals if applied incorrectly. Automating inefficient AR processes only exaggerates inefficiencies. Instead, companies must rethink their AR processes and digitally transform the function.

The key question for transformation is: How can technology help companies reorient themselves around customers? When viewed in this light, collaboration and communication emerge as critical functionalities to look for in any software solution since they help accounts receivable teams understand customer issues quickly.

The ability to deliver CX, not ROI, should be the standard company leaders use to evaluate a software purchase. Customer experience aligns an organization—and its software choices—around customers and ensures every department plays a role in delivering a memorable experience.

3. Create an accounts receivable transformation roadmap for success

Companies that invest in roadmaps succeed in transforming their accounts receivable compared to ones that don't. After identifying issues with existing AR processes, companies must define their goals and any KPIs they will use to measure progress.

After this, execution is the next step.

All this change might seem tedious and risky. However, as we've shown in this article, the cost of ignoring change is many multiples greater than embracing it. If getting started seems intimidating, we’ve made it easy for you to get a personalized accounts receivable transformation roadmap:

About the author

Vivek Shankar

Vivek Shankar specializes in content for fintech and financial services companies. He has a Bachelor's degree in Mechanical Engineering from Ohio State University and previously worked in the financial services sector for JP Morgan Chase, Royal Bank of Scotland, and Freddie Mac. Vivek also covers the institutional FX markets for trade publications eForex and FX Algo News. Check out his LinkedIn profile.